The Fertilizer Market Outlook 2024 analyzes the sector’s current landscape and emerging trends. This report explains the industry’s contributions to global agriculture and highlights its role in enhancing crop yields and ensuring food security. It explores recent advancements, investment activities, and the industry’s growth. It examines key metrics such as workforce expansion, innovation, and funding.

Moreover, this fertilizer industry report serves as a reference for stakeholders in the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Fertilizer Market Outlook 2024

- Executive Summary

- Introduction to the Fertilizer Market Outlook 2024

- What data is used in this Fertilizer Report?

- Snapshot of the Global Fertilizer Industry

- Funding Landscape in the Fertilizer Industry

- Who is Investing in Fertilizer?

- Emerging Trends in the Fertilizer Industry

- 5 Innovative Fertilizer Startups

Executive Summary: Fertilizer Market Report 2024

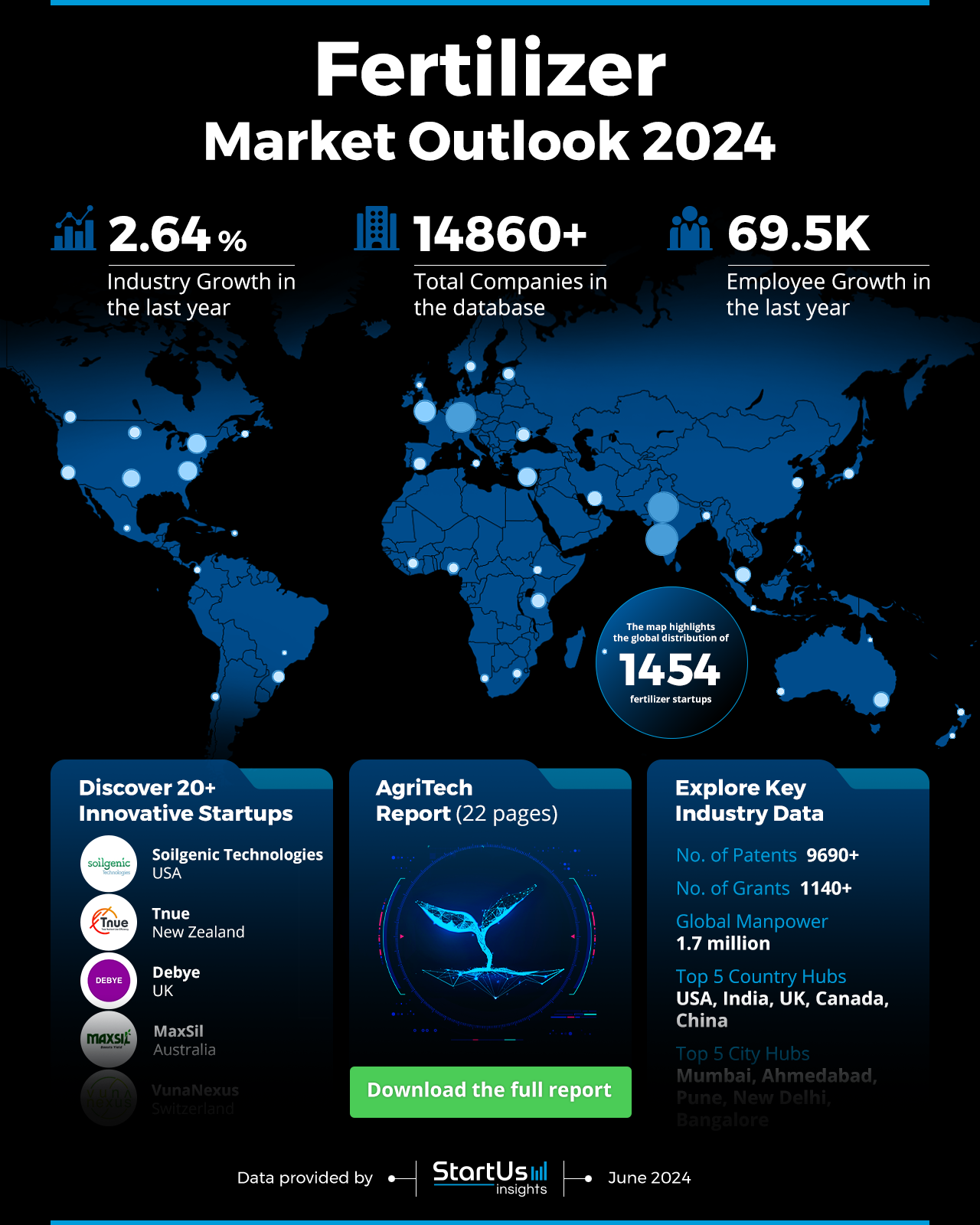

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. Also, we analyzed a sample of 1450+ fertilizer startups developing innovative solutions to present five examples from emerging fertilizer industry trends.

- Industry Growth Overview: The fertilizer industry comprises over 14860 companies and reflects the market coverage. Further, it experienced an annual growth of 2.64%.

- Manpower & Employment Growth: The sector employs a global workforce of about 2 million people. Also, it added 69K new employees in the last year.

- Patents & Grants: The industry filed over 9700 patents. Additionally, it received more than 1140 grants and highlighted the funding support for research and development.

- Global Footprint: The primary hubs of industry activity are in the USA, India, UK, Canada, and China. Key cities driving growth include Mumbai, Ahmedabad, Pune, New Delhi, and Bangalore.

- Investment Landscape: The average investment value of the fertilizer industry stands at USD 39 million per funding round. More than 670 investors offered financial support and closed over 2150 funding rounds.

- Top Investors: Some of the top investors are Origin Enterprises, Unigrains, and Forage Capital Partners. The combined investment value of top investors stands at USD 98 million.

- Startup Ecosystem: Five innovative startups include Soilgenic Technologies (enhanced efficiency fertilizer (EEF) technologies), Tnue (controlled release membrane technology), Debye (direct nitrogen capture by electricity), MaxSil (silicon fertilizer), and VunaNexus (urine fertilizer).

- Recommendations for Stakeholders: Investors should prioritize funding precision agriculture technologies and sustainable fertilizer alternatives. Also, this sector will benefit when governments offer subsidies and grants specifically to promote research in nutrient management and eco-friendly fertilizers. Collaborative efforts will address the challenges of soil degradation, climate change, and food security.

Explore the Data-driven Fertilizer Industry Report for 2024

The Fertilizer Market Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. For the fertilizer industry, our database includes 1454 startups that indicate the ecosystem of innovation and new business ventures. With over 14860 companies listed, our database offers extensive coverage of the industry.

The industry experienced a growth rate of 2.64% over the past year which reflects the expansion and development. The database includes information on over 9690 patents and showcases the level of innovation and intellectual property activity within the industry. More than 1140 companies received grants to emphasize the support and funding available for research and development.

The fertilizers sector employs a global workforce of 2 million people and highlights its contribution to employment worldwide. The industry saw an increase of 69K employees over the past year which underscores its growth and expansion. The primary hubs of industry activity are located in the USA, India, UK, Canada, and China. Key cities driving industry growth include Mumbai, Ahmedabad, Pune, New Delhi, and Bangalore where each serves as a critical center of innovation and development.

What data is used to create this fertilizer industry outlook?

Based on the data provided by our Discovery Platform, we observe that the fertilizer industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: Over 12640 news articles were published on the fertilizer industry to reflect the scholarly interest.

- Funding Rounds: Our database contains information on over 2150 funding rounds and highlights the industry’s financial support and investment activity.

- Manpower: With more than 2 million workers, the fertilizer industry showcases a substantial workforce. Last year, the industry added over 69K new employees.

- Patents: The industry filed over 9690 patents and showcases its commitment to innovation and technological advancement.

- Grants: The sector received more than 1140 grants and indicated a high level of funding support for research and development.

- Yearly Global Search Growth: This industry experienced a 16.02% yearly global search growth and demonstrated increasing interest and awareness on a global scale.

- and more. Reach out to us to explore all data points used to create this fertilizer report.

A Snapshot of the Global Fertilizer Market

The industry employs a global workforce of 2 million individuals and makes it a significant contributor to employment worldwide. Over the past year, the industry demonstrated growth by adding 69K new employees. This increase in manpower highlights the industry’s expanding footprint and its role in providing job opportunities across various regions.

Our comprehensive database includes over 14860 companies. This number of companies indicates a competitive market that fosters innovation and development across the sector.

Explore the Funding Landscape of the Fertilizer Market

The industry attracted strong financial support, with an average investment value of USD 39 million per funding round. This investment underscores the confidence investors have in the industry’s potential for growth and profitability.

The total number of investors involved in the industry exceeds 670 to indicate the range of interest and support from the financial community. The industry’s ability to close more than 2150 funding rounds highlights its nature and the continuous influx of capital to fuel innovation and expansion.

More than 770 companies benefited from investment rounds and showcased the distribution of financial resources within the industry. This investment drives growth and development across numerous companies to support both established players and emerging startups.

Who is Investing in Fertilizer Solutions?

The fertilizer industry gathered decent financial support from top investors, with a combined investment value of more than USD 98 million. Here are the leading investors and their contributions:

- Origin Enterprises invested USD 12 million across 5 companies.

- LIOF backed 3 companies with a total investment of USD 3 million.

- SOSV invested USD 3 million in 3 companies.

- Forage Capital Partners allocated USD 35 million to 3 companies.

- Miami-Dade Innovation Authority supported 3 companies with USD 300K.

- Unigrains invested USD 44 million in 3 companies.

- Sustainable Development Technology Canada contributed USD 1 million to 3 companies.

- and more. Book a demo to explore all investment data in the fertilizer industry

Access Top Fertilizer Innovations & Trends with the Discovery Platform

Precision Agriculture leverages advanced technologies like GPS mapping, IoT sensors, and data analytics to optimize fertilizer applications and enhance crop yields. This sector includes 1310 companies employing 74300 individuals, with 5500 new employees added in the last year. The precision agriculture trend grows with an annual trend growth rate of 19.18%.

Soil Management emphasizes techniques and products that maintain and improve soil health. There are about 400 companies dedicated to soil management, employing 21000 people, with 1500 new employees added in the past year. The trend has an annual growth rate of 26.65% to reflect the rising importance of sustainable agriculture practices.

Biostimulants focus on products that enhance plant growth and stress tolerance through natural processes. This sector comprises 1100 companies and employs 63600 individuals. It added 3500 new employees in the last year. The biostimulants trend experiences steady growth with an annual trend growth rate of 8.19%.

5 Top Examples from 1450+ Innovative Fertilizer Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Get in touch to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Soilgenic Technologies develops EEF Technologies

US-based startup Soilgenic Technologies develops climate-smart EEF Technologies to improve nitrogen fertilizers. The startup’s Phosgain Efficiency Technology enhances phosphate fertilizer availability and allows crops to utilize more phosphate over time. Its Visio-N Totus formulation offers protection for urea fertilizers and reduces both above-ground volatilization and below-ground nitrogen loss. Moreover, NitroBlock Enhanced DCD technology minimizes nitrogen leaching and denitrification for below-ground performance. These solutions, and more, collectively improve fertilizer efficiency, reduce environmental impact, and lower costs for manufacturers and users.

Tnue builds Controlled Release Membrane Technology

New Zealand-based startup Tnue customizes fertilizer delivery solutions to achieve optimal nutrient use efficiency (NUE). The startup’s Control Release Membrane (CRM) technology applies to fertilizer granules to ensure the availability of nutrients as plants demand. Precision blending with other fertilizers aligns nutrient release with plant growth requirements. The CRM technology considers environmental and operational factors to match nutrient release for optimal growth. This improved nutrient efficiency reduces greenhouse emissions and nitrate leaching.

Debye captures Direct Nitrogen by Electricity

UK-based startup Debye develops its Direct Nitrogen Capture by Electricity technology that mimics natural lightning to create nitrate fertilizers. This modular and containerized system combines air, water, and electricity to produce nitric acid and then compound fertilizers like calcium nitrate. In addition, the electrified process supports decarbonization and decentralization and reduces reliance on traditional fertilizer factories. It minimizes carbon emissions and enhances supply chain resiliency through on-site, on-demand production. Debye’s scalable solution offers cost-efficient, pure nitrogen fertilizers, free from heavy metals.

MaxSil develops Silicon Fertilizer

Australian startup MaxSil develops a silicon fertilizer derived from recycled glass that enhances food production and plant health while reducing fertilizer and pesticide needs. MaxSil contains plant-available silicon (PAS) to enhance the soil PAS levels. This fertilizer increases crop yield, quality, and financial returns for growers. Also, it makes the crop healthy, more productive, and pest-resistant.

VunaNexus makes Urine Fertilizer

Swiss startup VunaNexus addresses energy-intensive wastewater treatment and synthetic fertilizer production through a recycling process. The startup’s process begins with urine separation using dry urinals or urine-diverting toilets. It follows with the stabilization of urine through nitrification in a biological reactor to remove bad odors and activated carbon filters remove micropollutants. The liquid then undergoes pasteurization and concentration in an industrial distiller to produce distilled water and a ready-to-use fertilizer called Aurin. This methodology recycles all nutrients contained in urine to convert them into natural fertilizers.

Gain Comprehensive Insights into Fertilizer Trends, Startups, or Technologies

The 2024 fertilizer market report highlights the sector’s role in the global agricultural landscape. Despite various challenges such as high energy consumption, environmental pollution, and inefficient nutrient recycling, the industry’s innovation drove progress and growth. Some of these innovations include EEF, precision agriculture, and sustainable urine recycling processes. The report highlights the sustained investment and technological advancement that enhanced the sector. Get in touch to explore all 1450+ startups and scaleups, as well as all industry trends impacting fertilizer companies.