The 2025 Machinery Industry Report highlights key trends, technological advancements, and market opportunities shaping the sector. It covers sustainability, automation, patent filings, and investment trends, offering insights into industry health and growth. The report serves as a reference for stakeholders, investors, and analysts to understand the industry’s trajectory and innovation potential.

This report was last updated in January 2025.

Executive Summary: Machinery Industry Report 2025

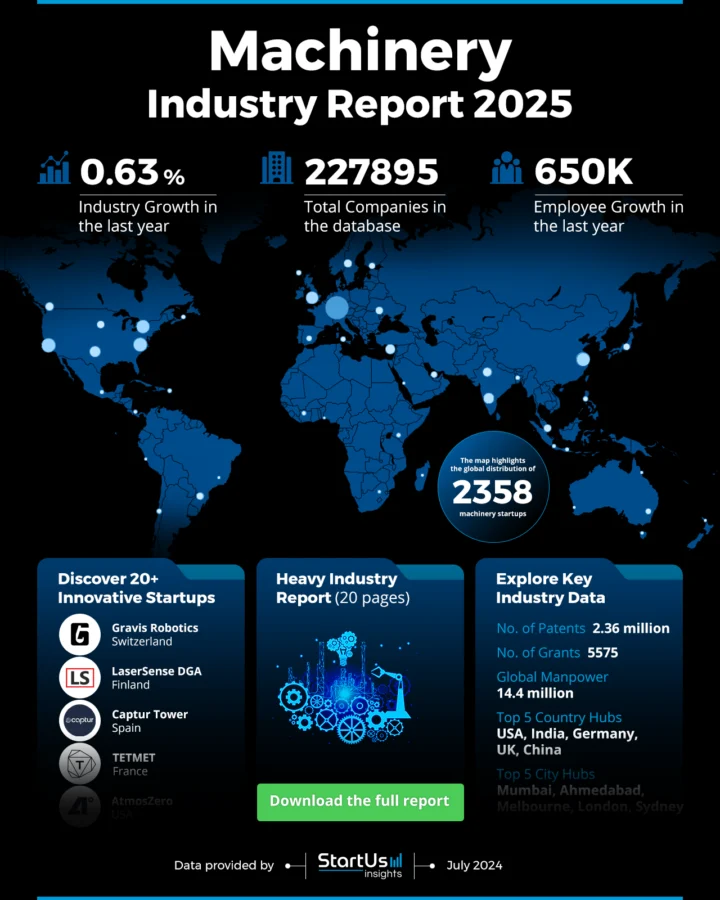

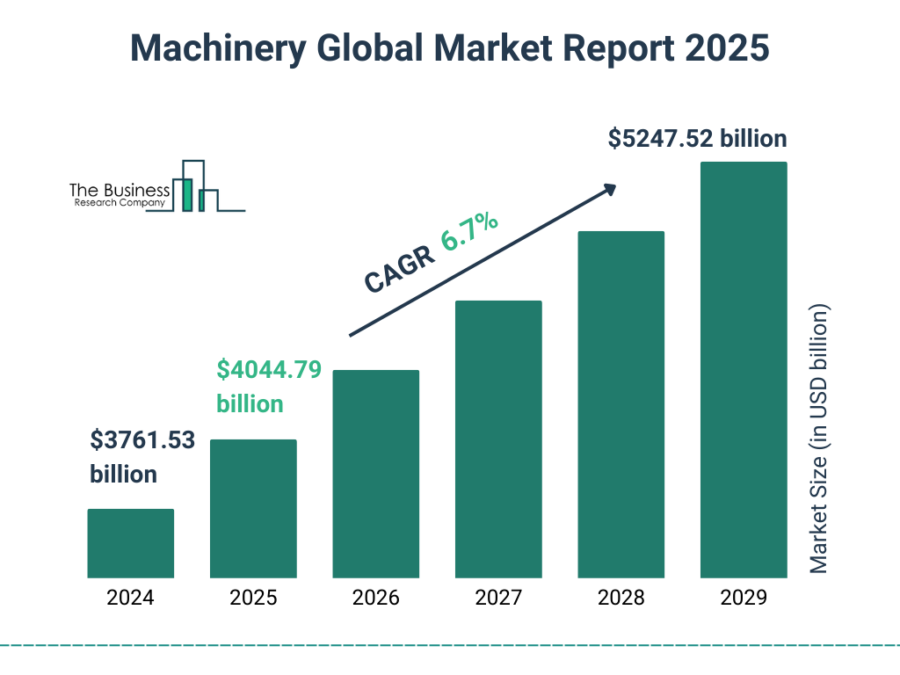

- Industry Growth: The global machinery industry will grow from USD 3761.53 billion in 2024 to USD 5247.52 billion in 2029 at a compound annual growth rate of 6.7%. On a granular level, the industry has experienced a growth rate of 2.61% over the past year as per the Discovery Platform’s latest data.

- Manpower & Employment: The global workforce in the machinery industry totals 22.6 million, with 1.4 million new employees added last year.

- Patents & Grants: The industry records 104K+ patents and over 5800+ grants that emphasize the innovation and research activities driving progress.

- Global Footprint: Major country hubs include the US, UK, India, Australia, and Canada, with prominent city hubs in London, New York City, Sydney, Mumbai, and Melbourne.

- Investment Landscape: The machinery industry sees substantial investment activity, with an average investment value of USD 39 million per round and over 16 300 funding rounds closed.

- Top Investors: Leading investors include the European Investment Bank, Ametek, T Rowe Price, and more who have collectively invested more than USD 2 billion.

- Startup Ecosystem: Five innovative startups include Gravis Robotics (heavy machinery automation), LaserSense DGA (gas analysis in transformers), CapturTower (carbon capture), TETMET (lattice manufacturing), and AtmosZero (electric boiler room).

Methodology: How We Created This Machinery Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of machinery over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within machinery

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the machinery industry.

What Data is Used to Create This Machinery Report?

Based on the data provided by our Discovery Platform, we observe that the machinery industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The machinery industry ranks high in news coverage and publications, with over 151K publications in the last year.

- Funding Rounds: Our database records more than 16 300 funding rounds within the sector.

- Manpower: The industry employs over 14.4 million workers and added 650K new employees in the past year.

- Patents: It holds a strong position in patents, with 2.36 million patents.

- Grants: The industry has received 5575 grants, enhancing its innovative capabilities.

- Yearly Global Search Growth: The yearly global search growth for the industry increased by 5.41%.

Explore the Data-driven Machinery Industry Report for 2025

According to The Business Research Company Report, the machinery market will grow from USD 4044.79 billion in 2025 to USD 5247.52 billion in 2029 at a compound annual growth rate of 6.7%.

This Machinery Industry Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

Our database includes 2300+ startups and 227K+ companies. The industry’s annual growth rate is 0.63%, indicating steady progress.

Credit: The Business Research Company

According to the report published by The Business Research Company, the industrial machinery market is anticipated to grow from USD 576.62 billion in 2024 to USD 621.23 billion in 2025, with a CAGR of 7.7%. However, on a micro level, the machinery industry grew by a rate of 2.61% last year as per the Discovery Platform’s latest data.

Additionally, the global workforce in the machinery sector totals 14.4 million, with an employee growth of 650K last year.

The major country hubs include the US, UK, India, Australia, and Canada and the prominent city hubs are London, New York City, Sydney, Mumbai, and Melbourne.

A Snapshot of the Global Machinery Industry

The machinery industry demonstrates a stable annual growth rate of 0.63%, reflecting gradual development. Our database includes 2350 startups, with more than 2600 early-stage startups.

In terms of company lifecycle, there have been over 11K mergers and acquisitions recorded. The patent landscape is strong, with 2.36 million patents filed by over 568K applicants.

The yearly patent growth rate is modest at 0.04%. The US and China lead in patent issuances, with 550K and 376K patents issued respectively. Additionally, the rapid industrialization in China and India drives machinery demand, as China’s fixed asset investments grow at an average rate of over 9% per month in 2024.

Explore the Funding Landscape of the Machinery Industry

Investment activities within the machinery industry are substantial, with an average investment value of USD 39 million per round. There are more than 7300 investors actively funding the industry, and over 16 300 funding rounds have been closed. The number of companies receiving investments exceeds 6800, highlighting a vibrant investment ecosystem.

Bain’s 2024 report highlights IoT and digital solutions impacting profit pools by increasing efficiency in machinery manufacturing.

Who is Investing in the Machinery Industry?

The combined investment value of the top investors in the machinery industry exceeds USD 2.7 billion. Here is a detailed breakdown of the top investors, including the number of companies they have invested in and the total invested value:

- European Investment Bank invested USD 756 million in 11 companies. NXP, a Netherlands-based semiconductor manufacturer, secured a USD 1.08 billion loan from the EIB for R&D projects across five European countries.

- AMETEK allocated USD 483 million to 15 companies. AMETEK’s IntelliPower and AMETEK programmable power businesses have collaborated with Radiant Futures to support the community and encourage sustainable development.

- T. Rowe Price invested USD 443 million in 2 companies.

- Enerpac Tool Group contributed USD 406 million to 8 companies. While expanding its heavy-lifting technology portfolio, Enerpac acquired DTA, a producer of automated horizontal movement products.

- Idex allocated USD 354 million to 8 companies. IDEX announced plans to acquire Mott Corporation, a leader in filtration products, for USD 1 billion.

- Middleby invested USD 310 million in 18 companies. Middleby acquired Gorreri Food Processing Technology for its heavy-lifting technology portfolio.

Moreover, companies are tapping into a USD 27 trillion green tech market with carbon-cutting machinery to support global sustainability goals.

Did you know Market.us and SP Automation project AI will drive predictive maintenance, quality control, and process optimization while growing the market to USD 90.1 billion by 2033?

Top Machinery Innovations & Trends

Explore the emerging machinery trends driving the industry forward, along with the firmographic insights:

- Transformers remain a critical trend in the machinery industry, with a total of 9110 companies identified. These companies collectively employ 607K individuals, reflecting the sector’s significant workforce. Over the past year, the industry has seen the addition of 33K new employees, indicating ongoing growth and the demand for skilled labor. The annual growth rate for transformers stands at 0.08%, showing steady but modest expansion.

- Flywheels are gaining traction within the machinery industry, with 1510 companies identified as key players in this segment. These companies employ 78K individuals, showcasing the specialized nature of this technology. The industry experienced an influx of 5200 new employees over the last year. The annual growth rate for flywheels is 1.03%, indicating a growing interest and investment in energy storage solutions.

- Heating Systems represent a rapidly expanding trend in the machinery industry, with 5490 companies identified in this segment. These companies employ a total of 208K individuals, reflecting the substantial workforce dedicated to this sector. Over the past year, 10K new employees joined the industry, highlighting robust employment growth. The annual trend growth rate for heating systems is 8.13%, underscoring the increasing demand for advanced heating solutions.

5 Top Examples from 2300+ Innovative Machinery Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Gravis Robotics enables Heavy Machinery Automation

Swiss startup Gravis Robotics develops autonomous robots for various industrial applications. Its platform, Gravis AI, enables robots to perform complex tasks with high precision and reliability.

Gravis Robotics’ robots, equipped with AI-driven capabilities, offer efficient operations in manufacturing and logistics. Its product, Gravis Vision, offers improved visual recognition for accurate object handling.

Further, Gravis Robotics collaborated with HD Hyundai to improve safety and productivity in construction through AI technologies.

LaserSense DGA offers Gas Analysis for Transformers

Finnish startup LaserSense DGA specializes in online dissolved gas analysis for transformers.

Its platform, LaserSense, employs laser technology to monitor gas levels in real time. This technology detects and quantifies gases to provide critical insights into transformer health.

The platform supports predictive maintenance to prevent potential failures before they occur. Further, its solution integrates with existing infrastructure for minimal disruption during implementation.

Captur Tower facilitates Carbon Capture for Machinery

Spanish startup CapturTower provides innovative tower design and monitoring solutions for the machinery industry.

Its platform, TowerInsight, integrates real-time data analytics to enhance tower performance and reliability. The platform uses sensor technology to track structural health and detect potential issues early.

Further, TowerInsight supports predictive maintenance to extend the lifespan of machinery components.

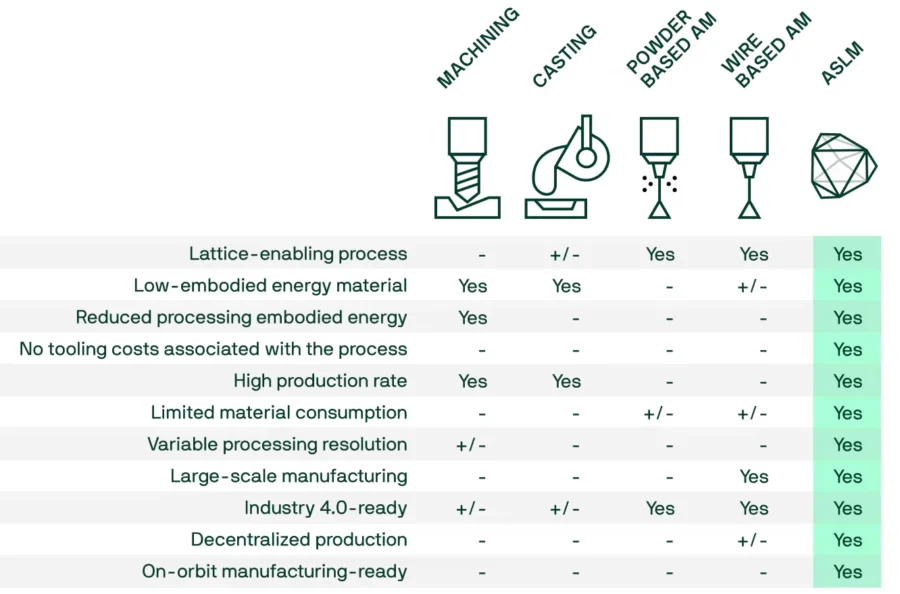

TETMET specializes in Lattice Manufacturing Technology

French startup TETMET develops innovative lattice structures using adaptive spatial lattice manufacturing (ASLM) technology. This technology enables the decentralized, automated production of lightweight and strong large-scale structures.

Further, ASLM facilitates applications across industries, including automotive, aerospace, and renewable energy. TETMET also allows high strength-to-weight ratios to optimize performance and sustainability.

AtmosZero provides Zero-emissions Electric Boiler Room Solutions

US startup AtmosZero focuses on providing industrial heat through zero-emission technologies. Its platform leverages renewable energy to replace traditional fossil fuel-based heating systems.

Its solutions include scalable industrial heaters that integrate with existing infrastructure. AtmosZero employs innovative heat pump technology for improved energy efficiency and cost savings.

Additionally, its systems offer real-time monitoring and analytics for optimized performance.

AtmosZero has also partnered with New Belgium Brewing Company to increase energy efficiency and reduce carbon emissions across industries.

Gain Comprehensive Insights into Machinery Trends, Startups, or Technologies

The 2025 machinery industry report highlights a sector characterized by steady growth, innovation, and substantial investment. The key trends such as automation, robotics, and 3D printing show significant advancements and employment figures. As the industry continues to evolve, it remains a vital contributor to economic growth and technological progress worldwide.

Get in touch to explore all 2300+ startups and scaleups and all industry trends impacting machinery companies.