The 2025 Fintech Report analyzes the rapidly evolving financial technology sector, disrupting traditional financial services through innovation, accessibility, and efficiency.

This report explores key trends driving the fintech market, including the rise of embedded finance, decentralized finance (DeFi), and artificial intelligence (AI) applications for fraud detection, personalized financial services, and credit risk assessment.

The report profiles major players, emerging startups, and industry collaborations driving growth and innovation. By examining market trends, investment patterns, and technological advancements, it offers insights into how fintech reshapes financial services and enables greater financial inclusion, efficiency, and transparency across the global economy.

Executive Summary: Fintech Industry Outlook 2025

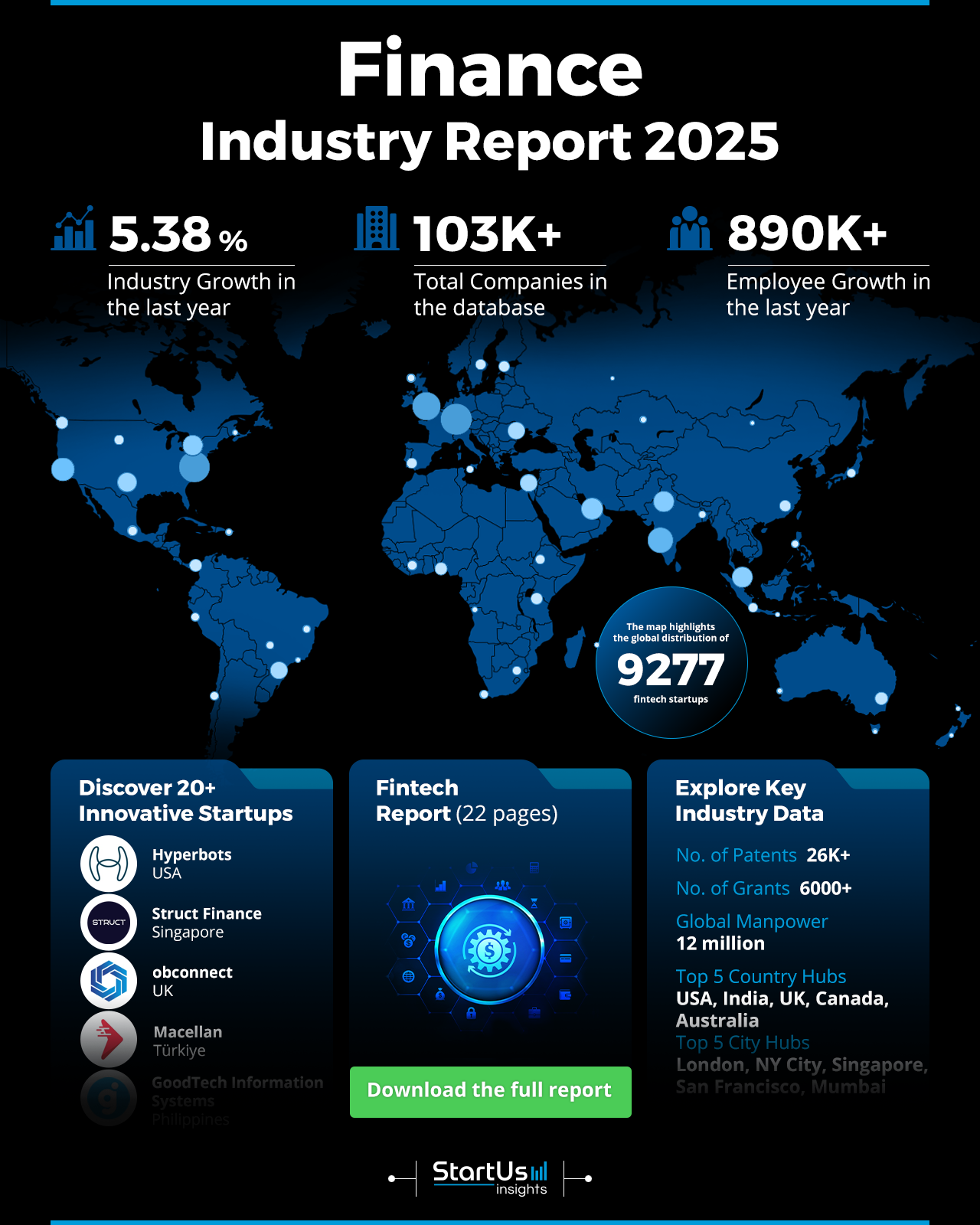

- Industry Growth Overview: The fintech industry grows at an annual rate of 5.38%, with over 103 000 companies. By 2030, the market will reach USD 686.85 billion, reflecting a CAGR of 14%.

- Manpower & Employment Growth: The industry employs 12 million people globally, adding 890 000 new employees last year.

- Patents & Grants: With over 26 000 patents and 6000 grants, the fintech sector focuses on intellectual property and research-driven innovation to support technological advancements.

- Global Footprint: Top country hubs include the United States, India, the United Kingdom, Canada, and Australia, with key city hubs like London, New York City, Singapore, San Francisco, and Mumbai driving innovation.

- Investment Landscape: The fintech industry exhibits robust financial activity, with more than 101 000 funding rounds and an average investment value of USD 46.5 million per round.

- Top Investors: The combined investment by key investors exceeds USD 64 billion. Leading investors include Goldman Sachs, JP Morgan, and SoftBank, reflecting institutional confidence in the sector.

- Startup Ecosystem: Innovative startups driving the industry include Hyperbots (AI for finance and accounting), Struct Finance (decentralized finance solutions), obconnect (open banking and confirmation of payee), Macellan (digital wallet marketplaces), and GoodTech Information Systems (financial inclusion for underserved communities).

What Data is Used to Create This Fintech Market Report?

- News Coverage & Publications: The fintech industry received over 46 000 publications last year, which highlights its prominence in news coverage and research.

- Funding Rounds: Our database includes 101 000 funding rounds, showcasing significant financial activity and investment interest.

- Manpower: Employing over 12 million workers globally, the industry added 890 000 new employees last year.

- Patents: With 26 000 patents, the fintech sector focuses on innovation and intellectual property development.

- Grants: The industry secured more than 6000 grants, attracting research and development funding.

- Yearly Global Search Growth: The global search interest in fintech grew by 68.22% over the past year. This indicates increased public and professional attention.

Methodology: How We Created This Fintech Industry Report

This fintech report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of fintech over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within finance industry

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the fintech market.

Explore the Data-driven Fintech Outlook for 2025

Approximately 64% of the world’s digitally active population uses at least one fintech service, such as digital payments, lending platforms, or investment apps.

The heatmap highlights key data points in the fintech industry, showcasing growth and innovation trends. Our database contains over 9200 startups, with a total of 103 000 companies. Last year, the industry grew by 5.38%, supported by advancements in technology and business models.

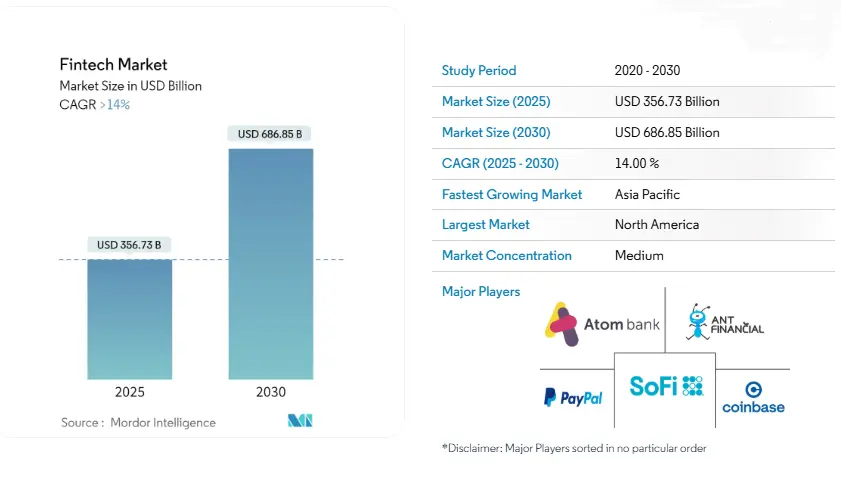

According to Mordor Intelligence, the fintech market size is estimated at USD 356.73 billion in 2025 and will reach USD 686.85 billion by 2030, with a CAGR of over 14% during 2025-2030.

Credit: Mordor Intelligence

Innovation metrics reveal over 26 000 patents and 6 000 grants, which indicates a strong focus on intellectual property. The industry employs 12 million people globally, with 890 000 new employees added last year. This is a reflection of steady expansion and talent acquisition.

Top country hubs include the United States, India, the United Kingdom, Canada, and Australia. Key city hubs driving activity are London, New York City, Singapore, San Francisco, and Mumbai, showcasing their role as innovation and business centers in the fintech landscape.

A Snapshot of the Global Fintech Market

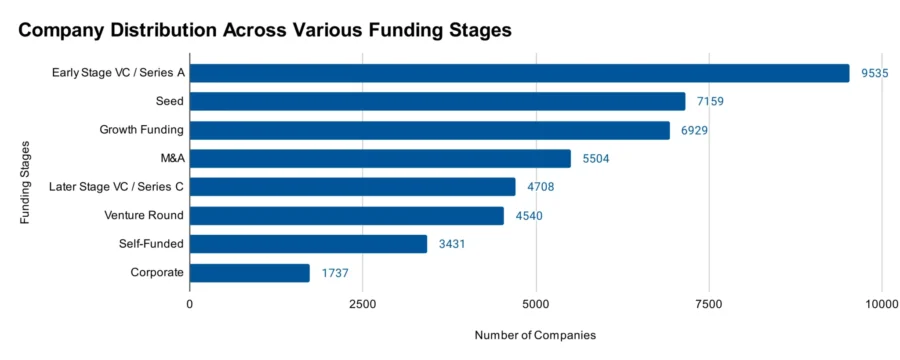

The fintech industry grows at an annual rate of 5.38%, supported by a dynamic ecosystem of startups and significant mergers and acquisitions. The sector includes, 9500 early-stage startups, indicating a strong pipeline of innovative companies. Additionally, 5400 M&A transactions highlight ongoing consolidation and collaboration.

In terms of intellectual property, the industry holds 26 000 patents which underscores its focus on technological advancements. These patents are attributed to 4500 applicants which reflects a diverse group of innovators. The yearly patent growth rate is 2.94% and showcases sustained innovation over time.

Geographically, the United States leads with 8800 patents, followed by China with 6000, signifying their dominant roles in shaping global fintech advancements.

Explore the Funding Landscape of the Fintech Market

The fintech industry shows strong financial activity, with an average investment of USD 46.5 million per funding round. This figure reflects investor confidence in the sector’s growth and innovation capabilities.

The industry has attracted over 48 000 investors. It appeals to a wide range of stakeholders, from venture capitalists to institutional investors. More than 101 000 funding rounds have been closed, highlighting many financial transactions and opportunities for startups and established companies.

Additionally, over 24 000 companies have secured funding, emphasizing the sector’s ability to support and sustain diverse businesses. These figures underscore the strong financial ecosystem driving the fintech industry’s expansion and technological advancement.

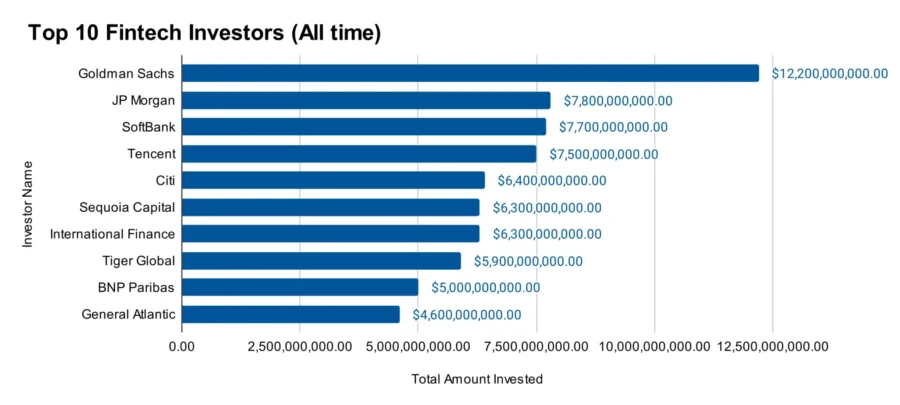

Who is Investing in the Fintech Market?

The top investors in the fintech industry have collectively invested over USD 64 billion, reflecting their confidence in the sector’s growth. Here are the key details about these investors:

- Goldman Sachs invested USD 12.2 billion across 153 companies.

- JP Morgan provided USD 7.8 billion to 79 companies, including a USD 300 million investment in Quantinuum, valuing the company at USD 5 billion.

- SoftBank supported 104 companies with USD 7.7 billion, including a USD 250 million investment in Zeta.

- Tencent invested USD 7.5 billion in 82 companies, including a USD 400 million funding round for Monzo.

- Citi directed USD 6.4 billion to 100 companies, including an investment in Rextie.

- Sequoia Capital backed 201 companies with USD 6.3 billion, including USD 300 million in Series D funding for Wiz.

- International Finance Corporation contributed USD 6.3 billion to 108 companies.

- Tiger Global invested USD 5.9 billion in 176 companies.

- BNP Paribas allocated USD 5 billion to 56 companies.

- General Atlantic invested USD 4.6 billion in 49 companies, including a USD 200 million Series B investment in QI Tech.

Top Fintech Innovations & Trends with the Discovery Platform

The fintech industry is undergoing major changes, driven by key trends that show growth and innovation.

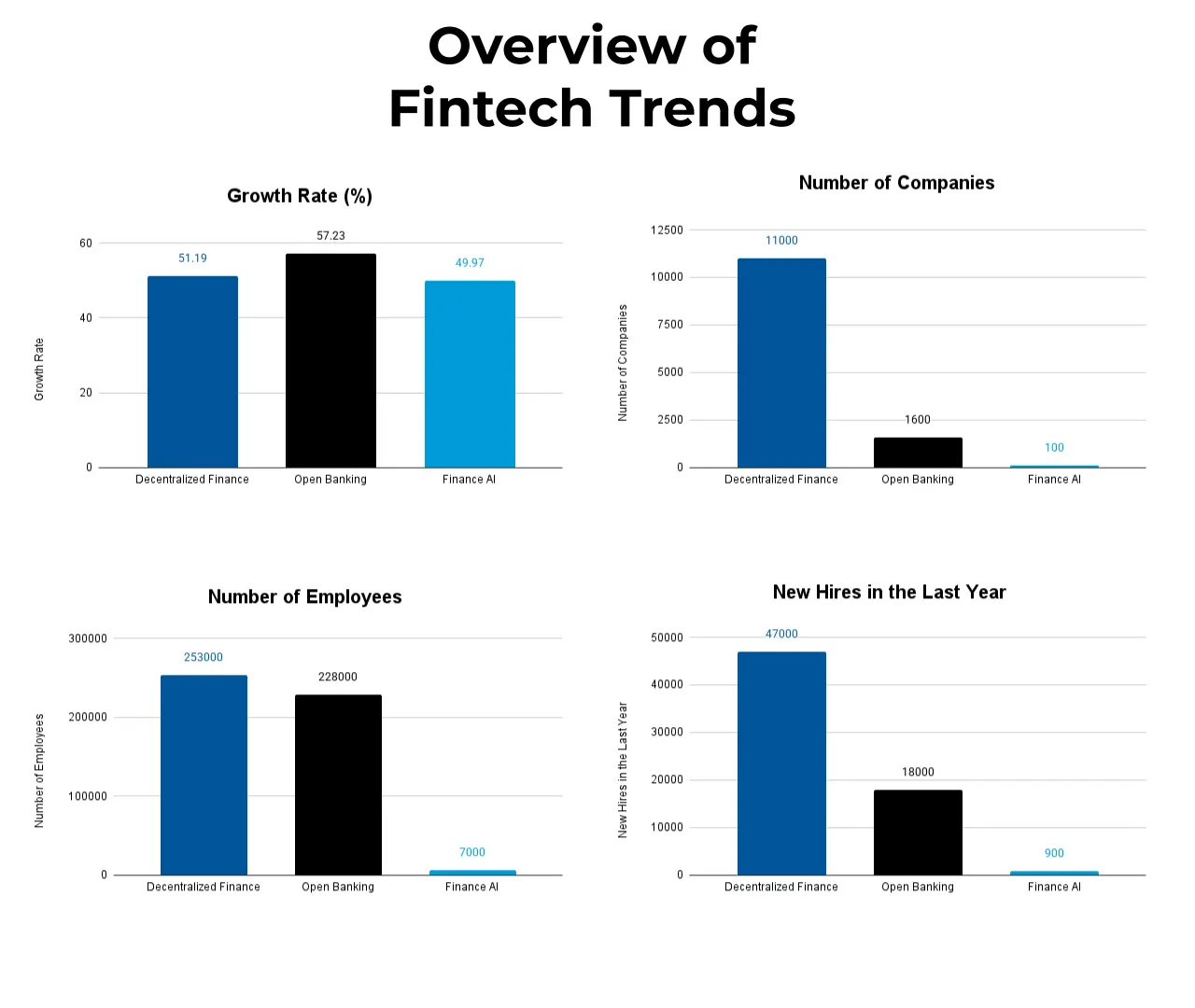

- Decentralized Finance (DeFi): This sector, with 11 000 companies and 253 000 employees globally, added 47 000 new employees last year. The annual growth rate of 51.19% reflects its reshaping of traditional financial systems using blockchain technology and decentralized platforms.

- Open Banking: This trend involves 1600 companies with 228 000 professionals worldwide. Last year, 18 000 new employees joined this segment. With an annual growth rate of 57.23%, it promotes financial transparency and collaboration through secure data-sharing frameworks.

- Finance AI: This trend, though smaller, is emerging with 100 companies employing 7000 professionals. The segment added 900 employees last year. Its annual growth rate of 49.97% highlights its role in driving intelligent decision-making and automation in financial services.

5 Top Examples from 9200+ Innovative Agritech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

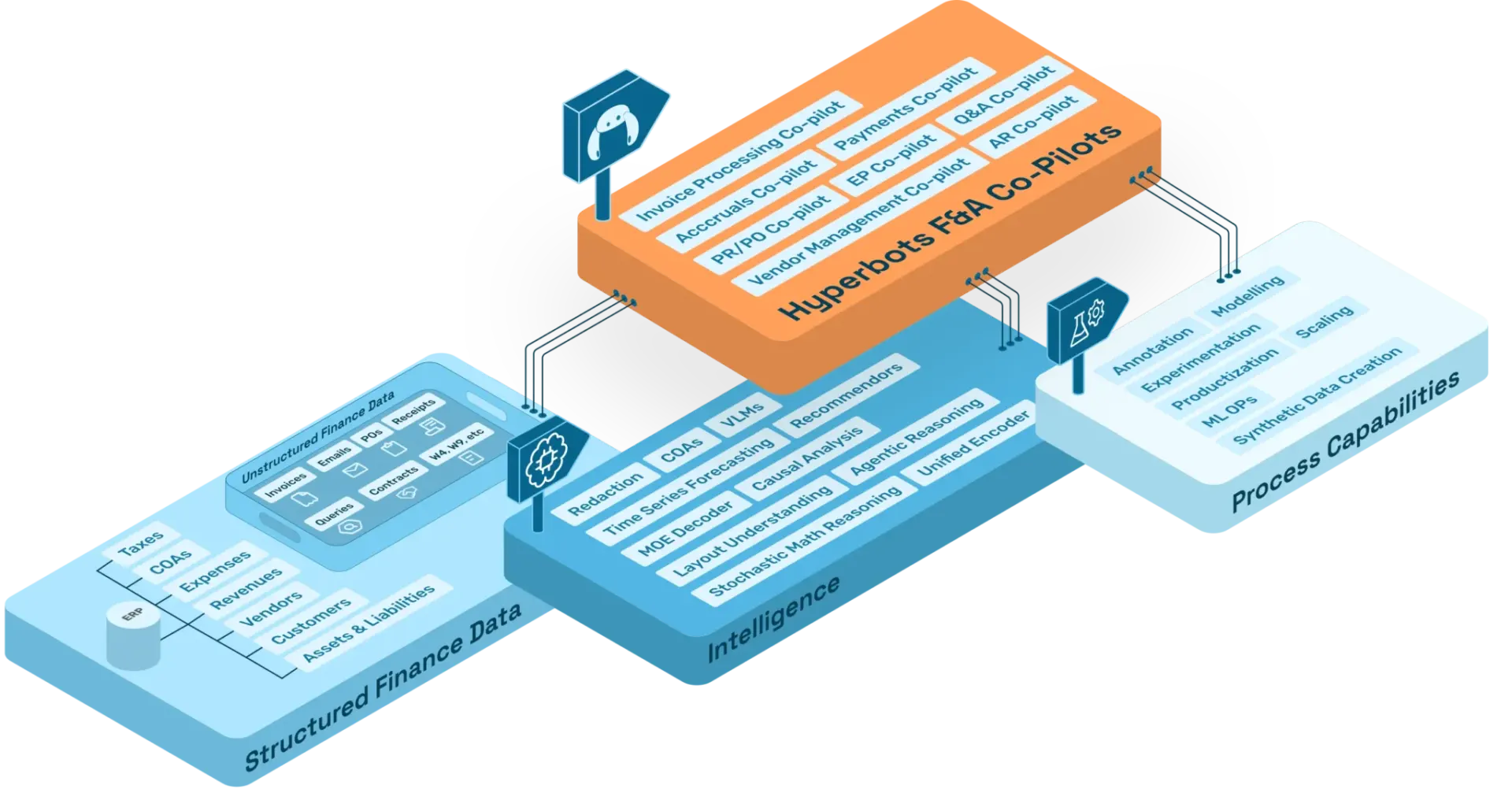

Hyperbots provides AI for Finance & Accounting

US startup Hyperbots develops an Agentic AI platform to enhance finance and accounting operations. The platform uses expert systems, vision-language models, and large language models to extract, validate, and augment data from financial documents.

It reads structured data from ERP systems to create data models for tasks involving charts of accounts, expenses, assets, liabilities, vendor and item masters, and revenues.

It offers features such as intelligent redaction for data security, enhanced OCR techniques, finance-aware large language models trained on over 3 million samples, and vision-language models fine-tuned for finance tasks.

The startup’s platform also offers flexible workflows, contextual notifications, robust security measures, and system analytics. Further, it includes single sign-on integration, no-code configurability, observability features, a generalized user interface framework, and comprehensive audit trails.

Hyperbots provide precise and efficient AI co-pilots that streamline financial processes to ensure accuracy, security, and operational efficiency for businesses.

Struct Finance delivers DeFi Platform

Singaporean startup Struct Finance offers a decentralized finance (DeFi) platform that tailors structured financial products to retail and institutional investors.

The platform segments yield-bearing assets into fixed and variable return vaults using a tranching mechanism. This allows investors to choose between predictable fixed returns and leveraged variable returns.

Key features include permissionless customization of interest rate products through a smart contract factory that enables investors to create bespoke financial instruments.

Struct Finance enhances investment opportunities and capital efficiency within the DeFi ecosystem to bridge traditional finance and blockchain-based solutions.

obconnect enables CoP and Open Banking

UK-based startup obconnect provides open banking and confirmation of payee (CoP) solutions to enhance payment security and compliance for banks, financial institutions, and corporates. Its CoP software verifies recipient account details during payment initiation to reduce fraud and ensure accurate transactions.

The startup’s open banking compliance architecture allows banks to meet PSD2 regulatory requirements by securely exposing APIs to regulated third-party providers and facilitating account information requests and payment initiation.

Further, obconnect offers TPP software for corporates, enabling them to access open banking services through a simple API to support functions such as account information services and payment initiation. The startup enables clients to thrive in the evolving financial landscape by ensuring security, compliance, and operational efficiency.

Macellan offers Digital Wallet Marketplace

Turkish startup Macellan develops SuperApp, a digital wallet marketplace that consolidates multiple brands’ wallets into one application.

It allows users to create wallets for selected brands, load balances via credit cards, and make secure payments by displaying a QR code at the point of sale. The startup’s platform includes real-time campaign notifications, loyalty program integration, and transaction history tracking.

Businesses also create customized campaigns using ready-made templates, manage customer relationships through a CRM module, and offer digital gift cards. Macellan enhances consumer convenience and streamlines digital transactions across various sectors.

GoodTech Information Systems supports Financial Inclusion

Filipino startup GoodTech Information Systems creates financial technology solutions to improve financial inclusion for underserved communities.

Its products include GoodBank, a mobile banking platform that enables instant account opening with identity verification and compliance checks.

Further, GoodLoan, an application digitizes and enhances lending processes for rural banks and financing companies. GoodPay, is a service that provides branded payment pages for merchants to facilitate quick onboarding for small and medium-sized enterprises.

GoodTech Information Systems supports families by connecting them with rural financial institutions to improve financial resilience and access to essential services.

Gain Comprehensive Insights into Agritech Trends, Startups, or Technologies

The finance industry in 2025 is poised for continued growth, driven by technological innovation and expanding global access to financial services.

Trends like decentralized finance, open banking, and AI-driven solutions are reshaping traditional systems and creating new opportunities.

Get in touch to explore all 9200+ startups and scaleups, as well as all market trends impacting agritech companies.