The 2025 Mobility Market Report analyzes the global mobility sector to focus on how innovation, sustainability goals, and urbanization trends are reshaping transportation.

The report highlights key trends such as the rise of electric and autonomous vehicles, the growth of shared mobility platforms, and the adoption of mobility-as-a-service (MaaS) ecosystems. Advances in battery technology, connected vehicle infrastructure, and real-time traffic management support the development of flexible and cleaner transport systems.

It also profiles tech startups and examines market shifts, technological progress, and investments. These insights show how the mobility industry is creating resilient and inclusive transportation systems for the coming decade.

Executive Summary: Global Mobility Outlook 2025

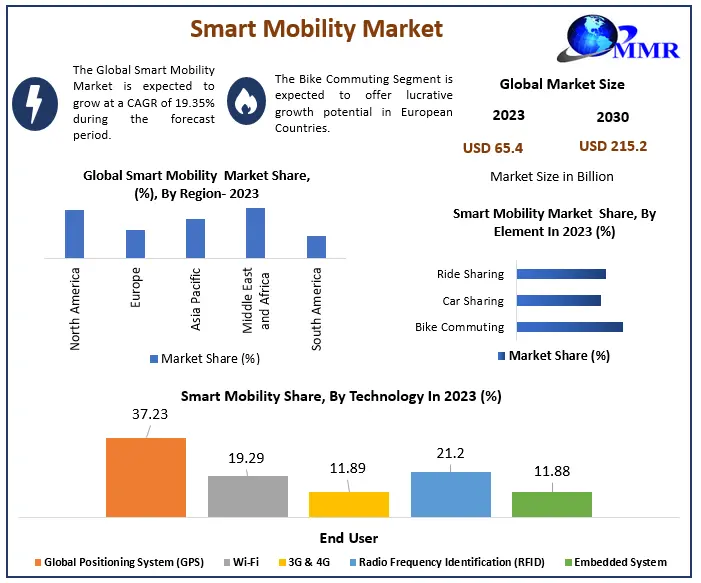

- Industry Growth Overview: The mobility industry recorded an annual decline of 0.23%. It includes over 533 000 companies and 6500 startups driving innovation and transformation. By 2030, the smart mobility market is projected to reach USD 215.2 billion, with a compound annual growth rate (CAGR) of 19.35% during the 2024–2030 forecast period.

- Manpower and Employment Growth: The sector employs over 67 million people globally. Last year, it added more than 2 million employees, which makes it one of the fastest-growing industries for workforce expansion.

- Patents and Grants: The industry holds over 1.74 million patents and 39 000 grants. Around 483 000 applicants support this growth, with a yearly patent growth rate of 2.53%, primarily driven by innovators in the United States and China.

- Global Footprint: Major hubs include the United States, Germany, the United Kingdom, India, and Canada. Key city hubs are London, New York City, Melbourne, Dubai, and Sydney.

- Investment Landscape: The mobility sector has completed over 111 000 funding rounds, involving more than 60 000 investors. These investments span 39 000 companies, with an average of USD 80.5 million per round.

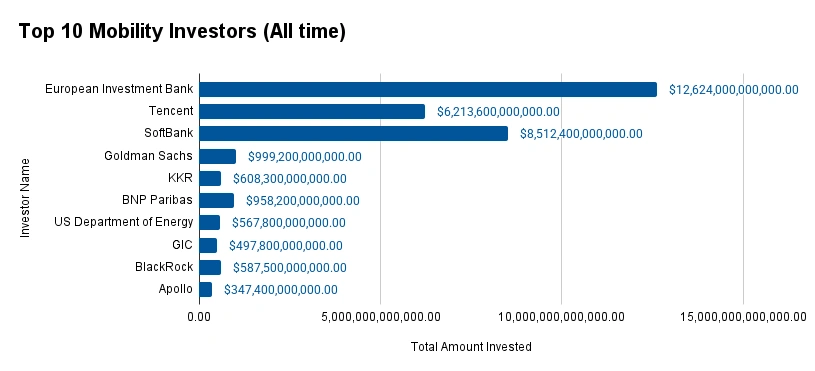

- Top Investors: Leading investors include the European Investment Bank, Tencent, SoftBank, and more. Together, they have contributed over USD 96 billion to the sector.

- Startup Ecosystem: Innovative startups like SURE Mobility (electric vehicle infrastructure), LendoCare (assistive mobility devices), MetroAir (urban air mobility), Mobility-Metrix (multimodal mobility data), and HEY Mobility (smart mobility platforms) highlight the industry’s global reach and entrepreneurial spirit.

Methodology: How we created this Global Mobility Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of mobility over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within mobility

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the mobility market.

What Data is used to create this Mobility Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the mobility market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: The mobility industry appeared in over 55 000 publications last year, which showcases its growing influence.

- Funding Rounds: Our database records data on more than 111 000 funding rounds, reflecting sustained investment interest.

- Manpower: The industry employs over 67 million workers globally and added more than 2 million employees in the past year.

- Patents: It holds over 1.74 million patents and demonstrates consistent innovation activity.

- Grants: The sector received 39 000 grants, which reinforces financial support for research and development.

- Yearly Global Search Growth: The global search interest in the industry increased by 6.18% annually, signaling growth in online visibility and public awareness.

Explore the Data-driven Mobility Outlook for 2025

Did you know shared mobility originated in Switzerland during the 1940s, with modern ride-hailing services emerging only about a decade ago? Today, users book over 40 million e-hailing trips daily on the two largest global platforms.

Maximize Market Research projects that the smart mobility market will reach USD 215.2 billion by 2030, with a CAGR of 19.35% during 2024–2030.

Credit: Maximize Market Research

The mobility industry comprises more than 6500 startups and 533 000 companies, reflecting its broad landscape of innovation, infrastructure, and global employment.

Despite a slight 0.23% decline in annual growth, as per our database, the sector added over 2 million employees last year. It is increasing its workforce to more than 67 million worldwide.

The industry holds over 1.74 million patents and 39 000 grants, which underscore ongoing advancements in transport, logistics, and infrastructure.

Major country hubs include the United States, Germany, the United Kingdom, India, and Canada, with leading city hubs such as London, New York City, Melbourne, Dubai, and Sydney. These hubs actively shape mobility solutions through technology and policy development.

A Snapshot of the Global Mobility Market

The mobility industry experienced a 0.23% annual decline but maintains resilience through active startup activity and ongoing innovation in global markets.

Our database includes over 6500 mobility-focused startups, along with 12 000 early-stage companies. In addition, 23 000 mergers and acquisitions continue to shape the sector’s growth.

With over 1.74 million patents filed by 483 000+ applicants and a consistent annual patent growth rate of 2.53% across a variety of subdomains, innovation is still going strong.

Further, with over 446 000 and 435 000 patents, respectively, China and the United States lead the world in patent filings, demonstrating their ongoing commitment to mobility technologies.

Explore the Funding Landscape of the Mobility Market

The mobility industry consistently secures financial support, with investments averaging USD 80.5 million per funding round.

More than 60 000 investors have participated in mobility-focused deals, and it reflects varied backing from institutional, corporate, and public sector stakeholders.

The industry has completed over 111 000 funding rounds, highlighting steady activity in venture capital and strategic investment.

Funds have reached more than 39 000 companies, which showcases the sector’s wide scope and the development of solutions in transportation, logistics, and infrastructure technologies.

Who is Investing in the Mobility Market?

The top investors in the mobility industry have invested over USD 96 billion, reflecting the sector’s ability to attract consistent institutional funding.

- The European Investment Bank leads with USD 24 billion invested in 126 companies. It allocated nearly EUR 5 billion to support India’s climate action and transportation goals.

- Tencent has funded 62 companies with a total of USD 13.6 billion. One of its investments includes Ruqi Mobility, a ride-sharing platform focused on robo-taxi services.

- SoftBank has invested USD 12.4 billion across 85 companies. Its Vision Fund 2 led a USD 250 million Series C funding round for TIER, a European micro-mobility firm specializing in e-scooters, bicycles, and mopeds.

- Goldman Sachs committed USD 9.2 billion to 99 mobility companies. It provided USD 60 million in asset-backed financing to TIER, supporting the expansion of its e-scooter fleet and the development of its TIER Energy Network with charging stations across Europe and the Middle East.

- KKR has funded 60 companies with USD 8.3 billion. It invested in Enilive, a company focused on sustainable mobility solutions. KKR recently increased its stake in Enilive to 30%, advancing its decarbonized products and integrated services.

- BNP Paribas has invested USD 8.2 billion in 95 companies. It finances over 3 million vehicles globally through partnerships with manufacturers such as Stellantis, Geely Group, Jaguar Land Rover, Hyundai, and Kia. It also supports infrastructure financing for sustainable mobility projects.

- The US Department of Energy allocated USD 7.8 billion to 56 companies. It invested USD 2 billion to retrofit 11 auto manufacturing facilities for EV production across eight US states.

- GIC invested USD 7.8 billion in 49 companies. It led a USD 60 million funding round for Euler Motors, an Indian EV company specializing in electric cargo three-wheelers.

- BlackRock contributed USD 7.5 billion to 58 companies. It acquired additional shares in Verra Mobility Corp, which provides transportation solutions like tolling and violation management for rental car companies and fleet owners.

- Apollo invested USD 7.4 billion across 34 companies. It committed USD 2 billion to preferred equity securities issued by AT&T Mobility II LLC, supporting wireless business operations.

Top Mobility Innovations & Trends

Discover the emerging trends in the mobility market along with their firmographic details:

- Electric mobility is the most prominent trend in the mobility industry, with 25 000+ companies contributing to vehicle development, infrastructure, and battery technology. The sector employs 2.6 million people globally and added 178 000+ employees last year. The annual trend growth rate of 7.84% highlights the global shift toward electrification. It is supported by regulatory policies, consumer demand, and energy-efficient innovation.

- Shared mobility is rapidly evolving to optimize vehicle usage through services like car-sharing, ride-hailing, and micromobility platforms. This sector includes 650+ companies and employs more than 97 000 people. In the past year, over 6000 new employees joined. Its annual growth rate of 28.08% reflects expansion driven by urbanization, digital adoption, and sustainability-focused transportation planning in major cities.

- Urban air mobility is an emerging trend involving 450+ companies developing technologies like electric vertical takeoff and landing (eVTOL) aircraft, cargo drones, and air taxis. The segment employs over 85 000 people globally and added 7000+ employees last year. Further, an annual growth rate of 34.86% indicates momentum driven by private investment, prototype advancements, and regulatory progress supporting low-altitude air traffic systems.

5 Top Examples from 6500+ Innovative Mobility Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

SURE Mobility offers a Rental Electric Bike

Dutch startup SURE Mobility provides electric vehicles and infrastructure solutions to improve urban mobility, leisure travel, and last-mile delivery. Its flagship E-Chopper uses an electric motor and high-capacity battery to cover up to 50 km per charge.

It offers a smooth and quiet ride at a speed of 25 km/h. The vehicle is designed with fat tyres, a sturdy frame, and a lightweight 57 kg build to ensure easy handling and durability. Its features include a telephone holder, lock alarm, footrest, and double seat.

The startup also produces the BikeTower, an automated self-service storage system for e-bikes and accessories. It operates 24/7 and protects vehicles from theft, vandalism, and weather.

LendoCare builds Assistive Mobility Devices

UK startup LendoCare makes mobility equipment for hire, including wheelchairs, mobility scooters, and walking aids, to support mobility and independence. Its product range includes the Drive Devilbiss Manual Fold Plus Mobility Scooter, which has a 125kg weight capacity and reaches speeds of up to 4mph.

The startup’s LendoCare Lightweight Self-Propelled Wheelchair is foldable and user-friendly, and offers attendant brakes for added control. For electric mobility options, the LendoCare Light Electric Wheelchair features a foldable design with electric support, suitable for urban commuting.

In addition, the LendoCare Folding Rollator offers stability with its four large wheels to ensure smooth movement for those needing walking assistance.

MetroAir advances Urban Air Mobility

South Korean startup MetroAir develops MultiCruiser, an eVTOL aircraft for urban air mobility and sustainable transportation. It uses the RimFoil propulsion system and a lightweight structure to improve lift efficiency, lower noise levels, and reduce energy consumption.

The aircraft incorporates autonomous flight control with sensors and intelligent systems to ensure safe and precise operations. It supports applications like cargo delivery, passenger transport, and emergency missions.

The MultiCruiser shifts transportation to the air and reduces road congestion. This enhances access to remote areas and improves urban air quality.

Mobility-Metrix enables Multimodal Mobility Data Visualization

French startup Mobility-Metrix creates a software as a service (SaaS) platform that analyzes and visualizes multimodal mobility data to guide urban transport planning decisions. It gathers and processes information from various sources. This includes GPS, telephony, sensors, public transport systems, and open data to provide a detailed view of regional travel patterns.

The platform allows users to assess modal share, journey times, origin-destination flows, and trip-generating or attracting hubs by time slot, day, and mode of transport. It uses machine learning to reconstruct incomplete datasets and displays results through dashboards and interactive maps.

Mobility-Metrix enables mobility authorities, public transport operators, venue managers, and planners to optimize infrastructure, adjust services, and predict peak usage.

HEY Mobility supports Ticketing, Parking & Micro Mobility

Turkish startup HEY Mobility develops a smart mobility platform for ride-sharing, vehicle management, and parking solutions in urban and institutional settings. It integrates electric scooters, mopeds, and cars into a single system that enables operators to track fleets, analyze performance, and manage services using real-time data and AI-driven tools.

The startup’s platform offers features such as customizable user interfaces and mobile payments. It also offers operational controls for entrepreneurs, campus administrators, and transportation providers.

Its HEY Scooter module provides scalable solutions for on-demand vehicle fleets. The abfGO service simplifies airport shuttle operations by combining voyage management, booking integration, and payment processing through mobile apps and Android POS devices.

Moreover, its ParkoMobil offering improves parking management with smart systems. It optimizes off-street and on-street parking to reduce congestion and enhance space utilization.

Gain Comprehensive Insights into Mobility Trends, Startups, and Technologies

The mobility industry is undergoing significant change driven by electrification, automation, and multimodal integration in global transport systems. Trends like urban air mobility, shared platforms, and AI-driven logistics are redefining how people and goods move.

Get in touch to explore 6500+ startups and scaleups, as well as all market trends impacting mobility companies.