The Insurance Industry Report provides an in-depth analysis of the changes and adaptability observed within the sector. Amidst global economic fluctuations, insurance companies have managed challenges and capitalized on opportunities for innovation and growth. This report examines key firmographic data, emerging trends, and the strategic movements shaping the landscape. The surge in digital claims management, integration of risk assessment technologies, and more are advancing insurance services.

This report was last updated in July 2024.

This insurance outlook serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

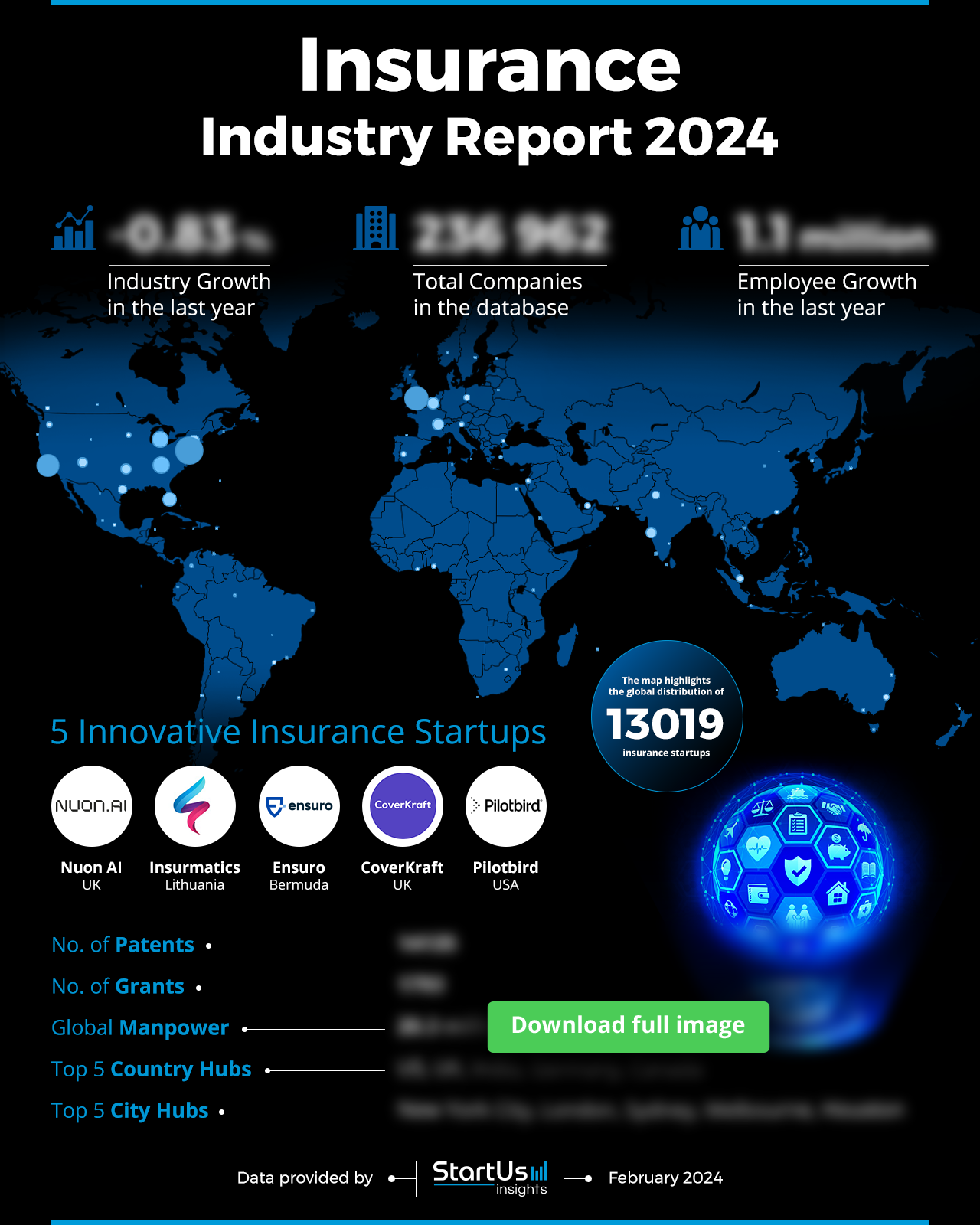

StartUs Insights Insurance Industry Report 2024

- Executive Summary

- Introduction to the Insurance Industry Report 2024

- What data is used in this Insurance Industry Report?

- Snapshot of the Global Insurance Industry

- Funding Landscape in the Insurance Industry

- Who is Investing in the Insurance Industry?

- Emerging Trends in the Insurance Industry

- 5 Insurance Startups impacting the Industry

Executive Summary: Insurance Industry Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 13K+ insurance startups developing innovative solutions to present five examples from emerging insurance industry trends.

- Industry Growth Overview: The insurance sector experienced a slight contraction of 0.83% in annual growth with over 23600+ companies listed.

- Manpower & Employment Growth: With a total workforce of 20.3 million, including 1.1 million new employees added in the last year. The industry demonstrates its position as a major employer.

- Patents & Grants: The sector also demonstrates robust innovation with 14000+ patents and 1793 grants.

- Global Footprint: Major country hubs include the USA, UK, India, Germany, and Canada with top city hubs in New York City, London, Sydney, Melbourne, and Houston.

- Investment Landscape: It displays strong investor confidence with over 42000 funding rounds and an average investment value of USD 44.6 million per round.

- Top Investors: Leading investors such as SoftBank Vision Fund, Tiger Global Management, International Finance Corporation, and more have collectively invested over USD 20 billion.

- Startup Ecosystem: The report features 5 innovative global startups: Nuon AI (Real-time Insurance Pricing), Insurmatics (IoT for Property Insurance), Ensuro (Decentralized Capital for Insurance), CoverKraft (Insurance SaaS), and Pilotbird (Insurance Analytics).

- Recommendations for Stakeholders: Focus on technological integration and customer-centric services. Despite slight contractions in growth across the industry, leveraging the growing manpower will help stakeholders find new opportunities. The rising damages caused by changes in global weather patterns further highlight the key role of insurance in managing future disasters.

Explore the Data-driven Insurance Industry Report for 2024

The insurance report uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The report reveals a slight contraction of 0.83% in the sector growth over the last year. It incorporates data from 236000+ insurance companies that constitute the database. The global workforce in the industry stands at 20.3 million, with 1.1 million new jobs created in the last year.

What data is used to create this Insurance Industry report?

Based on the data provided by our Discovery Platform, we observe that the insurance industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: With over 220000 publications in the last year, the industry coverage is growing in media.

- Funding Rounds: Our database reveals more than 42000 funding rounds, indicating robust financial support.

- Manpower: The sector employs over 20 million workers and added more than 1 million new employees in the last year.

- Patents: 14000+ patents reflect the emphasis on innovation and technological advancement in the industry.

- Grants: With 1793 grants awarded, the industry receives support for research and development.

A Snapshot of the Global Insurance Industry

The insurance sector demonstrates steady growth and investor confidence, as reflected in the industry statistics. The manpower strength stands at 20.3 million, with an increase of 1.1 million employees over the last year. This highlights the industry’s expanding job market and its role as a major employer.

Explore the Funding Landscape of the Insurance Industry

Investor engagement in the insurance industry is robust, with the average investment value reaching USD 44.6 million. This statistic points to substantial financial commitments from the investment community. The sector has attracted more than 13000 investors, indicating broad confidence in its stability and growth prospects.

The dynamism of the market is further evidenced by the closure of more than 42000 funding rounds. This suggests a fertile environment for startups and established companies alike. With over 17000 companies receiving investments, the insurance industry underscores its potential for innovation and growth.

Who is Investing in the Insurance Industry?

The collective funding of the top investors in the insurance sector has exceeded USD 20 billion, underscoring the industry’s potential for growth and innovation.

- SoftBank Vision Fund leads this financial initiative, having invested USD 4.9 billion across 21 companies.

- Tiger Global Management follows with USD 3.2 billion invested in 41 companies, reflecting a broad and diverse investment strategy.

- International Finance Corporation, with investments of USD 2.9 billion in 38 companies, showcases its commitment to fostering growth in the insurance landscape.

- Goldman Sachs matches this investment figure with USD 2.9 billion distributed over 28 companies.

- Tencent has strategically positioned itself by injecting USD 2.7 billion into 32 companies, indicating its confidence in the sector’s tech-driven evolution.

- General Atlantic has concentrated its investments of USD 2.3 billion in 26 companies, preferring targeted growth areas within the industry.

- GIC, with an investment of USD 2 billion in 16 companies, signifies a focused approach to backing firms with strong innovation potential.

These top investors are injecting capital and actively shaping the future of insurance, thereby bringing an era of growth and innovation.

Explore Firmographic Data for All Insurance Industry Trends

- Insurance Claim Management, with 11000+ companies identified, remains a vital component of the industry. It experienced a slight reduction in growth, with an annual rate of -1.46%. Despite this, the sector welcomed 58000 new employees over the last year, employing 1 million individuals globally.

- Insurance Risk Management is a key trend, with 5000+ companies dedicated to this crucial function. The sector employs nearly half a million workers and has expanded its workforce by 22K+ in the last year. However, the annual trend growth rate has decreased slightly by -1.14%.

- Insurance Software, though smaller with 774 companies, is an emerging trend. It employs over 90K professionals and has grown by 7500 new employees in the last year. This segment has nearly maintained its momentum with a slight annual growth rate decline of -0.06%.

These trends suggest a sector that is adapting to changes, embracing new technologies, and continuously evolving to meet the needs of its clientele.

5 Top Examples from 13K+ Innovative Insurance Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Nuon AI supports Real-time Insurance Pricing

UK-based startup Nuon AI focuses on real-time retail pricing for insurance products to enhance market competitiveness and profitability. Its proprietary algorithms enable dynamic pricing adjustments in response to market conditions.

The startup’s technology caters to digital insurers and brokers dealing with a high volume of quotes, requiring real-time pricing adjustments via API. Nuon AI’s dashboard provides a configurable interface to monitor and control the AI’s pricing performance, ensuring secure, compliant, and auditable operations.

Insurmatics offers IoT As A Service for Property Insurance

Lithuanian startup Insurmatics provides IoT as a Service to transform workflows for property insurance, focusing on the Smart Home industry. Its all-digital approach allows insurers to cut costs and save time.

The startup trains AI models for various insurance processes, thereby enhancing claim management and customer service. Its cloud-based infrastructure offers insurance companies flexibility, faster time to market, and cost savings. Insurmatics also ensures compatibility with existing sensors, allowing for the integration of various protocols and technologies.

Ensuro builds Decentralized Capital For Insurance

Bermuda-based startup Ensuro provides a decentralized approach to capital provision for insurance risk. It enables easy investment in insurance risk, diversifying the insurance market’s capital sources. Further, it leverages smart contracts to curate competitive insurance portfolios.

The startup offers products like Koala Flex, ResilientGrowth, StormStrong, and more, each serving unique insurance needs. For instance, Koala Flex allows travelers to cancel bookings without justification, offering a substantial portion of the trip price back. ResilientGrowth, a blockchain-based solution, protects Kenyan farmers against climate change-induced losses. Lastly, StormStrong provides a resilience contribution to members if a hurricane strikes within a predefined distance.

CoverKraft offers Insurance Software as a Service

UK startup CoverKraft develops a SaaS low-code platform for the insurance industry. The platform enables insurance providers to offer their products and services online efficiently. The startup’s platform ensures reliability and cost savings compared to traditional legacy policy administration systems. CoverKraft’s SaaS platform allows rapid market entry with low investment.

Pilotbird provides Insurance Analytics

US startup Pilotbird develops a platform that analyzes social data points to enhance the insurance value chain. It offers Pilotbird Lifestyle Risk Scoring, Pilotbird Engage, and Pilotbird Revocation. These solutions assist in risk scoring, customer acquisition, and claims verification.

The platform matches specific lifestyle elements to relevant insurance products, engaging prospects and customers at the right time. Further, it applies social data analytics to validate claims. Pilotbird provides insights on potential customers, enhancing underwriting accuracy for group and individual insurance products.

Gain Comprehensive Insights into Insurance Trends, Startups, or Technologies

The 2024 Insurance Industry Report presents a sector undergoing a customer-centric transformation with innovations in claims and risk management, along with advancements in insurance software. These solutions make insurance more accessible, intuitive, and seamlessly integrated into our digital lives. Get in touch to explore all 13K+ startups and scaleups, as well as all industry trends impacting insurance companies.

![AI in Automotive: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Automotive-SharedImg-StartUs-Insights-noresize-420x236.webp)