Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial sector. This time, you get to discover 5 hand-picked FinTech startups developing post-COVID solutions.

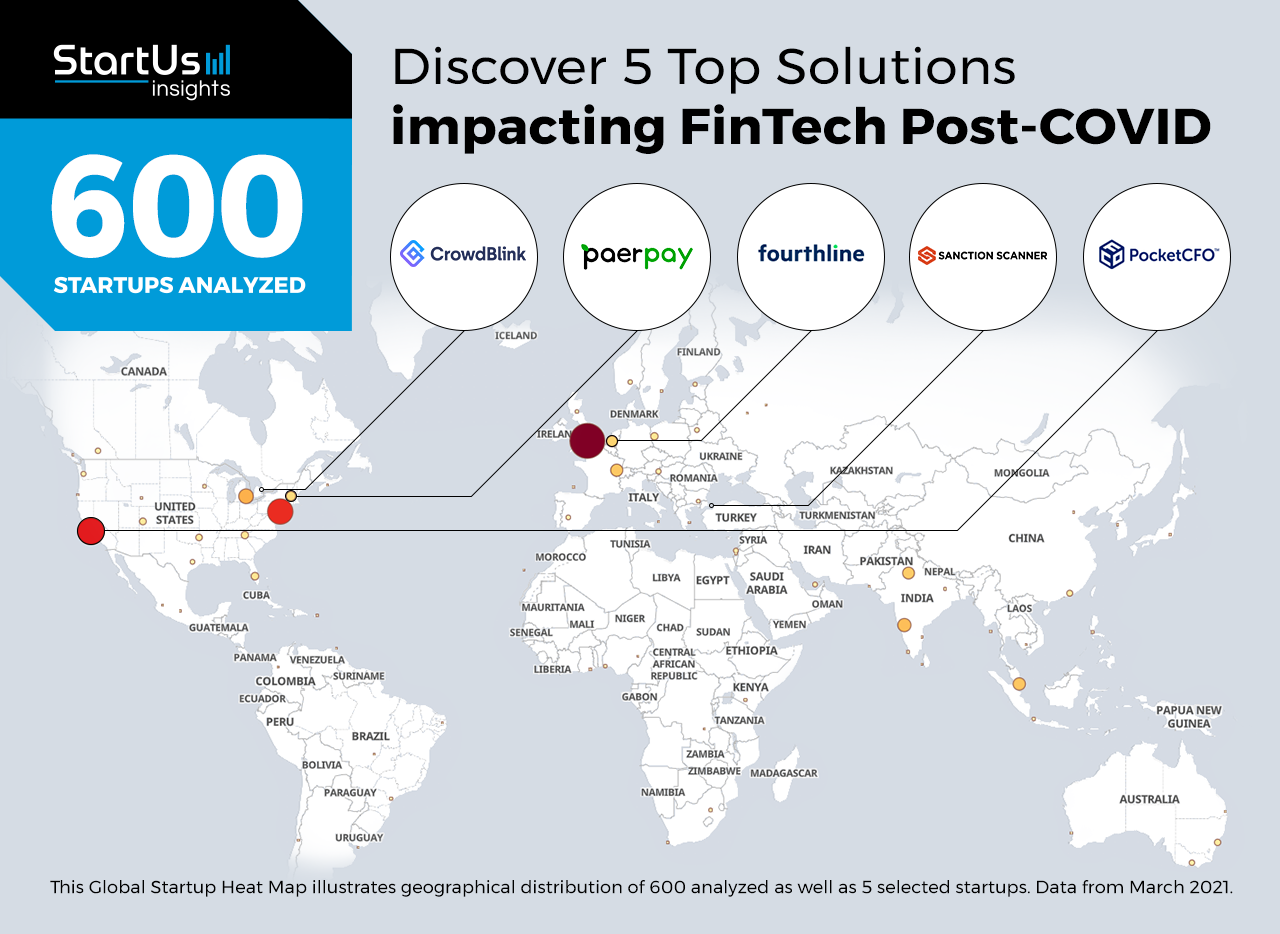

Global Startup Heat Map highlights 5 Top Post-COVID Solutions impacting FinTech out of 600

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 1.379.000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 600 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups developing post-COVID solutions, that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 595 FinTech startups developing post-COVID solutions, get in touch.

CrowdBlink designs a Cashless Payment System for Events

The coronavirus pandemic has accelerated the shift from cash to digital payments. The events industry has been hit especially hard due to the lockdowns and other COVID-19 restrictions. By slowly resuming their activities, event organizers actively adopt cashless payments to minimize crowding near entrances. Moreover, contactless payments also provide a safe and comfortable option for people still dealing with health risks.

Canadian startup CrowdBlink develops a cashless payment system for events. The solution enables event organizers to accept cashless radio-frequency identification (RFID)-based payments, mobile payments, and credit cards to eliminate the risks of handling cash. The system works out-of-the-box on tablets and smartphones, as well as payment terminals, and provides into the spending habits of attendees.

Paerpay develops Contactless Payment for Restaurants

To meet COVID-19 requirements and create a safe work environment for their employees, restaurants look to minimize interactions between visitors and waiters. As a result, there has been a rise in the adoption of contactless payment solutions for restaurants. This allows patrons to follow the COVID-related restrictions to maintain social distancing.

US-based startup Paerpay develops a contactless payment platform for restaurants. The solution enables guests to view, split, and pay for their orders with a text message or QR code to arrest the spread of pathogens. Further, Paerpay easily integrates with the existing Point-of-Sale (PoS) systems. The solution also reduces credit card fraud, recovers walkouts, and minimizes swipe transactions.

Fourthline offers Intelligent Know Your Customer (KYC) products

With the growing popularity of online banking and e-wallet services, the pandemic has increased fraud and cybersecurity risks. As a result, companies were encouraged to revisit their Know Your Customer (KYC) procedures to be better equipped to deal with digital threats and provide convenient services to the growing number of customers.

Fourthline is a Dutch startup that develops intelligent KYC and digital identity products. The AI-based solutions use near-field communication (NFC) to identify and authenticate official documents. Digital identity solutions comprising biometric analysis, database checks, location tracking & verification, and other modules help prevent fraud and achieve compliance.

Sanction Scanner offers Anti-Money Laundering (AML) solutions

As in any other industry, the COVID-19 pandemic has also increased the risk of financial crime. Criminals, too, are exploiting the vulnerabilities caused due to restrictions, with a growing number of criminal financial interactions online. Startups develop solutions that enable compliance with regulations and offer AML solutions to mitigate the risks.

Turkish startup Sanction Scanner offers AML solutions for the FinTech industry. The AI-powered solution automates the control of sanctions lists, as well as collects and structures sanctions and watch lists of the regulatory and law enforcement agencies. Sanction Scanner enables companies to create custom search options based on their risk level.

PocketCFO develops a Cash Flow Forecasts Platform

Companies with unstable cash flow become particularly vulnerable during the COVID-19 pandemic. By understanding the importance of managing cash flows, enterprises leverage automated solutions to collect data for analysis and strategic planning. Startups further offer advanced analytical solutions to allow businesses to predict their cash flows and make the right decisions.

US-based startup PocketCFO develops a financial insights platform that automates cash flow forecasts. The all-in-one platform centralizes financial data to provide full control of cash flows. The platform offers a transaction categorization feature, as well as the startup’s personalized Pocket Insight, to help companies extend their cash runway.

Discover more FinTech startups

The 600 FinTech startups developing post-COVID solutions, such as the examples highlighted in this report, focus on contactless payments, cash flow management, and fraud detection solutions such as AML & KYC. While all of these technologies play a major role in advancing FinTech, they only represent the tip of the iceberg. To explore more FinTechs, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.