This article provides an analytical overview of 10 new banking solutions transforming the industry through innovative technologies and specialized applications. These companies offer solutions such as finance automation platforms for streamlined financial operations, neo banks offering novel digital banking experiences, and more. This overview highlights the advancements in digital finance, emphasizing the impact of these innovations on the banking industry’s future.

Continue reading to gain up-to-date and data-driven insights on:

Key Takeaways

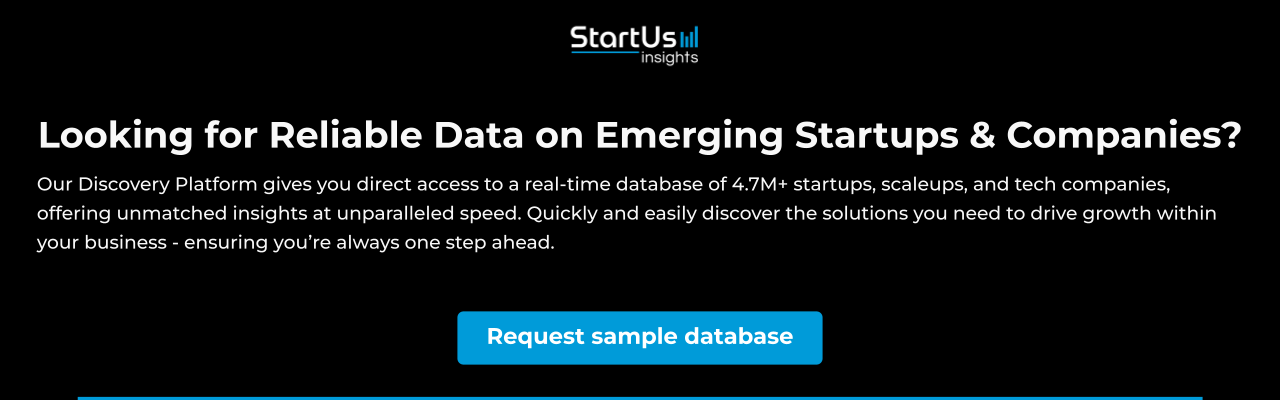

Drawing insights from the Big Data & AI-powered StartUs Insights Discovery Platform that provides data on over 4.7+ million emerging companies globally, we explore the evolving landscape of the banking industry. This sector is marked by key trends and a substantial workforce, shaping its future. This report was last revised 5 days ago. See a missing piece? Your input can help — contact us. Here are some key insights at a glance:

- Latest Banking Trends: Key trends in the banking sector include AI, blockchain, cryptocurrencies, robotic process automation (RPA), and cloud computing.

- Banking Industry Statistics: The sector comprises 21K+ organizations worldwide. Out of these, 8K+ new banking solutions were founded in the last five years, with 2021 as the average founding year. On average, each of these companies employs about 27 people. Moreover, the average funding received by these 8K+ banking solutions per round in the same span is USD 26.8 million.

- 10 New Banking Solutions to Watch:

- tell.money – Open Banking

- Z.ro Bank – Multi-Currency Payment Platform

- Mysa – Finance Automation

- TheTenn – Neobank

- Lirium – Crypto-as-a-Service Solution

- Weyay Bank – Customizable Prepaid Cards

- FCC ANALYTICS – Anti-Money Laundering

- Statement – Cash Intelligence Platform

- Utorg – Crypto Exchange Infrastructure

- OPTO – Automated Cash Collection

Discover 10 out of 14K+ Emerging Banking Solutions

In this section, we highlight 10 emerging new banking solutions advancing the financial industry through technologies. These solutions include digital asset banks offering secure management of cryptocurrencies, finance automation platforms enhancing operational efficiency, and neo-banks providing digital banking experiences. Innovations also encompass blockchain and digital asset APIs enabling transactions and integrations, along with crypto exchange infrastructures supporting trading environments. The integration of these solutions highlights the ongoing transformation in banking practices and the increasing reliance on technological advancements.

Note on Signal Strength

One of the unique metrics we feature for each company is Signal Strength, a proprietary data point generated by our Discovery Platform. It gauges the extent to which a company’s influence has permeated the global ecosystem of startups, scaleups, and emerging companies. This proprietary metric serves as a valuable guidepost for understanding a company’s standing in the broader market landscape.

1. tell.money

- Founding Year: 2020

- Employee Range: 11-50

- Location: UK

- Signal Strength: Very Strong

- What they do: tell.money provides an open banking gateway solution, tell.gateway, for account providers to meet PSD2 regulatory requirements. Its technology offers a cloud-based API gateway that enables secure and scalable integration that allows businesses to become compliant with off-the-shelf or customized options. The features include secure consent management for third-party provider (TPP) access, built-in regulatory reporting, and a developer portal for interaction. tell.money handles the complexities of open banking infrastructure and enables financial institutions to focus on delivering quality services to their customers while ensuring compliance and operational efficiency

2. Z.ro Bank

- Founding Year: 2019

- Employee Range: 51-100

- Location: Brazil

- Signal Strength: Very Strong

- What they do: Z.ro Bank offers a multi-currency payment platform that features crypto-to-fiat conversion. It functions as a comprehensive digital bank account, complete with a VISA debit card and cashback in Bitcoin. The platform supports a range of payment methods, including Pix, remittances, and digital wallets, through a unified back-office system. Z.ro Bank’s platform allows businesses and individuals to simplify financial transactions and ensure security across currencies.

3. Mysa

- Founding Year: 2023

- Employee Range: 2-10

- Location: India

- Signal Strength: Very Strong

- What they do: Mysa automates cash flow management, accounting, and tax processes for businesses. The company’s automation solution digitizes and streamlines essential financial tasks like invoice processing and approval as well as payment scheduling. Utilizing optical character recognition (OCR), the solution also captures and verifies invoice data to improve accuracy and ensure real-time visibility. This minimizes manual errors, accelerates data processing, and provides detailed financial reporting. By automating these processes, Mysa allows startups, direct-to-consumer (D2C) brands, and technology service providers to maintain better control over their finances and reduce administrative burdens.

4. TheTenn

- Founding Year: 2022

- Employee Range: 11-50

- Location: USA

- Signal Strength: Very Strong

- What they do: TheTenn simplifies financial management. The company provides a platform for spending, saving, and sending money without fees or credit checks. It enables instant transfers between accounts and automatically credits to users’ accounts. The platform also builds a credit history through regular transactions, offers insurance for deposits, and enhances security with biometric locks. TheTenn thus delivers accessible, transparent, and customer-centric banking for improved financial well-being and convenience.

5. Lirium

- Founding Year: 2020

- Employee Range: 11-50

- Location: Liechtenstein

- Signal Strength: Strong

- What they do: Lirium offers a regulated blockchain and digital asset API that enables financial institutions, digital wallets, and marketplaces to provide secure cryptocurrency services. Its technology facilitates listing, trading, holding, and transferring regulated digital assets while ensuring compliance with know your vendor (KYV), anti-money laundering (AML), and transaction screening requirements. The features include secure regulated custody with dedicated insurance and access to liquidity from all regulated exchanges. Lirium’s turnkey solution provides operational, compliance, and regulatory support, making it easy for clients to integrate digital assets into their offerings.

6. Weyay Bank

- Founding Year: 2021

- Employee Range: 51-100

- Location: Kuwait

- Signal Strength: Very Strong

- What they do: Weyay Bank offers customizable prepaid cards that provide customers with control and flexibility over their financial transactions. The bank’s digital-first approach enables them to open accounts instantly via their mobile app, allowing immediate access to their prepaid cards. These cards come equipped with features like real-time transaction tracking and the ability to freeze or unfreeze the card through the app. It also includes cashback rewards on all purchases, which increase for those receiving allowances or salaries through Weyay accounts. Weyay Bank’s prepaid cards are made from recycled plastic and contribute to sustainability.

7. FCC ANALYTICS

- Founding Year: 2019

- Employee Range: 11-50

- Location: Hong Kong

- Signal Strength: Very Strong

- What they do: FCC ANALYTICS creates an AI-powered anti-money laundering compliance solution for financial institutions. It analyzes datasets to detect suspicious activities and ensure adherence to anti-money laundering regulations. The solution also integrates with existing financial systems to provide real-time monitoring and automated reporting. The company’s solution enhances efficiency by reducing manual review workload and improving accuracy in compliance processes. FCC ANALYTICS allows traditional banks, virtual banks, and securities firms to mitigate risks and support financial institutions in maintaining regulatory standards.

8. Statement

- Founding Year: 2022

- Employee Range: 11-50

- Location: USA

- Signal Strength: Very Strong

- What they do: Statement develops a cash intelligence platform that streamlines corporate finance by connecting financial data from multiple sources like banks, billing tools, and more. The platform automates workflows for common tasks like bank reconciliations, analytics, and payments to reduce manual labor and increase data accuracy. It also features multi-bank connectivity, automated A/R reconciliation, AI-powered cash flow forecasting, and real-time cash management. These features allow finance teams to optimize financial operations, enhance decision-making, and drive business growth.

9. Utorg

- Founding Year: 2019

- Employee Range: 11-50

- Location: Lithuania

- Signal Strength: Very Strong

- What they do: Utorg provides a fintech platform that provides fiat-to-crypto exchange infrastructure. The platform operates through a globally compliant API that integrates with businesses to offer a streamlined on/off-ramp for cryptocurrencies. The company’s infrastructure supports multiple payment methods and fiat currencies. It also features AI-powered KYC verification and PCI DSS Level 2 certification for secure transactions. Utorg simplifies and secures the user experience in the Web3 space by driving the adoption of cryptocurrency.

10. OPTO

- Founding Year: 2022

- Employee Range: 2-10

- Location: UAE

- Signal Strength: Strong

- What they do: OPTO simplifies cash collection with advanced automation. The company’s platform automates invoicing, tracks payments, and manages accounts receivable efficiently. It also integrates with existing financial systems to deliver real-time insights and optimize payment workflows. By reducing manual intervention, OPTO minimizes errors and accelerates cash flow. Its features include customizable payment reminders, automatic reconciliation, and detailed financial analytics. The company’s system ensures timely collections and enhances overall financial management.

Quick Tip to Find New Banking Solutions

Utilizing a SaaS platform like the Discovery Platform for identifying new banking solutions provides significant benefits compared to traditional scouting methods:

- Streamlined Efficiency: The Discovery Platform offers advanced tools that streamline the scouting process. It replaces your hours of conventional desk research, saving time and resources in identifying banking innovations.

- Access to Real-time Insights: Gain a competitive edge with up-to-date information on the latest trends in the banking industry. The platform keeps you informed with near real-time updates on emerging banking solutions and news, enabling you to make swift and informed decisions.

- Tailored Exploration: Customize your search to focus on specific niches within the banking sector, such as automated cash collection, crypto exchange infrastructure, or digital banking. The platform’s diverse filtering options allow you to target your scouting efforts precisely, ensuring that you find the most relevant and groundbreaking companies in the field.

Ready to Explore All New Banking Solutions?

We’ve explored the dynamic landscape of the banking industry, examining the latest trends and spotlighting exceptional companies driving innovation. To dive deeper, download our free FinTech Report or schedule a demo of the Discovery Platform for a customized exploration of these groundbreaking developments. Partner with us to offer cutting-edge insights into startups and tech. We welcome your input.