The 2025 Industrial Automation Industry Report analyzes the latest trends, technologies, and market dynamics shaping the sector. This report examines key advancements in applications that drive operational efficiency and productivity. It also explores the impact of regulatory changes, global supply chain disruptions, and evolving customer demands on the industry. Moreover, the report offers a detailed overview of how companies leverage automation to enhance competitiveness and sustainability.

The report was last updated in January 2025.

This industrial automation report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: Industrial Automation Outlook 2025

- Industry Growth Overview: The industrial automation sector includes over 16 300+ companies and 3400+ startups. It experienced an annual growth rate of 0.05%. The industrial automation market. The industrial automation software market is expected to reach USD 109.34 billion by 2032, growing at a compound annual growth rate (CAGR) of 8.39% from 2025 to 2034.

- Manpower & Employment Growth: The global workforce in the industry stands at 827 000+. In the last year, it added over 56 000 new employees.

- Patents & Grants: The industry holds over 14 000 patents filed by more than 6400+ applicants and secured over 760 grants.

- Global Footprint: The top five country hubs are the USA, India, Italy, China, and Germany. North India is becoming a major player in the industrial automation market, driven by a strong manufacturing base and increasing focus on modernization. Leading city hubs include Pune, Bangalore, Chennai, Shenzhen, and Singapore.

- Investment Landscape: The average investment value is USD 14.7 million per round. The industry attracted over 780 investors, closing more than 2100+ funding rounds, and supporting over 710 companies within the sector.

- Top Investors: Top investors include Techstars, Y Combinator, and the National Science Foundation. The combined investment from these top investors amounts to more than USD 213 million.

- Startup Ecosystem: The top startups in this segment include Vieaura (Codeless AI SaaS platform), SONOBOTICS (NDT inspection robotics), Tesseract Technologies (FFF 3D printer), FORTAI (mining value chain management), and Capra Robotics (mobile robot).

Methodology: How we created this Industrial Automation Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies, and market trends.

For this report, we focused on the evolution ofthe industrial automation sector over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the industrial automation sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the industrial automation market.

What data is used to create this industrial automation report?

Based on the data provided by our Discovery Platform, we observe that the industrial automation industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: Over 6000 news articles were published about the industrial automation sector in the last year

- Funding Rounds: Our database records the closure of over 2190 funding rounds.

- Manpower: In terms of workforce, the industry employs 827 000+ workers, adding over 56 600 new employees in the last year alone.

- Patents: The industry holds 14 000+ patents.

- Grants: It also secured over 760 grants.

Explore the Data-driven Industrial Automation Report for 2025

The Industrial Automation Industry Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap illustrates key metrics from our extensive database, which encompasses over 16 300+ companies, including 3467 startups.

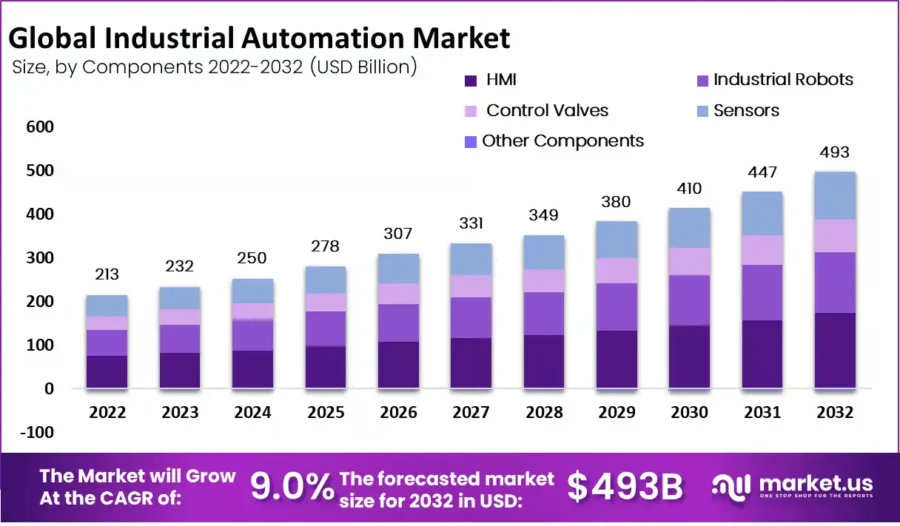

The global industrial automation market is expected to be worth around USD 493 billion by 2032 from USD 232 billion in 2023, growing at a compound annual growth rate (CAGR) of 9.0% during the forecast period.

Credit: Market.us

The industry experienced an annual growth of 0.05%, supported by over 14 000 patents and 760+ grants. The global workforce across these companies stands at 827 000, with an employee growth of 56 000+ in the past year.

A Snapshot of the Global Industrial Automation Industry

The industrial automation industry experiences an annual growth of 0.05%, supported by an ecosystem of 3467 startups. Additionally, Rockwell Automation plans to open a new 98 000-square-foot manufacturing facility in Chennai, India, by the first half of 2025, employing about 230 workers.

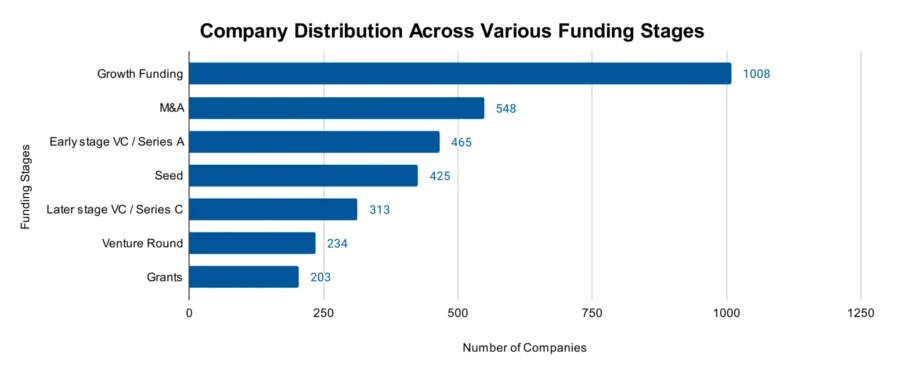

These startups span various stages of development, with over 400 in the early stages and more than 560 having gone through mergers and acquisitions (M&A).

The industry’s innovative drive is evidenced by 14 000 patents filed by over 6400 applicants. Moreover, it reflects a yearly patent growth rate of 3.90%. China and the USA lead in patent issuance, with China accounting for 4K patents and the USA close behind with 3900.

Explore the Funding Landscape of the Industrial Automation Industry

Investment in the industrial automation sector stands with an average investment value of USD 14.7 million per round. The industry attracted over 780 investors, who closed more than 2100+ funding rounds and supported more than 710 companies.

This data highlights the sector’s dynamic nature, characterized by innovation, financial backing, and a pipeline of emerging companies to drive future growth.

Who is Investing in Industrial Automation Companies?

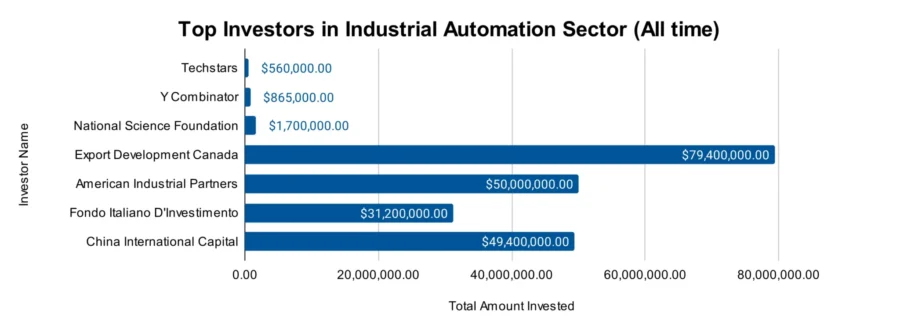

The industrial automation industry attracted investment from top investors, with a combined value of more than USD 213 million. Here are the details of the top investors and their contributions:

- Techstars supported 6 companies with a total of USD 560K. It invested in industrial automation companies like AutoMetrics, Dig Robotics, Slytrackr, and more.

- Y Combinator backed 5 companies with USD 865K. It also invested in Pivot Robots, founded by students of Carnegie Melon University.

- National Science Foundation funded 3 companies with USD 1.7 million.

- Export Development Canada contributed USD 79.4 million to 3 companies. It supported the launch of 15 new advanced manufacturing projects valued at USD 59 million, run by 31 companies in Canada.

- American Industrial Partners financed 2 companies with USD 50 million. It invested in Trew Automation, a company which provides warehouse automation systems (WES), warehouse control systems (WCS), and more.

- Fondo Italiano D’Investimento invested USD 31.2 million in 2 companies. Through its Fondo Italiano Tecnologia e Crescita (FITEC), it led a Series B investment round of over USD 17 million in Inxpect.

- China International Capital Corporation (CICC) injected USD 49.4 million into 2 companies.

These investments highlight the diverse range of financial support within the industry, spanning early-stage startups to more established companies.

Access Top Industrial Automation Innovations & Trends with the Discovery Platform

Explore the firmographic details of emerging trends in the industrial automation sector:

- The Power Management trend includes over 1500+ companies. It employs a workforce of 108 300+ individuals, including 8700+ new employees added in the last year. The sector demonstrates an annual trend growth rate of 3.69%.

- Collaborative Robotics encompasses 1800+ companies. This area employs 91 300+ individuals, with over 5000 new employees joining in the last year. The annual trend growth rate is 17.59%.

- Embedded Systems are developed by over 4100+ companies that have been identified. It employs a workforce of 173 300+ individuals, with 16 200+ new employees added in the last year. The sector’s annual trend growth rate stands at 3.79%.

5 Top Examples from 3460+ Innovative Industrial Automation Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Vieaura develops a Codeless AI SaaS platform

US-based startup Vieaura advances industrial processes with a no-code extended reality (XR0 platform. This SaaS platform extends edge access while enabling guided workflows and optimizing standard operating procedures (SOPs).

The platform integrates with back-office applications through an API gateway without customization for real-time data collation and analysis with structured and unstructured data, and analytics. Moreover, Vieaura’s cloud platform centralizes data to secure reliable access for process control and analysis.

SONOBOTICS offers NDT Inspection Robotics

UK-based startup SONOBOTICS improves the inspection workflow by integrating robotic and non-destructive testing (NDT) technologies for enhanced safety and efficiency. The startup’s platforms enable autonomous operation and low-power demands. Its Sonus EVO, an electromagnetic acoustic transducer (EMAT) acquisition system, offers non-contact ultrasonic testing without surface preparation.

The Sonus EVO Lite, another EMAT system, provides hardware and software integration with robotic systems. Both platforms support wireless communication and the robotic operating system (ROS) for quick deployment.

Tesseract Technologies builds an FFF 3D Printer

Dutch startup Tesseract Technologies uses direct drive technology in 3D printing. This fused deposition modeling (FDM) 3D printer ensures submicrometer precision to achieve accuracy levels.

The direct drive technology simplifies assembly complexity and reduces costs by optimizing and developing motors specifically for additive manufacturing. It incorporates a dedicated computerized numerical control (CNC) positioning system based on direct-drive linear motors for faster and more accurate printing.

FORTAI manages the Mining Value Chain

Canadian startup FORTAI manages the value chain in the mining industry through its ADMMIT technology. This technology autonomously manages material movement in real time while integrating with planning and inventory controls. Its SmartCubes and SmartModules products provide inventory visibility, using GPS, Wi-Fi, Bluetooth, and integrated sensors for real-time tracking.

These technologies ensure full chain visibility and eliminate shadow inventory by maintaining an accurate audit trail. Keycard access and the ADMMIT app control material access, and enhance security and operational efficiency. The system also supports inventory updates outside network coverage by leveraging mobile device data.

Capra Robotics develops a Mobile Robot

Denmark-based startup Capra Robotics designs Capra Hircus, an outdoor mobile robot that maneuvers and carries different loads in diverse terrains. It integrates with tools and applications via a direct interface to its operating system.

The robot’s autonomous navigation utilizes odometry, global navigation satellite system (GNSS), and visual simultaneous localization and mapping (VSLAM) for movement and positioning. Moreover, the Capra Hircus robot features a robust suspension system to navigate tight spaces and challenging environments.

Get Insights into Industrial Automation Trends, Startups, or Technologies

The 2025 Industrial Automation Industry Report highlights the sector’s resilience in addressing challenges like supply chain disruptions and regulatory complexities. Advancements in robotics, AI, and IoT drive innovation and create a competitive edge. These technological breakthroughs enhance scalability, efficiency, and market adaptability. Get in touch to explore all 3460+ startups and scaleups, as well as all industry trends impacting industrial automation companies.