Executive Summary: Food Industry Outlook 2025

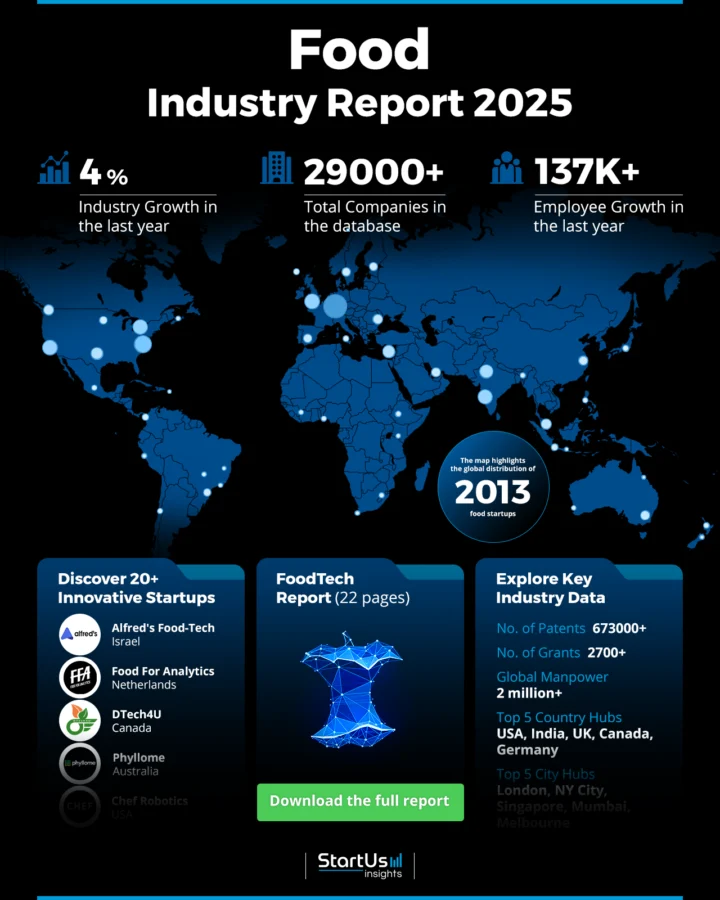

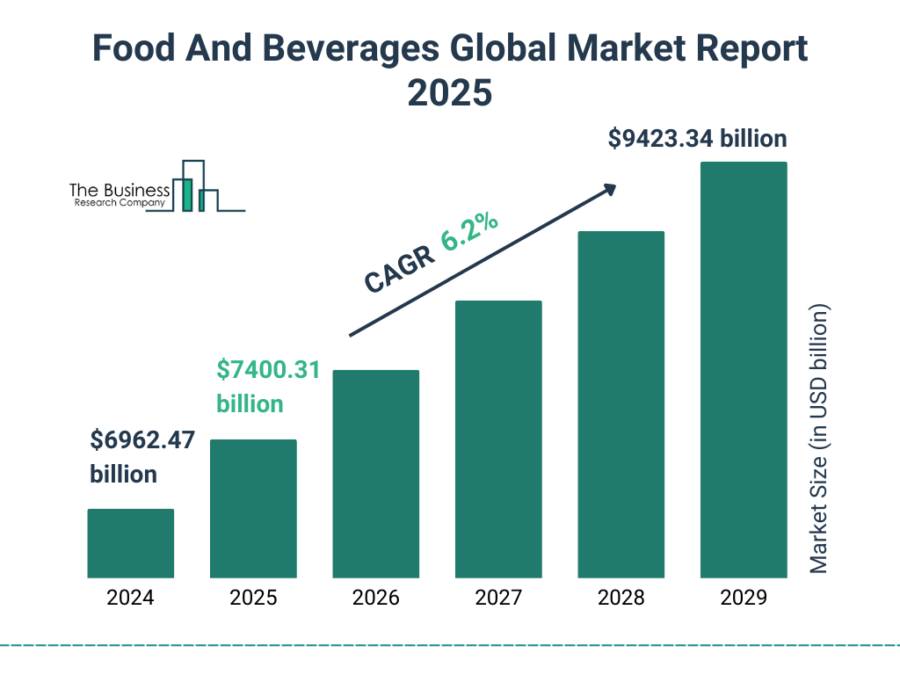

- Industry Growth Overview: The food and beverages market will grow from USD 7400.31 billion in 2025 to USD 9423.34 billion in 2029 at a compound annual growth rate of 6.2%. On a granular level, the food industry is growing steadily at an annual rate of 4.00% as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The industry employs more than 2 million people globally and added 137K new employees last year. It showcases strong workforce expansion.

- Patents & Grants: The sector leads innovation with over 673K patents filed by 120K+ applicants and has secured 2700+ grants that drive research and development.

- Global Footprint: Key country hubs include the USA, India, UK, Canada, and Germany. Leading city hubs are London, New York City, Singapore, Mumbai, and Melbourne.

- Investment Landscape: The food industry has closed more than 16K funding rounds, with an average investment value of USD 23.7 million per round, involving over 9600 investors.

- Top Investors: Top investors have combined investment values exceeding USD 4 billion. Notable investors include International Finance Corporation, Hormel Foods, Tiger Global Management, and more.

- Startup Ecosystem: Innovative startups include Alfred’s Food-Tech (plant-based food alternatives), Food For Analytics (food data & analytics), DTech4U (agricultural products traceability), Phyllome (automated plant factories), and Chef Robotics (food assembly robotic systems).

Methodology: How We Created This Food Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of food over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the food industry

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the food industry.

What Data is Used to Create This Food Industry Report?

Based on the data provided by our Discovery Platform, we observe that the food industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The food industry generated over 216K publications last year.

- Funding Rounds: Our database records 16K+ funding rounds which shows significant investment activity.

- Manpower: Employing over 2 million workers globally, the food industry added 137K new employees last year.

- Patents: The sector leads in innovation with 673K+ patents which underscores its prominence in intellectual property development.

- Grants: A total of 2700 grants support research and initiatives. This highlights the industry’s focus on development and sustainability.

- Yearly Global Search Growth: Experiencing 15.85% yearly global search growth, the food industry remains highly relevant and attracts increasing global interest.

Explore the Data-driven Food Industry Report for 2025

As per The Business Research Company, the food and beverages market will grow from USD 7400.31 billion in 2025 to USD 9423.34 billion in 2029 at a compound annual growth rate of 6.2%.

According to the Mordor Intelligence report, the Indian foodservice market size is estimated at 85.19 billion USD in 2025 and is expected to reach 139.8 billion USD by 2030, growing at a compound annual growth rate of 10.41% during the forecast period 2025-2030.

The global food and beverage output is projected to increase by 3.1% in 2025. Investment in the sector is expected to grow by 3.9% in 2025.

The Food Industry Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

The food industry is growing steadily, with an annual rate of 4.00%. Our database includes 2000+ startups and over 29K companies.

Credit: The Business Research Company

With 673K+ patents and 2700+ grants, intellectual property, and funding opportunities drive advancements across the sector.

The industry employs over 2 million people globally, with a net growth of 137000 employees last year. This signals a strong demand for talent. The USA, India, the UK, Canada, and Germany emerge as top country hubs.

Meanwhile, London, New York City, Singapore, Mumbai, and Melbourne are key city hubs contributing significantly to global activity.

The largest segment within the food market is confectionery and snacks, valued at approximately USD 1.77 trillion. The majority of revenue is generated in China, accounting for about USD 1.63 trillion.

Moreover, online sales represent 4.3% of total revenue in the food sector, with expectations to reach a volume of 3118 billion kilograms by 2028.

A Snapshot of the Global Food Industry

The food industry grows steadily at an annual rate of 4.00%, supported by startups, patents, and market activities. With over 2000 startups, including 1400+ early-stage ones, the industry thrives on entrepreneurial energy and innovation.

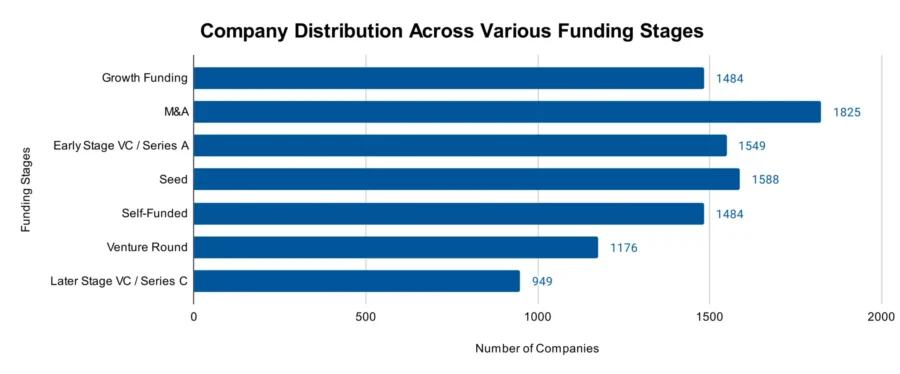

Further, the sector has experienced consolidation with 1600+ mergers and acquisitions, which highlights strategic collaborations and market expansion.

Innovation drives the industry’s growth, with 673K+ patents filed by 120K+ applicants. The yearly patent growth of 2.32% offers sustained innovation, with China having 166K+ patents and the USA having 124K+ patents as global leaders in intellectual property.

Explore the Funding Landscape of the Food Industry

With an average investment value of USD 23.7 million per round, funding activity demonstrates investor confidence.

The industry has attracted more than 9600 investors and engages diverse financial stakeholders across various market segments. Over 16K funding rounds have been closed, showing consistent capital inflow and robust investor activity.

In addition, more than 4200 companies have secured investments. This is an indication of widespread capital distribution to fuel innovation and growth across the sector.

Who is Investing in the Food Industry?

The top investors in the food industry have collectively invested more than USD 4 billion, underscoring their critical role in driving the sector’s growth.

- International Finance Corporation has invested USD 913.5 million across 5 companies. The IFC committed a record USD 56 billion to private companies and financial institutions in developing countries.

- Hormel Foods has invested USD 728 million in 4 companies. Hormel reported net sales of USD 2.89 billion, driven by growth in its Foodservice segment.

- Tiger Global Management has spread its USD 658 million investment across 6 companies. Tiger Global participated in a secondary market investment in Revolut, a financial technology company.

- Barclays has allocated USD 651.1 million to 6 companies. Barclays supports impactful charity partnerships in Asia Pacific, highlighting its social responsibility alongside financial services.

- Caisse de Dépôt et Placement du Québec has focused its USD 600 million investment on 2 companies. CDPQ, Desjardins Group, and Capital régional et coopératif Desjardins will invest USD 600 million in Quebec SMBs over three years.

- European Bank for Reconstruction and Development has invested USD 432.4 million in 11 companies. The European Council approved increasing the EU’s EBRD shares by subscribing to 12 102 additional shares at USD 10 700 each.

- CVC Capital Partners has invested USD 431.2 million across 4 companies. CVC acquired CVC DIF to improve its infrastructure capabilities and diversify its private markets strategy.

Top Food Industry Innovations & Trends

The food industry is shaped by trends addressing sustainability, innovation, and efficiency. Firmographic data reveals key insights:

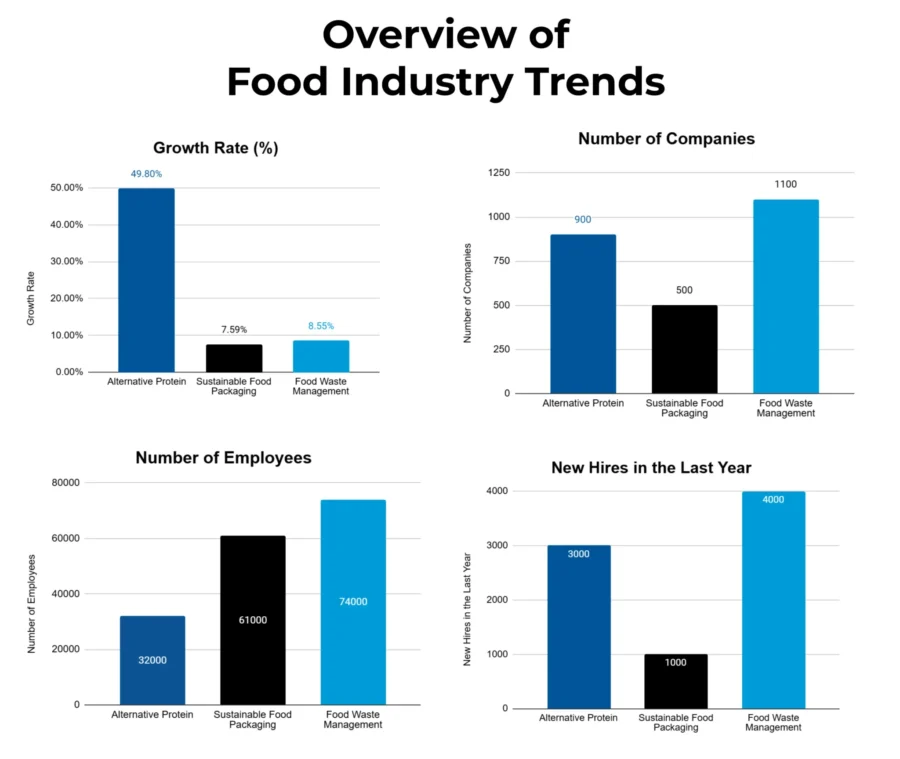

- Alternative Protein grows rapidly with an annual rate of 49.80%. Over 900 companies employ 32000 individuals, including 3000 new hires last year. This trend reflects rising consumer demand for plant-based and lab-grown protein solutions.

- Sustainable Food Packaging gained traction with an annual growth rate of 7.59%. The segment includes over 500 companies employing 61000 people, with 1000 new employees added last year. This trend emphasizes reducing waste and improving environmental impact through innovative packaging solutions.

- Food Waste Management shows a critical focus despite an annual decline of 8.55%. It remains significant with over 1100 companies employing 74000 individuals, including 4000 new hires last year. The trend optimizes food supply chains and minimizes waste through technology and planning.

Moreover, innovations such as AI in food manufacturing are projected to expand from USD 29.45 billion by 2026, with an estimated compound annual growth rate of around 45.7%.

The food market is projected to grow by 3.9% in 2025, driven by demand for convenience and sustainability.

5 Top Examples from 2000+ Innovative Food Industry Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Alfred’s Food-Tech creates Plant-based Food Alternatives

Israeli startup Alfred’s Food-Tech develops alternative protein products using its proprietary Protein Layering And Nutrient Embedding Technology (PLANET).

This platform constructs continuous, fibrous structures by transforming emulsions into tissue-like forms to mask undesirable flavors and aftertaste. It creates plant-based alternatives to meat, poultry, fish, and cheese with high protein content and minimal ingredients.

Alfred’s Food-Tech allows food manufacturers to produce sustainable, plant-based products that replicate the taste and texture of traditional animal-derived foods.

Food For Analytics provides Food Data & Analytics

Dutch startup Food For Analytics offers data-driven solutions for the food industry, focusing on operational efficiency and decision-making.

Its suite of products includes SmartFactory, which identifies and eliminates production bottlenecks to improve equipment availability and increase overall equipment effectiveness (OEE).

SmartC360 provides a comprehensive view of customer data to enable informed sales strategies. SmartSupply optimizes logistics with real-time visibility into delivery rates, quality, and order accuracy for enhancing supply chain efficiency.

Further, SmartSource streamlines procurement with data-driven insights to improve supplier performance and purchase order accuracy.

The startup also offers SmartStock that maintains optimal inventory levels with real-time tracking and demand forecasting to reduce waste and costs.

SmartCapital offers financial strategies with real-time insights into the general ledger and journal postings to facilitate margin improvement.

DTech4U facilitates Agricultural Product Traceability

Canadian startup DTech4U offers a SaaS platform that connects stakeholders in the agriculture and food industry through a unified digital interface.

The platform uses AI, blockchain, and IoT for real-time monitoring and sensing of food items throughout the supply chain to ensure traceability from origin to consumer.

It manages and integrates information across the supply chain, addressing challenges like fraud, data alteration, and the use of harmful chemicals.

Each transaction contains product-specific attributes added by supply chain participants that enable them to recognize and investigate product associations at every stage.

DTech4U’s solution enables farmers to set competitive prices, supports efficient supply chain management, and ensures product authenticity.

Phyllome operates Automated Plant Factories

Australian startup Phyllome develops automated plant factories that use robotics and AI to supply fresh produce daily. These indoor facilities recycle water and fertilizers to minimize environmental impact and preserve soil biomes.

By growing indoors, Phyllome’s system protects crops from adverse weather to ensure consistent year-round harvests. The produce contains more nutrients than traditionally grown plants and offers enhanced flavor due to increased flavonoid content.

Phyllome delivers sustainable, nutrient-rich, and flavorful produce while promoting resilience in the food supply chain.

Chef Robotics designs Food Assembly Robotic Systems

US startup Chef Robotics develops AI-enabled robotic systems to automate high-mix food production processes.

Its ChefOS platform uses AI and computer vision to adapt to various ingredients, portion sizes, trays, and conveyor systems to ensure precise and consistent food assembly. ChefOS selects placement strategies based on ingredient properties, pan topography, and preparation methods.

The startup’s platform detects and tracks trays along the production line and re-train models to place items into any tray, compartment, or conveyor setup.

The system integrates into existing production lines without retrofitting, and its collaborative robots operate safely alongside human workers to enhance efficiency.

Chef Robotics addresses labor shortages and increases production capacity enabling food companies to maintain high-quality standards while meeting growing demand.

Gain Comprehensive Insights into Food Industry Trends, Startups, or Technologies

The food industry in 2025 is set for sustainable growth, driven by innovation, consumer demand, and advancements in technology. Emerging trends like alternative proteins, sustainable packaging, and food waste management will shape the future, emphasizing environmental responsibility and efficiency.

Get in touch to explore all 2000+ startups and scaleups, as well as all industry trends impacting food companies.

![Food and Beverage Industry: Top 10 Technology Trends [2025 & Beyond]](https://www.startus-insights.com/wp-content/uploads/2024/11/Food-and-Beverage-Industry-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)