Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the healthcare industry. This time, you get to discover five hand-picked InsurTech solutions impacting healthcare.

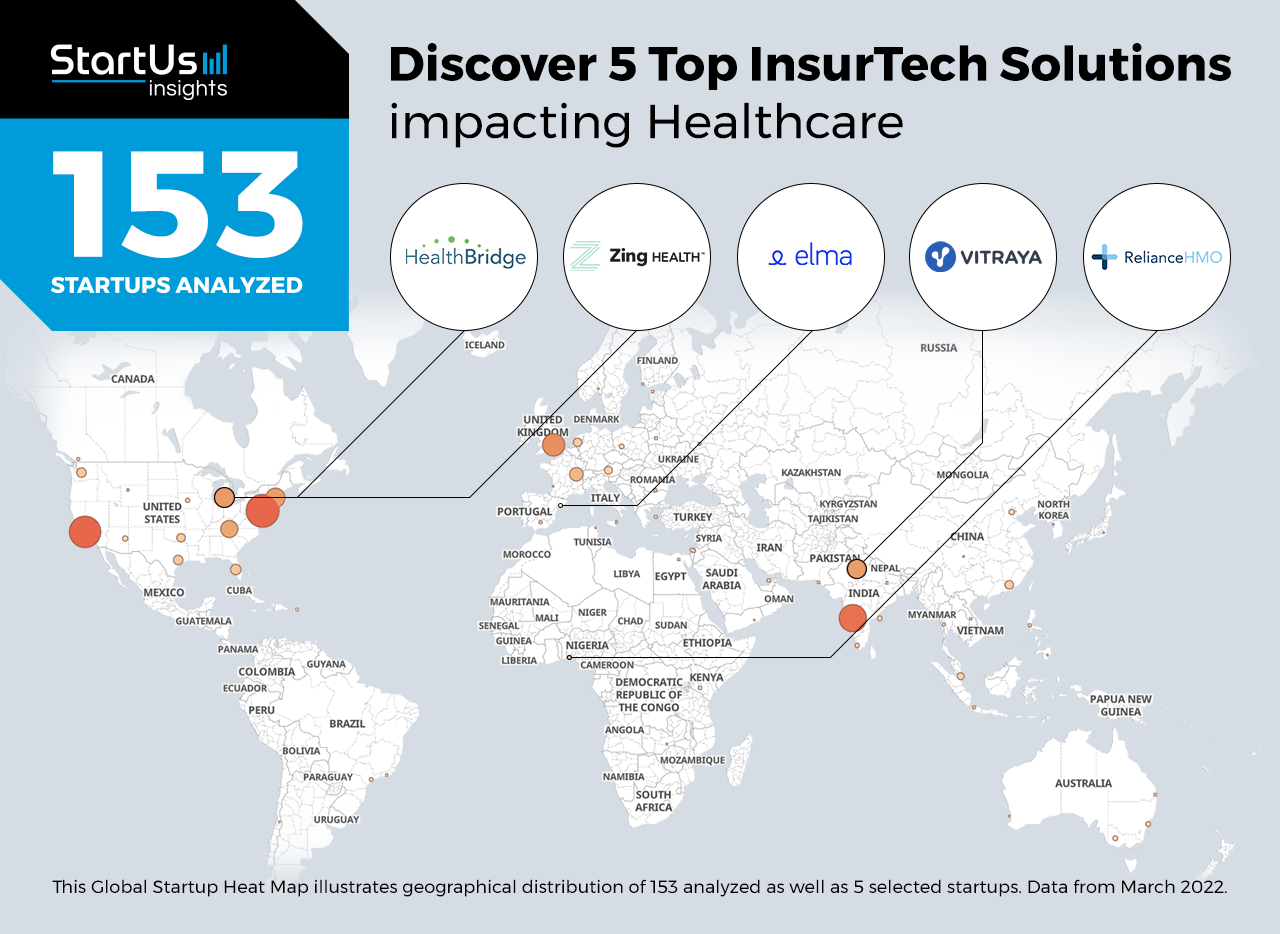

Out of 153, the Global Startup Heat Map highlights 5 Top InsurTech Solutions impacting Healthcare

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 153 exemplary startups & scaleups we analyzed for this research. Further, it highlights five InsurTech startups impacting healthcare that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 148 healthcare solutions, get in touch with us.

HealthBridge streamlines Health Claims Payment

Founding Year: 2017

Location: Grand Rapids, US

Funding: USD 30 M

Partner with HealthBridge for Insurance Claims Cost Coverage

HealthBridge is a US-based startup offering financial coverage for users before health claims kick in. It partners with employers and allows their employees to pay medical bills immediately after the claims to cover the cost of their treatments. Moreover, it provides friendly repayments terms for returning the money after the health insurance claims are passed. This enables employers to give additional financial security to their employees during medical emergencies.

Vitraya advances Health Insurance Settlement

Founding Year: 2019

Location: Jalandhar, India

Funding: USD 2 M

Work with Vitraya for Claims Payment Automation

Indian startup Vitraya develops a health insurance claims settlement platform. It uses blockchain-based smart contract technology to secure all transactions by avoiding any forgeries and detecting compliant violations. During health insurance claims, the platform processes the data and instantly informs how much amount the insurer has approved. It also initiates claims payments for hospitals. Blockchain further enables faster and more secure transactions, leading to instant approvals for insurance claims. Thus, Vitraya enables healthcare providers and health insurers to settle claims more efficiently.

Elma enables Personalized Medical Plans

Founding Year: 2017

Location: Barcelona, Spain

Funding: USD 7,8 M

Use Elma’s solution for Employee & Individual Health Coverage

Elma is a Spanish startup that builds a digital healthcare platform for personalized medical plans. It offers multiple insurance plans ranging from individual to employee-specific for suiting different requirements of the clients. These plans give users access to their health network, consisting of thousands of medical professionals, creating a holistic care platform. Elma also enables the clients to secure their medical financial status and gain access to expert medical advice.

Reliance HMO offers Integrated Health Insurance

Founding Year: 2016

Location: Lagos, Nigeria

Funding: USD 40 M

Innovate with Reliance HMO for Need-based Health Cover

Nigerian scaleup Reliance HMO makes a healthcare platform that advances integrated health insurance. It integrates telehealth and affordable insurance services to address financial and care facets of medical requirements. The plans on the platform cover health insurance for individuals, families, and businesses. The platform also allows access to expert medical consultation and lets the users avoid documentation hassles involved during insurance purchases.

Zing Health provides Medicare Advantage Plans

Founding Year: 2019

Location: Chicago, US

Funding: USD 25 M

Reach out to Zing Health for Inclusive Medicare Access

Zing Health is a US-based startup that enables medicare advantage plans for historically neglected communities. It offers a monthly subscription for providing users with access to medical care and insurance. This enables patients to avoid deductibles on their insurance and get benefits such as regular doctor visits, diagnostic cost coverage, and dental coverage, among others. This way, Zing Health is enabling people to get access to first-rate healthcare services even with fewer resources.

Discover more InsurTech Startups

InsurTech startups such as the examples highlighted in this report focus on health insurance settlement, personalized medical plans, integrated health insurance as well as medicare advantage plans. While all of these technologies play a major role in advancing the insurance industry, they only represent the tip of the iceberg. To explore insurance technologies in more detail, let us look into your areas of interest. For a more general overview, download our free InsurTech Innovation Report to save your time and improve strategic decision-making.