The 2025 Drone Report provides an overview of the rapidly evolving drone sector. It highlights key trends and technological advancements that are shaping the future of aerial, aquatic, and autonomous operations. As drones continue to permeate various industries—from agriculture and filmmaking to logistics and defense—the report offers a comprehensive analysis of firmographic data, investment patterns, and innovative startups.

This report was last updated in January 2025.

This drone industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: Drone Industry Outlook 2025

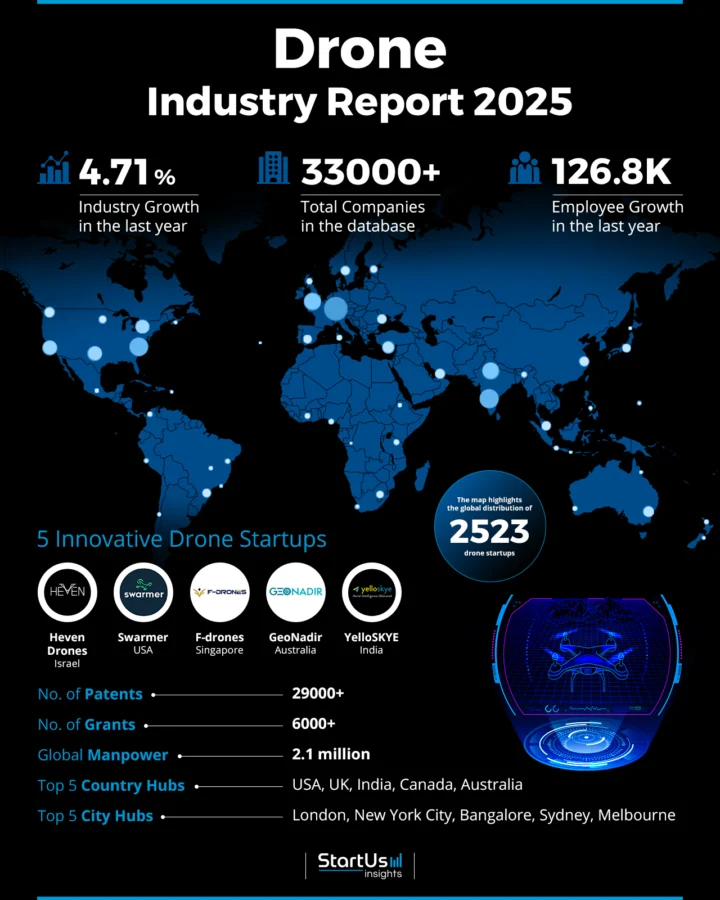

- Industry Growth Overview: The drone industry grew by 4.71% last year, with over 33 000 companies listed. The global drone market is projected to reach USD 54.6 billion by 2025, growing at a compound annual growth rate (CAGR) of 7.7% from 2024.

- Manpower & Employment Growth: Over 2.1 million people worldwide work in the drone industry and the last year, it added 126 800 employees.

- Patents & Grants: The drone sector has received over 29 000 patents and more than 6000 grants, demonstrating its dedication to research and development.

- Global Footprint: The United States, United Kingdom, India, Canada, and Australia are major hubs for the drone industry. Cities like London, New York City, Bangalore, Sydney, and Melbourne are leading in drone innovation. North America dominated the drone market in 2024, whereas Asia-Pacific region is expected to be the fastest growing region in the upcoming time..

- Investment Landscape: The drone industry has received substantial investment, with an average of USD 27.2 million per funding round. Over 2000 investors have participated in more than 7000 funding rounds.

- Top Investors: Goldman Sachs, Baidu, Rise Fund, and more have invested substantial amounts, totaling over USD 1 billion.

- Startup Ecosystem: Five innovative startups, including Heven Drones (Hydrogen-powered Drones), Swarmer (Multi-drone Mission Control), F-drones (Maritime Drones), GeoNadir (Drone Data Mapping), and YelloSKYE (Asset Risk Management), showcase the sector’s global reach and entrepreneurial spirit.

Methodology: How we created this Drone Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies and market trends.

For this report, we focused on the evolution of drones over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the drone sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the drone market.

What data is used to create this drone industry report?

Based on the data provided by our Discovery Platform, we observe that the drone industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The drone industry has seen over 47 000 publications in the last year, showcasing its increasing media presence.

- Funding Rounds: Our database includes more than 7000 funding rounds for this sector, marking its excellence in attracting investments.

- Manpower: It employs over 2 million workers and has added more than 126 000 new employees in the last year, showcasing its robust growth.

- Patents: The industry has more than 29 000 patents, showing its technological advancements and creative prowess.

- Grants: It has received 6000+ grants, emphasizing its significance and potential for innovative research and development worldwide.

- Yearly Global Search Growth: The drone industry has seen an impressive yearly global search growth of 33.80%, indicating its increasing popularity and relevance in the digital age.

Explore the Data-driven Drone Industry Report for 2025

The industry has seen a growth rate of 4.71% over the last year. Over 33 000 companies are recorded in our database, including 2000+ startups developing new technologies and applications for drones.

Further, the industry employs 2.1 million people and has added 126 000 employees in the last year, indicating the sector’s growing job market and role in the global economy.

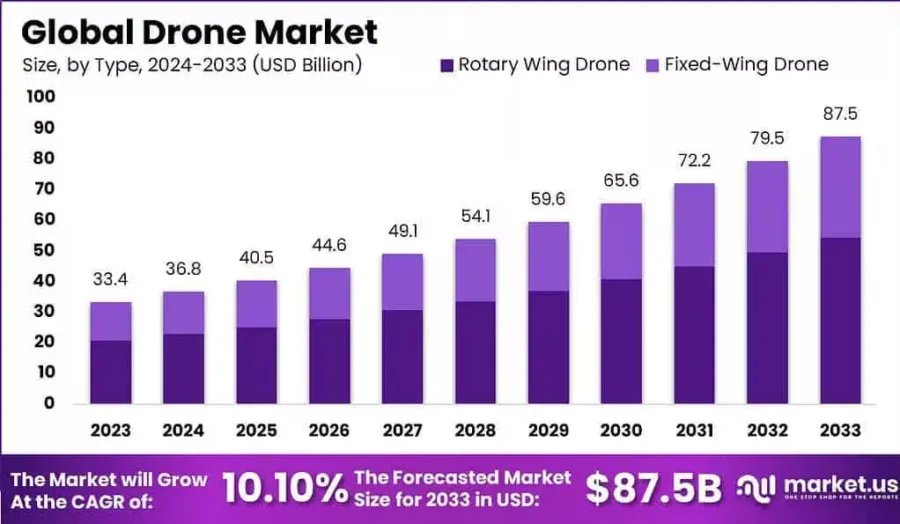

The global drone market size is expected to be worth around USD 87.5 billion by 2033, growing at a CAGR of 10.1%. Additionally, the commercial drone market is expected to grow to USD 41.89 billion in 2025, with a CAGR of 15.00% from 2025 to 2030.

Credit: Market.us

The heatmap also displays the geographical spread of industry activity, identifying the United States, United Kingdom, India, Canada, and Australia as key country hubs. Cities like London, New York City, Bangalore, Sydney, and Melbourne stand out as important points for innovation, collaboration, and investment. The Indian drone market was valued at USD 2.1 billion in 2024, growing at an annual rate of 40.03% through 2030.

A Snapshot of the Global Drone Industry

The drone industry has seen growth and innovation, as highlighted by a workforce of 2.1 million. The sector has added 126 000 employees in the last year, underscoring the sector’s expanding job market and increasing importance in the global economy. Further, the autonomous drone market is forecast to reach USD 25.24 billion in 2025, growing at a CAGR of 21.7%.

Moreover, the industry’s foundation is strong, with over 33 000 companies pioneering new technologies and applications for drones.

Explore the Funding Landscape of the Drone Industry

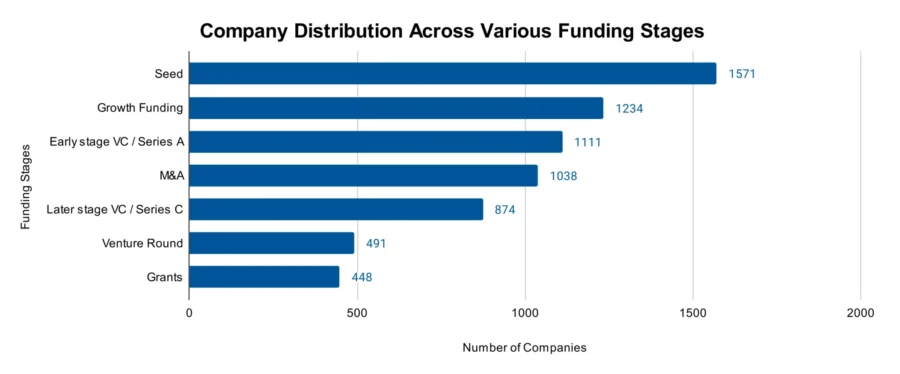

The drone sector has received robust investment, with the average investment value reaching USD 27.2 million per funding round. This level of investment shows confidence and interest in the potential of drone technology.

More than 2000 investors have participated in over 7000 funding rounds, indicating a supportive ecosystem for startups and established companies. Further, over 3000 companies have received investments, illustrating the range of innovation and entrepreneurial activity in the sector. This also highlights the financial stability of the drone industry and its role in technological advancement and economic development.

Who is Investing in the Drone Industry?

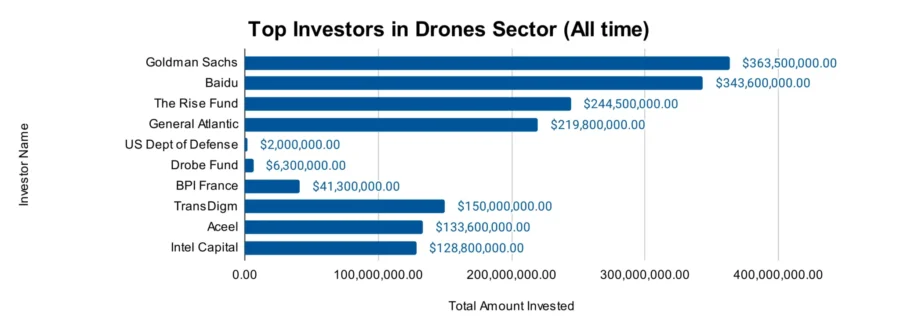

The drone industry’s innovation and growth have attracted over USD 1 billion in investments from key players, indicating the sector’s potential.

- Goldman Sachs has invested a notable USD 363.5 million in 2 companies, showing its interest in drone technology.

- Baidu has allocated USD 343.6 million to 3 companies, suggesting a belief in the sector’s future. It invested USD 182.2 million in XAG, an agricultural drone maker.

- The Rise Fund has invested USD 244.5 million in 2 companies, reflecting faith in the industry’s growth.

- General Atlantic has contributed USD 219.8 million across 3 companies, showing its dedication to promoting innovation in drone tech.

- The U.S. Department of Defense supports 17 companies with an investment totaling USD 2 million, indicating a varied interest in drone advancements. It provided USD 250 million to Anduril Industries for its Roadrunner interceptor drones.

- Drone Fund, with investments of USD 6.3 million in 10 companies, displays a focused approach to backing emerging drone technologies. It invested USD 6.2 million in drone tech firm Marut Drones.

- BPI France has invested USD 41.3 million in 9 companies, showing its support for the sector’s growth. Along with Andera Partners, it acquired MC2 Technologies.

- TransDigm’s investment of USD 150 million in 2 companies signals a commitment to important players in the drone industry.

- Accel, investing USD 133.6 million in 4 companies, shows its strategic focus on drone startups with potential.

- Intel Capital completes the list with USD 128.8 million invested in 4 companies, reflecting its vision for drones’ role in the future of technology.

This combined investment from major financial entities highlights the drone industry’s significance and role in shaping the future of technology and innovation.

Explore Firmographic Data for All Drone Industry Trends

The drone industry is witnessing a surge in innovation, with the latest trends transforming the industry as well as creating new opportunities and challenges worldwide.

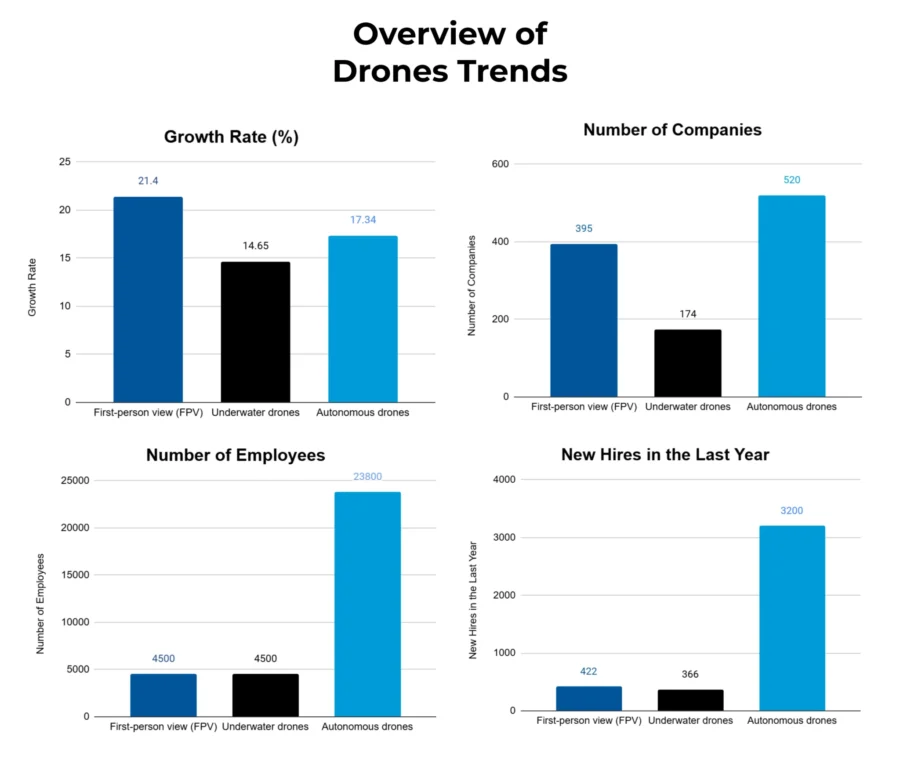

- First-person view (FPV) drones are a growing trend in the industry, with 395 companies developing this technology. It employs over 4500 individuals and has added more than 422 new employees in the past year, showing steady growth. The annual trend growth rate is 21.4%, indicating consistent advancements and interest in FPV drones. These drones provide a bird’s-eye view to users and are changing photography, racing, recreational flying, and more.

- Underwater drones are another emerging trend in the drone industry. These drones are creating new opportunities for marine research, underwater infrastructure inspection, and aquatic cinematography. With 174 companies in this area, the sector employs around 4500 people and has added over 366 new employees in the last year. The annual trend growth rate of 14.65% shows the growing interest in underwater exploration technologies.

- Autonomous drones are leading the industry trends with an annual growth rate of 17.34%, the highest among the segments analyzed. With 520 companies leading the way, the sector employs 23 800 people, which has increased by 3200 in the last year. This increase reflects the developments in AI and machine learning, which allow drones to operate without human controllers. The use of autonomous drones ranges from agricultural monitoring to emergency response, showing their impact across multiple industries.

5 Top Examples from 2000+ Innovative Drone Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Heven Drones builds Hydrogen-powered Drones

Israeli startup Heven Drones develops an advanced control system for drones. This system utilizes multiple gyroscopes and supporting algorithms to extend the operating boundary of stable flight.

Its DMSS ensures drone stability even when the center of gravity deviates up to 120% from the midpoint. Further, its Drones Battery Management System (DBMS) increases the efficiency of Li-Po batteries with its hydrogen fuel-cells allowing for extended flight times with substantial payloads.

Swarmer enables Multi-drone Mission Control

US startup Swarmer develops drone swarm technology. It offers Drone Platform, a secure firmware, featuring video streaming, logging and monitoring.

The startup also provides Control Center, an AI-powered mission delivery planning solution with dynamic forecasting. This solution coordinates various drone types and swarm configurations, offering fleet management, multi-drone mission estimation, and mission optimization.

Lastly, Swarmer’s AI Copilot, enhances drones with onboard AI, proficient in managing operations, executing missions, and ensuring safe returns

F-drones offers Maritime Drones

Singaporean startup F-drones builds unmanned aerial cargo delivery platforms for industrial logistics. It offers the HyperCopter, a drone capable of carrying up to 10kg over 30km. Designed for maritime conditions, this drone operates in all types of weather.

F-drones also provide the HyperLaunch, a VTOL with a 5kg payload capacity and a 50km range. These drones reduce costs, time, and emissions across various sectors, thereby enhancing the efficiency and sustainability of logistics.

GeoNadir manages Drone Mapping Data

Australian startup GeoNadir provides a platform for handling drone mapping data. The platform processes this data to produce orthomosaics, DSMs, and DTMs of high quality.

It facilitates data measurement and annotation, easy vector import/export, dataset access, and integration with spatial platforms for AI algorithm enhancement. Further, GeoNadir’s platform promotes collaboration by enabling the sharing of drone mapping projects.

YelloSKYE streamlines Asset Management

Indian startup YelloSKYE offers Asset Risk Management Solution (ARMS) for drone-based inspections and project management across various industries. The platform generates accurate 2D and 3D digital twins of assets using drone imagery, enabling detailed analysis and simulations on a cloud platform.

It employs AI and machine learning for accurate quality and quantity estimations, facilitating decision-making. Further, CAD overlay integration enables real-time comparisons between plans and reality with frequent drone captures providing the latest progress monitoring. The platform also supports inspections of difficult-to-access areas, enhancing safety and maintenance.

Gain Comprehensive Insights into Drone Industry Trends, Startups, or Technologies

The 2025 Drone Industry Report shows that the drone sector is set for significant growth, fueled by progress in autonomous technology and the expanding use of drones in various sectors. Trends like AI integration for improved operational efficiency and the investigation of new areas such as urban air mobility indicate an upcoming phase of transformation. Get in touch to explore all 2000+ startups and scaleups, as well as all industry trends impacting drone companies.