The global metals industry stands at a pivotal juncture in 2024. Demand is shaped by technological advancements in sectors like renewable energy, electric vehicles, and aerospace. Supply chain resilience continues to be a critical factor, influencing sourcing and production strategies. This report analyzes key market dynamics, including the adoption of sustainable technologies. Innovations in alloys and processing further promise to transform manufacturing, driving efficiency and performance.

This report was last updated in July 2024.

This metals industry outlook serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Metals Industry Report 2024

- Executive Summary

- Introduction to the Metals Industry Report 2024

- What data is used in this Metals Industry Report?

- Snapshot of the Global Metals Industry

- Funding Landscape in the Metals Industry

- Who is Investing in Metal Companies?

- Emerging Trends in the Metals Industry

- 5 Metals Industry Startups

Executive Summary: Metals Industry Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1140+ metals industry startups developing innovative solutions to present five examples from emerging metals industry trends.

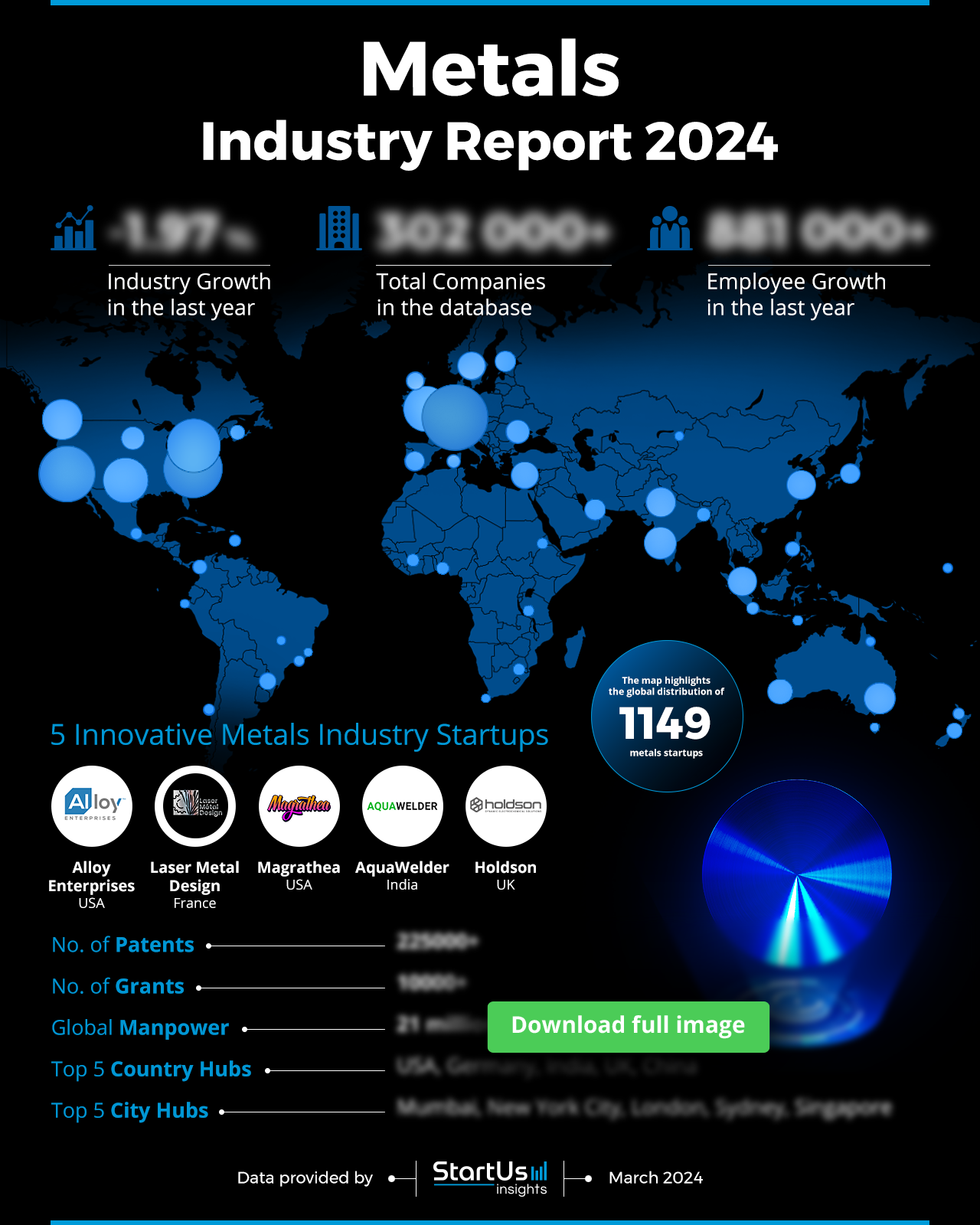

- Industry Growth: The metals industry experienced a slight downturn (1.97% decline) in 2023, yet remains a massive global sector with over 302000 companies.

- Manpower & Employment Growth: Demonstrating resilience, the industry added 881000 new jobs in the past year, reaching a global workforce of 21 million.

- Patents & Grants: Innovation is robust, with over 225000 patents filed and 10000+ grants awarded, fueling continuous advancement in metalworking.

- Global Footprint: Top country hubs are in the USA, Germany, India, UK, and China. Leading city hubs include Mumbai, New York City, London, Sydney, and Singapore.

- Investment Landscape: The industry attracts significant investment, with an average of USD 48 million per funding round and more than 9400 investors active.

- Top Investors: Leading investors include European Investment Bank, Orion Mine Finance, Macquarie Group, Timken, Watts Water Technologies, African Export-Import Bank, Summit Partners, and Societe Generale.

- Startup Ecosystem: Five innovative startup features include Alloy Enterprises (Aluminum Fabrication), Laser Metal Design (Precision Metal Laser Cutting), Magrathea (Carbon-neutral Magnesium Production), AquaWelder (Green Brazing Technology), and Holdson (Sustainable Electrochemical Polishing).

- Recommendations for Stakeholders:

- Prioritize Sustainability: Invest in eco-friendly practices and circular economies to secure a leading position in the market.

- Focus on Advanced Alloys: Drive innovation in lightweight, high-performance alloys to meet the needs of the automotive and aerospace sectors.

- Strengthen Supply Chains: Enhance resilience and adaptability to navigate global uncertainties and secure reliable supplies.

- Support Innovation: Collaborate with startups and invest in research to unlock the potential of emerging metal technologies.

Explore the Data-driven Metals Market Report for 2024

This metals industry report uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The industry saw a 1.97% decline in growth over the previous year; it comprises over 302000 companies globally, indicating its massive scale and importance.

Employee growth presents a more optimistic picture, with an addition of 881000 workers in the last year, pointing towards a trend of employment opportunities in the industry. The sector also boasts a vast global workforce of 21 million people, underlining its critical role in the global economy.

The USA, Germany, India, the UK, and China are identified as the top five country hubs, driving forward the industry’s development and expansion. City hubs like Mumbai, New York City, London, Sydney, and Singapore stand out as epicenters for metal industry startups and innovation.

Emerging startups exemplify the sector’s dynamic nature, embracing cutting-edge technologies to reshape the metals industry landscape. With more than 1140 startups in the database, the metals industry demonstrates adaptability and a forward-looking approach in the face of global economic challenges.

What data is used to create this metals industry report?

Based on the data provided by our Discovery Platform, we observe that the metals industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The metals industry has featured prominently in the media, with over 200000 publications.

- Funding Rounds: With information on over 21000 funding rounds, the industry showcases a dynamic investment climate and capacity for attracting capital.

- Manpower: The workforce in the metals industry is a formidable force, exceeding 21 million globally. It is further boosted by the addition of more than 881000 new employees over the past year.

- Patents: Innovation is thriving, as evidenced by the filing of over 225000 patents, demonstrating the industry’s commitment to advancing metalworking techniques.

- Grants: With over 10000 grants provided, there is substantial financial support for research and development as well.

A Snapshot of the Global Metals Industry

The metals industry is a sector with significant vitality and capacity for employment. The industry supports a manpower pool of 21 million individuals, with a notable increase of 881000 employees in the last year. This showcases the industry’s ability to generate jobs even in times of overall economic challenges.

With over 302000 companies forming the backbone of this industry, there is a wide array of entities contributing to its diversity and resilience. These companies, ranging from large conglomerates to innovative startups, have been instrumental in sustaining the industry’s momentum.

Innovation within the industry remains vigorous, with over 225,000 patents filed and more than 10,000 grants awarded, reflecting a strong commitment to advancing metal technologies and applications.

Explore the Funding Landscape of the Metals Industry

The investment landscape in the metals sector is robust, characterized by an average investment of USD 48 million per funding round. This figure is indicative of the high stakes involved and the investors’ confidence in the industry’s future. More than 9400 investors have been active in the metals industry, closing over 21400 funding rounds. This is a testament to the sector’s dynamic nature and its potential for growth and innovation.

Of the vast number of companies in the sector, more than 11400 have received investments, highlighting the industry’s expansive reach. It also shows investor willingness to back a broad spectrum of metal ventures. This financial backing drives research, development, and the commercialization of new metal technologies, reinforcing its position at the forefront of industrial advancement.

Who is Investing in Metal Companies?

The metals industry is attracting substantial interest from top-tier investors, with a combined investment value exceeding USD 4.5 billion, showcasing strong confidence in the sector’s growth and innovation prospects.

- The European Investment Bank leads with significant backing, investing USD 762 million in 8 companies, underpinning strategic advancements in the industry.

- Orion Mine Finance follows with a commitment of USD 660 million across 5 companies, emphasizing the potential of mining opportunities.

- Macquarie Group has diversified its portfolio by investing USD 601 million in 10 companies, signaling a bullish outlook on the metals sector.

- Timken’s investment strategy includes USD 585 million distributed among 10 companies, showcasing their belief in the industry’s robustness.

- Watts Water Technologies has contributed USD 520 million to 7 companies, indicating a focus on sustainable metal processing technologies.

- The African Export Import Bank has targeted its funds, injecting USD 500 million into 2 companies, highlighting the sector’s significance in the African market.

- Summit Partners, with an investment of USD 498 million in 11 companies, underscores the scope for growth and innovation in metals.

- Societe Generale rounds out this list with USD 471 million invested in 9 companies, reinforcing the metals industry’s appeal to global banking investors.

Explore Firmographic Data for All Metals Industry Trends

Explore some details about the top emerging metals industry trends in the last year:

- Custom Fabrication in the metals industry involves 6652 companies and sustains a workforce of 260000. Despite a slight decrease in its annual trend growth rate of -2.1%, the sector added 12000 new jobs last year. This suggests resilience in the face of challenges, maintaining its role in delivering metal solutions across various applications.

- Brazing stands as a critical process within the metals sector, with 2993 companies engaged in this high-precision joining technique. Employing 264000 individuals, the field saw an addition of 9700 new employees over the last year. However, the annual trend growth rate dipped by -3.66%, indicating the sector may be facing headwinds amidst shifting industry dynamics.

- Plasma Cutting has a strong presence in the industry, represented by 3582 companies. It supports 185000 employees and welcomed 8000 new workers in the last year. The slight decline in its annual trend growth rate of -1.7% doesn’t overshadow its importance in metalworking, where precision and efficiency are paramount.

5 Top Examples from 1140+ Innovative Metals Industry Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Alloy Enterprises advances Aluminum Fabrication

US-based startup Alloy Enterprises advances aluminum manufacturing with its Stack Forging process, enabling the production of complex, high-quality components. This process ensures the creation of parts with superior material properties and intricate designs. The company’s focus extends to applications like thermal management and aftermarket parts, demonstrating versatility across sectors such as automotive and heavy equipment. Through Alloy’s innovative approach, industries benefit from rapid prototyping and scalable manufacturing solutions, enhancing speed to market.

Laser Metal Design specializes in Precision Metal Laser Cutting

Laser Metal Design, based in France, specializes in precision metal laser cutting. Its expertise lies in cutting metal pieces for both technical and design purposes. With its powerful 6kW Fiber Laser, it achieves high-quality finishes and creates a range of products, from mechanical parts to architectural and interior design elements. The company manages custom drawings, and finishing processes, and collaborates with local partners for operations like bending, threading, zinc coating, galvanization, polishing, and painting.

Magrathea extracts Magnesium without Mining

Magrathea is a US-based startup that develops an electrolytic process for crafting carbon-neutral magnesium metal. Unlike traditional metals like steel and aluminum, which emit substantial carbon during production, Magrathea’s approach minimizes environmental impact. Its technology extracts magnesium from seawater and brines, eliminating the need for mining. Magnesium, known for its lightweight properties, is suitable for any company or industry seeking fuel efficiency and sustainability.

AquaWelder builds Green Brazing Tech

Indian startup AquaWelder introduces a metal joining technology using water as fuel. This process eliminates traditional oxy-acetylene setups, replacing them with a system that generates brown gas (hydrogen and oxygen). This brown gas fuels an underwater torch for various metalworking applications including brazing, soldering, cutting, and welding. AquaWelder’s approach offers increased portability and safety compared to conventional methods. The system also features an automatic flashback arrestor and is compatible with additional hydrogen production devices.

Holdson develops Electroform Technology

Holdson is a UK-based startup that addresses the issue of inconsistent surface finishes on additively manufactured metal components with its electrochemical polishing solutions. The company’s Electroform machines offer a more sustainable and efficient alternative to traditional polishing methods. These machines utilize recyclable consumables and electrolytes, minimizing environmental impact and reducing energy consumption. Holdson’s solutions streamline the post-processing phase of additive manufacturing for the metals industry. This technology also achieves high-quality and consistent surface finishes on complex metal components.

Gain Comprehensive Insights into Metals Trends, Startups, or Technologies

The 2024 metals industry is poised for strategic transformation. The drive for lightweight, high-performance alloys will fuel innovation, especially in the automotive and aerospace sectors. Stakeholders prioritizing adaptability, collaboration, and a focus on sustainable solutions will shape the future of this vital sector, unlocking new opportunities. Get in touch to explore all 1140+ startups and scaleups, as well as all industry trends impacting metal companies.