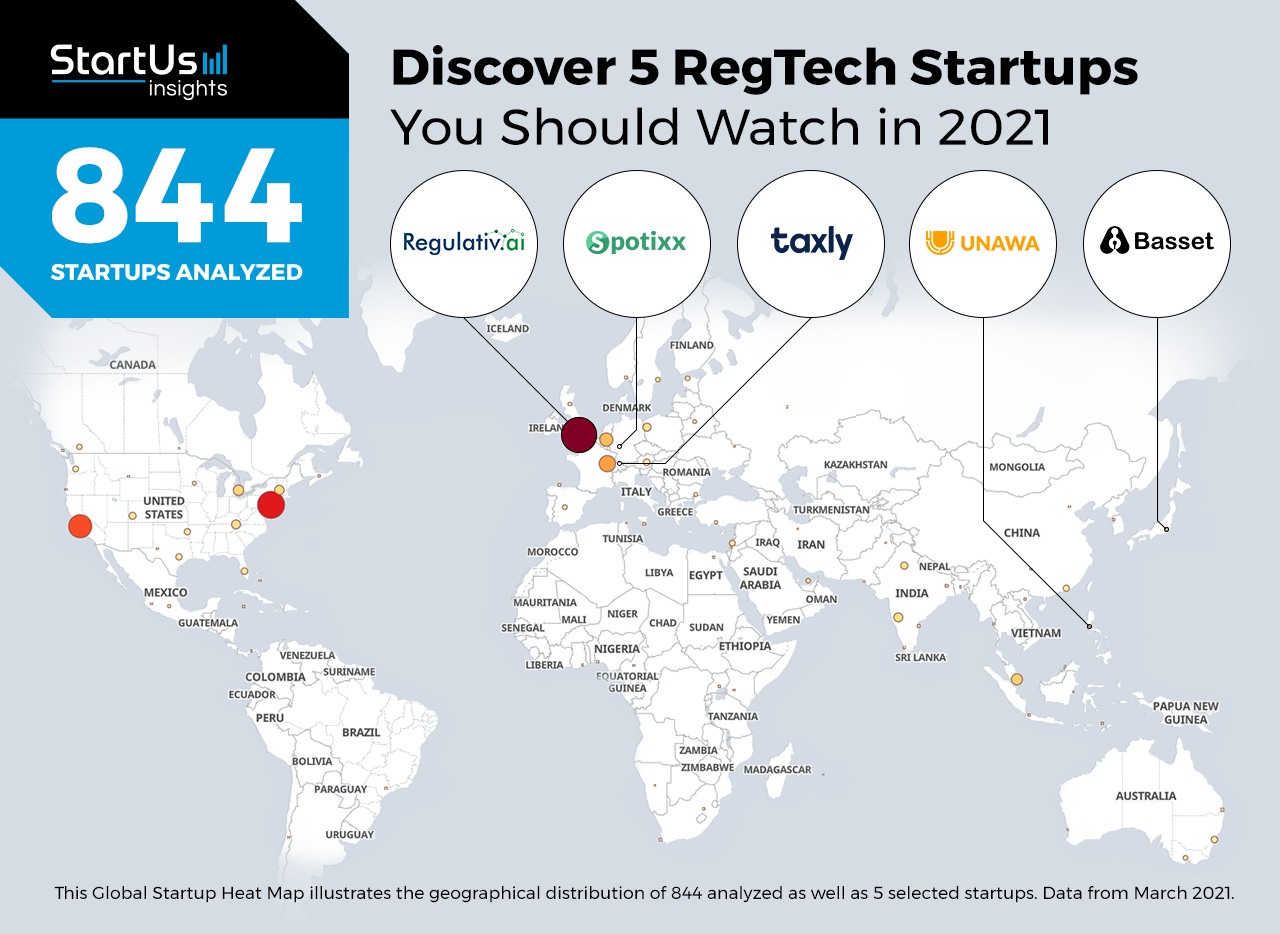

Thousands of new startups are founded every year, despite considerable disruptions and challenges to the global economy. To introduce you to emerging technologies and startups in the regulatory technology (RegTech) sector, we analyzed a total of 844 RegTech startups & scaleups.

Global Startup Heat Map reveals 5 RegTech Startups You Should Watch in 2021

Out of 844, the 5 RegTech startups to watch this year are chosen through the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering over 1.3 million startups & scaleups globally. The platform gives you the most exhaustive collection of solutions and ensures you continuously discover new startups, scaleups, and technologies. This enables you to easily scout for RegTech technologies and startups that matter to you and drive innovation in your industry forward.

The Global Startup Heat Map below highlights the 5 RegTech startups you should watch in 2021 as well as the geo-distribution of the other 839 startups & scaleups we analyzed for this research. The 5 highlighted RegTech startups are hand-picked based on our data-driven startup scouting approach, taking into account factors such as location, founding year, relevance of technology, and funding, among others.

Unawa enables Business Compliance

Doing business is a complex task in many economies with too many bureaucratic hurdles and unclear regulations. This discourages a lot of entrepreneurs and prevents many others from digitizing their businesses. RegTech startups offer innovative solutions to help businesses meet regulatory compliance. This makes enterprises cost-efficient and frees up their time to focus on their products or services.

Doing business is a complex task in many economies with too many bureaucratic hurdles and unclear regulations. This discourages a lot of entrepreneurs and prevents many others from digitizing their businesses. RegTech startups offer innovative solutions to help businesses meet regulatory compliance. This makes enterprises cost-efficient and frees up their time to focus on their products or services.

Filipino startup Unawa provides business compliance solutions for a digital economy. The startup’s solutions make it easy for Filipino companies to do business in the country. SafeForm digitizes paper forms and creates simple, automated workflows for customer registrations or sales orders. SignSecure and RNotary enable secure and legally-binding e-signatures and notarizations, respectively.

spotixx develops Fraud Detection Technology

Fraudsters keep adapting to sidetrack any preventive mechanisms. Consequently, fintech startups and institutions need to keep innovating to develop new fraud detection technologies. On the other hand, frequently flagging legitimate transactions may lead to customer dissatisfaction. Startups combine domain knowledge with machine learning to detect and prevent fraud while minimizing false hits.

Fraudsters keep adapting to sidetrack any preventive mechanisms. Consequently, fintech startups and institutions need to keep innovating to develop new fraud detection technologies. On the other hand, frequently flagging legitimate transactions may lead to customer dissatisfaction. Startups combine domain knowledge with machine learning to detect and prevent fraud while minimizing false hits.

German startup spotixx uses machine learning to detect financial crimes. It offers a fully automated, up-to-date process for anti-money laundering (AML) and fraud analytics. The interpretable AI solution is rapidly deployable and prevents frauds related to payments & cards, insurance claims, and credit applications. It offers high flexibility while reducing the risk, cost, and time involved in fraud detection.

Regulative.ai provides Cybersecurity Regulatory Assessment

Today, when most businesses operate partially or fully online, assessing the risk of cyberattacks is critical. Cybersecurity assessment solutions inspect a company’s information technology (IT) infrastructure. This helps evaluate protective systems, as well as ensure compliance with security regulations. RegTech startups offer cybersecurity assessment solutions to help companies stay secure and compliant.

Today, when most businesses operate partially or fully online, assessing the risk of cyberattacks is critical. Cybersecurity assessment solutions inspect a company’s information technology (IT) infrastructure. This helps evaluate protective systems, as well as ensure compliance with security regulations. RegTech startups offer cybersecurity assessment solutions to help companies stay secure and compliant.

Regulativ.ai is a British startup that provides cybersecurity regulatory assessment solutions. The startup’s scalable, cloud-based platform encompasses data governance and data compliance capabilities. It also integrates with third-party tools for workflows, reporting, analytics, and external regulations. It uses machine learning and natural language processing (NLP) algorithms to automatically prepare regulatory submissions for large corporations and financial institutions.

Basset offers Blockchain Data Visualization

Traditional financial institutions and banks are warming up to cryptocurrencies. However, the anonymity of the Blockchain technology makes it incredibly difficult to detect money laundering and other fraudulent incidents. RegTech startups are developing forensics and investigative tools to monitor the crypto ecosystem. These tools utilize pattern recognition and heuristics to detect any anomalies in the market.

Traditional financial institutions and banks are warming up to cryptocurrencies. However, the anonymity of the Blockchain technology makes it incredibly difficult to detect money laundering and other fraudulent incidents. RegTech startups are developing forensics and investigative tools to monitor the crypto ecosystem. These tools utilize pattern recognition and heuristics to detect any anomalies in the market.

Japanese startup Basset offers Blockchain data visualization tools. The solution provides actionable insights into the Japanese and Asian cryptocurrency ecosystems. It enables compliance teams to detect unusual activity and file suspicious activity reports (SARs). Basset’s tools also allow visualization of the flow of funds and monitor transactions and entities with digital identity profiles.

Taxly simplifies Tax Returns

Filing tax return applications is a complex task for most individuals and enterprises. Even though most governments accept online tax returns, bureaucratic hurdles, cumbersome documentation, and other challenges make it an arduous affair. RegTech startups offer automated AI-based solutions that simplify the process of filing tax returns.

Filing tax return applications is a complex task for most individuals and enterprises. Even though most governments accept online tax returns, bureaucratic hurdles, cumbersome documentation, and other challenges make it an arduous affair. RegTech startups offer automated AI-based solutions that simplify the process of filing tax returns.

Taxly is a Swiss startup utilizing AI to simplify tax return processes. Roger, the startup’s solution, asks questions to compute and optimize tax returns. It checks relevant regulations, swiftly determining any deductions. Powered by verification with local tax authorities and one-click submission, Roger makes filing tax returns easy for Swiss citizens, as well as non-citizen residents.

Discover all 844 RegTech Startups

The 844 RegTech startups are only a small sample of what we identified during our research. Explore our free Industry Innovation Reports for a broad overview of the industry or get in touch for quick & exhaustive research on the latest technologies and emerging solutions that will soon impact your company.