In this Food and Beverage Industry Report for 2025, we explore a sector undergoing rapid evolution, driven by innovation and changing consumer habits. Amidst this transformation, the report analyzes key growth areas, from technological adoption to product development. The focus on distribution efficiency and the rise of AI in food tech form pivotal themes. It offers a deep dive into industry trends, firmographic data, and the forces shaping the food and beverage landscape.

This report was last updated in January 2025.

This battery report provides a reference for industry stakeholders, investors, policymakers, and economic analysts. It also explores the startup ecosystem making major changes.

Executive Summary: Food and Beverage Industry Report 2025

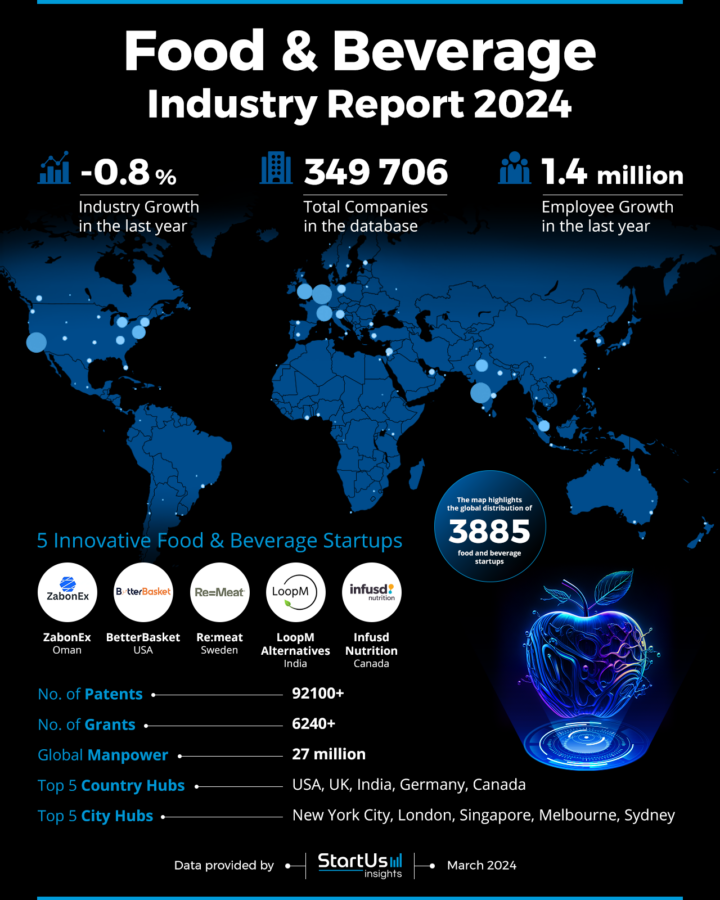

- Industry Growth: The sector experiences a slight decline in growth (-0.8%), yet exhibits resilience through innovation. Additionally, the functional beverage market is also growing. In 2024, the energy drink category witnessed sales going up by 5%.

- Manpower & Employment Growth: The industry employs over 27 million individuals and added 1.4 million new jobs last year.

- Patents & Grants: Startups contribute to over 92 100+ patents and secured more than 6200+ grants, reflecting strong R&D and investor confidence.

- Global Footprint: The USA, UK, India, Germany, and Canada emerge as top hubs, with top city hubs in New York City, London, Singapore, Melbourne, and Sydney leading as central nodes for innovation.

- Investment Landscape: The average investment value stands at USD 28 million per round, with over 19 000 investors participating in more than 76 000 funding rounds.

- Top Investors: Notable investors include SoftBank Vision Fund, Tiger Global Management, and Tencent, among others, investing over USD 14.5 billion collectively.

- Startup Ecosystem: Five innovative startups include ZabonEx (Distribution Prediction), BetterBasket (Automated Merchandising Intelligence), Re:meat (Cultivated Meat), LoopM Alternatives (Sustainable Packaging Materials), and Infusd Nutrition (Water-soluble Functional Ingredients).

Methodology: How we created this Food and Beverage Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of the food and beverage sector over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the food and beverage sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the food and beverage market.

What Data is used to Create this Food and Beverage Report?

Based on the data provided by our Discovery Platform, the food and beverages sector ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The food and beverage industry was featured in over 110 000 publications last year, reflecting significant media coverage.

- Funding Rounds: The database reveals data on more than 76 000+ funding rounds within the food and beverage sector.

- Manpower: The industry employs over 27 million workers, with an increase of more than 1.4 million new employees in the past year.

- Patents: Holders of food and beverage innovation own upwards of 92 000+ patents.

- Grants: The sector has secured over 6200 grants, showcasing support for its advancements and developments.

Explore the Data-driven Food and Beverage Report for 2025

The Food and Beverage Industry Report uses data from the Discovery Platform and covers the key metrics that underline the sector’s dynamic growth and innovation. The report showcases a detailed analysis of the sector’s performance and innovation. Despite a marginal industry growth decline of 0.8% over the past year, the food and beverage landscape shows resilience with 349K+ companies actively documented in the database.

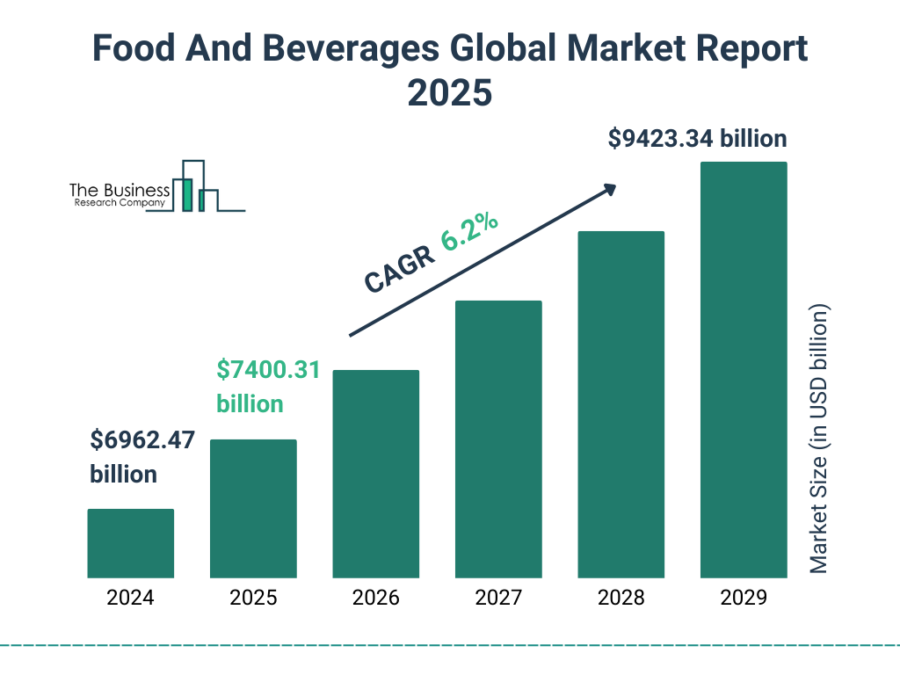

The food and beverage market is set to reach from USD 6962 billion in 2024 to USD 9423 billion in 2029, which is a CAGR of 6.2%. Additionally, the better-for-you (BFY) beverages will reach USD 484 million in 2025, marking a CAGR of 8.5%.

Credit: The Business Research Company

Employee growth in the sector remains robust, with a significant addition of 1.4 million workers, reflecting the industry’s capacity for job creation amidst challenges. Globally, the industry boasts a workforce of 27 million, showing its significant impact on the economy.

The report identifies the USA, UK, India, Germany, and Canada as the top five country hubs for the food and beverage sector, with cities like New York City, London, Singapore, Melbourne, and Sydney recognized as the leading city hubs. This geographical distribution underscores the global reach and the entrepreneurial spirit that fuels the food and beverage industry. The Southeast Asian market was valued at USD 667 billion in 2023 and is predicted to reach USD 900 billion by 2028, which marks an annual growth rate of 6.99%.

A Snapshot of the Global Food and Beverage Industry

The food and beverage industry continues to demonstrate its significance as a major global employer, boasting a remarkable workforce of 27 million people. This sector has exhibited a commendable growth trajectory, as evidenced by the substantial addition of 1.4 million employees over the last year, signifying the industry’s resilience and expanding nature.

This growth highlights the sector’s expanding capacity and its critical role in national security and technology development. This number is only set to increase with the renewal of defense budgets across Europe and also in other parts of the world. For instance, India and Japan signed their first military technology transfer pact for the development of UNICORN mast for naval ships.

Explore the Funding Landscape of the Defense Industry

Financially, the average investment value in the defense sector stands at USD 48 million. This indicates strong investor confidence and the strategic importance of defense technologies. The involvement of more than 9700 investors has resulted in over 27 900 funding rounds, a testament to the vibrant and dynamic nature of investments.

Over 31 000 companies have benefited from these investments, showcasing the depth and breadth of innovation and entrepreneurship that thrives within the food and beverage space. This financial engagement underscores a keen interest in nurturing a diverse range of businesses, from startups aiming to disrupt the market to established companies scaling new heights.

Who is Investing in Food and Beverage Companies?

The top investors in the Food and Beverage industry collectively channel more than USD 14.5 billion into the sector, displaying significant financial commitment and foresight.

- SoftBank Vision Fund invested USD 2.9 billion in 24 companies. Kitopi, a tech-powered cloud kitchen, received significant funding from SoftBank Vision Fund.

- Tiger Global Management follows with USD 2.7 billion allocated across 48 companies. It led a USD 23 million Series B funding round for Wow! Momo in 2019, marking its first investment in an Indian quick-service restaurant (QSR) brand.

- Temasek Holdings has laid down USD 2.1 billion in 22 companies, showing their targeted investment approach. It led a USD 210 million Series G funding round in Rebel Foods, which operates cloud kitchen brands like Faasos, Behrouz Biryani, and Oven Story Pizza.

- Tencent’s strategic investments amount to USD 2 billion in 19 companies, showcasing their focus on growth and innovation. It invested in one of the popular coffee chains in China named Manner Coffee.

- Sequoia Capital China infuses USD 1.3 billion into 37 companies, underpinning the value they see in the sector’s expansion.

- Kohlberg Kravis Roberts commits USD 1.2 billion across 16 companies, indicating their selective investment policy. It also invested USD 60 million to USD 70 million in December 2024 in Rebel Foods, making its valuation approximately USD 860 million.

- T. Rowe Price’s investment strategy includes USD 1.2 billion distributed among 11 companies, focusing on high-impact opportunities. T. Rowe Price, along with Act III Holdings invested USD 70 million in BJ’s Restaurants through the purchase of common stock.

- Goldman Sachs completes the list with a significant USD 1.1 billion invested in 22 companies, reinforcing its trust in the sector’s robustness and future growth prospects. It manages a Global Food & Beverages Equity Fund, which invests in various F&B companies worldwide including Procter &Gamble, and PepsicCo Inc.

These investments reveal a clear conviction in the ongoing evolution and long-term sustainability of the food and beverage industry.

Top 3 Food and Beverages Innovations and Trends

- Food & Beverage Distribution represents 940+ companies and employs 277 000 individuals. This indicates a stable yet modest growth, with 9500 new jobs added last year. However, it’s experiencing a slight contraction, with an annual trend growth rate of -1.5%, suggesting potential disruptions or shifts in the traditional distribution models as the industry evolves.

- AI for Restaurants is an emerging trend with 198 companies developing this technology further. The segment boasts a workforce of 12 600, bolstered by 1400 new hires in the previous year, reflecting its rapid expansion with an impressive annual growth rate of 31.61%. This growth underscores the increasing adoption of AI to optimize restaurant operations and enhance customer service.

- Ultra-Processed Foods, while smaller, includes 111 companies and employs 4700 people. It has grown by 400 employees in the last year, marking an annual trend growth rate of 3.90%. This trend points to a continued demand for convenience foods, despite the global push towards healthier eating habits.

5 Top Examples from 3800+ Innovative Food and Beverage Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

ZabonEx develops a Food Distribution Prediction Platform

Oman-based startup ZabonEx specializes in deploying machine learning to forecast product distribution in the food and beverage sector. Its platform connects to various data sources, offering intelligent suggestions for data processing. It enables the construction and implementation of explainable machine learning models, enhancing accuracy and customer focus.

By leveraging machine learning, ZabonEx assists manufacturers and retailers in maximizing perishable product value and minimizing waste. The platform’s Prediction Engine adapts to consumer consumption habits, refining supply and distribution strategies. This approach increases sales by aligning with real-time demand and also enables product freshness.

BetterBasket offers Automated Merchandising Intelligence

US-based startup BetterBasket offers real-time pricing and assortment solutions for grocery stores. Its platform leverages a proprietary algorithm to match items across markets, enabling informed pricing and product decisions. It provides insights for optimizing margins and sell-through by indexing market pricing and analyzing local competitor data. BetterBasket’s technology also provides automated updates, eliminating the need for manual oversight in pricing strategies. This solution tracks over 20000 US ZIP codes, offering granular, real-time pricing data. The system is designed to enhance category margins for retailers and brands.

Re:meat provides Cultivated Meat

Swedish startup Re:meat focuses on meat production through cellular agriculture. The company combines expertise in various fields to construct a large-scale cultivated meat facility, starting with beef. Its innovation includes cultivated Swedish meatballs, which received positive feedback at consumer tastings.

The startup enables scaling production, utilizing serum-free technology for large-scale outputs, contrasting with the industry’s R&D focus. Re:meat offers sustainable protein sources, highlighting a shift in the food industry towards environmentally friendly alternatives.

LoopM produces Sustainable Packaging Materials

LoopM is an Indian startup that produces sustainable packaging solutions using advanced biomaterials. The startup’s Bio-Based Coatings enhance the longevity of perishables, ensuring food safety and reducing waste. LoopM’s packaging solutions employ active packaging technology to optimize product shelf life. B

y repurposing agro-waste, LoopM contributes to environmental sustainability and waste reduction. The firm’s processes also align with efforts to minimize global greenhouse gas emissions by tackling food spoilage.

Infusd Nutrition creates Water-soluble Functional Ingredients

Canadian startup Infusd Nutrition creates ingredients for multiple markets including beverages, nutrition, and cosmetics. It specializes in producing water-soluble versions of typically fat-soluble and insoluble nutrients.

Specifically, the startup explores new uses for Omega-3 hemp seed oil, leading to the development of its novel ingredients. Infusd’s technology also promises a new approach to integrating beneficial nutrients into everyday products.

Gain Comprehensive Insights into Food & Bev Trends, Startups, or Technologies

The 2025 food and beverage report showcases the industry’s growth challenges, and how companies are reinventing with advanced distribution technology. As the industry marches towards sustainability and technological integration, the insights from this report are instrumental for stakeholders to navigate the evolving market and harness the opportunities that lie within these trends. Get in touch to explore all 3800+ startups and scaleups, as well as all industry trends impacting food and beverage companies.