Blockchain advancements, digital banking evolution, and cloud computing are revolutionizing the financial services sector, enhancing scalability, and transforming product portfolios. We offer a detailed insight into global fintech industry trends to help you understand their potential impact on your business. AI stands as a pivotal trend in the sector, influencing other key areas including cybersecurity, digital banking, and WealthTech.

Incorporating blockchain into the financial ecosystem bolsters data and transaction security, facilitating crypto transactions and decentralized finance (DeFi) structures. Open banking paves the way for banks to capitalize on customer data, while also granting non-banking financial companies (NBFCs) access to this valuable information.

This article was last updated in July 2024.

Top Trends in Fintech (2025)

- Artificial Intelligence

- Decentralized Finance

- Open Banking

- Digital Banks

- Cybersecurity

- Customer Engagement

- Internet of Things

- Sustainable Finance

- Quantum Computing

- WealthTech

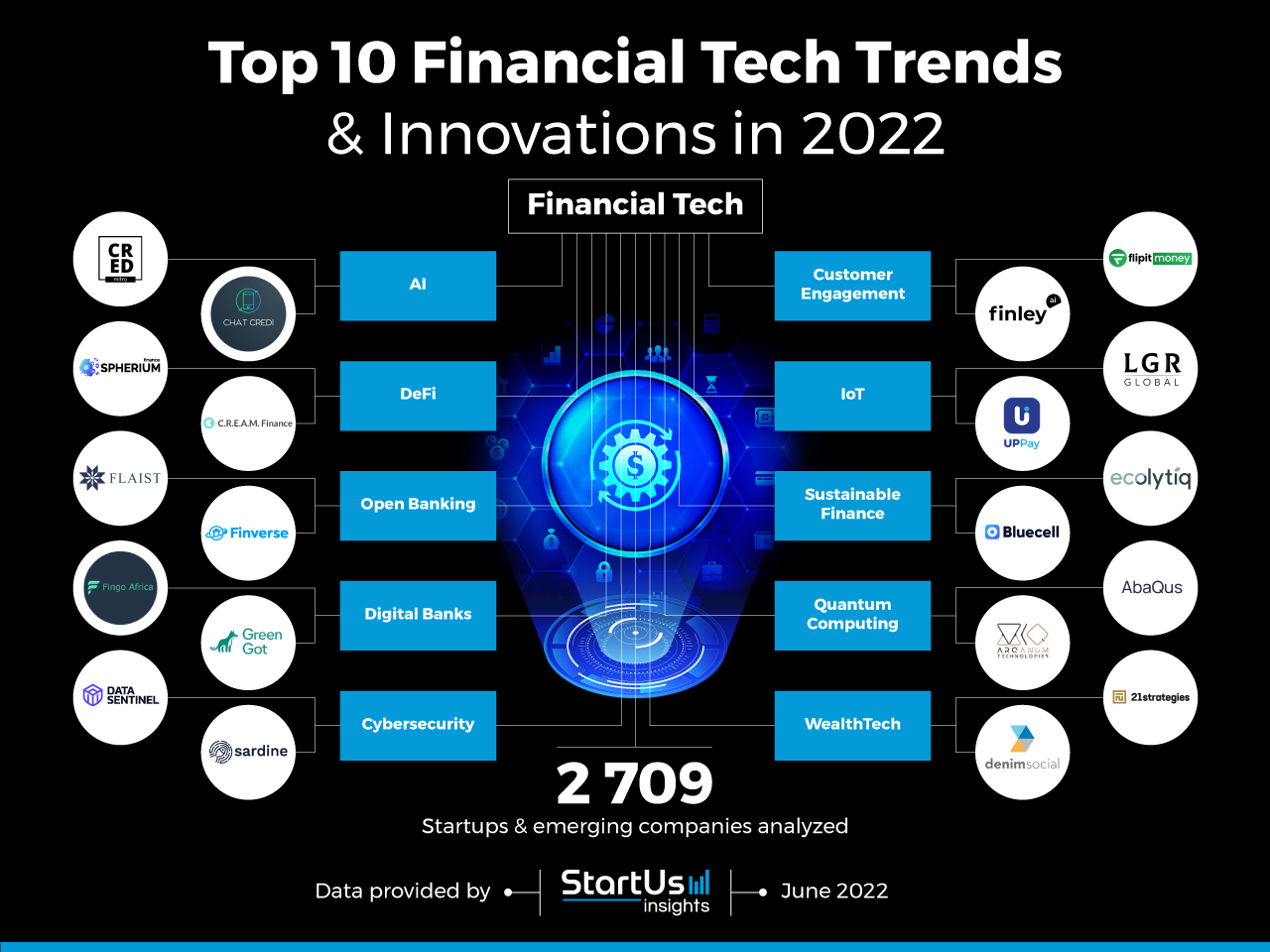

Innovation Map outlines the Top 10 Fintech Industry Trends & 20 Promising Startups

For this in-depth research on the top fintech industry trends and startups, we analyzed a sample of 2500+ global startups & scaleups. This data-driven research provides innovation intelligence that helps you improve strategic decision-making by giving you an overview of emerging technologies in the finance and banking industries. In the Fintech Innovation Map below, you get a comprehensive overview of the innovation trends & startups that impact your company.

These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 4.7M+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant technologies and industry trends quickly & exhaustively.

Want to explore all Fintech innovations & trends?

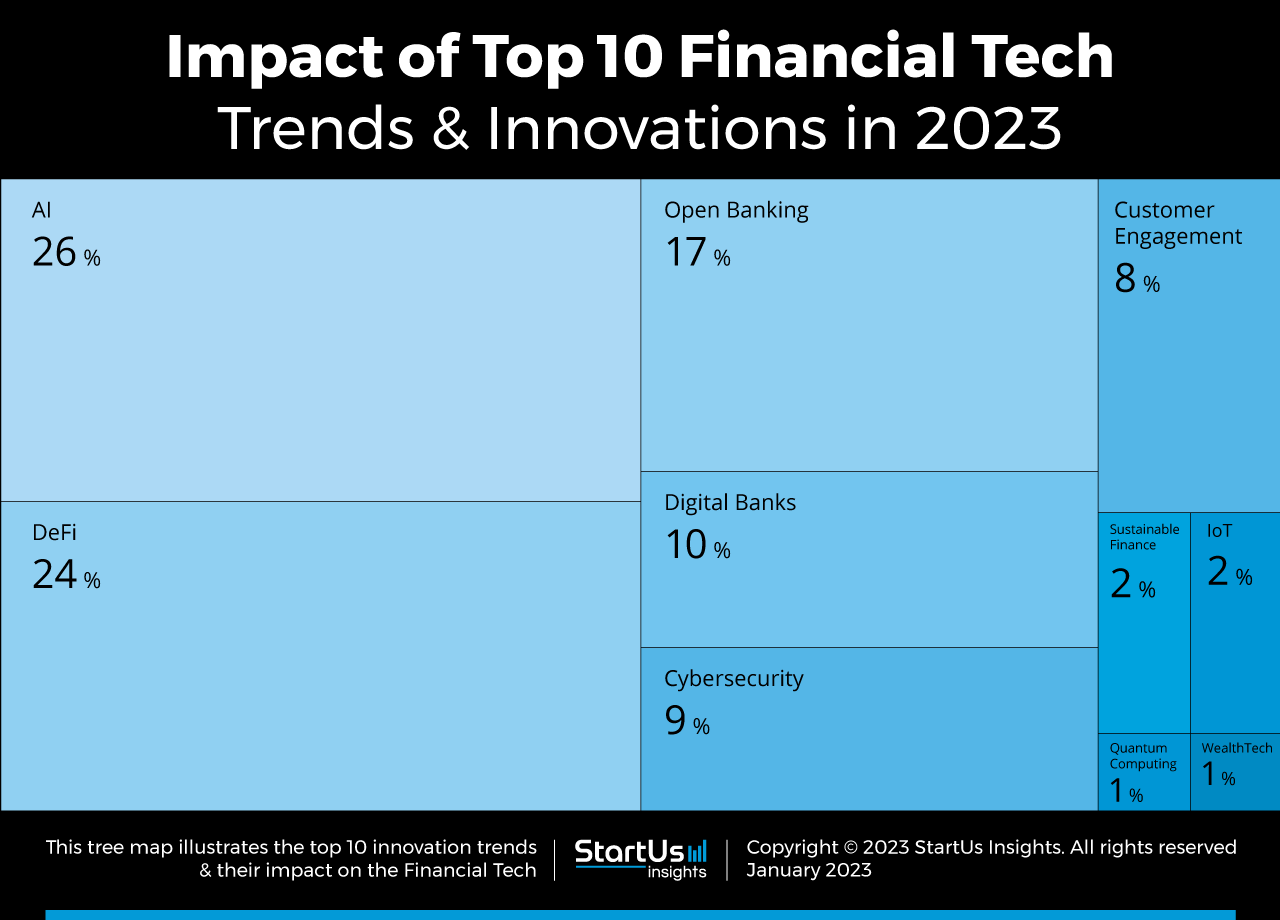

Tree Map reveals the Impact of the Top 10 Fintech Trends

The Tree Map below illustrates the impact of the top 10 fintech trends in 2025. The finance sector is witnessing a surge in the adoption of robotic process automation (RPA) and AI-powered chatbots for automating manual tasks. DeFi and open banking are democratizing financial infrastructure and data access. With the ascent of neobanks and digital banking services, the demand for financial cybersecurity solutions is escalating to counter money laundering and cyber-attacks.

Moreover, the industry is enhancing customer engagement through voice-enabled services and utilizing IoT devices to tailor services based on customer data. The preference for banks supporting high-impact projects is steering the growth of sustainable financing in FinTech. Concurrently, quantum computing is honing market predictability precision, and wealth management solutions are gaining increased market traction.

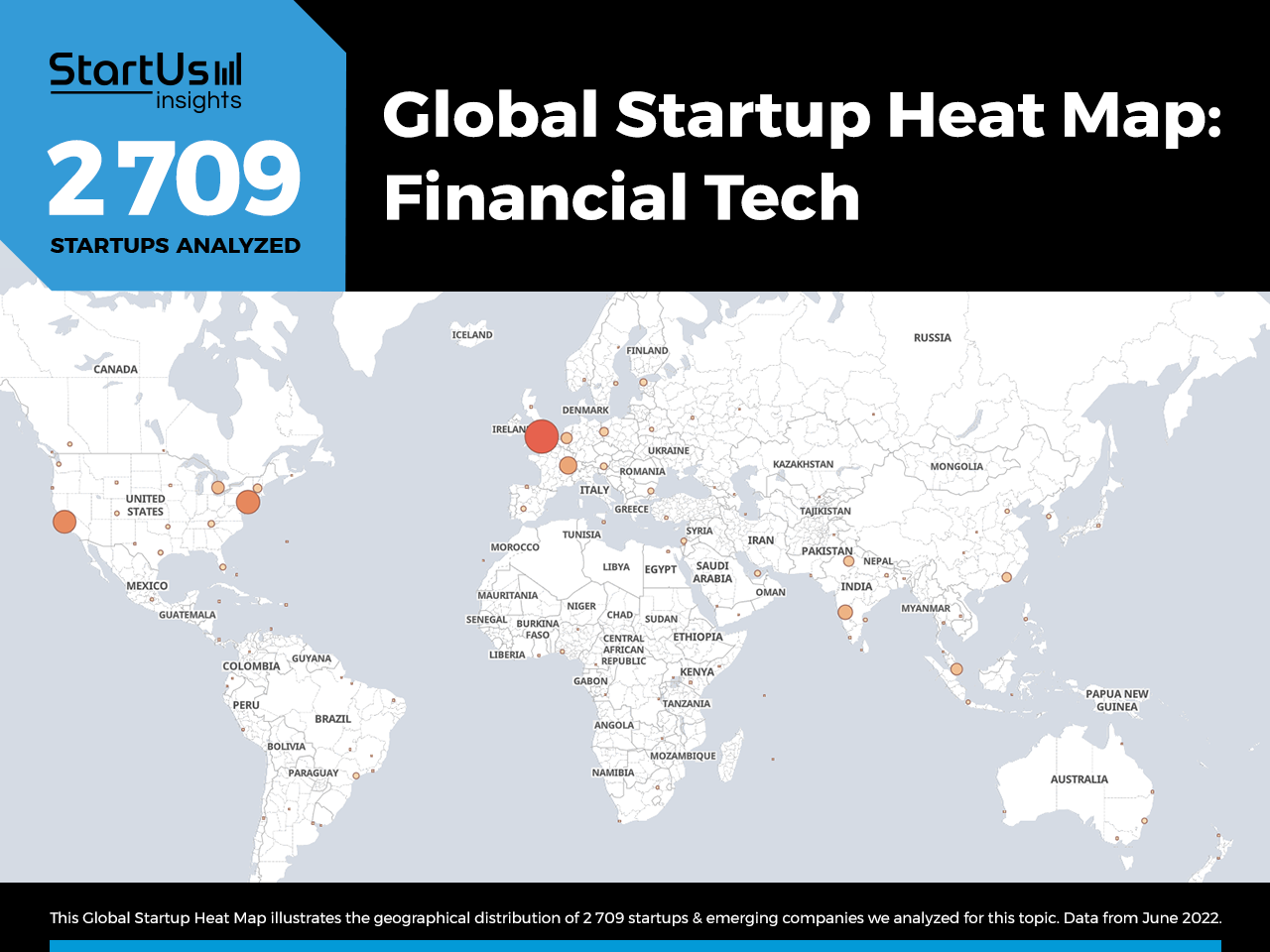

Global Startup Heat Map covers 2709 Fintech Startups & Companies

The Global Startup Heat Map below highlights the global distribution of the 2709 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals that Western Europe and the US have a high concentration of financial tech startups.

Below, you get to meet 20 out of these 2709 promising startups & scaleups as well as the solutions they develop. These 20 startups are hand-picked based on criteria such as founding year, location, funding raised, and more. Depending on your specific needs, your top picks might look entirely different.

10 Top Fintech Trends in 2025

1. Artificial Intelligence

Financial institutions are utilizing AI and machine learning (ML) to streamline repetitive and labor-intensive tasks, including customer verification and screening. The digitization of financial operations is generating a wealth of data, which startups are harnessing to create AI- and ML-driven solutions such as financial chatbots and robotic advisors, enhancing automation in customer interactions and boosting satisfaction.

Further, FinTech startups are introducing autonomous finance solutions, eliminating manual interventions and thereby elevating the customer experience, fostering higher conversion and repeat sales, and saving time. These solutions also provide a deep understanding of customer behavior, enabling financial entities to tailor their product offerings.

Finory.tech streamlines Loan Processing

Malaysian startup Finory.tech develops AI-powered APIs for document automation and financial assessment in loan processing. These APIs allow lenders to analyze borrowers’ bank statements, perform financial assessments, and detect any fraudulent activity. The platform leverages data science algorithms and includes an income verification feature to assess borrowers’ financial standing. The startup’s affordability assessment tool evaluates income versus expenditures, aiding lenders in making informed decisions. Further, Finory.tech’s financial credibility solution integrates credit reports with bank statement data, allowing for a thorough assessment of creditworthiness.

2Digit offers AI-powered Stock & Loan Management Platforms

2Digit is a South Korea-based startup that designs digital financial services using artificial intelligence. Its flagship product News Salad is an AI-powered stock investment information service that analyzes news and provides insights. It also offers Plum – an AI-based P2P service that allows users to design loans and investment products with customized conditions and match them with investors to maximize operating profits. Further, 2Dijit also offers future-forecasting risk management tools that utilize AI.

2. Decentralized Finance

Blockchain is fostering a decentralized finance (DeFi) ecosystem, granting users greater control. DeFi leverages smart contracts to supplant centralized banking systems and oversee financial settlements, thereby accelerating transactions and facilitating real-time cross-border payments. Additionally, blockchain-based ledgers augment transaction security. While cryptocurrencies remain a component of the DeFi structure, startups are expanding DeFi services.

These expansions encompass decentralized exchange (DeX) protocols, non-fungible tokens (NFTs), peer-to-peer (P2P) protocols, and Web3-ready infrastructure, allowing users to opt for more democratic and secure digital protocols over traditional banks. Concurrently, financial institutions are employing blockchain to protect sensitive data, enhancing their brand value and bolstering customer trust.

Spherium Finance develops a Decentralized Wallet

Spherium Finance is a Singaporean startup that offers a decentralized wallet. It features cross-chain interoperability, thus streamlining multi-chain and multi-source assets management. The wallet enables users to swap tokens and receive rewards for using decentralized apps (DApps). This way, the solution provides the convenience of centralized infrastructure while ensuring high-speed, high-security transactions.

Cream Finance enables Decentralized Lending

Taiwanese startup Cream Finance provides a peer-to-peer decentralized lending platform. It leverages liquidity mining to lend crypto assets through its marketplace. Cream Finance also allows CREAM token owners to participate in governance and voting rights. The startup’s DeX protocol, Cream Swap, is permissionless, open-source, and blockchain-agnostic as well as an automated market maker (AMM). It thus automates token swapping and speeds up transactions while eliminating centralized components.

3. Open Banking

While financial operation digitization produces abundant data, it remains out of reach for NBFCs. Open banking is mitigating this issue, facilitating data transfer between banks and third-party financial providers through APIs. Startups are also presenting banking-as-a-service, leveraging cloud solutions to expedite financial product development.

These strategies empower fintech firms to enhance customer profiling and risk evaluations. Furthermore, granting NBFCs access to customer financial data allows for deeper insights into spending patterns, fostering the creation of tailored financial products and services. Startups are additionally advancing open finance solutions, encouraging collaboration between third-party entities and traditionally isolated financial organizations.

Agitate simplifies Global Transactions using Open Banking

UK-based startup Agitate leverages secure portable wallet technology, a tool that is compatible with any device, facilitating a seamless and secure financial transaction experience for businesses globally. Agitate’s solution advances open banking through its “pay-as-you-go” feature, eliminating the need for account sign-ups or commitments. This provides users with a high degree of flexibility and ease of use. Further, the platform can be accessed globally, ensuring a seamless transaction experience across borders.

Finverse Technologies simplifies Financial Data Access

Finverse Technologies is a Hong Kong-based startup that offers financial data with user consent. The startup’s API allows financial product developers to access customer account data with data encryption at rest and in transit. This enables businesses to improve financial management, monitor digital transactions, and track investment accounts.

4. Digital Banks

Changes in regulations and improvements in digital infrastructure are increasing the adoption of online banking services. COVID-19 significantly accelerated this transition and forced conventional banks to offer all of their products and services through online channels.

Similarly, many financial tech startups emerged during the pandemic that leveraged open banking infrastructure and cloud-based services to deliver banking services. Since these digital-only banks save on capital expenses, they offer lower service charges for the customers. Besides, digital-only banks focus more on customer preferences and leverage customer-friendly processes, improving convenience.

Fingo Africa is a Youth-focused Neobank

Kenyan neobank Fingo Africa provides youth-focused banking. The startup’s smartphone app allows customers to pay utility bills, create savings goals, and earn rewards. It mitigates difficulties associated with opening bank accounts for teenagers and, in turn, improves their financial wellness and independence.

Green-Got is a Green Neobank

French neobank Green-Got funds social-impact projects for each payment made through its system. The startup funds projects such as renewable energy, sustainable agriculture, waste treatment, and forest protection, among others. Companies use Green-Got’s payment account to achieve sustainability goals. Additionally, the startup allows the companies to fund sustainable projects as well as track their CO2 impact.

5. Cybersecurity

The migration of financial operations into online channels makes banks and NBFCs even bigger targets for cyber attacks than before. In addition, the financial services industry deals with massive amounts of sensitive customer information, and data leaks lead to high legal expenses. This is why financial tech startups offer cybersecurity solutions tailored for financial institutions.

For instance, startups provide automated data compliance, financial data encryption, role-based access control, biometric authentication, and network monitoring solutions. They enable network admins to monitor data access and network activities in real-time and mitigate cybersecurity risks. The FinTech industry is also leveraging quantum computing to ensure data integrity and security in the quantum era.

Data Sentinel provides Automated Financial Data Compliance

Data Sentinel is a Canadian startup that enables automated financial data compliance. The startup’s SaaS solution discovers, classifies, and quantifies financial data. It also offers data audit-as-a-service to identify sensitivity exposure and data quality. This enables financial and insurance businesses to comply with regulations and protect sensitive customer information. Consequently, the startup allows financial institutions to monetize customer data without compromising data security.

Sardine facilitates Financial Fraud Prevention

US-based startup Sardine offers financial fraud prevention for digital financial products. The startup’s platform filters and searches users by customer and device attributes as well as provides a summary of social profiles and geolocation. Financial companies integrate Sardine’s software development kit (SDK) to verify identities, receive behavior metrics, and monitor transactions for anti-money laundering (AML) compliance. This enables low-cost, scalable fraud prevention and compliance infrastructure.

6. Customer Engagement

Fintech solutions are continually evolving to enhance customer engagement, with financial firms now incorporating game elements to facilitate goal setting, track progress, and reward clients. These gamification strategies motivate customers to save more, elevate their financial literacy, and better manage their finances daily. Fintech startups are introducing voice-enabled services for payments to enrich the customer experience.

Moreover, banks are adopting voice-to-text features in chatbots to foster conversational banking, thereby elevating service accessibility. The integration of immersive technologies such as augmented reality (AR) and virtual reality (VR) further refines the customer banking journey, making virtual transactions a reality.

Entroq Technologies enables Gamified Investment Learning

Entroq Technologies is an Indian startup that applies gamification to stocks and crypto investing. The startup’s smartphone app offers real-time, short finance and capital market news. It also provides investment recommendations from top stock brokers to facilitate decision-making. The app’s polls, quizzes, and tutorials enable contextual learning about financial topics and capital market investment. Moreover, it builds a community of financial literates and capital market enthusiasts, increasing user engagement.

INATIGO develops a Financial Assistant

UK-based startup INATIGO makes Finley Ai, an AI-powered financial and pension assistant. Users are able to access it as a Google Assistant action and ask general finance-related questions that are otherwise forwarded to financial advisors. Furthermore, the solution matches users with an advisor on demand. INATIGO is also working on an Alexa-based integration of the same solution for improving access to financial information.

7. Internet of Things

Credit and debit cards are leveraging wireless technologies like radio frequency identification (RFID) and Bluetooth low energy (BLE) to facilitate cashless transactions. Startups are also crafting IoT-enabled wearables to streamline cashless payments while maintaining security. IoT further enhances financial transaction safety through real-time network surveillance and biometric verification.

Location tracking, particularly in mobile transactions, aids banks in detecting anomalous activities to curb fraud. Moreover, integrated kiosks and point-of-sale (POS) systems utilize IoT to observe customer interactions and gather analytics, thereby refining services.

LGR Global simplifies Supply Chain Financing

LGR Global is an Estonian startup that facilitates supply chain financing. The startup’s solution leverages IoT, data analytics, AI, and smart contracts to create digital twins of real-time supply chain conditions. This improves the transparency of supply chain operations and allows trading partners to upload digital documents.

The platform then validates its content using smart contracts to identify discrepancies in trade finance processes. Besides, LSR Global’s solution enables instantaneous cross-border money movement and manages customer compliance risks.

TalkItAll streamlines Digital Payments for SMEs and Small Merchant Traders

Indian startup TalkItAll offers its Soundbox – a device that provides instant audio and visual notifications for merchants when payments are received through various apps like Google Pay, PhonePe, or Paytm. It helps small shops and vendors by announcing transactions verbally in multiple languages. The Soundbox integrates with different banks and payment providers to offer this notification service.

It allows merchants to track every payment and makes sure they can easily manage transactions in real-time. The Soundbox is also available for payment companies as a private-label product to enhance their services for small merchants.

8. Sustainable Finance

To meet climate-friendly customer attitudes, companies are transitioning to sustainable operations and actively trying to offset their carbon emissions. Sustainable or green finance solutions aid this by providing opportunities for financial companies to fund sustainability projects. These include renewable energy projects, forestation activities, and low-carbon transport.

Startups also incentivize businesses that manage their climate impacts and offer analytics tools to simplify carbon reporting. Green financing, thus, increases financial flows from the banking sector to power sustainable development.

ecolytiq provides Sustainable Finance Infrastructure

German startup ecolytiq offers sustainable finance infrastructure-as-a-service solutions. The startup’s solution uses proprietary financial data aggregation and analytics engines to calculate environmental impact. It also provides individual compensation and investment opportunities. This enables financial institutions to offer environmental footprinting for their customers and drive climate actions.

Zero Circle facilitates Sustainable Financing

US startup Zero Circle enables financial institutions and small to midsize businesses (SMBs) to assess their sustainability impact. It offers an AI-powered platform to automate sustainability reporting and facilitates connections to green bonds and sustainability-linked loans. Further, the platform emphasizes reducing scope 3 emissions by offering insights for carbon footprint reduction. Zero Circle actively monitors suppliers’ sustainability performance to enhance supply chain transparency.

9. Quantum Computing

Financial institutions require robust hardware to handle the extensive data processing essential for delivering real-time market prices and instant transactions. The increasing accessibility and practicality of technology necessitate quantum-resistant solutions to secure financial infrastructures. Addressing this, FinTech startups are offering solutions grounded in quantum computing, specifically designed for financial services.

These solutions facilitate market movement predictions, financial data pattern recognition, and refined risk profiling, among other benefits. Moreover, quantum computing solutions enhance AI and analytics, optimizing trading and asset management decisions and enabling fund managers to boost returns for clients.

AbaQus facilitates Financial Risk Management

AbaQus is a Canadian startup that offers risk management solutions for financial services. The startup’s research platform leverages quantum computing-based machine learning to analyze and optimize finance strategies and offer financial forecasts. Moreover, AbaQus provides quantum readiness strategies based. This allows financial tech companies to classify and categorize complex datasets to predict trends more accurately than conventional ML techniques.

Arqanum Technologies builds a Quantum Computing-based Blockchain Network

Indian startup Arqanum Technologies develops a hybrid blockchain network. The startup’s network combines distributed quantum computing and classical computing to create a proprietary hashing algorithm. It runs on quantum processing units for faster transaction processing and makes them quantum-proof. The startup also offers quantum computing-based smart contracts to accelerate DApp development and decentralized autonomous organization (DAO) creation.

10. WealthTech

Enhanced access to diverse investment vehicle data, encompassing stock markets, crypto, and real estate, is enabling FinTech firms to refine wealth management. WealthTech startups are utilizing analytics and AI to glean insights from market trends and bolster trading decisions, catering to both corporate and retail investors.

Several startups are employing algorithmic trading to mirror the investment choices and portfolios of renowned advisors and investors. By doing so, fund managers adhere to optimal trading strategies, aiming to secure elevated returns for their clientele.

21strategies enables AI-based Hedging

21strategies is a German startup that makes hedge21, an AI-based hedging platform. It leverages decision theory, data fusion, and AI to develop a situational picture of markets in real-time. Then hedge21 offers quantitative and systematic recommendations to smoothen earnings before interest and taxes (EBIT) for hedge funds. This allows investment managers to efficiently navigate markets and achieve better investment outcomes. And for corporate treasurers, hedge21 optimizes hedge decisions for foreign currency exposure.

Denim Social improves WealthTech Customer Relationship Management (CRM)

US-based startup Denim Social offers a CRM platform for financial advisors. It features publishing, advertising, and compliance tools to deliver, scale, and secure content. This enables wealth management brands to increase their social media presence and expand advisor networks. The platform also provides compliant, curated, and pre-approved content libraries to increase customer engagement. Besides, its built-in compliance processes enable it to protect its brand and reduce risks.

Discover all Fintech Industry Trends, Technologies & Startups

Looking ahead, open finance aims to bridge the data divide between banks and NBFCs, promising customers more tailored and cost-effective financial products. Additionally, the growing fascination with Web3 presents companies with a golden opportunity to further DeFi development and enhance its accessibility. Notably, biometrics, immersive technologies, and open finance stand as transformative forces in the contemporary sector landscape.

The fintech trends and startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.