Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2024 Maritime Industry Report presents an in-depth analysis of current trends, technological advancements, and investment patterns shaping the global maritime sector. This report highlights key growth areas, such as maritime security, ship management, and offshore energy, while providing valuable insights into employment statistics, firmographic data, and regional hubs. It also examines the industry’s innovation landscape, focusing on new technologies and their impact on operational efficiency.

This maritime industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Maritime Report 2024

- Executive Summary

- Introduction to the Maritime Report 2024

- What data is used in this Maritime Report?

- Snapshot of the Global Maritime Industry

- Funding Landscape in the Maritime Industry

- Who is Investing in the Maritime industry?

- Emerging Trends in the Maritime Industry

- 5 Maritime Startups impacting the Industry

Executive Summary: Maritime Industry Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 3700+ maritime industry startups developing innovative solutions to present five examples from emerging industry trends.

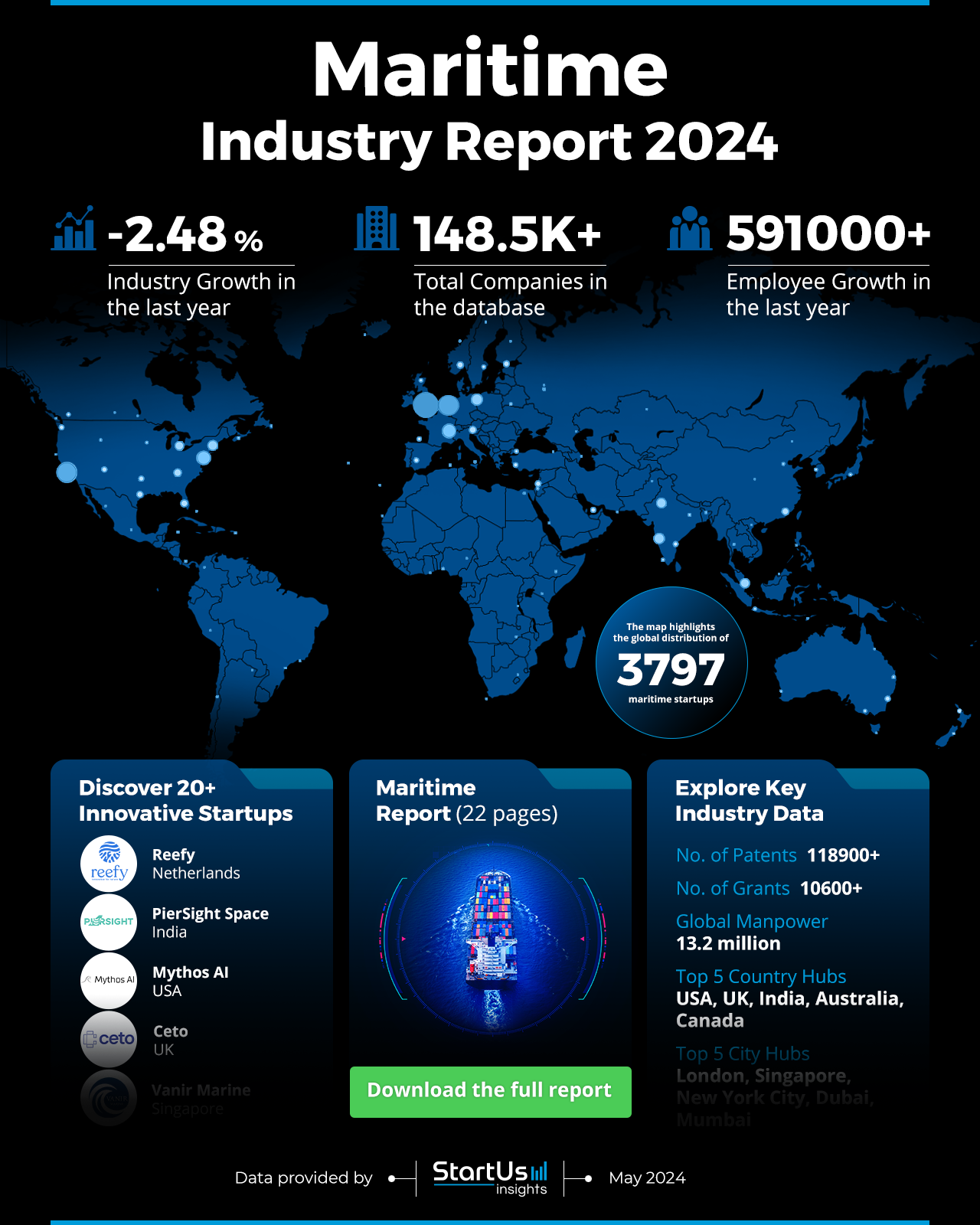

- Industry Growth: The maritime industry saw a 2.48% decrease in growth last year but remains substantial with over 148500 active companies.

- Manpower & Employment Growth: The global workforce encompasses 13.2 million individuals, with 591000 new employees added in the last year.

- Patents & Grants: Innovation is evident with more than 118900 patents and 10600 grants supporting the sector.

- Global Footprint: Key hubs include the USA, UK, India, Australia, and Canada, with leading cities being London, Singapore, New York City, Dubai, and Mumbai.

- Investment Landscape: The sector has attracted more than 7,700 investors who have participated in over 17700 funding rounds, with an average investment value of USD 64 million per round.

- Top Investors: TPG (USD 875 million), OneX (USD 848 million), Ares Management (USD 817 million), and more.

- Startup Ecosystem: Five innovative startups include Reefy (offshore ecosystem solutions), PierSight Space (maritime intelligence), Mythos AI (fleet automation), Ceto AI (maritime analytics), and Vanir Marine (digital procurement).

- Recommendations for Stakeholders: Investors should focus on diversifying portfolios with emerging maritime technologies and sustainable solutions to maximize returns and drive industry innovation. Government bodies should implement supportive policies, provide incentives, and fund research to foster industry development and meet regulatory standards. Companies need to invest in R&D, form strategic partnerships, and adopt new technologies to remain competitive and drive growth.

Explore the Data-driven Maritime Industry Outlook for 2024

The Maritime Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The maritime industry, despite a slight decline with a 2.48% decrease in growth last year, remains substantial. The database includes 3797 startups and over 148500 companies. Innovation is evident with more than 118900 patents and 10600 grants supporting the sector.

The global workforce encompasses 13.2 million individuals, with a notable addition of 591000 employees in the last year. Key hubs include the USA, UK, India, Australia, and Canada, with leading cities being London, Singapore, New York City, Dubai, and Mumbai. The heatmap above visualizes these data points, offering a comprehensive overview of the industry’s landscape and key hubs.

Based on the data provided by our Discovery Platform, we observe that the maritime industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry received more than 130000 publications in the last year, showcasing extensive news coverage and research interest.

- Funding Rounds: Our database records over 17700 funding rounds, reflecting strong investment activity within the sector.

- Manpower: With a workforce exceeding 13.2 million, the industry has demonstrated significant growth by adding over 591000 new employees in the past year.

- Patents: The sector holds over 118000 patents, highlighting its innovation and technological advancements.

- Grants: More than 10,600 grants have been awarded to support ongoing research and development in the industry.

- Yearly Global Search Growth: The industry experienced a 4.94% growth in yearly global search interest, reflecting increased public and professional attention.

A Snapshot of the Global Maritime Industry

The maritime industry has demonstrated substantial activity and investment despite facing challenges. The industry saw an employee growth of 591000 in the last year, contributing to a total workforce of 13.2 million. With over 148000 companies operating within the sector, the industry’s scale is significant.

Explore the Funding Landscape of the Maritime Industry

Investment activity remains strong, with an average investment value of USD 64 million per round. The sector has attracted more than 7700 investors who have participated in over 17700 funding rounds, supporting over 8600 companies. This robust investment landscape underscores the industry’s potential and investor confidence in its future growth.

Who is Investing in Maritime Solutions?

The combined investment value by the top investors in the maritime industry exceeds USD 5 billion, highlighting the sector’s significant potential. Notable investors and their contributions include:

- TPG has invested USD 875 million across 4 companies.

- OneX has allocated USD 848 million to 4 companies.

- Ares Management has invested USD 817 million in 5 companies.

- Warburg Pincus has allocated USD 815 million to 6 companies.

- Insight Partners has invested USD 796 million across 8 companies.

- Credit Agricole has invested USD 740 million in 2 companies.

This substantial financial backing highlights the industry’s potential for long-term success and development, emphasizing the importance of strategic investments in shaping the future of maritime operations.

Access Top Maritime Innovations & Trends with the Discovery Platform

Maritime Security is a rapidly growing trend within the industry, with 730 companies identified. This sector employs approximately 86000 people, with 3700 new employees added in the last year, reflecting its dynamic expansion. The annual growth rate for maritime security is 24.48%, underscoring its increasing importance. Companies in this sector focus on safeguarding maritime operations against threats such as piracy, terrorism, and smuggling.

Ship Management is a significant and expanding segment of the maritime industry, with 1,588 companies identified. This sector employs around 309000 people, with 12100 new employees added in the past year, demonstrating substantial workforce growth. The annual growth rate for ship management is 13.23%, highlighting its steady expansion. Companies in this sector provide comprehensive management services for vessels, including crew management, maintenance, and operational efficiency.

Offshore Energy is a vital and growing trend within the maritime industry, with 1,219 companies identified. This sector employs approximately 239,000 people, with 12,400 new employees added in the last year, reflecting significant workforce expansion. The annual growth rate for offshore energy is 22.31%, showcasing its rapid development. Companies in this sector focus on harnessing energy from offshore sources such as wind, oil, and gas.

5 Top Examples from 3700+ Innovative Maritime Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Reefy creates Sustainable Offshore Ecosystem Solutions

Dutch startup Reefy specializes in developing environmentally friendly artificial reefs for offshore applications. Its ReefBlock technology integrates long-duration stability and active carbon capture, enhancing marine habitats. The ReefBlocks meet tender requirements for offshore wind farms by providing efficient scour and cable protection. Engineered from plastic-free materials, the ReefBlocks support oyster attachment, promoting natural reef regeneration. Each ReefBlock, weighing up to six tons, remains stable even in high-velocity environments.

PierSight Space offers Maritime Intelligence

PierSight is an Indian startup that develops a constellation of Synthetic Aperture Radar (SAR) satellites to provide persistent maritime monitoring. The platform offers all-weather imaging capabilities, ensuring visibility through clouds and darkness. PierSight’s technology guarantees 100% ocean coverage, capturing comprehensive data on maritime activities. The system delivers low-latency data, providing actionable insights at 30-minute intervals. By integrating SAR and Automatic Identification System (AIS) data, the platform enhances situational awareness. This technology supports applications including oil spill detection, illegal fishing monitoring, and Exclusive Economic Zone (EEZ) protection.

Mythos AI develops Fleet Automation Solutions

US-based startup Mythos AI specializes in developing autonomous solutions for the maritime industry, focusing on port resilience and decarbonizing shipping. The company’s platform, Archie, leverages autonomy, self-driving technology, and a cloud backend to provide critical navigation information. Archie optimizes loading and scheduling for ships and maintains channel information for ports. It aids authorities in keeping ports open, enhancing operational efficiency. The technology reduces human error, significantly lowering vessel-based accidents. Mythos AI collaborates with manufacturers and fleet operators to automate task-specific workflows, ensuring vessels eventually operate without intervention.

Ceto AI provides Maritime Analytics

Ceto AI is a UK-based startup specializing in optimizing vessel performance using advanced artificial intelligence. The company’s Watchkeeper device and existing data logging solutions offer predictive analytics to prevent machinery breakdowns. Ceto’s platform tracks fuel consumption, emissions, and voyage data, providing actionable insights for operational efficiency. The system establishes a baseline with its Machinery Performance Index, spotting anomalies early. CarbonID, another product, ensures compliance with emission regulations. Ceto’s solutions enhance maritime safety and efficiency, supported by high-frequency data capture.

Vanir Marine simplifies Digital Procurement

Singapore-based Vanir Marine offers a Digital Smart Procurement Platform (DSPP) for the maritime industry. This platform streamlines procurement processes through advanced digital solutions. The DSPP integrates real-time data analytics to optimize procurement efficiency. The platform ensures transparent and traceable transactions across the supply chain. It supports automated procurement workflows, reducing manual intervention and errors. The DSPP features secure, blockchain-based transactions, enhancing data security and trust. The platform aims to improve cost-efficiency and operational effectiveness in maritime procurement.

Gain Comprehensive Insights into Maritime Industry Trends, Startups, or Technologies

The 2024 Maritime Industry Report highlights a sector driven by advancements in maritime security, ship management, and offshore energy. Despite a slight decline in overall industry growth last year, significant investments and workforce expansion underscore its resilience. Contact us to explore all 3700+ startups and scaleups, as well as all industry trends impacting maritime companies worldwide.

![15 Top Defense Companies and Startups to Watch in Europe [2026]](https://www.startus-insights.com/wp-content/uploads/2025/03/Defense-Companies-in-Europe-SharedImg-StartUs-Insights-noresize-420x236.webp)