Emerging technologies like artificial intelligence (AI), quantum computing, and blockchain in finance processes address challenges such as high operational costs, regulatory pressures, and cybersecurity threats while elevating the future of finance. AI improves fraud detection and provides real-time customer insights for better decision-making. Startups are leading the charge in developing tech-driven solutions to redefine the future of finance.

For instance, Basepilot automates back-office operations in insurance and financial services. Meanwhile, quantum computing-led startup yiyaniQ optimizes portfolios through advanced algorithms. Blockchain secures financial transactions, while big data and analytics enhance risk management and forecasting. As these innovations reshape the financial landscape, financial institutions and stakeholders must integrate tech-driven solutions to manage costs, comply with regulations, and mitigate risks to ensure sustainable growth and competitive advantage.

Why should you read this report?

- Gain insights into the top 10 technologies shaping the future of finance.

- Explore three practical use cases for each technology.

- Discover 10 innovative startups driving these financial innovations.

Key Takeaways

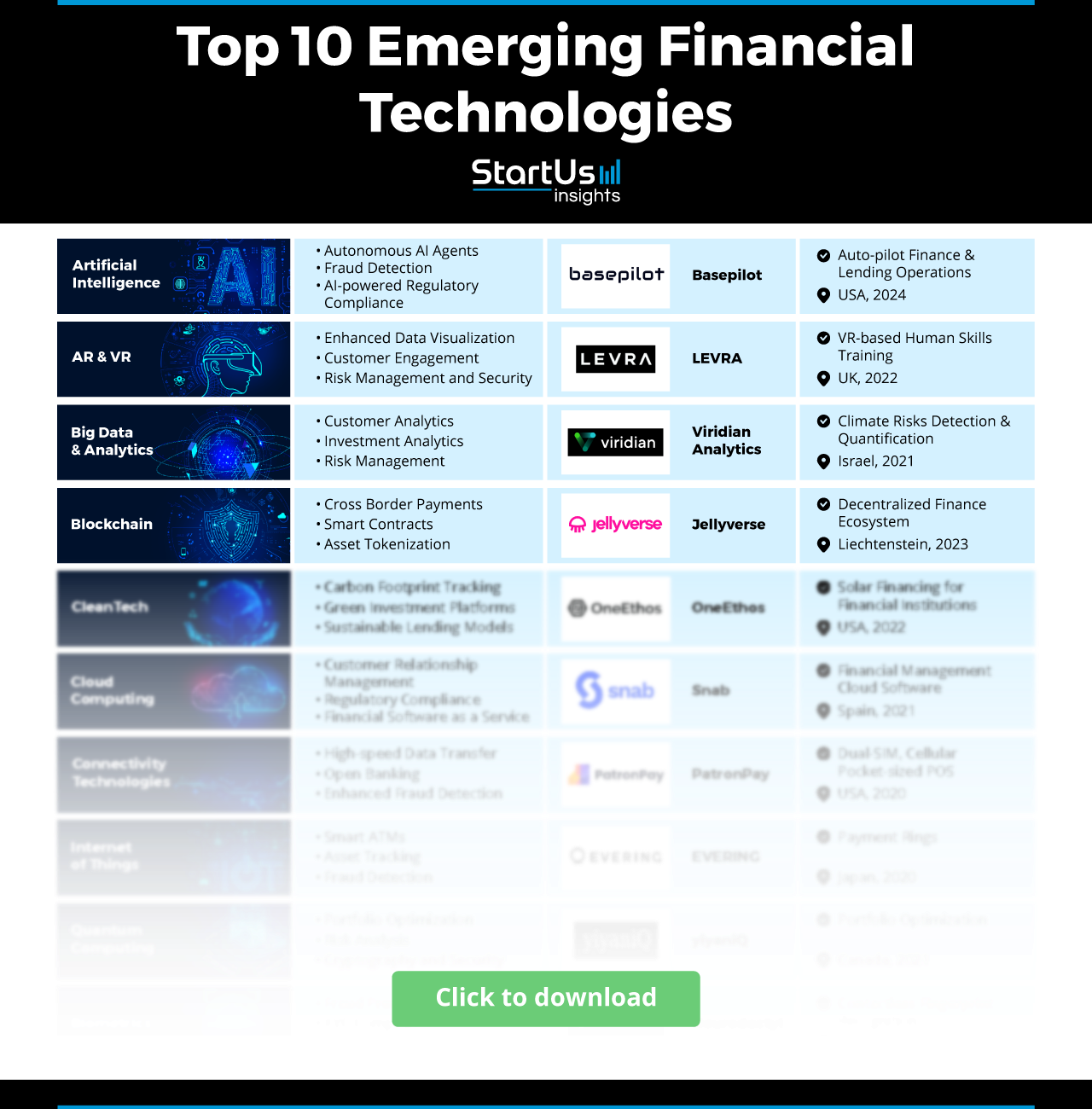

- Artificial Intelligence (AI)

- Use Cases:

- Autonomous AI Agents

- Fraud Detection

- AI-powered Regulatory Compliance

- Startup to Watch: Basepilot

- Use Cases:

- Augmented Reality (AR) & Virtual Reality (VR)

- Use Cases:

- Enhanced Data Visualization

- Customer Engagement

- Risk Management and Security

- Startup to Watch: LEVRA

- Use Cases:

- Big Data & Analytics

- Use Cases:

- Customer Analytics

- Investment Analytics

- Risk Management

- Startup to Watch: Viridian Analytics

- Use Cases:

- Blockchain

- Use Cases:

- Cross Border Payments

- Smart Contracts

- Asset Tokenization

- Startup to Watch: Jellyverse

- Use Cases:

- CleanTech

- Use Cases:

- Carbon Trading

- Green Building Certifications

- Sustainable Offices

- Startup to Watch: Cosysense

- Use Cases:

- Cloud Computing

- Use Cases:

- Customer Relationship Management

- Regulatory Compliance

- Financial Software as a Service

- Startup to Watch: Snab

- Use Cases:

- Connectivity Technologies

- Use Cases:

- High-Speed Data Transfer

- Open Banking

- Enhanced Fraud Detection

- Startup to Watch: PatronPay

- Use Cases:

- Internet of Things (IoT)

- Use Cases:

- Smart ATMs

- Asset Tracking

- Fraud Detection

- Startup to Watch: Evering

- Use Cases:

- Quantum Computing

- Use Cases:

- Portfolio Optimization

- Risk Analysis

- Cryptography and Security

- Startup to Watch: YiyaniQ

- Use Cases:

- Biometrics

- Use Cases:

- Fraud Prevention

- KYC Compliance

- Mobile Payments

- Startup to Watch: Neurodactyl

- Use Cases:

- Artificial Intelligence (AI)

Finance Industry FAQs

How big is the fintech industry?

The global fintech industry is projected to be worth USD 209.7 billion in 2024 and is expected to grow to USD 644.6 billion by 2029, with a compound annual growth rate (CAGR) of approximately 25.18% during the forecast period. The advancements in technologies such as blockchain, AI, and data analytics fuel this growth.

What is financial technology?

Fintech, or financial technology, uses technology to improve and automate financial services. This includes innovations like mobile banking, digital payments, cryptocurrency, and robo-advisors, which provide customers with faster, more accessible, and often cheaper financial services.

How has technology changed the finance industry?

Technology has transformed the finance industry by enhancing operational efficiency and customer experience. Digital payments, mobile banking, and AI-driven customer support have changed traditional banking. Further, blockchain technology has introduced secure, decentralized transactions, while data analytics enables fraud detection and personalized financial services.

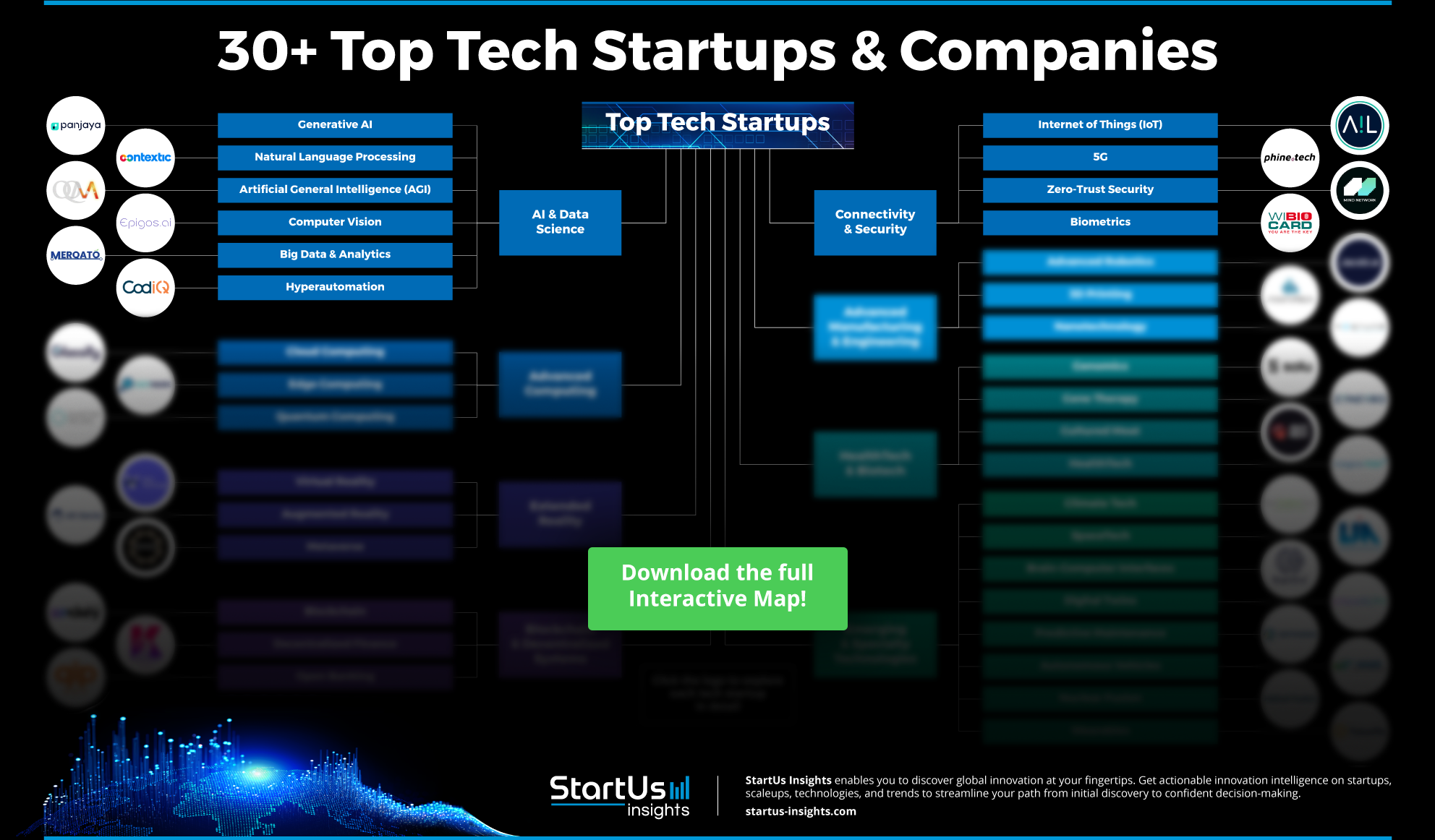

Where We Get Our Data From

StartUs Insights gathers data through its exhaustive Discovery Platform, covering information on 4.7 million startups, scaleups, and tech companies globally, alongside 20,000 emerging technologies and trends. The Discovery Platform accelerates startup and technology scouting, trend intelligence, and patent searches, offering thorough insights into technological advancements. By leveraging the trend intelligence feature for this report, we identified emerging technologies within specific industries. This process allows us to uncover patterns and trends, and pinpoint relevant use cases and the startups creating solutions for each scenario. Additional capabilities and information can be found at StartUs Insights Discovery Platform.

10 Emerging Technologies Impacting the Future of Finance [2025 & Beyond]

1. Artificial Intelligence

Machine learning (ML) analyzes large datasets to aid financial institutions make data-driven decisions quickly and accurately. Deep learning (DL), a subset of ML, uses neural networks to process financial data to enhance credit scoring, algorithmic trading, and anti-money laundering efforts. Natural language processing (NLP) interprets human language for analyzing earnings reports, monitoring regulatory updates, and detecting market sentiment from news. Further, generative AI automates the creation of financial insights and reports with predictive analytics allowing institutions to anticipate market trends and risks.

3 Practical Use Cases of Artificial Intelligence in Finance

- Autonomous AI Agents: Automates repetitive and manual operations saving time and money for finance institutions. They interpret client’s financial data, provide personalized advice and assist with investment decisions.

- Fraud detection and prevention: AI enhances fraud detection by analyzing transaction patterns and identifying anomalies that could indicate fraudulent activity. Machine learning algorithms continuously learn from new data that allows them to detect fraud schemes in real-time.

- AI-Powered Regulatory Compliance: Banks utilize AI to streamline compliance processes and manage regulatory requirements. The bank’s AI systems analyze vast amounts of regulatory data to ensure adherence to compliance standards, identify potential breaches, and automate reporting tasks.

Startup to Watch: Basepilot

US-based startup Basepilot develops AI assistants that automate financial services, insurance operations, and back-office work. The company’s AI platform builds co-pilot without running code that enables users to take actions and scale them. The AI assistant performs operations such as loan origination & processing, compliance, KYC & KYB, trading order management, and applications & document processing. This cuts costs and improves efficiency for all the resource-intensive financial and insurance services such as filling out forms and entering information into a CRM within a few clicks.

2. Augmented Reality & Virtual Reality

AR overlays digital elements in the real world to improve tasks like data visualization by transforming complex financial information into intuitive 3D representations. VR tools let investors view their portfolio as a virtual city to make financial analysis more accessible. VR supports virtual trading, immersing users in 3D environments for dynamic and informed decision-making. Integrating biometric security, such as facial and voice recognition in AR, enhances security for transactions and identity verification.

3 Practical Use Cases of AR & VR in Finance

- Enhanced Data Visualization: VR provides immersive data visualization experiences that allow users to interact with financial data in three dimensions, which helps in understanding complex datasets and trends.

- Customer Engagement: AR provides interactive elements in mobile banking apps, such as visualizing investment portfolios or showing financial data overlays on real-world objects for informed decision-making.

- Risk Management and Security: VR simulates risk scenarios and stress tests for financial institutions and professionals to prepare for potential challenges and develop better risk management strategies. AR implements multi-factor authentication or other security measures, adding layers of protection for financial transactions and account access.

Startup to Watch: LEVRA

UK-based startup LEVRA develops a human skills assessment platform to upskill young professionals of financial institutions through their immersive learning programs. The company addresses the essential problem of equipping young adults with essential human skills as they transition from school/university into the workforce. The immersive VR role-play scenarios allow professionals to practice their learning in a simulated environment that offers hands-on learning, which is also evaluated.

3. Big Data & Analytics

Technologies like Hadoop, Spark, and NoSQL databases handle the scale, velocity, and variety of financial data and offer real-time insights beyond traditional systems. Predictive analytics and machine learning algorithms improve decision-making, fraud detection, and customer insights to enhance operational efficiency and personalization. These tools are used for credit risk assessment, fraud prevention, and market analysis that aid financial institutions in making informed decisions.

3 Practical Use Cases of Big Data & Analytics in Finance

- Customer Analytics: Financial organizations use big data to understand customer behavior and preferences. By segmenting customers based on spending habits and demographics, banks tailor marketing strategies and improve engagement.

- Investment Analytics: Big data and analytics offer real-time insights into market trends and stock performance. Financial institutions use advanced analytics to inform trading strategies and investment decisions, enabling agile responses to market changes.

- Risk Management: Big data analytics assists financial institutions in managing various risks, including credit risk and market risk. By analyzing historical data and market trends, banks assess potential risks associated with investments or loans.

Startup to Watch: Viridian Analytics

Israeli startup Viridian Analytics develops a big data climate and sustainability risk assessment solution for investors and asset managers. It highlights sustainability risks using the climate data present in their portfolio and addresses the need for correct pricing. The big-data platform consolidates data from multiple sources, cross-references it with internal data, and isolates the relevant insights. Viridian Analytics enables investors and financial stakeholders to assess risk management, and sustainability data management and delivers a complete risk profile of their assets.

4. Blockchain

Distributed ledger technology (DLT), such as blockchain, makes financial transactions immutable and transparent. This enables real-time auditing and reduces the need for intermediaries. Smart contracts automate payments, loan agreements, insurance claims, securities trading, and supply chain financing to improve efficiency and reduce manual intervention. This also enhances compliance and reduces operational costs. Blockchain also secures and transparently facilitates asset tokenization. Further, technologies like Ethereum and Hyperledger support these advancements.

3 Practical Use Cases of Blockchain in Finance

- Cross-Border Payments: Blockchain platforms allow banks to process international payments in real-time. This reduces transaction times and fees by eliminating intermediaries.

- Smart Contracts: Ethereum automates financial agreements, such as loans and derivatives. It ensures terms are executed without intermediaries to reduce costs and enhance trust.

- Asset Tokenization: Blockchain enables the tokenization of real-world assets like real estate, stocks, or commodities to allow fractional ownership and easier trading of these assets on digital platforms.

Startup to Watch: Jellyverse

Based out of Liechtenstein, Jellyverse is a startup that develops a decentralized finance platform through blockchain technology. It accelerates the development of various decentralized applications that foster the progress of real-world asset tokenization and meet the realization of DeFi 3.0. The company’s platform offers digital and tangible assets and provides a user-friendly experience for asset management. Its product JLY acts as the utility token that fosters governance operations based on reward systems. Another product JellySwap allows flexible trading options using optimized algorithms for stablecoin trading while JellyStake combines a rewards system based on inflation and a share of transaction fees from Jellyverse.

5. CleanTech

Carbon emissions tracking systems, integrated into finance platforms, allow institutions to measure and disclose the environmental footprint of their investments. Sustainable finance products, such as green bonds, direct capital towards renewable energy and eco-friendly infrastructure projects. Carbon accounting tools streamline reporting and ensure compliance with sustainability regulations. Moreover, cleantech supports renewable energy financing by providing structured financial products for clean energy projects like wind and solar power.

3 Practical Use Cases of CleanTech in Finance

- Carbon Footprint Tracking: Fintech companies integrate AI-powered solutions that track and analyze users’ carbon emissions based on their spending patterns, offering personalized insights to promote eco-friendly lifestyle choices.

- Green Investment Platforms: They enable users to invest in renewable energy projects, sustainability-focused startups, and green bonds, facilitating access to environmentally responsible investment options.

- Sustainable Lending Models: Tools for climate-risk assessments enable lenders to offer preferential interest rates to businesses and individuals engaged in sustainable practices, like energy-efficient infrastructure or circular economy models.

Startup to Watch: OneEthos

US-based startup OneEthos offers a solar financing technology for installers and financial institutions. Its platform facilitates easy loan processing and decision-making through a point-of-sale application for solar installers that includes features like a loan calculator and a pay-off scenario tool. The platform supports ethical financing with expedited solar loan decisions, full financing options, and integration with project management and CRM systems through APIs. Financial institutions benefit from this technology by expanding their solar loan portfolios, diversifying loan types, and fulfilling corporate social responsibility goals while ensuring compliance with reporting requirements.

6. Cloud Computing

Technologies like serverless computing enable financial institutions to deploy applications quickly and scale them based on demand to reduce infrastructure management and costs. Edge computing brings data processing closer to the source for minimizing latency and improving real-time decision-making. The multi-cloud approach allows institutions to avoid vendor lock-in while optimizing performance and security across platforms. Further, enhanced encryption techniques, such as homomorphic encryption and confidential computing, increase data security and regulatory compliance to ensure the secure handling of sensitive financial data within cloud environments.

3 Practical Use Cases of Cloud Computing in Finance

- Customer Relationship Management (CRM): Financial firms use cloud-based CRM systems to manage client interactions, track customer data, and enhance service delivery. These systems offer integrated solutions for marketing, sales, and customer support.

- Regulatory Compliance: Cloud computing supports compliance by providing tools for automated reporting and data management. Financial institutions use cloud solutions to generate and submit regulatory reports, track compliance with evolving regulations, and ensure data security and integrity.

- Financial Software as a Service (SaaS): Provides financial institutions with access to a range of financial tools and services, such as accounting, financial planning, and analytics software. These applications are accessible from anywhere, offering flexibility and reducing the need for in-house software management.

Startup to Watch: Snab

Spanish startup Snab automates financial processes for small to mid-sized businesses through a cloud-based platform that integrates AI. Its platform digitizes and simplifies B2B payments, cash management, and treasury operations allowing businesses to manage all financial activities from a single interface. It integrates multiple bank accounts, synchronizes with accounting systems, and automates tasks such as invoicing and payments. Snab’s real-time cash flow visualization and customizable workflows enable businesses to maintain better financial control.

7. Connectivity Technologies

Connectivity technology supports high-speed and reliable data transmission in financial systems. Technologies like 5G provide fast, low-latency communication for real-time financial transactions. Ethernet ensures stable, secure wired connections, often used in data centers for high-bandwidth applications. LoRaWAN offers low-power, long-range connectivity, useful for IoT-enabled financial services. Further, Wi-Fi allows flexible, wireless network access in banking environments to enable seamless communication across devices.

3 Practical Use Cases of Connectivity Technologies in Finance

- High-speed Data Transfer: Facilitates rapid transmission of financial data and market information, essential for high-frequency trading where millisecond delays impact outcomes.

- Open Banking: APIs allow fintech companies to access banking data and services with customer consent, creating new financial products like budgeting apps or loan aggregation services, and integrating various financial services into a single platform.

- Enhanced Fraud Detection: Secure communication protocols protect transaction data, while AI and machine learning algorithms analyze transaction patterns to detect anomalies and potential fraud.

Startup to Watch: PatronPay

US-based startup PatronPay offers a pocket-sized point-of-sale (POS) device that processes payments even in areas without cellular connectivity. The company’s device combines payment processing, a cellular plan, a customer portal, customizable transaction amounts, and comprehensive reporting. The device supports quick-pay options, customizable transaction amounts, and multi-user tracking, which makes it adaptable for mobile use or fixed installations.

8. Internet of Things

IoT technologies like connected sensors, smart ATMs, and wearable payment devices provide financial institutions with continuous data on asset performance, customer behavior, and market conditions. This data drives operational efficiency, enhances risk management, and improves customer engagement. IoT-powered security solutions, such as biometric authentication and real-time surveillance, strengthen financial systems’ defense against fraud and cyber threats.

3 Practical Use Cases of the Internet of Things in Finance

- Smart ATMs: IoT-enabled ATMs monitor real-time performance and health to predict maintenance needs before malfunctions occur. This reduces downtime and ensures ATMs are operational and stocked with cash.

- Asset Tracking: Financial institutions use IoT to track physical assets, such as valuable documents and secure storage units. Sensors and GPS technology provide real-time location data, preventing loss and theft.

- Fraud Detection: IoT devices integrated with payment systems enhance fraud detection by analyzing transaction patterns and detecting anomalies. For example, IoT sensors in smart cards verify transactions through biometric data and add an extra layer of security.

Startup to Watch: Evering

Japanese startup Evering provides a contactless payment solution embedded in a wearable ring that enables transactions in a second without digital wallets or smartphones. The ring employs NFC technology to communicate with payment terminals to ensure secure and fast transactions. It features a maintenance-free design that never requires charging, is waterproof, and functions across millions of locations. The company’s solution simplifies the payment experience and offers a hands-free approach to daily transactions.

9. Quantum Computing

Quantum annealers and quantum machine learning systems improve optimization processes that enable financial institutions to analyze large datasets quickly and accurately. Also, quantum cryptography, including post-quantum cryptography (PQC) and quantum key distribution (QKD), enhances cybersecurity to protect financial transactions and sensitive data from future quantum attacks. As quantum processors evolve, financial institutions use these advancements for tasks like portfolio optimization, risk modeling, and real-time decision-making.

3 Practical Use Cases of Quantum Computing in Finance

- Portfolio Optimization: Traditional portfolio optimization involves analyzing multiple asset combinations to identify the best allocation. Quantum bits (qubits) evaluate them faster, identifying optimal portfolios and informed decision-making.

- Risk Analysis: By analyzing customer profiles and transaction histories in the form of large datasets, quantum computing enables precise risk assessment and credit scoring models.

- Cryptography and Security: Fintech companies utilize quantum-safe digital signatures that improve the authenticity of transactions. Quantum computing protects the financial data by developing quantum resistant algorithms like multivariate polynomial cryptography.

Startup to Watch: yiyaniQ

Canadian startup yiyaniQ develops quantum-inspired algorithms for the financial industry. These algorithms combine artificial neural networks with quantum-inspired techniques to create tools for solving complex optimization problems, such as portfolio optimization and pricing complex derivatives. The technology leverages simulated quantum dynamics to tackle challenges that arise when balancing risks across various financial assets. yiyaniq’s quantum intelligent optimizer provides near-optimal solutions while accommodating real-world constraints.

10. Biometrics

Key biometric technologies include fingerprint recognition, facial recognition, voice authentication, and iris scanning. These methods verify identity by analyzing unique biological traits. They are integrated into mobile banking apps, ATMs, and payment systems to provide secure authentication. Behavioral biometrics also analyze user behavior patterns like typing or voice dynamics for enhancing fraud detection and regulatory compliance.

3 Practical Use Cases of Biometrics in Finance

- Fraud prevention: High-value transactions or changes to account settings are enabled by biometric authentication. Users need to provide a fingerprint or facial scan to confirm a wire transfer or update contact information and prevent unauthorized transactions and fraud.

- KYC Compliance: Identity verification during account onboarding ensures that they meet KYC compliance standards. Customers submit biometric data, such as a selfie with a government-issued ID, to verify their identity and comply with regulatory requirements.

- Mobile Payments: Biometric authentication verifies mobile payments and transactions from digital wallets. Users approve payments using their fingerprints or facial recognition, offering a secure alternative to entering passwords or PINs.

Startup to Watch: Neurodactyl

Georgian startup Neurodactyl develops biometric technologies for contactless fingerprint capture and recognition on mobile devices without the need for physical scanners. It employs deep learning and neural network algorithms to enable high-accuracy fingerprint detection by simply holding a finger in front of a mobile camera and capturing multiple fingerprints simultaneously. It secures financial data through reliable biometric authentication and ensures high recognition accuracy and good matching speed which process both scanned images and photos.

Outlook for the Finance Industry

Patents & Grants

The fintech industry showcases an innovative landscape with over 33700 patents and 2200+ grants. This high number of intellectual property filings reflects the sector’s drive for technological advancement, fueling progress across financial services and solutions.

For more actionable insights, download our free Fintech Innovation Report.

Investment Landscape

Top investors like Y Combinator, Techstars, Google for Startups, Antler, and Tenity actively fund fintech innovations. Key funding types include seed, early stage VC/series A, pre seed, accelerator/incubator, and angel investments. Also, the average funding per round is USD 9.3 million. These investment trends indicate a strong focus on early-stage growth.

Global Footprint

Major fintech hubs include the US, UK, India, Canada, and Australia, with top cities like London, New York City, San Francisco, Mumbai, and Sydney. The industry’s international presence highlights its broad influence and adoption across diverse financial ecosystems.

Don’t Miss Out on the Latest Innovations in Fintech

Ready to access the latest fintech insights shaping the future? With StartUs Insights, you gain quick and easy access to over 4.7 million startups, scaleups, and tech companies, along with 20000 emerging technologies and trends. Our AI-powered search and real-time database provide exclusive solutions that set you apart from the competition.

Industry giants like Samsung, Nestlé, and Magna trust our innovation intelligence tools to lead trends, optimize operations, and uncover new market opportunities. Dóra Avar, Innovation Consultant at OTP Group says “StartUs Insights enables us to discover new partners for PoCs, scale our outreach, and further strengthens OTP’s position as a leading innovation player globally.”

Like them, benefit from our unmatched data, comprehensive industry views, and reliable insights to drive strategic decision-making. Get in touch to learn how our tailored discovery options can accelerate your innovation journey.

Discover All FinTech Innovations & Startups!