Food technology trends are improving supply chain transparency and operational efficiency while addressing dynamic consumer demands. For instance, plant-based proteins, meat substitutes, and gluten-free products cater to diverse dietary preferences while waste management and sustainable packaging solutions address environmental concerns.

What are the Top 10 Food Technology Trends in 2025?

- Food Traceability

- Food e-Commerce

- Plant-based Proteins & Ingredients

- Food Safety & Security Management

- Automation of Food Processing

- Food Waste Management

- Gluten-free Food Products

- Sustainable Food Packaging

- Personalized Food

- Meat Substitutes

Methodology: How We Created the Food Tech Trend Report

For our food industry trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 5M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the food industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the food technology innovation ecosystem while highlighting startups driving technological advancements in the food industry.

Innovation Map outlines the Top 10 Food Technology Trends & 20 Promising Startups

For this in-depth research on the Top FoodTech Trends & Startups, we analyzed a sample of 12 390+ global startups & scaleups. The Food Technology Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the food industry trends & startups that impact your company.

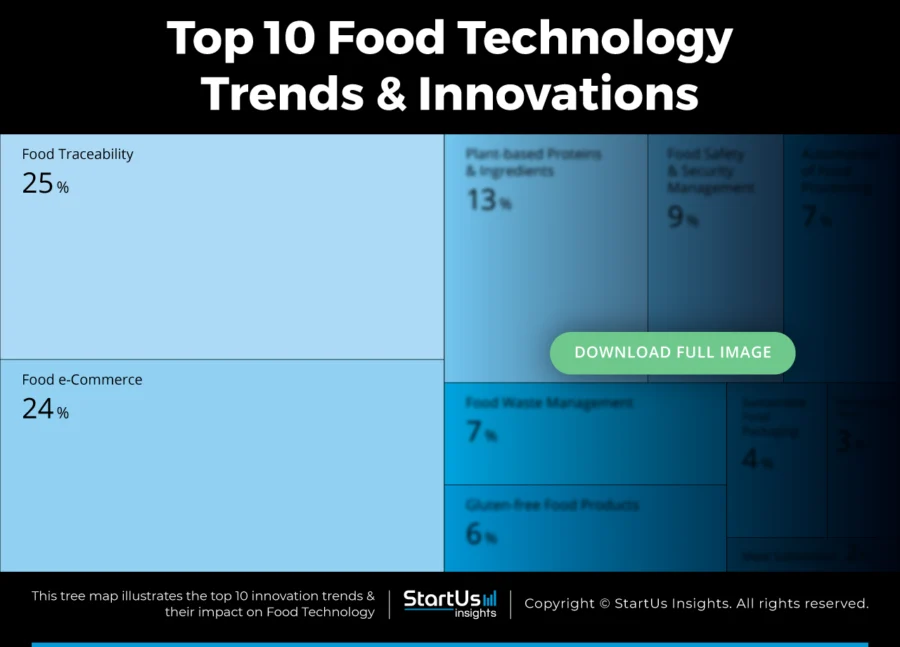

Tree Map reveals the Impact of the Top 1o Food Technology Trends

The Tree Map below highlights the top 10 trends shaping the food industry in 2025. Food traceability and e-commerce are impacting supply chains and consumer access to products. Plant-based proteins and ingredients, along with meat substitutes, are diversifying dietary options and promoting sustainability.

At the same time, food safety and security management, alongside food processing automation, are optimizing production. Food waste management and sustainable packaging solutions address environmental concerns.

Additionally, the rise of gluten-free food products and personalized food offerings is catering to individual health needs and preferences – marking a new era in food technology.

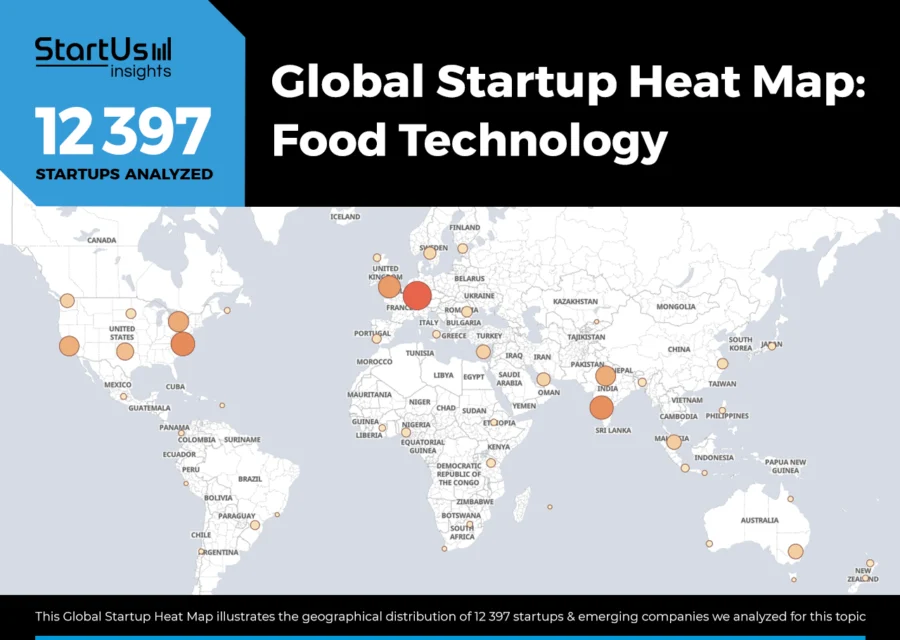

Global Startup Heat Map covers 12 390+ Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 12 390+ exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the US and India, followed by the UK. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Food Technology Innovations & Trends?

Top 10 Emerging Food Technology Trends [2025 and Beyond]

1. Food Traceability

The adoption of blockchain ensures secure and immutable records to build transparency and trust in the supply chain. Internet of Things (IoT), on the other hand, uses sensors and devices to monitor and report real-time data on food products.

Carrefour and Walmart are two popular companies that use blockchain to trace fresh produce and meat origins for quick contamination responses and to build consumer trust.

Additionally, radio-frequency identification (RFID) also allows efficient tracking of products through the supply chain, reduces errors, and improves inventory management.

To improve food traceability, companies in the food, beverage, and ingredient sectors are prioritizing investments in mobile app technologies (23%), tech-enabled traceability systems (21%), and IoT devices (16%).

Canada and Manitoba are funding Manitoba agri-food producers and processors through the sustainable CAP to improve food safety and traceability.

Moreover, the governments are implementing stricter regulations to ensure food safety. In the US, the food safety modernization act (FSMA) mandates detailed tracking of food products. This compels producers and distributors to improve supply chain transparency.

The food traceability market size will grow from USD 25.74 billion in 2025 to USD 39.17 billion in 2029 at a compound annual growth rate (CAGR) of 10.4%.

Credit: The Business Research Company

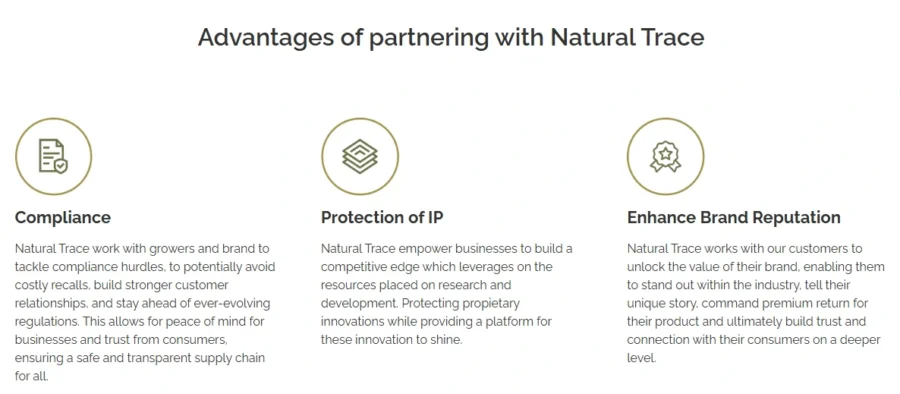

Natural Trace delivers Advanced Biotechnology for Traceability

Natural Trace is a Singaporean startup that offers NaturalTag, a food-grade, DNA-based traceable tag. It integrates into food products and embeds DNA markers directly into the product without altering its taste or quality.

To detect these markers, the startup provides NaturalDetect, which is a sensitive kit to read the embedded tags with precision and accuracy at any stage of the supply chain.

Additionally, the company offers NaturalCloud, a digital surveillance platform, that analyzes data from NaturalDetect to offer detailed supply chain insights and enable informed decision-making.

Trackvision AI provides a Standards-compliant Traceability Platform

UK-based startup TrackVision AI delivers a standards-compliant traceability platform that captures and shares supply chain data using GS1 EPCIS 2.0 and digital link standards.

The platform enables food industry stakeholders to monitor product provenance while ensuring transparency and compliance with food safety regulations.

Moreover, the platform executes targeted product recalls, detects and prevents diversion, reduces carbon footprints, and substantiates sustainability claims.

2. Food e-Commerce

This rapid growth is driven by advancements in AI-powered recommendation systems, smart shopping carts, and predictive analytics. They enable personalized shopping experiences in the food industry.

IoT-enabled kitchen devices also automatically reorder ingredients and suggest recipes by integrating with e-commerce platforms.

As consumers become more conscious of food sourcing, allergens, and sustainability, the demand for clear labeling has increased. Features like QR codes and blockchain tracking are providing greater transparency, helping shoppers make informed decisions.

Meanwhile, robotic food deliveries adopted by companies, like Uber, are reducing delivery times and making online food shopping even more convenient. Cold-chain logistics and last-mile delivery solutions are other factors that ensure that perishable goods reach consumers fresh and efficiently.

These innovations are expanding food e-commerce, with online transactions now driving 35% of total food and beverage dollar sales growth.

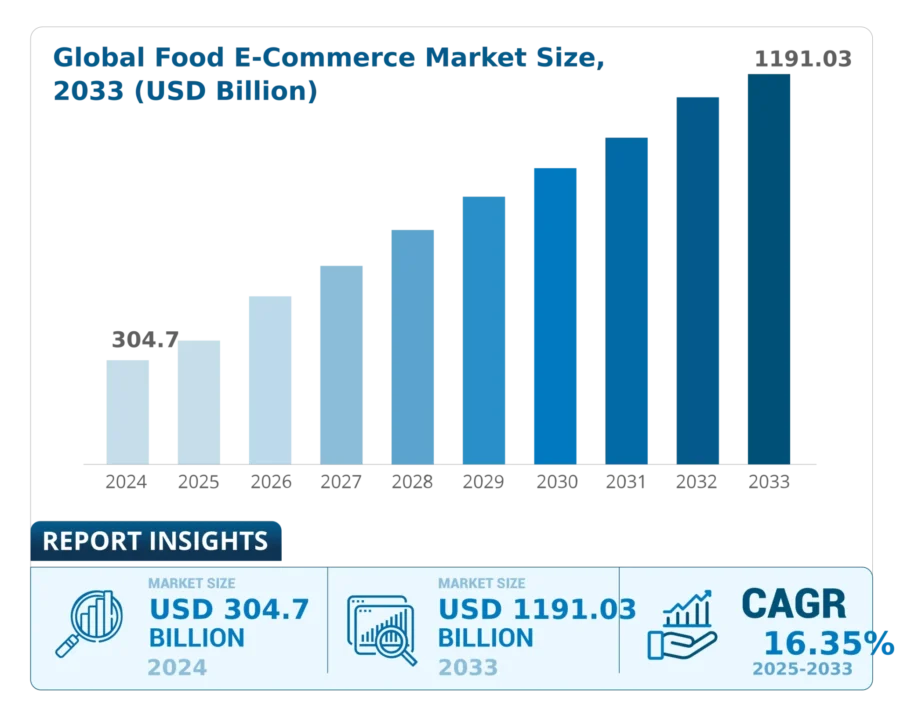

The global food e-commerce market was valued at approximately USD 304.7 billion in 2024 and is projected to reach USD 1 191.03 billion by 2033, growing at a CAGR of about 16.35% from 2025 to 2033.

Credit: Business Research Insights

FoodsUp offers a Restaurant Supply Platform

FoodsUp is a Canadian startup that offers fresh produce, meat and dairy, seafood, and food service supplies tailored to restaurant needs that are accessible through its user-friendly app.

By partnering directly with local farms and manufacturers, the startup offers prompt next-day delivery of high-quality products like broccoli, cucumbers, and tomatoes, as well as numerous beverage options.

Further, the app has features such as free next-day delivery, no minimum order requirements, and transparent pricing that improve the convenience and efficiency of the service.

Additionally, FoodsUp’s collaboration with VoPay has led to a 20% reduction in operational costs and a tenfold increase in transaction volume within a year.

Hortee builds a Digital Agro-Food Marketplace

Portuguese startup Hortee offers an e-commerce platform that connects local producers with consumers seeking fresh, regionally sourced products. Producers list their vegetables, fruits, legumes, and other goods on the marketplace which further makes them accessible to nearby buyers.

Consumers select desired items, choose a delivery method, home or work delivery, market pickup, or collection point, and receive their orders promptly. This direct-to-consumer system eliminates intermediaries and allows producers to sell at fair prices and receive quick payments.

Additionally, consumers enjoy fresh, traceable food and reduced ecological footprints. The startup also received an EUR 50 000 investment from EIT Food as part of the New European Bauhaus program.

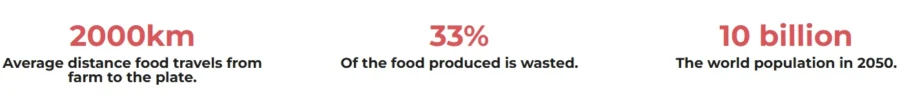

3. Plant-based Proteins & Ingredients

Precision fermentation, synthetic biology, and metabolic engineering are creating plant-based proteins using microbes to produce tailored proteins and enzymes. This enables scalable production of ingredients that improve taste, texture, and nutrition.

The global plant-based protein beverages market is projected to grow at a 9.6% CAGR, rising from USD 1372.1 million in 2025 to over USD 2689.3 million by 2035. This surge is shifting consumer preferences toward vegan, flexitarian, and health-conscious diets. The rising lactose intolerance cases and the demand for dairy-free alternatives are also key factors that are driving this growth.

Consumer awareness regarding health and wellness is also driving market growth. Plant-based proteins support weight loss and provide essential nutrients with fewer calories and fats compared to animal proteins

The food industry is exploring different plant proteins, including walnut, hazelnut, pecan, pistachio, buckwheat, and sunflower seed options, to meet consumer preferences. Moreover, veganism, flexitarian diets, and health-conscious behavior further increase the demand for plant-based proteins.

The plant protein market size is estimated at USD 18.16 billion in 2025 and is expected to reach USD 23.48 billion by 2030, growing at a CAGR of 5.27%.

Credit: Mordor Intelligence

Meanwhile, the European plant-based protein market alone is expected to reach USD 7.83 billion by 2032, with a CAGR of 8.9% from 2025 to 2032.

Devigere BioSolutions produces Cow Pea Pulse and Mung Beans Protein

Devigere BioSolutions is an Indian startup that offers plant-based protein concentrates, including cowpea protein concentrate, mung bean protein concentrate, plant-based egg mix, and plant-based peptides.

The startup utilizes a chemical-free, water-based extraction method to produce water-soluble proteins with balanced amino acid profiles. These proteins are non-GMO, soy-free, gluten-free, easily digestible, and cater to different dietary needs.

Each product serves specific applications like cow pea protein concentrate is rich in sulfur-containing amino acids. Mung bean protein concentrate provides a neutral flavor for versatile use. Additionally, plant-based egg mix acts as a sustainable egg substitute, and plant-based peptides function as collagen alternatives.

Moreover, Devigere BioSolutions secured an undisclosed amount of funding from Rainmatter Capital.

Edonia develops Microalgae-based Protein

Edonia is a French startup that develops a clean, nutrient-rich plant-based protein ingredient derived from microalgae.

Through its Edonization technology, the startup changes raw microalgae biomass into a versatile component suitable for plant-based products.

This ingredient provides a meat-like texture and a natural umami flavor without relying on additives or artificial flavorings. Additionally, the startup partners with European microalgae farmers to offer high-quality and sustainable sourcing.

Edonia also secured approximately USD 2.1 million in pre-seed funding led by Asterion Ventures, with participation from Bpifrance.

4. Food Safety & Security Management

Rising foodborne illness outbreaks, stringent regulations, and growing consumer demand for transparency are enabling companies to adopt real-time monitoring and food safety solutions.

The adoption of artificial intelligence and machine learning in food quality control has led to autonomous monitoring systems. Blockchain is also improving transparency and rapid data retrieval in food supply chains for compliance and safety verification.

About 26% of technology trends survey respondents say their companies plan to invest in advanced pathogen identification and detection technologies.

Additionally, nearly 60% of US food and beverage manufacturers use IoT and smart sensors for real-time tracking. This ensures product safety and quality through temperature and humidity monitoring.

The global food safety monitoring system market size accounted for USD 24.73 billion in 2024 and is anticipated to be worth around USD 53.94 billion by 2034, growing at a CAGR of 8.11% from 2024 to 2034.

Credit: Precedence Research

HyperSpectral utilizes AI-infused Spectroscopy

HyperSpectral is a US-based startup that deploys an AI-powered spectroscopy platform to detect pathogens and contaminants in food products. This platform analyzes the electromagnetic spectrum of materials through quick scans by identifying spectral patterns associated with harmful substances.

The AI-enabled platform also integrates different datasets like geographic location, environmental conditions, and personnel schedules to deliver deep insights into contamination sources and underlying causes.

Additionally, its hardware-agnostic design enables simultaneous testing for multiple contaminants at food processing. This delivers real-time results while allowing processors to address issues promptly. The platform facilitates the inspection of sealed food products before distribution while improving safety measures.

HyperSpectral also raised USD 8.5 million in Series A funding co-led by RRE Ventures and Kibo Ventures.

Celsi provides Real-time Monitoring Solutions

Celsi, an Australian startup, offers a smart temperature monitoring service that automates compliance with temperature logs and alerts.

Its system employs wireless Bluetooth sensors and a WiFi-enabled smart hub to provide real-time temperature data accessible via mobile devices, laptops, desktops, or tablets. This setup offers continuous monitoring of cold rooms and freezers and promptly alerts to any temperature fluctuations or system issues.

Celsi also supports hazard analysis and critical control points (HACCP) compliance for businesses to maintain food safety and reduce spoilage.

5. Automation of Food Processing

Robotic chefs are improving food processing by automating tasks like chopping, mixing, and cooking with precision and efficiency. These AI-powered machines reduce labor costs and improve food safety in commercial kitchens and manufacturing facilities.

This shift is due to labor shortages and the demand for consistent quality, along with consumer expectations for faster, cost-effective production in the food industry.

Additionally, robotic automation is also on the rise, with the global food robotics market projected to reach approximately USD 8.9 billion by 2033.

This surge is due to the increasing demand for packaged foods, rising food safety standards, and the need for efficient production lines.

For example, Chipotle introduced the Autocado – a robotic system that cuts, cores, and peels avocados in 26 seconds. This streamlines kitchen operations and reduces labor costs.

The food processing automation market size is estimated at USD 27.00 billion in 2025 and is expected to reach USD 38.58 billion by 2030, at a CAGR of 7.4%.

Credit: Mordor Intelligence

Further, Asia-Pacific is anticipated to experience the fastest growth in the food automation sector, with projections indicating an increase from USD 8.64 billion in 2023 to USD 15.51 billion by 2030, at a CAGR of 9.15%.

Faster Food Tech develops AI-driven Robotics and Process Automation

Faster Food Tech is a Polish startup that develops AI-driven robotics and process automation solutions for the food industry.

Its technology uses fully automated systems, from basic raw produce processing to food preparation machines through AI and machine learning to improve efficiency and precision. The startup’s offerings include custom-made, patent-protected machines and commission-based devices.

VCU Robotics specializes in Customized Robotization

VCU Robotics is a Dutch startup that develops customized automation and robotization solutions for the food processing industry.

Its pick-and-place systems utilize delta robots equipped with high-flow grippers to handle fresh and frozen food products with precision. The startup’s graders employ vision software and pneumatically controlled arms to detect and sort fish by species, length, or weight for sorting efficiency.

Additionally, VCU Robotics offers the conserve and cool system, which automates the preservation and cooling of langoustines on fishing vessels. Moreover, its hygienic depalletizers feature six-axis robots to handle products.

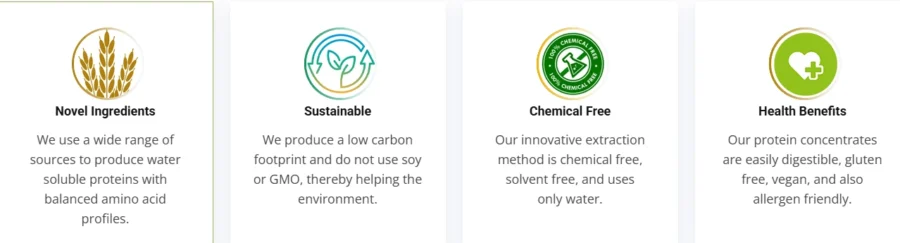

6. Food Waste Management

Approximately 40% of food and beverage companies are currently utilizing AI to reduce waste within their operations. Rising concerns over food security and regulatory pressure on waste reduction are improving AI adoption in food systems.

Additionally, at the consumer level, companies like Reencle Prime offer consumers the ability to compost food waste directly in their kitchens. Such solutions process food waste daily and convert it into usable compost within 24 hours.

In commercial settings, companies like Winnow and Phood Solutions use computer vision and AI to track food waste in commercial kitchens. Also, BioteCH4 uses anaerobic digestion technology to convert food waste into biogas and fertilizer.

AI-powered innovations are also improving smart food management systems. Samsung, for instance, has introduced its AI-powered food and recipe app, Samsung Food, with features to reduce food waste.

Further, researchers have developed a proprietary shelf life expiration date (SLED) tracking system, which uses machine learning algorithms to predict food spoilage based on sensory observations. This system allows consumers to reduce waste and prevent foodborne illnesses.

The global food waste management market size accounted for USD 81.40 billion in 2024 and is anticipated to reach around USD 152.80 billion by 2034, expanding at a CAGR of 6.50% between 2024 and 2034.

Credit: Precedence Research

Positive Carbon offers Precision Analytics

Irish startup Positive Carbon provides a solution that identifies and monitors food waste in real time. By installing overhead sensors in commercial kitchens, the system detects each discarded item to offer detailed analytics on waste patterns.

Food tech businesses receive detailed data, including cost correlations, environmental impact assessments, and trend analyses that are accessible across web and mobile platforms.

Additionally, the startup offers a learning platform featuring courses and zero-waste recipes to engage staff in waste reduction initiatives.

It secured USD 2.4 million in seed funding led by Business Venture Partners’ EIIS Fund, with participation from Heartfelt, Gateway Ventures, and Enterprise Ireland.

BillionCarbon Solutions delivers 3-day Precision Food Waste Treatment

BillionCarbon Solutions is an Indian startup that develops a rapid, low-cost, fully circular food waste treatment technology.

Its 3-day precision food waste treatment achieves biomass reduction in less than three days by employing IoT-enabled, micro-climate-controlled bioreactors that accelerate the decomposition process.

This further eliminates odors and diseases, reduces land usage, and minimizes electricity consumption. The process also concentrates nutrients from food waste into a micro-nutrient-rich liquid biofertilizer, under field trials that enable large-scale soil regeneration.

7. Gluten-free Food Products

The growth in gluten-free products is driven by health-conscious consumers, leading food businesses to adopt microencapsulation technology to improve shelf life. This technique protects sensitive ingredients with a protective coating, preserving freshness and reducing the need for artificial preservatives.

Meanwhile, food businesses are also employing thermoplastic extrusion to develop gluten-free products. This method processes whole grains without separating the bran, resulting in airy, crunchy snacks and diverse flour types.

Further, gene editing, particularly using clustered regularly interspaced short palindromic repeats (CRISPR) technology, has enabled scientists to produce wheat variants with significantly reduced gluten content. 3D food printing also allows for the creation of gluten-free products with personalized nutrition profiles.

Companies like Novameat are advancing plant-based meat alternatives that are free from soy, gluten, and added sugars. It raised USD 19.2 million to launch its new plant-based beef products.

The global gluten-free food market is projected to grow from USD 9.4 billion in 2025 to USD 13.57 billion in 2029 at a CAGR of 9.6%.

Credit: The Business Research Company

Bread Free manufactures Gluten-Free Flours

Bread Free is a Spanish startup that develops PURA, which is a gluten-free flour derived from wheat, barley, and rye that is suitable for celiac diets.

The startup’s technology removes gluten from these grains and allows individuals with gluten-related disorders to enjoy traditional baked goods without compromising taste or texture. This further maintains the nutritional value and familiar characteristics of conventional flours, while expanding gluten-free options beyond typical alternatives.

The startup received an EUR 20 000 grant from the Consorcio EDER and is co-financed by the European Union’s Rural Development Fund (FEADER) and the Government of Navarra.

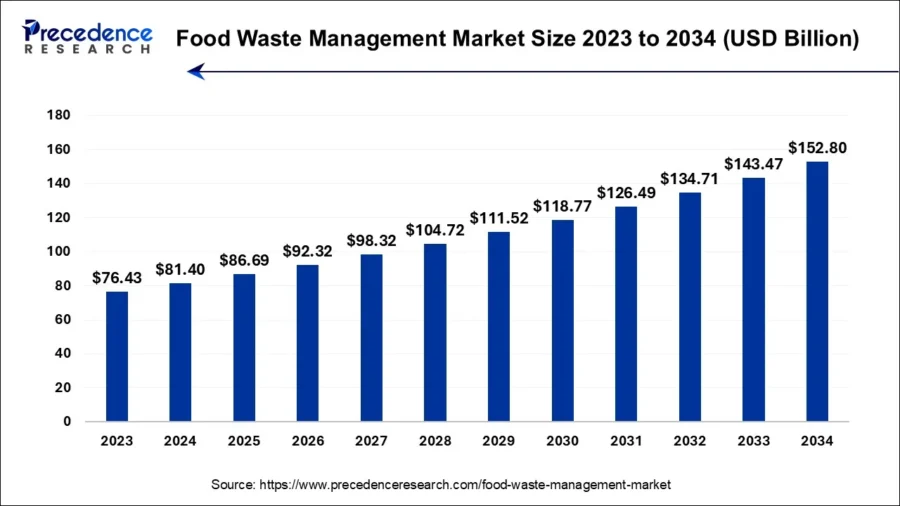

Farmhood utilizes Freeze-drying Technology

Farmhood is a Turkish startup that produces gluten-free, freeze-dried fruit and vegetable products. The startup employs freeze-drying technology that removes water from fresh produce through low-pressure, low-temperature sublimation.

This technology also preserves nutritional value, structure, and flavor. The method extends shelf life without additives or preservatives while it also offers convenient, healthy snack options.

8. Sustainable Food Packaging

The key drivers of sustainable food packaging are increasing awareness of plastic pollution, stringent regulations on single-use plastics, and rising demand for eco-friendly alternatives among consumers. As a result, the food industry is innovating with algae-based and mushroom-derived packaging.

Amcor PLC is acquiring Berry Global Group for USD 8.4 billion in stock to expand its U.S. presence and advance sustainable packaging innovation.

The sustainable food service packaging market size is estimated at USD 65.73 billion in 2025 and is expected to reach USD 88.46 billion by 2030, at a CAGR of 6.12%.

Credit: Mordor Intelligence

Additionally, the edible packaging market is projected to reach USD 1.4 billion by 2030, growing at a CAGR of 5.6%.

Friendlier provides Reusable Containers and Centralized Reuse Systems

Friendlier is a Canadian startup that offers reusable food and beverage containers to replace single-use packaging. Its product line includes locally made containers, such as frosted cold cups with lids, coffee cups, clear containers, and more.

Each container endures up to 100 uses and undergoes recycling at the end of its lifespan. By providing these sustainable alternatives, the startup makes waste reduction easy for consumers while promoting environmental responsibility in everyday dining experiences.

The startup also raised USD 5 million in a seed extension funding round led by Relay Ventures and Garage Capital.

Anchor Packaging produces Eco-friendly Packaging Solutions

Anchor Packaging is an Australian startup that provides eco-friendly food packaging solutions to the hospitality and food service sectors.

Its product range includes bamboo and pulp containers, paper boxes and trays, paper bowls, cold food containers, coffee cups, and more, all designed to minimize environmental impact.

Additionally, the startup employs a three-step approach which includes acknowledging ecological impact, offering eco-training resources, and delivering curated product solutions.

Moreover, Anchor Packaging joined the Cyclyx Consortium to improve the recovery and recyclability of food-grade plastics.

9. Personalized Food

Consumer demand for health and wellness, advancements in genetic testing, biomarker analysis, and wearable devices facilitate the creation of personalized dietary recommendations.

Additionally, 3D food printing customizes meals to individual needs while enabling sustainability with alternative ingredients like plant-based proteins and insect flours.

The UK’s Food Standards Agency (FSA) highlights that 3D food printing customizes shape, color, flavor, texture, and nutritional content to meet specific individual needs.

Moreover, the global personalized nutrition market size accounted for USD 15.56 billion in 2024 and is anticipated to reach around USD 60.94 billion by 2034, growing at a CAGR of 14.63% from 2025 to 2034.

Credit: Precedence Research

Eat Beat offers Food Recommendations & Healthy Meal Planning AI App

Estonian startup Eat Beat offers an AI-powered meal planning and nutrition tracking application that personalizes meal recommendations based on dietary preferences and health goals.

The app utilizes artificial intelligence to analyze individual habits and nutritional needs. It also provides tailored meal suggestions aligned with the Nordic diet principles.

Additionally, the app has features like automatic recognition of micro- and macronutrients from food images and a go-to restaurant function that offers Nordic diet-friendly dining options.

Mefood Omics provides a Personalized Meal-planning platform

Mefood Omics is a Spanish startup that offers Oorenji, a platform designed to improve personalized nutrition for healthcare professionals.

The platform enables nutritionists, personal trainers, and physicians to create customized meal plans by analyzing clients’ physical data, dietary preferences, and health objectives.

Oorenji‘s extensive database includes healthy recipes that accommodate dietary approaches like Mediterranean, paleo, vegetarian, vegan, and keto.

Moreover, the platform offers artificial intelligence and, optionally, DNA analysis to refine dietary recommendations based on genetic insights. This integration allows for continuous monitoring and adjustment of clients’ progress and encourages effective collaboration between professionals and clients.

10. Meat Substitutes

Vegetarianism and veganism, are the two major factors that are driving the food industry. Additionally, the shift towards flexitarian, vegetarian, or vegan diets is also driving the food market expansion.

Lab-grown or cultured meat and fermentation-based alternatives are the innovations that are growing in the food industry. Precision fermentation also produces specific proteins and enzymes that increase the quality and nutritional value of meat substitutes.

The global meat substitute market is projected to grow from USD 8.09 billion in 2025 to USD 12.64 billion in 2029, reflecting a CAGR of 11.8%.

Credit: The Business Research Company

Moreover, the Indian meat substitutes market is expected to reach approximately USD 407.86 million in 2025.

Millow.co specializes in Mycelium-based Food Production

Millow.co is a Swedish startup that develops mycelium-based meat substitutes that integrate with plant-based substrates.

Its fermentation process combines mycelium and plants, improves nutritional profiles, and creates products that are easily digestible. This method yields meat alternatives free from artificial additives, GMOs, and binders while providing high protein and fiber content.

The startup’s offerings are versatile, suitable for barbecuing, frying, baking, or roasting, and feature a neutral taste that adapts to various flavors. Moreover, the startup emphasizes sustainability, utilizes minimal water and energy, and produces fewer emissions.

Chunk utilizes Fermentation Technology

Chunk is a US-based startup that develops plant-based meat alternatives using a fermentation process.

It combines soy and wheat proteins with natural ingredients like beets and coconut oil. This method yields products that replicate the taste, texture, and appearance of traditional meat without artificial additives, gums, stabilizers, or preservatives.

The startup’s offerings, including the chunk steak, steakhouse cut, and pulled varieties, are versatile and suitable for cooking methods such as pan-searing, grilling, smoking, braising, and baking. Moreover, each serving provides high protein content, fortified iron, and vitamin B12 that caters to health-conscious consumers.

Chunk raised an additional USD 7.5 million in seed funding, led by Cheyenne Ventures.

Discover all Food Technology Trends, Technologies & Startups

Food technology is rapidly advancing, with precision fermentation creating sustainable alternative proteins and 3D food printing improving customization.

Cultured meat development offers ethical solutions for meat consumption, while plant-based proteins gain popularity as health-conscious alternatives. Additionally, automation in food processing increases efficiency, and sustainable packaging solutions reduce environmental footprints.

The Food Technology Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.

![Food and Beverage Industry: Top 10 Technology Trends [2025 & Beyond]](https://www.startus-insights.com/wp-content/uploads/2024/11/Food-and-Beverage-Industry-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)