Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the FinTech industry. This time, you get to discover five hand-picked machine learning startups impacting FinTech companies.

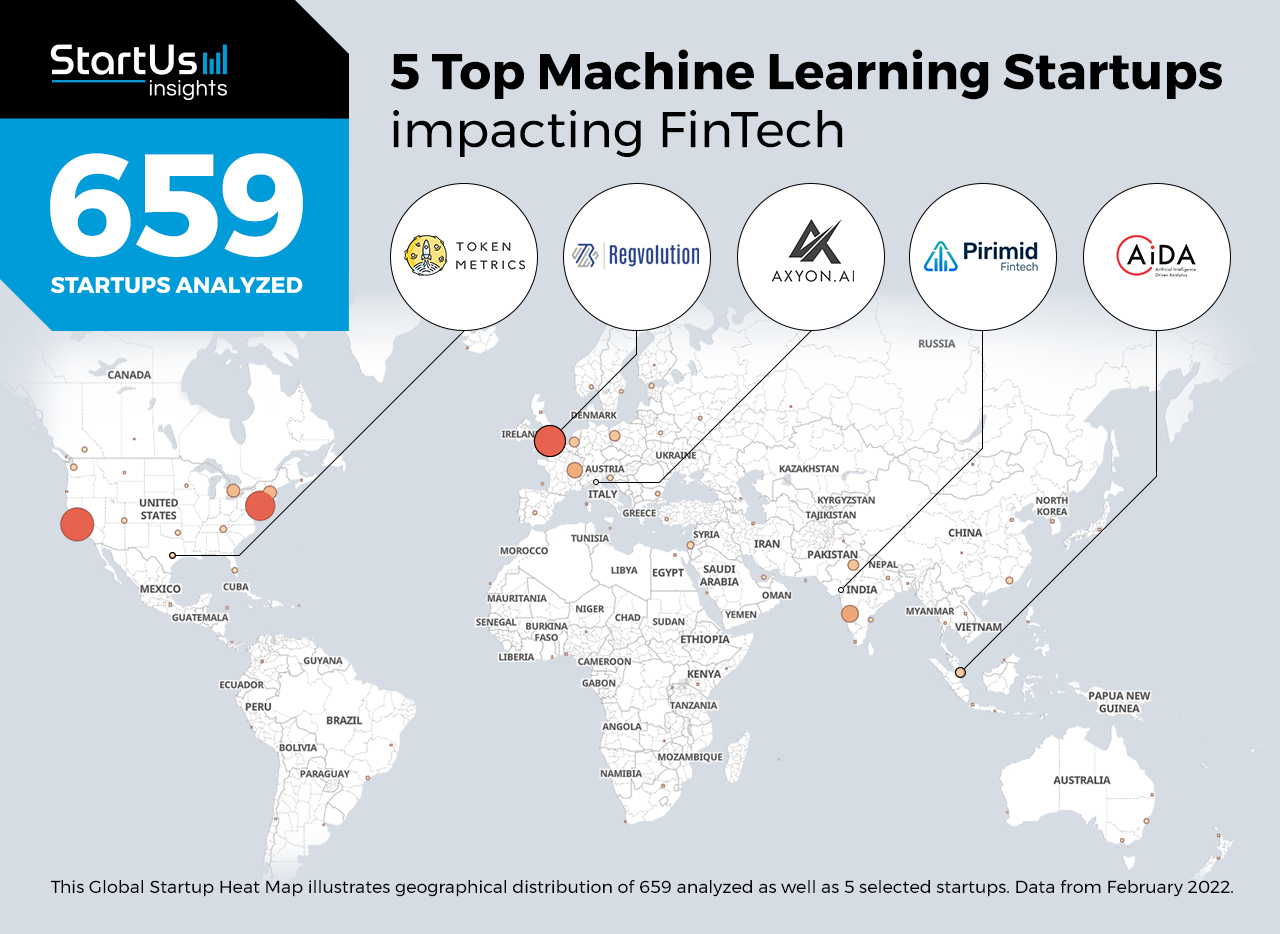

Out of 659, the Global Startup Heat Map highlights 5 Top Machine Learning Startups impacting FinTech

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 659 exemplary startups & scaleups we analyzed for this research. Further, it highlights five ML startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 654 machine learning solutions for FinTech companies, get in touch with us.

Axyon AI advances Asset Management

Founding Year: 2016

Location: Modena, Italy

Funding: USD 1,67 M

Partner with Axyon AI for Investment Portfolio Enhancement

Axyon AI is an Italian FinTech startup that provides AXYON IRIS, an asset management platform. It combines big data, predictive analysis, and high-performance computing (HPC) to offer insights into complex market patterns. AXYON IRIS mitigates the need for manual market analysis and detects anomalies in the market data to improve prediction accuracy. Additionally, the platform provides relative asset performance data and consistent forecasts of top-performing stocks, hedge funds, and exchange-traded funds (ETFs). This allows asset and portfolio managers to save time and improve investment portfolio management.

Pirimid Fintech facilitates Loan Portfolio Monitoring

Founding Year: 2017

Location: Ahmedabad, India

Use Pirimid’s solution for Fraud Mitigation

Pirimid Fintech is an Indian startup that offers an early warning system for loan monitoring. The startup’s software leverages ML to collate borrower information from banking data, trade details, social media sentiments, and digital footprints to identify trends and patterns. It also provides a web-deployable model through an application programming interface (API) and an alternate scoring system for loan portfolios. Additionally, a dashboard allows users to easily monitor loan portfolios across products and industries. Besides, it offers market analytics based on various data sources such as credit information and tax filing databases. This enables lenders and banks to identify loan book patterns, improve loan management, and mitigate fraud.

Token Metrics provides a Crypto Analytics Platform

Founding Year: 2017

Location: Austin, USA

Funding: USD 4,5 M

Reach out to Token Metrics for Daily Crypto Price Predictions

US-based startup Token Metrics develops a crypto analytics platform. It utilizes machine learning to analyze on-chain data from Ethereum and Bitcoin, social sentiment trends, and daily market updates to provide cryptocurrency investment insights. The platform offers long- and short-term investment decision support through cryptocurrency indices, allowing traders to compare real-time crypto performance. It also offers visual trend indicators and rolling daily price predictions. Token Metrics provides increased transparency into the crypto market, simplifying investment decisions for crypto investors and traders.

AiDA offers Finance Analytics

Founding Year: 2016

Location: Singapore

Funding: USD 72 000

Partner with AiDA for AI-driven Insurance Claims Underwriting

AiDA is a Singaporean startup that provides a product suite for financial analytics and process automation. The startup’s ML-based solutions allow banks and insurance companies to develop novel products for fraud detection, underwriting automation, and agent performance management. These solutions provide insights into banking processes and, in turn, identify productivity bottlenecks, accelerate processes, reduce costs, and manage risks. Besides, AiDA’s on-premise product suite mitigates cybersecurity risks and eliminates data silos.

Regvolution develops a Risk & Finance Optimizer

Founding Year: 2018

Location: London, UK

Funding: USD 415 000

Work with Regvolution for Credit Risk Management

UK-based startup Regvolution makes a risk and finance optimizer for banks and non-banking financial companies (NBFCs). The startup’s solution analyzes regulatory data to detect data redundancies, verify relationships between variables, and optimize data processes. The insights are based on benchmark data from 130 banks and it offers guidance on portfolios and risk parameters. Regvolution’s anomaly detection algorithms allow risk data analysts to simplify credit risk management.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on ML-driven claims underwriting, finance optimization, portfolio monitoring as well as cryptocurrency analytics. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.