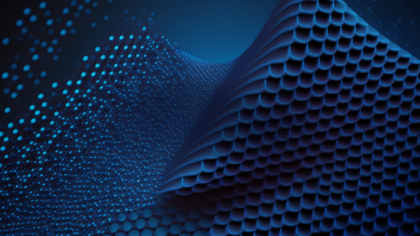

The Material Report 2025 summarizes key global trends in the materials industry using firmographic, innovation, and investment data. It highlights how materials firms respond to economic, environmental, and technological challenges through innovation and strategic shifts.

This report maps investment flows, explores leading innovation hubs, and outlines the influence of major corporate and financial stakeholders. Based on recent performance metrics, it also highlights top-performing segments, including advanced materials, biomaterials, and sustainable materials.

Executive Summary: Material Report 2025

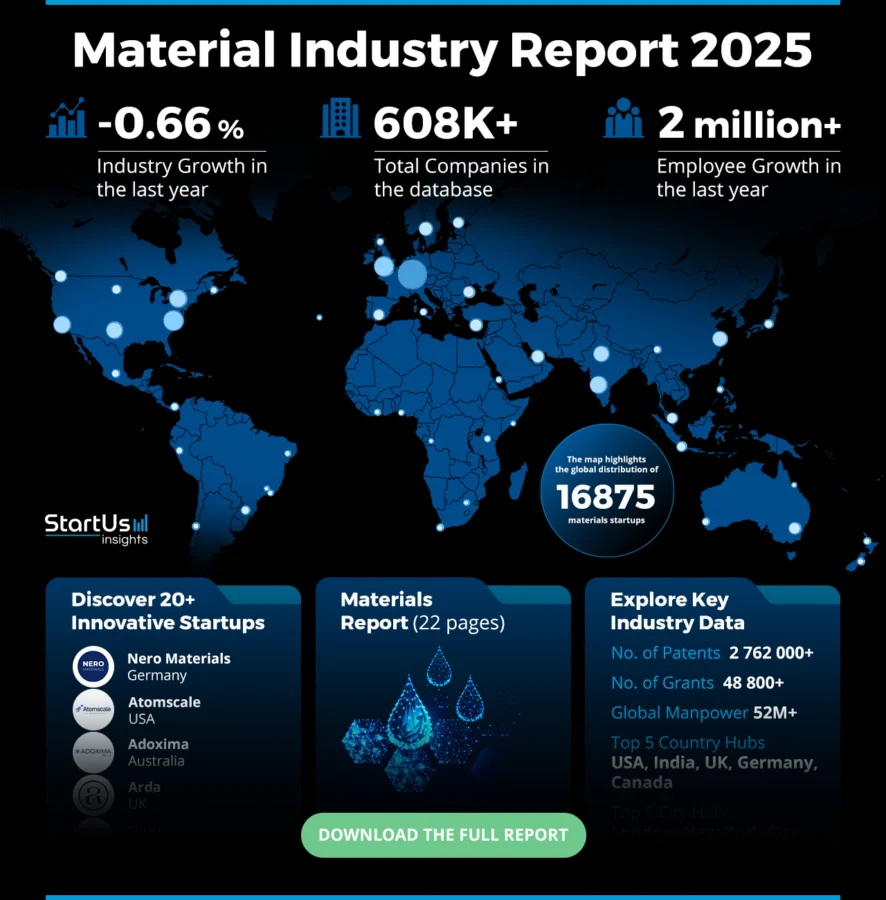

- Industry Growth Overview: The materials industry saw a marginal annual decline of 0.66%, but continues to show strong signals of innovation, patent activity, and funding interest. The material products market is projected to amount to USD 5.82 trillion in 2025, growing further at a compound annual growth rate (CAGR) of 1.45% from 2025 to 2029.

- Manpower & Employment Growth: Global employment surpassed 52 million, with more than 2 million new roles added in the past year. According to Statista, the number of employees in the material products market is projected to amount to 54 million in 2025, while further expanding at a CAGR of 1.70% from 2025 to 2029.

- Patents & Grants: Industry players filed more than 2.76 million patents and secured 48 800+ grants across global markets. China and the US led the 0.79% annual increase in patent filings through active innovation efforts.

- Global Footprint: India, the US, Germany, Canada, and the UK lead the global materials landscape. Key city centers include London, New York City, Bangalore, Berlin, and Dubai, which serve as major innovation hubs.

- Investment Landscape: The industry saw more than 124 500 funding rounds, with an average round size of USD 43 million. Over 44 700 companies have received investment from 61 300+ investors.

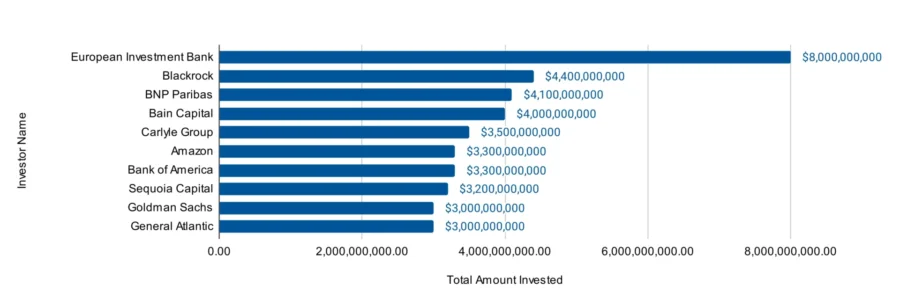

- Top Investors: The European Investment Bank, BlackRock, BNP Paribas, and more emerged as leading investors. They have collectively invested over USD 39.8 billion in the sector.

- Startup Ecosystem: Innovative startups such as Nero Materials (structured carbon nanomaterials), Atomscale (atomic-scale engineering), Adoxima (specialized oxide materials), Arda (spent barley-based circular materials), and Uluu (seaweed-based plastic alternative) demonstrate the sector’s entrepreneurial momentum.

Methodology: How We Created This Materials Industry Report

This material industry report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7M+ global companies, 20K+ technologies and trends as well as 150M+ patents, news articles, and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of materials over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within materials

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the materials market.

What Data is Used to Create This Materials Sector Outlook?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the materials market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: Over the past year, analysts and journalists published over 198 600 news and research articles, reflecting strong academic and media interest.

- Funding Rounds: Our database shows that investors conducted over 124 500 fundraising rounds, showing the sector’s high investor engagement and capital activity.

- Manpower: Companies in the industry employ over 52 million people and added more than 2 million workers in the past year.

- Patents: Industry players filed over 2.76 million patents, showcasing consistent technological progress and research productivity.

- Grants: Organizations awarded 48 800+ grants to support innovation, sustainability, and infrastructure within the materials sector.

- Yearly Global Search Growth: Global online searches for the materials industry rose 9.53% over 12 months, signaling rising public and professional curiosity.

Explore the Data-driven Material Report for 2025

This section uses important innovation, employment, and geography data from our extensive database to illustrate the current status of the global materials sector.

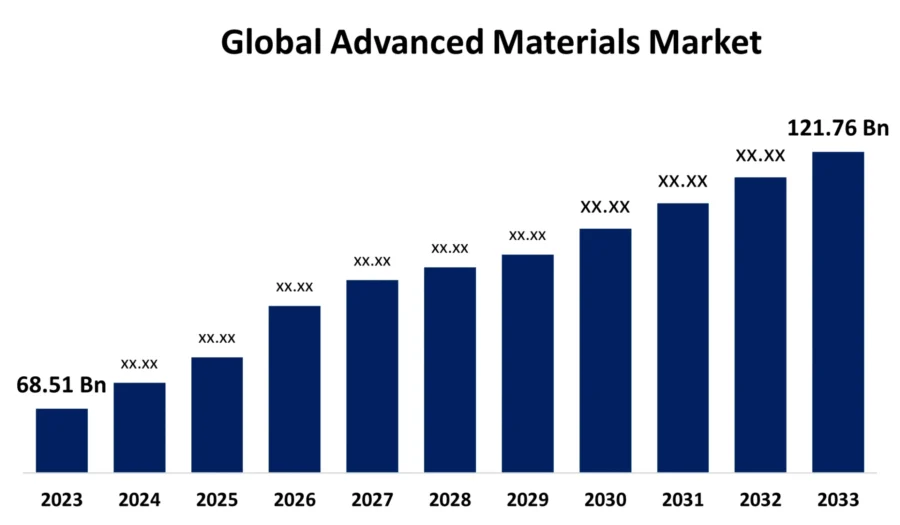

Spherical Insights projects that the global advanced materials market size will grow at a CAGR of 5.92%, estimating a value of USD 121.76 billion by 2033. During this period, North America is expected to dominate the global advanced materials market.

Despite a minor sector loss of 0.66% over the previous year, over 16 800 of the 608 200+ companies tracked are classified as startups as per our platform data, indicating active participation from early-stage players.

Credit: Spherical Insights

With over 48 800 awards given out and over 2.76 million patents filed across a wide range of applications, from sustainable alternatives to composites, the sector continues to drive innovation.

With a net workforce gain of over 2 million over the last year due to expansion in emerging economies, the materials sector employs more than 52 million people worldwide.

The US, India, the UK, Germany, and Canada are among the top country hubs. London, New York City, Bangalore, Berlin, and Dubai are important hubs for innovation at the local level.

A Snapshot of the Global Material Market

Despite a small 0.66% drop in the last 12 months, the materials sector remains active, as key indicators of company activities and innovation show.

Currently, there are 16 800+ startups operating in the sector, with more than 12 100 identified as early-stage ventures. Additionally, the number of enterprises in the Material Products market is projected to amount to 2 million in 2025, further expanding at a CAGR of 1.75% from 2025 to 2029.

More than 2300 companies have completed mergers or acquisitions, reflecting ongoing structural changes and sustained investor confidence in consolidation.

Industry players have filed over 2.76 million patents, with contributions from 588 000+ distinct applicants, maintaining consistent patent activity. Year over year, patent filings increased by 0.79%, showing that companies continue to invest in R&D despite the downturn.

China leads in patent filings, with 700 500+ patents, while the US follows with over 595 000 patents related to the industry. These figures underscore both nations’ strategic focus on driving innovation in materials.

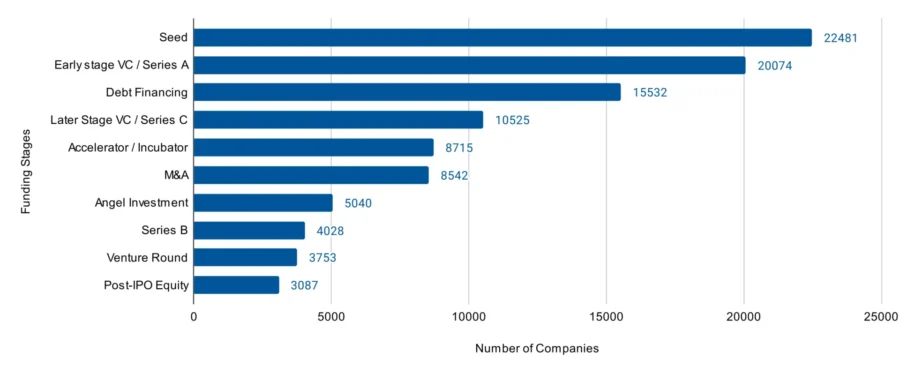

Explore the Funding Landscape of the Material Market

With more than 124 500 fundraising rounds documented in our database thus far, investment activity in the materials sector is still growing steadily.

The amount of capital entering the sector is reflected in the average of about USD 43 million in capital per round. With over 61 300 distinct investors from a wide range of business stages, regions, and technological domains, the investment base is extensive.

More than 44 700 businesses in the sector have received funding thus far. Thus, demonstrating the active participation of venture capital and strategic investors who are interested in materials innovation.

Who is Investing in the Material Market?

The top investors in the materials industry have collectively invested over USD 39.8 billion, highlighting the sector’s continued appeal to both financial and strategic backers.

- The European Investment Bank leads with investments in 72 companies, totaling over USD 8 billion in committed capital.

- BlackRock has supported 38 companies, contributing approximately USD 4.4 billion in funding across the sector. The Brown to Green Materials Fund supports the decarbonization of the materials sector. It invests in metals, chemicals, steel, construction materials, and the equipment makers driving the green transition.

- BNP Paribas has invested USD 4.1 billion in 68 companies, showing strong interest in materials ventures.

- Bain Capital has backed 34 companies with total investments reaching USD 4 billion. Bain Capital Private Equity became the majority owner in Ahlstrom-Munksjo (a sustainable fiber solutions manufacturer) with a 55% ownership.

- Carlyle Group has committed USD 3.5 billion across 40 companies.

- Amazon has funded 24 companies with USD 3.3 billion. It also led USD 25 million funding round for Paebbl, a sustainable building material company.

- Bank of America has supported 30 companies and invested more than USD 3.3 billion in the sector.

- Sequoia Capital has invested in 126 companies totaling over USD 3.2 billion.

- Goldman Sachs has allocated USD 3 billion across 74 companies. Goldman Sachs Asset Management, along with other investors, led a Series D round and invested more than USD 1 billion in Redwood Materials.

- General Atlantic invested USD 3 billion in 31 companies across the industry, including Ecore, a company providing circular rubber materials (amount undisclosed). Additionally, RoadRunner Recycling received USD 70 million in a Series D round.

Top Material Innovations & Trends

Discover the emerging trends in the material market along with their firmographic details:

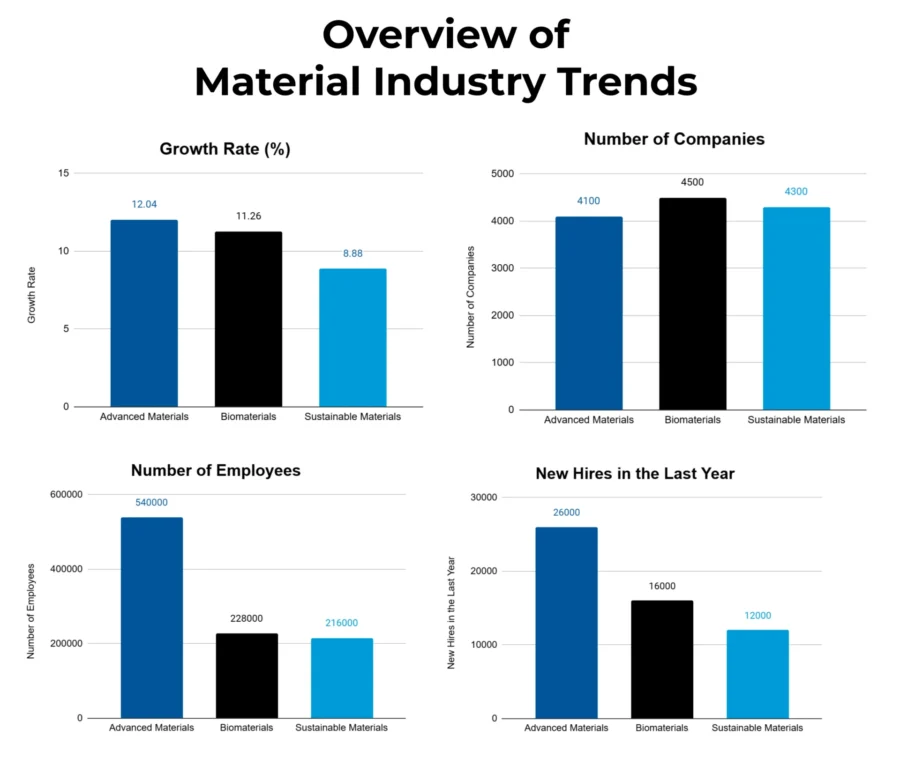

- Sustainable Materials: Due to the growing demand for environmentally friendly alternatives in manufacturing, packaging, and building, the sustainable materials market has expanded at an annual pace of 8.88%. With 4300+ active companies, it employs more than 216 000 people and 12 000+ new workers joined in the last year.

- Biomaterials: As companies look for renewable, biodegradable solutions, the healthcare, agricultural, and bioplastics sectors have boosted their acceptance, as seen by the 11.26% annual growth rate of the biomaterials market. It has 4500+ enterprises and over 228 000 total employees. Moreover, 16 000+ new people were hired last year.

- Advanced Materials: With the advancements in electronics, aerospace, and performance composites, the advanced materials market had a 12.04% annual growth rate and has witnessed the creation of 26 000+ new jobs in the last year. Also, there are more than 4100 businesses active with a combined workforce of 540 000+.

5 Top Examples from 16 870+ Innovative Material Startups

The five innovative startups showcased below were picked based on data, including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Nero Materials offers Structured Carbon Nanomaterials

German startup Nero Materials makes structured carbon nanospheres that improve the performance and durability of hydrogen fuel cells and electrolyzers. It also synthesizes porous carbon materials with precise control over particle size, pore structure, graphitization level, and surface chemistry.

These nanosphere technologies integrate into catalyst layers to reduce platinum usage, increase efficiency, and extend fuel cell system lifetime. The structured carbon nanospheres support efficient mass production and consistent quality, enabling scalable application in hydrogen energy systems. Additionally, the startup targets use cases in heavy-duty transport, stationary power, batteries, supercapacitors, and direct air capture (DAC) systems.

Atomscale advances Atomic-Scale Engineering

US-based startup Atomscale offers an AI-driven platform that enables real-time feedback and control during atomic-scale materials synthesis using electron microscopy. It captures electron-matter interaction signals and applies deep learning to interpret atomic configurations and dynamic phase transformations.

Moreover, the platform extracts parameters, like strain, defect behavior, and electronic structure, to guide precise synthesis adjustments in real time.

The platform automates data curation and uses reinforcement learning to optimize synthesis conditions during material fabrication continuously. It integrates with transmission electron microscopes and links to simulation tools for predictive atomic-level modeling.

Thus, Atomscale increases materials discovery by improving visibility, precision, and speed in developing semiconductors, quantum devices, and advanced functional materials.

Adoxima makes Specialized Oxide Materials

Australian startup Adoxima develops disordered nano-cluster (DNC) technology to produce high-purity, customizable oxide materials with low environmental impact. It engineers metal oxides and hydroxides by controlling surface area, particle size, doping, and mixed metal oxide formation.

The technology enables precise tuning of material properties like tensile strength, thermal resistance, and electrical conductivity. It uses proprietary reactions to achieve consistent particle-level modification without requiring high energy input or harsh chemical conditions.

Moreover, the technology supports applications in advanced ceramics, battery materials, composites, coatings, and electronic components.

Arda provides Barley-based Circular Materials

UK-based startup Arda manufactures New Grain, a leather-like material made from spent barley grain sourced from breweries and distilleries. It extracts plant proteins from brewers’ spent grain and restructures them into collagen-like polymers using supramolecular chemistry. The process produces a plastic-free, animal-free material with adjustable properties, including texture, thickness, durability, and color.

New Grain achieves a major reduction in CO2 emissions compared to traditional leather and leaves no microplastic pollution. It meets industry standards for abrasion, flexibility, and tear resistance while supporting alternative material sourcing. Arda thus converts agricultural byproducts into high-performance biomaterials to enable circular production in fashion, automotive, and home goods sectors.

Uluu offers a Seaweed-based Plastic Alternative

Australian startup Uluu develops a seaweed-based polyhydroxyalkanoate (PHA) material that replaces fossil-based plastics in multiple use cases. It ferments farmed seaweed using salt-loving microbes to produce PHAs, a natural class of biodegradable polyesters.

Moreover, the process runs in saltwater and avoids freshwater use, synthetic chemicals, arable land, and petroleum-based feedstocks. The resulting material is home-compostable, marine-biodegradable, and breaks down without releasing microplastics or toxic residues. It supports tunable properties, enabling use in flexible films, rigid packaging, coatings, and other plastic-replacement applications.

Gain Comprehensive Insights into Material Trends, Startups, and Technologies

The Material Report 2025 highlights a sector in transition, balancing modest overall decline with strong pockets of growth, innovation, and investment activity. Trends, such as sustainable materials, biomaterials, and advanced materials, continue to attract talent and capital, supported by global investor interest and expanding startup ecosystems.

Get in touch to explore 16 870+ startups and scaleups, as well as all market trends impacting material companies.