As consumers, we are bombarded with new technologies faster than ever before. Within the lifespan of many of us, we have come from phones hung on the walls to phones with far more computing power than the first rockets. New technologies simplify our lives by making tasks easier, but these new technologies also complicate things as they are often harder to understand and use. This is why your grandmother most likely won’t get on TikTok anytime soon. Clearly, not all new technologies (or devices or services) are worth investing our time in. Companies seeking external collaborators face a similar conflict.

In the age of information and distributed innovation, the barrier to entry for startups is low. Startups around the world learn from each other as well as established companies and have access to funding at an unprecedented scale. For large corporations, this means that young startups are always developing competing technologies that challenge the status quo. Many of these upcoming technologies will fizzle out, but some will have a lasting impact. Which technologies to bet on and when is a question that companies need to continuously ask themselves. However, getting it right is incredibly difficult.

Do you invest early in emerging technologies and risk possible failures? Or do you wait till these technologies are more mature and risk losing the early-mover advantage? This is the paradox that companies must confront and overcome to stay in business long-term.

Why is it hard to time Technology Investments?

To answer this, we need to look at the four ways a company might approach investing in new technologies.

The Reactive Approach

A company that takes this approach has deep pockets and buys out any competition that may arise. This company will react to disruptive technology trends with mergers and acquisitions with younger companies and startups leading the disruption. While this company would have fared well in the last century, that’s no longer the case in the 21st century. As innovation occurs simultaneously around the world, it will see fierce competition spring up all of a sudden, especially in industries with short time-to-market times. Needless to say, this company will find it hard to survive.

The Early Investor Approach

In this age of failing fast and often, no company can afford to ignore emerging trends. This company regularly monitors emerging startups and partners with the startups that meet its innovation goals. However, betting on the future is not without risks. If this company invests too much in one or more trends that die out soon, it will impact their finances. To succeed, this company can diversify its bets. This company is likely to survive, but bad bets may hurt its growth.

The Wait it Out Approach

Just like companies that invest early, this company monitors emerging trends every now and then. However, it mainly collaborates with proven startups and technologies. This company is more likely to bet on technologies that disrupt the industry. However, its competitors are also monitoring the same startups and technology trends. What is the guarantee then that it will get the best deal when it is late to place its bid? Not much. Therefore, this company may get consistent growth but risks losing out to its competitors.

The Trend Intelligence Approach

This company balances the benefits of investing in both very early and relatively matured technology trends. To do so, it does two things differently. First, it takes a data-driven approach to trend scouting. Second, it performs continuous trend intelligence to monitor startups and technologies at all stages. Because this approach follows technology trends over a prolonged period of time, it is better at predicting where they are headed. No points for guessing, this is the best bet when investing in technology. However, at current rates of innovation, companies need to analyze large amounts of data to do this efficiently.

Trend Intelligence Can Tell You When to Invest

At any given time, there are dozens of new trends emerging in any industry. Predicting which ones of these will disrupt the industry and which ones will die out is often not easy even for industry stalwarts. Considering how quickly industry disruptions occur now, predicting the future of a single technology trend is a hit or a miss most of the time. However, making no predictions at all isn’t something that companies can afford either. Data-driven trend intelligence allows companies to manage risk, the double-edged sword of innovation.

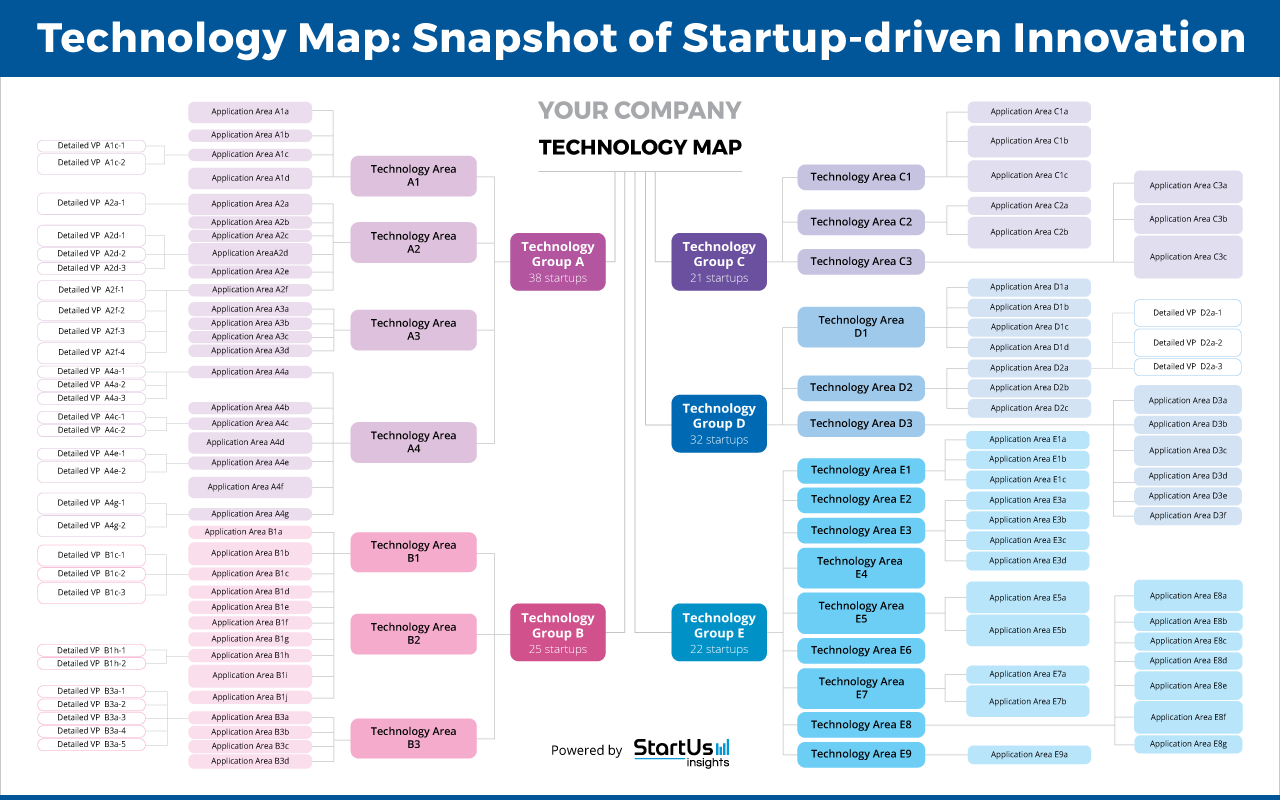

The Trend Analysis Map is an example of a Data-Driven Technology Scouting Deliverable. It gives you an overview of emerging technology trends, ensuring that you don’t worry about the right time to invest in technologies. Example provided by StartUs Insights.

While big corporations spend millions or billions on research and development (R&D) teams, most innovation happens in the startup ecosystem. This is mainly due to the fact that startups are leaner and, thus, move faster. Like a horse with blinders, companies can often miss out on the developments happening in their peripheral vision.

This is why companies need solutions that analyze publicly available innovation data to discover emerging trends and the industries they impact. Trend intelligence fills this gap to enable companies to stay updated. It is the process of identifying emerging and latent trends and developments that will impact a company’s competitiveness in the long term. As part of innovation intelligence, it allows companies to find the emerging and latent trends and developments.

Which Questions does Trend Intelligence Answer?

Companies leverage trend intelligence to seek answers to different questions based on their size, innovation needs, and internal capabilities. This is a sample of questions that trend intelligence allows you to answer.

- Which nascent technologies are most likely to disrupt your industry?

- If multiple emerging technologies solve the same problem, which of them is likely to have a bigger impact?

- How do emerging technology trends improve your bottom line?

- Which technology trends have the most potential in value addition for your customers?

- How much should you invest in which emerging technology and when?

With billions of data points from multiple sources, it’s difficult to discover the right trends if you do not have the adequate expertise or tools required to navigate the trend landscape. The StartUs Insights Discovery Platform takes a systemic data-driven approach to find trends that are most relevant to your needs.

Depending on your innovation goals and requirements, we customize the deliverables of our trend intelligence services. These deliverables include:

- Trend Analysis Map: Based on data-driven research, we classify emergent trends and group them into categories.

- Trend Analysis Report: This report provides quantitative insights into top relevant trends as well as exemplary startups.

- Exemplary Startups Database: Innovative startups that are advancing the emerging technologies in the industry.

To discover how StartUs Insights can empower you to find the most relevant trends impacting your industry and stay competitive in a dynamic market, we offer a free consultation. If you want to quickly find and track industry trends that will shape your industry, get in touch today to identify what’s next.