Driven by the increasing demand to improve patient care and operational efficiency while reducing costs, digital transformation in healthcare is growing at a rapid pace. For instance, the global digital health market is projected to grow at a compound annual growth rate (CAGR) of 21.9% from 2024 to 2030.

In this guide, you will explore the top 10 digital technologies transforming healthcare operations. You will also discover strategies for healthcare organizations to effectively implement these technologies, real-world examples, enabling technologies, and more!

Key Takeaways

- The Time to Act is Now: AI-driven personalization, improved efficiency with automation, expanding accessibility via telehealth, and driving compliance with regulatory shifts are making now the critical time for adoption.

- Top 10 Healthcare Digital Transformation Trends

- Key Benefits: Digitizing healthcare operations increases efficiency, reduces costs, improves care coordination, and more.

- Roadmap for Successful Digitization: This section guides healthcare digitization with a clear strategy, tech scouting, data integration, workforce training, and continuous innovation for seamless transformation.

- Future Trends: Discover the next wave of healthcare innovation – AI-powered precision medicine, an expanded telehealth ecosystem, bio-printed organs for replacement, and more.

How do we research and where is this data from?

We reviewed over 3100 industry innovation reports to extract key insights and construct the comprehensive Technology Matrix. To increase accuracy, we cross-validated this information with external industry sources.

Additionally, we leveraged the StartUs Insights Discovery Platform – an AI and Big Data-powered innovation intelligence tool covering over 5 million startups and more than 20K+ technologies & trends worldwide to:

- Confirm our findings using the Trend Intelligence feature.

- Gather market statistics for each technology.

- Identify startups for the “Spotlighting an Innovator” sections.

Why the Time to Act is Now

1. Improved Patient Care and Outcomes

Healthcare providers are leveraging digital transformation technologies like AI and machine learning to personalize treatment based on genetic, environmental, and lifestyle factors.

This is reflected in the global digital healthcare transformation market, projected to reach USD 210 billion by the end of 2025.

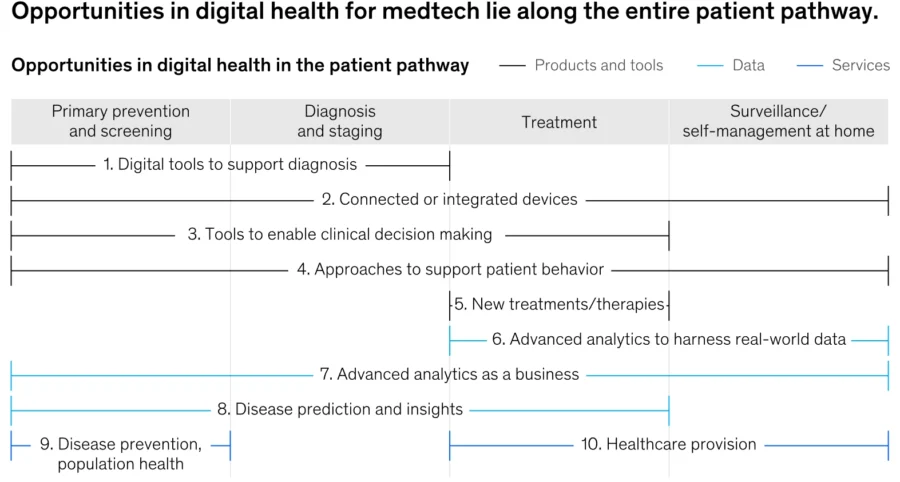

Source: McKinsey & Company

Similarly, the shift towards hospital-at-home programs and wearable health technologies showcases the increasing adoption of remote patient monitoring (RPM) among healthcare providers.

Spending on edge computing, a key enabler of RPM, is expected to reach USD 110.6 billion by 2029, growing at 13%.

2. Enhanced Efficiency and Cost-Effectiveness

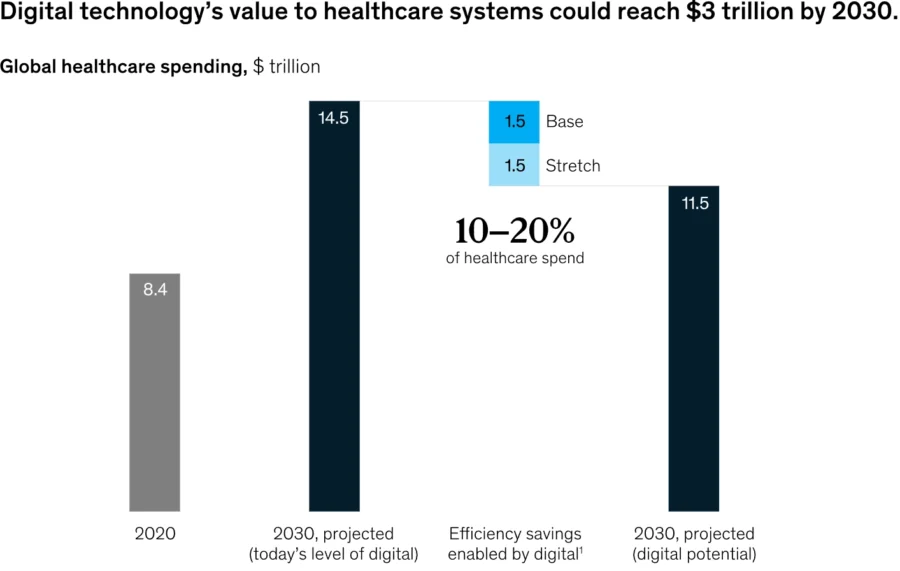

Digital interventions, including AI-driven scheduling, virtual assistants, and automated billing systems, will save between USD 1.5 trillion and USD 3 trillion annually by 2030.

Source: McKinsey & Company

Meanwhile, data management and analytics are becoming important for healthcare systems. The electronic health records (EHRs) market is forecasted to reach USD 139.4 billion by 2025. It indicates EHR’s role in improving patient management, interoperability, and clinical decision-making.

3. Increased Accessibility and Health Equity

Virtual care surged during the COVID-19 pandemic, and continues to thrive, especially in rural and underserved areas. Telehealth adoption in the US has seen an unprecedented 3000% growth since early 2019. This growth highlights its role in making healthcare more accessible.

Additionally, the rise of digital health tools, including mobile apps, wearable devices, and patient portals, empowers individuals to manage their health proactively.

By 2028, the global digital health market is projected to exceed USD 549.7 billion. highlighting the accelerating adoption of digital-first healthcare solutions that promote preventive care and patient engagement.

4. Regulatory and Market Pressures

Governments and regulatory bodies are enforcing interoperability mandates to ensure seamless data exchange between healthcare providers.

Approximately, 60% of healthcare executives have identified the need to invest in core technologies such as electronic medical records (EMRs) and enterprise resource planning (ERP) software to comply with these evolving regulations.

Moreover, the industry-wide shift towards value-based care models encourages healthcare organizations to invest in digital solutions that prioritize patient outcomes over service volume.

The digital transformation market in the healthcare sector is expected to grow from USD 97.19 billion in 2025 to USD 198.91 billion in 2029, with a CAGR of 19.6%, signaling the ongoing transition toward technology-driven efficiency and quality improvements.

Top 10 Healthcare Digital Transformation Technologies to Watch in 2025

1. Artificial Intelligence

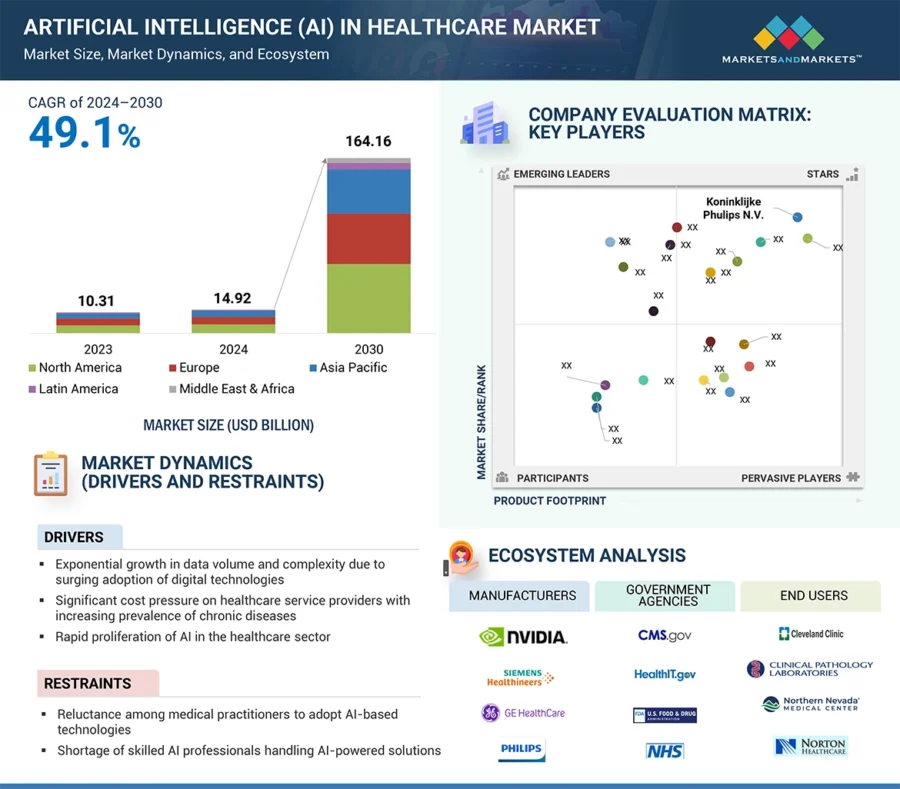

The global AI in healthcare market is projected to grow at a CAGR of 48.1% from 2024 to 2029, reaching an estimated USD 148.4 billion by 2029.

Source: MarketsandMarkets

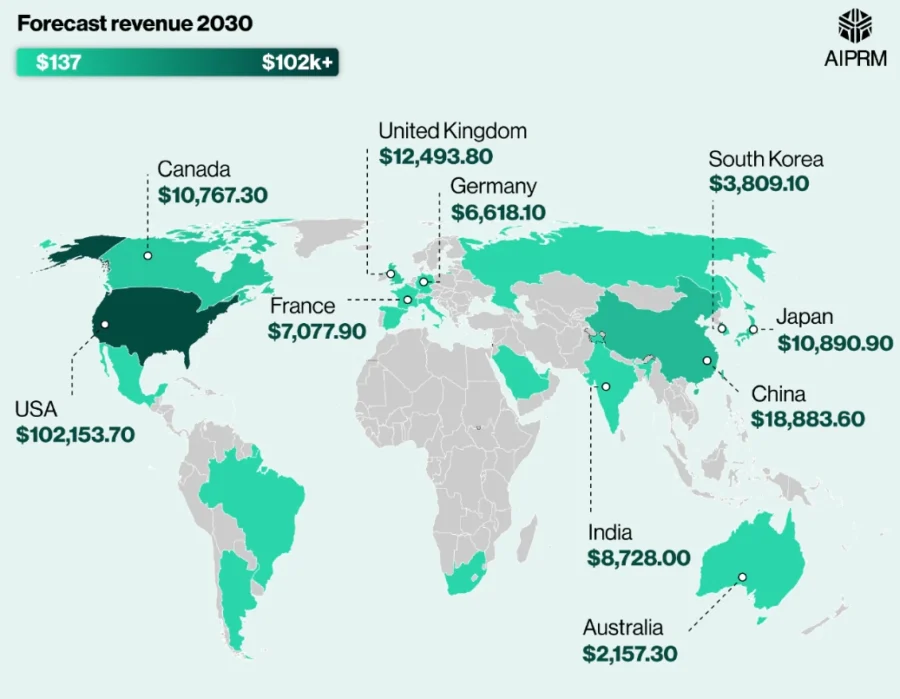

In the US, the AI healthcare market is projected to grow to USD 102.2 billion by 2030, reflecting a 36.1% growth rate.

In the healthcare sector, 40% of organizations have already implemented AI models and 34% more companies are experimenting or evaluating AI solutions.

100% of healthcare payer CIOs and tech executives report that AI and ML technologies will be implemented in their systems by 2026.

Source: AIPRM

Further, AI is projected to reduce healthcare costs by USD 13 billion by 2025. AI-assisted surgeries could shorten hospital stays by over 20%. This will lead to savings of USD 40 billion annually.

Machine learning holds the largest market share, with adaptive AI projected to grow at a 44.71% CAGR and reach USD 12.53 billion by 2029.

Yet, consumer perception remains mixed as 53% of them believe generative AI can improve access to care and 46% see it as a way to make healthcare more affordable. Only 10% feel confident in their understanding of AI’s role in patient health.

Some of the emerging trends like multimodal AI for text, images, and video give new shape to diagnostic and therapeutic possibilities. Meanwhile, advances in AI agents will also improve patient interactions.

Leading industry players such as GE Healthcare, Siemens Healthineers, and Philips are also pushing the boundaries with numerous FDA-approved AI devices.

Market Insights & Growth Metrics for AI

Scale and Magnitude

According to StartUs Insights, there are currently 107 584 AI-focused companies worldwide. This explains AI’s widespread adoption across various industries.

The global AI market size is expected to reach USD 3680.47 billion by 2034, expanding at a CAGR of 19.1% from 2024 to 2034.

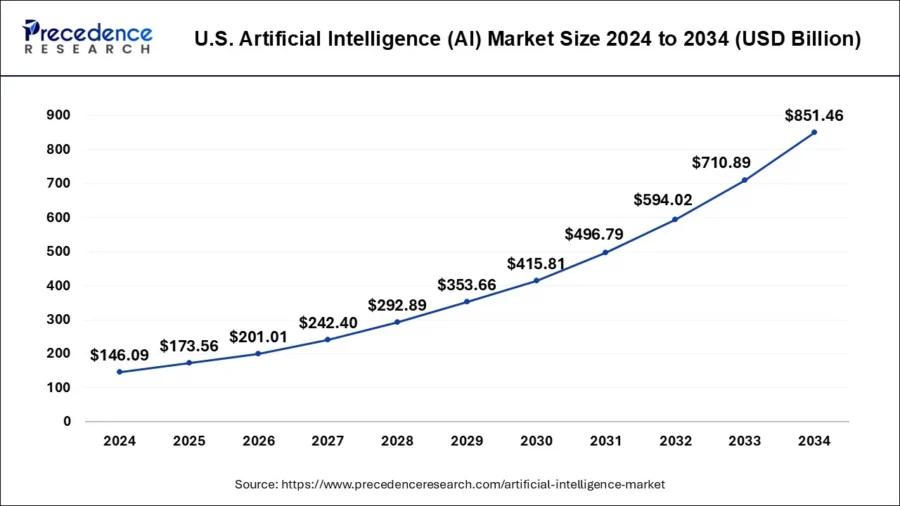

US accounts for 56% of North America’s market i.e. USD 173.56 billion in 2025, primarily driven by gen AI startups and enterprise adoption.

Source: Precedence Research

In terms of media coverage and public attention, AI ranks 16th among all emerging technologies according to StartUs Insights. This ranking reflects AI’s significant presence in media narratives, public discourse, and its perceived impact.

Growth Indicators

AI has seen a notable increase in global interest, with annual search interest rising by 28.09%, as reported by StartUs Insights. This surge reflects the growing curiosity and engagement with AI technologies.

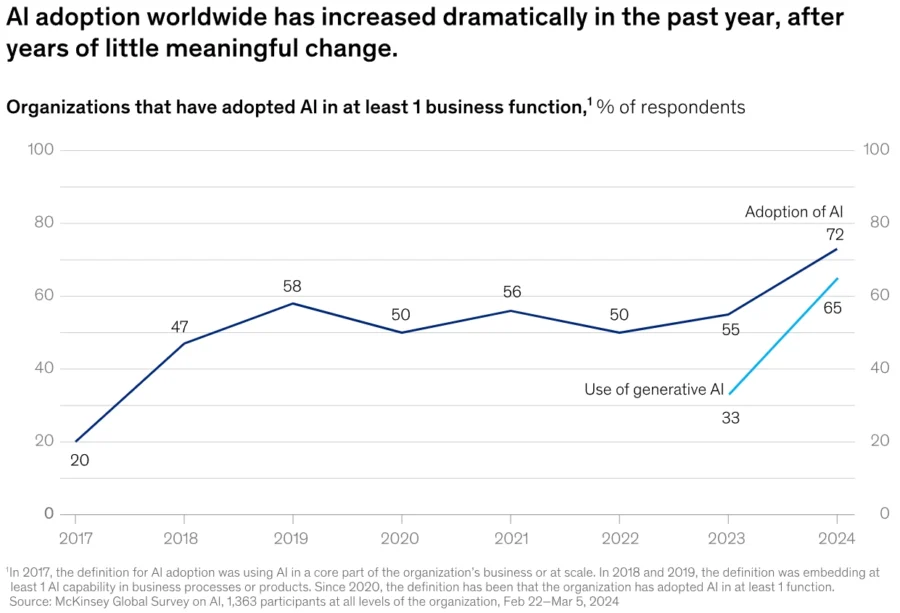

According to a McKinsey report, only 50% of organizations in the past six years could adopt AI but in 2024 there’s a jump to 72%. More than two-thirds of respondents in every region say their organizations are using AI.

Source: McKinsey & Company

In terms of funding, AI has experienced a five-year growth rate of 67%, indicating a substantial increase in investments dedicated to AI development and implementation.

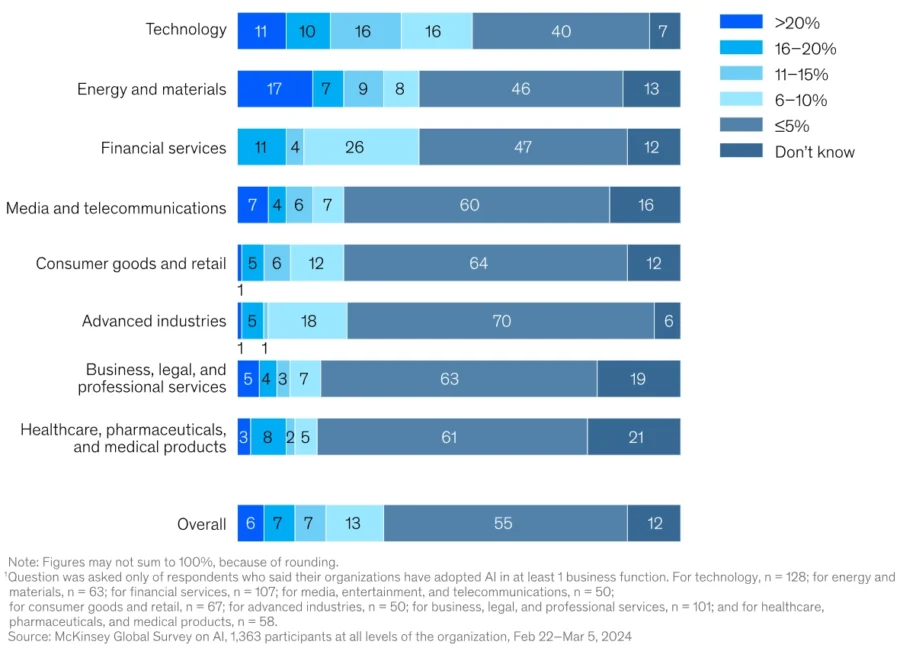

Share of organization’s digital budget spent on generative AI

Source: McKinsey and Company

Innovation and Novelty

According to StartUs Insights, there have been more than 841 390 AI-related patents filed worldwide.

The US has dominated in terms of the share of AI patent application publications, with around 5% of all patent application publications being AI-related. Korea, however, looks to overtake the US by the end of 2024.

The European Patent Office (EPO) reported that AI patent application numbers remained steady at around 3% of total patent applications in 2024.

In terms of research support, StartUs Insights indicates that there have been 23 191+ grants awarded for AI research.

Top Use Cases of AI in Healthcare

- Administrative Task Automation: AI automates repetitive tasks such as transcribing patient-clinician conversations, generating summaries for medical records, or automating the claiming process.

- Chatbots and Virtual Assistants: AI-driven chatbots and virtual assistants improve patient engagement and support by providing accessible health information and assistance.

- Diagnostic Imaging and Disease Detection: AI is reshaping diagnostic imaging by enhancing the speed and accuracy of disease detection.

Noteworthy Advancements

- GE HealthCare Taps AWS for Generative AI in Medical Use: This collaboration focuses on developing purpose-built foundation models to accelerate healthcare application development. It leverages AWS’s Bedrock offering of AI models to improve workflows and patient outcomes.

- Jivi’s LLM answers Medical Questions: Jivi developed Jivi MedX, a specialized medical large language model (LLM), to reshape primary healthcare through generative AI. Its proprietary medical dataset and odds ratio preference optimization (ORPO) algorithm use generative AI to provide 24/7 high-quality healthcare at a lower cost.

Core Technologies Connected to AI

- Natural Language Processing (NLP): Processes and analyzes large volumes of unstructured text data to extract meaningful patterns and insights. In healthcare, this allows for the interpretation of clinical notes.

- Deep Learning: Learns complex patterns and representations within the data for image recognition, predictive analytics, and personalized treatment recommendations.

- Computer Vision: Processes and interprets visual data from medical imaging modalities such as MRI, CT scans, and X-rays. These algorithms analyze visual inputs to identify anomalies and structures within images.

Spotlighting an Innovator: Artera

Artera is a US-based company that offers a comprehensive patient communication platform, Artera Harmony. It features a virtual agent and 4 co-pilots for real-time translation, message shortening, conversation summaries, and predictive text.

The platform also provides patient engagement data to deliver actionable insights and recommendations. As a result, it improves patient communications and response times while reducing administrative burden.

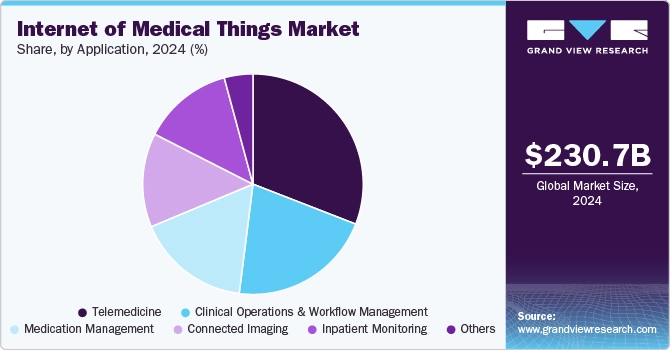

2. Internet of Medical Things

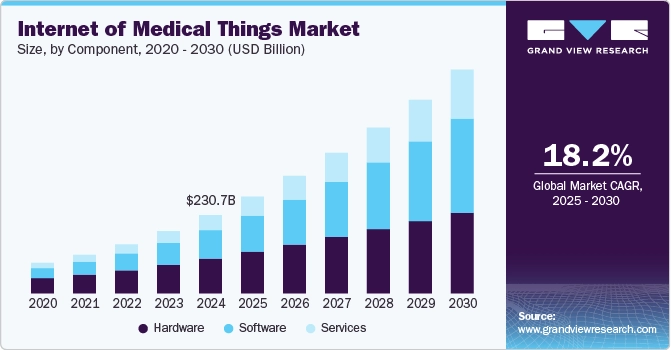

The global IoMT market size is projected to grow at a CAGR of 18.2% from 2025 to 2030. By 2034, the market is expected to surge to USD 368.06 billion.

The US IoT market in healthcare alone is predicted to grow to USD 92.12 billion by 2034 at a CAGR of 21.47%. This reflects a rapid transformation in digital healthcare infrastructure.

Source: Grand View Research

The expansion of IoMT is fueled by the rising adoption of IoT-enabled healthcare solutions, with over 1.27 billion IoT connections in 2024.

Remote patient monitoring has emerged as a pivotal trend, with 45% of healthcare providers using it for acute condition management and 77% of businesses expecting a shift from traditional inpatient monitoring.

Further, healthcare facilities leveraging IoT technology report an average cost reduction of 26% and a 50% decline in patient wait times. This illustrates its role in improving both clinical and administrative efficiency.

IoMT adoption is expected to reach more than 83% among healthcare organizations by 2025 and also reach a market valuation of USD 1 trillion by 2035.

Market Insights & Growth Metrics for IoMT

Scale and Magnitude

StartUs Insights identifies 5000+ companies actively developing IoMT solutions.

The global IoMT market is projected to expand to USD 658.57 billion by 2030. This growth is driven by increased adoption of remote monitoring, wearable devices, and telehealth services.

Source: Grand View Research

According to StartUs Insights IoMT ranks 6271 in media coverage, lagging behind consumer-facing technologies like AI or the broader IoT domain.

Growth Indicators

According to data from StartUs Insights, annual search interest in IoMT has risen by 38.31%, indicating a substantial increase in public and professional curiosity about this technology.

59% of healthcare providers reported that they have already implemented IoMT solutions in their organizations. About 83% of organizations have adopted IoMT solutions. 85% of healthcare providers also use IoMT devices to support patient engagement and monitoring.

Geographically, the Asia-Pacific region leads in IoMT development within healthcare centers, followed by North America, Europe, Latin America, the Middle East, and Africa.

India holds the largest share at 18.7%, with South Korea (16.4%), Germany (14%), and Japan (8.2%) following closely.

Innovation and Novelty

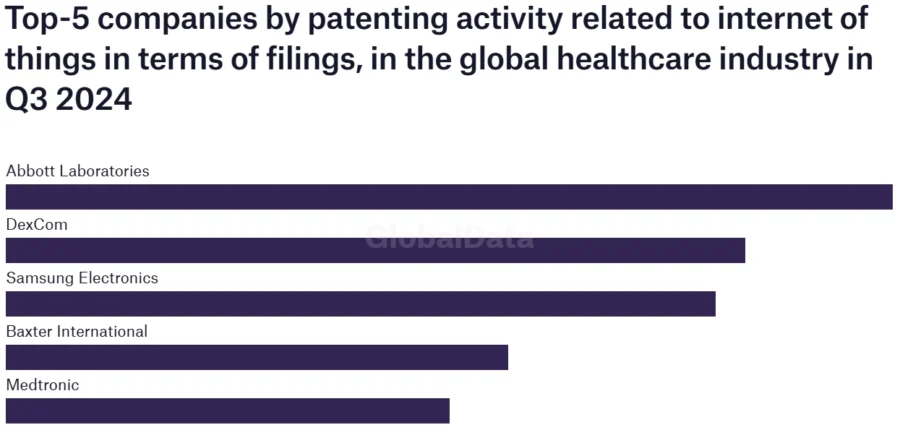

According to StartUs Insights, there have been 309 patents filed globally in the IoMT sector. 935 IoT-related patent applications were filed in Q3 2024 and the US dominates patent filings with 44% of global activity.

Source: Hospital Management

Hospital Management also reports that a total of 60 grants are dedicated to IoMT research. For instance, the MedKnights initiative received a USD 599 924 grant for IoMT research.

Top Use Cases of IoT in Healthcare

- Remote Patient Monitoring: Connected patient monitoring devices, including healthcare wearables, monitor patient vital signs to ensure real-time issue detection and timely medical interventions.

- Asset and Inventory Management: IoT devices equipped with radio frequency identification (RFID), Bluetooth low energy (BLE), and other connectivity technologies track medical equipment and supplies to offer real-time visibility into asset locations and inventory levels.

- Telemedicine: Connected medical devices allow patients to share real-time conditions remotely. This enables healthcare professionals to offer service to more patients while patients benefit from timely care delivery and reduced hospital visits.

Noteworthy Advancements

- KORE & Social Mobile Partner for Connected Health: This collaboration provides purpose-built hardware for healthcare applications like connected health and remote patient monitoring. Moreover, it improves data transfer and real-time communication between patients and healthcare providers.

- Queens Hospital’s Real-Time Location System (RTLS): JHMC deployed a BLE-based RTLS from Cognosos to track approximately 1700 medical assets. It offers real-time visibility into equipment locations to quickly locate necessary devices, reduce excess inventory, and ensure timely maintenance.

Core Technologies Connected to IoMT

- Sensor Technology: Collects critical physiological data from patients and continuously monitors health metrics like heart rate, blood pressure, and blood glucose levels.

- Edge Computing: Processes data from medical devices closer to its source to reduce latency and bandwidth usage for enabling rapid responses to life-threatening conditions.

- 5G Connectivity: Increased bandwidth and reduced latency enhances connectivity between medical devices. It supports applications like remote surgery, real-time telemedicine consultations, and more.

Spotlighting an Innovator: Healthcare Originals

Healthcare Originals is a US-based startup that develops cardiopulmonary wearable systems. The company’s product, ADAMM, is a small, flexible device that adheres to the patients’ upper torso using medical-grade adhesives.

Equipped with sensors, ADAMM unobtrusively monitors respiratory parameters, including cough rate, respiration patterns, heartbeat, and temperature.

The device then wirelessly transmits the collected data to a companion application to provide real-time insights into respiratory health.

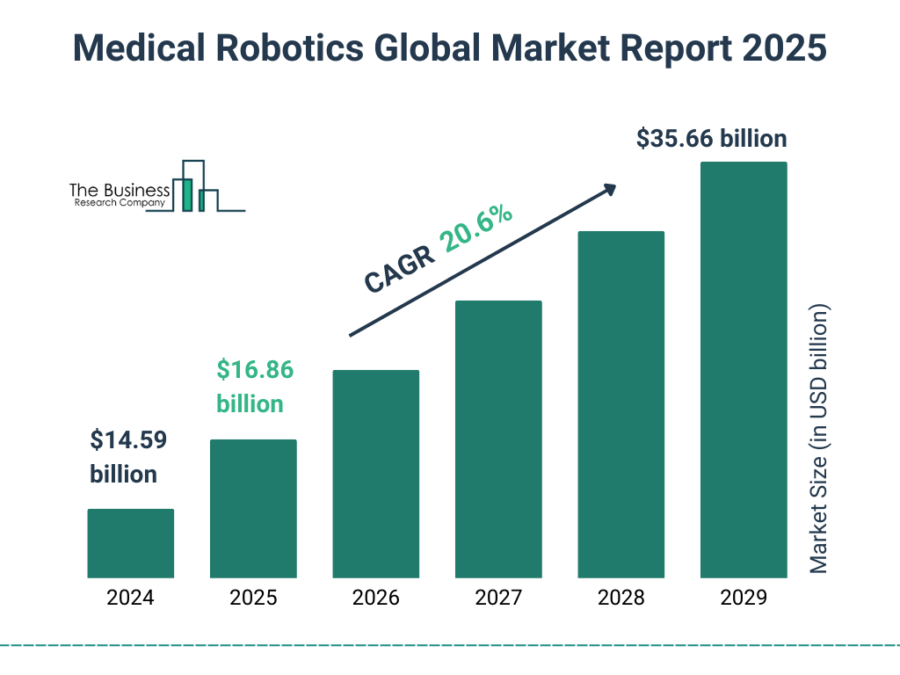

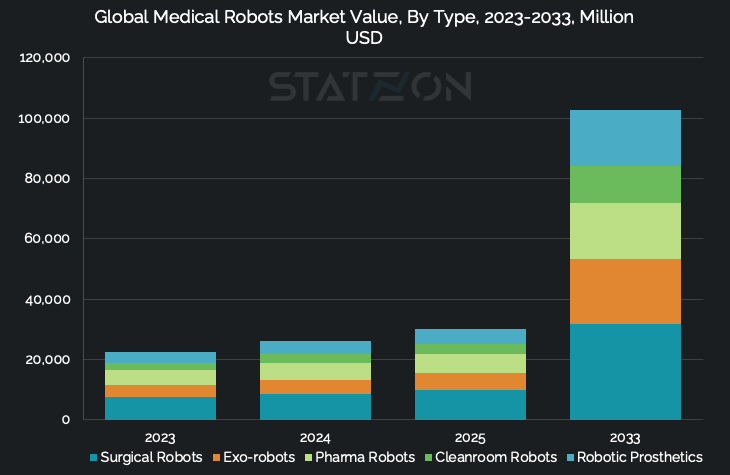

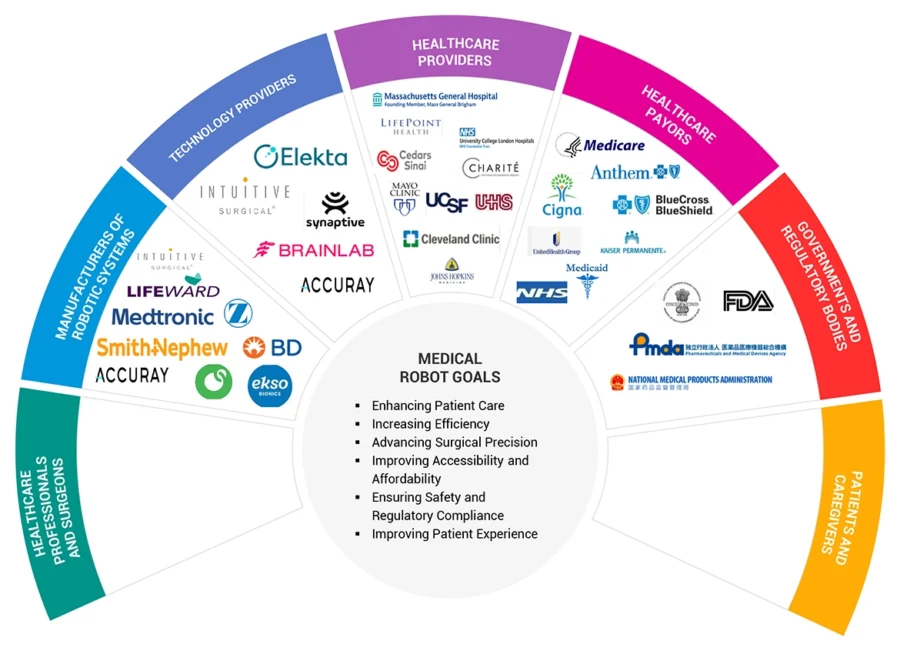

3. Medical Robots

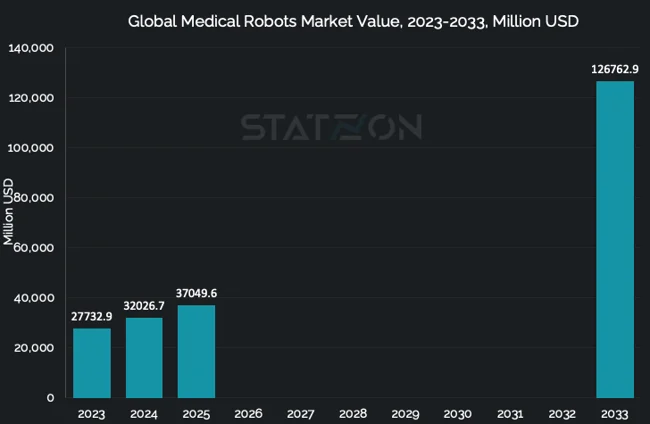

The global medical robots market is projected to reach USD 35.66 billion by 2029, growing at a CAGR of 20.6% from 2025 to 2029.

Source: The Business Research Company

Hospitals, ambulatory surgery centers, and rehabilitation centers are the primary end-users of medical robots.

Hospitals account for approximately 47% of the market share, followed by ambulatory surgery centers at 26%, and rehabilitation centers at 23%.

Source: Statzon

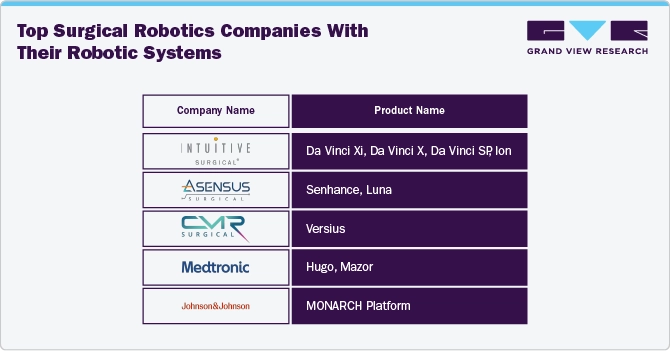

Some of the leading medical medical robot companies are Intuitive Surgical, Stryker Corporation, Medtronic, and Zimmer Biomet Robotics.

Market Insights & Growth Metrics for Medical Robots

Scale and Magnitude

As per our platform’s database, there are currently 6000+ companies specializing in medical robotics worldwide and medical robotics ranked 3845th in media coverage among emerging technologies.

Source: Market Research Firm

While North America, led by the US (USD 8.8 billion), currently dominates, Asia Pacific is expected to take the lead by 2033, growing at a 19.7% CAGR to reach USD 45.6 billion., with China leading at a 22.95% CAGR.

Source: Statzon

Growth Indicators

The annual search interest for medical robots has increased by 24.20%, as reported by StartUs Insights.

Over 1.2 million robotic procedures were performed globally by 2020 even though most of these were robotic‐assisted radical prostatectomies (RARPs).

Surgical robotic systems have been at the forefront, and that market is projected to grow at 12.4% CAGR from 2025 to 2030. The laparoscopy segment, in particular, is anticipated to grow at a CAGR of 16.5%, potentially reaching USD 9.1 billion by 2030.

Source: Grand View Research

Regionally, Asia Pacific is emerging as a rapidly growing market, with a projected CAGR of 22.9% until 2033. This growth is driven by increased healthcare investments and technological advancements in countries such as China and India.

Innovation and Novelty

A report from IAM Media indicates that the IP landscape for surgical robotics encompasses over 20 000 patents.

A study by the Center for Security and Emerging Technology (CSET) found that approximately 11% of granted robotics patents are in the medical robotics category.

Top Use Cases of Medical Robotics

- Prosthetics and Implants: Robotic prosthetics detect electrical signals from nervous or muscular systems to enable intuitive control of artificial organs. Bionic implants combine biological and electronic systems to replicate or augment natural body functions.

- Pharmacy Automation: In pharmacy settings, robots automate medication dispensing and inventory management from the moment of prescription processing. This eliminates manual errors and improves throughput.

- Surgical Assistance: Surgical robots enable surgeons to perform procedures with precision and control. They also provide a high-definition view of the surgical field and instruments that mimic the surgeon’s hand movements.

Noteworthy Advancements

- Medtronic’s Hugo Robotic-Assisted Surgery (RAS) Clinical Trials: Medtronic initiated clinical studies to expand the indications for its Hugo RAS system to include hernia and gynecologic procedures. Additionally, a prospective clinical study for gynecologic procedures is underway.

- Intuitive Surgical’s da Vinci 5: Intuitive Surgical Korea’s latest robotic surgery system, da Vinci 5, incorporates over 150 enhancements over its predecessor. They include force feedback technology that allows surgeons to precisely gauge the interaction between surgical instruments and tissue. This minimizes trauma and enhances patient safety.

Core Technologies Connected to Robotics

- Haptic Feedback: By utilizing force sensors, actuators, and control algorithms, haptic systems simulate the sense of touch and provide tactile sensations to users. In RAS, the absence of natural tactile feedback limits surgeons’ ability to assess tissue properties.

- Sensors and Actuators: Sensors provide real-time data for robots to interact safely with their environment, while actuators execute precise movements based on control signals. For instance, soft exoskeletons equipped with sensors assist patients in regaining mobility by providing tailored support.

- 3D Visualization: 3D real-time renderings of anatomical structures and surgical areas. This enables enhanced surgical planning and real-time visualization during surgeries to improve patient outcomes.

Spotlighting an innovator: ABLE Human Motion

ABLE Human Motion is a Spanish medical device company that manufactures an exoskeleton to improve mobility for individuals with disabilities. Its product, ABLE Exoskeleton, provides powered support to the hip and knee for assisting users in standing up, walking, turning, and sitting down.

This lightweight and quick-to-adjust device promotes a natural and smooth walking pattern through patented backdrivable actuator technology. It also facilitates the re-education of the brain and muscles in proper gait mechanics.

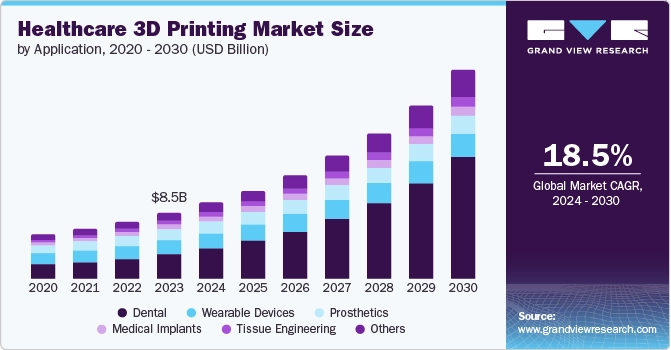

4. 3D Printing

The global healthcare 3D printing market is expected to reach approximately USD 8.71 billion by 2034 and is anticipated to grow at a compound annual growth rate of 18.5%.

Source: Grand View Research

Key areas benefiting from 3D printing include orthopedics, dentistry, and personalized medicine, where customized implants, prosthetics, and surgical planning models are becoming increasingly prevalent.

In orthopedics, 3D-printed implants integrated with AI are projected to reduce intraoperative errors by 50% and enhance patient safety and outcomes.

Point-of-care printing is also on the rise, with over 400 hospitals adopting on-site 3D printing for device production by 2024. This enables rapid prototyping and customization of medical devices.

Market Insights & Growth Metrics for 3D Printing

Scale and Magnitude

The 3D printing industry has experienced significant expansion, with over 17 360 companies operating worldwide.

The market is projected to grow to USD 101.74 billion, reflecting a CAGR of 23.4%.

This growth is accompanied by a moderate media presence, ranking 156th among emerging technologies, indicating a fair level of public and media attention.

Growth Indicators

Interest in 3D printing continues to rise, evidenced by a 42.84% annual increase in search activity. Funding in additive manufacturing has also seen a substantial uptick, with a 67.54% growth over the past five years. Additive manufacturing services grew 14% YoY in Q3 2024.

Moreover, the dental 3D printing market alone is expected to reach USD 8.65 billion by 2035.

North America stands at the forefront of this advancement, commanding a 38.0% share of the market. Within this region, the US accounts for 86.5% of the market share.

Innovation and Novelty

Based on our database, the 3D printing sector stands out as a center of innovation, demonstrated by over 179 470 patents filed worldwide. Some of the leading filers are RTX with 24 patents in Q3 2024, GE with 5, and Samsung with 30 in medical devices. However, 3D printing research has been supported by only 4625 grants.

Top Use Cases of 3D Printing in Healthcare

- Tissue Engineering: 3D bioprinting enables complex tissue structures that mimic natural human tissues to fabricate skin, bone, and cartilage constructs.

- Personalized Medication: The customization of drug dosages and release profiles using 3D printing based on individual patient needs enhances therapeutic efficacy. For instance, self-nano-emulsifying tablets improve the water solubility of certain drugs.

- Medical Device Prototyping: 3D printing enables rapid and cost-effective production of customized implants and prosthetics. As a result, companies are able to finalize product designs faster and at much lower costs.

Noteworthy Advancements

- Frontier Bio’s Lab-Grown Lung Tissue: Frontier Bio develops lab-grown lung tissue by combining bioprinting and the natural self-organizing properties of stem cells. This engineered tissue for transplants replicates essential lung structures like bronchioles, alveolar sacs, and cilia, and performs vital functions such as mucus and surfactant production.

- CollPlant and Stratasys’ Regenerative Breast Implants: These implants are produced using CollPlant’s recombinant human collagen-based bioinks and Stratasys’ Origin 3D printer. The study assesses the implants’ ability to promote natural breast tissue growth and their potential to fully degrade over time.

Core Technologies Connected to 3D Printing

- Bioprinting: Utilizes computer-aided design (CAD) and bio-inks for the precise design of complex tissue structures. Bio-inks facilitate the deposition of cells in predefined patterns and enable patient-specific tissue and organ fabrication.

- Selective Laser Sintering (SLS): Relies on high-powered lasers and powdered materials, such as biocompatible polymers and metals. SLS is instrumental in producing durable medical devices, including customized prosthetics and implants.

- Fused Deposition Modeling (FDM): Employs thermoplastic filaments and heated extrusion nozzles for creating anatomical models for surgical planning and educational purposes. Its cost-effectiveness and ease of use make it accessible for rapid prototyping of medical devices and custom surgical guides.

Spotlighting an innovator: Axolotl Biosciences

Axolotl Biosciences is a Canadian startup that provides reagents such as functional bio-inks and 3D tissue models.

Its fibrin-based bio-ink, TissuePrint, supports various cell lines, including patient-derived human-induced pluripotent stem cells, neural progenitor cells, and mesenchymal stem cells.

This bio-ink is compatible with multiple bioprinters as well as facilitates stable and reproducible 3D structures that maintain high cell viability and promote neuronal differentiation over extended culture periods.

5. Blockchain

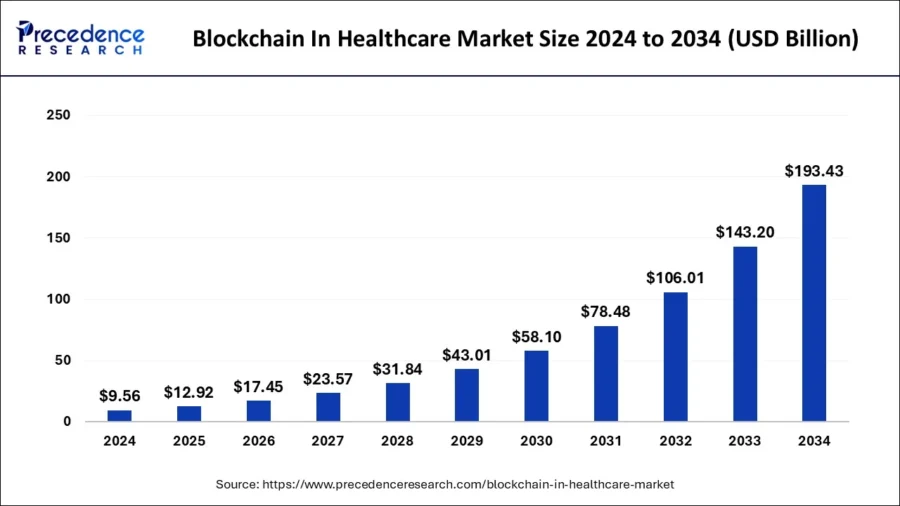

The blockchain market in healthcare is anticipated to reach around USD 193.43 billion by 2034, driven by the growing need for secure patient data management.

Source: Precedence Research

The financial impact of blockchain adoption in healthcare is significant, with potential annual savings of up to USD 100-150 billion by 2025 in costs related to data breaches, supply chain issues, and more.

Market Insights & Growth Metrics for Blockchain

Scale and Magnitude

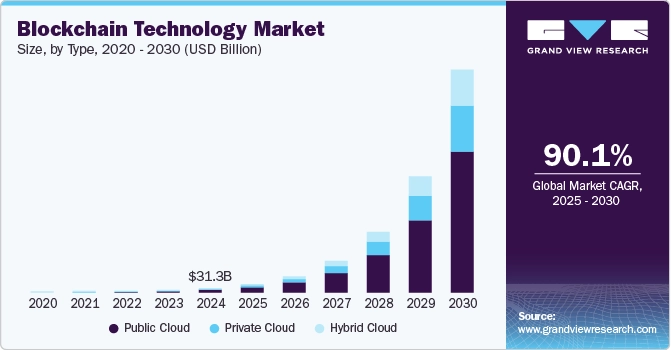

As per our database, blockchain has witnessed remarkable global expansion, as evidenced by the establishment of 42 862 companies specializing in this field. The blockchain market is projected to reach USD 1431.54 billion by 2030 at a 90.1% CAGR.

Source: Grand View Research

Despite its rapid growth, blockchain is ranked 61st in media coverage among emerging technologies in our database. This suggests that other technologies may currently capture more public and media attention.

Growth Indicators

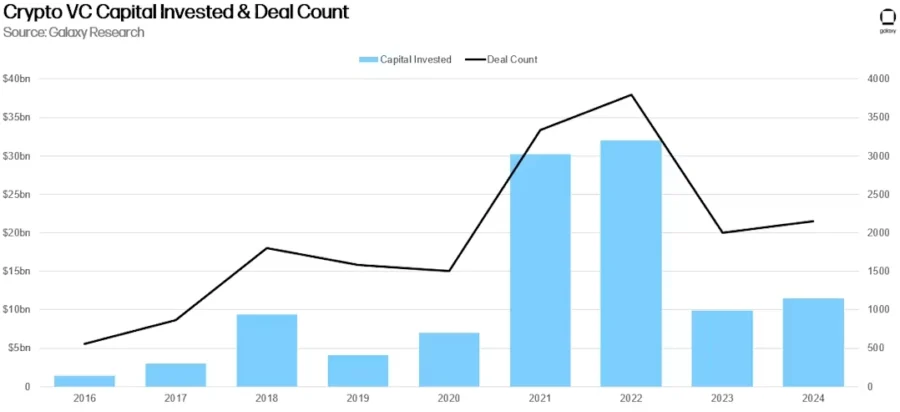

Blockchain has witnessed a significant surge in global interest, with annual search interest increasing by 72.47%, as reported by StartUs Insights. According to Galaxy, VCs invested USD 11.5 billion into crypto and blockchain-focused startups across 2153 deals in 2024.

Source: Galaxy

Over the past five years, blockchain funding has experienced a remarkable growth rate of 128.80%. This indicates substantial investments in blockchain development and implementation.

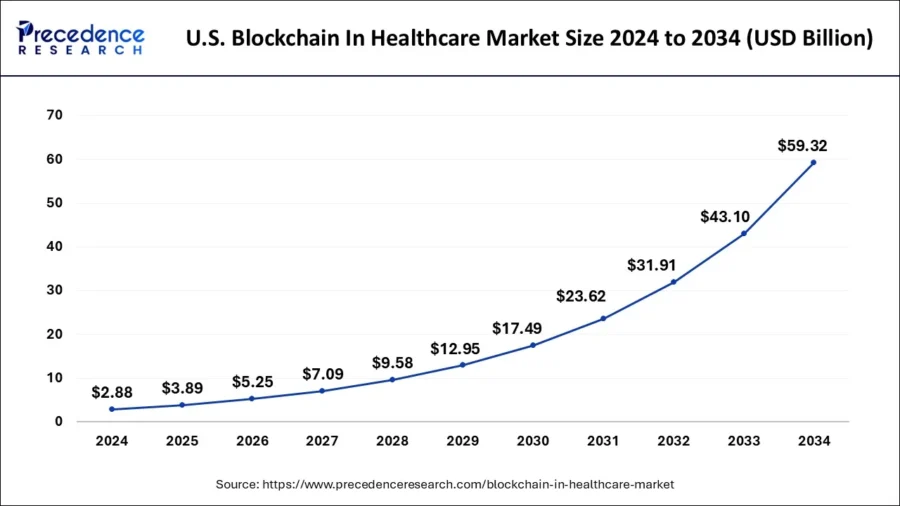

In 2024, North America led the market with a 43% revenue share, with the US alone capturing USD 2.88 billion in the global market.

Source: Precedence Research

Innovation and Novelty

Blockchain technology has demonstrated significant innovation, as evidenced by the filing of 89 022 patents globally, according to StartUs Insights.

In terms of research support, there have been 2251 grants awarded for blockchain-related studies. Key funding initiatives include a USD 2 million grant from the Ethereum Foundation for academic research in 2025.

Top Use Cases of Blockchain in Healthcare

- Secure Interoperable EHRs: Blockchain enables tamper-proof, decentralized EHRs for secure data sharing among authorized healthcare providers. This ensures that patient data remains accurate, up-to-date, and accessible.

- Claims Processing and Payments: It provides a transparent and immutable ledger for all transactions. This reduces the potential for fraud, minimizes administrative costs, and accelerates payment settlements.

- Medical Research and Data Sharing: Blockchain secures efficient data sharing among researchers while maintaining patient privacy by creating immutable records of clinical trial data. This ensures transparency and trustworthiness.

Noteworthy Advancements

- IIT-BHU’s Emergency Healthcare System: Provides real-time health data to mobile phones using Bluetooth-based sensors to detect emergencies like high blood pressure or heart attacks. It also uses blockchain to securely share the information to family members and nearby hospitals.

- MediLinker’s Decentralized Health Information Management Platform: Developed by The University of Texas at Austin, it addresses issues of fragmented health records and data security. The platform features self-sovereign identity management to ensure that patients control access through decentralized identifiers (DIDs) and verifiable credentials (VCs).

Core Technologies Connected to Blockchain

- Smart Contracts: Self-executing agreements with terms encoded directly into the software automatically enforce and execute actions when predefined conditions are met. This streamlines insurance claims by automatically verifying coverage and processing payments when conditions are satisfied.

- Cryptography: Protects sensitive health information by encrypting data. This ensures that patient records remain confidential and tamper-proof in blockchains.

- Distributed Ledger Technology (DLT): A decentralized database managed by multiple participants, where each node holds an identical copy of the ledger to ensure consistency and transparency. This improves data sharing across different healthcare providers.

Spotlighting and Innovator: Medicalchain

Medicalchain is a UK-based startup that develops a user-focused blockchain-based electronic health record. It creates a single version of patient data that is accessed by healthcare professionals.

Each interaction with this data is recorded transparently and securely on Medicalchain’s distributed ledger. Additionally, the platform allows third-party developers to build applications.

By placing patients at the center of personal data management, Medicalchain improves transparency, trust, and care delivery.

6. Connectivity Technologies

Connectivity technologies improve patient care and streamline operations. This is primarily driven by technologies like 5G, long-range wide area network (LoRaWAN), low-power WAN (LPWAN), and BLE.

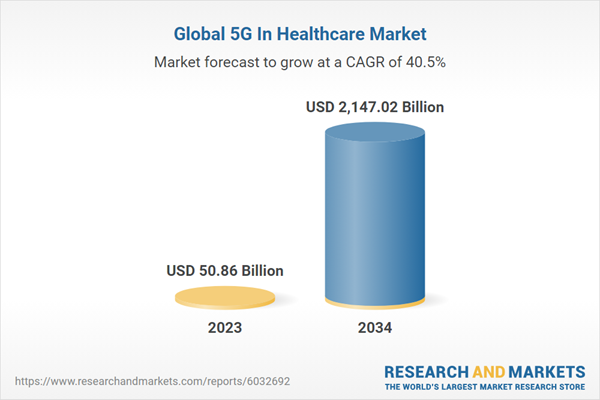

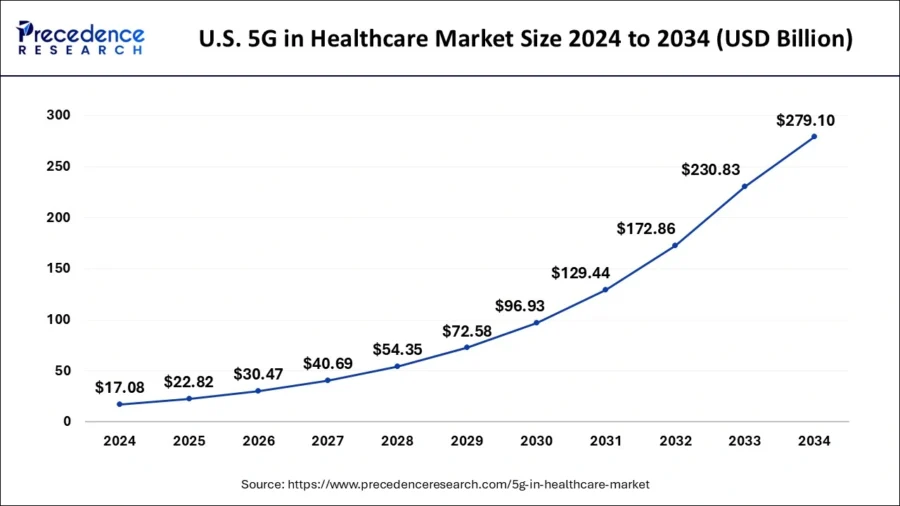

For instance, the 5G market associated with healthcare is expected to reach USD 2.14 trillion by 2034, with an accelerated CAGR of 40.53%. The adoption of 5G enables applications such as telemedicine, remote surgery, AI-driven diagnostics, and more.

Source: Research and Markets

Market Insights & Growth Metrics for Connectivity Technologies

Scale and Magnitude

According to StartUs Insights, there are 9584 companies working in 5G technology and 1016 companies in the LoRaWAN domain.

In Q3 2024, Ericsson reported a more than 50% increase in sales in North America, attributing this growth to heightened demand for 5G equipment. This surge reflects the US’s proactive approach to embracing advanced communication.

In 2024, the global market for 5G IoT was also valued at approximately USD 24.5 billion and is projected to reach USD 916.9 billion by 2030, with a CAGR of 67.8%.

In terms of media coverage and public attention, 5G holds a prominent position among emerging technologies. StartUs Insights ranks 5G at 73rd in media coverage, indicating substantial visibility. In contrast, LoRaWAN is ranked 1543rd, and RFID stands at 1081st.

Growth Indicators

Interest in 5G is surging, with search interest rising by 114.47% annually. Despite this, five-year funding growth has declined by 21.93%, likely due to slowed investment cycles following large-scale deployments.

By Q3 2024, North America recorded 264 million 5G connections, making up 37% of all wireless connections in the region.

LoRaWAN is also gaining traction, with search interest increasing by 68.68% annually. However, five-year funding growth declined by 44.28%. This indicates challenges in scaling beyond niche applications.

Source: Precedence Research

The LoRaWAN market is expected to soar to USD 370.49 billion at a CAGR of 33.5% by 2037. Prominent players in this market include Semtech, Cisco, Orange SA, and Bosch.

Source: Research Nester

BLE also remains a critical technology in healthcare, particularly for wearable health devices like fitness trackers and glucose monitors. The BLE market in healthcare is projected to reach USD 28.76 billion by 2028, at a CAGR of 4.8%.

Innovation and Novelty

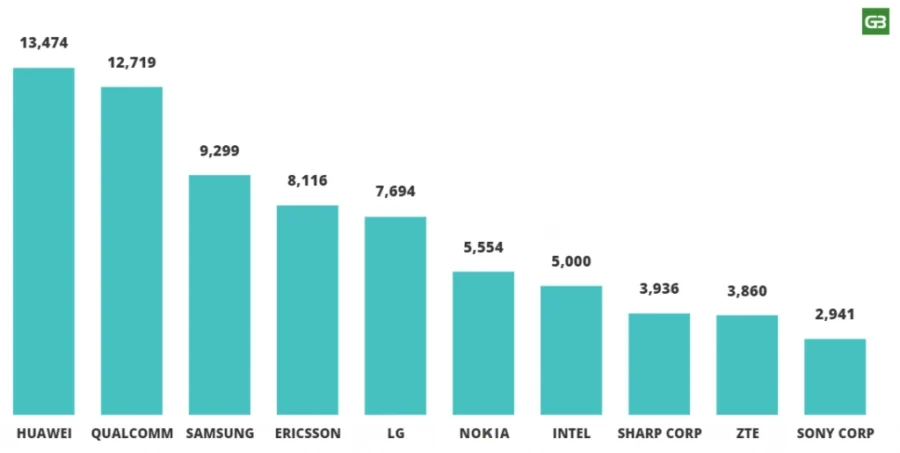

Innovation remains strong in this domain, with 76 200+ patents filed globally for 5G. Huawei leads this with 13 474 patents – followed by Qualcomm (12 719 patents ), LG (7694 patents), and Samsung (9299 patents).

List of top 10 companies holding most 5G patents

Source: GreyB

Research and development in 5G is backed by 1500+ grants, emphasizing institutional support for technological advancements.

In contrast, the LoRaWAN domain has seen 410+ patents filed globally and received 80+ grants, with a 2023 review analyzing 71 patents focused on performance improvements.

Top Use Cases of Connectivity Technologies in Healthcare

- Telehealth and Virtual Care: Advanced connectivity allows healthcare providers to offer remote consultations and leverage remote patient monitoring. This ensures timely care delivery and improves patient outcomes.

- Environmental Monitoring: IoT-enabled systems share real-time air quality, temperature, humidity, and infection control data. This allows hospitals to improve air quality, ensure safety standards in storage units, and maintain sterile environments.

- Data Interoperability and Integration: Continuous connectivity enables hospitals to share real-time information across healthcare platforms and institutions. These unified patient records enhance patient experiences.

Noteworthy Advancements

- Singapore’s LoRa Emergency Alert System: Singapore implemented a battery-powered wireless emergency alert system in 10 000 public housing flats for seniors. It has wall-mounted red buttons that initiate an emergency call to a 24-hour response center when pressed. It also notifies the next of kin via a companion app.

- ZTE & China Telecom Collaborate on 5G Smart Hospital Implementation: ZTE, in collaboration with the Hospital of Soochow University and China Telecom’s Suzhou Branch, has developed a 5G IoT integration network solution for smart hospitals. It supports extensive IoT applications to reduce medical staff workloads and improve patient outcomes.

Core Technologies Connected to Connectivity Technologies

- Ultra-Wideband Technology: Transmits short-duration pulses over a wide frequency spectrum for high-precision localization and low-power communication. UWB-enabled wearables track vital signs and patient movements.

- LoRaWAN: Wirelessly connects battery-operated devices to the internet in regional, national, or global networks. LoRaWAN facilitates the deployment of IoT devices that monitor patient health metrics in real time.

- 5G Network Slicing: Enables multiple virtual networks on a shared physical infrastructure. This allows healthcare providers to have dedicated network resources for critical applications, ensuring high reliability and low latency.

Spotlighting an innovator: X-CITE

Luxembourg-based startup X-CITE offers X-BRAiN, a cloud-based 5G IoT and AI accelerator platform. It integrates AI and machine learning engines with data lakes and connects to public and private 5G networks to manage devices and assets efficiently.

X-BRAiN‘s modular design allows easy integration with diverse industry protocols and data sources. It also includes advanced device management, comprehensive connectivity options, and blockchain-enabled analytics.

Moreover, all these features are orchestrated within a hyperscaler-agnostic cloud infrastructure. The platform thus enables hospitals to deploy IoT, AI, and 5G solutions reliably.

7. Cloud Computing

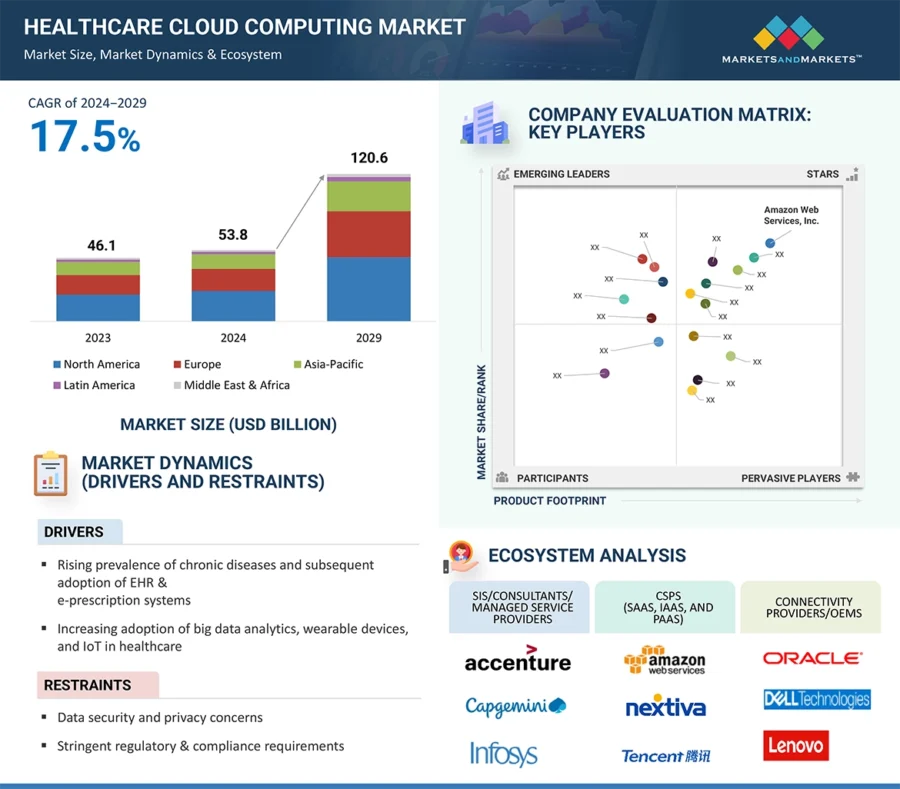

The cloud computing market associated with healthcare is projected to rise to USD 120.6 billion by 2029.

Source: MarketsandMarkets

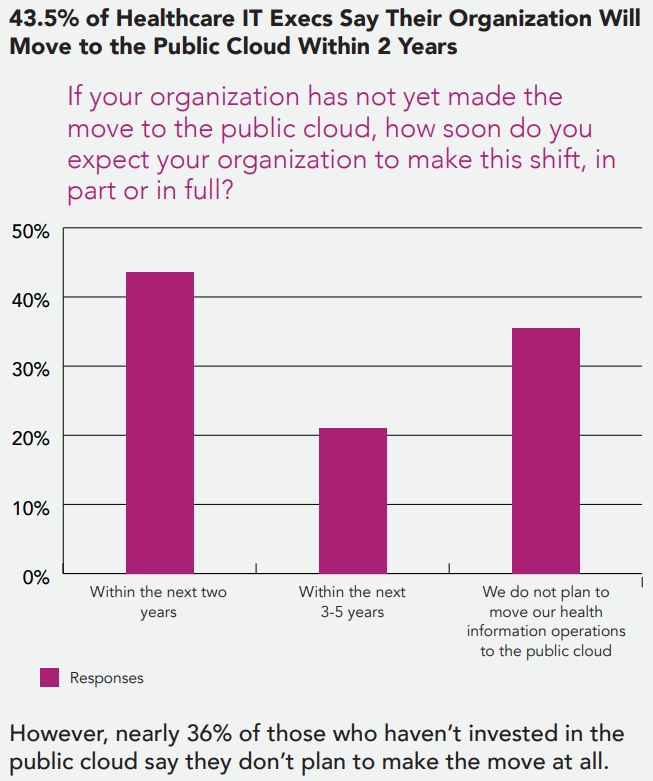

Cloud platforms facilitate real-time monitoring and virtual consultations to make healthcare more accessible and efficient. And that is why 43.5% of healthcare IT executives say that their organization will move to the public cloud.

Source: Healthcare Triangle

Cloud computing’s scalable infrastructure reduces capital expenditures and, hence, influences 66% of healthcare leaders to migrate to the cloud.

Moreover, cloud solutions ensure compliance with regulations like HIPAA and GDPR, thus encouraging its adoption.

Furthermore, a survey indicates that 96% of healthcare leaders planned to implement hybrid or multi-cloud strategies last year.

Market Insights & Growth Metrics for Cloud Computing

Scale and Magnitude

Cloud computing has seen remarkable global expansion, evidenced by the 109 008 number of companies, based on Discovery Platform’s data.

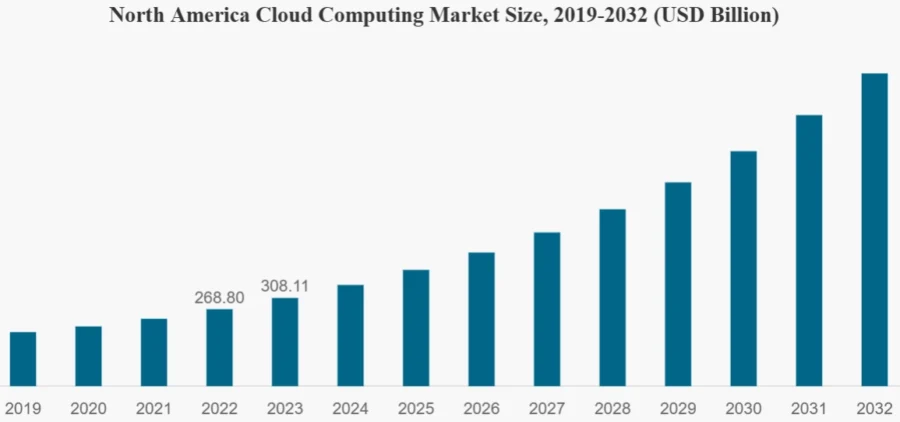

Cloud computing market size is projected to grow to USD 2.29 trillion by 2032 with North America dominating the market with a share of 52.42%.

Source: Fortune Business Insights

Cloud computing ranks 53rd in media coverage among emerging technologies, as indicated by Discovery Platform.

Growth Indicators

Cloud computing has experienced a significant surge in global interest, with annual search interest rising by 81.64%, as reported by StartUs Insights. Amazon Web Services remains the biggest public cloud provider with 32% of the market.

Over the past five years, cloud computing has seen a funding growth rate of 24.44%. This reflects a steady increase in investments dedicated to cloud development and implementation.

Source: MarketsandMarkets

Regional adoption varies, with North America holding a market share of 37.4% in 2024. This leadership is attributed to advanced IT infrastructure, high EHR adoption rates, and robust regulatory frameworks.

Europe accounts for 17.8% of the market share, driven by GDPR compliance, a focus on interoperability, and the deployment of hybrid cloud solutions.

Innovation and Novelty

According to data from StartUs Insights’ Discovery Platform, there have been 78 092 cloud computing patents filed worldwide.

The availability of grants plays a crucial role in fostering development in cloud computing. StartUs Insights reports that 7559 grants are supporting research in this field.

Top Use Cases of Cloud Computing in Healthcare

- EHR Management: Cloud-based EHR systems improve the sharing of personal patient data and EHRs. These allow patients, managed-care organizations, and hospitals to efficiently manage and access vital medical information.

- Revenue Cycle Management: Cloud-based solutions offer insights into revenue streams and enable them to identify bottlenecks quickly and make data-driven decisions. This approach improves patient satisfaction and payment processes.

- Data Analytics and AI Integration: Cloud healthcare platforms offer advanced data analytics and AI capabilities for insights into patient data. This improves diagnostic accuracy, personalizing treatment plans, and patient outcome prediction.

Noteworthy Advancements

- Contrast AI’s Partnership with AWS: Contrast AI partnered with AWS to implement AWS HealthScribe. On average, physicians spend approximately 4.5 hours daily on EHR tasks, contributing significantly to burnout and detracting from patient care. AWS HealthScribe reduces documentation time and saves up to 10 hours per week.

- ASUS & GE Healthcare’s Medical Imaging Service: DicomCloud integrates ASUS’s cloud services and GE Healthcare’s AW Server system to provide 3D medical imaging. This enables medical institutions to perform real-time diagnostics to ensure that more severe cases receive attention at specialized medical centers.

Core Technologies Connected to Cloud Computing

- Virtualization: Hypervisors create multiple virtual machines (VMs) on a single physical server. This abstraction layer allows for the isolation of applications and services to prevent lateral movement to other applications or systems.

- Distributed Computing: Involves a network of interconnected computers that share resources and workloads for data and applications to be distributed across multiple systems. This architecture ensures that critical applications remain available even during system failures or cyberattacks.

- Containerization: Utilizes container engines, like Docker, to package applications with their dependencies into containers. Containers ensure that applications run consistently across different environments and reduce configuration errors that could lead to security vulnerabilities.

Spotlighting and Innovator: Cohere Health

Cohere Health is a US-based company that provides intelligent prior authorization solutions that align physicians and health plans on evidence-based care paths.

The company’s platform digitizes prior authorization requests into an automated workflow that applies responsible AI and machine learning to assist clinical reviewers in adjudicating complex cases.

The platform also offers real-time analytics and predictive technologies that determine the next best action. By streamlining prior authorization, Cohere Health reduces administrative expenses and accelerates patient access to appropriate care.

8. Cybersecurity

The healthcare industry witnessed a dramatic rise in ransomware attacks with 67% of healthcare organizations reporting incidents in the past 12 months – a 7% increase from the previous year.

A staggering 92% of healthcare organizations reported experiencing at least one cyberattack during the year with the average organization facing 40 separate incidents.

The surge in cyber threats, including ransomware attacks and data breaches, has compelled healthcare organizations to invest heavily in advanced cybersecurity solutions.

The adoption of EHRs, telemedicine, and IoT devices further expands the attack surface and will continue to increase.

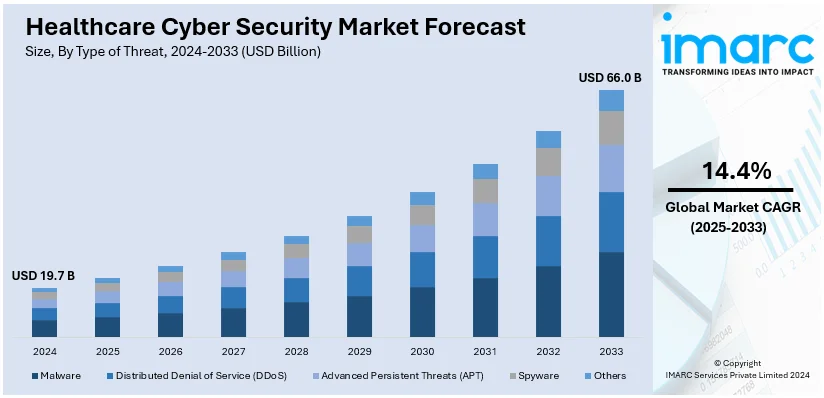

That is why the global healthcare cybersecurity market is projected to reach USD 66 billion by 2033, reflecting a CAGR of 14.4%.

The US Department of Health and Human Services proposed new regulations mandating multifactor authentication (MFA), network segmentation, and data encryption to better protect patient data.

Market Insights & Growth Metrics for Cybersecurity

Scale and Magnitude

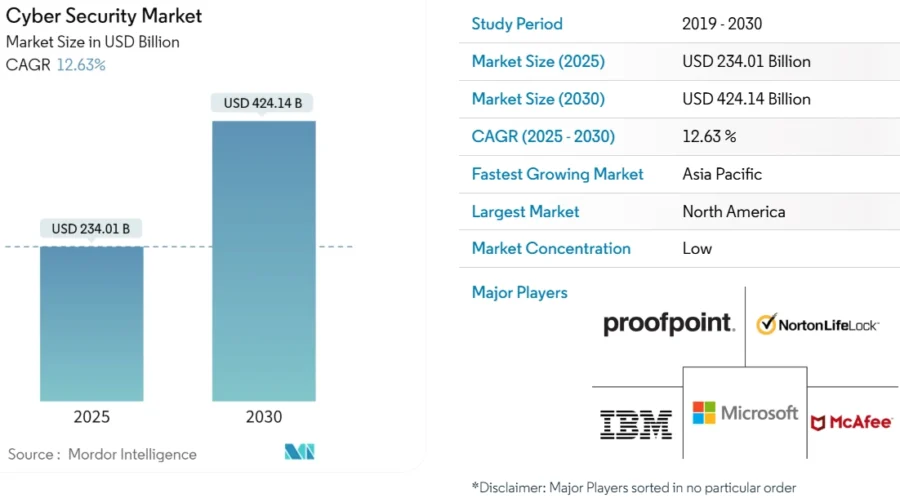

According to StartUs Insights, there are currently 172 438 companies specializing in cybersecurity worldwide. The cybersecurity market is projected to reach USD 424.14 billion by 2030 at a CAGR of 12.63%.

Source: Mordor Intelligence

Cybersecurity ranked 12th in media coverage among all emerging technologies, as reported by StartUs Insights.

Growth Indicators

According to data from StartUs Insights, there has been a 68.27% increase in annual search interest for cybersecurity. This surge reflects heightened awareness and concern over cyber threats among individuals and organizations.

Over the past five years, cybersecurity has seen a funding growth rate of 40.35%, as per StartUs Insights.

In Q3 2024, cybersecurity startups attracted significant venture capital investments. Notably, Wiz secured a USD 1 billion funding round – reaching a USD 12 billion valuation during this period.

Innovation and Novelty

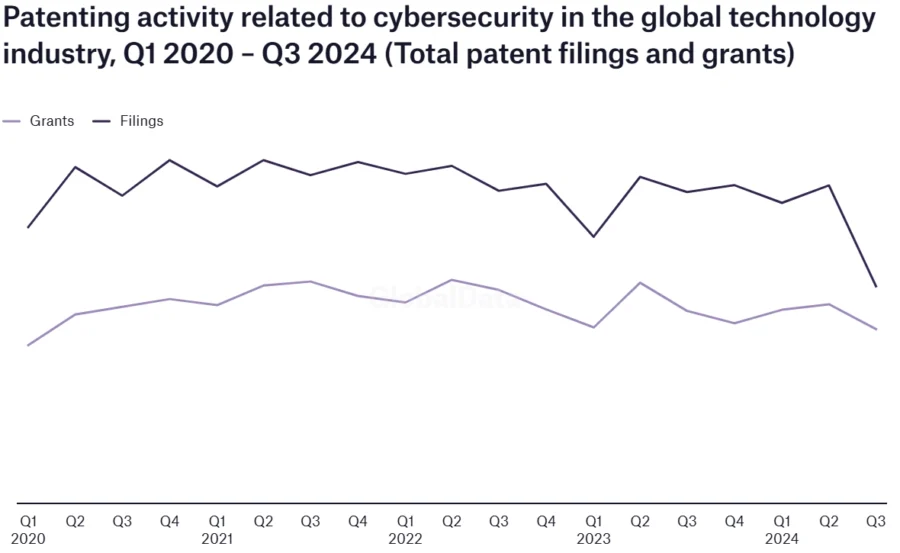

According to StartUs Insights, there have been 379 402 cybersecurity-related patents filed globally. In Q3 2024, cybersecurity-related patent applications saw a drop of 32% from the previous quarter.

Source: Verdict

Leading companies such as Huawei Investment, Qualcomm, Samsung Electronics, and Dell Technologies collectively accounted for 9% of the patenting activity. The United States led in patent filings and contributed 33% of the total, followed by China at 31% and Japan at 3%.

Leading the market with a significant share, North America accounted for over 38.9% of the global healthcare cybersecurity market in 2024.

Source IMARC Group

Top Use Cases of Cybersecurity in Healthcare

- Secure Connected Devices: The increased attack surface due to medical IoT devices is compensated with technologies like zero trust segmentation and continuous device/network monitoring. This allows healthcare companies to protect patient safety and data.

- Data Protection and Privacy Compliance: New cybersecurity measures such as multifactor authentication, network segmentation, and data encryption safeguard EHRs and protected health information (HPI).

- Advanced Threat Detection: AI systems predict potential vulnerabilities and recommend proactive measures to strengthen security posture. Additionally, AI’s adaptive learning capabilities enable it to identify anomalies that may not conform to known attack patterns.

Noteworthy Advancements

- Experis & ClearDATA enhance Cloud Security & Compliance: This collaboration offers healthcare organizations comprehensive services to ensure data protection, regulatory compliance, and secure cloud infrastructure management.

- Omega Healthcare Employs ColorTokern’s Zero Trust Microsegmentation: This architecture protects sensitive data, including personally identifiable information (PII), EHRs, and electronic PHI (ePHI), from potential breaches and ransomware attacks.

Core Technologies Connected to Cybersecurity

- Multi-Factor Authentication (MFA): Combines multiple independent credentials to verify user identity. It reduces the risk of unauthorized access, even if one factor (like a password) is compromised to ensure that only authorized personnel access sensitive patient information.

- Endpoint Detection and Response (EDR): Utilizes advanced monitoring tools and behavioral analysis to detect and respond to threats on endpoint devices such as computers, tablets, and medical devices.

- Homomorphic Encryption: An advanced cryptographic method that allows computations to be performed directly on encrypted data without decryption. The results of these computations remain encrypted and can be decrypted only by the intended recipient.

Spotlighting an Innovator: Cynerio

Cynerio is a US-based company that offers a comprehensive healthcare cybersecurity platform. It continuously monitors hospital networks to identify and classify connected medical and IoT devices.

This way, the platform analyzes device context and provides real-time visibility into device communications and behaviors to pinpoint vulnerabilities. It also offers automated micro-segmentation that creates and tests network policies to limit potential threats.

Additionally, the platform provides actionable insights and mitigation guidance for healthcare settings. Through these capabilities, Cynerio empowers healthcare organizations to ensure service continuity and maintain patient safety.

9. Wearables

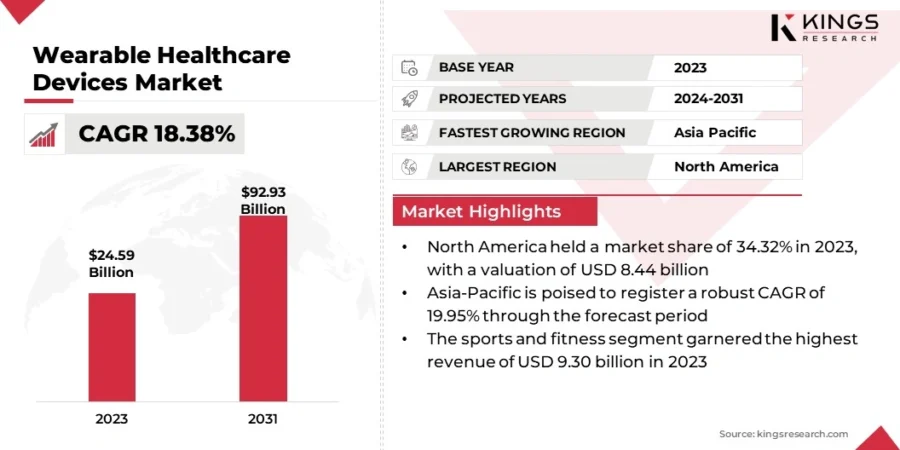

The market for wearable healthcare devices, such as fitness trackers and smartwatches, is projected to reach USD 92.93 billion by 2031 with an 18.38% CAGR.

Source: Kings Research

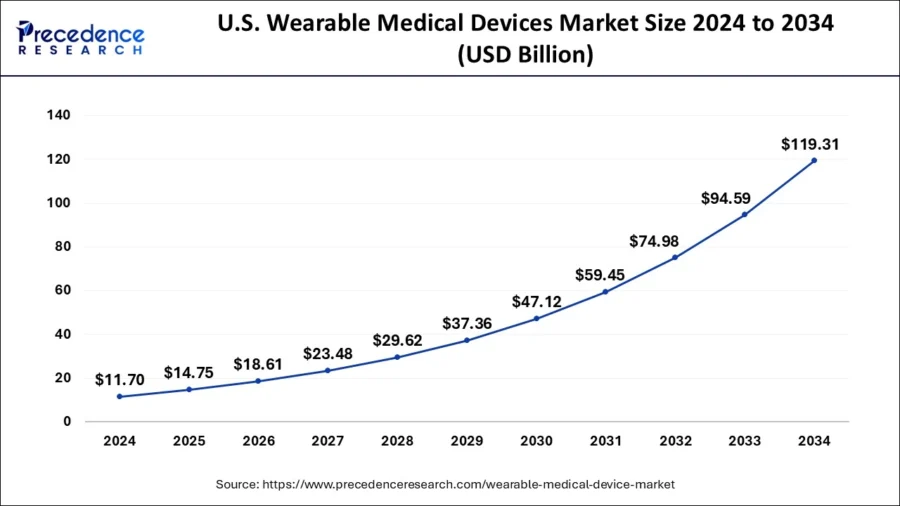

Regionally, North America leads the market, holding a 39% share. Specifically, the US wearable medical device market is projected to reach USD 119.31 billion by 2034, exhibiting a 26.10% CAGR.

In the Asia-Pacific region, India stands out with an anticipated 18.4% CAGR from 2024 to 2034, supported by government initiatives.

Source: Precedence Research

Wearables reduce hospital expenses by 16% over five years. Additionally, remote monitoring solutions are anticipated to save USD 200 billion over the next 25 years by enabling early detection and intervention of chronic conditions.

Top players like Medtronic, Fitbit (Google), Apple, and Abbott Laboratories lead innovation in medical-grade wearables.

Market Insights & Growth Metrics Wearables

Scale and Magnitude

There is substantial growth in wearable technology within the healthcare industry. StartUs Insights’ Discovery Platform reports identified that 74 484 companies are operating in this sector.

This growth is further supported by market projections, with the industry’s value expected to reach USD 168.29 billion by 2030.

According to our data, wearable technology ranks 78th in media coverage among emerging technologies.

Growth Indicators

The wearable technology sector has witnessed a notable increase in global search interest, growing at an annual rate of 23.11%.

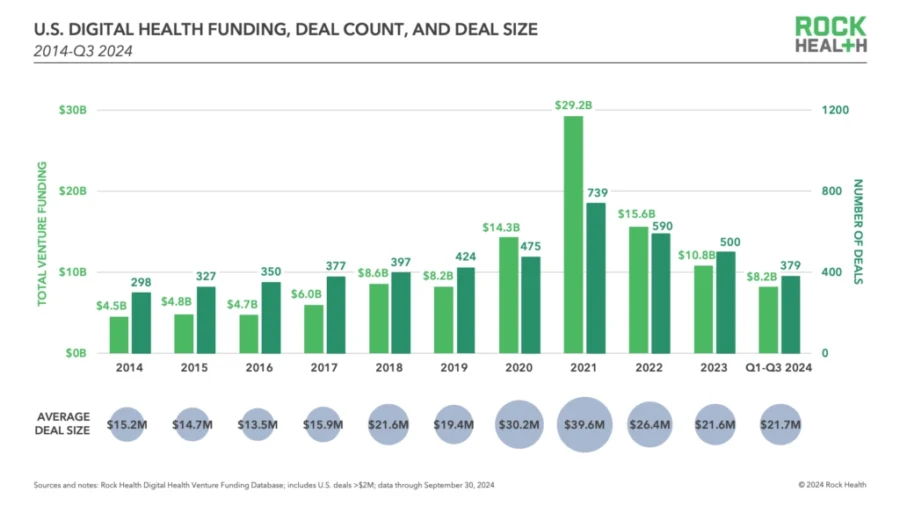

Over the past five years, the industry has experienced a funding growth decline of 41.17%. This downturn aligns with broader market trends, where venture capital investments have become more selective, focusing on startups with clear profitability paths.

Source: Rockhealth

In Q3 2024, the US digital health sector, encompassing wearable technology, secured USD 2.4 billion in venture funding across 110 deals.

Innovation and Novelty

The wearable technology sector has demonstrated significant innovation, as evidenced by the filing of 158 529 patents globally.

Leading companies in this space include Samsung Group, with 3716 patents, Apple holding 2973 patents, and Sony Group with 2523 patents.

Global: Top Wearable Tech Patents Holders in the Technology, Media and Telecom Sector (2002 – 2022)

| Company Name | Patents Published |

|---|---|

| Samsung Group | 3716 |

| Apple Inc. | 2973 |

| Sony Group Corp. | 2523 |

| Alphabet Inc. | 2175 |

| Microsoft Corp. | 1860 |

Note: The number of patents includes patents published by the holding company and its subsidiaries (data till October 2022)

Source: Global Data

There were 7941 grants awarded to support research in wearable technology.

Top Use Cases of Healthcare Wearables

- Sleep Disorder Management: Wearables monitor sleep patterns and detect disorders like sleep apnea. For instance, the Apple Watch Series 10 utilizes an ultra-sensitive accelerometer to monitor breathing patterns during sleep.

- Personalized Fitness and Wellness: The technology offers personalized fitness tracking for users to experience personalized exercise plans and health insights.

- Chronic Disease Management: Wearable devices manage chronic diseases by offering real-time monitoring and personalized care. For example, continuous glucose monitors provide real-time blood sugar readings for individuals to manage diabetes more effectively.

Noteworthy Advancements

- Apple’s Wearable Tech for Sleep Apnea & Hearing Loss Detection: The new Apple Watch detects signs of sleep apnea by monitoring breathing disturbances during sleep. Similarly, AirPods Pro 2 received a software update that enables them to function as over-the-counter hearing aids.

- Alva Health’s Wearable Stroke Detection Device: This non-invasive device employs AI and machine learning algorithms to identify early signs of stroke, specifically hemiparesis, which is muscle weakness or paralysis on one side of the body.

Core Technologies Connected to Wearables

- Biosensors: Biocompatible materials and miniaturization allow sensors to detect biological markers like glucose and electrolytes. These sensors integrate into wearables for continuous health monitoring.

- Photoplethysmography (PPG): Uses optical technology to measure blood volume changes in microvascular tissue. These sensors provide continuous monitoring of cardiovascular parameters.

- Wireless Connectivity: BLE, Wi-Fi, and cellular networks enable seamless data transmission between devices. Low-power electronics and energy-efficient communication improve battery life and device usability.

Spotlighting an Innovator: gaitQ

gaitQ is a UK-based company that develops gaitQ tempo, a discreet vibrational cueing system to assist individuals with Parkinson’s disease.

The device delivers subtle vibrational prompts through wearable pods secured to the lower legs. These vibrations serve as external cues, engaging alternative neural pathways to bypass the impaired basal ganglia.

This facilitates smoother walking patterns and improved mobility. Moreover, gaitQ tempo features a user-centric design developed with input from over 200 people with Parkinson’s, their carers, and clinicians.

10. Robotic Process Automation

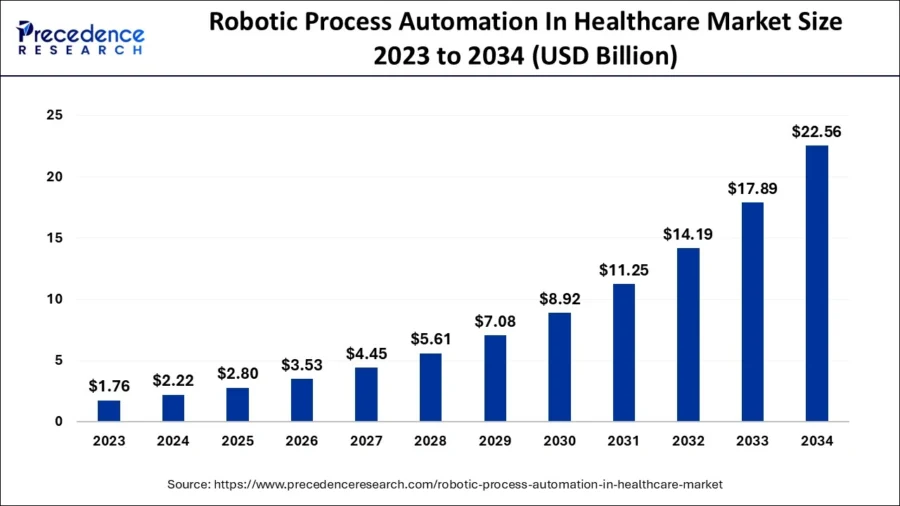

The RPA market in healthcare is projected to reach USD 22.56 billion by 2034, growing at a remarkable CAGR of 26.1%.

Source: Precedence Research

Studies suggest that up to 33% of tasks performed by healthcare professionals can be automated.

Moreover, 50% of US healthcare organizations plan to invest in RPA over the next three years as healthcare providers are under pressure to manage growing patient volumes.

RPA improves operational efficiency, with process cycle times enhanced by 30-70%, significantly expediting routine tasks.

The financial impact of RPA is particularly evident in claims processing, where automation reduces processing time by 80% while maintaining accuracy rates above 90%.

Traditionally, human intervention in claims processing costs approximately USD 4 per claim, but RPA-driven auto-adjudication reduces this to around USD 1.

A 10-12% increase in auto-adjudication rates alone could save the healthcare industry over USD 1 billion annually.

Some healthcare providers have already reported annual savings of USD 600 000 in administrative expenses after implementing RPA, reinforcing its value as a cost-reduction strategy.

Market Insights & Growth Metrics for RPA

Scale and Magnitude

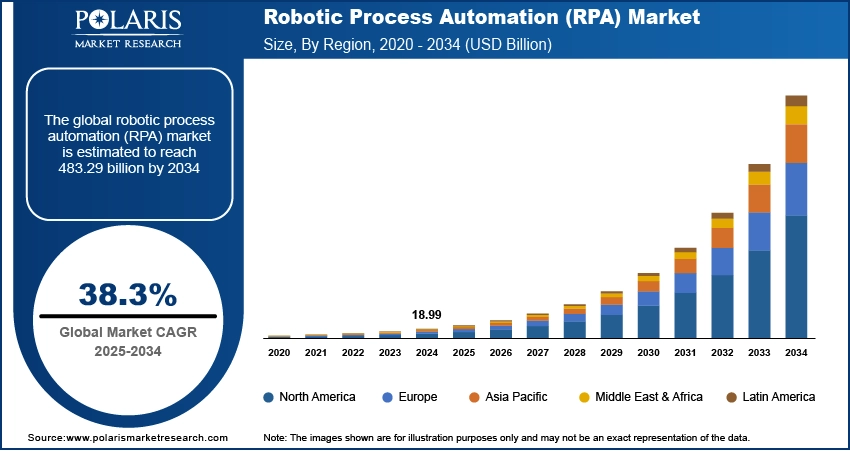

Robotic process automation has seen significant global expansion, with StartUs Insights identifying 7796 companies specializing in this technology. The global RPA market size is going to reach USD 483.29 billion by 2034, exhibiting a CAGR of 38.3%.

Source: Polaris Market Research

Despite its growth, RPA ranks 760th in media coverage among emerging technologies. This suggests that while adoption is increasing, there remains significant potential for heightened public awareness and discourse.

Growth Indicators

RPA witnessed a significant surge in global interest, with annual search interest rising by 64.02%, as reported by StartUs Insights. For example, the healthcare sector constitutes 10% of the RPA adoption share.

RPA is rapidly evolving into an enterprise-level strategy, with 64% of respondents now considering it a strategic or organization-wide initiative.

This marks a substantial increase from just a year ago when only 15% of respondents viewed RPA as part of a broader corporate strategy.

Over the past five years, RPA has experienced a remarkable funding growth rate of 255.03%. This reflects a substantial increase in investments dedicated to RPA development and implementation.

Innovation and Novelty

Robotic process automation has demonstrated significant innovation, as evidenced by the filing of 80 407 patents globally, according to data from the Discovery Platform.

There have been 2525 grants awarded globally for RPA-related studies based on our database. In 2024, UiPath, a leading RPA provider, secured multiple key patents, including those for an RPA-powered digital assistant, cloud-based RPA deployment, and workflow execution with resumption capabilities.

Top Use Cases of RPA in Healthcare

- Patient Scheduling and Appointment Management: RPA bots automatically send appointment reminders to patients, reschedule appointments based on patient responses, and update scheduling systems in real time.

- Regulatory Compliance and Reporting: RPA assists by automating the collection, processing, and reporting of compliance-related data. It automatically updates patient information based on eligibility changes, verifies insurance coverage against payer rules, and more.

- Revenue Cycle Management: By automating tasks such as patient data entry, insurance verification, claims processing, and payment posting, RPA reduces manual effort and errors while accelerating revenue cycles.

Noteworthy Advancements

- Empathic Podiatry implements eClinicalWorks RCM: Empathic Podiatry has adopted eClinicalWorks cloud EHR, RCM, and RPA solutions. The RPA-driven RCM streamlines administrative processes such as claim processing, payment posting, and statement generation and reduces manual workload.

- Omega Healthcare Processes 60M Transactions: The implementation of UiPath’s AI-driven document understanding and generative AI automation has improved operational efficiency while reducing claim denial rates and improving documentation accuracy.

Core Technologies Connected to RPA

- Optical Character Recognition (OCR): Enables software robots to extract and process data from unstructured sources to automate tasks that involve reading and interpreting text from images or scanned documents.

- Computer Vision: Allows machines to interpret and process visual information from images or videos. In radiology, computer vision algorithms aid in the detection of conditions such as pneumonia or tumors to support clinicians.

- Artificial Intelligence: Intelligent process automation (IPA) solutions handle complex tasks and make decisions. This enables chatbots and virtual assistants that interact with patients, provide information, and more.

Spotlighting an innovator: Element5

Element5 is a US-based company that develops a fully managed platform that orchestrates AI agents to perform and delegate work across patient financial journeys.

The platform also offers real-time centralized visibility, actionable insights through interactive dashboards, and integration with existing electronic health records.

It automates administrative tasks such as eligibility verification, authorization processing, and revenue cycle management by deploying AI agents.

Key Benefits of Digitizing Healthcare Technology in 2025

1. Enhanced Diagnostic Accuracy & Personalized Care

Digital transformation enhances precision in treatment and enables early intervention through remote monitoring. It improves real-time decision-making in critical procedures.

AI, big data, and analytics solutions personalize care by processing vast medical datasets, while edge computing ensures faster, more accurate responses in high-stakes scenarios like robotic surgeries.

2. Improved Accessibility & Health Equity

Digital healthcare solutions, like telemedicine and virtual consultations, eliminate the need for travel. This reduces costs and wait times while expanding access to specialists.

With over 50% of healthcare executives prioritizing virtual care, telehealth networks are enabling cross-border consultations and offering patients access to world-class expertise regardless of location.

3. Cost Reduction and Operational Efficiency

The integration of predictive analytics in healthcare is leading to an approximately 30% reduction in hospital readmissions by identifying at-risk patients early and implementing preventive measures.

Automation of administrative tasks, such as scheduling and billing, also cuts labor costs and allows clinicians to focus on patient care.

4. Patient Empowerment and Engagement

Digital health platforms support informed decision-making by providing instant access to EHRs, test results, and personalized treatment plans while wearable devices support self-management of chronic conditions.

Additionally, gamified health apps encourage positive behavioral changes by using incentives and personalized challenges to promote healthier lifestyles.

5. Streamlined Collaboration and Data Security

Blockchain and cloud computing enhance medical record security and ensure transparency and compliance with privacy regulations.

Further, AI-driven communication tools improve interdisciplinary teamwork as well as reduce errors, and improve the speed and efficiency of treatment coordination across hospitals and specialists.

6. Proactive and Preventive Healthcare

Predictive AI models are transforming healthcare by detecting diseases like pancreatic cancer up to 3 years earlier than traditional methods, shifting focus from reactive to preventive care.

Another example – digital therapeutics (DTx) combines wearable data and AI-driven coaching to improve chronic disease management and long-term health outcomes.

Step-by-Step Guide: A Roadmap for Successful Digitization of Healthcare

1. Define the Vision and Goals

Establish a Clear Vision: Align the digital transformation strategy with the organization’s healthcare objectives, focusing on patient-centered care, operational efficiency, and data security.

Set Measurable Objectives: Define quantifiable goals such as reducing administrative burdens as well as improving patient outcomes, hospital resource management, and telehealth services.

2. Conduct a Digital Maturity Assessment

Evaluate Current Capabilities: Assess existing healthcare technologies, data infrastructure, and staff expertise to identify strengths and gaps in digital readiness.

Benchmark Against Industry Leaders: Compare digital adoption levels with top healthcare institutions to understand competitive positioning and identify best practices for modernization.

3. Identify Key Technologies

Prioritize Investments: Focus on high-impact technologies such as AI-driven diagnostics, electronic health records interoperability, and blockchain.

Ensure Scalability: Choose solutions that can adapt to evolving healthcare demands, support regulatory compliance, and integrate with future advances in medical technology.

Use Technology Scouting: Leverage platforms like StartUs Insights’ Discovery Platform to track emerging technologies in digital healthcare.

4. Build a Robust Data Infrastructure

Leverage Big Data: Implement systems to collect, store, and analyze vast amounts of patient data from various sources to improve diagnostics, treatment plans, and predictive analytics.

Integrate Systems: Ensure seamless communication between EHR systems, hospital management platforms, and clinical workflows for enhanced data accuracy and interoperability.

5. Develop a Detailed Roadmap

Plan Incremental Implementation: Break down the digital transformation journey into manageable phases, starting with pilot programs to validate technological effectiveness.

Set Realistic Timelines: Establish achievable deadlines for each phase while maintaining flexibility to adapt to emerging healthcare needs and regulatory changes.

6. Foster Collaboration and Ecosystem Partnerships

Engage Stakeholders: Involve healthcare providers, insurance companies, patients, and technology partners early in the process to ensure alignment and commitment.

Form Strategic Alliances: Partner with health tech firms, startups, and research institutions to access cutting-edge innovations and expertise in digital healthcare.

7. Upskill the Workforce

Invest in Training: Provide healthcare professionals with training in digital tools, AI-driven diagnostics, data analytics, and telehealth solutions to enhance service delivery.

Cultivate a Digital Culture: Foster an environment of continuous learning and innovation that encourages medical staff to embrace new technologies and drive transformation.

8. Implement Cybersecurity Measures

Protect Critical Assets: Establish comprehensive cybersecurity protocols to safeguard patient records, digital health applications, and hospital networks against cyber threats.

Comply with Regulations: Ensure adherence to industry standards and legal requirements related to data privacy, HIPAA compliance, and electronic health information security.

9. Monitor, Measure, and Optimize

Track Key Performance Indicators (KPIs): Regularly assess performance metrics such as patient satisfaction, treatment efficiency, digital adoption rates, and cost savings to measure digitization success.

Adapt Strategies: Use data-driven insights to refine strategies, address inefficiencies, and respond to emerging trends in healthcare technology.

10. Scale and Innovate Continuously

Expand Successful Pilots: Scale up proven digital initiatives across hospital networks and ensure they remain adaptable and sustainable.

Embrace Continuous Improvement: Stay updated on evolving digital health technologies, regulatory shifts, and best practices to foster a culture of continuous innovation.

Future Trends in the Healthcare Industry: Top 4 Emerging Trends

AI-Powered Precision Medicine

What’s Next: AI-driven tools will integrate genomic data with clinical records and lab results to create highly individualized treatment plans. Machine learning algorithms will also support diagnostics with real-time analysis of medical images and patient data.

Why It Matters: AI-powered precision medicine will significantly reduce the trial-and-error approach to treatments.

Expansion of Telehealth Ecosystems

What’s Next: Telehealth will incorporate RPM through wearable and implantable devices to continuously track vitals and transmit data to care teams. There will also be an expansion of holistic virtual care through mental health counseling, remote rehabilitation, and digital pharmacies.

Why It Matters: Telehealth will eliminate geographical barriers, reduce the need for in-person visits, and lower costs. This shift is critical for rural communities, aging populations, and individuals with mobility challenges.

Advanced Robotics and Automation in Healthcare

What’s Next: Surgical robots will enhance precision for complex procedures. Automated laboratories and AI-driven pharmacy systems will further streamline repetitive tasks.

Why It Matters: Automation will optimize healthcare operations, address workforce shortages, and make healthcare delivery more efficient and scalable.

3D Bioprinting and Organ Replacement

What’s Next: Advances in tissue engineering will refine the development of bioprinted tissues for wound healing, organ patches, and implants. Although still experimental, organ bioprinting has the potential to create fully functional organs that will reduce the reliance on donor transplants.

Why It Matters: 3D bioprinting addresses organ shortages and offers life-saving alternatives for patients with organ failure. This will significantly improve patient survival rates.

Act Now to Stay Ahead of the Technology Curve

Staying competitive means more than just being aware of technological advancements. Every industry faces unique challenges and opportunities, and a one-size-fits-all approach isn’t enough.

That’s where our AI and Big Data-powered Discovery Platform comes in. With access to over 5 million emerging companies and 20K+ technologies & trends globally, it equips you with the actionable insights you need to stay ahead of the curve. Leverage this powerful tool to spot the next big thing before it goes mainstream. Stay relevant, resilient, and ready for what’s next.

![AI in Automotive: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Automotive-SharedImg-StartUs-Insights-noresize-420x236.webp)

![AI in Healthcare: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Healthcare-SharedImg-StartUs-Insights-noresize-420x236.webp)