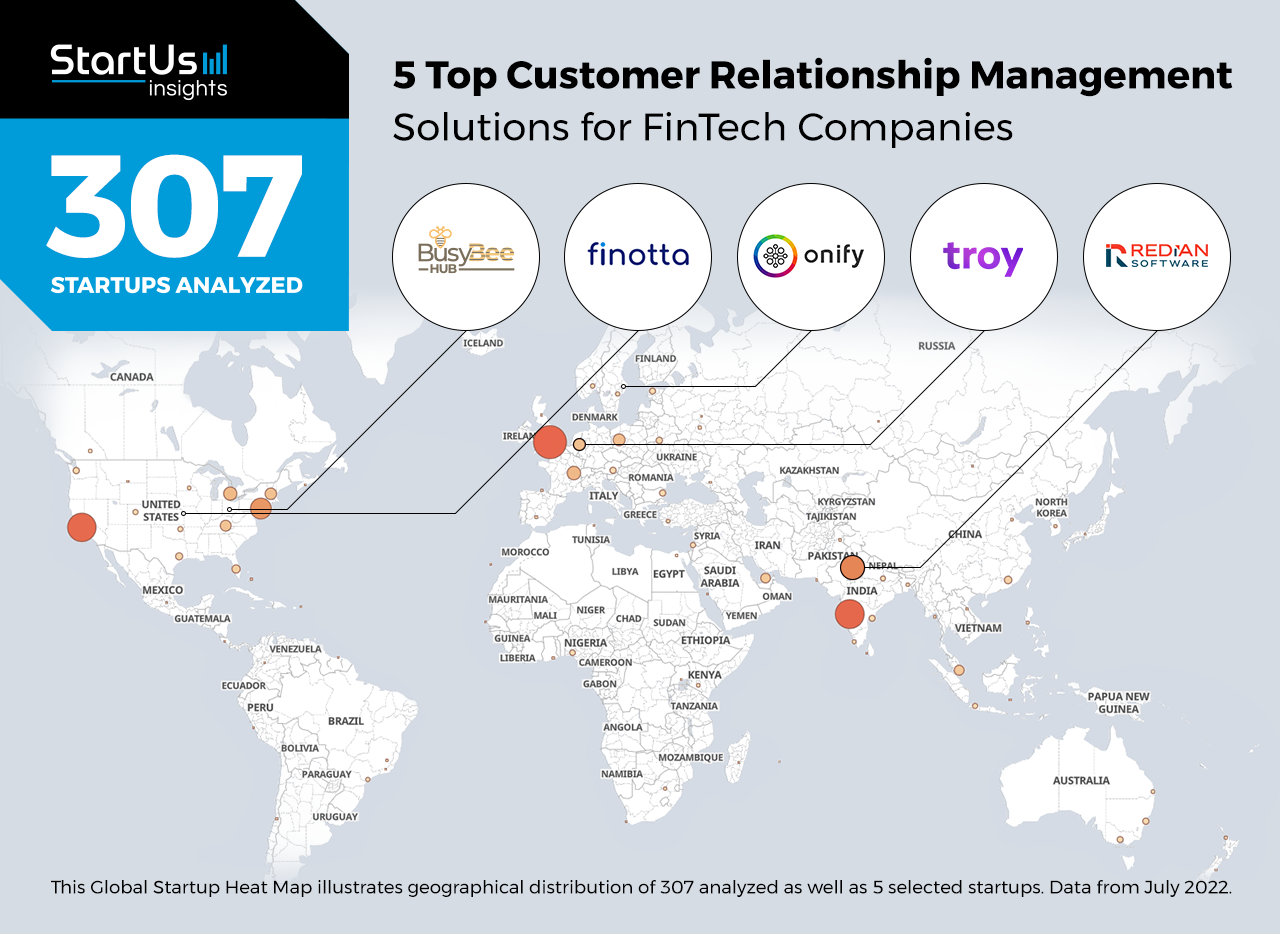

Out of 307, the Global Startup Heat Map highlights 5 Top Customer Relationship Management Solutions for FinTech Companies

Startups such as the examples highlighted in this report focus on finance management, digital debt collection, self-service platform, and personalized mobile banking. While all of these technologies play a significant role in advancing FinTech, they only represent the tip of the iceberg. This time, you get to discover five hand-picked customer relationship management solutions for FinTech companies.

The Global Startup Heat Map below reveals the geographical distribution of 307 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on scouting criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 302 customer relationship management solutions for FinTech companies, get in touch with us.

BohoTek simplifies Finance Management

Founding Year: 2018

Location: Dublin, US

Reach out to Busy Bee for Payment Integration

BohoTek is a US-based startup that develops Busy Bee Hub, cloud-based business management software. It integrates payment accounts and features a comprehensive dashboard, email marketing, quotes management, invoices management, payment management, and customer inquiries. By leveraging the combined data, Busy Bee Hub provides insights on profit from each invoice as well as overall monthly and annual profits.

Troy facilitates Digital Debt Collection

Founding Year: 2017

Location: Lippstadt, Germany

Partner with Troy for Customer Handling

Troy is a German startup that specializes in customer-friendly digital debt collection. The startup’s solution leverages machine learning algorithms to augment emotional intelligence, which supports agents in their customer handling. This optimizes the customer experience for all the customers, including defaulters. Additionally, the solution ensures data protection and provides the flexibility to form new compliance levels.

Onify aids Invoice Management

Founding Year: 2019

Location: Stockholm, Sweden

Work with Onify for Automated Customer Management

Swedish startup Onify builds a self-service platform that allows finance employees to manage invoicing, orders, suppliers, accounts, and customer data in one place. The platform integrates into the existing company’s infrastructure and provides an intuitive interface. It also allows access to employees from different departments to search and modify data across departments, increasing agility within organizations.

Finotta advances Personalized Mobile Banking

Founding Year: 2018

Location: Overland Park, US

Funding: USD 3 M

Use Finotta’s Solution for Financial Guidance

US-based startup Finotta builds a platform that enables financial institutions to offer personalized mobile banking to their users. It uses predictive analytics to personalize the user experience in terms of financial guidance and product recommendations. Additionally, the platform analyzes the financial health of users and gamifies the entire financial wellness process by awarding badges and points. Thus, Finotta makes mobile banking applications engaging and user-friendly while increasing bank revenues.

Redian Software Global makes Open-Source CRM Solutions

Founding Year: 2016

Location: Noida, India

Collaborate with Redian Software Global for Sales Process Automation

Redian Software Global is an Indian startup that offers open-source CRM development solutions for banking, finance, and insurance companies. The startup’s CRM, SuiteCRM, is a free and open-source alternative to Salesforce, Dynamics, and others. It allows banking and insurance companies to improve claims management, policy administration, and customer retention as well as leverage business intelligence (BI).

Where is this Data from & how to Discover More FinTech Startups?

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. The insights of this data-driven analysis are derived from our Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 500 000+ startups & scaleups globally.

The platform gives you an exhaustive overview of emerging technologies & lets you scout relevant startups within a specific field in just a few clicks. To explore financial technologies in more detail, let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.