The future of mobility is rapidly evolving through digital transformation. Emerging technologies enhance efficiency, safety, and sustainability. As a result, the global digital transformation market is projected to grow significantly with an estimated CAGR of 27.6% from 2024 to 2030.

In this guide, you will explore the top 10 digital technologies revolutionizing mobility operations. You will also discover strategies for organizations to effectively implement these innovations, real-world examples, enabling technologies, and more!

Key Takeaways

- The Time to Act is Now: Embrace AI-driven personalization, enhance efficiency through automation, expand accessibility via mobility-as-a-service (MaaS), and more to stay competitive.

- Top 10 Mobility Digitization Technologies to Watch

- Key Benefits: Digitizing mobility operations leads to increased efficiency, cost reductions, improved coordination, and enhanced traveler experiences.

- Roadmap for Successful Digitization: A clear strategy involves technology scouting, data integration, workforce training, and continuous innovation.

- Future Trends: Anticipate advancements like level 5 autonomy in autonomous vehicles, expanded MaaS ecosystems, and hydrogen fuel cells for alternative energy.

How do we research and where is this data from?

We reviewed over 3100 industry innovation reports to extract key insights and create the comprehensive Mobility Digital Transformation Guide you can download above. To increase accuracy, we cross-validated this information with external industry sources.

Additionally, we leveraged the StartUs Insights Discovery Platform – an AI and Big Data-powered innovation intelligence tool covering over 5 million startups and more than 20K+ technologies & trends worldwide to:

- Confirm our findings using the Trend Intelligence feature

- Gather market statistics for each technology

- Identify startups for the “Spotlighting an Innovator” sections

Mobility Digitalization – Why the Time to Act is Now

Technological Maturity

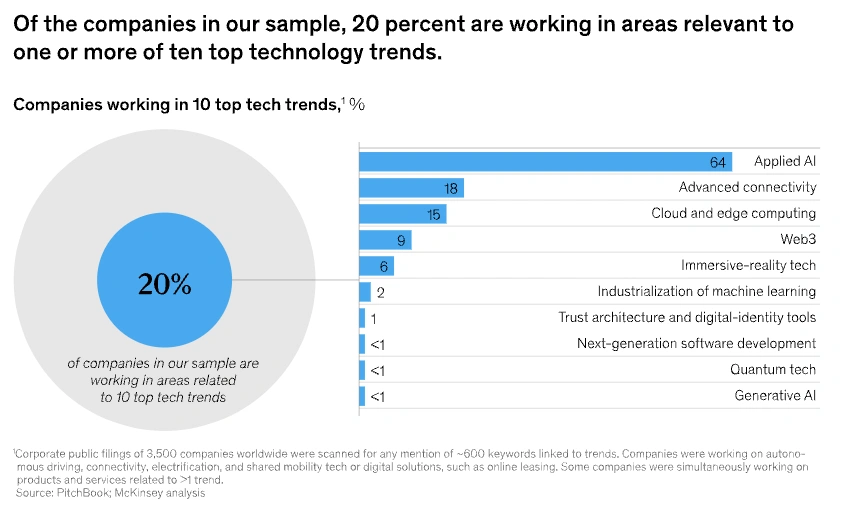

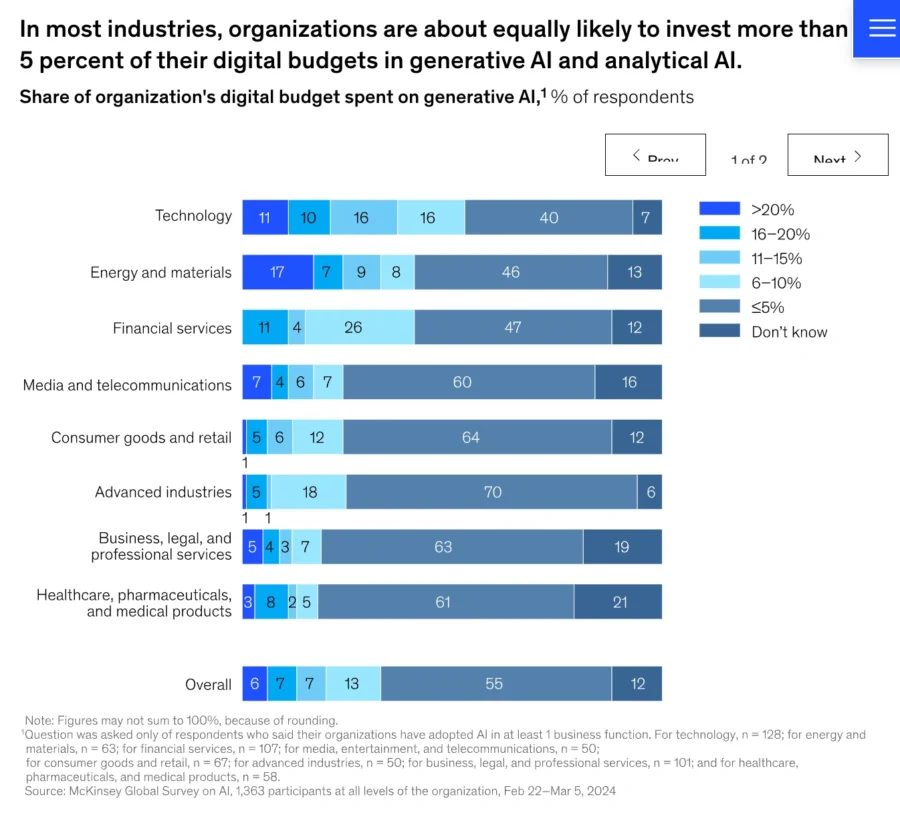

The maturation of AI, advanced connectivity, and electrification is compelling the mobility industry to undergo digital transformation. For instance, 64% of mobility companies are currently investing in AI-enabled solutions.

Source: McKinsey and Company

The shift is evident in the rise of mobility-as-a-service platforms and subscription-based vehicle models.

Moreover, the adoption of 5G and edge computing is accelerating real-time analytics and over-the-air (OTA) updates with 75% of enterprise-grade data expected to be processed at the edge by 2025.

Meanwhile, advances in lithium-ion batteries have increased energy density by 8% annually since 2020. This extends EV ranges beyond 400+ miles. At the same time, AI-driven charging and smart grid integration are reducing costs for fleet operators.

Increased Efficiency and Optimization

Digital transformation in the mobility industry enables real-time data analytics, AI-driven route optimization, and predictive maintenance to streamline operations.

Companies using AI for predictive maintenance have cut repair costs by 20% and reduced unplanned downtime by 50%. This has increased the overall reliability of the fleets.

The increasing road-based logistics market signifies the increasing competitiveness of the industry with the global road-based logistics market expected to grow to USD 952.61 billion in 2029. Meanwhile, 67% of logistics firms have already implemented a digital transformation strategy to improve performance and profitability.

Enhanced Safety and Risk Management

Digital transformation is increasing safety levels by leveraging IoT-enabled sensors, AI-driven analytics, and advanced driver assistance systems ADAS. For example, automatic emergency braking (AEB) reduces front-to-rear crash rates by 43% and front-to-rear injury by 45%.

Also, digitization supports the EU’s Sustainable and Smart Mobility Strategy – which targets a 90% reduction in transport-related greenhouse gas emissions by 2050.

Elevated Customer Experience (CX)

Digitization in the mobility industry optimizes operations in real time and improves customer experience. For example, Uber’s ML algorithms reduced average wait times for riders by up to 30% across cities.

Moreover, implementing advanced feedback analysis systems that use natural language processing (NLP) resulted in a 15% increase in overall customer satisfaction ratings within six months.

Top 10 Mobility Digitization Technologies to Watch in 2025

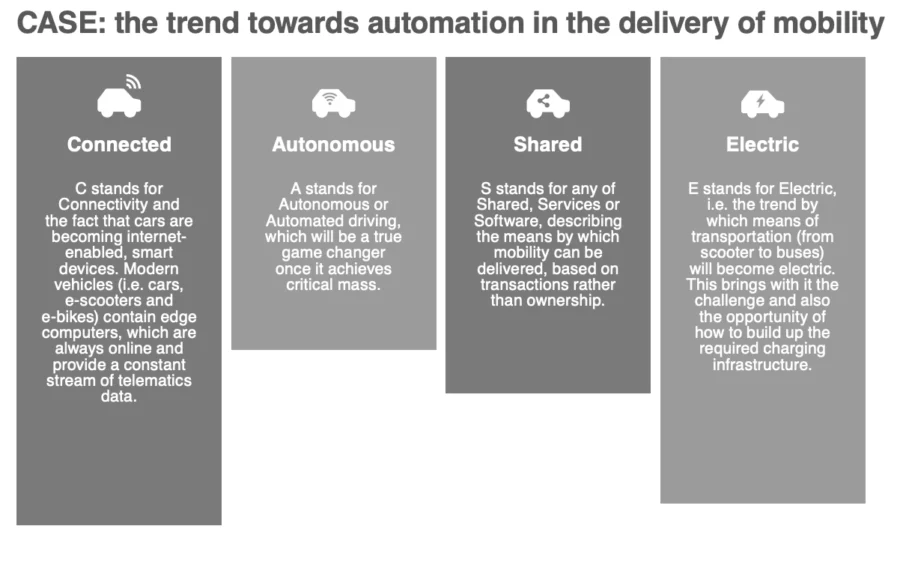

1. Connectivity Technologies

Connectivity technologies like 5G, LoRaWAN, LPWAN, and BLE enable real-time tracking, data analytics, and high-speed internet access for commuters, workers, and vehicles.

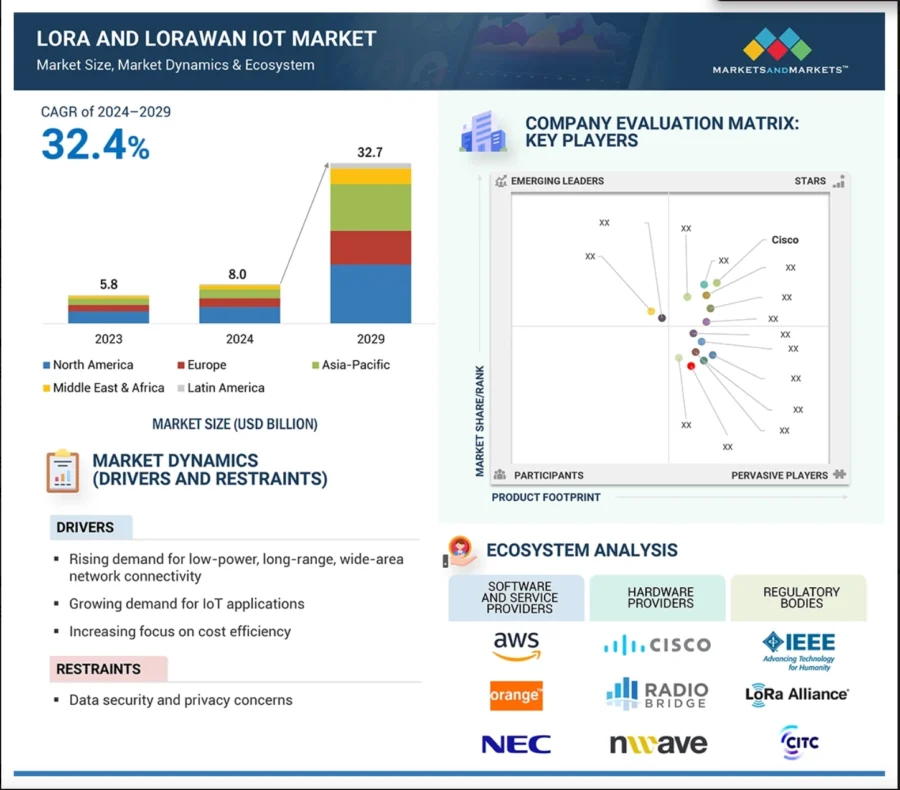

For instance, the global LoRA and LoRAWAN IoT market size, fueled by smart metering and asset tracking, is projected to grow USD 32.7 billion by 2029 at a CAGR of 32.4%.

Source: MarketsandMarkets

LoRaWAN reduced supply chain losses by 5% to 15% by enabling asset tracking. LoRaWAN supports smart parking systems in Europe to reduce traffic congestion.

BLE enables keyless entry, tire pressure monitoring, and infotainment systems in the automotive sector. Over 80% of Indian customers think increased vehicle connectivity, like Hyundai Bluelink, will be beneficial in the long term.

Market Insights & Growth Metrics for Connectivity Technologies

Scale and Magnitude

According to StartUs Insights, 9584 companies are working in 5G technology and 1016 companies operate in the LoRaWAN domain.

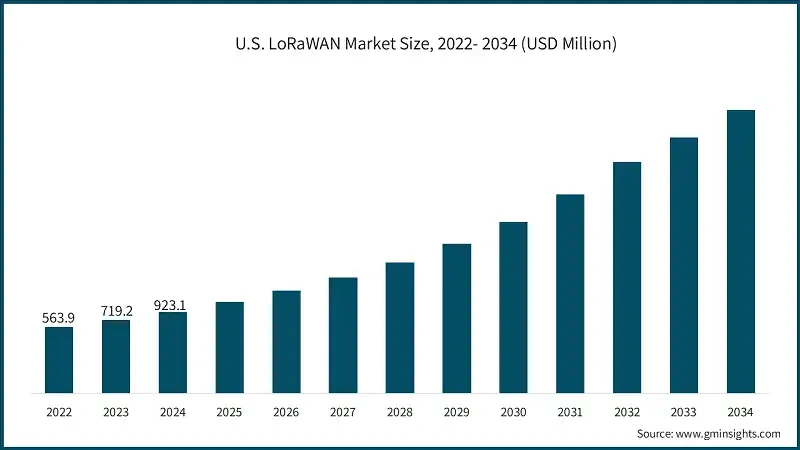

The global LoRaWAN market is projected to reach USD 183.9 billion by 2033 at a CAGR of 36.5%.

Source: Global Market Insights

In terms of media coverage and public attention, 5G holds a prominent position among emerging technologies. StartUs Insights ranks 5G at 73rd in media coverage among all technologies. In contrast, LoRaWAN is ranked 1543rd, and RFID stands at 1081st.

Source: GM Insights

Narrowband IoT (NB-IoT) holds a 58% market share due to extensive smart meter deployments in China, while LoRaWAN leads in other regions with a 41% share.

Growth Indicators

Interest in 5G is surging, with search interest rising by 114.47% annually. Despite this, five-year funding growth has declined by 21.93%, likely due to slowed investment cycles following large-scale deployments.

By Q3 2024, North America recorded 264 million 5G connections – 37% of all wireless connections in the region.

LoRaWAN is also gaining traction, with search interest increasing by 68.68% annually. However, five-year funding growth declined by 44.28%. This indicates challenges in scaling beyond niche applications.

Innovation and Novelty

Innovation remains strong in this domain, with 76 200+ patents filed globally for 5G. Huawei leads with 13 474 patents, followed by Qualcomm (12 719 patents ), LG (7694 patents), and Samsung (9299 patents).

Research and development in 5G is backed by 1500+ grants, emphasizing institutional support for technological advancements.

In contrast, the LoRaWAN domain has seen 410+ patents filed globally and received 80+ grants, with a 2023 review analyzing 71 patents focused on performance improvements.

Top Use Cases of Connectivity Technologies in Mobility

- Vehicle-to-Everything (V2X) Communication: V2X enables real-time data exchange between vehicles, infrastructure, and pedestrians to enhance road safety, reduce accidents, and optimize traffic flow.

- Smart Parking: IoT-enabled smart parking systems use real-time sensor data and connectivity technologies to guide drivers to available spots and reduce congestion.

- Connected Infotainment: Cloud-connected infotainment systems integrate voice assistants, navigation, and streaming services. This enhances in-vehicle experiences while ensuring seamless communication and real-time updates

Noteworthy Advancements

- LG’s Mobility Labworks’ Digital Cockpit Solutions: LG’s Digital Cockpit gamma comprises three modular solutions: Vision Display, Intelligent Human-Machine Interface (HMI), and Connectivity & Content. These modules offer customizable in-car experiences to improve entertainment, communication, and driver assistance.

- Swoop Aero and Red Lightning’s Long-Range Healthcare Delivery: This collaboration addresses healthcare delivery challenges in rural areas. Swoop Aero’s KITE drones transport up to 4 kilograms of medical supplies to any location in Eswatini within 45 minutes. These drones have a range of 175 kilometers and a cruising speed of 122 km/h. The program is operated by locally trained pilots and improves supply chain efficiency through TLC’s digital ecosystem, Luvelo.

Core Technologies Connected to Connectivity

- Low Earth Orbit (LEO) Satellite Connectivity: Supports connected fleet management by enabling real-time, high-speed communication for vehicles in remote or underserved areas.

- Cloud Computing: Provides scalable data storage and processing for mobility applications through real-time analytics, predictive maintenance, and efficient transportation network management.

- Internet of Things: Connects vehicles, infrastructure, and devices to enable smart mobility solutions through traffic optimization, vehicle diagnostics, and safety monitoring.

Spotlighting an Innovator: Movandi

Movandi is a US-based startup that develops 5G millimeter wave (mmWave) technologies. Its solutions integrate RF semiconductors, smart repeaters, and intelligent software to enhance 5G networks.

Movandi leverages its proprietary algorithms and BeamX software-defined networking to optimize beamforming and steering. This also extends signal range. These features address challenges such as line-of-sight blockages and high path loss.

2. Artificial Intelligence

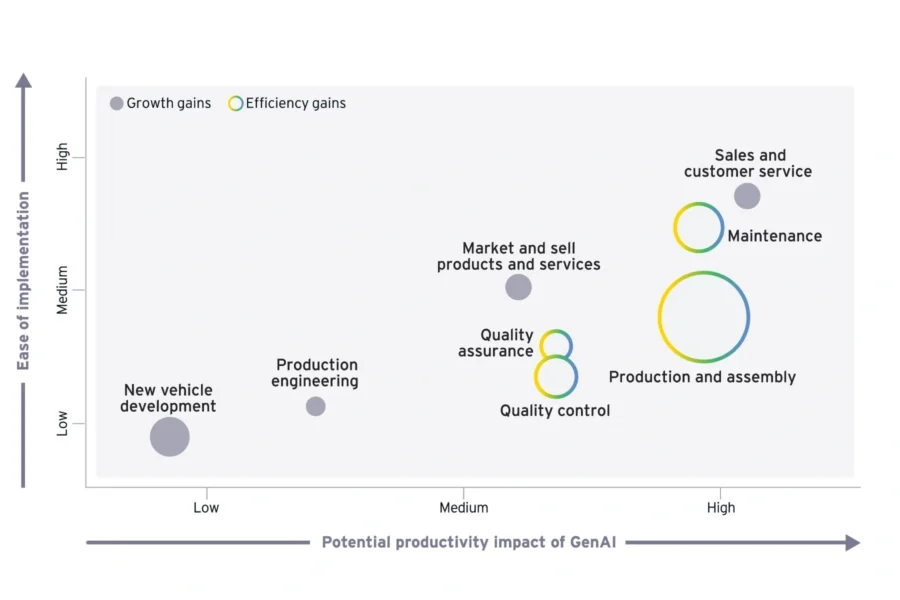

75% of business leaders believe advanced generative AI leads to competitive advantage. In the mobility sector, gen AI is projected to improve productivity by 30% to 32% by 2030.

Supporting this data, a McKinsey report suggests that mobility companies who applied AI as their dominant focus experienced 40% of productivity gains.

AI-powered systems are leveraged to reduce accidents; in the US, 3380 lives were lost due to distracted driving. AI mitigates the problem of finding parking spaces, which takes 41 hours per year otherwise for German drivers.

A substantial portion of the growth of this technology is attributed to its safety features, which are capable of reducing accidents by 20% to 30%. Singapore has seen a 25% reduction in road congestion by implementing AI algorithms that optimize traffic signals.

Gen AI Impact on Productivity Across Automobile Value Chain

Source: EY

AI’s influence extends to optimizing vehicle performance through designing models like the “Genesis G80 Electrified”. This model achieved a 7.9% reduction in drag coefficient compared to its gasoline counterparts and this translated to an estimated 50-mile increase in range.

China is also using AI to optimize traffic flow. This resulted in an 11.5% reduction in travel time, an 8.1% reduction in carbon emission, and a 10% reduction in accident rate.

Some of the tech giants leading the charge in AI development are WAYMO, Tesla, NVIDIA, and Intel.

Market Insights & Growth Metrics for AI

Scale and Magnitude

According to StartUs Insights, there are currently 107 584 AI-focused companies worldwide. This explains AI’s widespread adoption across various industries.

The global AI market size is expected to reach USD 1771.62 billion by 2032, expanding at a CAGR of 29.2.1%

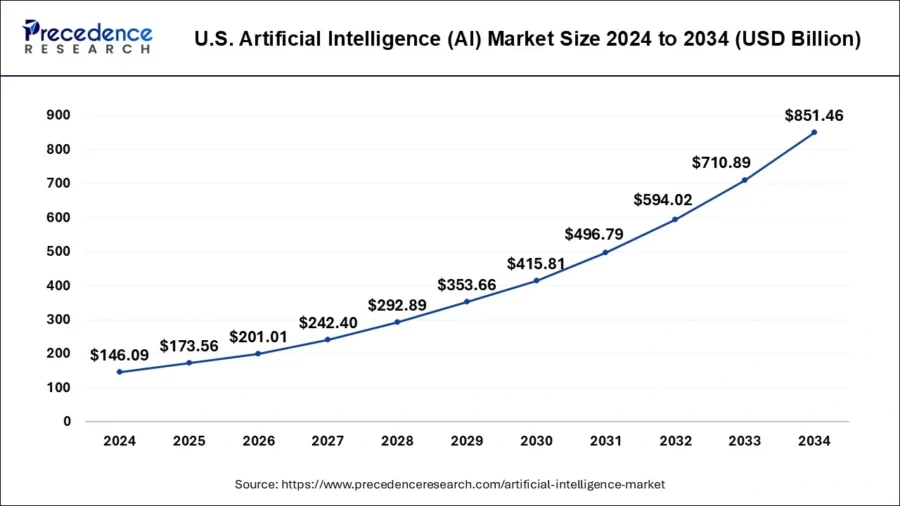

US is expected to reach around USD 851.46 billion by 2034, primarily driven by gen AI startups.

Source: Precedence Research

In terms of media coverage and public attention, AI ranks 16th among all emerging technologies according to StartUs Insights. This ranking reflects AI’s significant presence in media narratives, public discourse, and its perceived impact.

Growth Indicators

AI has seen a notable increase in global interest, with annual search interest rising by 28.09%, as reported by StartUs Insights. This surge reflects the growing curiosity and engagement with AI technologies.

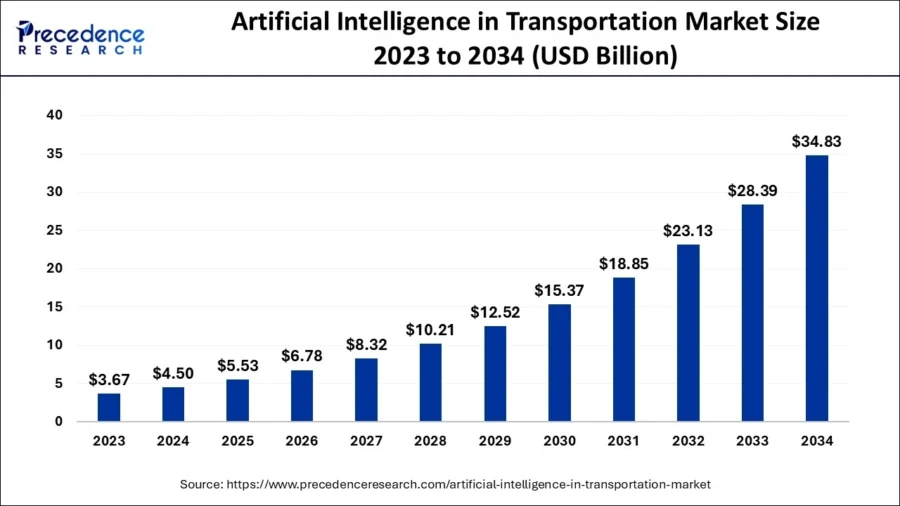

The global AI in mobility market is projected at a CAGR of 49.89%, reaching USD 337.27 billion by 2033. Recently, the AI segment within the transportation industry was valued at USD 4.50 billion, with North America dominating the micro-mobility market by holding a 41.3% share.

Source: Precedence Research

Over the past five years, artificial intelligence has seen a 67% increase in funding, reflecting a significant rise in investments for its development and implementation.

Source: McKinsey and Company

Innovation and Novelty

According to StartUs Insights, there have been more than 841 390 AI-related patents filed worldwide.

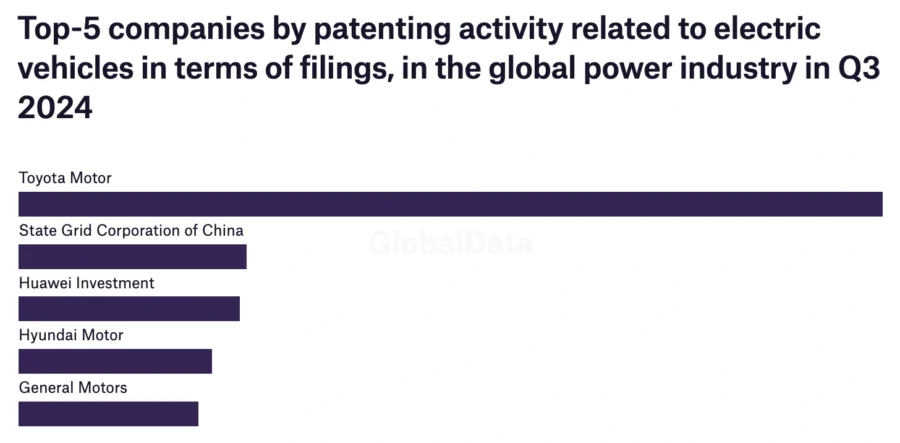

1391 EV-related patents were filed in Q3 of 2024. Toyota Motor led the activity with 125 patent filings, followed by State Grid Corporation of China (33), Huawei Investment (32), and Hyundai Motor (28).

Source: Power Technology

Region-wise, China leads patent filings in the V2X domain with 52 376 patents followed by 39 856 patents by the US.

In terms of research support, StartUs Insights indicates that there have been 23 191+ grants awarded for AI research.

Top Use Cases of AI in Mobility

- Route Optimization: AI-powered algorithms analyze traffic patterns, weather conditions, and historical data to determine the most efficient routes.

- Predictive Maintenance: Machine learning models process real-time vehicle diagnostics to detect potential failures that minimize downtime for fleets.

- Traffic Management: AI-driven systems leverage sensor and camera data to dynamically adjust traffic signals, manage congestion, and enhance road safety in urban environments.

Noteworthy Advancements

- Hyundai Motor Group & NVIDIA’s Omniverse Collaboration: This partnership develops a digital twin ecosystem for vehicle design and smart factory operations. It improves real-time simulation, AI-driven automation, and virtual prototyping for improving vehicle development and manufacturing efficiency.

- PURE EV’s X Platform 3.0 With Advanced AI: PURE EV’s X Platform 3.0 features AI-powered battery management and predictive analytics to optimize EV performance, safety, and longevity. It improves real-time diagnostics, adaptive energy optimization, and thermal management.

Core Technologies Connected to AI

- Edge Computing: Processes AI-driven mobility data closer to the source to reduce latency for real-time decision-making in autonomous vehicles and traffic management systems.

- Neuromorphic Computing: Mimics human brain processing to enhance AI performance in mobility. This enables faster perception, adaptive learning, and reduced energy consumption for autonomous driving systems.

- Sensor Fusion: Integrates data from multiple sensors, including LiDAR, radar, and cameras, to improve situational awareness, object detection, and navigation.

Spotlighting an Innovator: NoTraffic

NoTraffic is a US-based startup that develops an AI-driven traffic signal optimization platform. It uses edge devices with AI-powered video and radar sensors to detect and classify road users, including bicycles, cars, buses, pedestrians, and emergency vehicles, in real time.

This collected data also integrates with a cloud-based mobility operating system (OS) to define policies such as transit priority corridors and pedestrian safety measures.

The AI software autonomously implements these policies at each intersection to optimize signal timing based on actual traffic conditions. This reduces congestion and emissions while improving road safety.

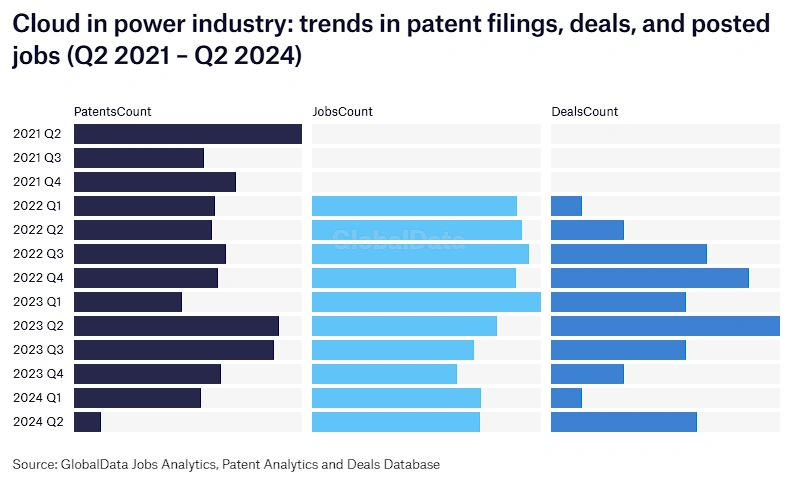

3. Cloud & Edge Computing

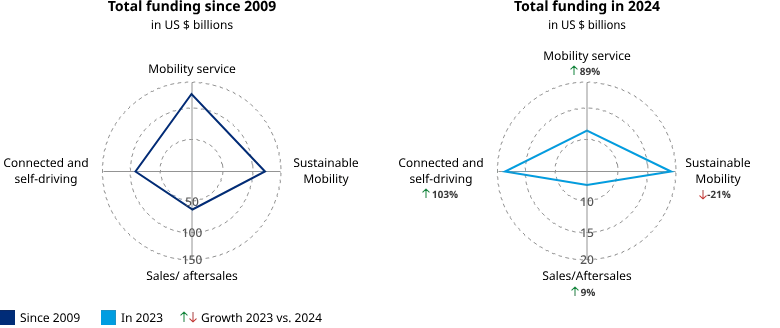

According to the McKinsey Report, cloud and edge computing rank among the top three technologies attracting investment in the mobility sector.

Further, public cloud spending is expected to surpass USD 1610 billion by 2028, while edge computing spending surged to USD 232 billion in 2024.

Mobility companies have emerged as key beneficiaries of these technologies. They secured over USD 54 billion in funding, with EV infrastructure and autonomous driving solutions attracting significant capital.

Source: Oliver Wyman

The edge computing market is projected to reach USD 154.7 billion by 2034 at a 28% CAGR. Last year, the connected and self-driving sector received USD 18.2 billion in funding. Companies like Waymo utilize Edge-AI to process data from vehicle sensors and support real-time urban navigation

The EU’s Digital Mobility Strategy has further accelerated adoption by mandating edge-based data localization for GDPR compliance.

Market Insights & Growth Metrics for Cloud Computing

Scale and Magnitude

Based on our database, there are over 105 000 companies globally operating in the cloud computing sector.

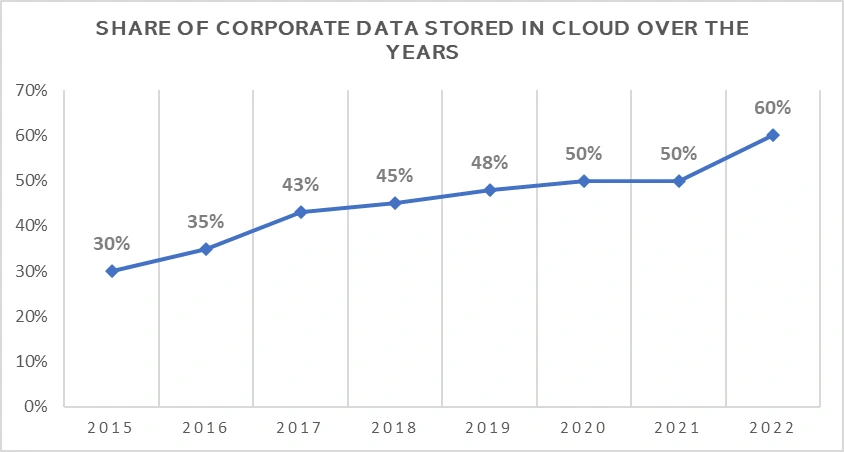

Notably, 98% of all companies worldwide utilize cloud computing in their operations.

Source: Edge Delta

Cloud computing holds the 58th position in media coverage among emerging technologies based on our data. This indicates significant attention in both industry and public domains.

Growth Indicators

StartUs Insights reports there has been a 20.05% annual increase in search interest for cloud computing. This reflects growing curiosity and adoption across various sectors.

Worldwide spending on public cloud services is expected to reach USD 723.4 billion in 2025.

Over the past five years, funding for cloud computing ventures has grown by 55.18%, according to our data. This demonstrates sustained investor confidence in the sector’s potential.

Innovation and Novelty

StartUs Insights reports that the cloud computing sector has witnessed substantial innovation with over 77 000 patents filed globally.

Source: PowerTechnology

Leading companies like IBM have been at the forefront, receiving numerous patents related to cloud technologies. Over the past 18 months, IBM secured 1200 patents related to general cloud processes and operations.

Cloud computing research has been supported by 6600+ grants based on our data.

Top Use Cases of Cloud and Edge Computing in Mobility

- Remote Vehicle Monitoring & Telematics: Cloud-based telematics platforms process real-time vehicle data from edge devices to monitor performance and optimize fleet operations.

- Emergency & Roadside Assistance: Edge computing enables instant crash detection and vehicle diagnostics that allow emergency responders to receive real-time alerts and reduce response times.

- In-Vehicle AI & Personalization: Cloud-connected AI models analyze driving behavior and user preferences to deliver personalized infotainment, navigation, and safety recommendations in real-time.

Noteworthy Advancements

- Lotus & AWS’s Connected Vehicle Platform: Lotus leverages AWS to enable real-time data processing, predictive maintenance, and personalized in-car experiences for next-gen mobility. Running its ROBO Soul self-driving software on AWS allows Lotus to analyze traffic conditions and driver behavior in real-time. AWS’s AI and IoT solutions power vehicle connectivity, optimize performance and support seamless over-the-air updates.

- Microsoft’s AI Agents for the Mobility Industry: Microsoft’s AI-powered agents improve automation, fleet management, and in-car assistance. These AI systems integrate with cloud services to optimize traffic predictions, enhance driver experiences, and enable more efficient operations.

Core Technologies Connected to Cloud and Edge Computing

- Virtualization & Containerization: Enable scalable deployment of mobility applications by isolating workloads in virtual machines or lightweight containers to optimize resource utilization.

- High-Performance Computing (HPC): Processes large volumes of real-time mobility data to support applications like autonomous driving simulations, traffic analytics, and predictive maintenance.

- Software-defined networking (SDN): Decouples network control from hardware and enables dynamic traffic management, secure data exchange between connected vehicles, and easy integration of mobility services.

Spotlighting an innovator: QARCO

Qargo is a UK-based company that develops a cloud-based transport management system (TMS) to streamline logistics operations for road transport companies. It leverages AI to automate workflows and reduce administrative tasks.

The platform facilitates faster implementation and minimizes training requirements by offering scalable solutions with lower upfront costs.

In June 2024, Qargo secured GBP 11 million in Series A funding led by Balderton Capital.

4. Augmented Reality and Virtual Reality

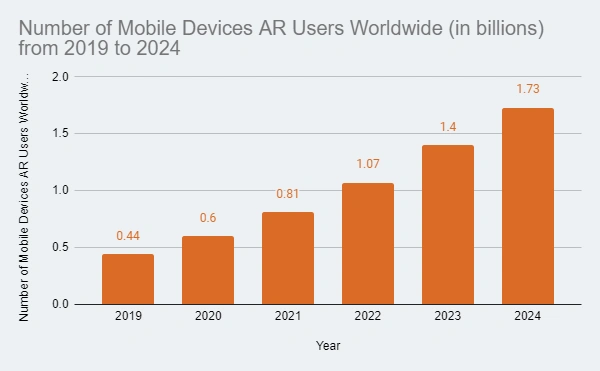

The global automotive AR market is anticipated to grow at a CAGR of 17.60% reaching USD 6.79 billion in 2025. On the other hand, the virtual reality market in the automotive industry is expected to reach USD 8.3 billion in 2026 with a CAGR of 38.03%.

AR-based remote assistance solutions reduce accidents by 12% while decreasing incident response time by 60%. Moreover, AR/VR technology deployed as maintenance solutions reduces machinery downtime by up to 50% with increased productivity by 25%.

By 2025, it’s estimated that over 70% of the top 200 global manufacturing companies will use AR/VR in industrial automation.

The advanced AR-based head-up display (HUD) segment will be the largest segment of the market with the increased use of sensing systems.

Market Insights & Growth Metrics for AR and VR

Scale and Magnitude

Based on our data, the AR and VR sectors are steadily growing with 21 800+ and 28 400+ companies globally. Their applications span industries like healthcare, manufacturing, retail, and education.

By the end of 2024, there were an estimated 1.7 billion AR user devices worldwide.

Source: Meetanshi

StartUs Insights reports that AR ranks 169th and VR ranks 140th in media coverage based on its database.

Growth Indicators

StartUs Insights reports that AR shows consistent growth with an annual search interest rise of 17.8%.

Over the past five years, AR has experienced a 76.2% growth in funding fueled by investments in hardware and enterprise solutions.

European spending on AR/VR is expected to grow at a CAGR of 21.9%, reaching USD 10.2 billion by 2028.

Innovation and Novelty

In the AR sector, 67 200+ patents filed globally. Additionally, AR-related research is supported by 4360+ grants.

On the other hand, VR is leading in innovation with 130 000+ patents and 3640+ grants.

Meta alone has filed over 250 patents in the AR/VR domain.

Top Use Cases of AR & VR in Mobility

- Head-Up Displays (HUDs): Project real-time navigation, speed, and safety alerts onto windshields to minimize driver distraction and enhance situational awareness.

- Smart Windows: AR-enabled smart windows in vehicles overlay interactive travel information such as nearby landmarks and safety warnings. This improves passenger experience and route awareness.

- VR-Based Traffic Simulations: It creates immersive training environments for drivers to ensure safe testing of emergency scenarios and traffic conditions without real-world risks.

Noteworthy Advancements

- Hyundai Mobis & Zeiss’ Full-Windshield Holographic Display: Together they developed a full-windshield holographic display that converts car windshields into immersive screens. This improved driver visibility by overlaying real-time navigation, safety alerts, and entertainment content.

- Zeekr & Qualcomm’s Immersive Infotainment Experience: Zeekr partnered with Qualcomm to integrate Snapdragon Digital Chassis solutions into its vehicles. This enhanced in-car infotainment with high-performance computing through seamless connectivity and delivered an interactive and personalized driving experience.

Core Technologies Connected to AR and VR

- 3D Mapping: Generates high-precision digital maps using real-time sensor data to enhance navigation, assist autonomous vehicles, and improve urban planning for mobility solutions.

- Simultaneous Localization and Mapping (SLAM): Enables real-time positioning and environment mapping for AR-based navigation, autonomous driving, and vehicle-to-infrastructure (V2I) interactions for spatial accuracy and adaptability.

- 5G Connectivity: Enhances AR/VR applications in mobility with ultra-low latency and high-speed data transmission to provide immersive experiences for driver assistance, remote monitoring, and smart city integration.

Spotlighting an innovator: holoride

holoride, based in Germany, offers an in-car entertainment platform that integrates extended reality (XR) content with real-time vehicle motion data.

This approach synchronizes virtual experiences with the car’s movements using data such as acceleration and steering. This creates immersive environments for passengers.

5. Digital Twins

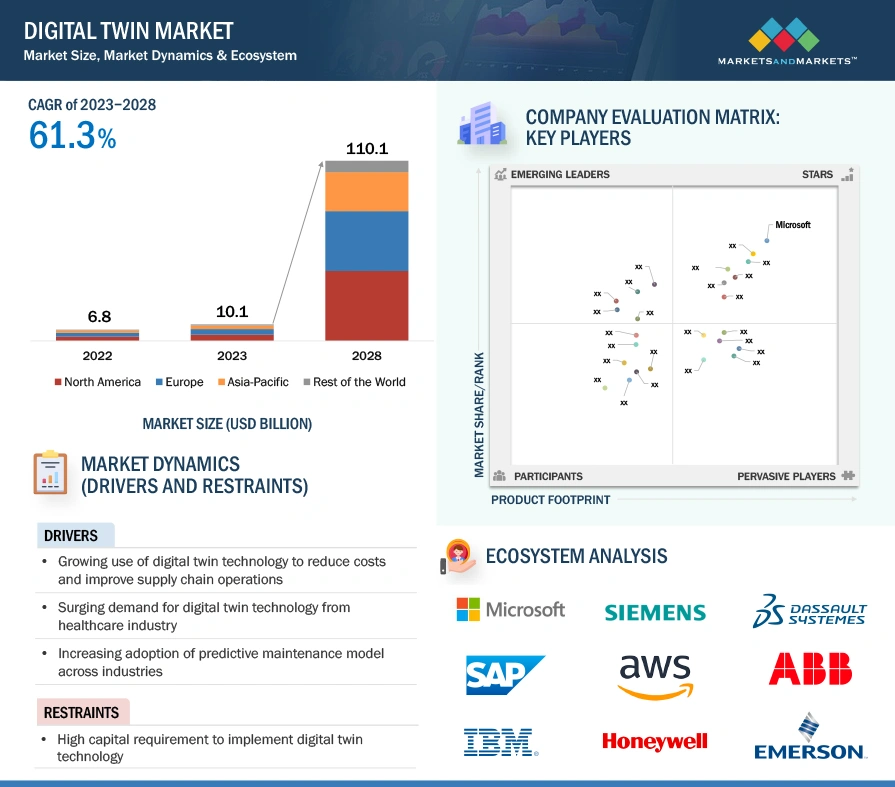

The global digital twin market size is expected to reach USD 110.1 billion by 2028 with a CAGR of 61.3%.

Source: MarketsandMarkets

29% of global manufacturing companies are reported to have either fully or partially implemented their digital twin strategies. Due to their ability to optimize resource usage and improve supply and transportation networks, companies are exploring digital twins.

57% of organizations agreed that one of the key drivers for their digital twin investments was to improve their sustainability.

Siemens deployed a new digital twin-based train control architecture to design 170 high-speed trains that reduced cost by USD 1 million to USD 8 million.

Market Insights & Growth Metrics for Digital Twins

Scale and Magnitude

StartUs Insights reports that the digital twin technology sector consists of 5870+ companies globally.

The US holds 77% of the North American digital twin market. IoT, big data, DevOps are attributed to this early adoption.

Source: Modor Intelligence

Despite its transformative potential, the domain ranks 496th in media coverage among all technologies. This reflects niche but growing recognition as a critical enabler of Industry 4.0.

Growth Indicators

Digital twins are experiencing significant momentum with an annual search interest rise of 26.98% based on our data. This highlights increasing awareness and adoption across industries.

Over the past five years, the sector has achieved a robust 126.34% growth in funding according to our database.

The US government also allocated USD 285 million in funding for digital twin chips.

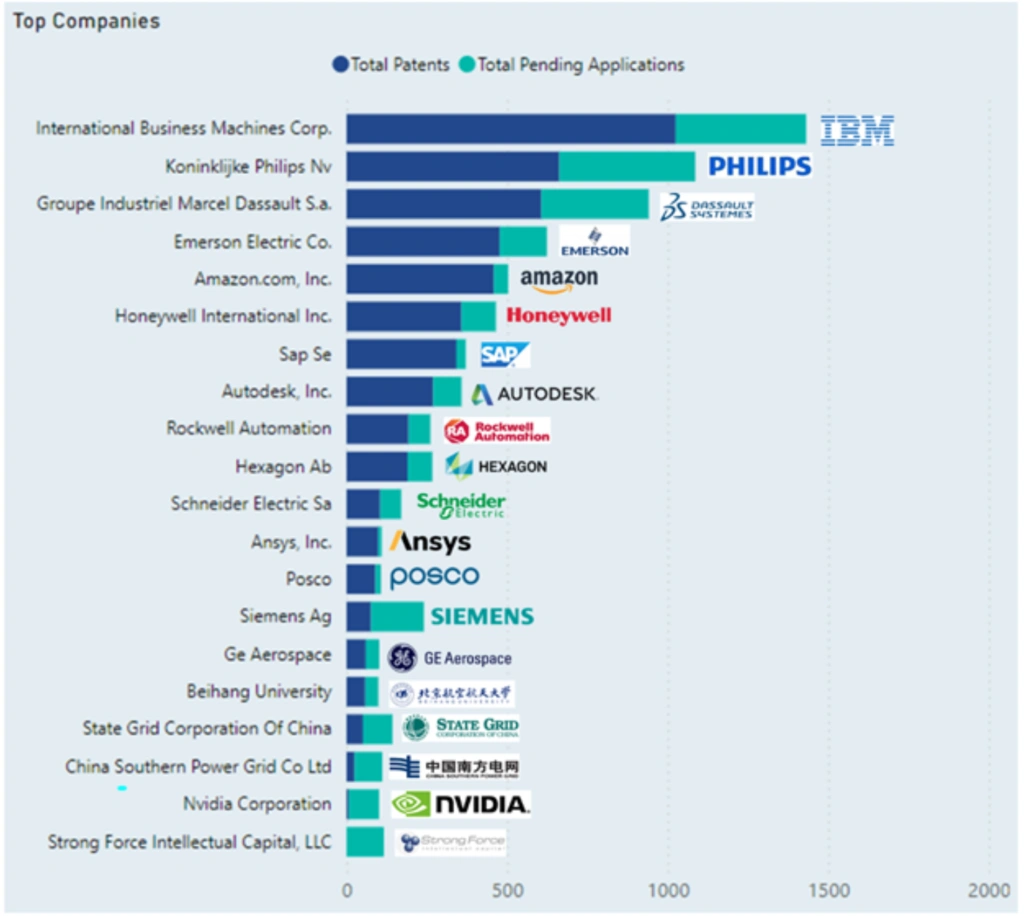

Innovation and Novelty

StartUs Insights reports that digital twins are at the forefront of innovation with 6160+ patents filed globally. IBM holds the highest number of patents in digital twin technologies.

Source: Harrity

Research and development in the domain have also been supported by 1490+ grants based on our data.

Top Use Cases of Digital Twins in Mobility

- Vehicle Design & Development: Digital twin models simulate real-world conditions for automakers to optimize aerodynamics, safety, and energy efficiency before physical prototyping.

- Predictive Maintenance: Real-time digital replicas of vehicles analyze performance data to detect early signs of wear.

- Fleet Management and Optimization: It integrates sensor data and AI analytics to monitor fleet operations and optimize routes to enhance fuel efficiency.

Noteworthy Advancements

- Siemens Mobility & Sogeclair’s Simulation Training Tool: Sogeclair’s OkSyGen software integrates with Siemens’ train control desk simulator to offer a realistic training environment that mirrors real-world driving. This solution reduced lifecycle costs and faster availability, even before initial train delivery.

- Mcity’s Digital Twin for Autonomous Vehicle Testing: This open-source digital twin system offers a virtual representation of the physical test environment to simulate and test autonomous vehicle software in a controlled setting. It generates safety-critical events and offers a more cost-effective method for testing.

Core Technologies Connected to Digital Twins

- Smart Sensors: Collect real-time data from vehicles, infrastructure, and traffic systems to create accurate virtual models for predictive maintenance, route optimization, and safety improvements.

- Edge Computing: Processes sensor data locally to reduce latency and enable real-time decision-making in autonomous driving, traffic management, and vehicle diagnostics.

- Deep Learning: Analyzes complex mobility data patterns to enhance digital twin accuracy and support simulations for vehicle performance, accident prevention, and urban planning.

Spotlighting an innovator: NavVis

NavVis is a German-based startup that develops photorealistic digital twin technology. Its reality capture solutions, including the NavVis LX-Series, utilize advanced laser scanning and precision SLAM technology to generate accurate 3D representations of complex environments.

These devices capture high-quality point clouds and panoramic images, which are processed and geo-registered to create immersive digital twins. The NavVis IVION platform further converts this data into intelligent, web-accessible spaces to facilitate tasks like modeling, drawing, and collaborative planning.

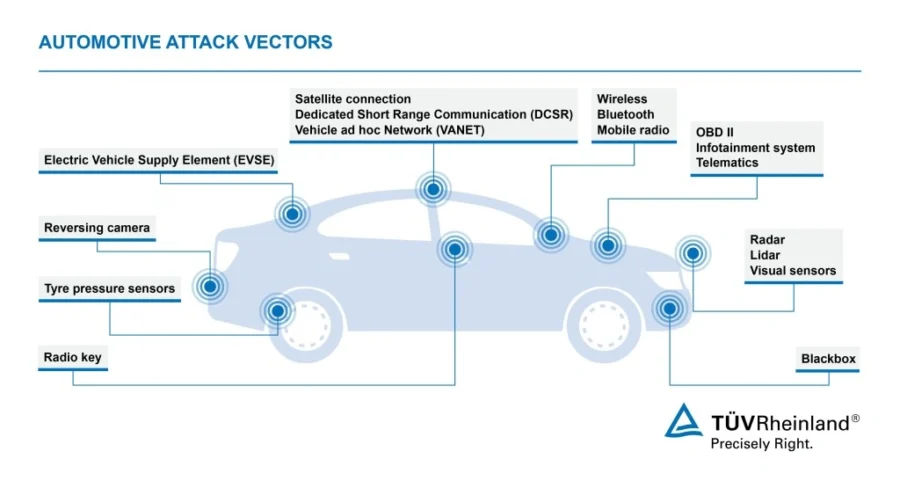

6. Cybersecurity

The global cybersecurity market is expected to exhibit a steady annual growth rate of 7.58% from 2025 to 2029 and reach USD 271.91 billion by 2029. The rise in the connected vehicle market, which is projected to rise to 367 million by 2027 is also making it more susceptible to cyber threats.

Potential vulnerabilities such as unauthorized access to vehicle control systems, data breaches, and the risk of vehicles being remotely commandeered are also on the rise.

Source: Via ID

Therefore, by 2032, the automotive cybersecurity market is projected to grow to USD 10.3 billion by 2032.

Source: Global Market Insights

Recognizing the rising cyber threats in the automotive sector, UNECE Cyber Security (UN R 155) and UNECE Software Updating (UN R 156) regulations have been mandatory since July 2024.

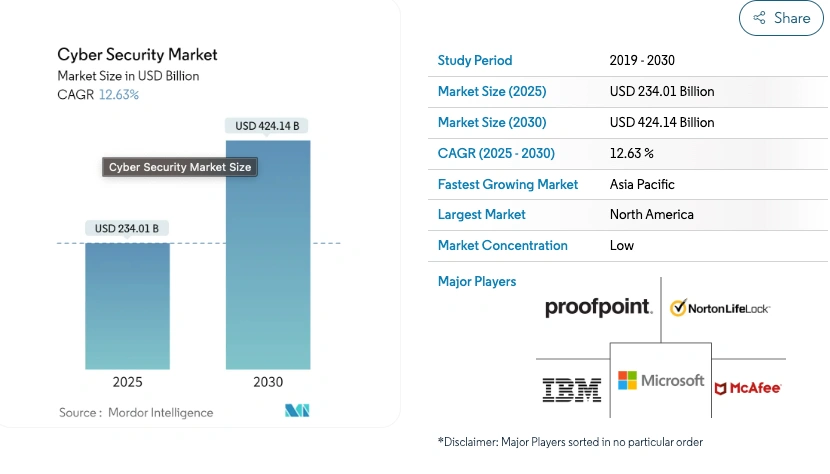

Market Insights & Growth Metrics for Cybersecurity

Scale and Magnitude

According to StartUs Insights, there are currently 172 438 companies specializing in cybersecurity worldwide. The cybersecurity market is projected to reach USD 424.14 billion by 2030 at a CAGR of 12.63%.

Source: Mordor Intelligence

Cybersecurity ranked 12th in media coverage among all emerging technologies, as reported by StartUs Insights.

Growth Indicators

According to data from StartUs Insights, there has been a 68.27% increase in annual search interest for cybersecurity. This surge reflects heightened awareness and concern over cyber threats among individuals and organizations.

Over the past five years, cybersecurity has seen a funding growth rate of 40.35%, as per StartUs Insights.

Some of the top funding startups in this space are Cybaverse that raised USD 1.43 million in a seed funding round, Nillion with USD 25 million in a venture funding round, and Hopae secured USD 4.34 million in seed funding.

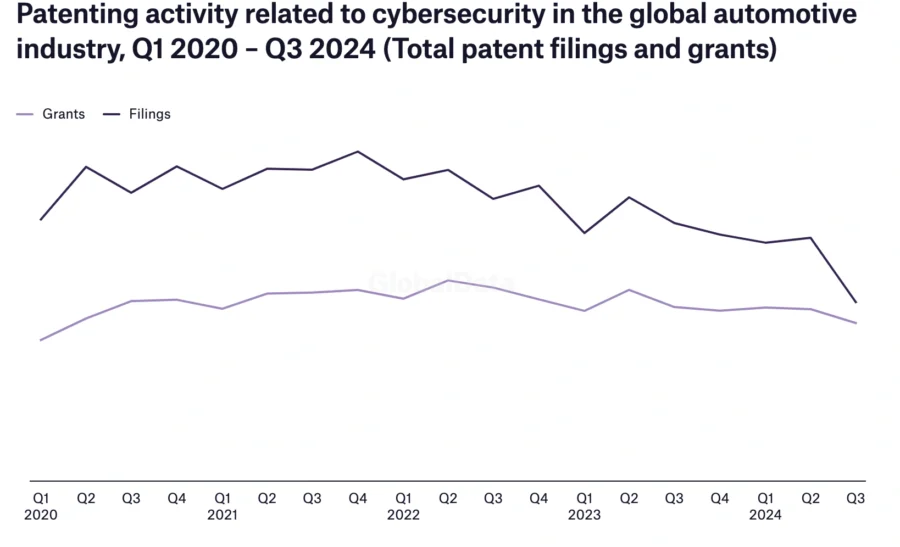

Innovation and Novelty

According to StartUs Insights, there have been 379 402 cybersecurity-related patents filed globally. The US accounts for 40% of global AI cybersecurity patent filings.

2580 patents filed for cybersecurity in the automotive industry in Q3 2024. The top patent filers are Huawei Investment with 104 patents and Samsung Electronics with only 51 filings.

Source: Just Auto

Region-wise, the US dominates the patent filings with a 34% share followed by China and Japan.

Top Use Cases of Cybersecurity in Mobility

- Connected Vehicle Security: Advanced encryption and intrusion detection systems protect connected vehicles from cyber threats. This ensures secure communication between onboard systems and external networks.

- In-Vehicle Network Security: Firewalls and anomaly detection solutions safeguard in-vehicle networks from unauthorized access and cyberattacks. This prevents the manipulation of critical vehicle functions.

- Traffic Management System Protection: Cybersecurity frameworks secure traffic control infrastructures and protect them from hacking attempts on traffic signals and road sensors.

Noteworthy Advancements

- VicOne’s Approach to Automotive Cybersecurity: VicOne collaborates with a leading chip manufacturer to enhance cybersecurity in SDVs. This partnership strengthens threat detection, secure OTA updates, and real-time risk mitigation to ensure compliance with evolving automotive security regulations.

- UNECE WP.29 & AWS IoT Connected Vehicle Security Standards: AWS IoT integrates with UNECE WP.29 regulations to enhance cybersecurity in connected vehicles. This allows automakers to implement standardized security frameworks and ensure data protection.

Core Technologies Connected to Cybersecurity

- Multi-Factor Authentication (MFA): Enhances access control for connected vehicles and mobility platforms by requiring multiple verification factors. This reduces the risk of unauthorized access and cyber threats.

- Endpoint Detection and Response (EDR): Monitors and analyzes vehicle and fleet endpoints for real-time threat detection. It enables rapid incident response to prevent cyberattacks on connected mobility systems.

- Homomorphic Encryption: Enables secure data processing by allowing computations on encrypted mobility data without decryption. This ensures privacy in vehicle-to-cloud communication and protects sensitive user information.

Spotlighting an innovator: SecureThings

SecureThings is a US-based startup that provides a multi-layered in-vehicle security suite for connected vehicles. Its real-time cybersecurity solution safeguards telematics units, electronic control units (ECUs), and in-vehicle networks by integrating deterministic and machine learning-based algorithms.

The system monitors external interfaces, secures internal components against memory-based attacks, and employs intelligent network intrusion detection and prevention mechanisms.

SecureThings provides end-to-end protection from vehicle to cloud and enhances the integrity of automotive ecosystems.

7. Internet of Things

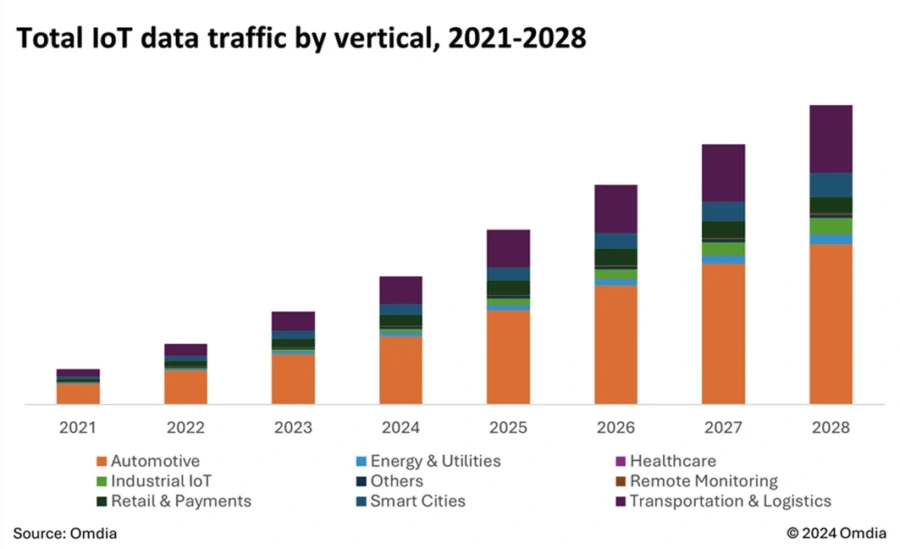

The Automotive IoT market is projected to grow from USD 322.0 billion by 2028, at a CAGR of 19.7%. The rise of connected vehicles, with 70% of all vehicles connected to the internet by 2025 will increase the volume of IoT data traffic.

Source: MarketsandMarkets

The automotive sector is set to become the largest contributor to global IoT data traffic, surging from 18.6 exabytes in 2023 to 59.4 exabytes by 2028.

Source: Telenor IoT

Market Insights & Growth Metrics for Internet of Things

Scale and Magnitude

Based on our data, there are over 56 000 companies globally operating in the IoT sector.

IoT holds the 93rd position in media coverage among emerging technologies in our database.

Despite this, IoT remains a top-three corporate priority among technologies as companies recognize its potential to drive efficiency and innovation.

Growth Indicators

StartUs Insights reports that IoT has experienced a 31.55% annual increase in search interest.

By 2030, the number of IoT devices worldwide is forecast to almost double to over 32.1 billion.

Despite the rise in interest, IoT’s five-year funding growth has declined by 67.76%, according to our database.

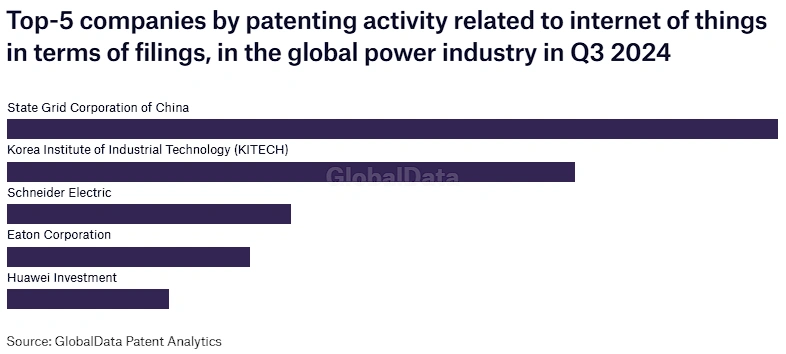

Innovation and Novelty

The IoT sector has seen significant innovation, with over 129 000 patents filed globally based on our data. Leading companies in IoT patent holdings include Samsung Electronics, Huawei Tech, and Ericsson Telefon.

StartUs Insights also reports that IoT-focused research has received 7000+ grants.

Source: PowerTechnology

Top Use Cases of IoT in Mobility

- Emergency Response Systems: IoT-connected vehicles and infrastructure detect accidents in real-time and notify emergency responders with precise location data.

- Remote Diagnostics: Connected vehicle sensors continuously monitor engine performance, tire pressure, and other critical parameters for detecting faults.

- Fleet Management: IoT-enabled tracking systems provide real-time visibility into vehicle locations, fuel consumption, and driver behavior.

Noteworthy Advancements

- Samsara & Stellantis Mobilisights Data Integration: Samsara expands its collaboration with Stellantis to integrate Mobilisights data to access millions of connected vehicles across Europe. This partnership improves fleet visibility, optimizes operational efficiency, and provides real-time telematics insights for vehicle tracking.

- Uber & NVIDIA Autonomous Mobility Acceleration: Uber partners with NVIDIA to integrate AI-driven platforms, including NVIDIA Cosmos and DGX Cloud, to advance autonomous vehicle development. This collaboration enhances real-time data processing, optimizes AI model training, and scales self-driving solutions for safer and more efficient mobility.

Core Technologies Connected to IoT

- Sensors: Collect real-time data from vehicles, infrastructure, and road conditions to enable predictive maintenance, traffic optimization, and enhanced safety monitoring.

- Edge Computing: Processes mobility data closer to the source that reduces latency and bandwidth use for faster decision-making in applications like autonomous driving and fleet management.

- 5G Connectivity: Provides high-speed, low-latency communication between connected vehicles and smart infrastructure to improve real-time navigation, V2X interactions, and automated traffic management.

Spotlighting an innovator: AS.CAR.I

AS.CAR.I is a company based in Italy that develops car intelligence technology. It improves high-performance driving experiences by providing on-track assistance to optimally control vehicles up to their limits.

The company’s system integrates telemetry, precise positioning, and track sensing to monitor real-time vehicle dynamics and track conditions. It also enables assisted performance driving to drivers that handle limits safely while improving lap times.

8. Blockchain

Smart contracts in mobility platforms reduce transaction costs and enhance automated ride matching, payment processing, and dispute resolution. Fraud in transportation transactions can be reduced through blockchain-powered real-time payment settlements.

Source: Economist

The Mobility Blockchain Platform (MBP) is integrating various transport services such as ride-hailing, car-sharing, parking, micro-insurance, and public transit into a decentralized, open ecosystem. This enhances interoperability that reduces the inefficiencies of the 750+ mobility services operating across 180 providers worldwide.

Market Insights & Growth Metrics for Blockchain

Scale and Magnitude

Blockchain technology has grown significantly with 42 100+ companies currently operating in the domain based on our data.

StartUs Insights reports that blockchain ranks 111th in media coverage among 20K+ emerging technologies.

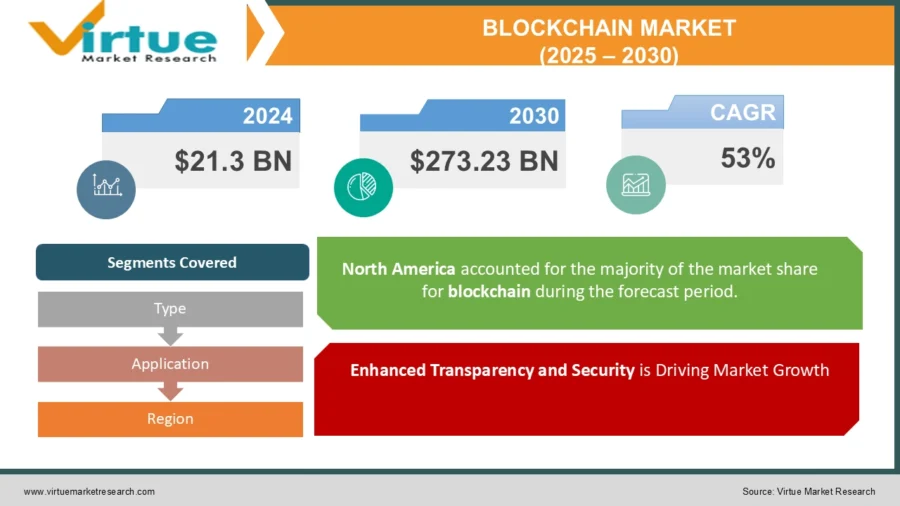

Source: Virtue

Global blockchain spending is projected to grow at a 53% CAGR, reaching USD 273.23 billion by 2030.

Growth Indicators

Based on our analysis, blockchain demonstrates remarkable growth with a 78.23% annual rise in search interest. This reflects increasing adoption across industries.

Over the past five years, blockchain has achieved a 97.41% funding growth based on our data.

The global blockchain market size is projected to grow from USD 248.9 billion by 2029 at a CAGR of 65.5%.

Venture capitalists invested around USD 13.7 billion in crypto last year, which is a 28% YoY growth.

Innovation and Novelty

As per our data, blockchain remains a highly innovative domain with 86 100+ patents filed globally. Blockchain-related research is also supported by 2120+ grants. China leads in the blockchain patent application.

Top Use Cases of Blockchain in Mobility

- Vehicle Identity & Lifecycle Management: Blockchain creates tamper-proof records of vehicle ownership and maintains history, and accident reports to ensure transparency. This also prevents fraud in resale markets.

- Usage-based Insurance (UBI): Insurers leverage smart contracts to securely record real-time driving behavior and offer dynamic, risk-based policies that promote safer driving and fairer premium calculations.

- Charging and Energy Trading: Decentralized blockchain networks facilitate peer-to-peer (P2P) energy trading. Therefore, EV owners are able to buy and sell excess electricity securely while ensuring transparent transactions between consumers and charging stations.

Noteworthy Advancements

- BPTChain’s Blockchain-Powered Transport: It introduces a decentralized platform for mobility services by leveraging blockchain. The platform ensures secure, transparent, and tamper-proof transaction records that enhance data integrity for ride-sharing, vehicle rentals, and logistics operations.

- Toyota’s Ethereum-based Vehicle Identity & Value Security: Toyota is integrating the Ethereum blockchain to secure digital vehicle identities and ownership records. This initiative prevents fraud and enhances resale value transparency for easy transfer of vehicle-related financial services.

Core Technologies Connected to Blockchain

- Distributed Ledger Technology: Maintains a decentralized and tamper-proof record of vehicle transactions, ownership history, and maintenance logs. It ensures transparency and prevents fraud in the mobility ecosystem.

- Cryptographic Hash Functions: Secure data integrity by generating unique, immutable digital signatures for vehicle records. This ensures trust in identity verification, insurance claims, and fleet management systems.

- Tokenization: Enables fractional ownership of mobility assets, secure in-vehicle payments, and decentralized energy trading for EV charging. It creates new financial models in the mobility sector.

Spotlighting an innovator: bloXmove

bloXmove is a German company that offers a mobility blockchain platform that decentralizes power and mobility sectors. It utilizes distributed ledger technology to automate and secure transactions between companies, vehicles, and customers.

By implementing digital identities and verified credentials, bloXmove facilitates efficient cross-company interactions and consumption-based settlements.

bloXmove creates a collaborative ecosystem that enhances operational efficiency and sustainability in urban mobility.

9. Mobility-as-a-Service

Some of the major trends in mobility-as-a-service are digital ticketing and payments, real-time data analytics, in-app mobility services, and last-mile connectivity solutions.

Source: Tata Consultancy Services

Digital payments also play an important role in the growth of MaaS platforms. As a report by Visa suggests, 45% of the people surveyed would be more likely to try different forms of public transit if they could use the same payment method.

Market Insights & Growth Metrics for MaaS

Scale and Magnitude

As per our platform’s database, there are currently 656+ companies specializing in MaaS and it ranked 3002nd in media coverage among emerging technologies.

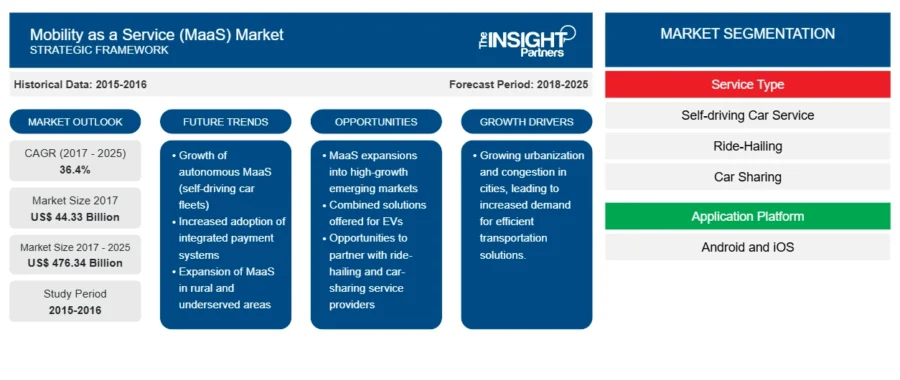

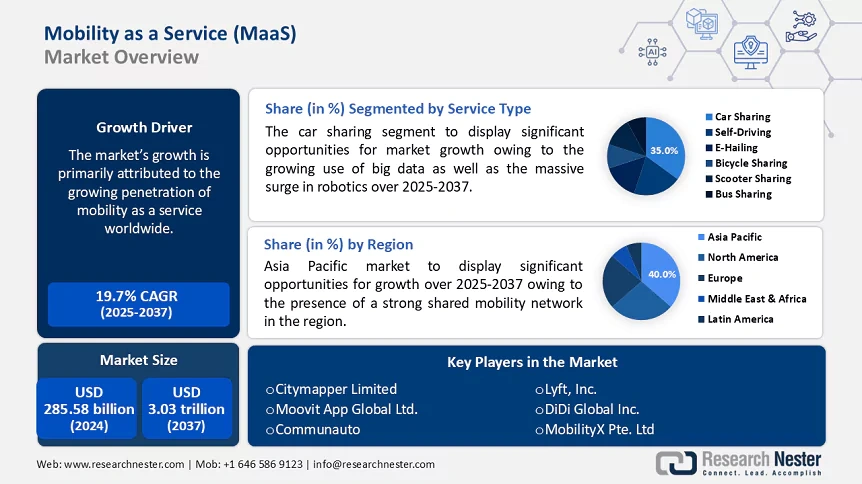

The mobility as a service market size is expected to reach USD 494.76 billion in 2029 at a CAGR of 20.2%

Source: The Insight Partner

Asia-Pacific is currently the largest and fastest-growing region in the MaaS market with a projected market size of USD 476.34 billion by the end of 2025. China is the major contributor to the APAC MaaS market, showing the highest CAGR.

Growth Indicators

The annual search interest for MaaS has increased by 35.18%, as reported by StartUs Insights.

Source: Research Nester

The rapid expansion of 5G connectivity is going to reach 8 billion by 2028. This, in combination with smart city initiatives, is accelerating the adoption of MaaS worldwide.

Innovation and Novelty

According to our report, MaaS research has been supported by 148 grants. China and the US dominate MaaS-related patents, while India shows rapid domestic innovation.

Between 2010 and 2024, approximately 126 906 patents were filed in the V2X sector, with China leading at 52 376 filings, followed by the United States with 39 856.

Top Use Cases of MaaS in Mobility

- Multi-Modal Trip Planning & Ticketing: Integrated MaaS platforms combine real-time data from public transit, ride-hailing, and micro-mobility services to plan and book end-to-end journeys through a single application.

- On-Demand Microtransit: AI-powered microtransit solutions optimize routes and vehicle allocation based on real-time demand. It offers flexible and efficient shared transportation in underserved areas.

- Ride-sharing: MaaS-enabled ride-sharing platforms leverage AI and dynamic pricing to match passengers with shared rides. This reduces traffic congestion and improves urban mobility.

Noteworthy Advancements

- Transport for Wales and Hitachi’s MaaS Implementation: They collaborated to develop a multimodal digital booking system accessible via an app. This initiative journey planning and payment processes by promoting sustainable, low-carbon travel options throughout both urban and rural areas of Wales.

- Siemens Mobility and RTC Collaborate on Québec’s MaaS Application: This regional MaaS platform consolidates Quebec’s public, private, and shared transportation services. It enables users to plan, book, pay for, and utilize various transport modes such as buses, bike-sharing, car-sharing, ferries, and taxis.

Core Technologies Connected to MaaS

- IoT: Connects vehicles, infrastructure, and users through real-time data exchange for multimodal transportation and efficient mobility management.

- AI and ML: Analyze mobility patterns, predict demand, and optimize routes for dynamic ride-sharing, traffic management, and personalized travel recommendations.

- Cloud Computing: Provides scalable infrastructure for MaaS platforms to ensure seamless integration of various transport services.

Spotlighting an innovator: MOBY

MOBY is an Irish startup that provides e-mobility solutions for various sectors and countries.

Its services include public bike-sharing schemes, managed e-bike and e-cargo bike fleets for delivery and logistics industries, and tailored e-bike programs for hotels and corporations.

By offering flexible subscription models and high-quality electric bikes, MOBY reduces urban congestion and promotes sustainable transportation solutions.

10. Autonomous Vehicles

By 2030, US roads will witness a rising number of autonomous cars. The UK’s integration of autonomous and connected vehicles is projected to yield approximately GBP 51 billion in annual economic and social benefits by 2030.

Source: McKinsey & Company

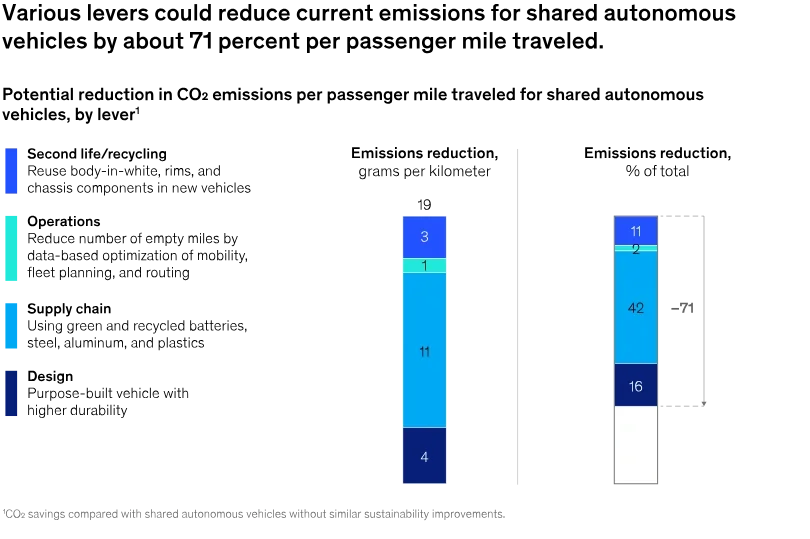

Shared battery electric AVs can lower emissions per passenger mile by up to 98% compared to private diesel vehicles. The significant reduction in emission is likely a reason for the growing adoption of AV in the mobility sector.

Market Insights & Growth Metrics for Autonomous Vehicles

Scale and Magnitude

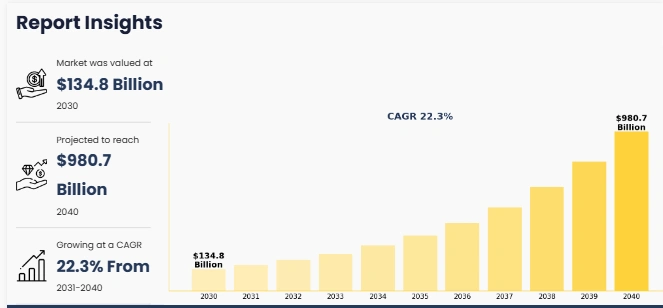

As per our platform’s database, autonomous vehicles ranked 4344th in media coverage among emerging technologies. The global autonomous vehicle market size is projected to reach USD 980.7 billion by 2040 with a CAGR of 23%.

Source: Allied Market Research

Growth Indicators

The annual search interest for MaaS has increased by 22.08%, as reported by StartUs Insights.

The North American market is expected to be the largest market for the autonomous vehicle market – with USD 457 billion by 2030. One of the key drivers is the US Department of Transportation’s automated vehicles.

Innovation and Novelty

According to our report, AV research has been supported by 53 grants. The UK government has allocated EUR 100 million in new R7D funding for connected and automated mobility.

Top Use Cases of AV in Mobility

- Robo Taxis and Ride-Hailing Services: Autonomous ride-hailing fleets use AI-powered navigation and sensor fusion to provide on-demand transportation and reduce urban congestion by improving accessibility.

- Long-Haul Trucking: Self-driving trucks leverage LiDAR, radar, and real-time data processing to enhance freight logistics. It ensures fuel efficiency, lower costs, and safer highway operations.

- Campus and Airport Shuttles: Autonomous electric shuttles operate on fixed routes using GPS, AI, and V2X communication by sustainable mobility in controlled environments.

Noteworthy Advancements

- Waymo’s Robotaxi Testing on LA Freeways: Waymo has expanded its AV testing to Los Angeles freeways that evaluate real-world performance in high-speed, multi-lane conditions. The initiative refines AV navigation in complex traffic environments while advancing the commercial deployment of robotaxi services.

- Uber & Cruise’s AV Deployment Partnership: Uber and Cruise have partnered to integrate autonomous vehicles into the Uber platform. This accelerates AV adoption in urban mobility by leveraging Cruise’s driverless technology to enhance transportation efficiency and scalability.

Core Technologies Connected to Autonomous Vehicles

- Sensor Fusion: Combines data from LiDAR, radar, and cameras to create a comprehensive real-time environment model for object detection and navigation.

- AI and Machine Learning: Process vast amounts of driving data to improve perception, decision-making, and path planning to adapt to dynamic road conditions.

- 5G Connectivity: Provides ultra-low latency and high-speed communication for real-time data exchange between vehicles, infrastructure, and cloud systems to improve safety and coordination.

Spotlighting an innovator: Venti Technologies

Venti Technologies is a Singapore-based startup that develops autonomous logistics solutions for industrial and supply chain hubs. Its AI-powered systems convert existing vehicles into self-driving units that navigate complex environments without additional infrastructure.

These systems also integrate with current fleet management systems. By enhancing operational efficiency and safety in ports, airports, warehouses, and factories, Venti Technologies strengthens supply chains.

Key Benefits of Digitizing Mobility Technology in 2025

1. Enhanced Operational Efficiency

- Route Optimization: Digital tools analyze traffic patterns and suggest optimal routes to reduce fuel consumption and travel time.

- Automated Processes: Automation in data entry and document processing minimizes manual effort and increases productivity.

2. Improved Customer Experience

- Real-Time Tracking: Customers gain access to live updates on their shipments or rides.

- Personalized Services: Data analytics enable personalized services to meet individual customer preferences and needs.

3. Increased Revenue Opportunities

- New Business Models: Digital platforms facilitate innovative services like ride-sharing and on-demand deliveries. This translates to additional revenue streams.

- Enhanced Collaboration: Improved communication and data sharing among stakeholders lead to strategic partnerships and business growth.

4. Better Supply Chain Visibility

- Real-Time Monitoring: It involves leveraging advanced technologies to continuously track goods and improve inventory management.

- Predictive Analytics: Anticipates demand and potential disruptions for proactive decision-making and smoother operations.

5. Enhanced Safety and Security

- Advanced Monitoring: IoT-enabled sensors and AI systems monitor vehicle conditions and driver behavior to prevent accidents.

- Fraud Reduction: Technologies like blockchain ensure secure data exchange that minimizes the risk of fraud.

6. Environmental Sustainability

- Reduced Emissions: Optimized routes and efficient operations contribute to lower fuel consumption and decreased carbon footprints.

Resource Efficiency: Smart technologies promote better utilization of resources and support environmental conservation efforts.

Step-by-Step Guide: Digital Transformation Strategy for the Mobility Industry

1. Define the Vision and Goals

- Set a Clear Direction: Align digital transformation efforts with the company’s core mission which will focus on optimizing mobility solutions.

- Establish Measurable Goals: Define quantifiable targets such as reducing fuel consumption, easing traffic congestion, and increasing automation.

2. Conduct a Digital Maturity Assessment

- Evaluate Current Capabilities: Evaluate existing digital tools, transportation networks, and workforce skills to identify gaps and areas for improvement.

- Benchmark Against Industry Leaders: Compare digital maturity with top mobility providers and transportation firms to gain insights into best practices and competitive positioning.

3. Identify Key Technologies

- Prioritize Strategic Investments: Focus on technologies with high impact, such as IoT for real-time vehicle tracking, AI-driven predictive maintenance, and automation, for mobility service optimization.

- Ensure Scalability: Select adaptable solutions that support business expansion and accommodate future technological advancements.

- Stay Ahead with Technology Scouting: Leverage data-driven platforms to track emerging innovations in urban mobility, autonomous transport, and connected vehicles.

4. Build a Robust Data Infrastructure

- Harness Big Data: Implement systems to collect, store, and analyze real-time mobility data from GPS tracking, connected vehicles, and multimodal transport networks.

- Seamless Integration: Connect operational technology (OT) with information technology (IT) systems to optimize fleet coordination, traffic management, and passenger experience.

5. Develop a Detailed Roadmap

- Phased Implementation: Break down the digital transformation into manageable phases, starting with pilot projects to test new mobility solutions before full-scale deployment.

- Realistic Timelines: Define achievable deadlines while maintaining flexibility to adapt to evolving challenges and opportunities.

6. Foster Collaboration and Ecosystem Partnerships

- Engage Key Stakeholders: Involve employees, transit authorities, regulatory bodies, and technology partners to ensure alignment and smooth adoption of digital solutions.

- Build Strategic Alliances: Partner with technology providers, mobility startups, and research institutions to integrate cutting-edge mobility innovations and share industry knowledge.

7. Upskill the Workforce

- Invest in Training Programs: Equip employees with the skills needed to operate and manage new automation, data analytics, and AI-driven mobility tools.

- Promote a Digital-First Culture: Encourage continuous learning, innovation, and adaptability to maximize technology utilization across all workforce.

8. Implement Robust Cybersecurity Measures

- Safeguard Critical Infrastructure: Deploy comprehensive cybersecurity frameworks to protect connected vehicle systems, transportation algorithms, and passenger data.

- Ensure Regulatory Compliance: Adhere to industry standards and legal requirements related to data security, operational safety, and network resilience.

9. Monitor, Measure, and Optimize

- Track Key Performance Indicators (KPIs): Regularly assess mobility efficiency, route optimization, sustainability impact, and user satisfaction.

- Refine Strategies with Data Insights: Utilize real-time analytics to continuously improve mobility operations and respond to evolving transportation challenges

10. Scale and Innovate Continuously

- Expand Successful Pilots: Scale up effective digital solutions across multiple transportation networks and urban mobility systems.

- Drive Continuous Innovation: Stay ahead of technological advancements, regulatory changes, and shifting consumer preferences to ensure long-term competitiveness in the mobility industry.

Future Trends in the Mobility Industry: Top 5 Emerging Trends

Level 5 Autonomy and V2X Communication

- What’s Next: Level 5 autonomous ride-hailing fleets will operate in geofenced areas. Automakers like Hyundai and GM are integrating AI-driven sensor fusion for safer navigation, while V2X communication will enhance vehicle coordination with traffic signals and infrastructure.

- Why It Matters: AV adoption could cut traffic fatalities. V2X integration will optimize traffic flow, reduce congestion, and improve urban mobility.

Electrification and Battery Advancements

- What’s Next: Solid-state batteries will significantly improve energy density that will extend EV coverage range per charge. Wireless charging solutions and localized battery production will reduce costs and improve EV efficiency.

- Why It Matters: Faster charging, longer range, and supply chain localization will accelerate EV adoption and lower costs. This makes electric mobility more practical and accessible.

AI-Driven Mobility and Predictive Analytics

- What’s Next: AI optimizes traffic management, with tools like PTV Model2Go reducing congestion and improving urban planning. AI-powered predictive maintenance is lowering fleet downtime, while conversational AI enhances in-car experiences.

- Why It Matters: AI-driven traffic solutions are projected to cut congestion, reduce maintenance costs, and create more personalized, efficient mobility experiences.

IoT-Enabled Smart Transportation

- What’s Next: Smart city initiatives will optimize multimodal transport. Sensor-embedded roads and blockchain-secured V2X communication will improve vehicle safety and data security.

- Why It Matters: Real-time traffic coordination reduces commute times, enhances road safety, and ensures secure, tamper-proof V2I communication.

Hydrogen Fuel Cell and Alternative Energy

- What’s Next: Hydrogen fuel cells are gaining traction in heavy transport, with Hyundai developing 1000 km-range fuel cell systems. Green hydrogen costs are dropping, making it a viable diesel alternative.

- Why It Matters: Hydrogen-powered transport will decarbonize trucking and maritime industries, supporting large-scale adoption of zero-emission logistics.

Act Now To Stay Ahead of the Technology Curve

Staying competitive in today’s economic landscape means more than just being aware of technological advancements. Every industry faces unique challenges and opportunities, and a one-size-fits-all approach isn’t enough.

That’s where our AI and Big Data-powered Discovery Platform comes in. With access to over 5 million emerging companies and 20K+ tech trends globally, it equips you with the actionable insights you need to stay ahead of the curve. Leverage this powerful tool to spot the next big thing before it goes mainstream. Stay relevant, resilient, and ready for what’s next.