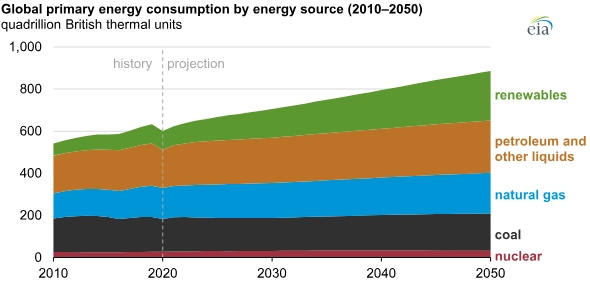

Global energy consumption is projected to increase by nearly 50% by 2050, primarily driven by economic and population growth in non-OECD countries. The surge in demand coincides with a critical need to achieve net-zero emissions by mid-century.

This report explores digital transformation in the energy industry and how you can effectively integrate emerging innovative solutions. Explore the key drivers, the top 10 technologies impacting energy, real-life examples, strategic insights, and more.

Key Takeaways

- The Time to Act Is Now: The energy sector faces rising demand, stricter environmental regulations, and increasing renewable adoption – making immediate digital transformation essential.

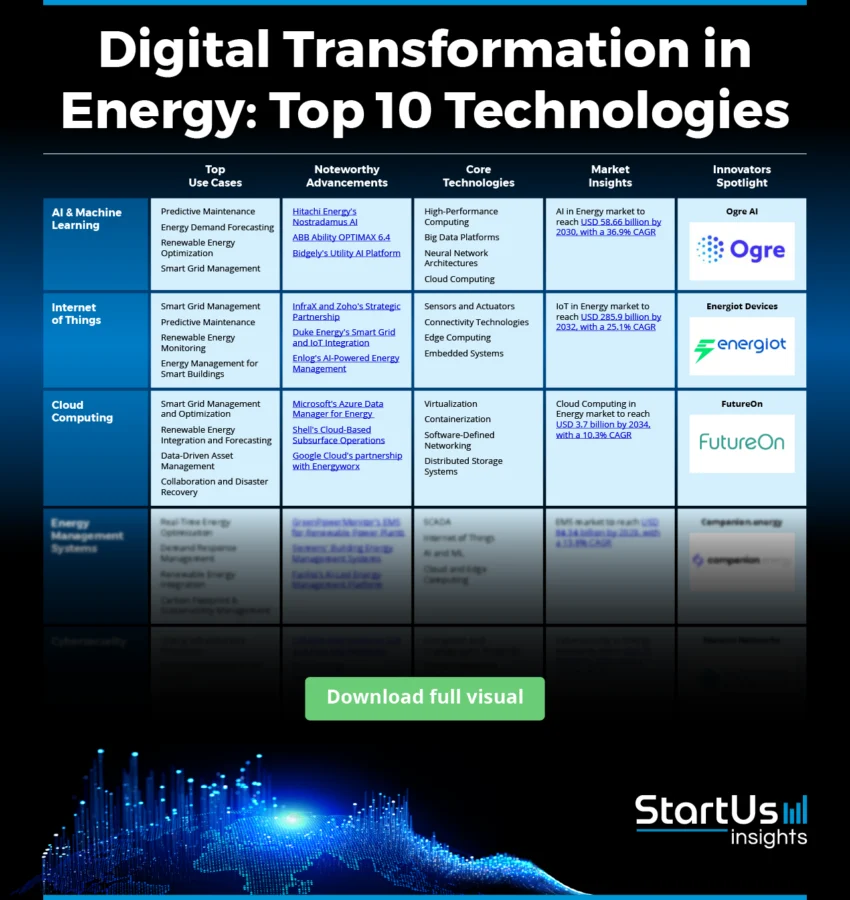

- Top 10 Digital Transformation Technologies in the Energy Industry

- Key Benefits: Digital transformation reduces costs, improves grid efficiency, enhances customer experience, and accelerates renewable energy adoption.

- Step-by-Step Guide: Includes defining goals, assessing readiness, implementing high-impact technologies, building resilient data systems, and continuously optimizing operations.

- Roadmap for Successful Digitization: Outlines critical phases, from stakeholder alignment and pilot project implementation to scaling proven solutions, strengthening cybersecurity, and fostering innovation.

- Future Trends: Predictive energy management, increased adoption of decentralized energy systems, and energy-as-a-service (EaaS).

How Do We Research and Where is This Data From?

We reviewed over 3100 industry innovation reports to extract key insights and construct the comprehensive Technology Matrix. To increase accuracy, we cross-validated this information with external industry sources.

Additionally, we leveraged the StartUs Insights Discovery Platform – an AI and Big Data-powered innovation intelligence tool covering over 4.7 million startups and more than 20K+ technologies & trends worldwide to:

- Confirm our findings using the Trend Intelligence feature.

- Gather market statistics for each technology.

- Identify startups for the “Spotlighting an Innovator” sections.

Why the Time to Act is Now

Escalating Global Energy Demand

By 2050, it is anticipated that the world’s energy consumption will increase by almost 50% – driven by rapid industrialization and population growth in emerging economies.

Source: U.S. Energy Information Administration, International Energy Outlook 2021 Reference case Note: Petroleum and other liquids include biofuels.

The majority of this increase is attributed to the growth of infrastructure and metropolitan centers in non-OECD countries. Without digital tools to optimize energy generation and distribution, meeting this demand will strain existing infrastructure and exacerbate inefficiencies.

Stricter Environmental Regulations

To combat climate change, governments are implementing aggressive policies to achieve net-zero emissions by 2050. For example, 40% of power must originate from sustainable sources in Europe by 2030 in accordance with renewable energy targets. Similar commitments have been made in other regions. To streamline this, blockchain and IoT-enabled sensors monitor emissions to guarantee compliance.

Integration of Renewable Energy Sources

Renewable energy sources like wind and solar are predicted to produce half of the world’s electricity by 2050. However, innovative solutions are required to guarantee efficiency and reliability when integrating these variable sources into conventional energy systems. To achieve this, digital twins, AI-based demand forecasting, and IoT-enabled smart grids are essential.

Competitive Pressures

As energy markets become increasingly dynamic, companies must innovate to stay ahead. Firms investing in digital transformation report a 20-30% reduction in operational costs and faster time-to-market for new services.

Competitors who fail to adopt technologies like blockchain-enabled energy trading, smart meters, or AI-driven demand response systems risk losing market share to more agile, tech-savvy players.

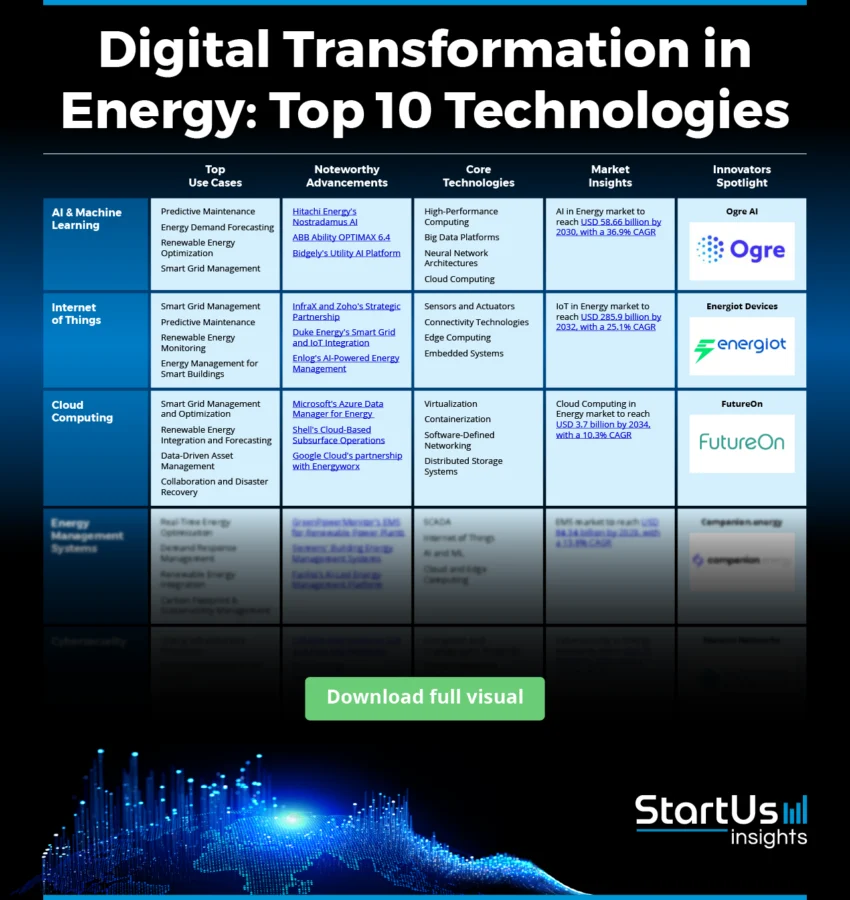

Top 10 Digital Transformation Technologies in the Energy Industry (2025)

1. Artificial Intelligence and Machine Learning

By leveraging vast datasets from IoT devices, smart grids, and energy assets, AI and ML enable predictive insights, real-time decision-making, and enhanced efficiency across the energy value chain.

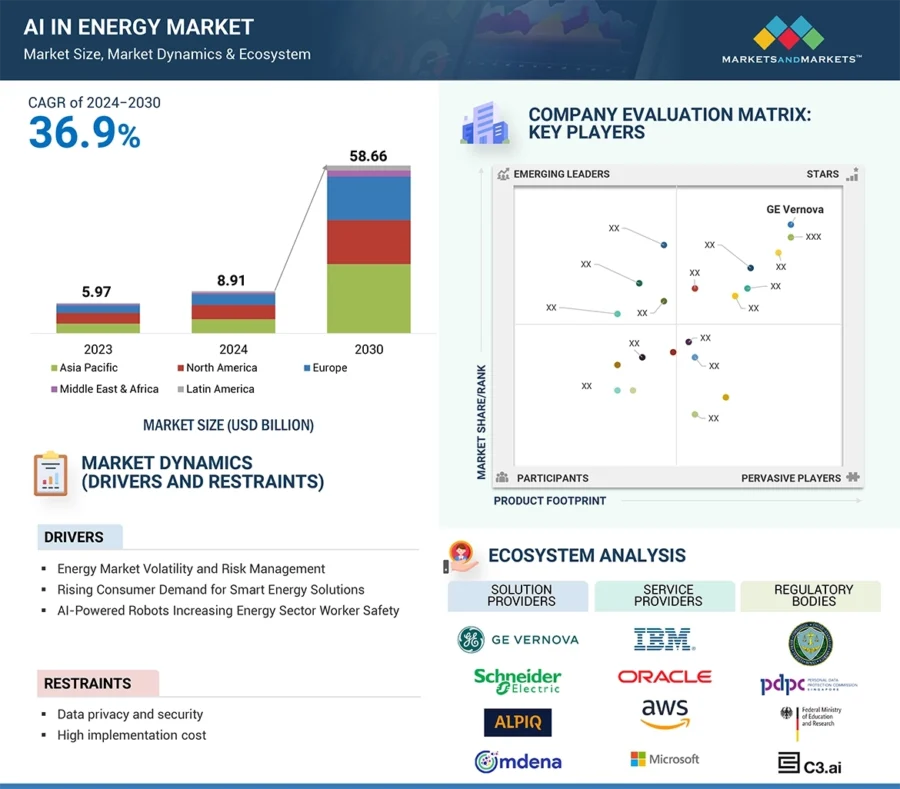

According to MarketsandMarkets, the global AI in energy market is projected to grow from USD 8.91 billion in 2024 to USD 58.66 billion by 2030, at a compound annual growth rate (CAGR) of 36.9%.

Source: MarketsandMarkets

Market.us expects that 70% of energy companies have implemented AI solutions in at least one operational area by the end of 2024. Additionally, over 55% of AI deployments in the energy sector will involve digital twins.

As AI and ML technologies mature, their applications in the energy sector will expand further. By 2030, the combination of AI, ML, and digital twin technologies is expected to save the energy sector over USD 2 trillion annually.

Market Insights & Growth Metrics for AI and ML

Scale and Magnitude

According to StartUs Insights, AI has seen substantial growth, with 104 800+ companies operating globally. The United States leads this domain, hosting about 31% of these companies, equating to roughly 32 800+ AI firms.

However, Cases Media reports a slightly lower figure of 57 900+ AI companies globally but still confirms that 25% of these are in the U.S.

This significant presence is also evident through media presence as AI ranks 16th among emerging technologies based on our data. This indicates a high level of public and media attention, especially driven by advances in generative AI and large language models.

StartUs Insights reports machine learning encompasses 40 250+ companies worldwide and ranks 116th in media coverage, suggesting it garners less attention compared to broader AI discussions.

Growth Indicators

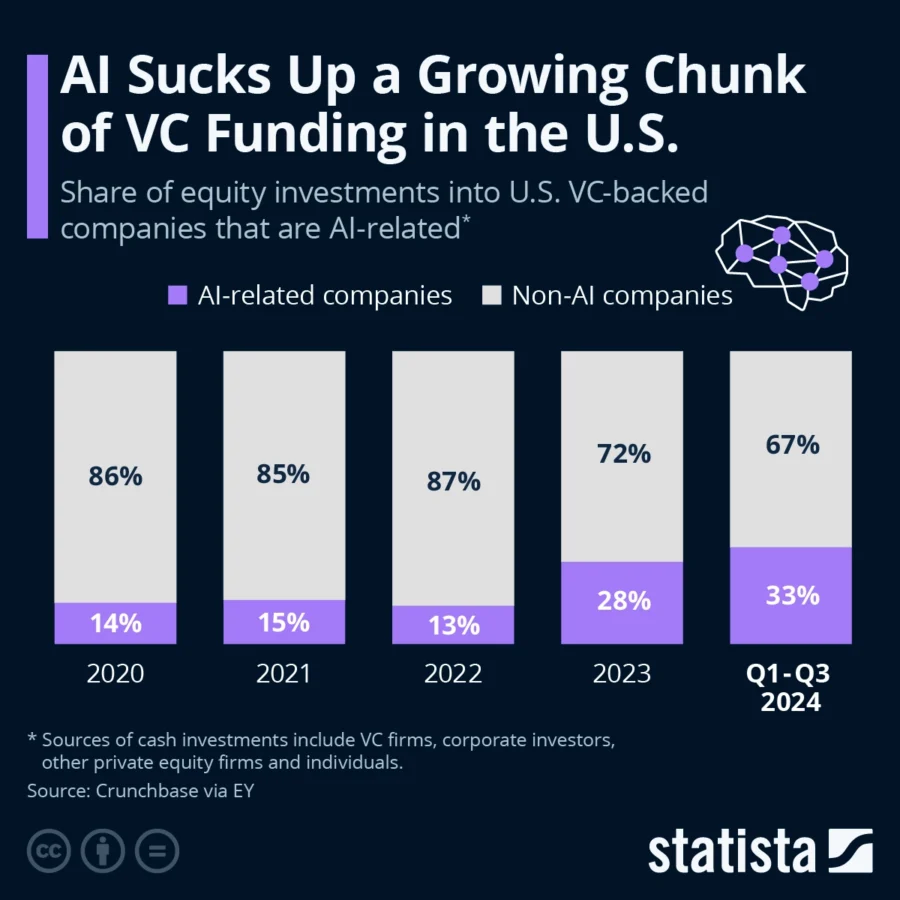

Interest in AI continues to grow, with a 28.13% annual increase in search interest. Funding in AI has also risen significantly, showing a 65.54% growth over the past five years. For instance, AI-related investments accounted for 37% of total venture capital funding in Q3 2024 in the US.

Source: Statista

According to our data, machine learning has witnessed even greater momentum, with search interest rising annually by 51.34%, and funding surging by an impressive 178.11% over the past five years.

StartUs Insights also reports that generative AI, a rapidly emerging subset, has seen explosive growth. Its search interest skyrocketed by 457.73% annually and funding increased by an extraordinary 670.19% over the past five years.

Innovation and Novelty

According to our data, the AI sector is a hub of innovation, evidenced by the filing of over 827 000 patents globally. Additionally, AI research has been supported by over 20 000 grants.

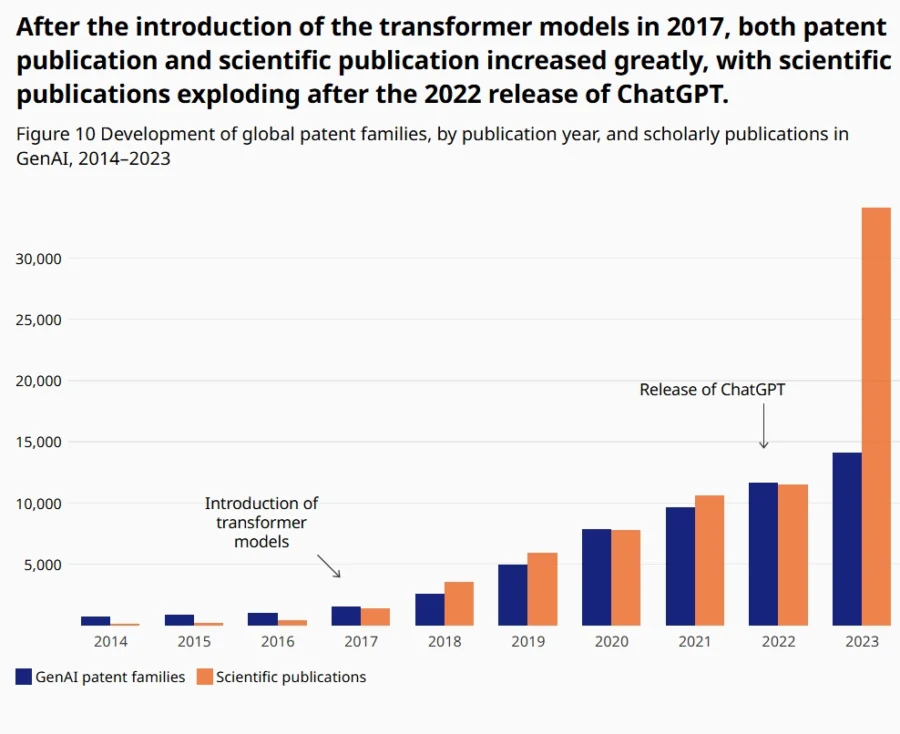

The World Intellectual Property Organization (WIPO) noted that generative AI patents represent a smaller subset of overall AI patents, with 54,000 GenAI-related inventions documented between 2014 and 2023. GenAI patents accounted for only about 6% of all AI patents globally.

Source: WIPO

StartUs Insights reports that the ML domain has contributed to the filing of over 333 000 patents. In 2022, the number of AI-related patent grants worldwide increased sharply by 62.7%. Additionally, ML research has benefited from over 9400 grants.

Top Use Cases of AI and ML in Energy

- Predictive Maintenance: AI and ML systems monitor vibration, temperature, and pressure to detect anomalies and predict equipment failures before they occur.

- Energy Demand Forecasting: AI and ML models analyze historical data, weather patterns, and real-time energy consumption to forecast energy demand with high accuracy. These forecasts allow utilities to optimize energy production, reduce waste, and maintain grid stability.

- Renewable Energy Optimization: AI algorithms analyze weather data to forecast solar and wind energy output. This allows grid operators to balance supply and demand effectively.

- Smart Grid Management: These systems detect and respond to grid imbalances to improve energy distribution and minimize outages. They automate energy flow adjustments while reducing transmission losses.

Noteworthy AI and ML Advancements

- Hitachi Energy’s Nostradamus AI: A cutting-edge energy forecasting solution for the energy industry. It leverages 30 years of energy market data and advanced machine learning models to provide highly accurate forecasts – 20% more precise than some industry targets.

- ABB Ability OPTIMAX 6.4: ABB’s digital energy management system enhances forecasting for energy demand, generation, and pricing while reducing errors in day-ahead and intra-day predictions.

- Bidgely’s Utility AI Platform: It enables utilities to optimize grid management, enhance customer engagement, and adapt to emerging trends like electric vehicle (EV) charging impacts.

Core Technologies Connected to AI and ML

- High-Performance Computing (HPC): Provides the computational power required for processing the vast datasets used in AI and ML models. For example, NVIDIA’s graphics processing units (GPUs) are widely used in AI applications.

- Big Data Platforms: Enable data collection, storage, and analysis for building predictive and prescriptive models. They are critical for managing and processing enormous amounts of structured and unstructured data.

- Neural Network Architectures: Convolutional neural networks (CNNs), recurrent neural networks (RNNs), and transformers enable AI systems to detect anomalies, forecast renewable energy generation, and optimize energy trading strategies.

- Cloud Computing: Provides the scalable infrastructure needed to train, deploy, and manage AI and ML models. Cloud platforms like AWS and Microsoft Azure offer AI-specific tools like TensorFlow and PyTorch.

Spotlighting an Innovator: Ogre AI

Ogre AI is a UK-based startup that offers an AI-based platform for energy forecasting and management. It provides accurate forecasts and quickly integrates with existing IT infrastructure.

The company recently closed a new investment round of EUR 3 million with VERBUND X Ventures to increase grid efficiency.

2. Internet of Things

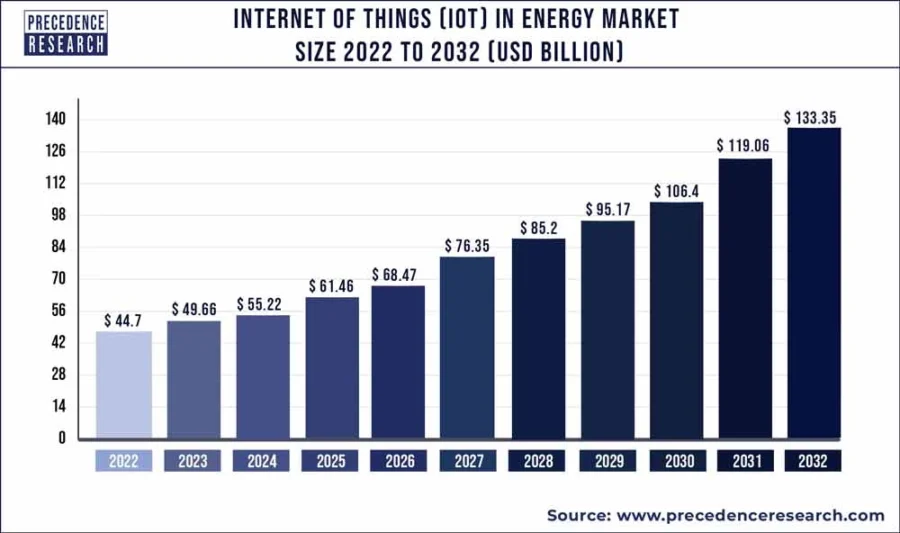

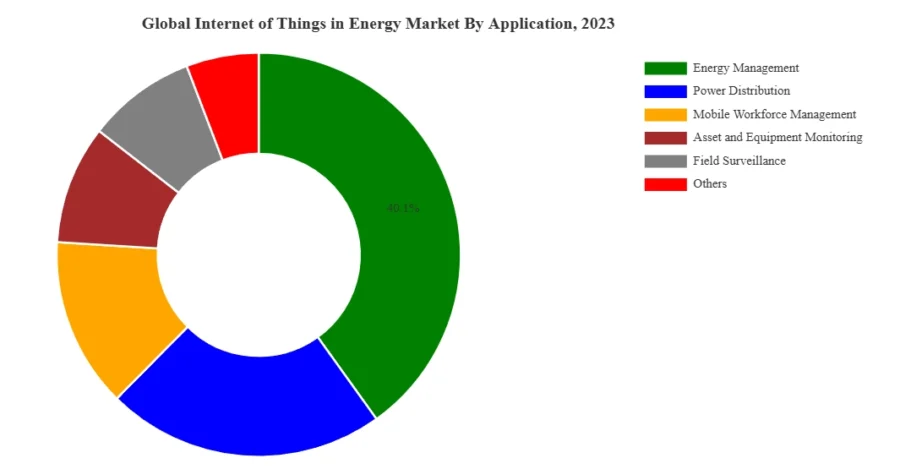

Astute Analytica forecasts that the IoT in energy market will reach USD 285.9 billion by 2032 at a CAGR of 25.1%. North America leads this transformation, with the US IoT energy market projected to reach USD 33.60 billion by 2032 at a CAGR of 11.6%.

Source: Precedence Research

IoT-enabled smart grids are driving significant change and are expected to account for over 30% of total grid infrastructure globally by 2024. These grids leverage IoT technologies to provide real-time monitoring and control – improving load forecasting accuracy by 10-20%.

Source: Astute Analytica

For instance, IoT in energy management systems is projected to reduce electricity consumption by over 1.6 petawatt-hours (PWh) by 2030. This is equivalent to powering more than 150 million homes annually.

With its ability to interconnect devices across vast energy systems, IoT will save the sector approximately USD 1 trillion annually through enhanced operational efficiency and reduced downtime by 2030.

Market Insights & Growth Metrics for Internet of Things

Scale and Magnitude

Based on our data, there are over 56 000 companies globally operating in the IoT sector. They provide innovative solutions across industries like smart cities, healthcare, and manufacturing.

IoT holds the 93rd position in media coverage among emerging technologies in our database. This indicates moderate attention compared to other tech domains.

Despite this, IoT remains a top-three corporate technology priority as companies recognize its potential to drive efficiency and innovation.

Growth Indicators

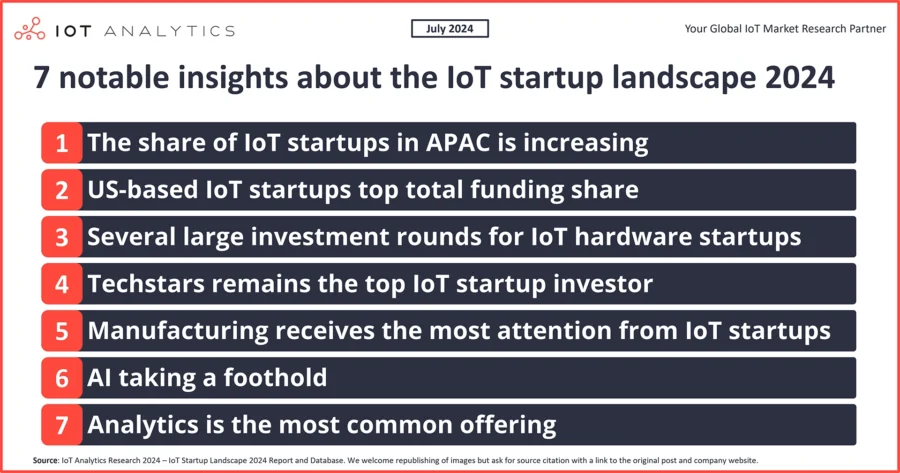

StartUs Insights reports that IoT has experienced a 31.55% annual increase in search interest. This reflects growing curiosity and adoption in both consumer and enterprise settings.

Source: IoT Analytics

Despite the rise in interest, IoT’s five-year funding growth has declined by 67.76%, according to our database. This is potentially due to market saturation in certain areas and a shift in investment focus toward technologies like AI and 5G.

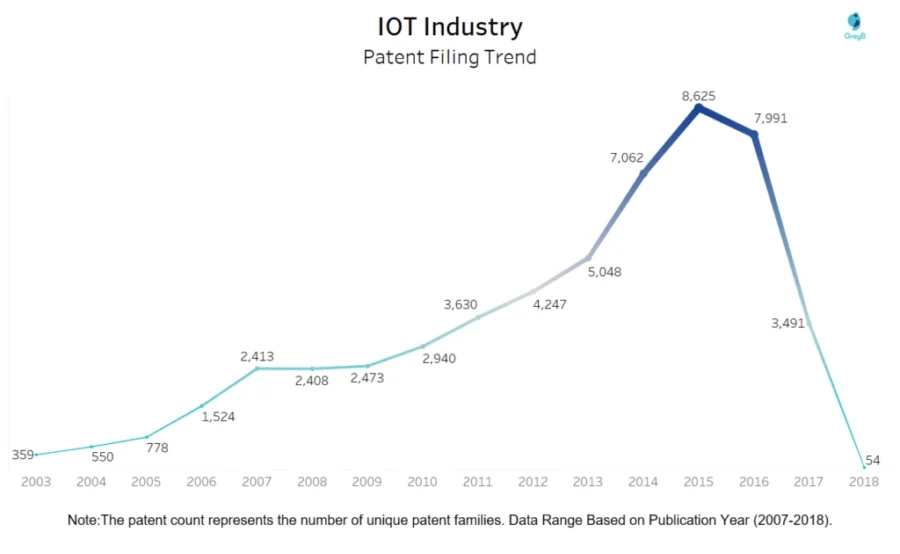

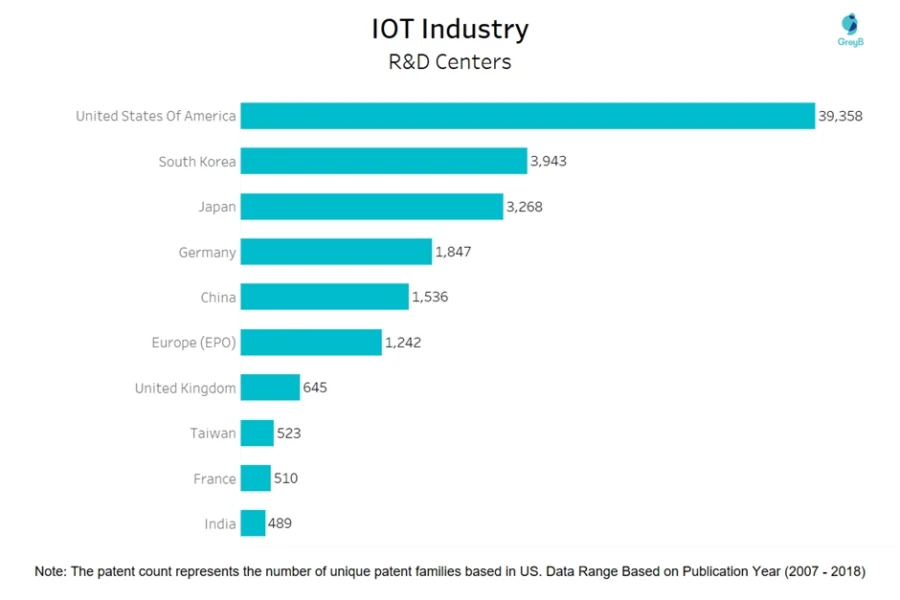

Innovation and Novelty

The IoT sector has seen significant innovation, with over 129 000 patents filed globally based on our data. Leading companies in IoT patent holdings include Samsung Electronics, Huawei Tech, and Ericsson Telefon.

Source: GreyB

StartUs Insights also reports that IoT-focused research has received 7000+ grants. This emphasizes the importance of public and institutional support in driving innovation and adoption.

Research grants, such as those offered by the Internet Society Foundation, fund projects that explore novel methodologies and real-world applications of IoT.

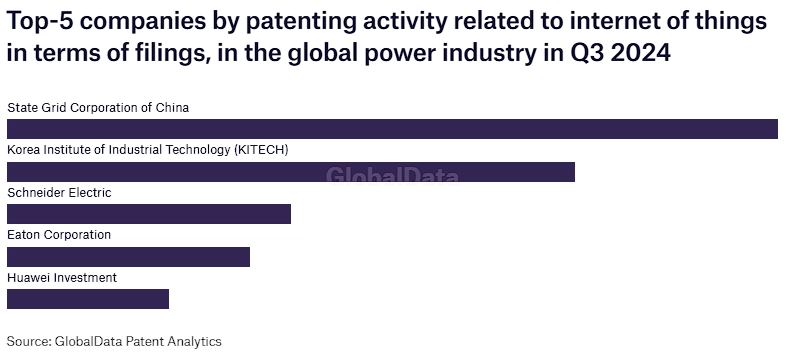

Source: GreyB

In the power industry specifically, China accounted for 36% of IoT-related patent filings in Q3 2024, underscoring its leadership in this sector.

Source: PowerTechnology

Top Use Cases of Internet of Things in Energy

- Smart Grid Management: IoT allows utilities to monitor and control energy flows in real time. IoT-enabled devices collect data on grid performance, energy consumption, and system health for automated adjustments.

- Predictive Maintenance: Sensors to monitor the condition of energy assets, such as transformers, turbines, and pipelines to enable predictive maintenance – reducing equipment downtime by 30-50%.

- Renewable Energy Monitoring: Sensors collect data on weather conditions, energy output, and system performance for operators to maximize energy generation and efficiency.

- Energy Management for Smart Buildings: Connected buildings optimize energy consumption by monitoring usage patterns and automating energy-saving measures. Smart meters, HVAC systems, and lighting systems collect and share data for intelligent control of energy usage.

Noteworthy IoT Advancements

- InfraX and Zoho’s Strategic Partnership: Drives IoT innovation in the UAE. This collaboration focuses on delivering comprehensive IoT solutions for energy management, smart facilities, and intelligent lighting using LoRaWAN and 5G.

- Duke Energy’s Smart Grid and IoT Integration: The company uses smart meters and digital sensors to collect real-time data on energy usage and grid performance. This data is analyzed to optimize energy distribution, improve grid reliability, and enable predictive maintenance.

- Enlog’s AI-Powered Energy Management: Utilizes IoT solutions to monitor and optimize electricity consumption for businesses. Its system, Smi-Fi, connects IoT devices to existing electrical systems to predict demand and reduce electricity consumption by up to 23%.

Core Technologies Connected to the Internet of Things

- Sensors and Actuators: Sensors gather real-time data such as temperature, pressure, humidity, and energy usage, while actuators perform actions based on that data. By 2030, the global sensor market is projected to reach USD 388.69 billion.

- Connectivity Technologies: These include Wi-Fi, Bluetooth, Zigbee, and cellular networks (4G, 5G), as well as LoRaWAN and NB-IoT. For instance, LoRaWAN connects low-power devices over long distances for real-time renewable energy systems and grid monitoring.

- Edge Computing: Processes data locally to reduce latency, improve response times, and minimize bandwidth use. This supports real-time fault detection in power grids and predictive maintenance of energy assets.

- Embedded Systems: Specialized hardware and software solutions that run IoT devices and ensure seamless operation. These systems include microcontrollers, processors, and real-time operating systems (RTOS).

Spotlighting an Innovator: Energiot Devices

Energiot Devices is a Spanish startup that develops a self-powered IoT device for the energy sector. It monitors power transmission assets such as conductors, towers, insulators, substations, and more.

The collected data is analyzed to detect power faults, accidents, and fires. This also enables predictive maintenance and dynamic line rating (DLR).

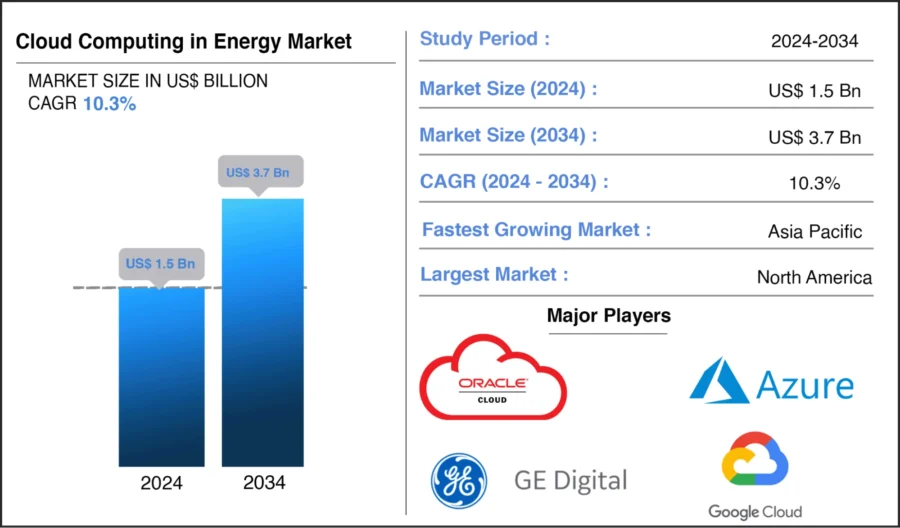

3. Cloud Computing

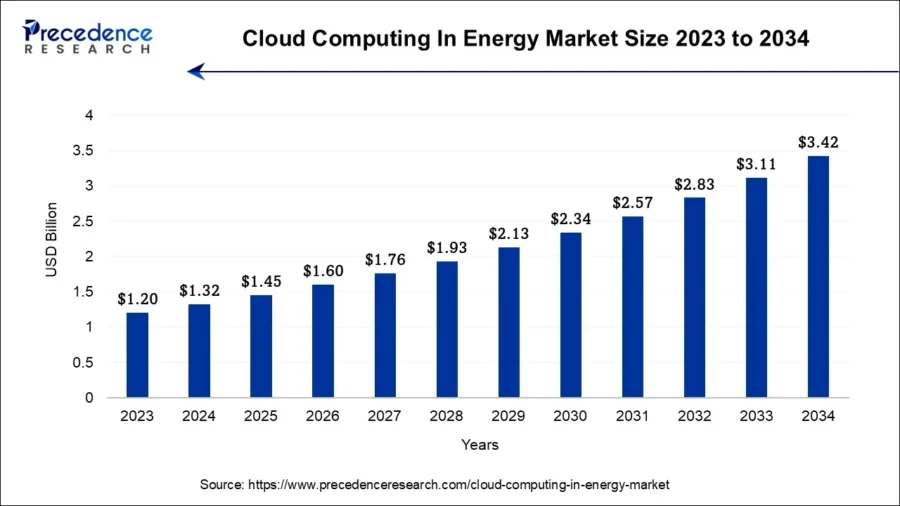

Cloud computing is enabling real-time data management while increasing scalability and operational efficiency. The global cloud computing in energy market is projected to grow from USD 1.5 billion in 2024 to USD 3.7 billion by 2034, at a CAGR of 10.3%.

Source: Prophecy Market Insights

Another estimate places the 2024 market size at USD 1.32 billion, projected to reach USD 3.42 billion by 2034.

Source: Precedence Research

Energy companies spend an above-average USD 37 million annually on cloud services, second only to healthcare.

Leading cloud providers like AWS, Google Cloud, and Microsoft Azure have reported growth rates of 17%, 28%, and 31% in Q1 2024. This is driven by increased AI adoption.

As cloud technologies continue to integrate with IoT and AI, the energy sector will achieve significant cost reductions, enhanced collaboration, and sustainability goals.

Market Insights & Growth Metrics for Cloud Computing

Scale and Magnitude

Based on our database, there are over 105 000 companies globally operating in the cloud computing sector. They offer a range of services including infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS).

Notably, 94% of all companies worldwide utilize cloud computing in their operations, highlighting its pervasive adoption.

Cloud computing holds the 58th position in media coverage among emerging technologies based on our data. This indicates significant attention in both industry and public domains.

Growth Indicators

StartUs Insights reports there has been a 20.05% annual increase in search interest for cloud computing. This reflects growing curiosity and adoption across various sectors.

The energy sector contributes an above-average annual cloud spend of USD 37 million – second only to healthcare. This highlights its significant investment in cloud technologies.

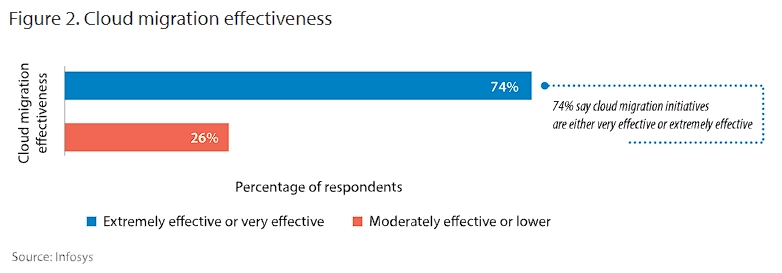

Moreover, energy companies have utilized only 45% of their cloud investments and this leaves a backlog of approximately USD 300 million. This suggests significant room for growth and optimization.

Source: Infosys

Worldwide spending on public cloud services is expected to reach USD 805 billion in 2024 and double by 2028 – with a five-year CAGR of 19.4%.

Over the past five years, funding for cloud computing ventures has grown by 55.18%, according to our data – demonstrating sustained investor confidence in the sector’s potential.

Innovation and Novelty

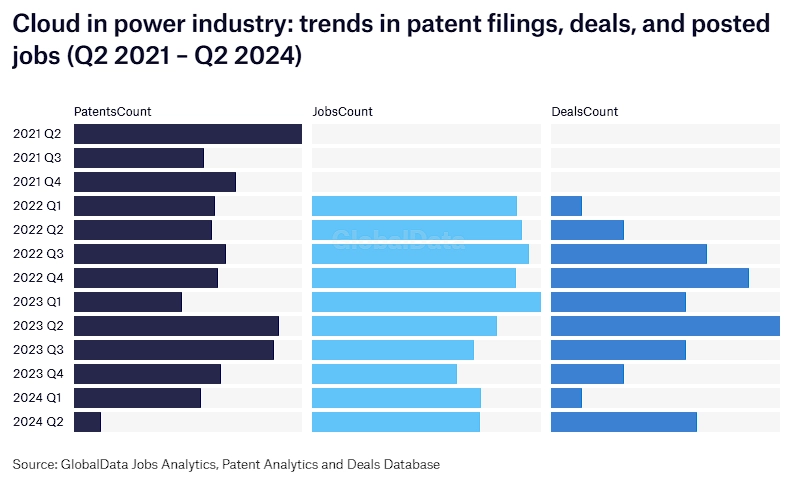

StartUs Insights reports that the cloud computing sector has witnessed substantial innovation with over 77 000 patents filed globally.

Leading companies like IBM have been at the forefront, receiving numerous patents related to cloud technologies.

Source: PowerTechnology

Over the past 18 months alone, IBM secured 1200 patents related to general cloud processes and operations. These patents address critical areas like secure data transfer protocols, encryption methods, and identity management systems.

Cloud computing research has been supported by 6600+ grants based on our data. This emphasizes the importance of public and institutional backing in driving technological advancements.

Top Use Cases of Cloud Computing in Energy

- Smart Grid Management and Optimization: Cloud computing enables real-time monitoring and control of energy flows by aggregating and processing data from smart meters and grid sensors.

- Renewable Energy Integration and Forecasting: Cloud platforms analyze weather data, generation patterns, and grid performance to predict energy output from solar farms and wind turbines.

- Data-Driven Asset Management: Energy companies use cloud-based solutions for asset management to monitor the health and performance of critical infrastructure like power plants, turbines, and transformers.

- Collaboration and Disaster Recovery: Cloud computing enhances collaboration across geographically dispersed teams by enabling centralized data access and real-time communication.

Noteworthy Cloud Computing Advancements

- Microsoft’s Azure Data Manager for Energy: Microsoft has been making significant strides with its Azure Data Manager for Energy. It integrates with industry datasets and applications for energy companies to manage compute-intensive workloads at scale.

- Shell’s Cloud-Based Subsurface Operations: Shell has transitioned from a siloed approach to a cloud-based strategy for its upstream subsurface operations. This enhances collaboration and data management.

- Google Cloud’s partnership with Energyworx: Provides a SaaS platform for utilities and businesses. This platform processes, manages, and analyzes energy data to optimize grid operations and reduce losses during electricity transmission and distribution.

Core Technologies Connected to Cloud Computing

- Virtualization: Enables the creation of multiple virtual environments on a single physical server. This allows energy companies to optimize hardware utilization and scale resources as needed.

- Containerization: Packages applications and their dependencies into lightweight, portable containers. These containers run consistently across different computing environments – Docker and Kubernetes are examples.

- Software-defined Networking (SDN): Separates the network control plane from the physical hardware to enable centralized and programmable network management. SDN dynamically adjusts network resources.

- Distributed Storage Systems: Provide scalable and fault-tolerant data storage essential for cloud computing. These systems split data across multiple servers and regions to ensure high availability and disaster recovery.

Spotlighting an Innovator: FutureOn

FutureOn is a Norwegian company that develops a cloud-based platform, FieldTwin, for integrated energy companies (IECs). It allows businesses to design, visualize, and manage subsea developments and renewable energy projects like offshore wind farms.

The platform fosters collaboration and efficiency by maintaining a consistent digital thread throughout a project’s lifecycle. It also reduces planning time, improves decision-making, and streamlines workflows.

FutureOn recently partnered with Rystad Energy to develop a tool that combines up-to-date cost estimation and live project data for energy developments.

4. Energy Management Systems

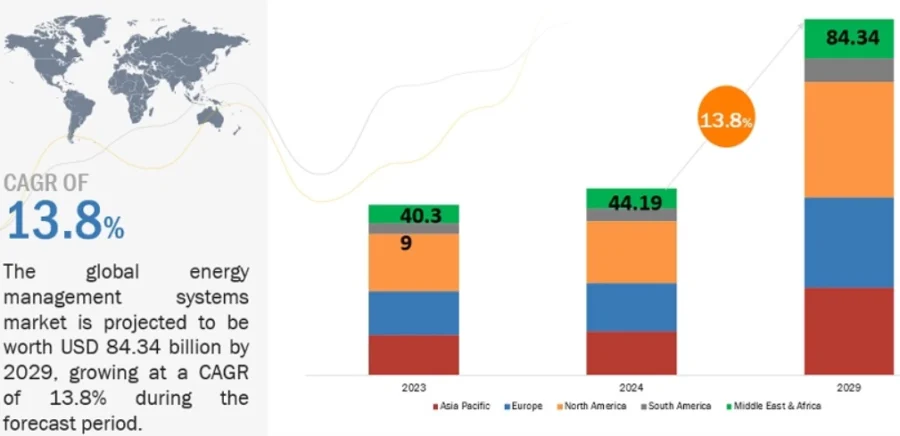

EMS enables businesses and utilities to monitor, control, and optimize energy usage in real time. The EMS market is projected to grow from USD USD 44.19 billion in 2024 to USD 84.34 billion by 2029, at a CAGR of 13.8%.

Source: MarketsandMarkets

The industrial EMS segment alone is expected to expand significantly, growing from USD 34.37 billion in 2024 to USD 76.08 billion by 2034 at a CAGR of 8.3%.

One of the key drivers of EMS adoption is the integration and management of renewable energy. EMS enables real-time balancing of supply and demand for utilities to integrate solar, wind, and other renewable sources into the grid.

AI and machine learning are becoming integral to EMS platforms, enabling real-time anomaly detection, predictive maintenance, and usage optimization.

As sustainability targets become increasingly stringent, EMS adoption is accelerating. By 2030, energy efficiency measures are expected to play a critical role in achieving global energy efficiency goals, including reducing energy-related CO2 emissions by 40%.

Market Insights & Growth Metrics for Energy Management Systems

Scale and Magnitude

Approximately 5700+ companies globally specialize in providing EMS solutions based on our data. They serve industries such as manufacturing, energy, and utilities.

Prominent players include Siemens, Schneider Electric, Honeywell , ABB, and General Electric.

StartUs Insights reports that EMS holds the 505th position in media coverage among emerging technologies. This indicates a niche yet crucial role in the broader technological landscape.

Over 60% of large US commercial buildings now utilize some form of EMS technology to manage HVAC systems, lighting, and refrigeration. They provide significant cost savings while reducing environmental impact.

Growth Indicators

Over the past five years, funding for EMS ventures has increased by approximately 591.63% based on our data. This reflects growing investor confidence in energy optimization technologies.

Source: gridX

Innovation and Novelty

Based on our data, the EMS sector has seen substantial innovation – with over 88 800 patents filed globally. This indicates a strong focus on developing advanced energy management solutions.

Studies published in Energies highlight the integration of machine learning into EMS frameworks to enhance stability, efficiency, and reliability in energy flow management.

StartUs Insights also reports that research and development in EMS have been supported by 740+ grants. This underscores the importance of public and institutional backing in advancing energy management technologies.

Top Use Cases of Energy Management Systems

- Real-Time Energy Optimization: EMS enables real-time tracking of energy consumption and generation in facilities and grids to optimize energy flows and minimize waste.

- Demand Response Management: Dynamically adjusts energy consumption based on grid conditions and pricing signals. Utilities use EMS to reduce peak demand, lower operational costs, and improve grid stability.

- Renewable Energy Integration: EMS platforms manage variability by forecasting renewable energy output and balancing it with demand in real time.

- Carbon Footprint & Sustainability Management: EMS platforms allow organizations to monitor and reduce their carbon footprint by tracking energy usage patterns and emissions to align with sustainability goals.

Noteworthy Energy Management System Advancements

- GreenPowerMonitor’s EMS for Renewable Power Plants: This DNV company launched an advanced EMS for renewable power plants. It enhances operational efficiency by automating power plant control and optimizing power output based on weather forecasts.

- Siemens’ Building Energy Management Systems (BEMS): They leverage IoT devices and connectivity to optimize energy consumption in smart buildings. Siemens’ BEMS provides real-time data to improve energy efficiency and integrate renewable energy sources.

- Facilio’s AI-Led Energy Management Platform: Optimizes property operations and maintenance in real time. It integrates tools for access control, HVAC management, and more into a centralized system.

Core Technologies Connected to Energy Management Systems

- Supervisory Control and Data Acquisition (SCADA): Provides real-time monitoring and control of energy infrastructure. These systems collect data from sensors and connected devices to make informed decisions.

- IoT: Connects devices and systems within an EMS for seamless communication and data exchange. IoT-enabled sensors monitor energy consumption, equipment performance, and environmental conditions.

- AI and ML: Enhance EMS by analyzing large volumes of data to provide actionable insights and predictive capabilities. AI algorithms optimize energy usage by forecasting demand and identifying inefficiencies.

- Cloud and Edge Computing: Offers the computational power and storage required for modern EMS to function effectively. Cloud platforms allow centralized data collection while edge computing reduces latency.

Spotlighting an Innovator: Companion.energy

Companion.energy is a Belgian startup that provides an energy management platform to optimize energy usage for industrial companies and electric utilities. It utilizes predictive models and machine learning to deliver real-time insights into energy consumption, costs, and emissions.

For electric utilities, the platform facilitates collaborative forecasting and flexible asset management. This reduces portfolio imbalances and aligns energy consumption with market conditions.

The company recently raised EUR 2.1 million from international investors – including Ubermorgen Ventures and Cavalry Ventures.

5. Cybersecurity

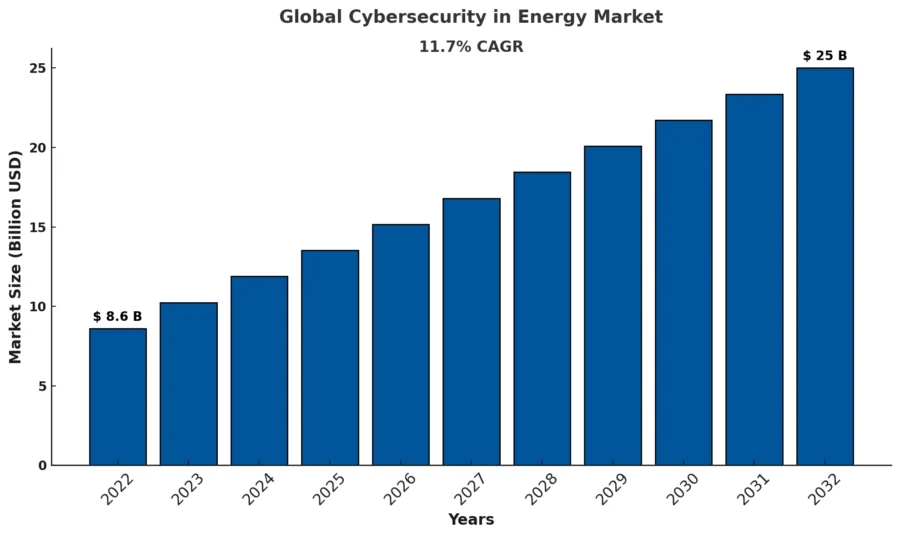

The cybersecurity market for the energy sector is projected to reach USD 25 billion by 2032, at a CAGR of 11.7%. This growth is driven by the rapid adoption of connected technologies like IoT and smart grids, which also increase vulnerability.

Source: Allied Market Research

By 2024, over 65% of AI platforms in the energy industry are expected to include advanced cybersecurity features to safeguard critical systems.

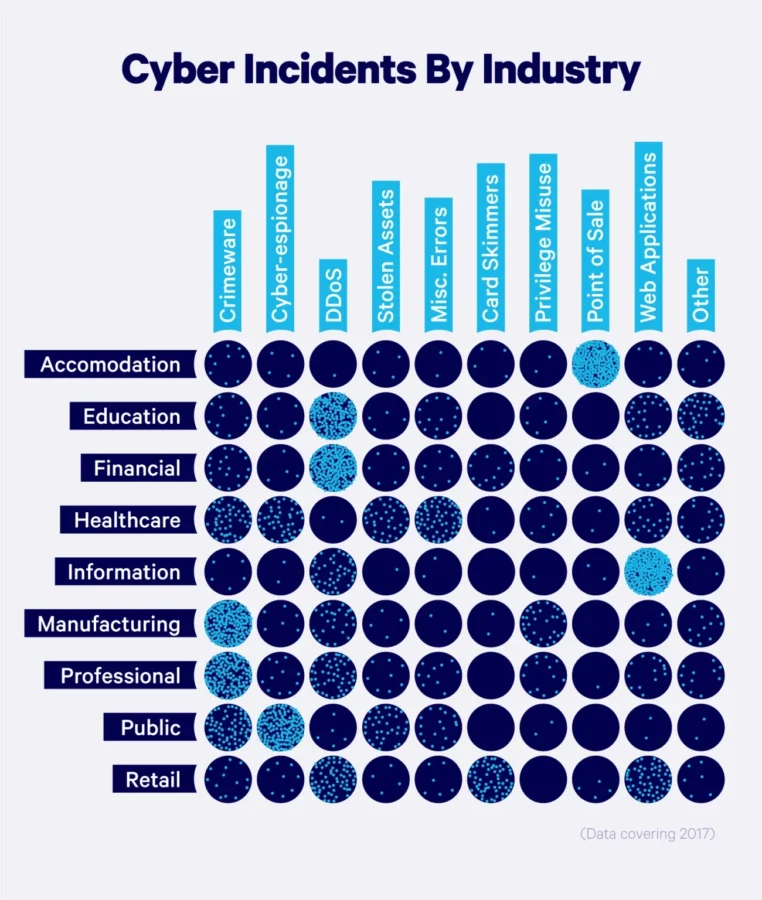

The energy sector accounted for 11% of all cyber incidents in 2023, nearly double the figure reported in 2019. This highlights the growing attractiveness of energy infrastructure as a target for cybercriminals.

Source: Embroker

Financially, the risks are severe as the average cost of a data breach in 2023 reached USD 4.45 million. While 81% of US energy companies earned “A” or “B” cybersecurity ratings, the remaining 19% with weaker scores pose significant risks to supply chains.

IBM also reports that cybercrime is expected to cost the global economy USD 10.5 trillion annually by 2025.

Governments are also stepping in, with the US Federal government pledging USD 45 million to improve cybersecurity for clean energy technologies and supply chains.

Market Insights & Growth Metrics for Cybersecurity

Scale and Magnitude

Our data shows there are over 15 000 cybersecurity companies worldwide.

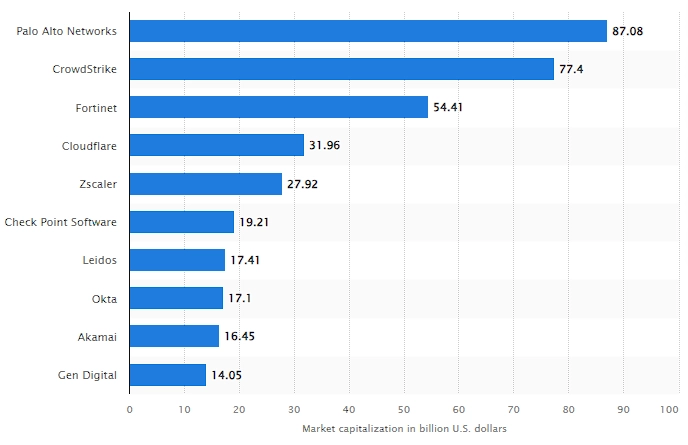

Palo Alto Networks, for example, is a market leader with a valuation of over USD 87 billion in 2024. It offers firewalls and endpoint detection solutions for critical infrastructure.

Leading cybersecurity companies worldwide in 2024, by market capitalization (in billion U.S. dollars)

Source: Statista

Cybersecurity holds the 26th position in media coverage among emerging technologies based on our data. This reflects its prominence in public discourse and the critical importance of digital security in today’s interconnected world.

Growth Indicators

There has been a 68.09% annual increase in search interest for cybersecurity based on our data. This indicates heightened awareness and concern over digital threats among individuals and organizations.

The US Department of Homeland Security (DHS) also allocated USD 279.9 million in 2024 under its State and Local Cybersecurity Grant Program. The initiative focuses on enabling governments to secure critical infrastructure.

Further, the European Commission increased cybersecurity research funding from EUR 60.4 million in 2024 to EUR 90.5 million planned for 2025.

Based on our data, funding for cybersecurity ventures has grown by approximately 24.99% over the past five years. This trend demonstrates sustained investor confidence in the sector’s potential to address escalating cyber threats.

Innovation and Novelty

The cybersecurity sector has witnessed substantial innovation, with over 151 000 patents filed globally based on our database. Consequently, this indicates a strong focus on developing advanced security solutions.

Research and development in cybersecurity have also been supported by over 10 100 grants. This underscores the importance of public and institutional backing.

For instance, Canada’s National Cybersecurity Consortium (NCC) committed USD 11.2 million toward projects protecting critical infrastructure using advanced technologies.

Top Use Cases of Cybersecurity in Energy

- Critical Infrastructure Protection: Cybersecurity solutions protect power grids, pipelines, and refineries by monitoring networks in real time to detect and prevent unauthorized access.

- Secure Smart Grids & IoT Devices: As energy systems become more interconnected, the growing use of IoT devices in smart grids introduces vulnerabilities. Cybersecurity frameworks secure devices by encrypting data transmission and implementing multi-factor authentication (MFA).

- Renewable Energy System Protection: As decentralized renewable energy systems rely heavily on digital technologies, cybersecurity solutions protect data and prevent unauthorized control.

- Regulatory Compliance & Risk Management: Energy companies must comply with strict cybersecurity regulations to protect critical infrastructure.

Noteworthy Cybersecurity Advancements

- Collaboration between SLB and Palo Alto Networks: Integration of AI-powered cybersecurity platforms including Prisma SASE, Prisma Cloud, and Cortex XSIAM. This collaboration provides comprehensive security solutions.

- Clean Energy Cybersecurity Accelerator (CECA): Comprehensive asset detection, advanced passive discovery, protocol conformant monitoring, rapid change detection. It enhances visibility and risk management for operational technology in the energy sector.

- DOE SolarSnitch Technology: Uses inspection tools to analyze cyber and physical data in PV smart inverters and employs custom machine learning algorithms to detect potential cyber-attacks.

Core Technologies Connected to Cybersecurity

- Encryption and Cryptographic Protocols: Transport layer security (TLS) and advanced encryption standards (AES) protect communication between systems, devices, and users. In the energy sector, encryption safeguards critical data from smart grids, SCADA systems, and IoT devices.

- Threat Intelligence Platforms (TIPs): Collect and analyze data on emerging cyber threats to proactively defend against potential attacks. These platforms use data from global cyber incidents to identify patterns and vulnerabilities, helping energy companies prepare for and mitigate threats.

- Intrusion Detection & Prevention Systems (IDPS): Monitor and analyze network traffic in real time to detect and block malicious activities. These systems are crucial for securing interconnected energy infrastructure.

- MFA and Zero Trust Architecture (ZTA): These frameworks ensure that only authorized users access critical infrastructure. MFA verifies user identities through biometrics and one-time passwords, while ZTA continuously validates access permissions.

Spotlighting an Innovator: Nozomi Networks

Nozomi Networks is a US-based startup that develops cybersecurity and operational visibility solutions for the oil and gas industry. The company’s platform delivers comprehensive OT and IoT asset management. This enables organizations to identify and mitigate critical cyber and operational risks effectively.

The platform features AI-powered threat analysis and continuous network monitoring. These features empower organizations to automate asset discovery, inventory management, and threat response while maintaining compliance.

Nozomi Networks also partnered with Advens to deliver advanced cybersecurity services for industrial and critical infrastructure environments. This collaboration addresses the growing demand for managed security services that meet the unique needs of OT and IoT systems.

6. Blockchain

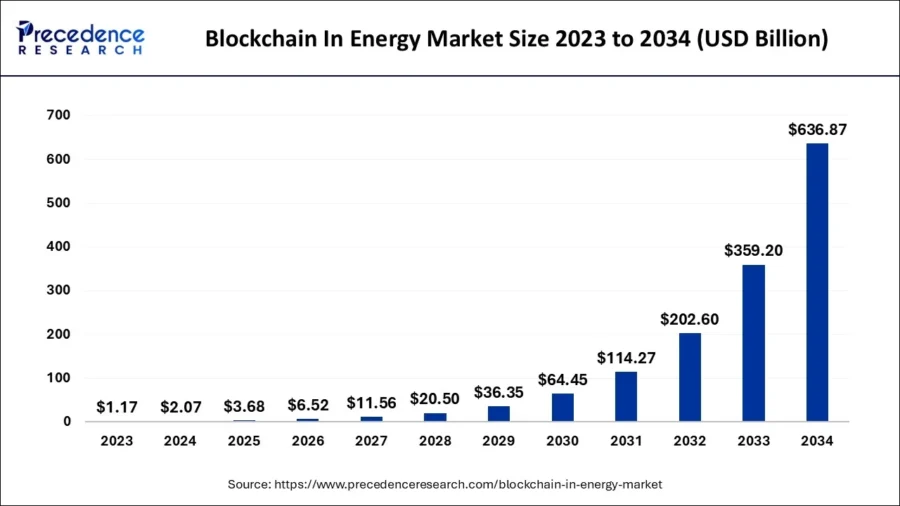

Blockchain is enabling secure, transparent, and decentralized energy management in the energy sector. From USD 2.07 billion in 2024 to USD 636.87 billion by 2034, blockchain technology in the energy market is projected to expand at a CAGR of 77.34%.

Source: Precedence Research

Another estimate values the market at USD 2.43 billion in 2024, reaching USD 155.86 billion by 2031, with a CAGR of 75.19%.

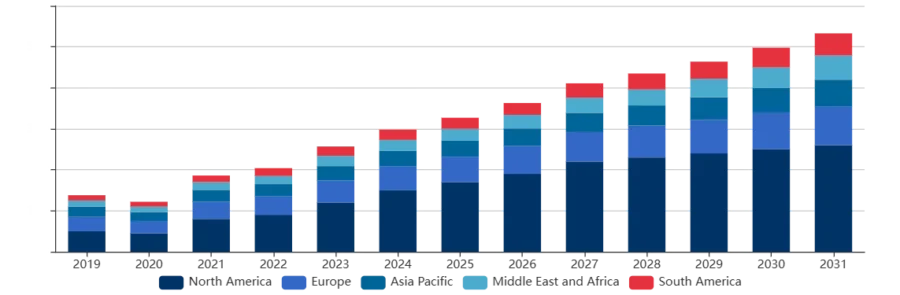

Geographically, North America dominated the blockchain energy market in 2024 – accounting for around 43% of global revenue.

Source: Cognitive Market Research

Meanwhile, the Asia-Pacific region is expected to be the fastest-growing blockchain energy market. This is fueled by rapid economic growth and rising energy demand in China and India.

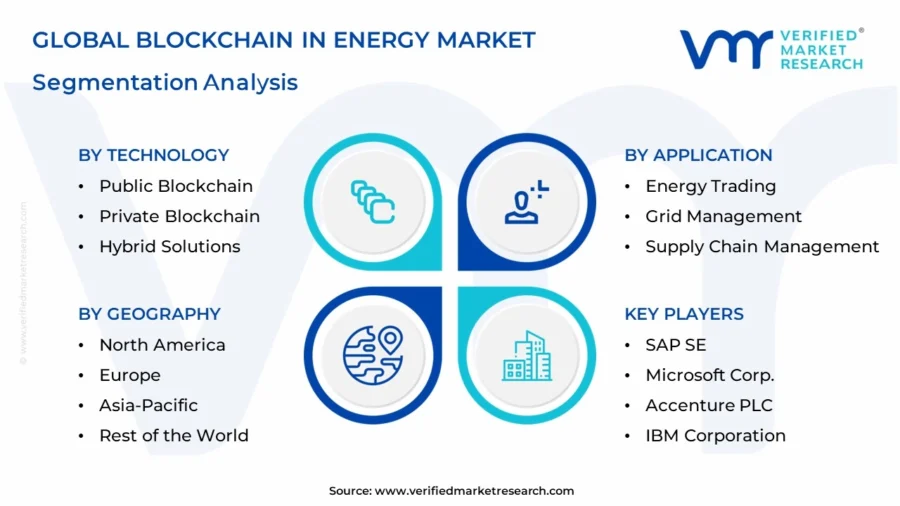

Beyond trading, blockchain bolsters cybersecurity in energy systems by preventing data tampering and unauthorized access. It secures communication between IoT devices in smart grids and improves supply chain transparency.

Source: Verified Market Research

By 2034, blockchain will drive significant cost savings, operational efficiencies, and sustainability. As the industry transitions toward decentralized energy systems, blockchain will create secure, transparent, and resilient energy ecosystems.

Market Insights & Growth Metrics for Blockchain

Scale and Magnitude

Blockchain technology has grown significantly with 42 100+ companies currently operating in the domain based on our data. These companies are focused on various industries, including finance, supply chain, healthcare, and energy.

StartUs Insights reports that blockchain ranks 111th in media coverage among 20K+ emerging technologies despite its broad applications. This reflects moderate attention compared to others like AI and cybersecurity.

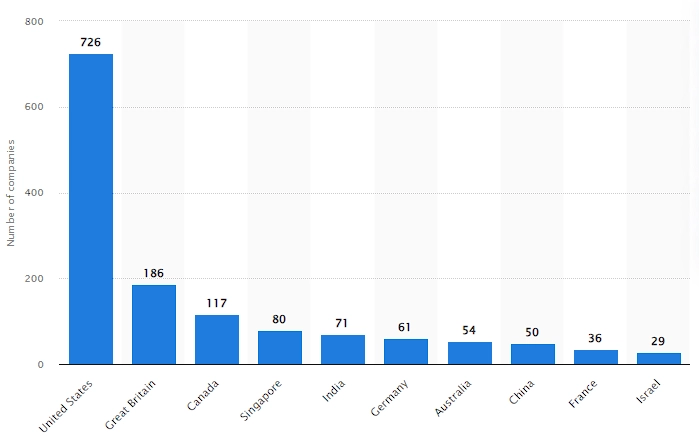

As of 2019, the US had 726 blockchain-focused companies.

Number of blockchain companies worldwide as of April 2019, by country

Source: Statista

Global blockchain spending is also projected to grow at a 48% CAGR, reaching USD 19 billion by 2024. This includes significant contributions from industries like banking and manufacturing.

Growth Indicators

Based on our analysis, blockchain demonstrates remarkable growth with a 78.23% annual rise in search interest. This reflects increasing adoption across industries.

Over the past five years, blockchain has achieved a 97.41% funding growth based on our data. This is fueled by cryptocurrency investments, decentralized finance (DeFi), and enterprise blockchain applications.

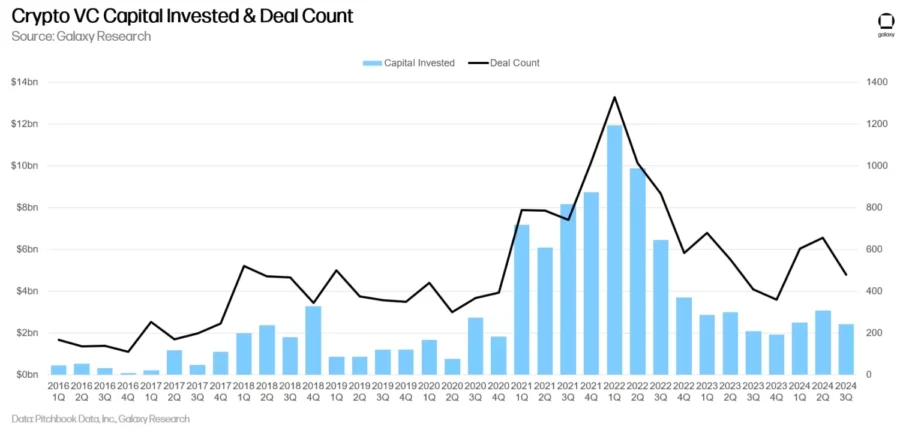

The total funding raised by blockchain startups in 2024 was reported at USD 4.78 billion by mid-year – primarily distributed across Seed and Series A, B, and C.

In Q3 2024 alone, USD 2.4 billion was invested across 478 deals – marking a 20% decline quarter-over-quarter (QoQ). This suggests a slowdown compared to earlier quarters but still reflects robust interest in blockchain ventures.

Source: Galaxy Research

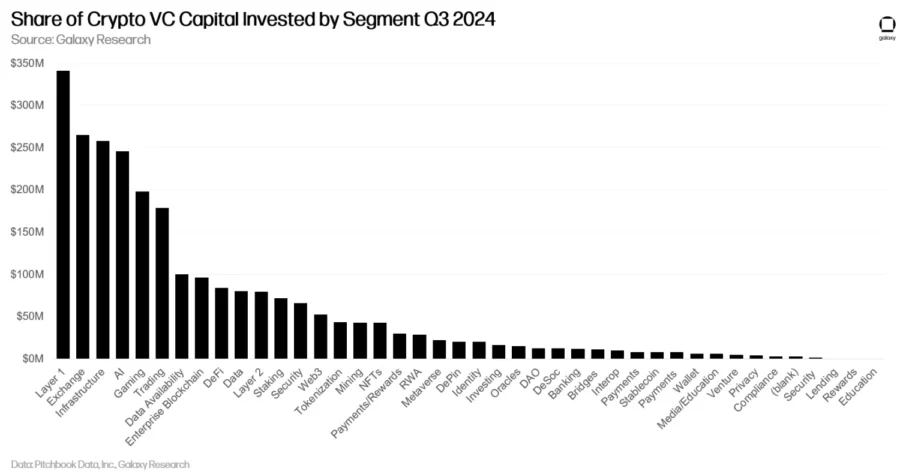

Web3/NFT/DAO/Metaverse/Gaming projects experienced a decline in funding (-39% QoQ). This indicates shifting priorities among investors.

Source: Galaxy Research

Innovation and Novelty

As per our data, blockchain remains a highly innovative domain with 86 100+ patents filed globally. This highlights advances in cryptographic protocols, distributed ledgers, and consensus mechanisms.

Blockchain-related research is also supported by 2120+ grants, showcasing institutional and governmental support for developing decentralized solutions.

Top Use Cases of Blockchain in Energy

- Peer-to-Peer (P2P) Energy Trading: Allows consumers and producers to buy and sell surplus energy without intermediaries. Smart contracts facilitate automatic transactions with predefined conditions, improving trust.

- Renewable Energy Certification (REC) & Carbon Credit Trading: This technology ensures transparency and trust in the issuance and trading of RECs and carbon credits. The technology creates immutable records of energy generation and consumption.

- Grid Management & Decentralized Energy Systems: Blockchain enhances grid management by securely recording and tracking energy flows across decentralized grids. It ensures that energy produced by distributed sources is efficiently integrated into the grid.

- Enhanced IoT Security: As IoT devices proliferate in energy systems, blockchain provides a secure foundation for managing and protecting connected devices. Blockchain’s decentralized and encrypted nature ensures data integrity and prevents unauthorized access.

Noteworthy Blockchain Advancements

- Engie’s The Energy Origin (TEO): A blockchain-based platform that ensures transparency and traceability in renewable energy usage. TEO leverages blockchain to track the origin of renewable energy and provide customers with verifiable data on their energy consumption.

- Blockchain for Energy (B4E) Consortium’s B4ECarbon: Launched by leading energy companies in 2024, the B4ECarbon platform integrates AI and IoT to enhance emissions tracking, reporting, and reduction strategies.

- Power Ledger’s Energy Trading Platform: Enables P2P energy trading among consumers and producers of renewable energy. By promoting decentralized energy markets, Power Ledger enhances grid efficiency and reduces costs for consumers.

Core Technologies Connected to Blockchain

- Cryptographic Algorithms: Create unique digital signatures that make tampering nearly impossible. In the energy sector, cryptographic algorithms secure transactions in peer-to-peer energy trading platforms.

- Distributed Ledger Technology (DLT): A framework that enables blockchain to operate across a decentralized network of nodes. Each node maintains a synchronized copy of the ledger to ensure transparency and eliminate intermediaries.

- Smart Contracts: Programmable protocols on the blockchain that automatically execute transactions when predefined conditions are met. These contracts are vital for automating processes like energy trading, grid balancing, and payments.

- Consensus Mechanisms: Enable blockchain networks to validate transactions without central authorities. Proof of Work (PoW) and Proof of Stake (PoS) are popular examples. These mechanisms ensure that all nodes in the network agree on the accuracy of the ledger, maintaining its integrity.

Spotlighting an Innovator: Energy Web

Energy Web is a Swiss company that accelerates the decarbonization of energy systems through blockchain and Web3 technologies. Its open-source Energy Web Chain and decentralized marketplace allow energy companies, grid operators, and other stakeholders to integrate renewable energy sources, enhance grid flexibility, and streamline sustainability efforts.

Recently, the Energy Web Token reported a market capitalization of USD 108.74 million, with a trading price of USD 1.85 per token and a circulating supply of 58.76M+ coins.

7. Augmented and Virtual Reality

The global AR market is projected to grow from USD 93.67 billion in 2024 to USD 1.86 trillion by 2032, with a remarkable CAGR of 45.4%.

Source: Fortune Business Insights

Virtual reality is experiencing parallel growth, with its market size expected to expand at a CAGR of 27.5%, reaching USD 123.06 billion by 2032.

Source: Fortune Business Insights

In the energy sector, AR and VR are proving essential for workforce training and enable immersive simulations in a risk-free environment. For instance, BP implemented VR training to improve critical safety behaviors and employee performance. The initiative led to an 84% improvement in safety-related behavior on the job.

Companies leveraging AR and VR for training and operations have reported productivity gains of up to 30% for overall manufacturing production.

As the AR and VR markets grow exponentially, these technologies are set to revolutionize the energy sector by saving costs – improving safety and operational efficiency.

Market Insights & Growth Metrics for AR and VR

Scale and Magnitude

Based on our data, the AR and VR sectors are steadily growing with 21 800+ and 28 400+ companies globally. Their applications span industries like healthcare, manufacturing, retail, and education.

By the end of 2024, there were an estimated USD 1.73 billion AR user devices worldwide. This reflects the technology’s widespread adoption across consumer and enterprise markets.

Despite their transformative potential, AR ranks 169th and VR ranks 140th in media coverage based on our database. This indicates relatively lower attention compared to other emerging technologies.

Growth Indicators

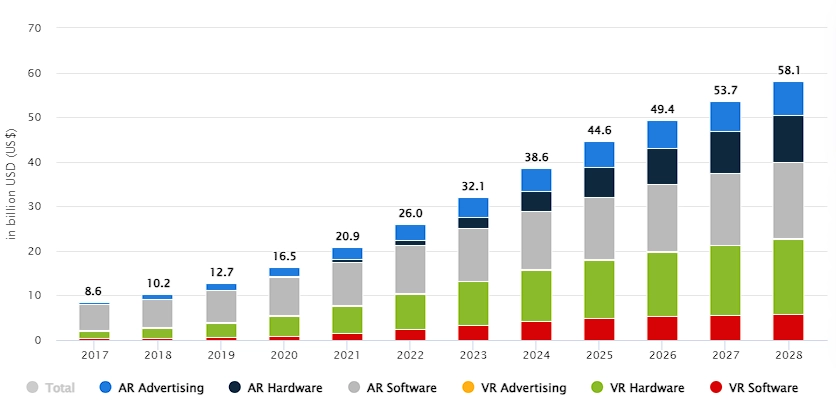

StartUs Insights reports that AR shows consistent growth with an annual search interest rise of 17.8%. This reflects increasing interest in its applications across sectors. VR also demonstrates strong growth with a 19.62% annual rise in search interest.

Revenue by Market

Source: Statista

Over the past five years, AR has experienced a 76.2% growth in funding fueled by investments in hardware and enterprise solutions. VR funding has also grown by 90.33% over the same period.

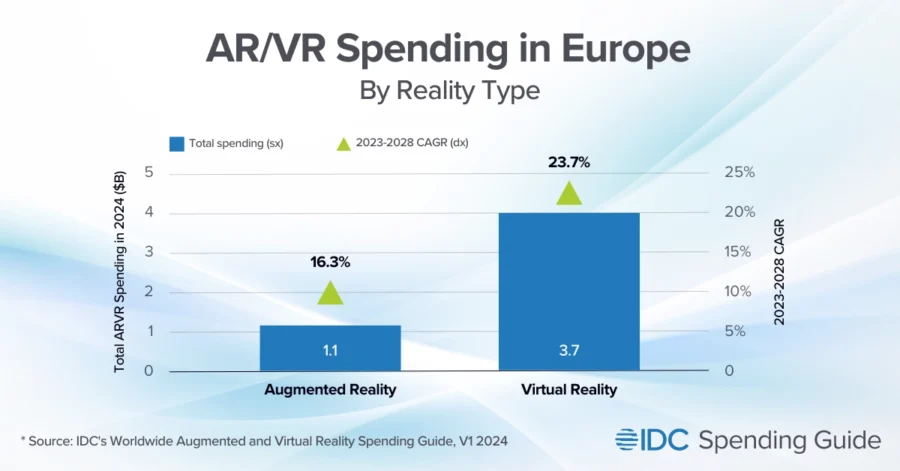

European spending on AR/VR reached USD 4.8 billion in 2024 and is expected to grow at a CAGR of 21.9%, reaching USD 10.2 billion by 2028.

Source: IDC

Innovation and Novelty

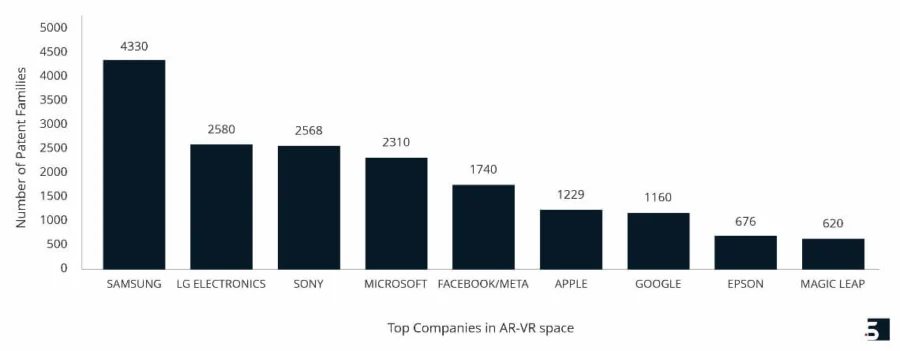

The AR sector is a hub of innovation with 67 200+ patents filed globally. Additionally, AR-related research is supported by 4360+ grants. This indicates strong public and institutional interest in advancing AR technologies.

On the other hand, VR is leading in innovation with 130 000+ patents and 3640+ grants. They further fuel development in applications like immersive training and medical simulations.

Source: Sagacious IP

In 2021 alone, 2735 AR/VR patents were issued globally in Q3 – China leading with 1213 patents and the US following with 780 patents.

For example, Qualcomm’s Snapdragon XR2 Gen 2 chip provides smoother graphics and better performance for next-generation VR headsets.

Top Use Cases of AR and VR in Energy

- Workforce Training and Simulation: Workers use AR and VR to practice handling emergencies, maintaining equipment, and navigating complex systems, like oil rigs or power plants, without exposure to actual hazards.

- Remote Maintenance and Troubleshooting: AR-powered smart glasses allow technicians to perform remote maintenance with real-time guidance from experts located elsewhere. AR overlays further provide step-by-step instructions and visualize critical system data during repairs.

- Infrastructure Design and Planning: VR facilitates infrastructure design and planning by enabling engineers to visualize energy systems in 3D before construction begins. This enables them to identify potential design flaws and improve collaboration among teams.

- Safety and Risk Management: AR and VR simulate potential risks and teach workers how to respond effectively to enhance safety in hazardous environments. AR further provides real-time hazard warnings and overlay safety instructions on equipment during operations to reduce accidents.

Noteworthy AR and VR Advancements

- Avangrid’s VR Training: The company offers VR training to wind and solar technicians. This initiative, launched at their National Training Center in Oregon, uses immersive VR modules to simulate real-world scenarios.

- Siemens Energy’s AR-based Maintenance Solution: Improves maintenance processes in energy plants. Technicians equipped with AR glasses receive real-time visual instructions and access to critical system data directly from the machinery to reduce downtime and improve accuracy.

- NextEra Energy’s AR-powered Inspections: The company uses AR to conduct inspections and maintenance of its infrastructure, such as wind turbines and other renewable energy installations. Technicians use AR to view diagrams and essential operational data in 3D right in their line of sight.

Core Technologies Connected to AR and VR

- Spatial Computing: Enables the integration of digital and physical environments through advanced sensors, cameras, and algorithms. It utilizes spatial mapping to create accurate 3D models of the physical world for AR overlays to align seamlessly with real-world objects.

- AI and ML: AR/VR applications use these to adapt and respond intelligently to user interactions and real-time data. In AR, AI enhances object recognition and contextual overlays, while ML algorithms simulate realistic scenarios for VR.

- High-Performance GPUs: Process vast amounts of graphical data to create smooth, lifelike visuals in real time. In the energy sector, GPUs are crucial for creating VR environments used in design planning and operational simulations, such as visualizing the layout of power plants or wind farms.

- 5G and Low-Latency Connectivity: Enable seamless AR/VR experiences, particularly in remote operations and real-time applications. With 5G’s ultra-low latency, AR/VR devices process and transmit data in real time.

Spotlighting an Innovator: VIRNECT

VIRNECT is a US-based company that offers extended reality (XR) solutions for the power and utility industries. Its Twin platform creates digital replicas of facilities, equipment, and processes to enable real-time monitoring, scenario modeling, and forecasting.

The View platform allows operators to access customized XR content on devices like tablets, phones, or computers. Further, the company develops platforms for creating XR content.

These products optimize operations, reduce capital expenditures, and improve recovery rates while enhancing collaboration.

8. Connectivity Technologies

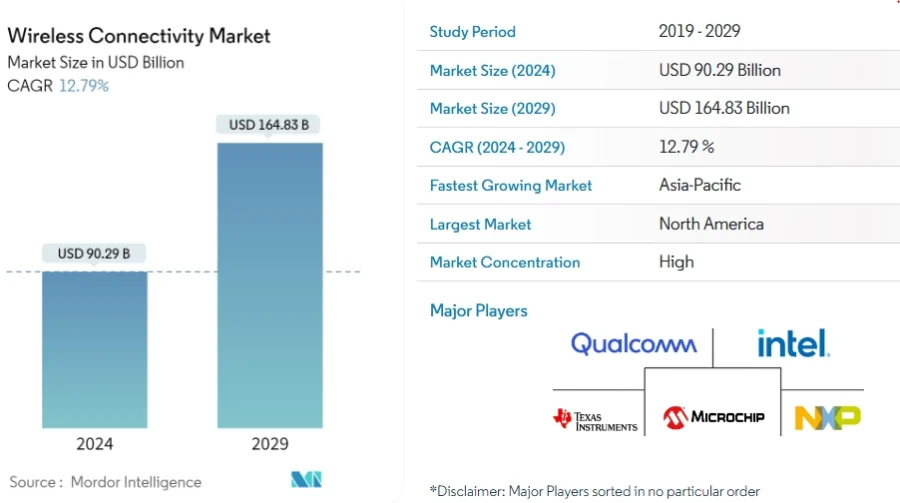

The global wireless connectivity market, encompassing 5G, long-range wide area networks (LoRaWAN), and more, is projected to grow from USD 90.29 billion in 2024 to USD 164.83 billion by 2029, at a CAGR of 12.79%.

Source: Mordor Intelligence

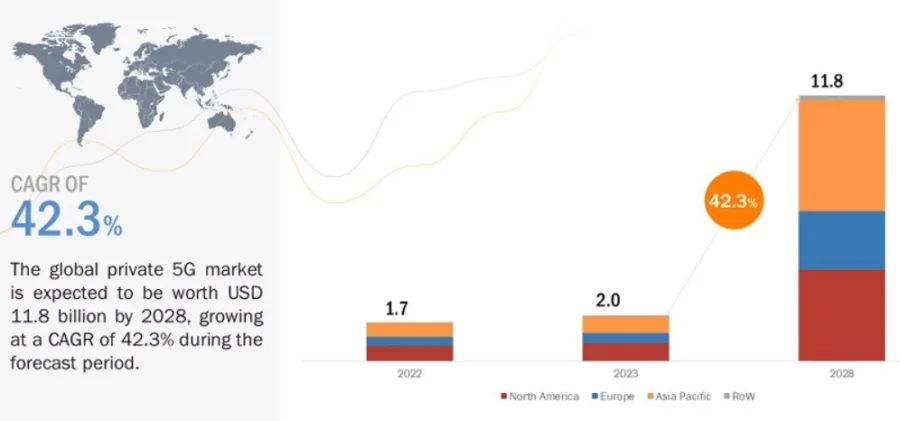

The rise of private 5G networks is particularly significant, as they enable real-time data processing for IoT applications in energy. The private 5G network market is expected to surpass USD 11.8 billion by 2028, growing at a CAGR of 42.3%.

Source: MarketsandMarkets

Investments in 5G for grid upgrades are substantial, with EUR 1.5 billion annually earmarked for the Swedish market alone, including EUR 150 million for Information and Communication Technology (ICT).

Globally, the digitalization revenues enabled by 5G are expected to reach USD 1.3 trillion by 2026. Among this, the energy and utilities sector is projected to account for approximately 19% of the total or USD 250 billion.

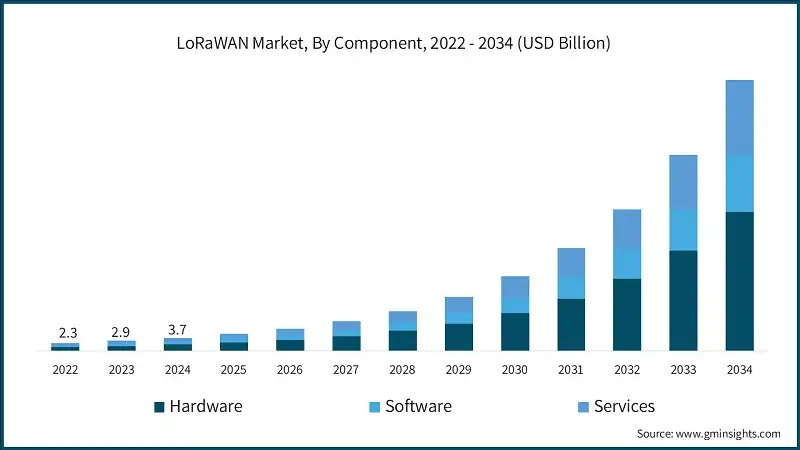

Low-power wide area networks (LPWAN) technologies, such as LoRa and LoRaWAN, are critical for connecting low-power IoT devices in decentralized grids and remote assets.

The LoRa and LoRaWAN IoT market is valued at USD 5.7 billion in 2024 and is projected to grow to USD 119.5 billion by 2034, at a CAGR of 35.6%. LoRaWAN alone was valued at USD 3.7 billion in 2024 and is expected to grow at a CAGR of 41.1% from 2025 to 2034.

Source: Global Market Insights

Countries like South Korea are spearheading connectivity advancements, announcing an investment of over USD 130 million in 5G and 6G technologies in 2024 to secure leadership in communication growth engines.

Market Insights & Growth Metrics for Connectivity Technologies

Scale and Magnitude

StartUs Insights reports that the 5G sector encompasses 9370+ companies globally. Despite its transformative potential, 5G ranks 316th in media coverage.

This suggests it is gaining attention but has not yet dominated conversations relative to other emerging technologies.

Source: Stellar Market Research

Asia Pacific led 2023 with over 40% market share, driven by aggressive rollouts in China, Japan, and South Korea.

For example, the UAE-based ADNOC is building the largest private 5G network in the energy industry – spanning 11 000 square kilometers. This network enables real-time data transmission from over 12 000 wells and pipelines.

LoRaWAN, a key enabler of IoT connectivity, has a smaller footprint with only 1000+ companies specializing in its applications. LoRaWAN also ranks 1985th in media coverage based on our data – reflecting niche but growing interest.

North America holds over 30% market share – primarily driven by IoT applications in smart utilities and industrial automation.

Growth Indicators

Interest in 5G is skyrocketing with a remarkable 114.47% annual rise in search interest based on our analysis.

However, the sector sees a 22.36% decline in five-year funding growth, potentially due to slowed investment cycles after initial large-scale deployments.

Funding for 5G ventures has declined by 22.36%, likely due to slowed investment cycles after initial large-scale deployments.

LoRaWAN has also experienced a 69.28% annual rise in search interest. However, five-year funding growth has declined by 44.28% – reflecting challenges in scaling adoption beyond niche applications.

TEKTELIC’s LoRaWAN-based energy management solution achieved power savings of up to 90 000 kWh per year. This translates into annual savings of approximately EUR 38 000 for a single tool restructuring operation.

Innovation and Novelty

According to StartUs Insights, 5G is a hub of technological advancements, with 76 200+ patents filed globally, focusing on millimeter-wave technology, massive MIMO, and network slicing.

Source: Intellias

Research and development in 5G is supported by 1300+ grants. This emphasizes the importance of public and institutional investment in advancing this transformative technology.

LoRaWAN has seen modest but impactful innovation based on our data, with 410+ patents filed globally. The domain also received 80+ grants to support research in sectors like precision agriculture and renewable energy monitoring.

Top Use Cases of Connectivity Technologies in Energy

- Smart Grid Management: Connectivity technologies enable reliable communication between smart grid components. This allows utilities to monitor and control energy flows in real time and reduce latency, optimize energy distribution, and improve grid resilience.

- Renewable Energy Integration: IoT-enabled sensors and communication protocols allow real-time monitoring of renewable energy systems. This allows grid operators to balance supply and demand effectively.

- Remote Monitoring and Maintenance: By using 5G and IoT-enabled sensors, operators collect performance data and detect anomalies remotely. This enables real-time monitoring and remote maintenance of critical energy infrastructure like offshore wind farms, solar farms, and oil rigs.

- Decentralized Energy Management: Connectivity technologies ensure seamless communication between distributed energy resources (DERs), storage systems, and central management platforms.

Noteworthy Advancements in Connectivity Technologies

- Actility’s ThingPark IoT Connectivity Platform: This platform utilizes LoRaWAN to enable smart utility services – including smart grids and smart meters. The platform supports interoperability between systems to reduce integration costs and complexities.

- Ericsson’s Cellular Connectivity for Smart Grids: These solutions leverage advanced cellular technologies like 4G and 5G to offer reliable and secure connectivity for energy utilities. Ericsson’s technology supports real-time monitoring and control of energy distribution systems.

- Siemens’ IoT Solutions for Energy Management: The company’s solutions enable real-time data collection and analysis across various components of the energy grid, including power generation, distribution, and consumption. They facilitate predictive maintenance and optimize resource allocation.

Core Technologies Connected to Connectivity Technologies

- 5G Networks: Offers ultra-low latency, high-speed data transfer, and enhanced device density. It enables real-time communication between IoT devices, smart grids, and energy assets to improve grid reliability and operational efficiency.

- Low-Power Wide Area Networks: LPWAN technologies, including LoRaWAN and NB-IoT, are essential for connecting low-power devices in decentralized energy systems. These networks provide long-range connectivity while consuming minimal energy.

- Fiber Optic Networks: Provides the backbone for high-speed and reliable data transmission in energy systems. These networks support the vast data demands of smart grids, enabling efficient energy flow monitoring and predictive analytics.

- Edge Computing: Complements centralized connectivity solutions by processing data locally, closer to energy assets. This reduces latency, enhances response times, and ensures continuity in critical energy operations.

Spotlighting an Innovator: DEWINE Labs

Austrian startup DEWINE Labs provides Bluetooth low energy (BLE) communication solutions for the energy industry. The company also leverages optimization algorithms to increase the uptime of BLE devices and ensure real-time data transmission over long distances.

This way, the company enables real-time monitoring and controlling of grid infrastructure. Its solutions also support wireless data exchange in solar or wind power systems to monitor performance and ensure reliability.

9. Digital Twins

The global digital twin market is set to grow exponentially from USD 12.8 billion in 2024 to USD 240.3 billion by 2035 – at an impressive CAGR of 41%. This rapid adoption reflects the technology’s transformative potential, with approximately 70% of technology leaders in major corporations integrating digital twins across industries.

Source: Roots Analysis

By simulating real-time conditions, digital twins allow operators to predict equipment failures and reduce unexpected downtimes by up to 20% in the oil and gas industry. This translates into substantial cost savings.

Furthermore, digital twins have the potential to drive substantial energy savings. By facilitating better demand management and operational efficiency, they could save up to USD 2 trillion annually by the end of this decade.

North America leads the digital twin market, driven by investments in smart grids and advanced energy systems, while the Asia-Pacific region is expected to grow the fastest. This is spurred by industrial expansion and energy infrastructure upgrades in countries like China and India.

Source: InsightAce Analytic

As digital twin adoption grows, the technology will expand into broader applications such as carbon tracking and demand response.

Market Insights & Growth Metrics for Digital Twins

Scale and Magnitude

StartUs Insights reports that the digital twin technology sector consists of 5870+ companies globally.

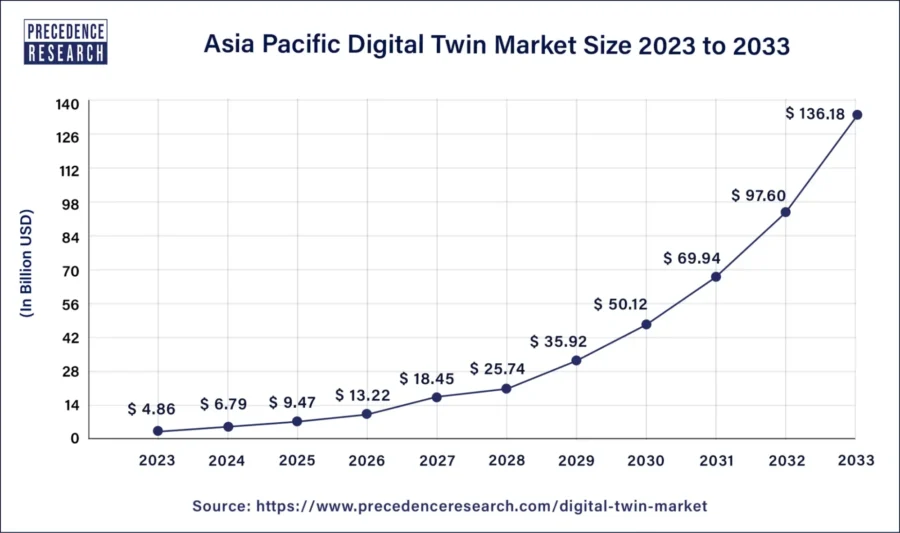

The Asia-Pacific digital twin market was valued at USD 9.47 billion in 2025 and is forecasted to reach USD 136.18 billion by 2033, with a CAGR of 39.5%.

Source: Precedence Research

Despite its transformative potential, the domain ranks 496th in media coverage. This reflects niche but growing recognition as a critical enabler of Industry 4.0.

Growth Indicators

Digital twins are experiencing significant momentum with an annual search interest rise of 26.98% based on our data. This highlights increasing awareness and adoption across industries.

Over the past five years, the sector has achieved a robust 126.34% growth in funding according to our database.

The US government also allocated USD 285 million in funding for digital twin research in semiconductors.

Innovation and Novelty

StartUs Insights reports that digital twins are at the forefront of innovation with 6160+ patents filed globally. Key areas of innovation include smart grid management, asset lifecycle optimization, and urban planning.

Siemens and GE offer proprietary platforms Predix (GE) and MindSphere (Siemens) that leverage real-time data for predictive analytics and operational efficiency.

Research and development in the domain have also been supported by 1490+ grants based on our data. This highlights public and institutional support for scaling this transformative technology.

Top Use Cases of Digital Twins in Energy

- Predictive Maintenance: By simulating the behavior of turbines, transformers, and pipelines in real time, digital twins detect anomalies and predict potential failures before they occur.

- Grid Optimization: Digital twins provide utilities with real-time insights into grid performance. This enables operators to balance supply and demand more effectively.

- Renewable Energy System Optimization: Digital twins maximize energy generation and storage by analyzing weather data, panel efficiency, and wind conditions.

- Infrastructure Design and Planning: Energy companies visualize and simulate infrastructure projects before construction to reduce design errors and costs.

Noteworthy Digital Twin Advancements

- BP’s APEX Digital Twin System: A comprehensive simulation and surveillance software that optimizes global oil and gas operations. APEX allows BP to map virtual production systems for engineers to conduct simulations quickly and efficiently.

- Vattenfall’s Digital Twin for Wind Energy: Uses real-time data from sensors to monitor structural behavior and operational conditions to extend turbine lifespan and reduce maintenance costs.

- Tokamak Energy’s SOPHIA Digital Twin: The company integrated the SOPHIA digital twin software into its ST40 fusion device operations. SOPHIA enables multiple simulations of experimental scenarios to optimize fusion experiments and accelerate research and development.

Core Technologies Connected to Digital Twins

- Internet of Things: Provides the data necessary to create and update virtual models in real time. IoT-enabled sensors monitor physical assets and capture critical metrics such as temperature, pressure, vibration, and energy output.

- Big Data & Analytics: Process and analyze vast amounts of data from physical assets. Big data and analytics enable digital twins to identify patterns, detect anomalies, and optimize operations.

- AI and ML: The “intelligence” behind digital twins, AI and ML simulate complex scenarios, predict outcomes, and optimize processes. AI enhances the accuracy of digital twin simulations while ML algorithms improve predictive maintenance.

- Cloud and Edge Computing: Cloud platforms allow organizations to create, access, and update digital twins from anywhere. Meanwhile, edge computing complements cloud computing by processing data locally to reduce latency and ensure faster responses.

Spotlighting an Innovator: TwinThread

TwinThread is a US-based startup that offers an AI-powered digital twin solution for oil and gas companies and modular plants. It combines asset and digital twins to deliver a comprehensive view of asset fleet health. This allows manufacturers to benchmark performance, diagnose issues in real time, and stabilize operations.

The solution also allows companies to deploy virtual operation centers to monitor asset health and coordinate actions. This reduces downtime and enables new revenue streams.

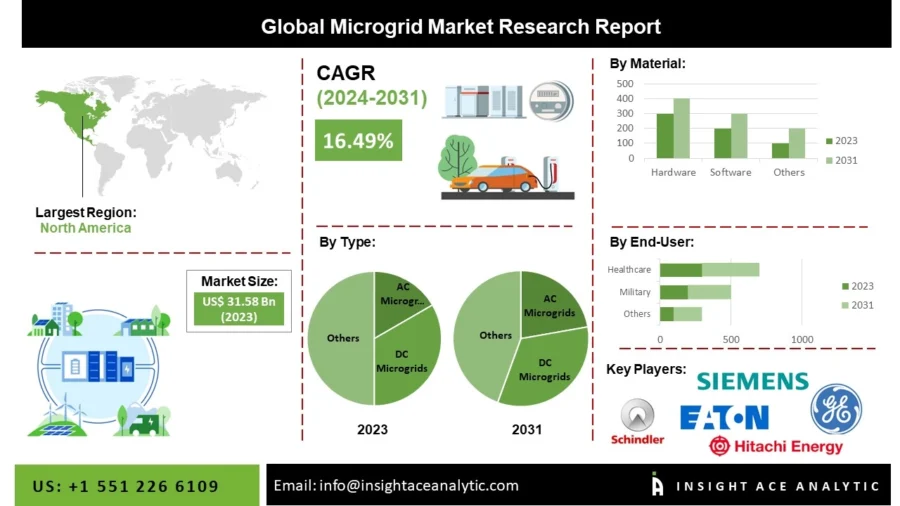

10. Microgrids

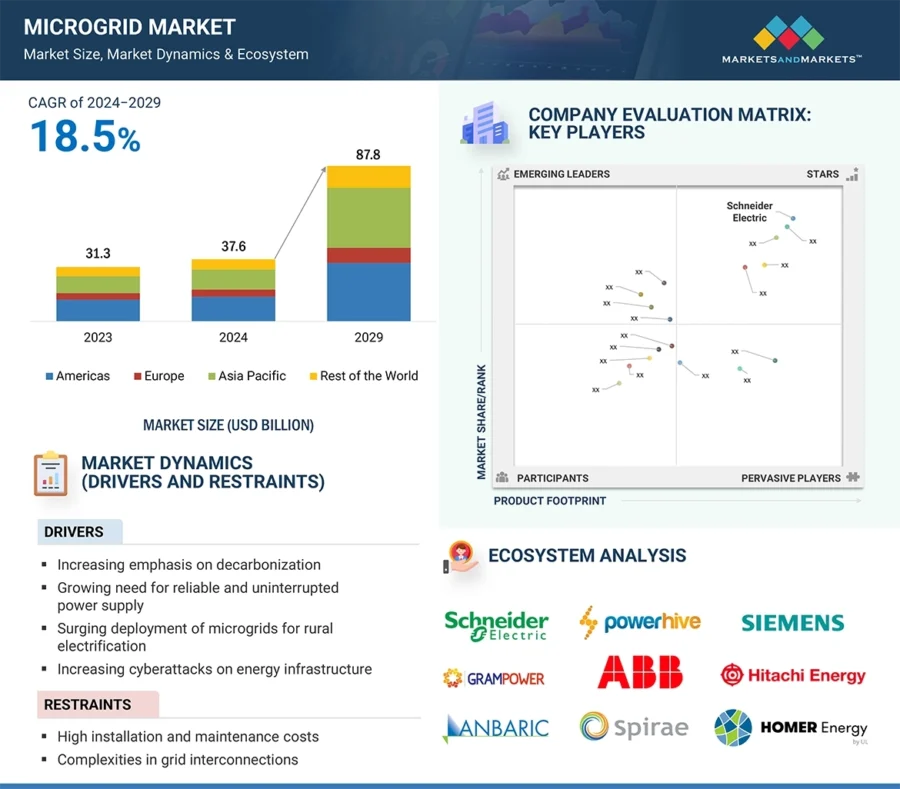

Microgrids are transforming the energy sector by enabling localized energy generation, storage, and distribution. The global microgrid market size is projected to grow at a CAGR of 17.1% from 2024 to 2030 – reaching USD 87.8 billion.

Source: MarketsandMarkets

This rapid growth is driven by the increasing need for energy resilience, the integration of renewable energy sources, and advancements in energy storage technologies.

Government investments are accelerating the deployment of microgrids. For instance, the US Department of Energy launched the Community Microgrid Assistance Partnership (C-MAP) in October 2024. It funds projects in remote and rural areas, including Alaska, Hawaii, and Indigenous tribal lands.

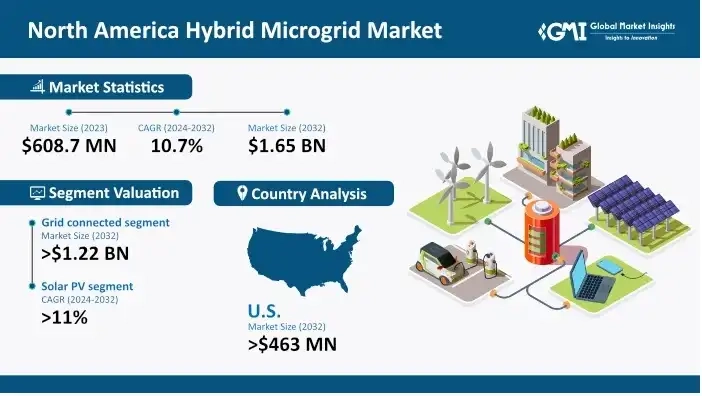

North America leads the global microgrid market, accounting for over 39% of revenue in 2024. This is driven by significant investments in grid modernization and renewable energy projects.

Source: Global Market Insights

By 2032, advancements in smart grid technologies and energy storage systems (ESS) will make microgrids even more efficient and cost-effective.

Market Insights & Growth Metrics for Microgrids

Scale and Magnitude

The microgrid sector includes 2170+ companies worldwide based on our data. These companies cater to industries and communities seeking energy resilience, efficiency, and sustainability.

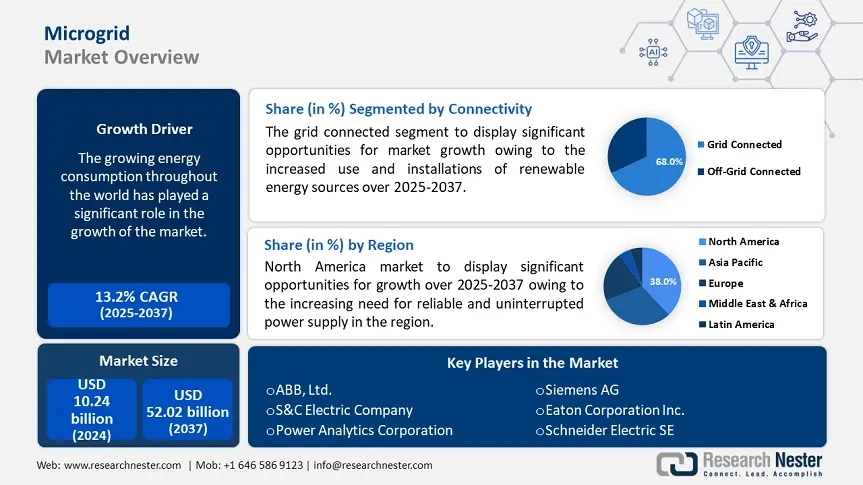

Asia-Pacific is the fastest-growing region – accounting for a 31% market share by 2037. This is fueled by rural electrification in countries like India, Malaysia, and the Philippines.

Source: Research Nester

Despite its growing importance in decentralized energy systems, microgrids rank only 1117th in media coverage in our database. This reflects a niche but increasing interest in this technology.

Growth Indicators

Microgrids are gaining traction with a 36.28% annual rise in search interest based on our data.

Source: InsightAce Analytic

Federal funding continues to support microgrid development.

The US Department of Energy (DOE) allocated USD 3.5 billion under the Grid Resilience and Innovation Partnerships (GRIP) program to fund 400+ microgrid projects.

Additional funding includes USD 7.2 million for underserved communities through the Community Microgrid Assistance Partnership (C-MAP).

However, the sector has faced a slight decline in funding, with a 10.18% decrease over the past five years. This could be due to the high initial costs of implementation and challenges in scaling projects.

Innovation and Novelty

StartUs Insights reports that the microgrids sector has 9530+ patents filed globally.

Additionally, microgrid research has been supported by 670+ grants. This reflects strong institutional and government interest in fostering energy resilience, particularly in underserved and remote areas.

In disaster-prone areas like Puerto Rico, microgrids reduce outage times. This ensures critical facilities remain operational during emergencies.

Top Use Cases of Microgrids

- Energy Resilience & Backup Power: Microgrids provide reliable backup power during outages and ensure continuous energy supply for critical facilities such as hospitals, military bases, data centers, and factories.

- Renewable Energy Integration: Incorporates energy storage systems to manage variability. Microgrids optimize the use of local renewable energy, reducing reliance on fossil fuels and lowering carbon footprints.

- Rural Electrification: Microgrids provide electricity in remote areas where extending traditional grid infrastructure is costly or impractical. Using DERs, microgrids bring reliable power to underserved communities.

- Cost Optimization & Energy Efficiency: Microgrids enhance cost efficiency by optimizing energy generation and consumption at the local level. They reduce energy losses associated with long-distance transmission and enable dynamic load management.

Noteworthy Microgrid Advancements

- Schneider Electric and Mainspring Energy’s Hybrid Microgrid: Combines Schneider’s EcoStruxure microgrid solution with Mainspring’s linear generator. This solution provides power and fuel flexibility as well as enhances energy resiliency for commercial and industrial customers.

- Alternus Clean Energy & Hover Energy’s Joint Venture: Deliver next-generation microgrid solutions to data centers and corporate customers. This collaboration provides onsite clean energy through a distributed architecture – especially beneficial for data centers.

- Aspen Technology’s Microgrid Management System: Reduces energy vulnerability and business risk in asset-intensive industries. It optimizes energy use and integrates various energy sources efficiently to ensure reliable power supply and support the transition to sustainable energy.

Core Technologies Connected to Microgrids

- Energy Storage Systems: Enable the storage of surplus energy generated from renewable sources. Battery technologies, especially lithium-ion batteries, dominate the ESS market due to their efficiency and scalability.

- Smart Grid Technology: Uses IoT-enabled sensors and communication networks to collect and analyze data on energy flows, demand patterns, and system performance.

- Renewable Energy Systems: Solar panels and wind turbines form the primary energy generation sources for most microgrids. These systems reduce reliance on fossil fuels and contribute to decarbonization.

- Advanced Control Systems: Orchestrate the interaction between generation, storage, and consumption. These systems use AI and ML to predict energy demand, optimize resource allocation, and prevent system imbalances.

Spotlighting an Innovator: 3 element Energy

3 element Energy is a Dutch startup that provides a microgrid platform. It supports grid-connected and off-grid configurations like photovoltaic (PV) solar canopies, battery energy storage systems (BESS), and optional EV charging capabilities.

This platform ensures uninterrupted power supply during outages while reducing operational costs and carbon emissions.

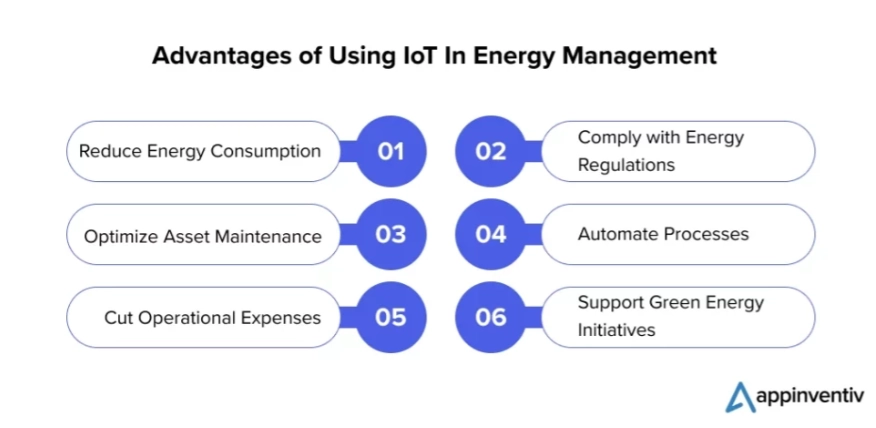

Key Benefits of Digitizing Energy Businesses in 2025

Source: Appinventiv

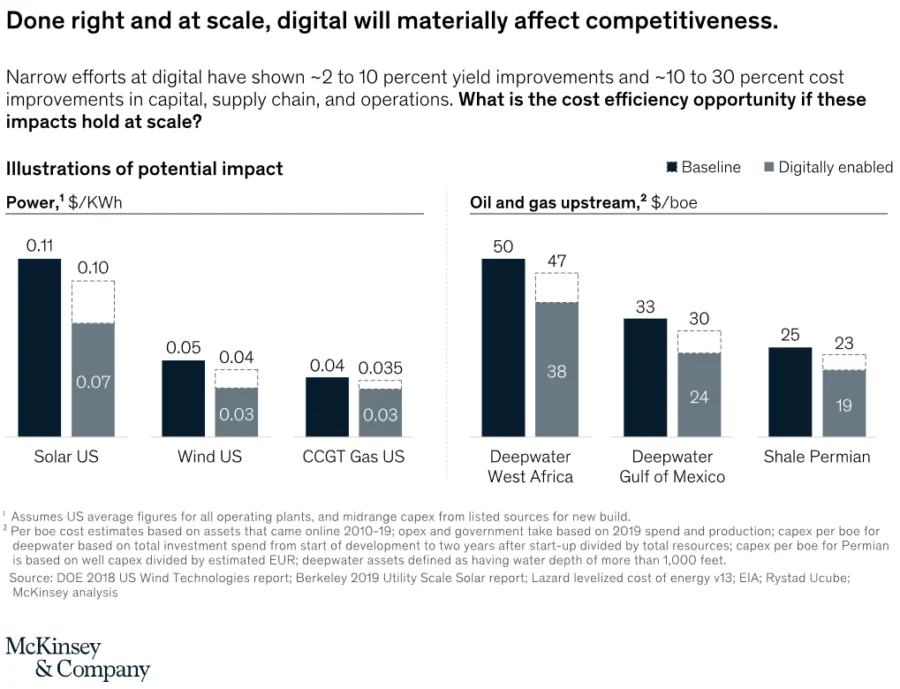

1. Enhanced Operational Efficiency

Energy companies report a 20-30% reduction in operational costs through digital tools such as IoT-enabled predictive maintenance and AI-driven optimization.

Source: McKinsey & Company

Automation of routine processes, real-time monitoring of assets, and efficient energy dispatch significantly minimize downtime and improve asset utilization.

2. Increased Grid Reliability

Smart grid technologies powered by IoT and AI improve reliability by enabling real-time monitoring and automated fault detection, reducing power outages by up to 44%.

Digital twins of grids help operators simulate and predict failures before they occur, ensuring an uninterrupted energy supply.

3. Integration of Renewable Energy

Renewable energy sources are volatile and weather-dependent, making integration into traditional grids a challenge. Digital solutions optimize renewable energy usage by balancing demand and supply in real time.

Source: Techstack

Smart grid and energy storage technologies enable smoother adoption of renewables, projected to contribute 50% of electricity generation by 2050.

4. Improved Sustainability and Emissions Reduction

Digital transformation is critical for meeting net-zero targets. Energy companies using AI and blockchain have achieved emissions reductions of up to 15%, according to recent studies.

Technologies like carbon tracking software ensure compliance with environmental regulations, helping organizations contribute to global climate goals.

5. Enhanced Customer Experience

Smart meters and advanced analytics allow for personalized energy services, enabling customers to track and manage consumption effectively.

Digital transformation enables energy companies to deliver personalized and efficient services, significantly improving customer satisfaction. By implementing multichannel digital experiences, utilities can engage customers more effectively.

6. Cost Optimization in Energy Trading

Blockchain technology has revolutionized energy trading, reducing transaction costs while enhancing transparency.

Peer-to-peer energy trading platforms are becoming popular, allowing customers to trade surplus renewable energy directly.

Blockchain technology is revolutionizing energy trading by enabling peer-to-peer transactions, which can significantly reduce costs. By eliminating intermediaries and automating processes through smart contracts, blockchain facilitates direct energy exchanges between producers and consumers.

7. Accelerated Decision-Making

Big data analytics and AI process vast amounts of data in real time, allowing companies to make quick and informed decisions.

Predictive insights from digital platforms help companies optimize resource allocation, detect inefficiencies, and address issues proactively.

8. Revenue Growth Opportunities

Energy-as-a-service business models, enabled by digital transformation, open new revenue streams. These models allow energy providers to offer subscription-based energy solutions tailored to consumer needs.

Market leaders adopting EaaS have observed a growth in revenue over traditional pricing structures. The global energy as a service market in terms of revenue is projected to reach USD 105.6 billion by 2027.

Step-by-Step Guide: Digital Transformation Strategy for the Energy Industry

Developing a comprehensive digital transformation strategy is essential for energy companies aiming to enhance efficiency, integrate renewable energy sources, and remain competitive in a rapidly evolving industry. The following expanded step-by-step guide provides a detailed roadmap, incorporating insights from industry leaders and reputable sources.

1. Define the Vision and Goals

Establish a Clear Vision: Align the digital transformation strategy with the company’s mission. It should focus on objectives such as operational efficiency, sustainability, and customer engagement.

Set Measurable Objectives: Develop specific, quantifiable goals – like reducing carbon emissions by a certain percentage, increasing the share of renewable energy in the portfolio, or enhancing customer satisfaction scores.

2. Conduct a Digital Maturity Assessment

Evaluate Current Capabilities: Assess existing digital tools, processes, and workforce competencies to identify strengths and areas for improvement.

Benchmark Against Industry Leaders: Compare your organization’s digital maturity with industry peers to understand competitive positioning and identify best practices.

3. Identify Key Technologies

Prioritize Investments: Focus on technologies that offer the highest impact, like IoT for real-time asset monitoring, AI for predictive maintenance, and blockchain for transparent energy trading.

Ensure Scalability: Select solutions that can grow with the organization, accommodating future technological advancements and business expansion.

Use Technology Scouting: Leverage tools like StartUs Insights’ Discovery Platform to track emerging technologies.

4. Build a Robust Data Infrastructure

Leverage Big Data: Implement systems to collect, store, and analyze vast amounts of data generated from various sources, enabling informed decision-making.

Integrate Systems: Ensure seamless communication between operational technology (OT) and information technology (IT) systems to optimize workflows and enhance data accuracy.

5. Develop a Detailed Roadmap

Plan Incremental Implementation: Divide the transformation journey into manageable phases – starting with pilot projects to test and refine digital initiatives.

Set Realistic Timelines: Establish achievable deadlines for each phase. This ensures flexibility to adapt to unforeseen challenges.

6. Foster Collaboration and Ecosystem Partnerships

Engage Stakeholders: Involve employees, customers, technology partners, and regulators early in the process to ensure alignment and buy-in.

Form Strategic Alliances: Collaborate with technology providers, startups, and research institutions to access innovative solutions and share knowledge.

7. Upskill the Workforce

Invest in Training: Provide employees with training programs to develop digital competencies. This ensures they can effectively utilize new technologies.

Cultivate a Digital Culture: Encourage a culture of continuous learning and innovation to empower employees to embrace change.

8. Implement Robust Cybersecurity Measures

Protect Critical Assets: Deploy comprehensive cybersecurity frameworks to safeguard against threats and ensure data integrity.

Comply with Regulations: Adhere to industry standards and legal requirements related to data protection and privacy.

9. Monitor, Measure, and Optimize

Track Key Performance Indicators (KPIs): Regularly assess progress against established metrics to evaluate the effectiveness of digital initiatives.

Adapt Strategies: Utilize data-driven insights to refine strategies – addressing emerging challenges and capitalizing on new opportunities.

10. Scale and Innovate Continuously

Expand Successful Pilots: Roll out proven digital solutions across the organization, ensuring they are scalable and sustainable.

Embrace Continuous Improvement: Stay abreast of technological advancements and industry trends, fostering a culture of ongoing innovation.

By meticulously following this comprehensive guide, energy companies can effectively navigate the complexities of digital transformation, achieving enhanced operational efficiency, sustainability, and customer satisfaction.

Strategic Solutions to Overcome Digitization Challenges

1. Overcoming High Initial Investment Costs

Challenge: Digitization often requires significant upfront capital for technology acquisition, infrastructure upgrades, and workforce training.

Strategic Solution:

- Adopt a Phased Implementation Approach: Start with small-scale pilot projects to validate the ROI before committing to full-scale deployment.

- Leverage Public and Private Funding: Tap into government grants, subsidies, and partnerships with private investors to share costs.

2. Addressing Cybersecurity Risks

Challenge: Increased digitization makes energy infrastructure more vulnerable to cyberattacks, with potential threats to grid stability and customer data privacy.

Strategic Solution:

- Deploy AI-Driven Cybersecurity Solutions: Use advanced threat detection and response systems to monitor and neutralize cyber risks in real time.

- Collaborate on Industry Standards: Partner with governments and industry bodies to adopt global cybersecurity standards and share threat intelligence.

3. Combating Resistance to Change

Challenge: Organizational inertia and resistance to adopting new technologies hinder transformation efforts.

Strategic Solution:

- Foster a Digital-First Culture: Conduct regular training sessions, workshops, and awareness programs to help employees embrace digital tools.

- Engage Leadership and Stakeholders: Secure executive buy-in and involve key stakeholders in decision-making to ensure alignment and support for digital initiatives.

4. Navigating Regulatory Uncertainty

Challenge: Varying and evolving regulations across regions can create compliance challenges for energy companies implementing digital technologies.

Strategic Solution:

- Proactive Engagement with Regulators: Work closely with regulatory bodies to influence policy decisions and stay informed about upcoming changes.