This Hospitality Industry Outlook presents an in-depth analysis of a sector undergoing significant change. In the face of dynamic global travel trends, it delves into emerging innovations, technological progress, and the economic factors influencing the industry’s trajectory. It examines firmographic data, growth patterns, investment activities, and innovative shifts from AI in restaurants to sustainable travel and tourism practices.

This report was last updated in January 2025.

This hospitality report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: Hospitality Sector Outlook 2025

- Industry Growth Overview: The hospitality market report notes a slight decrease in industry growth by 0.84%, with over 294 000 companies active in the sector.

- Manpower & Employment Growth: The sector has added 1.1 million new employees to its global workforce of over 20 million.

- Patents & Grants: It has accumulated over 30000 patents and received 1984 grants.

- Global Footprint: The industry has a broad global presence, with major hubs in the US, UK, India, Germany, and Canada, and city hubs in New York City, London, Dubai, Sydney, and Melbourne. Additionally, India is set to achieve USD 3 trillion in tourism GDP by 2047.

- Investment Landscape: The average investment value is USD 30.5 million per round, with over 14 000 investors actively participating in more than 48 000 funding rounds.

- Top Investors: Investors like Tiger Global Management, Goldman Sachs, SoftBank Vision Fund, and more have made significant investments, supporting sector growth and innovation.

- Startup Ecosystem: Five innovative startups include Thynk (cloud-based management), Xequence (AI assistance), Buk Protocol (decentralized bookings), Smart Servant (service robots), and Fastek (IoT sensors).

Methodology: How We Created This Hospitality Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of hospitality over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the hospitality industry

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the hospitality market.

What data is used to create this hospitality industry report?

Based on the data provided by our Discovery Platform, we observe that the hospitality market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The hospitality industry has a significant presence, with over 80000 publications in the past year.

- Funding Rounds: Our database contains data of more than 48 000 funding rounds, ranking it among the top performers.

- Manpower: The industry employs more than 20 million workers and has added over 1 million new employees in the last year.

- Patents: The sector shows a commitment to innovation, holding over 30 000 patents.

- Grants: It has also secured 1900+ grants, demonstrating its ability to attract support and funding for its projects and initiatives.

Explore the Data-driven Hospitality Industry Report for 2025

The report indicates a slight decrease of 0.84% in industry growth over the past year. Despite this, the ecosystem continues to be active with over 294 000 companies in the database. The sector shows solid employment growth, with a global workforce of 20.3 million, and an addition of 1.1 million new workers, indicating its adaptability and job creation capacity.

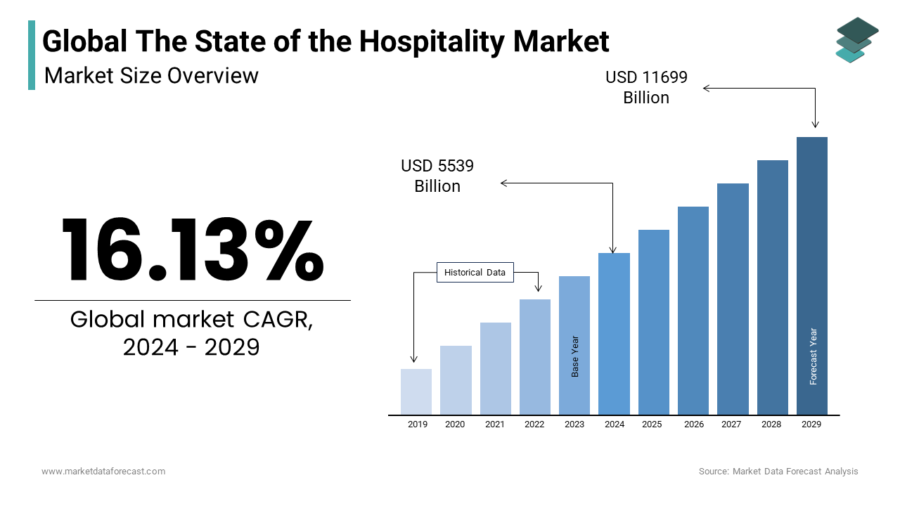

The hospitality market was valued at USD 5339 billion in 2024 and is set to reach USD 11 699 billion in 2029. The CAGR for the year 2024-2029 is 16.13%.

Credit: Market Data Forecast

A Snapshot of the Global Hospitality Industry

The hospitality industry shows steady resilience and growth. With a workforce of over 20 million individuals, this sector is a notable employer worldwide. The industry’s potential for growth is evident in its addition of 1.1 million employees over the past year. Further, the hospitality sector is vast and diverse, with over 294 000 companies.

Additionally, the Indian hospitality sector in India is set to grow by CAGR of 13.69%. These businesses, from small family-run establishments to large multinational chains, each add to the industry’s dynamism and innovation.

Explore the Funding Landscape of the Hospitality Industry

The hospitality industry presents a steady and promising investment environment. With an average investment value of USD 30.5 million per round, it is evident that stakeholders are promoting growth and innovation within this sector. The hospitality sector is also investing in energy-saving technologies, green building certifications, sustainable sourcing, etc.

The participation of more than 14 000 investors supports the industry’s robust investment ecosystem. This significant number of investors provides funds as well as expertise, advancing the industry in unique and innovative ways. Further, the industry has seen the closure of more than 48 000 funding rounds, reflecting its active financial transactions. The investment extends to more than 20 000 companies, indicating the industry’s wide reach and diversity.

Who is Investing in the Hospitality Industry?

The hospitality industry has received significant investment, totaling over USD 14 billion from top investors. Here’s the list of notable investors:

- Tiger Global Management has invested USD 2.8 billion across 43 companies, showing its influence in the hospitality sector. Way, a brand activation technology company for hotels received USD 20 million series A funding from Tiger Global Management.

- Goldman Sachs has invested USD 2.2 billion in 33 companies, indicating its commitment to the industry’s growth.

- SoftBank Vision Fund has directed USD 1.6 billion into 18 companies, demonstrating its focus on ventures with growth potential. SoftBank Vision Fund 1 includes companies like OYO gained USD 1.4 billion quarter on quarter.

- Insight Partners has also invested USD 1.6 billion across 21 companies, indicating a targeted investment approach. It participated in Canary Technologies’ USD 50 million series C funding round in 2024.

- Sequoia Capital has put USD 1.2 billion into 30 companies, showing its trust in the sector’s opportunities. It also earned USD 80 to 90 million by selling a part of its 3% stake in OYO.

- T. Rowe Price has invested USD 1.2 billion among 10 companies, indicating a strategy focused on select opportunities.

- Warburg Pincus has allocated USD 975.3 million to 12 companies, emphasizing targeted investments in promising hospitality ventures.

- Temasek Holdings has invested USD 939.8 million invested in 12 companies, underlining its interest in the sector’s growth.

- GIC has committed USD 832.1 million across 16 companies, showcasing its investment in the hospitality industry’s expansion. It also acquired around 35% stake in Hotel Investment Partners (HIP) from Southern Europe.

- Accel has invested USD 814.1 million spread over 31 companies, highlighting its broad and strategic engagement in the sector.

These investments from key financial entities support the hospitality industry’s operations and lay a foundation for its future.

Explore Firmographic Data for All Hospitality Industry Trends

In terms of company involvement, hospitality management, and food services equipment trends stand out, involving 1.5K and 1.7K companies respectively. Cloud kitchens, with 1.1K companies, also have a significant presence, reflecting the emergence of this new business model.

- AI for Restaurants is improving customer experiences, streamlining operations, and creating new service delivery and personalization opportunities. There are currently 182 companies in this space. These companies collectively employ 8400 individuals, with an addition of 1000+ new employees in the last year. The annual trend growth rate of 43.43% indicates the ongoing adoption and development of AI technologies in restaurants.

- Food Delivery Robots are changing the logistics of food delivery by increasing speed, reducing costs, and meeting the growing demand for contactless delivery options. There are 50 companies in this sector, employing a workforce of 8900+ employees, including 700+ new hires in the last year. The annual trend growth rate of 24.62% shows a steady interest and investment in robotic delivery solutions.

- Cloud Kitchen, also known as Ghost Kitchens, is becoming an important part of the restaurant industry, driven by the surge in online food ordering. There are 699 companies in this sector, employing a workforce of 44 300+ individuals. The sector added 7400+ new employees in the last year. With an annual trend growth rate of 28.64%, cloud kitchens are rapidly gaining traction, providing restaurants with a cost-effective way to expand their reach without the overhead of traditional dining spaces.

5 Top Examples from 4000+ Innovative Hospitality Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Thynk provides Hospitality Cloud

Belgium startup Thynk offers Thynk Platform, an integrated platform with hospitality modules. The platform uses Salesforce to streamline operations through process automation. It offers features such as multi-property management, automation, mobility & productivity, and security & administration.

The startup’s platform also provides access to PMS data, offering centralized and clean data along with robust analytics. Consequently, Thynk provides hoteliers with resources for making decisions that contribute to profitability and strategic planning.

Xequence offers AI-powered Virtual Assistant

Indian startup Xequence develops RIDA, an AI-driven virtual assistant to assist travelers and travel operators. This platform leverages AI to make travel plans quicker, smoother, safer, and more economical. Its RIDA AI Rail Assistant provides train information, simplifies ticket booking, customizes trip planning, and offers travel advice and suggestions.

The RIDA Flight Assistant offers updates on flights, assists with bookings, provides support for baggage and security, and gives local recommendations. Lastly, RIDA Hotel AI Assistant offers tailored assistance, optimizes processes, safeguards privacy, and ensures secure interactions.

Buk Protocol creates an Ecosystem for Dynamic RWAs

US startup Buk Protocol develops a decentralized, open-chain protocol to enhance the flexibility of travel inventory distribution and booking. It establishes a modular infrastructure for dynamic RWA dApps and marketplaces.

The startup also facilitates the creation of secondary markets for all expiring assets, which encompass dynamic RWAs such as hotel bookings, event tickets, airlines, and more. This protocol benefits all participants, including travelers and asset owners like hotels, airlines, tour operators, and event organizers.

Smart Servant provides Hospitality Robots

Dutch startup Smart Servant offers service and cleaning robots for the hospitality sector. Its Plato robots are adept at serving and clearing tasks, and handling food and drink delivery in self-service restaurants. These robots also gather dirty dishes and move them to the dishwashing area.

The startup’s Keenon W3 robots specialize in room service, delivering food and drinks to hotel rooms. These robots interact with elevators through an integrated lift module or an API connection. Smart Servant’s Gaussian robots concentrate on hygiene and efficiency, contributing to personnel cost reduction.

Fastek enables Remediation and Equipment Monitoring

US-based startup Fastek focuses on the application of sensor technology and IoT sensors. It provides solutions for remediation and equipment monitoring, which assist businesses in automating manual tasks. This leads to the creation of facilities that are safer, smarter, and more environmentally friendly, while also minimizing downtime.

The startup offers asset tracking, which contributes to a secure work environment for employees. A notable feature is the panic button technology, which improves worker safety.

Gain Comprehensive Insights into Hospitality Trends, Startups, or Technologies

The hospitality industry outlook report depicts a sector that is resilient in the face of global pressures – with millions of new tourists poised to join the industry soon. AI for personalized service and cloud-based operational platforms suggest a shift towards a more responsive, data-driven, and customer-oriented industry. Get in touch to explore all 4000+ startups and scaleups, as well as all industry data and trends impacting hospitality companies.

![AI in Automotive: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Automotive-SharedImg-StartUs-Insights-noresize-420x236.webp)