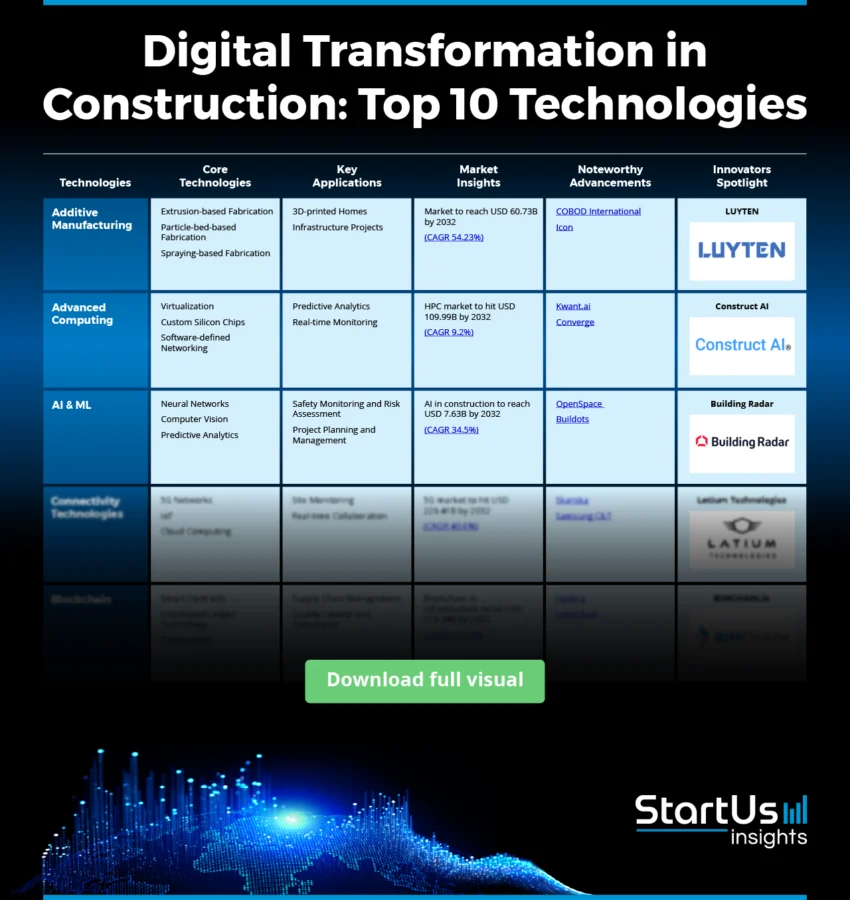

According to McKinsey, architecture, engineering, and construction (AEC) companies face unique challenges that make digital transformation complex! The industry must adopt technologies, like additive manufacturing, artificial intelligence (AI), and robotics, to address challenging on-site conditions.

This guide explores the digital transformation in the construction industry and provides insights into emerging trends and technologies. From understanding key tools to identifying the roadmap for successful adoption, it offers business leaders actionable strategies to digitize their operations.

Key Takeaways:

- Key Factors Driving Construction 4.0: Discover the key technologies such as BIM, AI, and IoT that drive efficiency and productivity in construction.

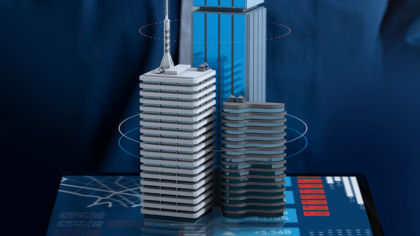

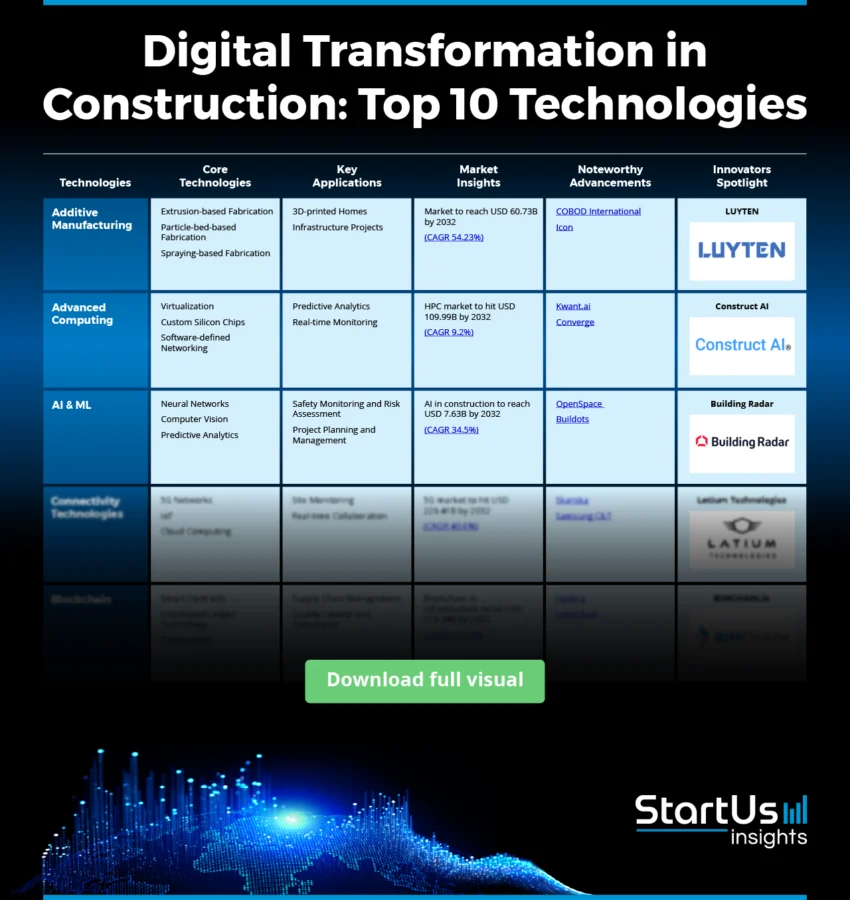

- Top 10 Digital Transformation Technologies in Construction (2025):

- Key Benefits: Learn about the productivity, cost efficiency, safety, client engagement, and sustainability that digital transformation technologies offer.

How do we research and where is this data from?

We reviewed over 3100 industry innovation reports to extract key insights and construct the comprehensive Technology Matrix. To increase accuracy, we cross-validated this information with external industry sources.

Additionally, we leveraged the StartUs Insights Discovery Platform – an AI and Big Data-powered innovation intelligence tool covering over 4.7 million startups and more than 20K+ technologies & trends worldwide to:

- Confirm our findings using the Trend Intelligence feature.

- Gather market statistics for each technology.

- Identify startups for the “Spotlighting an Innovator” sections.

Construction 4.0 – Why the Time is To Act Now

Digital transformation in the construction industry has witnessed unprecedented acceleration in recent years. This shift is largely driven by the adoption of AI technologies, marking a pivotal moment for the sector.

The report further highlights that 68% of surveyed businesses are either already leveraging or actively planning to implement AI technologies.

Several key factors underscore why now is the critical moment for construction businesses to digitize operations:

1. Efficiency and Productivity Gains

Digital tools are automating repetitive tasks and streamlining workflows by mitigating inefficiencies in project management, cost overruns, and inconsistent communication across teams.

Building information modeling (BIM), for instance, reduces project timelines by up to 50% while cutting costs by 52.36%. Similarly, research from Stanford and MIT reveals that AI tools increase productivity by up to 14%.

According to the McKinsey Global Institute, digital transformation can yield up to 15% productivity gains.

2. Data-Driven Decision Making

Construction firms are leveraging real-time data analytics to identify trends, optimize processes, and make informed decisions for better project outcomes.

3. Seamless Collaboration and Communication

Cloud-based collaboration tools are making efficient real-time cooperation among stakeholders to reduce bottlenecks and improve project coordination. Mobile-first solutions also enable workers to stay connected even while on-site.

4. Safety and Compliance

Real-time data and analytics are employed by sophisticated safety monitoring tools to identify potential hazards and improve worker safety.

These instruments mitigate accidents and also facilitate compliance with rigorous health and safety regulations.

5. Sustainability Focus

The construction industry is prioritizing sustainability due to the necessity of environmentally conscious practices. Digital tools evaluate and enhance environmental performance to facilitate green construction processes.

These technologies promote whole-life asset thinking to reduce waste and optimize resource utilization.

Top 10 Digital Transformation Technologies in Construction (2025)

1. Additive Manufacturing or 3D Printing

Additive manufacturing shifts the focus of construction firms toward sustainability, efficiency, and customization. Its substantial growth stems from innovations in materials and processes that enhance its application in building complex structures.

Over the last few years, the preference for 3D concrete printing has been on the rise, enabling the creation of complex structures. This includes houses, bridges, and emergency shelters.

Advancements in sustainable and high-performance materials further reduce the environmental impact. This allows for the production of complex geometries and optimized structures with minimal material waste.

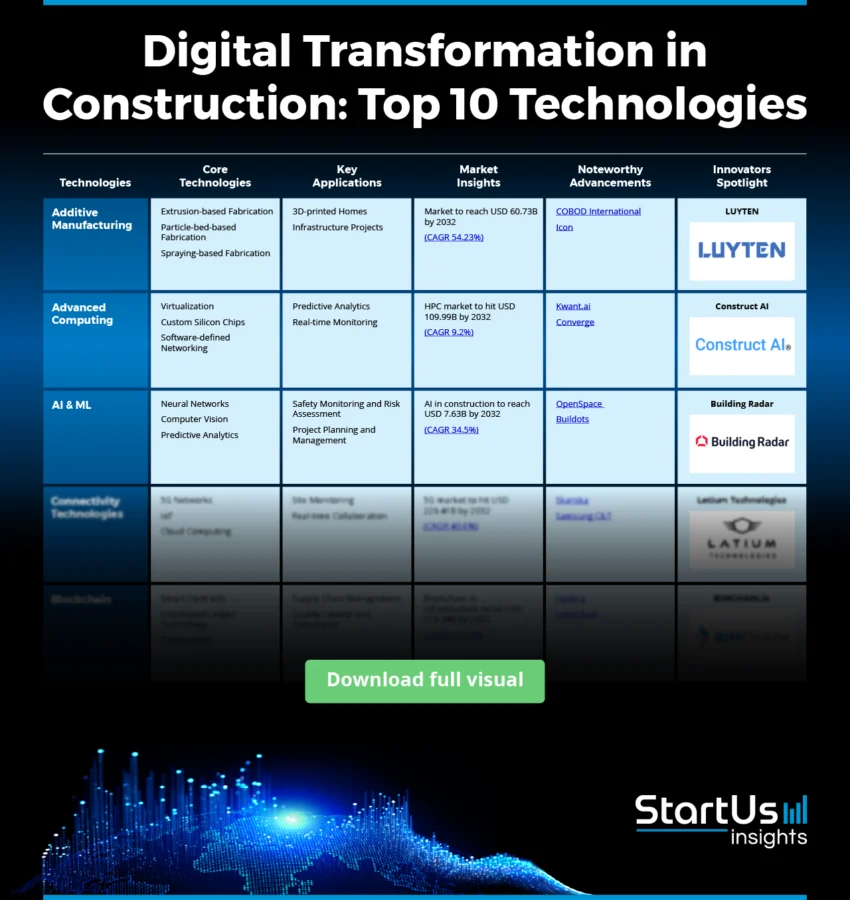

Source: Straits Research

Market Insights & Growth Metrics for Additive Manufacturing

- Scale and Adoption: In the construction industry, 3D printing has achieved significant global traction, with over 16 000 companies adopting the technology. Ranked 156th among all technologies in terms of media coverage, its widespread application highlights its transformative potential and enduring industry interest.

- Growth Indicators: A 43% annual rise in search interest and a five-year funding growth rate of 246.4% underline strong investor confidence and expanding applications in construction.

- Innovation and Development: With over 135 000 patents and 3200 grants awarded to 5.3% of companies, 3D printing demonstrates exceptional innovation. Between 2013 and 2020, patent filings for 3D printing technologies grew at an average annual rate of 26.3% – nearly eight times faster than the average growth rate of 3.3% for all technology fields combined.

- Economic Impact: As per Straits Research, the 3D printing construction market is expected to grow at a remarkable CAGR of 54.23% from 2024 to 2032, reaching a value of USD 60.73 billion.

Core Technologies Connected to Additive Manufacturing

- Extrusion-based Fabrication: Predominantly used for structural components under compression, such as walls and columns. It allows for the direct production of complex geometries without formwork.

- Particle Bed-based Fabrication: Suitable for prefabricated components subject to bending stress, such as slabs and beams. The process allows the creation of complex internal structures and overhanging elements otherwise difficult to achieve.

- Spraying-based Fabrication: While still primarily in the research phase, it is showing great potential for producing a wide range of components, including walls, columns, slabs, and beams.

Noteworthy Additive Manufacturing Advancements

- COBOD International: Provided a live demonstration of their technology at the international Bautec construction exhibition by 3D printing the walls of 4 small houses in just three days. Its BOD2 printer produces three-story buildings, with support for stories more than 300 square meters in area.

- Icon: This Texas-based startup developed the Vulcan construction system – which consists of the Vulcan printer and the Magma portable mixing unit. This system prepares a proprietary building material, Lavacrete, for printing.

Spotlighting an Innovator: LUYTEN

Australian company LUYTEN manufactures 3D construction printers and proprietary concrete mixtures. Its technology employs AI-driven optimization and non-destructive testing (NDT) to ensure precise and efficient 3D printing of complex structures.

The PLATYPUS series printers, including models like PLATYPUS X2 and X12, feature telescopic robotic designs that enable the construction of profiles up to 2 meters in height and width, with unlimited length.

Further, LUYTEN’s proprietary concrete mixture, Ultimatecrete, features a high compressive strength, which enhances the durability and resilience of printed structures.

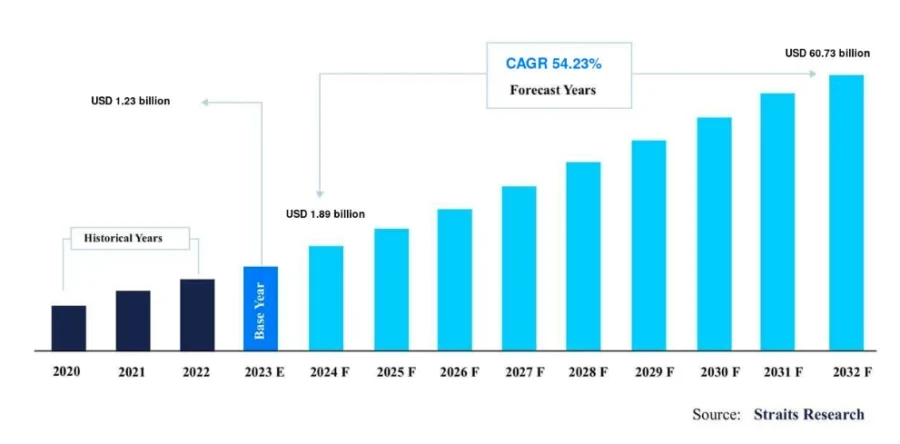

2. Advanced Computing

High-performance computing (HPC) enables complex simulations and data analysis to improve design precision and project planning. The HPC market is expected to grow from USD 54.39 billion in 2024 to USD 109.99 billion by 2032.

Similarly, cloud computing streamlines workflows through real-time collaboration and scalable data management, while the cloud-based quantum computing market is projected to hit USD 10.76 billion by 2031, growing at a CAGR of 38.5%.

Source: Consegic Business Intelligence

Quantum computing, though still emerging, shows promise in solving resource allocation and scheduling challenges, contributing to the growth of the next-generation computing market.

Market Insights & Growth Metrics for Advanced Computing

- Scale and Adoption: In the construction industry, over 99 000 companies actively work on cloud computing, ranking 49th in media coverage. Edge computing is rapidly expanding, with over 41 000 companies involved, ranking 231st globally.

- Growth Indicators: Cloud computing has witnessed a 19.8% rise in search interest and a 101.4% funding increase over the last five years. Edge computing follows closely, with a 96.4% surge in search interest and a 218.7% funding growth, reflecting growing adoption in construction workflows.

- Innovation and Development: Cloud computing companies hold over 35 000 patents, while edge computing boasts 9300 patents. Grant awards highlight their strategic importance, with 4400+ for cloud computing and 3800+ for edge computing, enabling innovation in project management and real-time operations.

- Economic Impact: According to Fortune Business Insights, the global high-performance computing market is projected to reach USD 109.99 billion by 2032, growing at a CAGR of 9.2%.

Core Technologies Connected to Advanced Computing

- High-Performance Computing: Performs complex simulations and data analyses at unprecedented speeds to improve design accuracy and project planning. HPC facilitates precise structural analyses and optimizes resource allocation for efficient construction processes.

- Quantum Computing: Solves intricate optimization problems in resource allocation and scheduling. Quantum computing’s rapid complex computation transforms project management and material science within the industry.

- Cloud Computing: Facilitates real-time collaboration and provides scalable data storage with seamless access to digital workflows. It reduces IT infrastructure costs and enhances communication across geographically dispersed teams.

Noteworthy Advanced Computing Advancements

- Kwant.ai: Offers a construction analytics platform powered by advanced computing technologies to enhance project performance and safety. It improves efficiency and reduces safety incidents.

- Converge: Develops AI and cloud-based technologies integrated with wireless sensors to enhance sustainability in construction. Its ConcreteDNA platform delivers real-time strength data and predictive analytics to design more efficient and eco-friendly concrete mixes.

Spotlighting an Innovator: Construct AI

US-based startup Construct AI develops an AI-powered project management platform for the construction industry. The platform utilizes machine learning algorithms to analyze real-time data from construction sites. It enables proactive identification and resolution of potential issues by leveraging its predictive analytics.

The platform automates task verification and integrates communication tools that streamline workflows and enhance collaboration among stakeholders. By providing real-time insights and automating routine processes, Construct AI increases productivity, reduces delays, and improves overall project outcomes in the construction sector.

3. Artificial Intelligence & Machine Learning

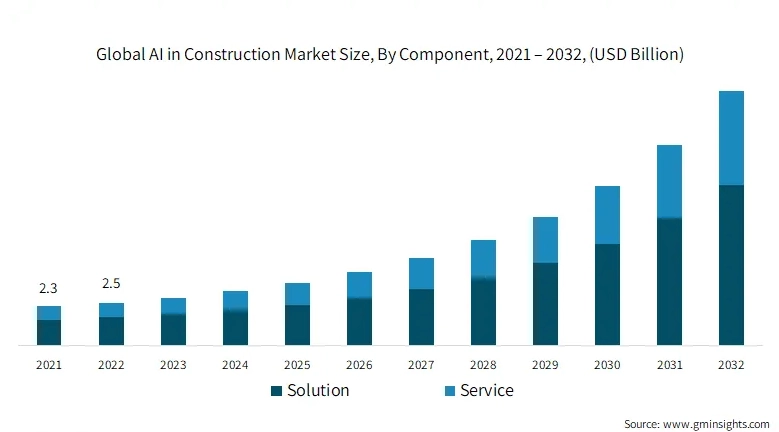

The AI in construction market is projected to grow at a CAGR of 20% from 2023 to 2032. This growth reflects the increasing adoption of AI technologies to enhance project efficiency, safety, and cost management.

Source: Global Market Insights

AI captures real-time site footage to track progress. For safety, AI monitors sites using cameras and sensors, detects hazards in real time, and sends automated alerts to improve response times. Additionally, machine learning analyzes historical data to predict risks and optimize resource allocation.

Further, AI and ML together power 3D BIM models to enable generative design algorithms. These technologies optimize energy efficiency, material usage, and structural integrity to deliver sustainable construction solutions.

Market Insights & Growth Metrics for Artificial Intelligence & Machine Learning

- Scale and Magnitude: According to our data, over 97 000 companies are actively developing AI solutions, with ML playing a significant role through 36 000+ active companies. Despite ranking 120th in media coverage, ML is experiencing robust growth.

- Growth Indicators: The AI sector in construction demonstrates increasing momentum, with a 27.5% rise in search interest and an 89.5% increase in funding. ML exhibits even more pronounced growth, showing a 50.37% rise in search interest and a 155.28% surge in funding over five years. This reflects the industry’s increasing reliance on AI and ML to address cost overruns, resource optimization, and schedule forecasting.

- Innovation and Novelty: AI-driven innovation in construction is underscored by 447 000+ patents globally, showcasing advancements in data-driven planning, safety enhancements, and automation technologies. ML companies contribute 183 000+ patents, emphasizing algorithm efficiency and domain-specific solutions. Additionally, 6.25% of AI companies (17 000+ grants) and 7.06% of ML companies (7500+ grants) have secured targeted grants.

- Economic Impact: According to Straits Research, the global artificial intelligence in construction market is projected to reach USD 7.63 billion by 2032, growing at a CAGR of 34.5% from 2024 to 2032.

Core Technologies Connected to AI and ML

- Neural Networks and Deep Learning: Artificial neural networks (ANNs) predict cost overruns, project timelines, and operational parameters with high accuracy. Deep learning, a subset of neural networks, is used for image recognition and processing, enabling real-time monitoring of construction sites.

- Computer Vision and Image Processing: AI-powered cameras and drones capture 3D scans of construction sites, which are then processed using computer vision algorithms. They enable real-time progress tracking, quality control, and safety monitoring.

- Predictive Analytics and Machine Learning: Analyze vast amounts of historical and real-time data to predict equipment maintenance needs, project risks, and resource requirements.

Noteworthy AI and ML Advancements

- OpenSpace: Uses AI-powered cameras to capture 360-degree images of construction sites. Its technology automatically maps these images to project plans that create a visual record of site progress for project management, quality control, and issue resolution.

- Buildots: Uses 360-degree cameras mounted on hard hats to capture detailed images of construction sites. These images are analyzed using AI algorithms to compare actual progress to identify discrepancies and perform quick corrective actions.

Spotlighting an Innovator: Building Radar

German company Building Radar offers an AI-powered lead generation platform utilizing artificial intelligence to identify new construction projects at their earliest stages.

It analyzes various online sources, including news articles, government records, and databases. The platform also features various search filters – such as region, building category, construction phase, and construction value. This enables sales teams to efficiently find leads.

Additionally, seamless integration with major CRM systems like Salesforce, HubSpot, and Microsoft Dynamics ensures streamlined workflows. By providing early project detection and automating lead qualification, Building Radar empowers sales teams to secure high-margin projects and enhance revenue potential.

4. Connectivity Technologies

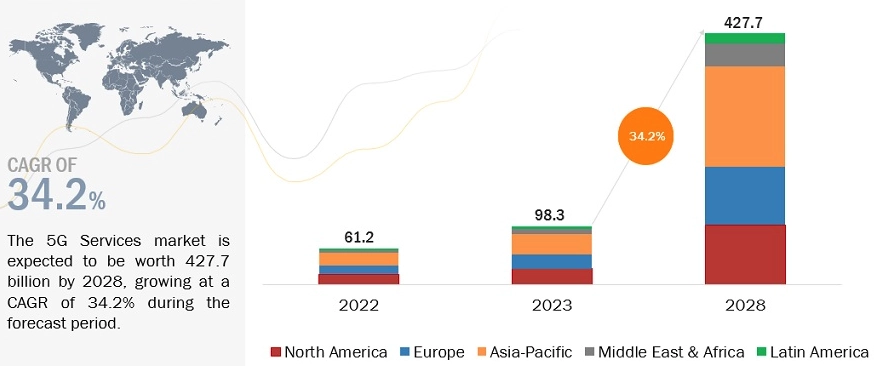

The rollout of 5G facilitates ultra-low latency communication that enables remote operation of machinery and supporting technologies like augmented reality for training and visualization. Cloud-based construction software streamlines collaboration by providing real-time access to project data, CAD drawings, and BIM, ensuring better coordination between on-site and off-site teams.

Source: MarketsandMarkets

Wireless infrastructure, such as mesh Wi-Fi networks, eliminates physical cabling, offering mobile connectivity and flexibility as project sites evolve. Additionally, connectivity supports advanced analytics and AI for predictive maintenance, risk assessment, and resource optimization.

Market Insights & Growth Metrics for Connectivity Technologies

- Scale and Magnitude: 5G is driving advancements in the construction industry, with over 9300+ companies globally working in this domain. Despite ranking 73rd in media coverage among 20 000 technologies, its adoption is accelerating, supporting real-time data transfer and remote operations.

- Growth Indicators: While the search interest for 5G surged by 114.47%, funding growth has declined by 17.1% over the last five years, signaling a shift toward more efficient investments and industry-driven adoption.

- Innovation and Novelty: 5G innovation is evident through 74 900+ patents, focusing on enhanced network capabilities, IoT integration, and mobile broadband. However, only 3.39% of companies secured 1290+ grants, highlighting limited public funding and an increasing reliance on private investment for development.

- Economic Impact: As per Market Research Future, the global 5G market is expected to grow significantly by 2032, with various estimates ranging from USD 229.41 billion (CAGR of 40.60% from 2024 to 2032).

Core Technologies Connected to Connectivity

- 5G Networks: The rollout of 5G has made a major difference to connectivity on construction sites. Its high-speed connectivity facilitates real-time collaboration, and faster data transfer, and supports the growing trend of IoT-based construction sites.

- Internet of Things: IoT-enabled sensors track equipment usage and worker safety, and assist in managing inventory. This enables real-time tracking and efficient resource allocation.

- Cloud Computing: Allows construction workers to communicate, share data, and collaborate on projects. enables real-time collaboration and comprehensive project tracking.

Noteworthy Connectivity Technology Advancements

- Skanska: Integrates advanced connectivity technologies to optimize construction processes and improve productivity. It uses digital twin technology combined with a custom analytics dashboard to enable real-time tracking of production control during construction.

- Samsung C&T: Prioritizes safety and operational efficiency on construction sites by adopting IoT technologies through its Occupational Health and Safety Management System (OHSMS). It incorporates devices like heart rate monitors, gas sensors, and air quality detectors to monitor worker health and site conditions in real time.

Spotlighting an Innovator: Latium Technologies

Latium Technologies, a US company, provides a job site security solution that integrates AI-driven surveillance cameras with smart sensors to monitor and detect threats in real time. It also sends instant alerts to keep site managers informed.

The solution’s AI-enhanced cameras feature dynamic surveillance, night vision, and computer vision. It is complemented by an extensive sensor network that includes vibration sensors for detecting anomalies. This way, it enhances job site safety and reduces downtime caused by security breaches.

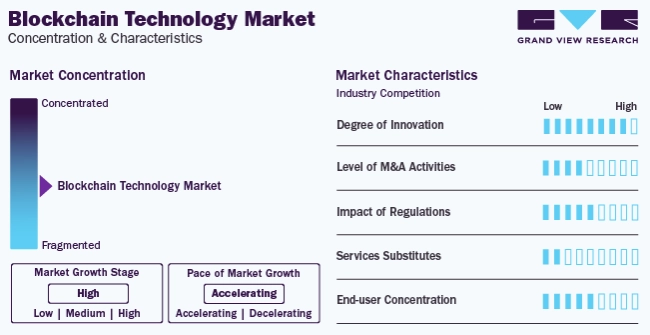

5. Blockchain

Blockchain technology has evolved to enhance supply chain management, automate contract execution, and ensure document authenticity in the construction industry. It is increasingly recognized for its potential to streamline workflows and improve transparency and efficiency in project management.

Source: Grand View Research

Market Insights & Growth Metrics for Blockchain

- Scale and Magnitude: There are over 40 000 blockchain companies worldwide across industries like finance, supply chain, and healthcare.

- Growth Indicators: A 76.66% increase in search interest highlights the growing focus on decentralized healthcare solutions and digital health technologies. Funding grew by 48.18% over five years.

- Innovation and Novelty: With more than 38 000 patents granted, blockchain innovations focus on improving protocols, smart contracts, and security for wider industry adoption. Grants total over 1800, and 2.45% of all companies received grant support, indicating a trend toward private sector-led development.

- Economic Impact: According to Market Research Future, the blockchain in infrastructure market is projected to grow from USD 13.66 billion in 2023 to USD 110.24 billion by 2032, with a CAGR of 26.11% from 2024 to 2032.

Core Technologies Connected to Blockchain

- Smart Contracts: Automate contract execution, streamline payment processes, and improve project management. This avoids disputes and makes contract enforcement easier by ensuring all parties can view progress and trigger actions based on predefined conditions.

- Distributed Ledger Technology (DLT): Enables real-time tracking of origin, location, and status of items, improving supply chain management and quality control. DLT also enhances document management by providing secure sharing, storage, and authentication of project documents.

- Blockchain-as-a-Service (BaaS): Simplifies blockchain adoption in the industry by providing cloud-based solutions that handle the backend operations. BaaS enables businesses to leverage blockchain for various applications like project management, procurement, and collaboration.

Noteworthy Blockchain Advancements

- Hedera: Offers a decentralized public ledger for construction companies that enables secure, real-time tracking of projects, materials, and payments. Its fast, energy-efficient platform ensures tamper-proof data. It streamlines workflows and enhances collaboration among stakeholders.

- LimeChain: Provides blockchain solutions for construction companies to increase transparency, streamline project management, and improve collaboration. Its technology secures contracts, tracks materials, and ensures compliance through tamper-proof documentation.

Spotlighting an Innovator: BIMCHAIN

Lutecium, a French company, develops BIMCHAIN, a platform that integrates blockchain technology with building information modeling. The platform creates immutable, time-stamped digital proofs for each action within the BIM process to ensure data integrity and authenticity.

Smart contracts that automate predefined actions, decentralized storage for secure data management, and proofs of ownership, context, approval, consistency, and certification are some of the features of the platform.

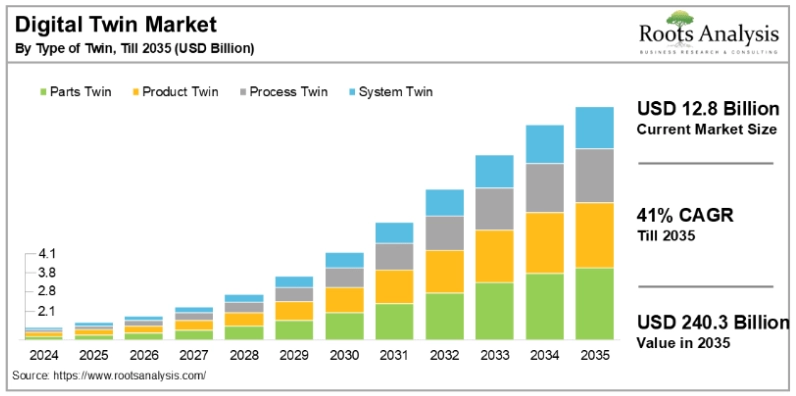

6. Digital Twins

Digital twins are used for real-time construction site monitoring, asset tracking and management, facility management, and predictive maintenance. They improve construction accuracy by providing continuous comparisons between physical builds and digital models, thus minimizing errors and rework.

Source: Roots Analysis

69% of construction firms are increasingly investing in digital twin technology. Buildings with this technology can achieve up to 20% reduction in energy usage. Properties equipped with digital twin technology can see a value increase of 7% to 20%.

Market Insights & Growth Metrics for Digital Twins

- Scale and Magnitude: Digital twins, with over 5600 companies worldwide and ranked 692nd in media coverage, remains a niche yet transformative technology in manufacturing, infrastructure, and healthcare.

- Growth Indicators: A 26.6% rise in global search interest and a 145.5% five-year funding growth highlight increasing investor confidence as its industrial benefits become more apparent.

- Innovation and Novelty: With 2500+ patents, digital twin innovation emphasizes simulation accuracy, data integration, and IoT-AI interoperability. Strong institutional support is reflected in 1300+ grants awarded to 7.79% of companies.

- Economic Impact: According to Astute Analytica, the global digital twin for buildings market is expected to reach USD 20.2 billion by 2032, growing at a CAGR of 32.6% from 2024 to 2032.

Core Technologies Connected to Digital Twins

- Building Information Modeling: Enables detailed 3D modeling and simulation of construction projects. This technology assists construction firms in planning, collaboration, and decision-making throughout the project lifecycle.

- Internet of Things: Enable real-time data collection on various aspects of construction sites, including equipment usage, environmental conditions, and structural health. This continuous stream of data feeds into the digital twin that supports precise analysis, optimization, and real-time asset monitoring.

- AI and ML: Enable autonomous decision-making based on the data collected by IoT sensors. AI-powered digital twins can forecast maintenance needs, simulate various scenarios, and continuously improve their accuracy over time.

Noteworthy Digital Twin Advancements

- cmBuilder.io: CadMakers offers this web-based platform for creating and sharing 4D site logistics plans to generate digital twins of construction sites. It integrates with BIM models for project visualization and simulates the entire construction process with accurate sequencing.

- AIOTEL: Develops a digital twin platform that combines 3D geospatial technology, XR visualization, IoT connectivity, and AI-driven analytics for immersive 3D visualization of physical assets. AIOTEL creates a comprehensive, data-driven digital twin ecosystem for construction and other industrial environments.

Spotlighting an Innovator: SmartBIM Innovations

Sri Lankan company SmartBIM Innovations develops a BIM-based digital twin platform for the construction industry. The platform creates digital replicas of physical construction projects by integrating BIM with real-time data.

It utilizes a digital workbook for daily progress updates and processes data through a cloud-based system. Features include 4D planning for progress visualization and simulation and 5D budgeting for automated cost estimation.

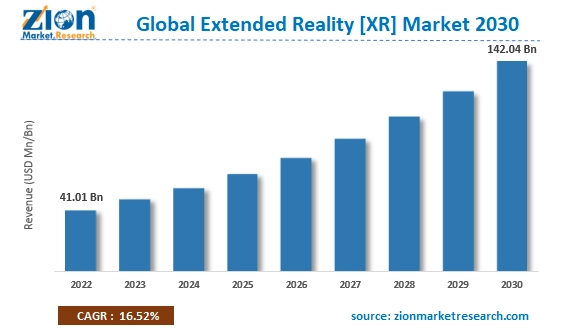

7. Extended Reality

Extended reality technologies are showing rapid growth in adoption and integration in construction project management, safety training, and immersive design reviews.

Source: Zion Market Research

Leading construction companies like AECOM, Hyundai E&C, Koninklijke BAM, Laing O’Rourke, Larsen & Toubro, and VINCI have partnered with equipment manufacturers and specialist AR vendors to develop in-house expertise.

Companies are increasingly adopting XR for better data management and visualization. It is leveraged for virtual design reviews, where stakeholders can walk through project models. The creation of digital twins for real-time monitoring and safety training simulations allows workers to practice in a controlled environment.

Market Insights & Growth Metrics for Extended Reality

- Scale and Magnitude: Virtual reality, with over 27 000 companies and ranked 84th in media coverage, dominates gaming, education, and training. Augmented reality, with 21 000+ companies and ranked 159th, is growing in retail, healthcare, and industrial design.

- Growth Indicators: According to our data, AR shows a 19.13% annual search growth and 109.45% funding growth over five years, reflecting expanding applications. VR, with a similar search growth of 19.21% but a slower funding growth of 35.98%, highlights its maturity in immersive experiences.

- Innovation and Novelty: VR leads with 82 000+ patents, while AR has been granted 39 000+, driving innovation in immersive and connected digital solutions. Grant support is notable, with 5.9% of AR companies (3700+ grants) and 3.8% of VR companies (3000+ grants) receiving funding.

- Economic Impact: According to Credence Research, the market value of extended reality in the construction industry is projected to reach USD 38.8 billion by 2032, growing at a CAGR of 25.00% from 2023 to 2032.

Core Technologies Connected to Extended Reality

- Head-Mounted Displays (HMDs): On-site, workers can access building plans, safety protocols, and installation guides directly within their field of view. HMDs also offer risk-free training simulations to practice construction tasks and safety procedures in realistic scenarios.

- Spatial Mapping and Tracking: Enables precise and interactive XR experiences by creating detailed 3D maps of construction sites. These technologies help with site mapping and progress monitoring by comparing real-time spatial data with digital plans.

- Digital Twin Technology: Integrates data from IoT sensors and BIM models for construction project’s lifecycle management. By simulating scenarios, digital twins predict potential issues in infrastructure and facilitate performance optimization by analyzing energy consumption and operational data.

Noteworthy Extend Reality Advancements

- Varjo: Its immersive virtual reality headsets enhance collaboration among architects, engineers, builders, and other project stakeholders. It creates an immersive experience for users and speeds up decision-making processes by shortening lead times.

- XYZ Reality: HoloSite, its AR device, integrates AR with BIM to visualize and position 3D BIM models on-site with millimeter accuracy. It ensures real-time validation, early error detection, and precise decision-making

Spotlighting an Innovator: XRIT

Italian company XRIT develops XRS, a comprehensive extended reality system for the construction industry. XRS integrates with existing systems through a customized cloud-based common data environment (CDE) platform.

It enables users to visualize static and dynamic virtual content – including 3D CAD and BIM models, as well as audio and video with centimeter-level precision. The system offers various setups, such as helmet visors, tablets, smartphones, and remote screens.

XRS facilitates real-time, georeferenced positioning and virtual-real overlays, even in outdoor and high-brightness environments. By reducing the need for physical site visits and minimizing rework, XRIT enhances efficiency.

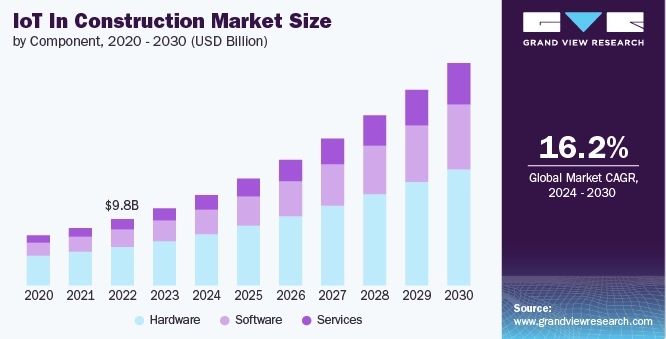

8. Internet of Things

IoT adoption in construction is accelerating globally, with the U.S. market projected to grow at a CAGR of 13% from 2024 to 2030. Leading the charge, the Asia Pacific and Middle East & Africa regions are set to experience significant growth rates of over 19% and 20%, respectively, during the same period.

Source: Grand View Research

The shift toward smart buildings and infrastructure, coupled with advancements in connected devices and AI-driven analytics, further propels adoption. Additionally, a rising focus on sustainability and energy efficiency underscores IoT’s pivotal role in modernizing construction practices.

In the construction industry, IoT monitors site conditions like temperature, air quality, and structural integrity and ensures proactive adjustments to maintain quality and timelines. Wearable devices and surveillance systems enhance worker safety by tracking vital signs, detecting hazards, and preventing unauthorized access.

Market Insights & Growth Metrics for Internet of Things

- Adoption and Scale: IoT is a widely adopted technology with over 53 000 active companies globally, ranking 71st in media coverage. Its versatility is evident in applications across industries, from smart homes to industrial automation, showcasing its broad impact and utility.

- Growth Trends: IoT continues to generate steady interest, reflected in a 35.3% increase in search activity. However, its five-year funding growth has seen a slight decline of 3.3%, signaling a focus on optimizing existing systems over new investments.

- Innovation and Funding: With over 68 000 patents, IoT innovations drive advancements in interoperability, security, and energy-efficient communication. Moderate public funding support is reflected in 5700 grants, covering 4% of IoT companies.

- Economic Impact: As per Global Market Insights, the IoT in the construction market is projected to exceed USD 46.3 billion by 2032, driven by the software segment’s 26.8% CAGR, reflecting its importance in data management and analysis.

Core Technologies Connected in IoT

- Sensors: Monitor temperature, humidity, and structural health, while wearables track workers’ vital signs and detect falls or hazardous conditions. They collect real-time data on various aspects such as environmental conditions, equipment usage, and worker safety.

- Cloud-based Platforms: Facilitate real-time data sharing, project coordination, and communication. These platforms enable instant access to critical project metrics and allow managers to make informed decisions and adjust plans on the go.

- Data Analytics and AI: Process the vast amounts of data collected by IoT devices to provide actionable insights, enable predictive maintenance, and optimize workflows. AI-driven analytics help in identifying inefficiencies and predicting potential risks.

Noteworthy IoT Advancements

- Ynomia: Ensures better oversight and resource allocation through a construction tracking platform that transforms worksites into digital warehouses. Its BLEAT (Bluetooth Low Energy Asset Tracking) system uses BLE-LoRaWAN-enabled beacons (BLEAcons) to relay location data that enables real-time tracking of critical, high-value building materials.

- Lattice: Utilizes a network of low-power wireless sensors, the platform collects and analyzes real-time data to track the location of people, tools, and materials. This improves transparency and optimizes asset allocation.

Spotlighting an Innovator: IoT Bridge

Swedish company IoT Bridge offers bridge monitoring systems for structural health assessment. Its platform integrates strain gauges, accelerometers, and inclinometers to collect real-time stress, strain, and vibration data.

This data streams continuously to the company’s cloud, hosting a digital twin of the bridge for accurate analysis. Some of the features include damage detection, rain flow analysis, frequency spectrum analysis, and lifetime assessments.

9. Cybersecurity

The construction industry has become a major target for cybercriminals, with ransomware attacks on construction companies rising by 48% between 2022 and 2023, and construction ranked as the most targeted sector by NordLocker.

As digitalization accelerates, the adoption of technologies like BIM, IoT devices, and cloud-based tools has expanded vulnerabilities and created significant cybersecurity challenges. Reflecting this urgency, North America leads the construction cybersecurity market with a 40% share, while the Asia Pacific region is experiencing rapid growth due to large-scale infrastructure and smart city initiatives.

Source: Global Market Insights

Cybersecurity implements advanced firewalls, encryption, and intrusion detection systems to protect sensitive data, including proprietary designs and financial records. Companies are also enhancing employee training and conducting awareness campaigns to combat phishing and cyber threats.

Market Insights & Growth Metrics for Cybersecurity Evolution

- Scale and Magnitude: Cybersecurity safeguards digital infrastructure, with over 162 000 companies globally contributing to its adoption. Ranking 12th in media coverage, its importance grows as construction firms increasingly rely on digital tools like BIM, IoT, and cloud-based platforms.

- Growth Indicators: Cybersecurity demonstrates steady growth, with a 67% increase in search interest driven by rising concerns over data breaches and privacy risks. Despite being a mature field, its 22.2% funding growth over five years reflects a stable demand for secure digital solutions.

- Innovation and Novelty: With over 223 000 patents in areas like threat detection, encryption, and identity management, cybersecurity innovations focus on protecting sensitive data. Only 1.6% of companies have received approximately 7200 grants, implying that growth is largely supported by private sector investments.

- Economic Impact: According to Global Market Insights, the construction cybersecurity market is expected to grow from USD 6.9 billion in 2023 to USD 30.9 billion by 2032, with a CAGR of over 18% from 2024 to 2032.

Core Technologies Connected to Cybersecurity

- AI and ML: Identify threats, analyze data, and automate security processes. AI-driven systems detect suspicious activities, predict potential vulnerabilities, and respond to threats faster than traditional security measures.

- Cloud-based Security Platforms: Offer enhanced data protection, secure collaboration tools, and real-time monitoring capabilities. These platforms store and share data securely while maintaining accessibility for authorized personnel.

- Endpoint Detection and Response (EDR): Monitors devices, detects cyber threats, and ensures data security by analyzing activity. It enables swift remediation for operational continuity by safeguarding sensitive project data and ensuring secure digital operations within construction firms.

Noteworthy Cybersecurity Advancements

- Vectra AI Platform: A network detection and response (NDR) solution that improves construction firms’ cyber-attack detection and response capabilities using AI and ML.

- Palo Alto Network: The company offers comprehensive security solutions specifically for the construction industry to protect against a wide range of external threats. Palo Alto Networks utilizes advanced AI-driven cybersecurity technologies to safeguard construction companies’ networks, data, and digital assets.

Spotlighting an Innovator: Huntress

US-based company Huntress provides a managed endpoint detection and response platform for comprehensive cybersecurity. It deploys lightweight agents on endpoints to monitor processes and detect malicious activities in real time.

The company also provides a human-led security operations center (SOC) that investigates threats and offers actionable remediation steps to ensure rapid incident response. By delivering continuous monitoring and expert analysis, Huntress enhances organizational security postures, effectively mitigating cyber threats.

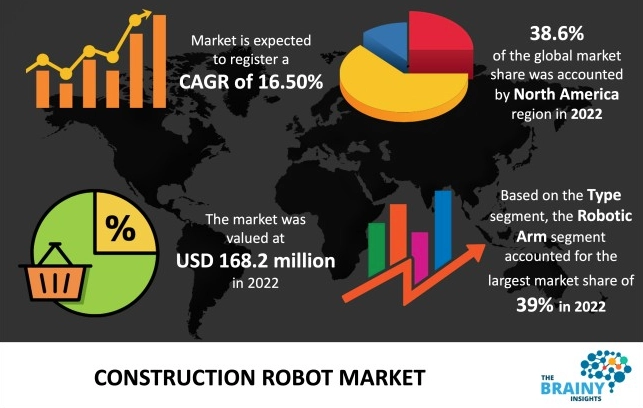

10. Robotics and Automation

The construction industry has adopted robotics and automation technologies like automated bricklaying systems, welding arms, and concrete-pouring robots to increase precision. Autonomous equipment, including excavators and bulldozers, reduces labor costs and improves accuracy by operating with minimal human intervention.

Source: The Brainy Insights

Technology like drones optimize site monitoring and inspections by providing real-time data, high-resolution maps, and 3D models, which improve workflows and safety. Similarly, automated construction techniques, such as 3D printing, accelerate project timelines and minimize material waste.

Market Insights & Growth Metrics for Robotics and Automation

- Scale and Magnitude: With 73 200+ robotics companies globally (30th in media coverage) and 129 000+ automation firms (79th in media rank), these technologies drive advancements in site inspection, material handling, modular assembly, workflow efficiency, quality control, and safety.

- Growth Indicators: Robotics records a 3.85% increase in search interest and 88.64% funding growth over five years, reflecting stable demand. Automation shows a 9.91% rise in search interest as firms focus on efficiency and compliance, while funding has decreased by 1.16%, signaling a shift toward optimizing existing systems over new investments.

- Innovation and Novelty: Robotics holds 422 000+ patents in areas like site surveys and AI-driven quality monitoring, with 4.76% of companies (10 270+ grants) funded for innovation. Automation, with 325 500+ patents, focuses on process automation and data analytics, with 2.78% of companies receiving grants to enhance efficiency in construction.

- Economic Impact: According to The Brainy Insights, the global construction robot market is expected to grow from USD 168.2 million in 2022 to USD 774.6 million by 2032, at a CAGR of 16.50%.

Core Technologies Connected to Robotics and Automation

- Sensors and Actuators: Detect environmental parameters like temperature, pressure, and proximity and provide real-time data. Actuators convert this data into mechanical actions for robots to perform tasks.

- Computer Vision: Allows robots to interpret and process visual information from the environment. Also, computer vision inspects progress and ensures safety compliance by detecting anomalies and assessing structural integrity.

- Haptic Feedback Systems: Simulate the sense of touch and enhance the precision of construction tasks like remote-controlled machinery operation and complex assembly processes.

Noteworthy Robotics and Automation Advancements

- Boston Dynamics: It developed Spot, an autonomous robot that navigates construction sites autonomously. It collects crucial data that would take humans much longer to gather. This robot performs repetitive inspection tasks and access areas that may be difficult or dangerous for human workers.

- ABB Robotics: Drives automation in the construction industry that focuses on modular housing manufacturing. Its pilot project develops innovative practices in modular construction and addresses labor shortages.

Spotlighting an Innovator: Weibuild

Weibuild, a Chinese company, offers construction robots to improve safety on job sites. Its AI Artisan system enables robots to perform tasks such as plastering and spraying with high precision.

The plastering robots autonomously navigate and execute plastering to achieve high vertical flatness by eliminating hollows. By integrating robotics with construction, Weibuild offers scalable solutions that increase productivity and reduce labor-intensive work

Key Benefits of Digitalization in Construction

Digital transformation is bringing significant advantages to the construction industry, revolutionizing traditional workflows and driving efficiency. Here’s a detailed look at the key benefits:

Enhanced Productivity

According to Deloitte, businesses investing in new technologies have seen an average increase of 1.4% in revenue growth and 1% in profit growth.

Digital twins and construction management software streamline operations by providing real-time tracking of tasks, resource allocation, and project progress. Teams can collaborate more effectively with access to up-to-date information, reducing delays and rework.

- Metrics to Measure: Increase in task completion rates and reduction in project delays.

Cost Savings

AI-driven analytics allows construction managers to identify inefficiencies like material wastage or scheduling conflicts. Digital workflows also minimize administrative overheads by automating manual tasks like documentation and reporting.

- Metrics to Measure: Decrease in project overruns and improved cost-to-budget ratios.

Improved Safety

Wearables and IoT devices enhance safety by monitoring worker health and site conditions in real time. Alerts are triggered for hazardous situations, reducing the risk of accidents.

Safety training simulations using VR technology also prepare workers for real-world scenarios. For example, Bechtel deployed IoT wearables across sites, reducing workplace injuries by 40% in 2023.

- Metrics to Measure: Reduction in incident rates and increase in compliance with safety protocols.

Better Client Engagement

Digital platforms provide clients with transparent updates on project progress, budgets, and timelines. Tools like AR/VR allow stakeholders to visualize designs and make informed changes, improving satisfaction.

- Metrics to Measure: Increase in client satisfaction scores and reduction in approval cycles.

Act Now to Stay Ahead of the Technology Curve

Staying competitive means more than just being aware of technological advancements. Every industry faces unique challenges and opportunities, and a one-size-fits-all approach isn’t enough.

That’s where our AI and Big Data-powered Discovery Platform comes in. With access to over 4.7 million emerging companies and 20K+ technologies & trends globally, it equips you with the actionable insights you need to stay ahead of the curve. Leverage this powerful tool to spot the next big thing before it goes mainstream. Stay relevant, resilient, and ready for what’s next.

![Digital Transformation in Construction: Trends, Benefits, and Future Insights [2025 & Beyond]](https://www.startus-insights.com/wp-content/uploads/2024/12/Digital-Transformation-in-Construction-SharedImg-StartUs-Insights-noresize-420x236.webp)

![AI Implementation | A Comprehensive Strategic Guide for Enterprises [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/04/AI-Implementation-SharedImg-StartUs-Insights-noresize-420x236.webp)

![AI in Agriculture: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Agriculture-SharedImg-StartUs-Insights-noresize-420x236.webp)

![AI in Automotive: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Automotive-SharedImg-StartUs-Insights-noresize-420x236.webp)