The logistics industry is expanding due to the exponential growth of the e-commerce sector over the past decade. The global digital logistics market size is projected to reach USD 120.33 billion by 2032, exhibiting a CAGR of 17.8%. In this guide, we explore advanced logistics technology that is digitizing operations. We will also cover how logistics companies can successfully implement these technologies for exponential growth.

Key Takeaways

- The Time to Act Is Now: Digital transformation is revolutionizing logistics, and early adoption is key to staying competitive.

- Top 10 Digital Transformation Technologies in the Logistics Industry [2025]

- Key Benefits: Digitization in logistics enhances efficiency, cost savings, real-time visibility, and customer experience.

- Step-by-Step Guide: A step-by-step approach ensures seamless logistics transformation and technology adoption.

- Future Trends: Quantum computing, AI-powered robotics, autonomous systems, and sustainable energy will shape logistics innovation.

How do we research and where is this data from?

We reviewed over 3100 industry innovation reports to extract key insights and construct the comprehensive Technology Matrix. To increase accuracy, we cross-validated this information with external industry sources.

Additionally, we leveraged the StartUs Insights Discovery Platform – an AI and Big Data-powered innovation intelligence tool covering over 4.7 million startups and more than 20K+ technologies & trends worldwide to:

- Confirm our findings using the Trend Intelligence feature.

- Gather market statistics for each technology.

- Identify startups for the “Spotlighting an Innovator” sections.

Why the Time to Act is Now

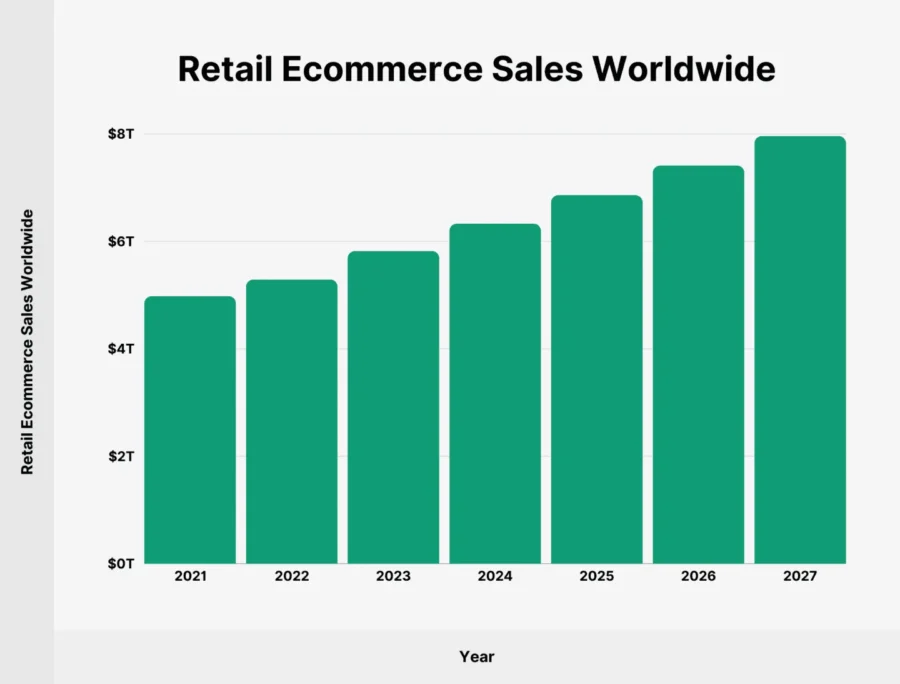

1. Rapid E-Commerce Growth

According to the US Census Bureau, US retail e-commerce sales accounted for USD 291.6 billion in Q2 2024, a 6.7% year-on-year (YoY) increase.

On a non-seasonal basis, the sales for the quarter amount to USD 282.3 billion of total sales. This highlights the expanding role of digital platforms in modern supply chain operations.

Source: Backlinko

2. Supply Chain Resilience and Visibility

Annual investment in supply chain resilience technologies is rising, covering risk monitoring, supplier collaboration portals, and IoT sensors.

This growth reflects the urgent need for agile, data-driven solutions capable of navigating dynamic market conditions and complex global trade routes. Digital transformation in logistics drives the adoption of real-time visibility platforms, advanced analytics, and more.

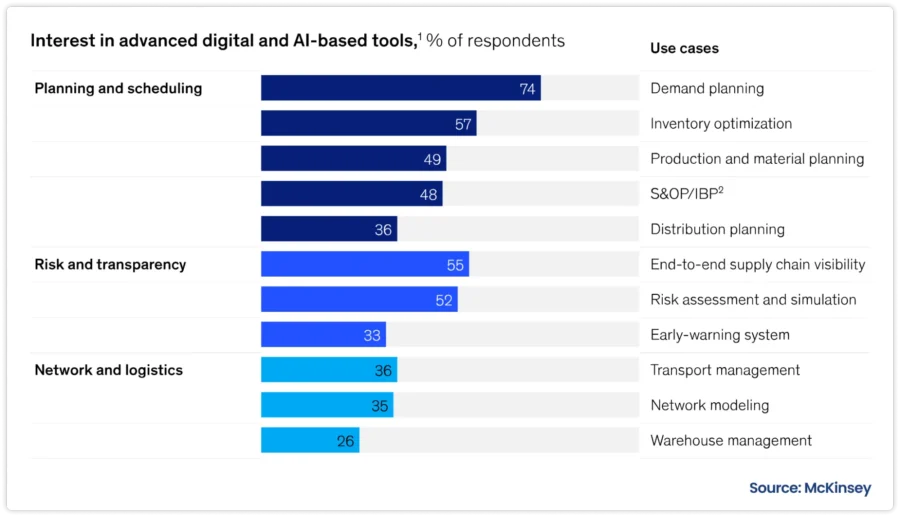

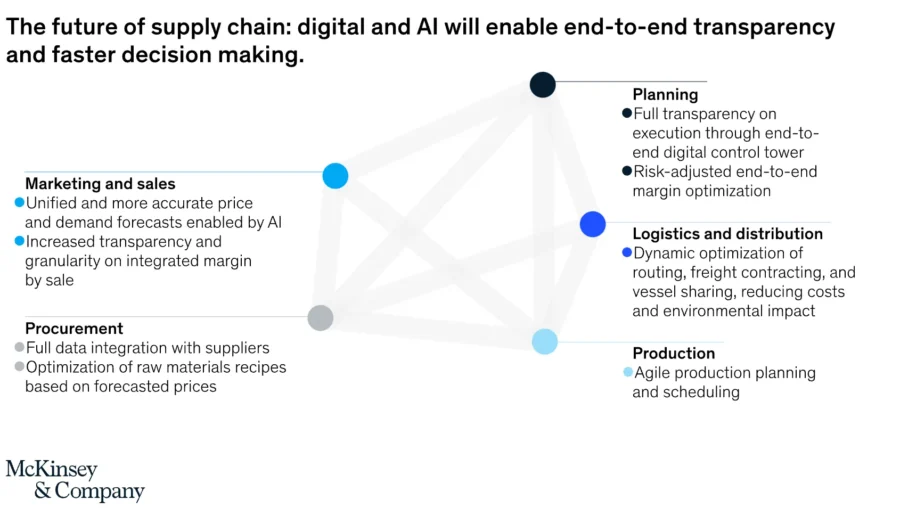

55% of organizations are prioritizing investments in digital and AI-powered solutions to enhance supply chain transparency and efficiency. On the other hand, Maximize Market Research reports that 70% of logistics enterprises are adopting digital strategies.

Source: Mckinsey

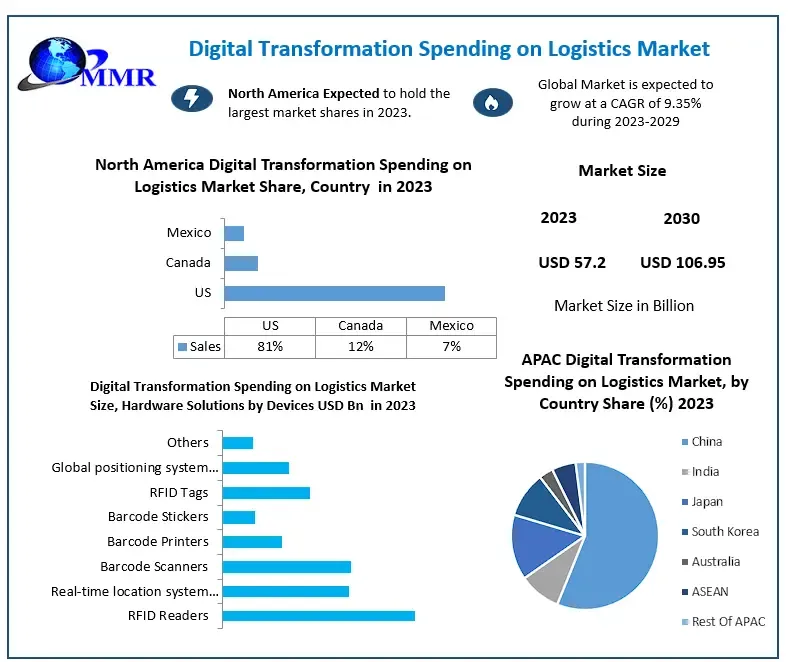

3. Rise of Advanced Technologies

AI, IoT, cloud computing, and blockchain fuel the rapid digital transformation in the logistics sector.

IoT-driven asset tracking solutions are expected to hit USD 5.56 billion in 2025, with real-time visibility-enhancing delivery accuracy.

Source: Maximize Market Research

Cloud adoption is surging, with cloud-based supply chain management anticipated to reach USD 71.93 billion by 2030.

Source: Data Bridge Market Research

Similarly, blockchain solutions are poised to jump from USD 1.26 billion in 2025 to USD 9.52 billion by 2030, reflecting a 49.87% CAGR.

These advanced technologies are redefining logistics processes, enhancing customer satisfaction, and fostering resilience in supply chains for years to come.

Top 10 Logistics Technologies to Watch in 2025

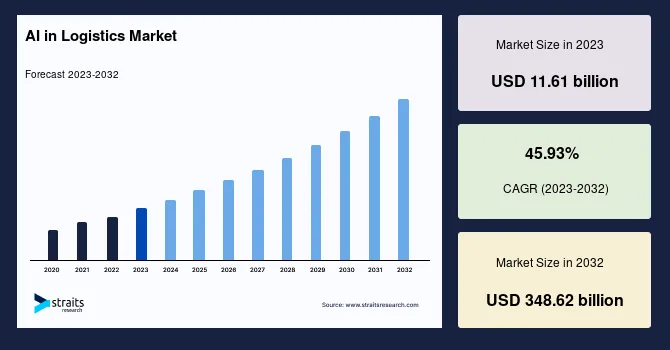

1. Artificial Intelligence and Machine Learning

AI in the logistics market is expected to reach USD 348.62 billion by 2032 with a CAGR of 45.93%. This growth is driven by the improvements AI brings to the industry – including cost reduction, enhanced inventory management, and increased service levels.

Source: Strait Research

Advanced AI and machine learning algorithms automate and optimize critical processes by handling routine tasks and offering critical insights.

As supply chains grow complex, the demand for efficient logistics operations intensifies. To tackle this, businesses are integrating AI-driven solutions.

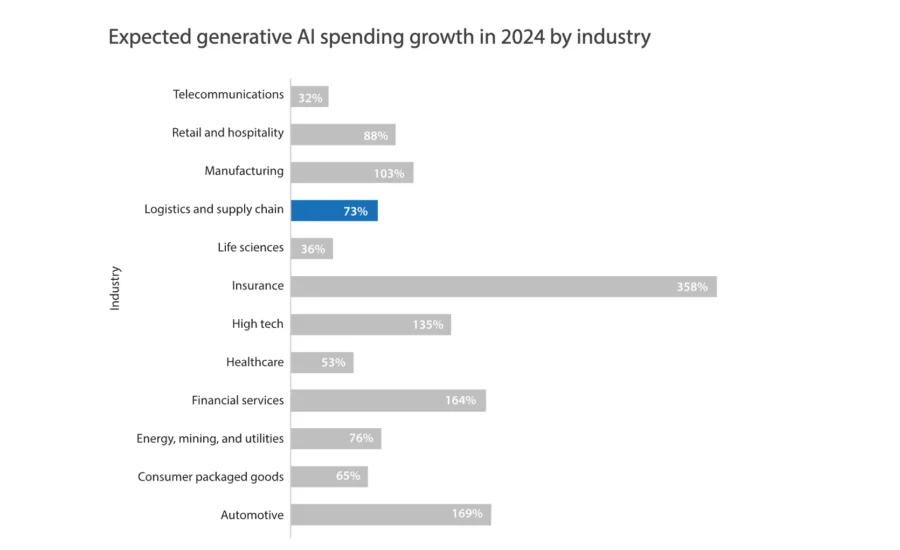

For example, generative AI spending by logistics and supply chain companies has grown by 73% in 2024, with more than 80% of these companies initiating their gen AI journeys.

Source: Infosys

Top corporates Amazon, Walmart, DHL, and FedEx are investing heavily in AI-powered warehouse and automation technologies for enhanced operational efficiency.

AI-enabled supply chain management has helped early adopters reduce logistics costs by 15%, inventory levels by 35%, and improve service levels by 65%.

AI-powered systems also enable real-time decisions that promote operational excellence by analyzing transportation routes, client demand patterns, and inventory levels.

Source: McKinsey & Company

European countries like Germany and the UK show similar trends, with a few companies yet to fully integrate AI into their logistic operations.

Market Insights & Growth Metrics for AI and ML

Scale and Magnitude

According to StartUs Insights, there are currently 107 584 AI-focused companies worldwide. This expansion underscores AI’s pivotal role in modern technology and its widespread adoption across various industries.

The US stands out as a leading region for AI firms and hosts approximately 34.6% of global AI companies. This significant concentration highlights the US’s robust AI ecosystem.

In terms of media coverage and public attention, AI ranks 16th among all emerging technologies according to StartUs Insights. This ranking reflects AI’s significant presence in media narratives, public discourse, and its perceived impact.

Growth Indicators

Artificial intelligence has seen a notable increase in global interest, with annual search interest rising by 28.09%, as reported by StartUs Insights. This surge reflects the growing curiosity and engagement with AI technologies.

In terms of funding, AI has experienced a five-year growth rate of 67.54%. This indicates a substantial increase in investments dedicated to AI development and implementation.

Regarding venture capital (VC) funding, AI startups were instrumental in the resurgence of US venture capital funding in 2024. The total capital raised by the US is nearly 30% higher YoY, amounting to a record USD 209 billion.

Notably, AI companies captured 46.4% of this total and this is a substantial increase from less than 10% a decade ago.

Innovation and Novelty

According to StartUs Insights, there have been more than 841 390 AI-related patents filed worldwide.

In the first ten months of 2024, China led in AI patent volume with almost 13 000 patents, followed by the United States with seven times more often than Chinese Patents.

However, it’s important to note that US patents had a significantly higher impact, with an average of 13.18 citations compared to 1.90 for Chinese patents.

In terms of research support, StartUs Insights indicates that 23 191+ grants have been awarded for AI research. This level of funding enables researchers and organizations to explore new AI applications.

Top Use Cases of AI in Logistics

- Route Optimization: AI analyzes real-time traffic, weather conditions, and delivery schedules to determine efficient routes and reduce fuel consumption.

- Demand Forecasting: AI analyzes historical sales data, market trends, and external factors to optimize inventory levels and resource allocation.

- Inventory Tracking: AI improves stock management through real-time monitoring and data analytics to reduce holding costs.

- Predictive Maintenance: AI-driven predictive maintenance reduces maintenance costs by up to 30% and decreases equipment downtime by 45%.

Noteworthy AI and ML Advancements

- Walmart’s AI-Powered Logistics Product: Optimizes driving routes, efficiently packs trailers and reduces miles traveled. By implementing this system, Walmart has successfully eliminated 30 million unnecessary miles, bypassed 110 000 inefficient paths, and avoided 94 million pounds of CO₂ emissions.

- FedEx Surround: An AI-powered solution for supply chain management. It includes real-time tracking with Bluetooth sensors, AI-driven predictive analytics to foresee delays, and continuous proactive monitoring to prevent disruptions.

Core Technologies Connected to AI and ML

- Natural Language Processing: Enhances communication within logistics by enabling systems to understand and process human language. This facilitates improved data extraction from unstructured sources, leading to better decision-making processes.

- Computer Vision: Automates inspection processes to improve quality and accuracy in operations. By employing image recognition, AI monitors inventory levels, detects damages, and oversees safety protocols.

- Neural Network Architectures: Learn from historical data and predict future trends in logistics. They analyze vast datasets to forecast demand, optimize routing, and manage supply chains.

Spotlighting an Innovator: Gatik

Gatik, a US-based company, deploys autonomous middle-mile logistics solutions using a fleet of Class 3–7 light and medium-duty trucks. It operates fully driverless commercial deliveries on fixed, repeatable routes to optimize short-haul B2B logistics.

Its proprietary Level 4 autonomous driving system, Gatik Carrier, ensures safe and efficient transportation between distribution centers and retail locations while reducing reliance on human drivers.

The company’s autonomy stack integrates advanced perception, planning, and control systems to navigate complex urban and suburban environments with minimal intervention.

2. Internet of Things

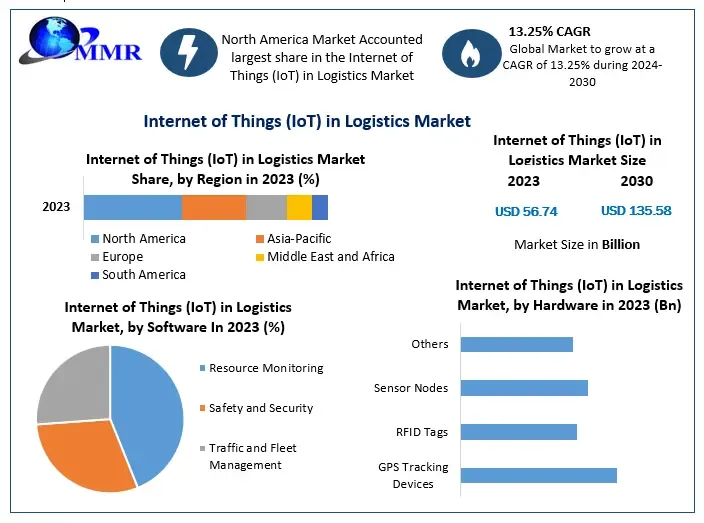

The global IoT-powered logistics market is expected to reach USD 116.70 billion in 2030 with a CAGR of 12.3%.

IoT-powered logistics involves using embedded sensors and devices to collect real-time data on location, package condition, fleet status, and more.

The surge in IoT adoption is driven by the rising demand for transparency and control over supply chain operations. This visibility minimizes delays, losses, and theft, thus improving overall supply chain reliability.

IoT adoption in logistics varies across regions. North America is leading the adoption with significant digital transformation in logistics driven by the high internet penetration and the expansion of the 5G network.

Whereas, Asia Pacific is projected to witness the fastest growth, attributed to shifting consumer behavior and rising urbanization in India and China.

Source: Maximize Market Research

Leading companies like Amazon Web Services, Cisco Systems, IBM Corp, and SAP are integrating IoT into their logistic operations.

Market Insights & Growth Metrics for IoT

Scale and Magnitude

According to StartUs Insights, there are currently 22 345+ IoT-focused companies worldwide.

The IoT startup landscape saw significant growth, with over 3300 active IoT startups identified in 2024, a substantial increase from the previous years. This represents a 2.7x growth in the number of IoT startups over a three-year period.

North America continued to lead in the number of IoT startups in 2024. It accounts for 36% of the total companies. The Asia-Pacific region gained prominence and represents 24% of all IoT startups.

In terms of media coverage and public attention, IoT ranks 301st among emerging technologies according to StartUs Insights.

Growth Indicators

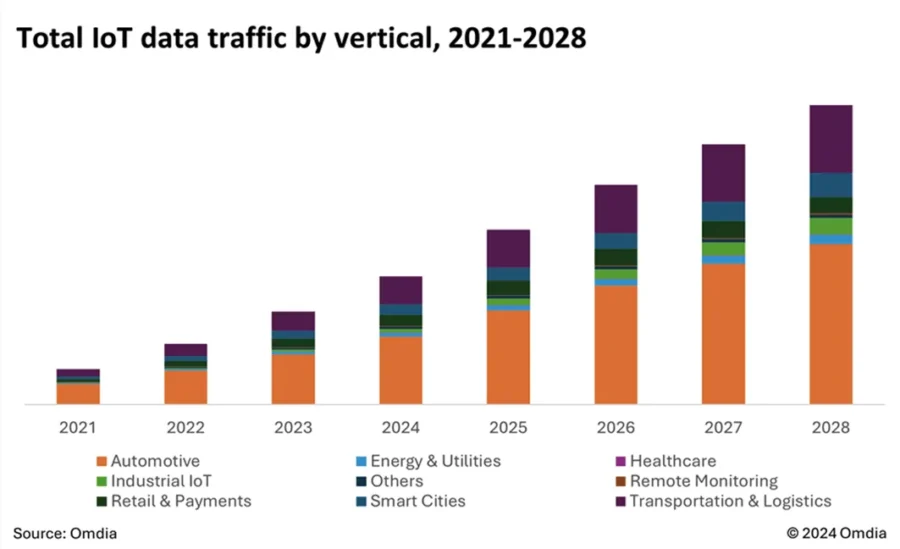

IoT has garnered significant global attention, with annual search interest rising by 54.61%, as reported by StartUs Insights. The number of connected IoT devices is estimated to grow to 40 billion by 2030.

The IoT Use Case Adoption Report 2024 from IoT Analytics revealed that 92% of enterprises reported positive ROI from their IoT projects.

Between 2021 and 2024, the number of IoT use cases increased by 53%. This reflects expanding adoption across industries like manufacturing, logistics, and automotive.

Source: Telenor IoT

According to a report by FICCI, the global IoT market is expected to surpass USD 1.1 trillion in 2025.

Over the past five years, IoT funding has experienced a decline of 54.51%. This downturn reflects broader market trends, where venture capital investments have become more selective.

Innovation and Novelty

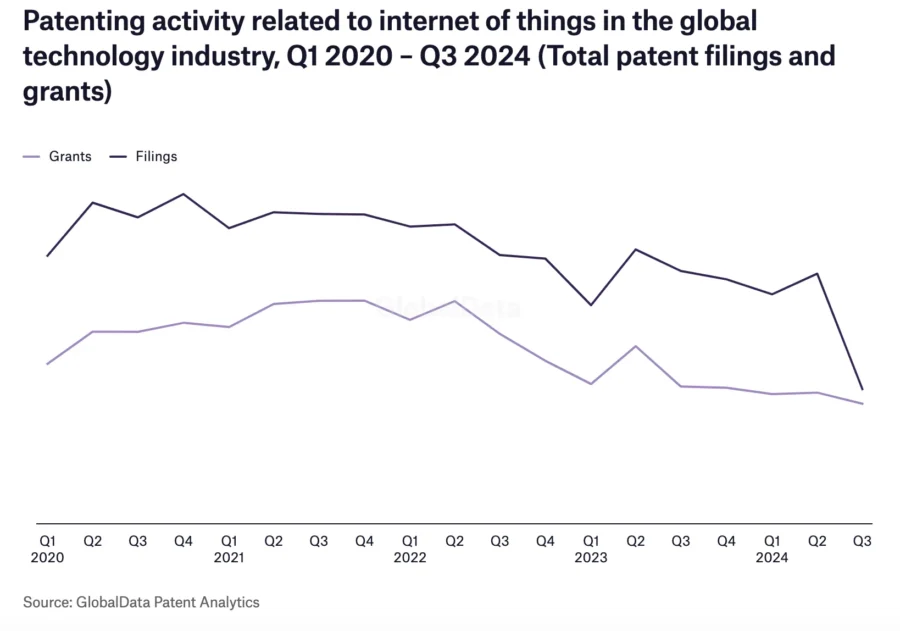

According to StartUs Insights, there have been 96 445 patents filed in the IoT sector. This extensive number of patents underscores the sector’s dynamic growth and the continuous development of new technologies within the IoT landscape.

In terms of research support, there have been 1773+ grants awarded to IoT-related projects, as reported by StartUs Insights. This significant level of funding is crucial for the ongoing advancement of IoT technologies.

However, there was a general downward trend in IoT patent applications across various industries in the later part of 2024.

Source: Verdict

For instance, 191 IoT-related patent applications in the retail industry in Q3 2024, down from 354 in Q2 2024. In the automotive industry, there were 1298 IoT-related patent applications in Q3 2024 compared to 2205 in Q2 2024, and IoT-related applications in the power industry were 203 in Q3 2024 compared to 434 in Q2 2024.

Top Use Cases of IoT in Logistics

- Route Optimization: It collects data that supports analyzing real-time traffic data, package delivery schedules, and weather conditions to dynamically optimize delivery routes.

- Demand Forecasting: By leveraging IoT sensors and analytics tools, companies monitor market trends and consumer behavior in real time. This data supports accurate demand forecasting.

- Inventory Tracking: IoT-enabled devices, such as RFID tags and barcode scanners, provide real-time visibility into inventory levels. This automation enhances accuracy in inventory counts and streamlines warehouse operations.

- Predictive Maintenance: Embedded sensors monitor the health of equipment like trucks and warehouse machinery to detect early signs of wear or malfunction.

Noteworthy IoT Advancements

- UPS’ Smart Package Initiative with RFID: It replaces manual barcode scanning with automated, real-time tracking. The system is being deployed across 60 000 vehicles with an additional 40 000 planned as packages move through facilities and delivery routes.

- Royal Mail and Wiliot’s IoT Tracking for Rolling Cages: Royal Mail is leveraging Wiliot’s Ambient IoT technology to track rolling cages that transport mail and parcels across distribution centers. Unlike traditional RFID, these battery-free IoT tags continuously transmit real-time location and environmental data without requiring an external power source.

Core Technologies of IoT

- Wireless Sensor Networks (WSNs): Enable logistics companies to track goods throughout the transportation chain. They monitor environmental conditions such as temperature, humidity, and exposure to light during transit.

- 5G: Offers significantly faster speeds, lower latency, and greater connectivity to facilitate real-time data exchange for improving supply chain visibility and responsiveness.

- Embedded Systems: Monitor the movement of goods, anticipate potential delays, and offer accurate delivery updates to customers. They enhance warehouse logistics by automating storage, retrieval, and transportation processes.

Spotlighting an Innovator: Intugine Technologies

Intugine Technologies, an Indian company, delivers real-time multimodal supply chain visibility solutions. It leverages IoT to optimize and digitize logistics operations.

The company’s tools provide manufacturers, shippers, retailers, and quick commerce companies with comprehensive visibility over their assets across various transportation modes on a single platform.

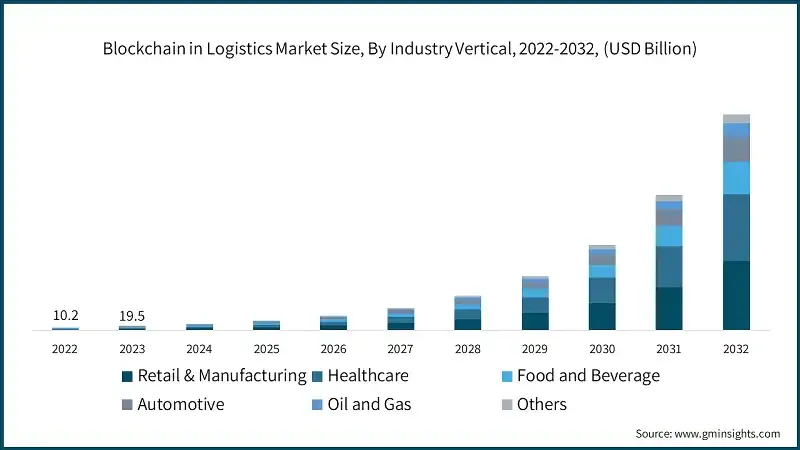

3. Blockchain

The blockchain in logistics market size is anticipated to grow to 900 billion by 2032 at a CAGR of 45% between 2025 to 2032.

Source: Global Market Insights

Security is a major concern in supply chain management especially for sensitive or high-value goods. Blockchain’s decentralized nature and cryptographic security make it perfect to prevent counterfeiting and ensure the integrity of the supply chain.

In 2024, global investment in blockchain technology is estimated at USD 19 billion.

Source: Global Market Insight

Major technology companies such as IBM, Microsoft, and SAP are investing heavily in blockchain solutions. North America leads in technology adoption, followed by Europe and Asia-Pacific.

Market Insights & Growth Metrics for Blockchain

Scale and Magnitude

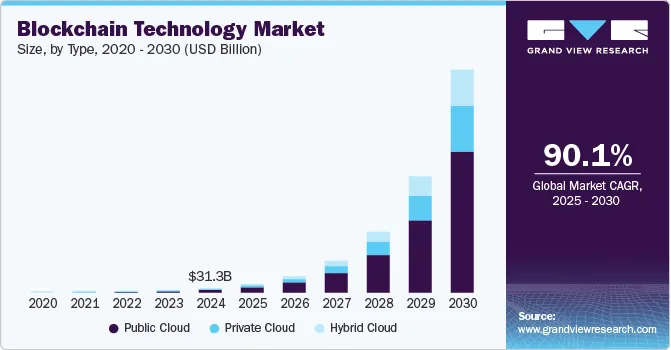

As per our database, blockchain has witnessed remarkable global expansion, as evidenced by the establishment of 42 862 companies specializing in this field.

In 2024, North America, with the US at the forefront, dominated the blockchain technology market, accounting for 37.4% of global revenue.

Projections indicate a significant growth trajectory, with expectations to reach USD 1.43 trillion by 2030, reflecting a CAGR of 90.1% from 2025 to 2030.

Source: Grand View Research

As of 2024, approximately 2.8% of the global population was utilizing blockchain technology. This highlights its increasing integration into daily activities and various sectors.

Despite its rapid growth, blockchain is ranked 61st in media coverage among emerging technologies in our database. This suggests that other technologies may currently capture more public and media attention.

Growth Indicators

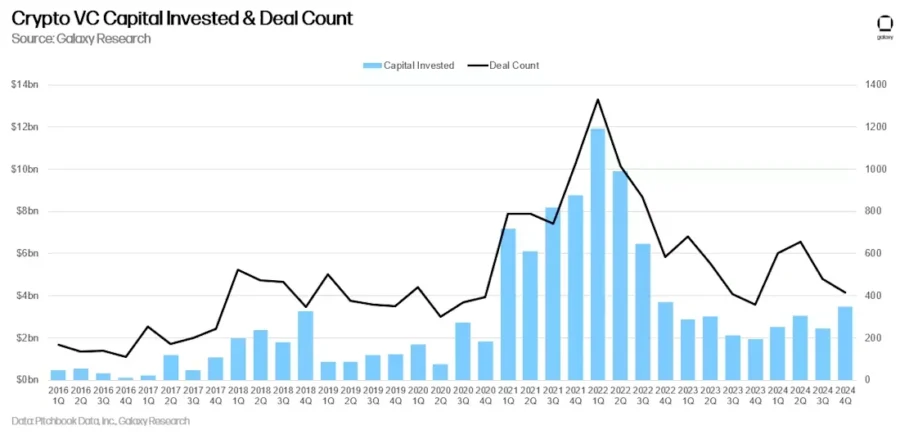

Blockchain has witnessed a significant surge in global interest, with annual search interest increasing by 72.47%, as reported by StartUs Insights.

Over the past five years, blockchain funding has experienced a remarkable growth rate of 128.80%. This indicates substantial investments in blockchain development and implementation.

In Q3 2024, venture capitalists invested USD 3.5 billion into crypto and blockchain-focused startups across 416 deals, marking a 46% increase from the previous quarter.

Source: Galaxy

Innovation and Novelty

Blockchain technology has demonstrated significant innovation, as evidenced by the filing of 89 022 patents globally, according to StartUs Insights.

In terms of research support, there have been 2251 grants awarded for blockchain-related studies.

Top blockchain patent holders included Advanced New Technologies (1311 patents), IBM (790 patents), and Bank of America (198 patents).

Also, the Ethereum Foundation’s Ecosystem Support Program distributed USD 12.8 million in grants in Q3 2024 to 75 companies – including five African projects focused on blockchain education and development.

Top Use Cases of Blockchain

- Real-Time Shipment Tracking: Blockchain enables precise real-time tracking of shipments by recording each package’s journey on an immutable ledger. This ensures that the location and status of packages are transparent and accessible to all stakeholders, reducing delays and enhancing operational efficiency.

- Inventory Management: Integrating blockchain with inventory management systems allows for accurate demand forecasting and efficient stock control. By providing a transparent and immutable record of inventory levels and movements, blockchain maintains optimal stock levels, reducing the risk of overstocking or stockouts.

- Fleet Management: It provides secure and transparent tracking of vehicles and assets. This streamlines maintenance and repair records, ensuring that all data is immutable and easily accessible. By tracking metrics such as fuel consumption, vehicle maintenance records, and carbon emissions on the blockchain, fleet managers gain valuable insights into their operations.

- Environmental Monitoring: Combining blockchain with sustainable logistics practices allows businesses to effectively streamline their supply chains, minimize waste, and lower carbon emissions. By recording environmental data on an immutable ledger, companies monitor and verify their environmental impact throughout the supply chain.

Noteworthy advancement of Blockchain

- Crurated’s Blockchain-based Virtual Wine Cellar: Leverages blockchain and NFTs to ensure authenticity, provenance tracking, and secure ownership transfers. Collectors interact with their inventory through an immersive digital interface to reduce the risk of fraud while improving supply chain transparency and accessibility.

- Provenance Partners with Sourcemap for Consumer Goods Traceability: By integrating blockchain-based traceability into supply chain mapping, it offers transparency for consumer goods. This advancement enables brands to collect and verify real-time data on sourcing, sustainability claims, and regulatory compliance.

Core Technologies of Blockchain

- Smart Contracts: These are self-executing agreements with terms directly embedded in code that enable the automatic execution of contract clauses when predefined conditions are met. In logistics, they facilitate automated processes such as freight agreements, customs clearances, and payment settlements.

- Interoperability Protocols: It enables different blockchain networks to communicate and share data seamlessly. In logistics, this allows various stakeholders to access and exchange information across disparate systems securely.

- Distributed Ledger Technology: DLT provides a decentralized database where all participants have synchronized access to the same information, ensuring data immutability and transparency.

In logistics, DLT is used to track the provenance of goods, monitor real-time shipment statuses, and verify transaction records.

Spotlighting and Innovator: TE-FOOD

TE-FOOD, a German company, offers a traceability solution that encompasses all logistics and food safety activities within the supply chain. Its system utilizes serialization and data capture to monitor livestock and fresh produce from farm to table.

By employing its blockchain network, TrustChain, TE-FOOD secures data governance and facilitates millions of daily business transactions across a decentralized ledger with hundreds of nodes globally.

This approach enhances traceability, reduces the risk of foodborne illnesses, and bolsters consumer confidence in food safety.

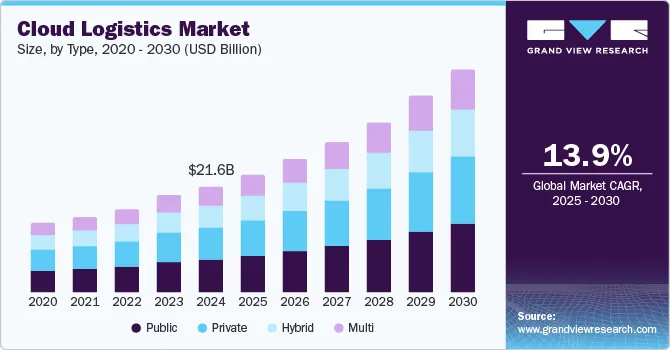

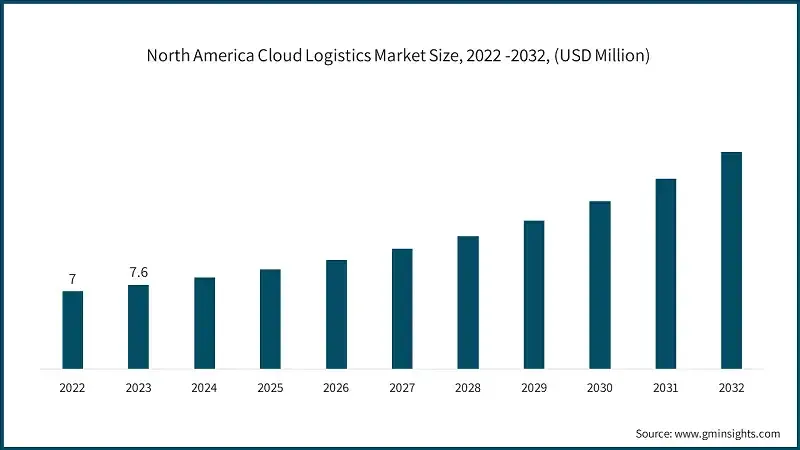

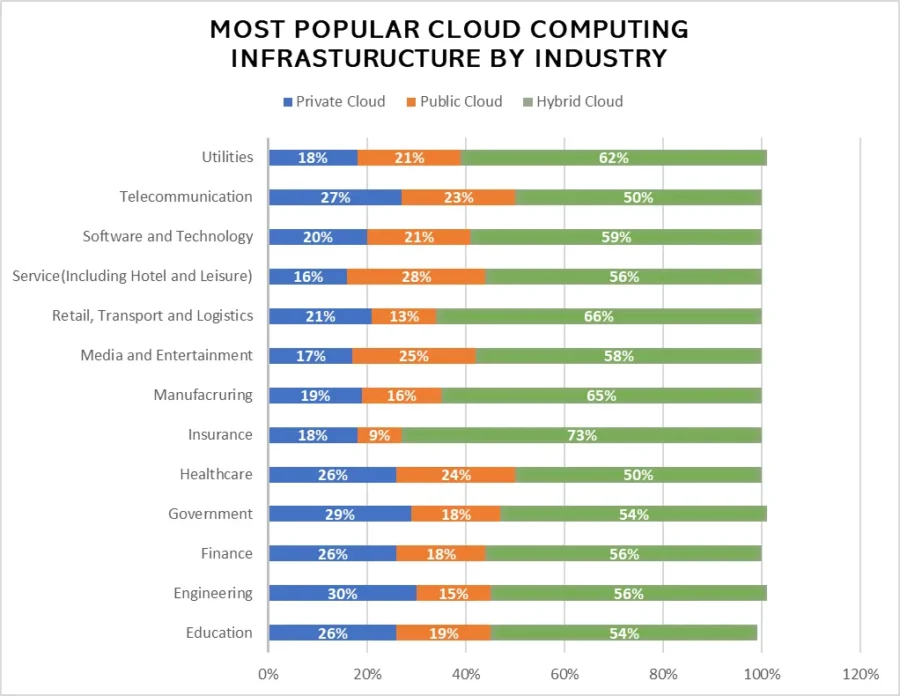

4. Cloud Computing

The Cloud Logistics Market size is anticipated to grow to USD 46.31 billion by 2030 at a CAGR of 13.9% between 2025 and 2030.

Source: Grand View Research

Cloud computing provides a scalable and cost-efficient infrastructure for logistics. This facilitates better decision-making, improves supply chain visibility, and reduces operational inefficiencies.

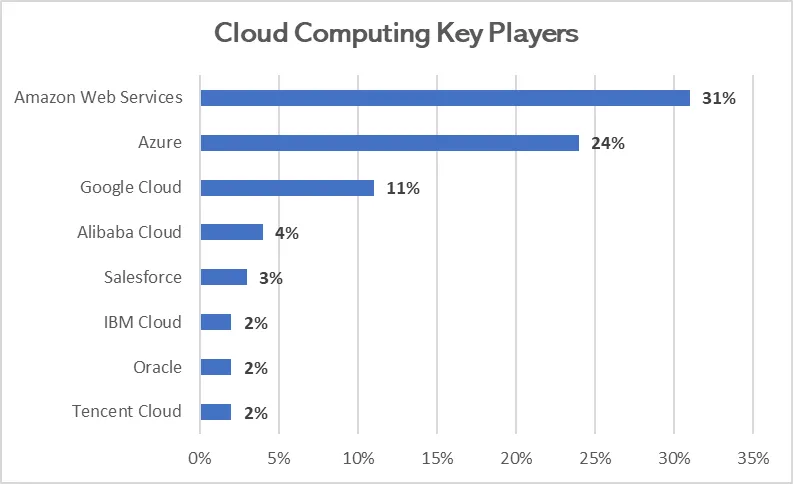

Major technology companies such as Amazon Web Services, Microsoft, and Google Cloud are heavily investing in cloud-based logistics solutions.

Source- Global Market Insights

Market Insights & Growth Metrics for Cloud Computing

Scale and Magnitude

Cloud computing has seen remarkable global expansion, evidenced by the 109 008 number of companies, as reported by StartUs Insights.

This growth is further underscored by the widespread adoption of cloud services, with over 90% of companies worldwide utilizing platforms such as AWS, Google Cloud, and Microsoft Azure.

Source: Edge Delta

The global cloud computing market was projected to grow at a compound annual growth rate of 21.2% from 2025 to 2030. This trajectory anticipates the market reaching approximately USD 2390.18 billion by 2030.

The adoption rate of cloud computing is notably high, with 94% of companies worldwide integrating cloud services into their operations. This reflects the technology’s critical role in modern business infrastructures.

Source: Edge Delta

Cloud computing ranks 53rd in media coverage among emerging technologies, as indicated by StartUs Insights.

Growth Indicators

Cloud computing has experienced a significant surge in global interest, with annual search interest rising by 81.64%, as reported by StartUs Insights.

Over the past five years, cloud computing has seen a funding growth rate of 24.44%, reflecting a steady increase in investments dedicated to cloud development and implementation.

In Q3 2024, global venture funding totaled USD 66.5 billion, with cloud computing-related investments accounting for a significant portion of this total.

Notably, the cloud sector’s growth was driven by increased spending on cloud infrastructure services, which reached over USD 84 billion in Q3 2024, marking a 23% year-over-year increase.

IDC forecasts that worldwide spending on public cloud services will reach USD 1.61 trillion by 2028, highlighting the accelerating adoption of cloud solutions across various industries.

Innovation and Novelty

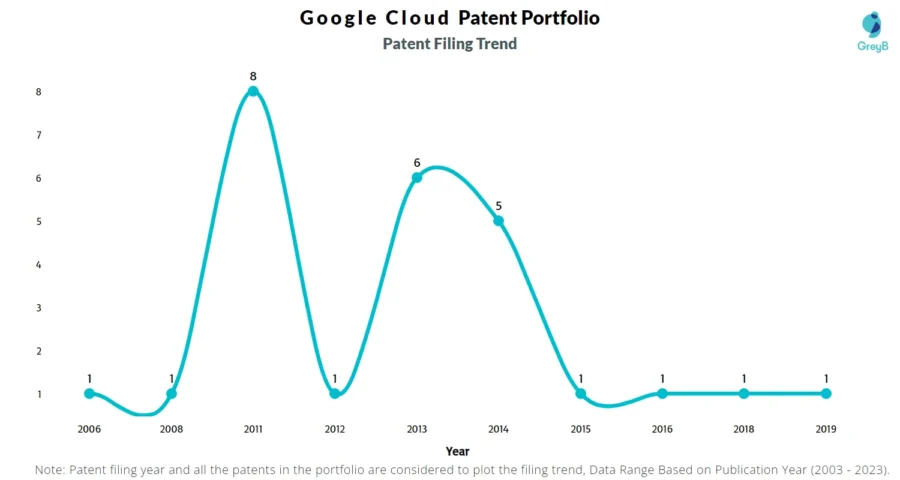

According to data from StartUs Insights, there have been 78 092 cloud computing patents filed worldwide.

Google Cloud has a total of 26 patents globally, out of which 2 have been granted. Of these 26 patents, more than 7% are active. The US is where Google Cloud has filed the maximum number of patents.

Source: Insights

The availability of grants plays a crucial role in fostering ongoing development in cloud computing. StartUs Insights reports a total of 7559 grants supporting research in this field.

Top Use Cases of Cloud Computing

- Inventory Management: Recent advancements in cloud-based inventory management systems have led to the integration of predictive analytics and artificial intelligence. These technologies enable real-time tracking and forecasting, allowing businesses to maintain optimal stock levels and reduce holding costs.

- Route Optimization: Cloud computing facilitates the processing of vast datasets in real-time, essential for effective route optimization. By leveraging AI and machine learning algorithms, logistics companies analyze traffic patterns, weather conditions, and delivery schedules to determine the most efficient routes. This approach not only reduces fuel consumption and operational costs but also enhances delivery speed and reliability.

- Warehouse Management: Modern WMS platforms offer features such as real-time inventory visibility, automated stock replenishment, and advanced analytics. These capabilities streamline warehouse operations, reduce manual errors, and optimize space utilization. Additionally, IoT devices with cloud platforms provide real-time data on equipment health and inventory movement.

- Predictive Analytics and Demand Forecasting: Cloud computing enables the aggregation and analysis of large datasets from various sources. In logistics, this translates to more accurate demand forecasting, allowing companies to anticipate market needs and adjust their supply chain strategies accordingly. By incorporating factors such as economic indicators, consumer behavior, and external events, businesses make informed decisions to optimize inventory levels, production schedules, and distribution plans.

Noteworthy advancement of cloud computing

- Fujitsu’s Cloud-based Logistics Data Standardization and Visualization: This service addresses challenges associated with truck driver shortages, carbon footprint, and regulatory compliance. Converting and standardizing data related to inventory and transport, it enables users to share insights securely within their organizations and with external partners.

- Samsung SDS’ Partnership with Korea Air Force: It focuses on the application of AI and cloud computing to improve logistics resource demand forecasting, analysis, and supply chain management.

Core Technologies of Cloud Computing

- Software-defined Networking (SDN): Enhances network management by decoupling the control plane from the data plane for centralized control and dynamic network configuration. It provides logistics companies with the agility to manage complex networks efficiently. It allows for real-time traffic management, reduces latency, and enhances the ability to scale network resources up or down based on demand.

- Distributed Storage Systems: Ensure that critical data is accessible across various locations, supporting real-time decision-making. They offer scalability to handle large volumes of data generated from supply chain activities and provide redundancy to protect against data loss, thereby enhancing reliability and business continuity.

- Containerization and Orchestration: Containerization allows applications to be packaged with their dependencies, ensuring consistent performance across environments. Implementing containerization and orchestration enables logistics companies to develop and deploy applications more rapidly and reliably. This approach enhances system scalability, improves resource utilization, and reduces deployment times, allowing for more responsive and flexible logistics operations.

Spotlighting and Innovator: Fleetbase

Fleetbase, a Singapore-based company, develops an open-source modular logistics platform to streamline supply chain management.

It operates as a comprehensive suite – encompassing a transport management system (TMS), driver and customer ordering applications, and a developer API for seamless integration.

Fleetbase allows businesses to customize and scale their logistics operations efficiently, promoting innovation and flexibility in supply chain solutions.

5. Robotics

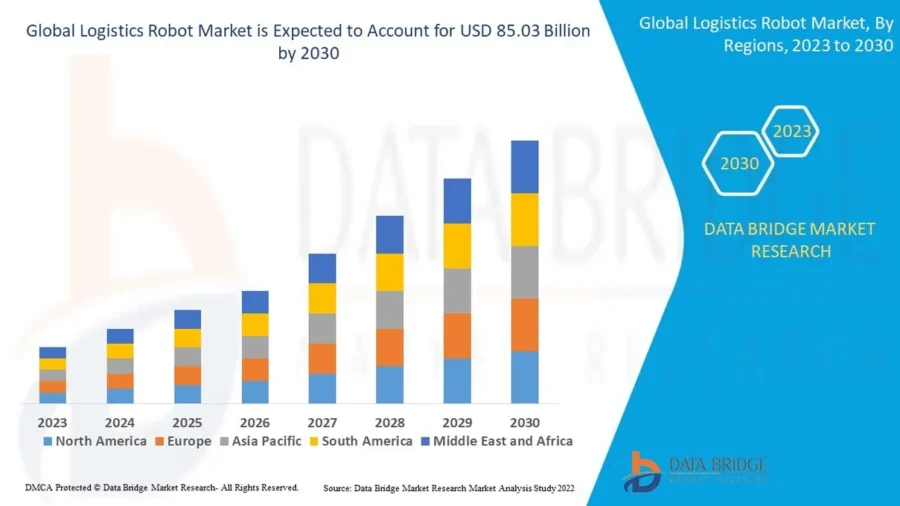

Robotics in the logistics market is anticipated to reach USD 85.03 billion by 2030, with a CAGR of 24.66%.

Source: Data Bridge Market Research

Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) automate key tasks like picking, sorting, and transporting goods to reduce reliance on manual labor and improve accuracy and efficiency.

Source: McKinsey & Company

As e-commerce continues to expand and the demand for faster, more reliable deliveries increases, robotics adoption is surging.

The Asia-Pacific region, projected to reach USD 59.2 billion by 2030, is leading this growth due to rapid industrialization and advancements in robotic automation.

Top corporations such as Amazon, Alibaba, DHL, FedEx, and others are investing heavily in robotics to enhance operational efficiency.

Amazon, for instance, utilizes a vast fleet of robots in its fulfillment centers, while Alibaba invested USD 15 billion to advance its robotic logistics capabilities.

Regionally, North America is a key hub for logistics robotics, driven by its advanced industrial infrastructure and high labor costs. In comparison, Europe and Asia-Pacific are rapidly catching up, with Asia-Pacific projected to grow the fastest.

Market Insights & Growth Metrics for Robotics

Scale and Magnitude

According to StartUs Insights, there are currently 75 042 companies specializing in robotics technology. This substantial figure reflects the industry’s rapid growth and the escalating demand for automation across various sectors.

The US distinguishes itself as a pivotal hub for robotics firms. The robotics market is expected to reach USD 100.59 billion in 2025.

The sales volume of collaborative robots is projected to increase significantly, with a 6100% growth expected between 2025 and 2045.

Regarding media coverage, robotics holds the 30th position among emerging technologies, as reported by StartUs Insights. This ranking indicates a moderate level of public attention compared to other emerging technologies.

Growth Indicators

Over the past five years, robotics has experienced a funding growth rate of 24.57%, as reported by StartUs Insights. This upward trend aligns with broader market dynamics, where significant investments are being channeled into automation and advanced manufacturing technologies.

Over a 12-week period in 2024, robotics startups secured USD 748.9 million in funding, with March alone seeing USD 642 million invested across 37 firms.

Notable funding rounds in 2024 include, Physical Intelligence raising USD 400 million, Path Robotics securing USD 100 million and Third Wave Automation receiving USD 27 million.

According to StartUs Insights, annual search interest in robotics has risen by 3.85%, indicating a growing global curiosity and engagement with the field.

Innovation and Novelty

As per our data, Cloud Computing remains a highly innovative domain with 78 092 patents globally, according to StartUs Insights. In terms of research support, there have been 7559 grants awarded for cloud computing research.

IBM obtained 1200 patents on cloud computing over the past year and a half, covering general cloud processes and operations.

Manjrasoft has two valuable cloud computing patents that could affect major companies like Amazon, Microsoft, IBM, and others.

When comparing cloud computing patents to the broader technology landscape, the tech industry accounted for 40% of all global patent applications with over 1.4 million tech-related patent applications filed worldwide.

Top Use Cases of Robotics

- Last-Mile Delivery: Autonomous delivery robots and drones are transforming last-mile logistics by addressing urban traffic challenges and reducing delivery costs.

- Sustainable Logistics: Automated systems, such as autonomous mobile robots (AMRs) and aerial drones, streamline supply chain processes, leading to more efficient resource utilization. AI-driven route optimization in delivery robots minimizes fuel consumption, further promoting sustainability.

- Warehouse Automation: It includes autonomous picking and packing robots, for material handling, drone-based inventory management, robotic palletizing and depalletizing systems. These technologies streamline operations by automating repetitive tasks, reducing human error, improving safety, and increasing overall productivity.

- Automated Sorting and Packaging: Robotics in sorting and packaging enhances speed and precision. Automated systems equipped with advanced sensors and AI can handle tasks such as assembling boxes, sealing, labeling, and palletizing goods.

Noteworthy Advancement in Robotics

- ArcBest Launches Vaux Smart Autonomy: It enhances material handling within warehouses, distribution centers, and manufacturing facilities by integrating autonomous mobile robot forklifts and trucks. This reduces unloading times and optimizes supply chain efficiency.

- Amazon’s Proteus Collaborates with Cardinal: Amazon advances warehouse automation with Proteus, its first AMR that works alongside human employees to transport carts weighing up to 880 pounds.

Core Technologies of Robotics

- Sensors and Perception: Integrate high-resolution cameras, LiDAR, and ultrasonic sensors for precise environmental awareness. These technologies capture and interpret spatial data, enabling accurate object recognition and depth perception.

- Actuators and Locomotion: Enable precise movement and control in automated systems. Integrated with AI-driven controls, these systems adjust speed, force, and trajectory in real time for optimal performance.

- Speech Recognition and Synthesis: Enable seamless human-machine interaction by converting spoken language into text and generating human-like speech responses. Natural language processing enhances contextual understanding, enabling more intuitive communication.

Spotlighting an innovator: Rapid Robotics

Rapid Robotics, a US-based company, develops end-of-line robotic solutions for tasks such as packing, palletizing, and kitting across various industries.

Its proprietary Rapid iD system employs generative AI and 3D vision to instantly identify new objects and autonomously learn to execute pick-and-place tasks in under two minutes.

This technology enables the robots to adapt swiftly to diverse operational requirements, ensuring high-speed and accurate performance.

6. Digital Twins

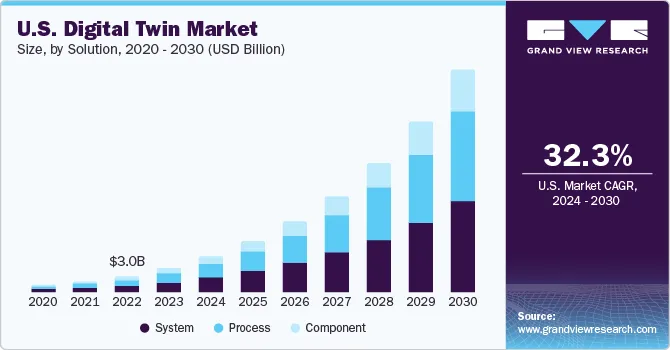

Digital twin technology in the logistics market is expected to reach USD 137.67 billion by 2030, with a CAGR of 35.7%.

Source: Grand View Research

Digital twin technology creates virtual replicas of physical assets, systems, and processes for real-time monitoring, simulation, and optimization. It plays a vital role in improving supply chain visibility, predictive maintenance, and decision-making.

Companies leveraging digital twins have seen revenue increases of approximately 10%, accelerated time-to-market by 50%, and enhanced product quality by 25%.

Top corporates such as Walmart, DHL, Amazon, Microsoft, and Siemens are heavily investing in digital twin technologies. Walmart, for instance, has collaborated with NVIDIA to create virtual replicas of over 1700 stores. Similarly, DHL is using digital twins for shipment tracking and logistics system optimization.

Europe is experiencing a growth rate of 43.7% during the forecast period, making it a significant player. The Asia-Pacific region is also witnessing rapid expansion.

Market Insights & Growth Metrics for Digital Twin

Scale and Magnitude

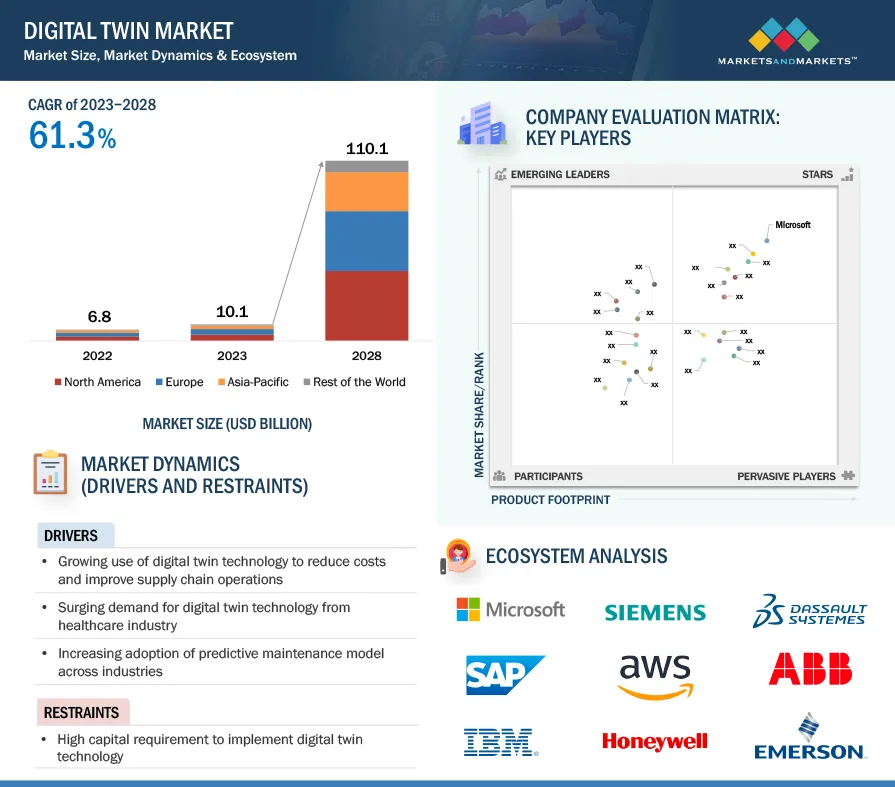

As per our report, there are currently 5995 companies worldwide focusing on digital twin solutions. The global digital twin market is expected to reach USD 110.1 billion by 2028, reflecting a CAGR of 61.3%.

Source: MarketsandMarkets

Digital twin technology currently holds a media coverage rank of 689 among emerging technologies, as reported by StartUs Insights.

Growth Indicators

According to StartUs Insights, there has been a 26.72% annual increase in search interest. Didimi, a digital twin platform for the construction industry, raised EUR 880 000 in pre-seed funding.

Over the past five years, funding for digital twin initiatives has surged by 137.57%, as reported by StartUs Insights.

In the Q3 of 2024, global venture funding totaled USD 66.5 billion. This led to record-high investments in construction technology and cleantech, totaling USD 734 million over 85 deals.

Innovation and Novelty

According to StartUs Insights, the digital twin domain witnessed more than 6308 patents filed globally. In terms of research support, there have been 1589 grants awarded to digital twin initiatives.

Top use cases of Digital Twin

- Spatial Design and Optimization: The technology facilitates the creation of virtual models of warehouses, distribution centers, and retail spaces. This allows for the simulation of various layouts and processes to identify the most efficient configurations.

- Route Optimization: It models and simulates transportation networks for companies to optimize delivery routes in real time. By integrating real-time data such as traffic conditions and weather forecasts, logistics providers adjust routes dynamically to minimize delays.

- Inventory Management: The technology provides real-time visibility into inventory levels and allows companies to simulate various demand scenarios and optimize stock levels. This approach reduces holding costs and prevents stockouts.

- Supply Chain Scenario Planning: It enables companies to simulate different supply chain scenarios, such as shifts in demand or supply disruptions, for better planning and decision-making.

Noteworthy Advancement of Digital Twin

- AWS Simulation & Digital Twin for Warehouse: This initiative creates virtual replicas of their fulfillment centers to test and optimize layouts, processes, and automation systems. By integrating robotics, computer vision, and IoT capabilities, warehouses achieve optimized pick-and-put-away operations, leading to a 40% increase in labor productivity. Additionally, 3D visualization and digital twins improve space utilization by 15%, while automated inventory tracking ensures 99.9% accuracy.

- Siemens’ Holistic Digital Twin for Logistics Centers: This holistic digital twin encompasses all aspects of warehouse operations, including goods receipt, transport, storage, picking, packaging, and shipping. By utilizing end-to-end automation and digitalization solutions from the Siemens Xcelerator portfolio, the digital twin allows for the simulation and optimization of material flow systems.

Core technologies of Digital Twin

- Edge Computing: Brings computational power closer to data sources to reduce latency, bandwidth usage, and reliance on centralized cloud infrastructure. By processing data locally, edge computing minimizes delays and ensures faster response times in logistics operations.

- Smart Sensors: Collect real-time data on various parameters like temperature, humidity, location, and movement of goods. The also facilitate proactive issue detection to ensure timely interventions and prevent potential disruptions.

- Simulation and Modeling Tools: Provide detailed virtual representations of logistics networks for testing various scenarios within the digital twin environment. This aids in identifying potential bottlenecks and optimizing processes without disrupting actual operations.

Spotlighting an innovator: Cognition Factory

Cognition Factory, a Germany-based company, develops an AI-based Robot Execution System to facilitate autonomous robot analysis, deployment, and continuous optimization.

Its CognitiveFlow platform creates a predictive digital twin of factory and warehouse environments, utilizing advanced algorithms to simulate future states and monitor live data streams.

This system integrates with existing technologies, including ERP, MES, and WMS, to enhance material handling efficiency.

7. 5G

5G in the logistics market is expected to grow to USD 249.81 billion by 2030, with a CAGR of 59.4%.

Source: Grand View Research

5G ensures seamless communication between connected devices. This makes logistics operations faster, smarter, and more efficient.

As the need for real-time tracking and automation grows, the adoption of 5G technology in logistics has surged. Ports like Valenciaport in Spain are implementing their own 5G networks to support Smart Port initiatives, while autonomous vehicles and drones rely heavily on 5G for accurate and responsive operations.

Top corporates such as DHL are exploring 5G-enabled connected vehicles, while Amazon is leveraging 5G to support its extensive logistics network.

In the US, 45% of mobile connections are already 5G-enabled – driven by the advanced infrastructure and the rise of digital logistics solutions.

Europe is seeing significant investments in 5G for logistics, especially in countries like Spain, with Smart Port initiatives taking center stage. Meanwhile, Asia-Pacific is experiencing rapid growth due to industrialization and the booming e-commerce market.

Market Insights & Growth Metrics for 5G

Scale and Magnitude

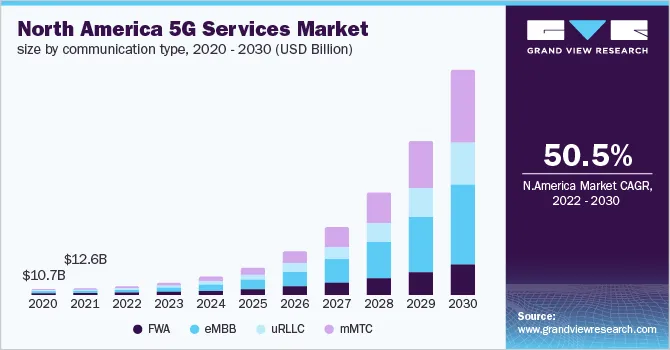

There are 9584 companies specializing in 5G as reported by StartUs Insights. This surge reflects the escalating demand for high-speed, low-latency connectivity across various sectors. The global 5G services market size is calculated at USD 200.55 billion in 2025.

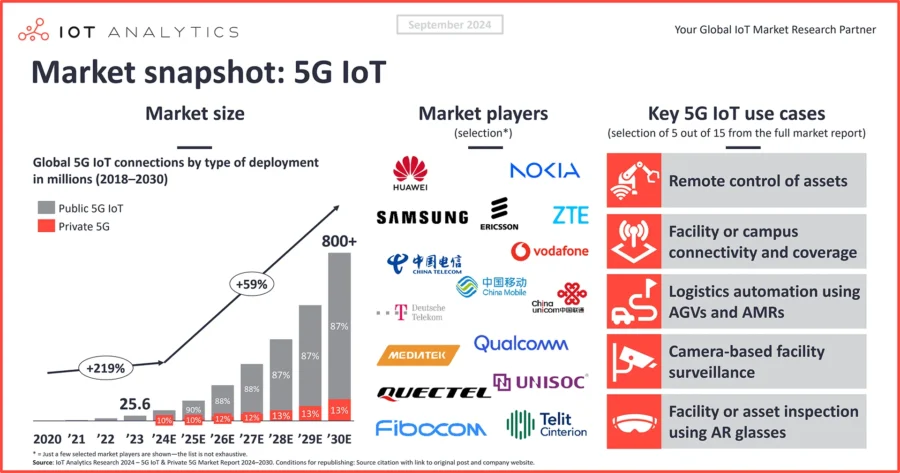

5G IoT connections are expected to grow at a CAGR of 59% by 2030, surpassing 800 million connections.

T-Mobile leads US carriers with nearly 54% 5G coverage. This underscores the nation’s commitment to widespread deployment.

Source: IoT Analytics

Globally, 5G adoption is accelerating with North America – forecasted to achieve a 90% adoption rate by 2030, followed by Greater China at 88%.

5G ranks 73rd in media coverage among emerging technologies, according to StartUs Insights.

Growth Indicators

5G technology has witnessed a significant surge in global interest, with annual search interest increasing by 114.21%, as reported by StartUs Insights.

Over the past five years, funding for 5G has contracted by 21.93%. This decline may be indicative of broader market trends, such as market saturation and the maturation of 5G technology.

As per WIPO’s report, Europe leads in 5G deployment, with 68% population coverage, followed by the US at 59% and Asia-Pacific at 42%.

According to PwC, 5G technology is expected to add USD 1.3 trillion to global GDP by 2030.

Innovation and Novelty

According to StartUs Insights, there have been 76 859 patents filed globally in the 5G sector. A report by LexisNexis indicates that there were over 60 000 declared 5G patent families, nearly 2.5 times the 24 000 declared for 4G.

As per our report a total of 1541 grants are dedicated to 5G research. This funding is crucial for ongoing development, facilitating advancements in infrastructure and applications.

Top use cases of 5G

- Real-Time Asset Tracking: 5G’s high-speed, low-latency connectivity enhances real-time asset tracking by enabling continuous monitoring of goods throughout the supply chain. Advanced tracking devices utilize cellular networks, Bluetooth, and RFID technologies to provide precise, up-to-date information on asset locations.

- Smart Warehousing: 5G facilitates the seamless integration of sensors and cameras into warehouse ecosystems. This integration enables real-time inventory tracking, autonomous vehicle operations, and enhanced environmental monitoring.

- Fleet Management: 5G enhances fleet management with real-time data on vehicle location, condition, and driver behavior to improve safety and efficiency. Connected vehicles optimize routes, reduce accidents, and lower fuel costs.

- Port Logistics: Ports are leveraging 5G networks to support advanced applications such as real-time monitoring, environmental sensing, and drone operations.

Noteworthy advancement of 5G

- Huawei’s 5G Smart Warehouse: This facility integrates 5G technology with IoT and big data analytics to enhance warehouse management. The implementation of digital twins and real-time data analysis allows for optimized inventory control, while the 5G network ensures efficient communication between staff and autonomous guided vehicles to streamline goods movement.

- U Mobile & Enfrasys Deploy 5G for Logistics: By leveraging U Mobile’s 5G private network and Enfrasys’ Container Vision application, the inspection time is reduced by 70% compared to traditional methods. The initiative also improved data processing and response times, leading to end-to-end digitalization of the inspection process and greater transparency.

Core Technologies of 5G

- 5G Protocol Stack: Manages data transmission across various network layers, including the physical, data link, network, transport, and application layers. It supports ultra-reliable low-latency communications (URLLC) and massive machine-type communications (mMTC), which are crucial for real-time tracking and autonomous vehicle operations.

- Radio Access Network (RAN): Connects user devices to the core network via radio connections. It promotes interoperability and flexibility by allowing equipment from different vendors to work seamlessly together. Improved RAN capabilities support high device densities and low-latency communications.

- Core Network (5GC): Manages data routing, mobility, and access control. Its service-based architecture (SBA) enhances scalability and flexibility by modularizing network functions. This modularity allows logistics companies to tailor network services to specific needs.

Spotlighting an innovator: Niral Networks

Niral Networks, an Indian company, offers NiralOS, a modular network operating system powers private 5G networks on commodity hardware. NiralOS integrates with various 5G radios and third-party edge applications to provide a unified dashboard for simplified management of network and edge applications.

By deploying NiralOS, enterprises gain complete control and security over their standalone 5G network infrastructure and accelerate operational effectiveness.

In 2024, UnoTelos, a leading telecommunications innovator in Nigeria, announced a strategic partnership with Niral Networks

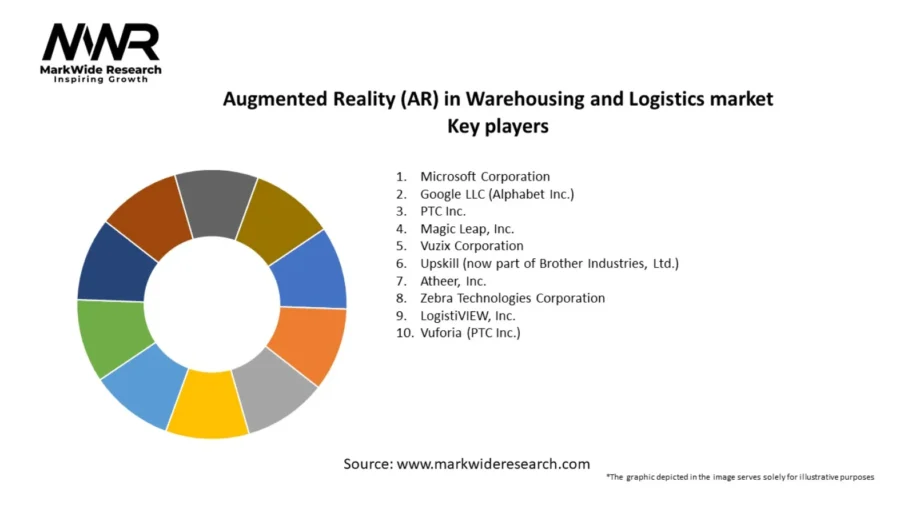

8. Augmented Reality and Virtual Reality

The AR and VR market is expected to grow significantly from USD 22.12 billion in 2024 to USD 96.32 billion by 2029, with a CAGR of 34.2%.

AR and VR technologies offer immersive training experiences by overlaying critical data on the physical environment, while VR creates simulations for training, safety, and process optimization.

In the logistics sector, companies using AR reported significant productivity improvements. DHL has implemented AR smart glasses for warehouse operations, resulting in a 25% boost in productivity.

The IBM Institute of Business Value found that businesses implementing AR experienced an average productivity increase of 32%, as well as a 46% reduction in time to complete tasks.

Source: MarkWide Research

Regional adoption of AR and VR varies significantly. In North America, businesses lead adoption due to advanced infrastructure and high investment levels. Europe shows strong growth with Smart Port initiatives, while Asia-Pacific sees rapid adoption driven by e-commerce expansion and industrialization.

Market Insights & Growth Metrics for Augmented Reality and Virtual Reality

Scale and Magnitude

According to StartUs Insights, there are 22 415 companies specializing in AR and 29 017 in VR worldwide.

This growth is further corroborated by a report from MarketsandMarkets, which estimates that the combined AR and VR market was valued at approximately is projected to reach USD 96.32 billion by 2029, reflecting a CAGR of 34.2%.

Source: MarketsandMarkets

China is reported to be the largest investor in virtual reality, spending USD 5.8 billion.

According to VR statistics, industrial maintenance VR will receive USD 4.1 billion in investments, while retail showcasing is expected to receive USD 2.7 billion.

Based on our data, AR ranks 159th, while VR ranks 84th in media coverage among emerging technologies. This indicates that VR currently enjoys higher media visibility compared to AR.

Growth Indicators

Virtual reality has seen an annual search interest rise of 19.72%, slightly surpassing AR’s 17.68%, as reported by StartUs Insights.

The enterprise application segment is predicted to lead the AR market during the forecast period.

Basemark raised EUR 22 million in series B funding and KIT-AR secured EUR 3.3 million.

Innovation and Novelty

According to StartUs Insights, a total of 68 280 patents have been filed globally for AR technologies, while VR has seen an even higher count with 131 759 patents filed worldwide.

Supporting this innovation, the European Union’s Horizon program allocated EUR 24 million in total funding, offering grants of up to EUR 12 million per project for AR/VR-enabled digital twins.

Additionally, Meta provides research grants of up to USD 75 000 each, focusing on fostering responsible innovation in AR/VR.

In terms of research, 4635 grants have been awarded to support AR research, whereas VR research has received 3944 grants.

Top Use Cases of AR and VR

- Warehouse Management: It provides real-time information and allows warehouse employees to visualize inventory data as they navigate through shelves.

- Navigation and Route Optimization: Drivers equipped with AR-enabled devices receive dynamic navigation assistance for adjusting routes based on traffic conditions and delivery priorities, ensuring timely and efficient deliveries.

- Virtual Training: VR provides immersive training to train employees in order-picking scenarios. This allows them to familiarize themselves with warehouse layouts and procedures in a controlled, virtual setting.

- Interactive Packaging: It enhances packaging by adding interactive elements such as additional product details, video tutorials, or even tracking product supply chain by scanning the packaging with their smartphone.

Noteworthy advancement of AR and VR

- DB Schenker’s VR Training: It implements virtual reality technology to train forklift operators. The VR training program allows operators to practice in realistic, simulated environments, including handling exceptional and hazardous situations that are difficult to replicate in real life.

- Walmart’s AR showroom: Walmart developed AR applications such as virtual try-ons for beauty products and apparel. This allows customers to visualize items before purchase. Additionally, the company explores AR-powered virtual showrooms and digital twins to create immersive shopping journeys to transform both customer and associate experiences at scale.

Core Technologies of AR VR

- Smart Glasses and Headsets: Equipped with high-resolution displays and advanced sensors. They enable real-time data visualization and hands-free operation.

- High-Performance GPUs: Process large datasets and real-time visualization for tasks such as route optimization, load planning, and virtual simulations.

- Haptic Feedback Systems: Allow employees to experience realistic simulations of equipment handling, packaging, and other operational tasks in a controlled environment.

Spotlighting an Innovator: ARuVR

ARuVR, a UK-based company, develops an AI-powered extended reality (XR) learning and development platform for enterprises and public sector organizations.

ARuVR’s patented platform empowers in-house teams to create, distribute, analyze, and manage on-demand and instructor-led XR training using advanced generative AI.

By merging digital and physical environments, the platform enhances workforce skills, delivers proven pedagogical benefits, and ensures strong ROI in the modern digital ecosystem.

9. Autonomous Vehicles and Drones

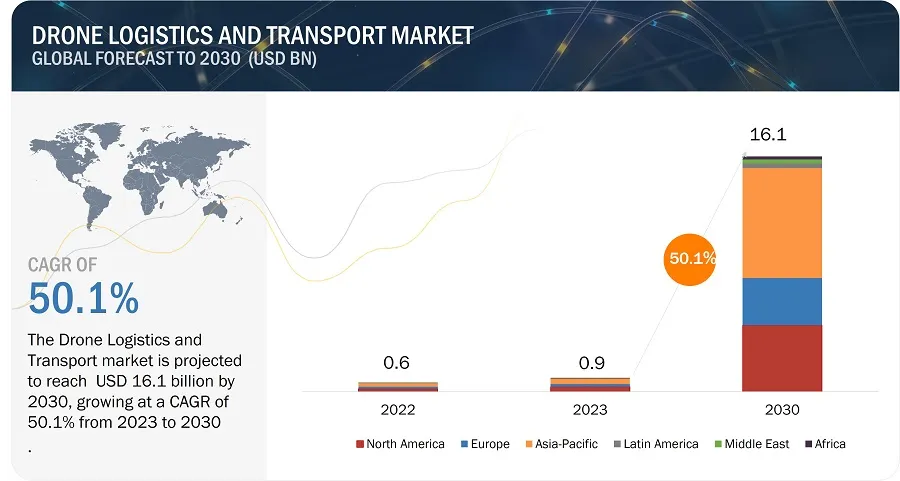

The drone logistics and transportation market is projected to grow to USD 16.1 billion by 2030, growing at a CAGR of 50.1%. Whereas, the autonomous vehicle (AV) market is expected to grow by USD 337.2 billion by 2033 with a CAGR of 20.2%.

Source: MarketsandMarkets

AV utilizes advanced AI and sensor technologies to ensure safe and efficient transportation, while drones facilitate last-mile deliveries in both urban and remote areas.

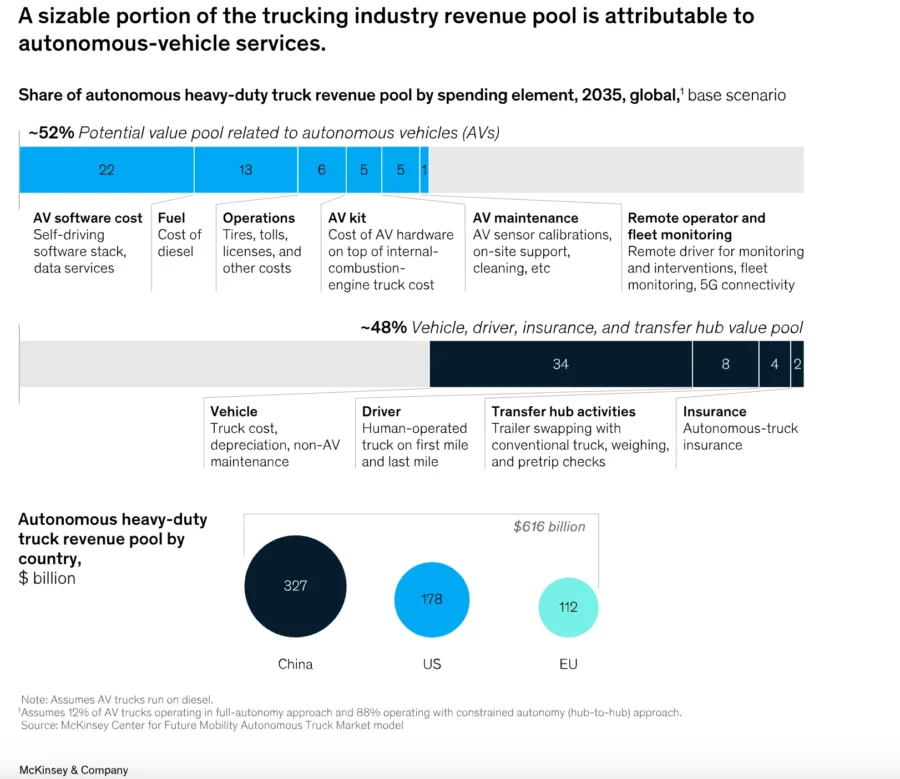

According to McKinsey, the autonomous heavy-duty trucking market is projected to reach an aggregated USD 616 billion by 2035.

Source: McKinsey & Company

By 2035, autonomous heavy-duty trucks will make up 13% of US fleets, 11% in China, and 4% in Europe, the slowest adopter.

Market Insights & Growth Metrics for Autonomous Vehicle and Drones

Scale and Magnitude

StartUs Insights reports there are 7538 companies specializing in autonomous vehicle technology and 26 755 companies focusing on drone technology. The US stands out as a leading region for the AV sector.

The global AV market is expected to reach USD 4.76 trillion by 2030, with new car sales rising by 10%. The L3 autonomous car market is set to grow at an 86% CAGR, surpassing 6 million units by 2030.

Sales of autonomous vehicles are projected to reach 7.61 million units in 2024 and 10.67 million units in 2025.

Despite the significant growth and adoption, AV technology ranks 132nd in media coverage, while drone technology holds the 83rd position, according to StartUs Insights.

Growth Indicators

Drones have also seen a remarkable surge in global interest, with annual search interest rising by 253.40% while autonomous vehicles have garnered 112.66% annual search interest as reported by StartUs Insights.

Over the past five years, funding for AVs has grown by 23.98%, indicating a steady influx of investments into the sector. While the funding for drone technologies has increased by 71.73%.

Current R&D spending on drone technology exceeds USD 3 billion annually. The Indian government offered USD 14.5 million as an incentive to manufacturers of drones and drone components.

AeroVironment, a leading manufacturer of Uncrewed Aircraft Systems announced plans to acquire BlueHalo, known for its drone swarm and counter-drone technology, for approximately USD 4.1 billion

Innovation and Novelty

According to StartUs Insights, there have been 80 407 patents filed globally in the AV sector.

The AV sector has secured a total of 2525 grants supporting research and development. This financial backing is crucial for advancing AV technologies and facilitating breakthroughs in safety, navigation, and automation. Cyngn was granted its 21st US patent with 11 additional patents granted.

StartUs Insights reports 109 185 patents filed globally in the drone sector. The industry has benefited from 6867 grants dedicated to research.

Top Use Cases of AV and Drones

- Last-Mile Delivery: They optimize last-mile delivery by reducing transit times, cutting costs, and minimizing human intervention. This enables rapid, contactless deliveries in urban and suburban areas.

- Inspection and Surveillance: Drones monitor warehouse operations by providing real-time data. This improves security and reduces the need for manual inspections in hard-to-reach locations.

- Freight Transportation: They improve freight transport by optimizing routes, reducing fuel consumption, and addressing driver shortages. These vehicles enhance efficiency in long-haul and urban logistics, ensuring reliable and scalable operations.

- Delivery to Remote Areas: Drones overcome geographical barriers by reaching remote and underserved locations and ensuring timely delivery of critical supplies.

Noteworthy Advancements in AV and Drones

- Amazon’s MK30 Delivery Drone: The MK30 covers double the range and operates at half the noise level of its predecessors. Equipped with perception technology, it detects and navigates around unexpected obstacles during its delivery descent.

- Matternet’s Home Drone Delivery Service in Silicon Valley: It employs a Tether Drop system to drop packages directly to customers’ doorsteps safely. After delivery, drones automatically swap batteries and pick up new packages. This service reduces urban congestion and emissions by decreasing reliance on traditional vehicle deliveries.

Core Technologies of AV and Drones

- Light Detection and Ranging (LiDAR): Provides high-definition 3D mapping capabilities for safe navigation. LiDAR enhances obstacle detection and collision avoidance in complex environments.

- 5G Connectivity: Offers ultra-low latency and high-speed data transmission for real-time communication between autonomous vehicles, drones, and central control systems. This connectivity supports instantaneous data exchange.

- High-Precision GPS: Provides centimeter-level accuracy for the precise navigation of AVs and drones. It ensures accurate positioning and precise delivery placements in the warehouse.

Spotlighting an Innovator: Wingcopter

Wingcopter, a Germany-based company, manufactures eVTOL fixed-wing unmanned aircraft systems to optimize medical supply chains and last-mile logistics.

The Wingcopter 198 uses a patented tilt-rotor system for vertical takeoff like a multicopter and fast-forward flight like a fixed-wing aircraft, even in adverse weather conditions.

It also includes a redundant flight control system with dual sensors and a fail-safe powertrain architecture with eight motors and two batteries. Its triple-drop delivery mechanism allows up to three separate package deliveries per flight.

Wingcopter’s delivery drone transported red blood cell fluid and whole blood recently, maintaining the required temperature control of 2 to 6 degrees Celsius in Japan.

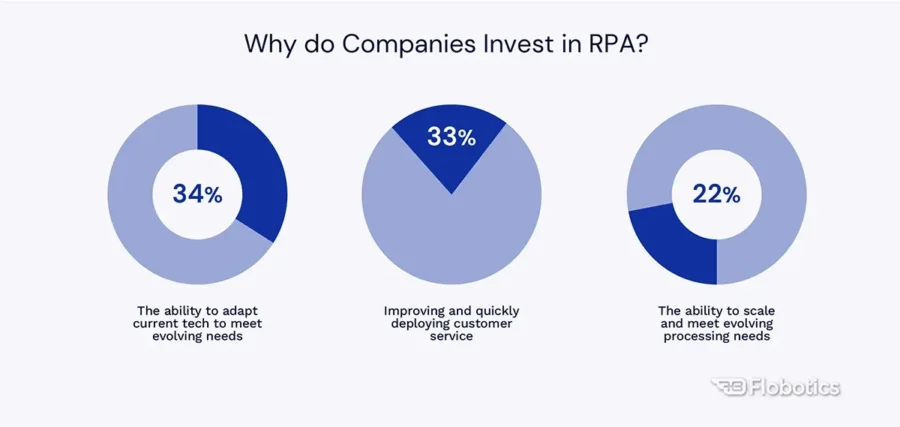

10. RPA

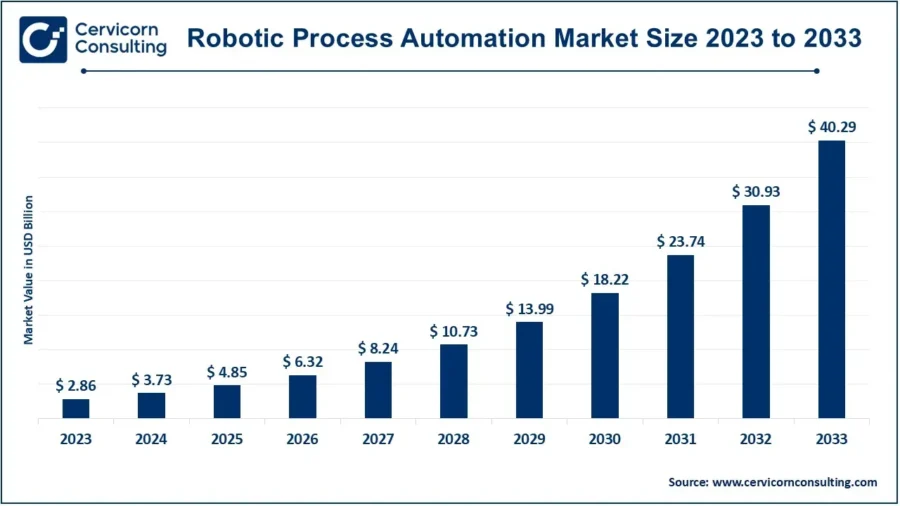

The RPA market is anticipated to reach USD 25.13 billion by 2030, with a CAGR of 43.9%.

Specifically for the US market, the RPA market size is estimated to reach around USD 12.25 billion by 2033, with a CAGR of 30%.

Source: Cervicorn Consulting

The technology automates repetitive and time-consuming tasks in logistics, such as order management, inventory control, and shipment tracking.

Source: Flobotics

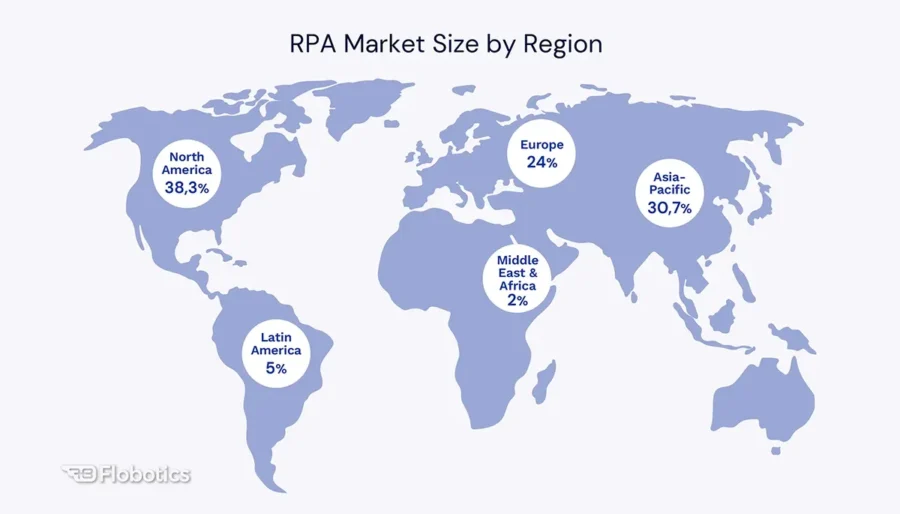

The North American RPA market size is expected to grow to USD 15.31 billion by 2033, at a CAGR of 29.8%. Europe’s RPA market size is projected to grow to USD 12.09 billion by 2033, at a CAGR of 28.7%.

Germany, the UK, and France are leading countries in RPA adoption due to their industry 4.0 initiatives and integration of AI.

Source: Flobotics

As of 2024, 53% of organizations have already started their RPA journey, with an additional 19% planning to adopt RPA within the next two years.

Market Insights & Growth Metrics for RPA

Scale and Magnitude

RPA technology has grown significantly with 7796 companies currently operating in the domain based on our data. Fortune Business Insights predicts the RPA market will grow to USD 64.47 billion by 2032.

The US accounts for approximately 38.3% of the global market share.

StartUs Insights reports that RPA ranks 760th in media coverage among emerging technologies.

Growth Indicators

Based on our analysis, RPA witnessed a significant surge in global interest, with annual search interest rising by 64.02%.

Over the past five years, RPA has achieved a 255.03% funding growth based on our data.

Major RPA companies have secured substantial funding in recent years. For example, UiPath has raised USD 1.2 billion across six rounds, while Automation Anywhere has secured USD 840 million over four funding rounds.

Innovation and Novelty

Robotic Process Automation has demonstrated significant innovation, as evidenced by the filing of 80 407 patents globally, according to data from StartUs Insights.

There have been 2525 grants awarded globally for RPA-related studies. 43% of manufacturers were employing RPA in 2024, with an additional 43% planning to launch new RPA projects.

Top Use Cases of RPA

- Order Processing and Management: It automates order receipt, verification, and status updates and accelerates order fulfillment.

- Shipment Scheduling and Tracking: RPA automates the coordination of shipment times and provides real-time tracking updates. This ensures timely deliveries and enhances transparency for customers.

- Invoice and Payment Processing: RPA automates data extraction, validation, and entry into financial systems. This reduces processing time and minimizes errors.

- Logistics Data Management: In logistics data management, RPA automates the collection, processing, and analysis of data from various sources, providing real-time insights into supply chain operations.

Noteworthy Advancement of RPA

- UiPath’s Collaboration with EXPO Group: Expo Group automated freight forwarding with UiPath’s attended robot. The company automated booking confirmations, cargo receipt updates, and shipment planning by reducing 87% working hours and decreasing the average handling time from 8.35 hours to just 48 minutes daily.

- Automation Anywhere and Genpact’s Partnership: Automation Anywhere’s RPA platform automates data logging and trend analysis. As a result, the company experienced a 30% improvement in productivity and a 25% increase in transaction speed. The implementation was completed within seven weeks.

Core Technologies of RPA

- Artificial Intelligence: Allows for real-time decision-making and adaptation to changing situations that enhance operational efficiency.

- Internet of Things: Connected sensors collect data, which triggers RPA bots to perform predefined actions or workflows. This streamlines processes and enables intelligent decision-making based on IoT insights.

- Optical Character Recognition (OCR): Integrating OCR with RPA improves data extraction and document management accuracy in logistics.

Spotlighting an innovator: KlearNow.AI

KlearNow.AI, a US company, develops AI-powered platforms to streamline global supply chains. Its technology digitizes paper-based transactions, automates workflows, and provides visibility for international shipments.

By leveraging AI and ML, KlearNow.AI reduces manual errors and accelerates customs clearance processes in global trade operations. This simplifies and automates complex logistics processes through collaborative digital platforms for customs clearance and drayage.

KlearNow.AI has been shortlisted for the Global Logistics Award in the inaugural Global Procurement & Supply Chain Awards 2024.

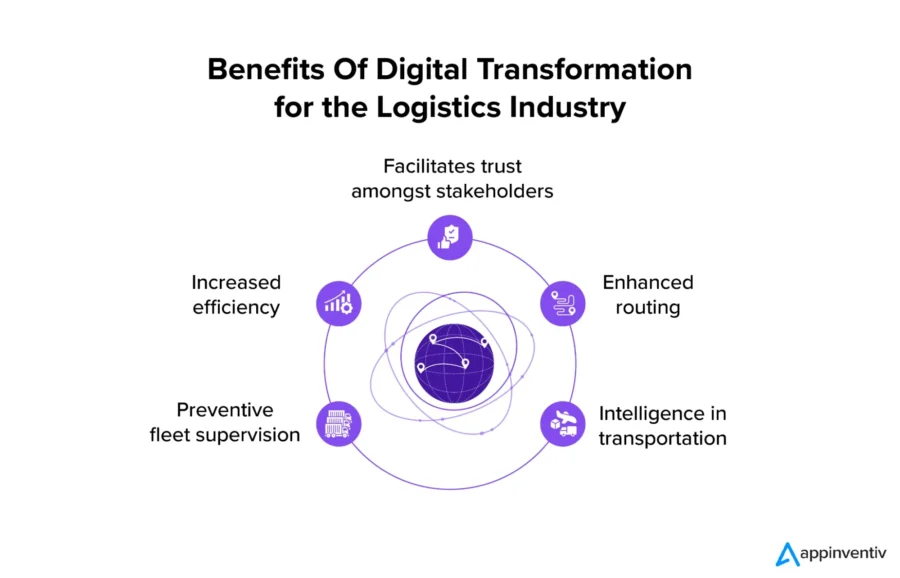

Key Benefits of Implementing Advanced Logistics Technology in 2025

Source: appinventiv

1. Cost Reduction and Efficiency

Automation through technologies like route optimization software and AI-driven inventory management enables substantial savings by cutting fuel costs, reducing overstocking, and minimizing stockouts.

Walmart’s vendor-managed inventory system kept distribution costs at just 1.7% of sales.

2. Enhanced Visibility and Real-time Tracking

Technologies like GPS, RFID, and IoT sensors provide continuous updates on shipment status and location that offer an unprecedented level of traceability, transparency, and data-driven decision-making capabilities.

Reports suggest that only 4% of retailers lack visibility into their logistic operations while nearly 20% are using advanced tools like towers and analytics.

3. Improved Customer Experience

Digitizing logistics enhances customer experience through real-time shipment tracking, dynamic route adjustments, and instant updates. AI-driven optimization improves delivery times, reduces costs, and ensures efficient operations.

4. Scalability and Future Proofing

According to Gartner, 85% of organizations will adopt a cloud-first approach to fully execute their digitally-driven growth strategies. Similarly, adaptive technologies such as RPA and AI further enhance scalability.

Together, these advancements ensure logistics companies scale efficiently, address disruptions proactively, and meet evolving customer expectations in a digital-first world.

Step-by-Step Guide: Roadmap for Successful Logistics Digitization

A strategic, phased approach to implementing digital transformation in the logistics sector ensures a seamless transition to modern logistics systems. Here’s a planned guide for logistics companies to implement it effectively:

1. Define the Vision and Goals

- Establish a Clear Vision: Align the digital transformation strategy with the company’s logistics objectives, focusing on efficiency, sustainability, and enhanced supply chain visibility.

- Set Measurable Objectives: Define quantifiable targets such as reducing transportation costs, optimizing delivery routes, increasing warehouse automation, or improving customer satisfaction ratings.

2. Conduct a Digital Maturity Assessment

- Evaluate Current Capabilities: Assess existing logistics technologies, operational workflows, and workforce expertise to identify strengths and gaps in digital readiness.

- Benchmark Against Industry Leaders: Compare digital adoption levels with top logistics companies to understand competitive positioning and identify best practices for modernization.

3. Identify Key Technologies

- Prioritize Investments: Focus on high-impact technologies such as IoT for real-time shipment tracking, AI for predictive demand forecasting, and blockchain for secure and transparent supply chain management.

- Ensure Scalability: Choose solutions that can evolve with the organization, supporting future technological advancements and business growth.

- Use Technology Scouting: Leverage platforms like StartUs Insights’ Discovery Platform to track emerging innovations in logistics and supply chain technology.

4. Build a Robust Data Infrastructure

- Leverage Big Data: Implement systems to collect, store, and analyze vast amounts of logistics data from multiple sources, improving decision-making and operational efficiency.

- Integrate Systems: Ensure seamless communication between logistics management systems, warehouse operations, and transportation networks for synchronized workflows and enhanced data accuracy.

5. Develop a Detailed Roadmap

- Plan Incremental Implementation: Break down the digital transformation journey into manageable phases, starting with pilot programs to validate technological effectiveness.

- Set Realistic Timelines: Establish achievable deadlines for each phase while maintaining flexibility to adapt to market shifts and operational challenges.

6. Foster Collaboration and Ecosystem Partnerships

- Engage Stakeholders: Involve logistics providers, suppliers, customers, and technology partners early in the process to ensure alignment and commitment.

- Form Strategic Alliances: Partner with technology firms, startups, and research institutions to gain access to innovative solutions and shared expertise.

7. Upskill the Workforce

- Invest in Training: Provide logistics professionals with training in digital tools, automation, and data analytics to ensure they can effectively leverage new technologies.

- Cultivate a Digital Culture: Foster an environment of continuous learning and innovation, encouraging employees to embrace change and drive transformation

8. Implement Robust Cybersecurity Measures

- Protect Critical Assets: Establish comprehensive cybersecurity protocols to safeguard logistics data, shipment tracking systems, and operational networks against cyber threats.

- Comply with Regulations: Ensure adherence to industry standards and legal requirements related to data privacy, supply chain security, and regulatory compliance.

9. Monitor, Measure, and Optimize

- Track Key Performance Indicators (KPIs): Regularly evaluate performance metrics such as delivery accuracy, order fulfillment speed, and cost efficiency to measure digital transformation success.

- Adapt Strategies: Use data-driven insights to refine strategies, addressing inefficiencies and capitalizing on emerging logistics trends.

10. Scale and Innovate Continuously

- Expand Successful Pilots: Scale up proven digital initiatives across the logistics network, ensuring they remain adaptable and sustainable.

- Embrace Continuous Improvement: Stay updated on evolving logistics technologies and industry best practices, fostering a culture of ongoing innovation.

Future Trends in the Logistics Industry: Top 4 Emerging Technologies

1. Quantum Computing for Complex Optimization

What’s Next: Quantum computing is solving complex optimization problems much faster than traditional computers. This includes optimizing routes, supply chain management, and demand forecasting.

Why It Matters:

- Efficiency Gains: Accelerates data processing for real-time decision-making.

- Cost Reduction: Optimizes resource allocation, reducing operational expenses.

2. Advanced AI-Powered Robotics

What’s Next: The integration of artificial intelligence with robotics is leading to more sophisticated automation in logistics. For instance, Nvidia develops AI-powered robots to handle complex tasks in warehouses and distribution centers.

Why It Matters:

- Labor Optimization: Addresses labor shortages and reduces dependency on manual work.

- Scalability: Allows for flexible scaling of operations without proportional increases in labor costs.

3. Autonomous Delivery Systems

What’s Next: The deployment of autonomous vehicles and drones is set to transform last-mile delivery. The Flying Ship Company’s drone ship, which skims over water surfaces at high speeds, offers faster and more cost-effective delivery solutions.

Why It Matters:

- Speed: Significantly reduces delivery times.

- Accessibility: Improves delivery capabilities in hard-to-reach areas

4. Sustainable Energy Solutions

What’s Next: The logistics sector is moving towards sustainable energy sources. Companies like Amazon are investing in electric heavy goods vehicles to establish zero-emission truck fleets.

Why It Matters:

- Environmental Impact: Reduces greenhouse gas emissions.

- Regulatory Compliance: Meets evolving environmental regulations and standards.

Act Now to Stay Ahead of the Technology Curve

Staying competitive means more than just being aware of technological advancements. Every industry faces unique challenges and opportunities, and a one-size-fits-all approach isn’t enough.

That’s where our AI and Big Data-powered Discovery Platform comes in. With access to over 4.7 million emerging companies and 20K+ technologies & trends globally, it equips you with the actionable insights you need to stay ahead of the curve. Leverage this powerful tool to spot the next big thing before it goes mainstream. Stay relevant, resilient, and ready for what’s next.

![Top 10 Logistics Technology for Digital Transformation [2025]](https://www.startus-insights.com/wp-content/uploads/2025/02/Logistics-Technology-SharedImg-StartUs-Insights-noresize-420x236.webp)

![AI in Automotive: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Automotive-SharedImg-StartUs-Insights-noresize-420x236.webp)