The 2024 Last Mile Delivery Report offers a comprehensive analysis of the logistics sector, which is undergoing significant changes. The report emphasizes the adoption of advanced technologies and sustainability practices that are transforming the industry. With increasing consumer expectations for quick and efficient services, companies are offering autonomous delivery, optimization software, and eco-friendly logistics. The report explores key trends, firmographic data, and investment insights and offers a clear view of the present scenario and potential future developments.

This report was last updated in July 2024.

This last mile industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Last Mile Delivery Report 2024

- Executive Summary

- Introduction to the Last Mile Delivery Report 2024

- What data is used in this Last Mile Delivery Report?

- Snapshot of the Global Last Mile Delivery Industry

- Funding Landscape in the Last Mile Delivery Industry

- Who is Investing in Last Mile Delivery?

- Emerging Trends in the Last Mile Delivery Industry

- 5 Last Mile Delivery Startups impacting the Industry

Executive Summary: Last Mile Logistics Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1100+ last mile startups developing innovative solutions to present five examples from emerging last mile industry trends.

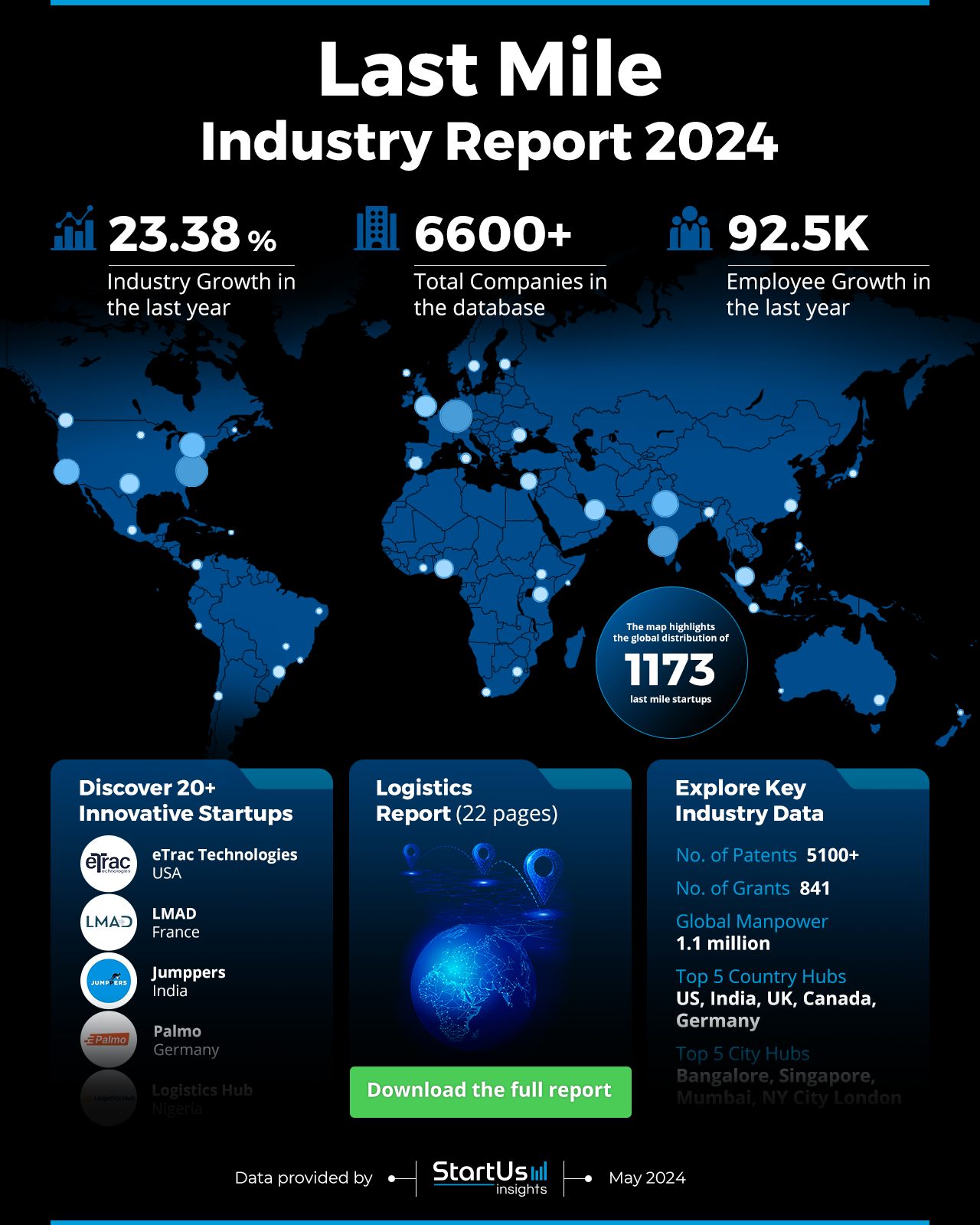

- Industry Growth Overview: The last mile logistics sector, with an annual trend growth rate of 23.38%, is a significant contributor to logistics innovations. It also comprises over 6600 companies.

- Manpower & Employment Growth: The industry’s workforce is over 1.1 million, with an increase of 92500 new employees in the past year. This indicates positive employment growth and sector vitality.

- Patents & Grants: The sector has over 5100 patents and 841 grants. This shows a clear emphasis on innovation, which supports its technological advancements.

- Global Footprint: The industry has operations worldwide, with notable activities in the United States, India, the UK, Canada, and Germany, and key city hubs in Bangalore, Singapore, Mumbai, New York City, and London.

- Investment Landscape: The sector has seen over 5000 funding rounds with an average investment value of USD 18 million per round. It has drawn the attention of more than 10000 investors.

- Top Investors: Notable investors such as Alibaba Group, SoftBank Vision, Fidelity, and others have collectively invested over 14 billion in the industry.

- Startup Ecosystem: Highlights include five innovative startups eTrac Technologies (Last Mile Visibility), LMAD (Last Mile Autonomous Delivery), Jumppers (Last-mile EV Ecosystem), Palmo (Sustainable City Logistics), and Logistics Hub (API-driven Delivery Management).

- Recommendations for Stakeholders: Stakeholders should maintain growth by investing in emerging technologies like AI and blockchain. Forming partnerships with startups that focus on sustainability and AI optimizations could enhance competitiveness.

Explore the Data-driven Last Mile Delivery Report for 2024

The Last Mile Delivery Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database holds a substantial collection of more than 6600 companies, inclusive of 1173 startups that contribute significantly to industry innovation.

The industry has seen growth of 23.38% in the past year, which is supported by intellectual contributions. This is marked by over 5100 patents and 841 grants. The global workforce now includes 1.1 million individuals, with an increase of 92500 employees in the last year, indicating strong employment opportunities and sector health.

Countries like the United States, India, the United Kingdom, Canada, and Germany are key hubs that nurture a diverse ecosystem for business operations and growth. Similarly, cities such as Bangalore, Singapore, Mumbai, New York City, and London are important city hubs that are contributing to the strategic market presence and operational success.

What data is used to create this last mile delivery report?

Based on the data provided by our Discovery Platform, we observe that the last mile industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The last mile industry has a strong presence in news coverage and publications, with over 6000 publications in the last year.

- Funding Rounds: Our database contains data on over 5000 funding rounds, indicating that this industry is successful in attracting investment.

- Manpower: The industry employs more than 1 million workers and added over 92000 new employees last year, showing its substantial workforce.

- Patents: Innovation in the last mile sector is marked by its 5100+ patents, underlining its contribution to technological advancements.

- Grants: The industry has obtained 841 grants, showing considerable support and recognition from various funding bodies.

- Yearly Search Growth Rate: With a yearly global search growth rate of 19.32%, the industry’s relevance and interest are on the rise and it performs well compared to many other sectors.

A Snapshot of the Global Last Mile Industry

The last mile industry shows consistent growth and investor trust. With a workforce of over 1.1 million, the industry has seen an influx of talent and has added more than 92000 employees in the past year. This growth in workforce is mirrored across more than 6600 companies operating within the sector, which indicates a lively and growing industry landscape.

Explore the Funding Landscape of the Last Mile Industry

The industry’s investment dynamics are noteworthy. The average investment per funding round is USD 18 million, showing the considerable financial support that fuels innovation and growth in this sector. Over 10000 investors have interacted with the industry, participating in more than 5000 funding rounds.

This financial activity has benefited over 1700 companies, showing a wide and effective distribution of resources that supports a range of enterprises from startups to established leaders. This depicts the last mile industry’s economic impact and also its important role in shaping future logistics and delivery solutions globally.

Who is Investing in the Last Mile Industry?

The last mile industry has attracted significant investment, with leading investors contributing more than USD 14.8 billion combined. Here’s a closer look at these key players and their commitments:

- Alibaba Group has invested USD 5.3 billion across 7 companies, marking it as a major single investor in terms of monetary value.

- SoftBank Vision Fund has made investments totaling USD 2.4 billion in 5 companies, indicating its strategic focus on businesses with high growth potential.

- Fidelity Investments has contributed USD 1.5 billion, spread over 3 companies, showing its belief in the industry’s future.

- T. Rowe Price has invested USD 960.5 million in 4 companies, demonstrating a strong interest in fostering innovation.

- JD.com has allocated USD 815.8 million to 2 companies, highlighting its focused investment approach.

- Temasek Holdings has committed USD 711.5 million to 4 companies, reflecting its diverse portfolio strategy.

- DST Global’s investment strategy includes USD 650 million distributed among 4 companies.

- Luxor Capital Group has directed USD 587.8 million towards 2 companies, emphasizing its selective investment criteria.

- Amazon, with its varied business interests, has invested USD 583 million in 4 companies, reinforcing its involvement in the industry’s growth.

- Techstars, while investing a smaller amount of USD 5.9 million, has spread this across 29 companies, showcasing a strategy of wide-ranging, foundational support.

Gain Access to Top Last Mile Innovations & Industry Trends with the Discovery Platform

Take a look at the emerging last mile delivery trends along with the firmographic insights:

- The autonomous robot sector is evolving at a steady pace, with 1800+ companies actively contributing to technological advancements. These firms employ over 141600 individuals, with an addition of 11900 new employees over the last year. This indicates the industry’s expansion. The annual trend growth rate is 12.39%, which shows continued interest and investment in robotics technology. This trend points to the growing use of automation and robotics in logistics, enhancing efficiency and innovation.

- Optimization software plays an important role in improving operational efficiencies in logistics. With 1400+ companies dedicated to this technology, the sector employs around 73800 workers and has added 6600 new hires in the past year. The trend’s growth rate is 7.23% annually, suggesting a consistent demand for software solutions that enhance decision-making processes and resource utilization.

- Green logistics is becoming more prevalent as industries shift their focus towards sustainability. The field comprises 398 companies that merge innovative logistics solutions with environmental stewardship. These companies collectively employ over 113100 individuals, with 3400 new employees joining last year. An annual growth rate of 15.19% indicates growing corporate and consumer interest in environmentally friendly practices.

5 Top Examples from 1100+ Innovative Last Mile Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

eTrac Technologies offers Last Mile Visibility

US startup eTrac Technologies provides visibility solutions for the final mile of the supply chain. Its platform integrates directly with existing transportation management systems (TMS) to enhance operational visibility. This integration allows users to manage compliance and optimize carrier networks without the need for multiple integrations. The technology extends the functionalities of any TMS and enables companies to better handle the complexities of final mile logistics. eTrac’s Final Mile Carrier Network connects users to a vast network of carrier options and streamlines processes. In addition, its Final Mile Marketplace feature facilitates effective management of logistics partnerships and operational demands.

LMAD enables Last Mile Autonomous Delivery

French startup LMAD offers a platform that manages various autonomous delivery robots across multiple locations. This platform offers a unified solution for handling different types of deliveries efficiently. By using electric autonomous robots, LMAD promotes a greener, more economical logistics approach. These robots enable direct deliveries from city hubs or mobile hubs and facilitates faster and more flexible service. Retailers and restaurants utilize this service to expand their customer reach and ensure direct delivery of online orders.

Jumppers builds Last-mile EV Ecosystem

Indian startup Jumppers offers a green last-mile delivery platform to focus on sustainable last-mile delivery solutions using electric vehicles. The platform simplifies last-mile operations for e-commerce, logistics, and delivery companies. It transforms the sector by establishing an EV ecosystem that improves efficiency and sustainability. Jumppers offers a modern, on-demand, hyperlocal delivery service that aligns with environmental objectives.

Palmo supports Sustainable City Logistics

German startup Palmo provides an AI-powered PalmoDMS optimized for light electric vehicles (LEV). This platform enhances the efficiency of urban logistics by integrating parcel data from various sources. It automates dispatch processes and consolidates parcel volumes to scale operations effectively. Further, Palmo supports driver performance with tools like co-pilot and optimized LEV routing. The system maintains flexibility and control with the operators. Palmo’s method simplifies last-mile deliveries and contributes to sustainable city logistics.

Logistics Hub enables API-driven Delivery Management

Nigerian startup Logistics Hub improves last-mile delivery operations in Africa with its digital platform. The platform includes a Delivery Management Dashboard that facilitates effective scheduling and real-time tracking of deliveries. The Riders App allows delivery personnel to handle tasks and navigate routes efficiently. The API integrations enable businesses to link their systems for coordinated operations. Further, the Admin Dashboard offers centralized control over delivery management and contributes to improved customer satisfaction.

Gain Comprehensive Insights into Last Mile Trends, Startups, or Technologies

As we wrap up the 2024 Last Mile Delivery Report, the sector seems ready for substantial growth, fueled by technological progress and sustainability initiatives. Trends like autonomous delivery systems, AI-powered optimization software, and a greater focus on green logistics are establishing benchmarks for efficiency and environmental stewardship. Get in touch to explore all 1100+ startups and scaleups, as well as all industry trends impacting last mile companies.