The 2025 EdTech Industry Report highlights adopting AI-driven personalization, VR, AR, and gamified education to modernize learning across schools, universities, and corporations. It examines key trends such as personalized learning, mobile platforms, data-driven insights, and investment and patent activities fueling growth. The report serves as a reference for industry stakeholders, investors, and policymakers to track innovation and future opportunities.

This report was last updated in January 2025.

Executive Summary: EdTech Market Report 2025

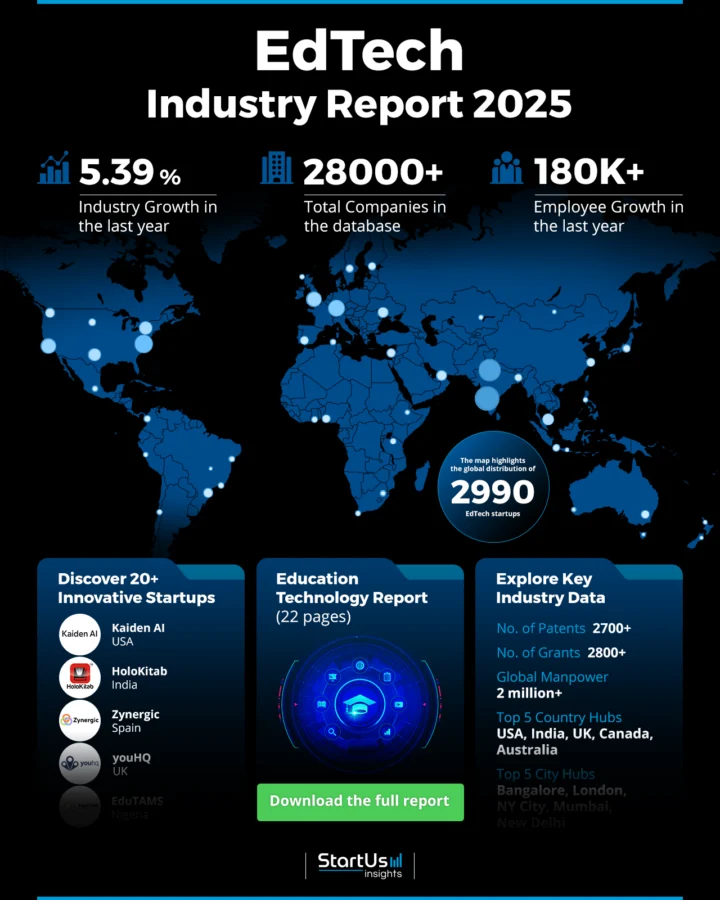

- Industry Growth Overview: The global edtech and smart classrooms market size will grow from USD 214.73 billion in 2025 to USD 445.94 billion in 2029 at a compound annual growth rate of 20.0%. On a micro level, the edtech industry grew at an annual rate of 5.39% as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: EdTech employs over 2 million people globally, adding, 180K new employees last year. This reflects continued expansion and employment opportunities.

- Patents & Grants: The industry holds over 2700 patents and 2800 grants, with an annual patent growth rate of 22.12%, led by innovators in China and the USA.

- Global Footprint: The top five country hubs for EdTech are the USA, India, UK, Canada, and Australia, with major city hubs in Bangalore, London, New York City, Mumbai, and New Delhi.

- Investment Landscape: The sector’s average investment per round is USD 14.1 million, with over 22K funding rounds closed.

- Top Investors: Tiger Global Management, General Atlantic, Hongshan, and more lead investment efforts. They have contributed to a combined investment value exceeding USD 10 billion.

- Startup Ecosystem: Innovative startups include Kaiden AI (AI-powered school management), HoloKitab (AR-based learning), Zynergic (educational video games), youHQ (student well-being), and EduTAMS (education management systems).

Methodology: How We Created This EduTech Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of edutech over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within edtech

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the edutech industry.

What Data is Used to Create This EduTech Report?

Based on the data provided by our Discovery Platform, we observe that the edtech industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry generated over 5900 publications in the past year, which reflects strong media and academic coverage.

- Funding Rounds: Our database has recorded more than 22K funding rounds in the EdTech sector.

- Manpower: With a workforce exceeding 2 million, edtech added over 180K new employees last year.

- Patents: Over 2700 patents highlight its contributions to intellectual property (IP) and innovation.

- Grants: The industry has secured more than 2800 grants.

- Yearly Global Search Growth: The yearly global search growth reached 40.59%, demonstrating rising global interest and awareness in EdTech.

Explore the Data-driven Educational Technology Market Report for 2025

According to The Business Research Company, the edtech and smart classrooms market size will grow from USD 214.73 billion in 2025 to USD 445.94 billion in 2029 at a compound annual growth rate of 20.0%.

Another projection estimates the edutech market size to reach USD 705.75 billion by 2034, exhibiting a compound annual growth rate of 15.50% during the forecast period 2025 – 2034.

The EdTech Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

The heatmap highlights steady expansion in the edtech sector. With over 2990 startups and 28K companies, the industry has an annual growth rate of 5.39%.

Credit: The Business Research Company

The global edtech workforce exceeds two million, with an increase of 180K employees last year. It indicates growing employment opportunities.

The top country hubs are the USA, India, the UK, Canada, and Australia. Leading city hubs include Bangalore, London, New York City, Mumbai, and New Delhi.

Moreover, North America accounted for over 40% of global revenue, with a market size of USD 57.53 billion in 2024, and is projected to grow at a 12.2% compound annual growth rate through 2031.

A Snapshot of the Global EdTech Industry

The edtech industry is growing at an annual rate of 5.39%, with over 2900 startups. More than 2000 of these are early-stage startups.

The industry has seen over 1000 mergers and acquisitions, which shows a trend toward consolidation.

In intellectual property, edtech holds over 2700 patents from more than 750 applicants, with a yearly patent growth rate of 22.12%.

China leads as the top patent issuer with over 1000 patents, followed by the USA with more than 900.

Explore the Funding Landscape of the EdTech Industry

The edtech industry has strong financial backing, with an average investment of USD 14.1 million per funding round. Over 13K investors have contributed to the industry, resulting in more than 22K closed funding rounds.

Further, over 5500 companies have received investments, which indicates broad and diverse support for innovation and development across the sector.

Who is Investing in the EdTech Industry?

The top investors in the edtech industry have collectively contributed over USD 10 billion, highlighting their strategic focus on this growing sector. Key investors include:

- Tiger Global Management has invested USD 2.1 billion across 31 companies. Tiger Global considered joining a multi-billion-dollar funding round for OpenAI, valuing the ChatGPT maker at USD 150 billion.

- Tencent invested USD 1.8 billion in 17 companies. Tencent increased its stake in Xiaohongshu, valuing the platform at USD 20 billion.

- SoftBank Vision Fund funded 21 companies with USD 1.5 billion. SoftBank, OpenAI, and Oracle announced a USD 500 billion, four-year investment to build AI infrastructure in the USA’s data centers.

- General Atlantic allocated USD 1.1 billion to 9 companies. General Atlantic agreed to acquire UK-based LTG, a corporate training tools provider, for USD 1 billion.

- Yuanfudao invested USD 886.6 million across 4 companies. Yuanfudao announced that it would fund around USD 13 million in future quality education development.

- Sequoia Capital supported 32 companies with USD 834.3 million. Sequoia Capital joined a USD 5 billion funding round for Elon Musk’s AI startup, xAI.

- Hongshan invested USD 760.3 million in 10 companies. Li Ning and HongShan formed a USD 25.6 million joint venture, with HongShan investing USD 8.03 million.

- Owl Ventures has invested USD 694.18 million in 47 companies. Owl Ventures led a USD 10 million seed round for Jotit, a platform merging handwriting with digital learning.

- IDG Capital allocated USD 694.1 million across 12 companies.

- FountainVest Partners invested USD 693.8 million in 2 companies. FountainVest Partners and Unison Capital acquired Japanese jeweler Tasaki & Company for USD 660 million.

Further, Eruditus raised USD 150 million in Series F funding, led by TPG, at a USD 3 billion valuation to advance AI-based teaching and expand courses.

Top EdTech Innovations & Trends

Explore the growing trends in the edtech landscape including the firmographic insights:

- E-Learning leads the industry, with over 82K companies, and employs more than six million individuals. The sector added 400K employees last year and shows an annual trend growth rate of 8.24%. This growth reflects the rising demand for digital education platforms and remote learning solutions.

- Personalized Learning focuses on adapting educational content to individual needs, with over 2K companies employing 170K workers. The industry added 16K new employees last year and shows an annual trend growth rate of 2.14%. This area is gaining traction as institutions and organizations seek tailored educational experiences.

- Gamified Learning is expanding rapidly, with over 500 companies and 17K employees, adding 2K new roles last year. The annual trend growth rate is 28.58%, driven by increasing interest in using game-like elements to enhance learning engagement and retention.

Further, AI and ML integration in EduTech enables personalized learning and improves student engagement and outcomes.

5 Top Examples from 2900+ Innovative EdTech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Kaiden AI provides AI-powered School Management Assistants

US-based startup Kaiden AI offers AI-driven, voice-enabled training simulations through its VELS platform. Learners engage in realistic, adaptive conversations with AI personas to simulate various scenarios like job interviews or crisis management.

VELS adjusts interactions and feedback based on user performance to provide immediate insights and improve communication skills.

Moreover, Kaiden AI supports personalized skill-building at scale to offer organizations an efficient solution for developing proficiency across roles and industries.

HoloKitab offers AR-based Learning

Indian startup HoloKitab provides AR learning tools that make education interactive and engaging for young learners.

Its products include AR-enabled books, globes, and flashcards that work with a companion app. The startup improves educational content using 3D animations, sounds, and interactive elements.

Learners scan printed materials with mobile devices to experience dynamic visuals and hear audio that complements the educational content. This further increases understanding and knowledge retention.

HoloKitab’s AR technology allows educators and parents to deliver immersive, effective educational experiences that support foundational learning.

Zynergic develops Educational Video Games

Spanish startup Zynergic develops Eutopia, an educational platform that gamifies curriculum-based learning and assessment for K-12 students.

It allows educators to create interactive learning experiences by integrating content into a game-like environment. Students engage with subjects through activities that track competencies and generate detailed, standards-compliant evaluations.

It also captures performance data to provide insights into each student’s progress and aligns with diverse educational requirements.

youHQ builds School Wellbeing Platform

UK-based startup youHQ offers a digital well-being platform for schools and colleges to support the mental health and personal growth of students.

It enables students to set values-based goals access well-being resources and track their emotional progress through a secure journal. This encourages self-awareness and resilience.

Educators receive detailed reports, insights, and data-driven assessments on student well-being trends to ensure timely interventions and targeted support.

EduTAMS provides an Education Management Information System

Nigerian startup EduTAMS builds a cloud-based school management system for K-12 schools and higher education institutions.

It automates tasks such as student enrollment, attendance tracking, and academic record management through integrated modules that support data collection and analytics.

Moreover, the platform also allows administrators to set up schools independently, customize tools to meet local needs, and facilitate secure payments with an embedded payment gateway.

Gain Comprehensive Insights into EdTech Trends, Startups, or Technologies

In 2025, the edtech industry will continue to grow, driven by advancements in e-learning, personalized learning, and gamified learning. These trends show a shift toward adaptive, engaging, and accessible education solutions that meet diverse learner needs. As technology integrates further into education, edtech will shape the future of learning, fostering innovation and expanding global access to quality education.

Get in touch to explore all 2900+ startups and scaleups and all industry trends impacting edtech companies.