The 2025 Oil & Gas Industry Report provides a comprehensive analysis of a sector in transition. It balances global energy demands with environmental and economic challenges.

It looks at the industry’s initiatives to improve sustainability and operational efficiency while highlighting important trends like workforce growth, technology innovation, and investment dynamics.

This report provides a comprehensive picture of the potential and difficulties influencing the oil and gas industry’s future, with an emphasis on data-driven insights.

Executive Summary: Oil and Gas Market Outlook 2025

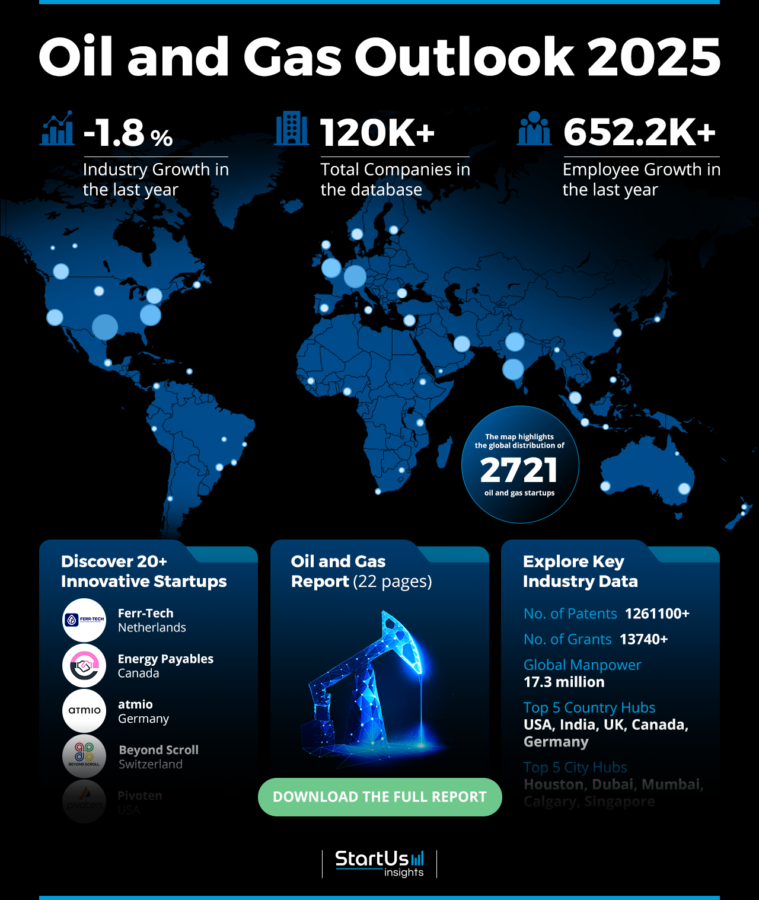

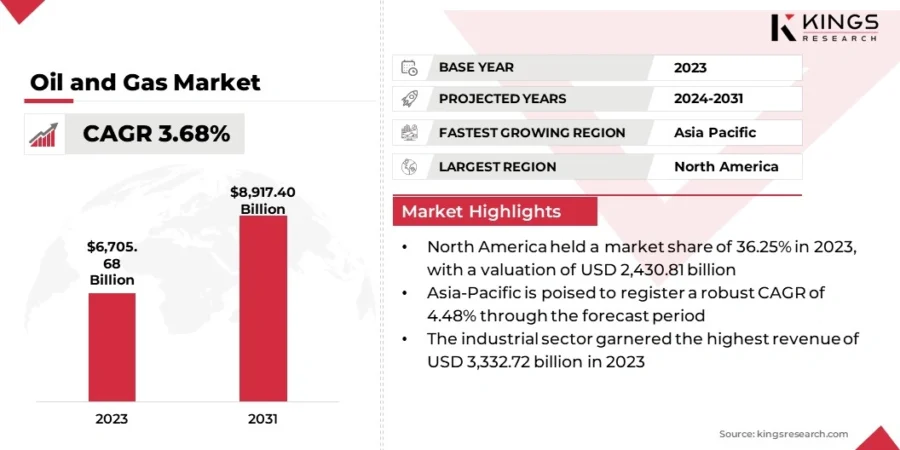

- Industry Growth Overview: Due to changing market dynamics and worldwide challenges, the oil and gas industry saw an annual growth rate of -1.8%. The global oil and gas market size is projected to reach USD 8917.40 billion by 2031, growing at a CAGR of 3.68% from 2024 to 2031.

- Manpower & Employment Growth: The industry has over 17.3 million employees and has added over 652 200 new workers in the last 12 months, demonstrating its ongoing economic importance and capacity to create jobs.

- Patents & Grants: The industry shows a focus on innovation and technology development, as seen by the 1261 100+ patents filed and the 13 740+ grants awarded worldwide.

- Global Footprint: The United States, India, the United Kingdom, Canada, and Germany are the top country hubs for the sector, with Houston, Dubai, Mumbai, Calgary, and Singapore among its major hubs. These sites highlight the industry’s global strategic significance.

- Investment Landscape: With over 32 700 funding rounds closed and 16 700 investors actively backing 11 790+ startups, the average investment value per funding round is USD 115.9 million.

- Top Investors: Among the top investors are BNP Paribas, EnCap Flatrock Midstream, and the European Investment Bank, which, along with others, have invested around USD 54.4 billion in total in the industry.

- Startup Ecosystem: Five innovative startups showcase the sector’s global reach and entrepreneurial spirit – Ferr-Tech (circular wastewater treatment), Energy Payables (vendor-customer collaboration platform), atmio (methane emissions reporting), Beyond Scroll (low-pressure scroll compressors), and Pivoten (oil & gas accounting software).

Methodology: How we created this Oil and Gas Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 150M patents, news articles and market reports. This data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of oil and gas over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the oil and gas sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the oil and gas market.

What Data is used to create this Oil and Gas Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the oil and gas market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: Over 36 690 publications were published in the last year, indicating that the industry attracted a lot of attention.

- Funding Rounds: There have been more than 32 700 funding rounds documented, indicating a high level of financial activity.

- Manpower: The industry now employs over 17.3 million employees, and in the last year alone, it added over 652 200 new workers.

- Patents: With more than 1261 100 patents registered worldwide, innovation is a defining characteristic of the sector.

- Grants: Within the industry 13 740 grants have been given out to fund ongoing research and development.

- Yearly Global Search Growth: As a result of increased relevance and attention, the industry saw a 7.26% growth in annual global search interest.

Explore the Data-driven Oil and Gas Industry Outlook for 2025

The heatmap offers a comprehensive overview of the current status of the oil and gas sector, highlighting important indicators that characterize its worldwide reach.

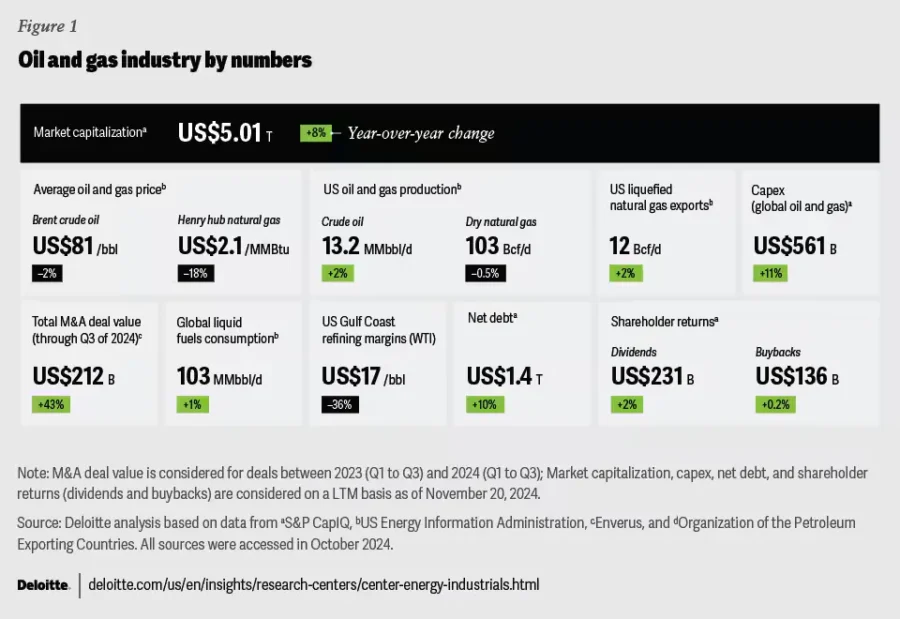

According to Deloitte’s report, the global oil and gas industry distributed nearly USD 213 billion in dividends and USD 136 billion in buybacks between January 2024 and mid-November 2024.

Credit: Deloitte

As per our database, despite a 1.8% growth slowdown last year, the industry is still strong, as seen by the addition of 652 200+ new workers, bringing the total number of workers worldwide to 17.3 million.

There are more than 120 000 companies in the sector, and more than 2700 startups are spearheading innovation.

With 1261100+ patents and 13740+ grants promoting innovations, a strong emphasis on technology is evident.

Geographically, the industry is anchored by major country hubs, including the United States, India, the United Kingdom, Canada, and Germany, while leading city hubs such as Houston, Dubai, Mumbai, Calgary, and Singapore play pivotal roles in its operations.

As per Kings Research, the Asia-Pacific oil and gas market is set to grow at a significant CAGR of 4.48% in the forthcoming years, primarily due to rapid economic development, urbanization, and industrialization across the region.

Credit: Kings Research

A Snapshot of the Global Oil and Gas Market

Despite a difficult growth environment, the oil and gas sector exhibits a dynamic landscape that is fueled by innovation, mergers, and the existence of startups. The industry’s -1.8% annual growth rate was a result of challenges from the larger market.

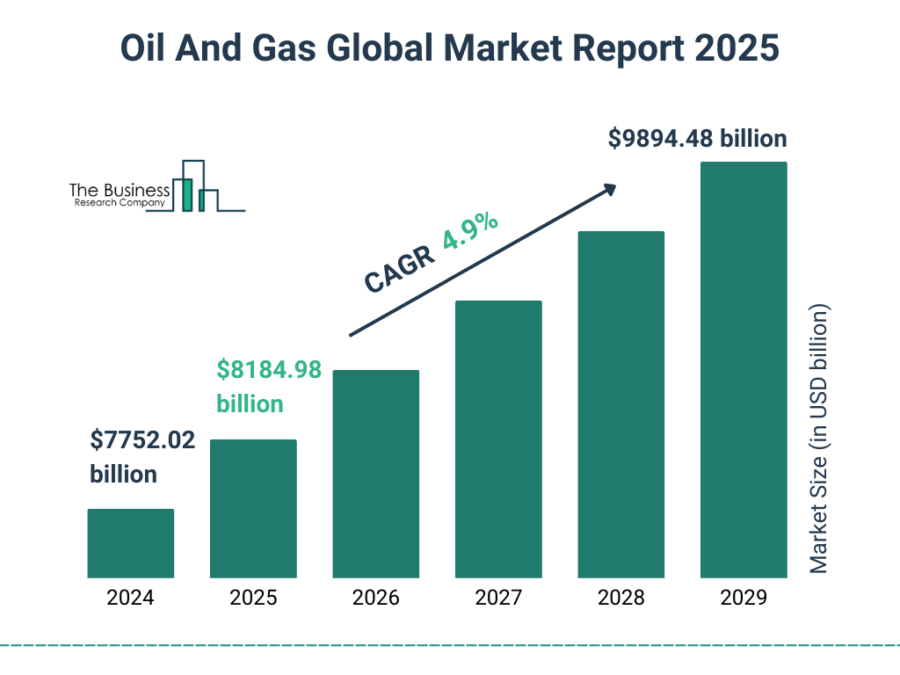

According to The Business Research Company, the oil and gas market size will grow from USD 8184.98 billion in 2025 to USD 9894.48 billion in 2029 at a CAGR of 4.9%.

Credit: The Business Research Company

With 2700+ startups, including 2470+ early-stage startups, the entrepreneurial environment is still vibrant and focuses on continuous efforts to spur innovation.

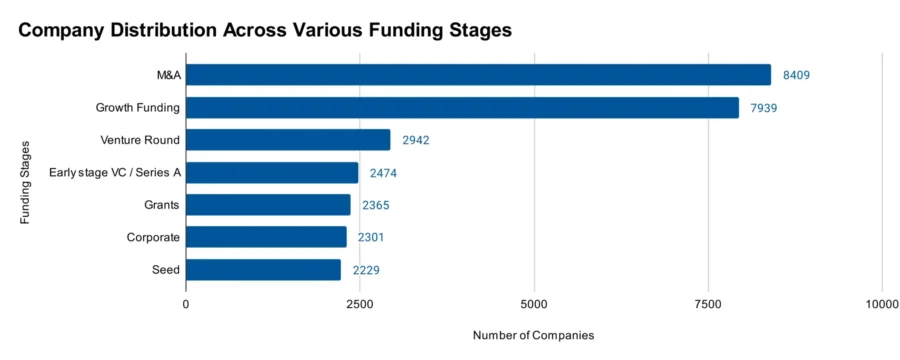

Further, 8400 M&A transactions demonstrate consolidation trends and strategic alliances throughout the industry, and mergers and acquisitions play a big part. With more than 1261 100 patents filed worldwide, intellectual property continues to be a key component of competitiveness.

More than 210 570 applicants have backed these patents, demonstrating a strong dedication to research and development. The annual patent growth of -0.46%, however, points to a minor slowdown in filing activity.

The worldwide nature of innovation in the industry is shown by the United States leading the world in patent issuance with 326800+ patents, followed by China with 212100+ patents.

Explore the Funding Landscape of the Oil and Gas Market

The sector’s strong capital intensity and investors’ faith in its growth potential are reflected in the average investment value per round, which is USD 115.9 million.

IEF reports that the annual upstream oil and gas capital expenditures will need to rise by 22 percent by 2030 to ensure adequate supplies due to growing demand and cost inflation. More than 16 700 investors have contributed to the industry’s growth. Over 32700 investment rounds have been closed, demonstrating the steady flow of funds to support operations and innovation.

Further, 11 790+ startups received investments in these funding initiatives. It highlights the sector’s capacity to interact with a wide range of stakeholders and the broad distribution of financial resources.

Who is Investing in the Oil and Gas Market?

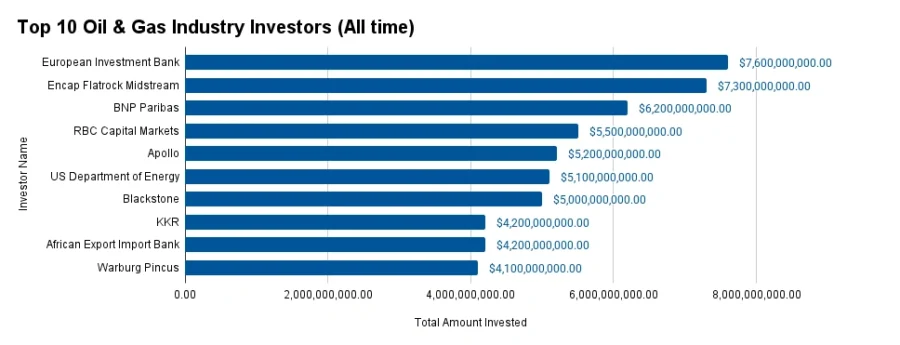

With a combined contribution of an astounding USD 54.4 billion, the leading investors in the oil and gas sector have demonstrated their crucial role in influencing the expansion and innovation of the industry. The major investors, the amount they have contributed, and the number of businesses they have backed are listed below:

- European Investment Bank invested USD 7.6 billion across 27 companies, leading in financial backing.

- EnCap Flatrock Midstream contributed USD 7.3 billion to 17 companies, showcasing its commitment to the midstream sector.

- BNP Paribas backed 30 companies with investments totaling USD 6.2 billion.

- RBC Capital Markets invested USD 5.5 billion in 19 companies, emphasizing strategic financial support.

- Apollo provided USD 5.2 billion to 15 companies, focusing on high-value investments. It entered into a USD 1 billion agreement with BP to fund its stake in the Trans Adriatic Pipeline (TAP).

- US Department of Energy funded 25 companies with USD 5.1 billion, reflecting its role in fostering energy advancements. Recently, it announced its intent to invest over USD 100 million to prepare the grid for a net-zero economy.

- Blackstone contributed USD 5 billion to 17 companies, reinforcing its presence in the sector.

- KKR invested USD 4.2 billion across 29 companies.

- African Export-Import Bank supported 9 companies with USD 4.2 billion, focusing on African market growth. It announced its aim to double CANEX funding to USD 2 billion to boost Africa’s creative economy.

- Warburg Pincus backed 22 companies with USD 4.1 billion. This emphasizes its influence in private equity investments.

Top Oil and Gas Innovations & Trends

Discover the emerging trends in the oil and gas market along with their firmographic details:

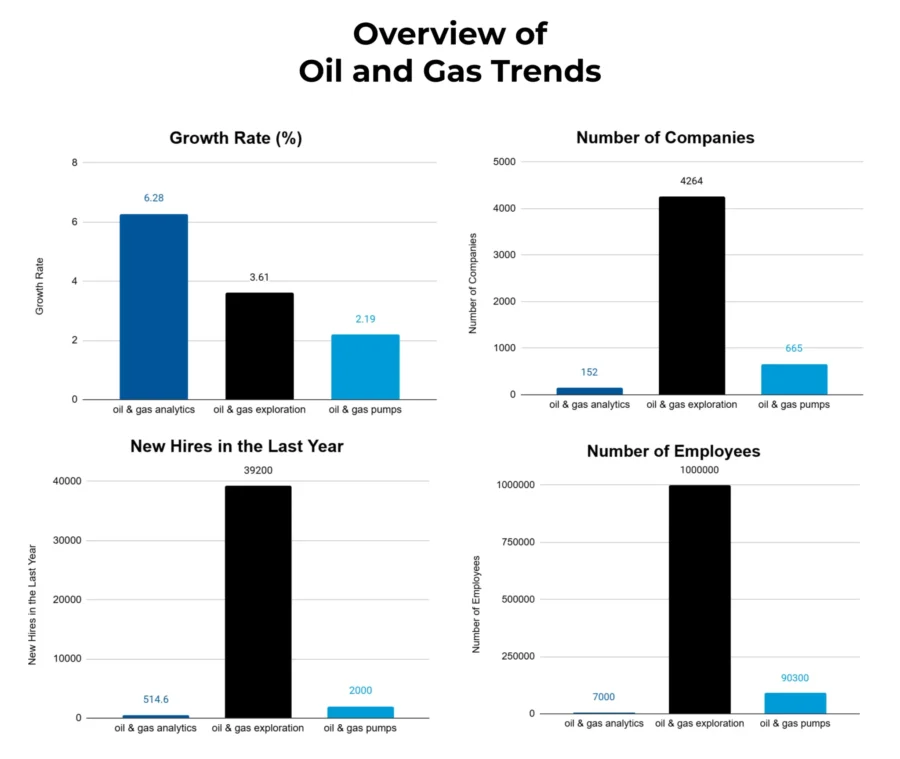

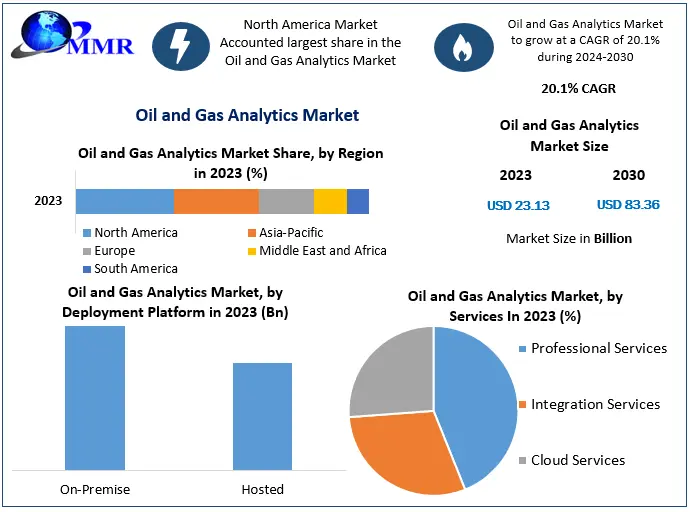

- Oil & Gas Analytics: Decision-making and operational efficiency in the sector are changing as a result of the implementation of oil & gas analytics solutions. With more than 150 startups in this sector and 7000+ workers, including 510 new hires last year, this market is growing quickly. The growing reliance on data-driven technology to optimize exploration, production, and distribution operations is reflected in the annual trend growth rate of 6.28%.

Further, the oil and gas analytics market is expected to reach USD 83.36 billion by 2030, at a CAGR of 20.1% during the forecast period.

Credit: Maximize Market Research

- Oil & Gas Exploration: With almost 4260 startups involved worldwide, oil & gas exploration continues to be a fundamental aspect of the sector. The sector employs more than 1 million professionals. Further, it has recruited more than 39 200 new workers in the past year. This demonstrates its vital role in supplying energy demands. Driven by advancements in geological modeling, exploration technologies, and sustainability-focused exploration techniques, the 3.61% annual trend growth rate shows consistent development.

The oil & gas exploration & production market size is expected to hit USD 17926.77 billion, with 11.8% CAGR by 2034.

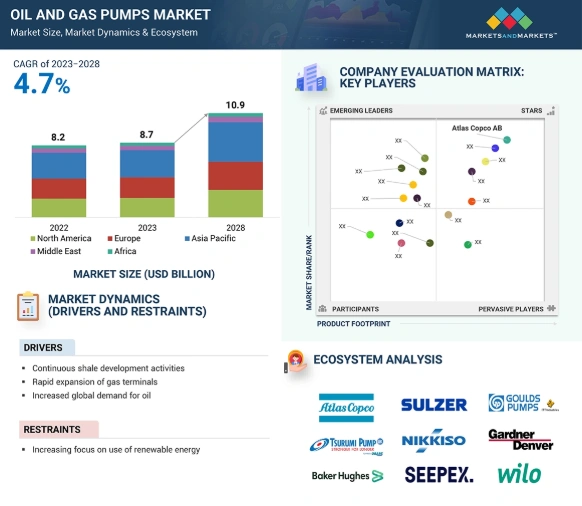

- Oil & Gas Pumps: In order to support operations throughout upstream, middle, and downstream activities, the oil & gas pumps segment is essential. This trend has consistent demand, with 660+ startups and 90 300+ workers, including 2000+ new hires in the previous year. The segment’s annual trend growth rate is relatively moderate at 2.19%.

The global oil and gas pumps market is estimated to grow to USD 10.9 billion by 2028. It is expected to record a CAGR of 4.7% during the forecast period 2023-2028.

Credit: Markets and Markets

5 Top Examples from 2700+ Innovative Oil and Gas Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Ferr-Tech enables Circular Wastewater Treatment

Dutch startup Ferr-Tech creates novel circular wastewater treatment solutions to improve water purification using ferrate chemistry. Its proprietary process leverages ferrate, a highly reactive and environmentally friendly compound. It oxidizes contaminants and neutralizes harmful substances in industrial wastewater.

This method allows for the safe reuse of treated water, decreases the environmental impact of water treatment procedures, and reduces chemical waste.

Its FerSol is sodium or potassium ferrate (VI) in a liquid and preservable form. It makes wastewater treatment sustainable, efficient, and circular. FerCa is sodium ferrate (VI) in cake form that provides an alternative method for wastewater treatment where a solid but dissolvable format is preferred.

FerPo is sodium ferrate (VI) in powder form, offering another preservable and versatile option for water purification processes. Ferr-Tech offers a sustainable and scalable solution for handling industrial water issues by integrating with current wastewater systems.

Moreover, in 2024, Ferr-Tech celebrated its KvK Innovative Top 100 victory by opening the AEX stock exchange. This marks a milestone in its journey as a leader in Ferrate(VI) technology for sustainable water treatment.

Energy Payables offers a Vendor-Customer Collaboration Platform

Canadian startup Energy Payables provides a platform for vendor-customer collaboration. It improves efficiency and streamlines financial procedures in the oil and gas sector. The software offers real-time visibility into financial workflows. It also automates crucial accounts payable and receivable tasks, such as document management, payment monitoring, and invoice approvals.

Its integration with current corporate systems increases operational precision and reduces the need for manual interventions. The platform also improves transparency and trust between customers and sellers by allowing direct communication and expediting dispute resolution.

Energy Payables enables businesses to enhance cash flow management, shorten payment cycle times, and optimize supplier relationships. It allows businesses to make data-driven decisions with its user-friendly interface and strong analytics capabilities, which provide actionable insights.

atmio simplifies Methane Emissions Reporting

German startup atmio combines sensor technologies with data analytics to provide methane emissions reporting systems. Its platform locates methane discharge sources, detects leaks, and records emissions data in real time from field activities.

atmio aids businesses in reducing their environmental footprint with actionable insights through user-friendly dashboards. It allows them to address emissions quickly and effectively. The solution also facilitates adherence to stringent international environmental rules by producing detailed reports that adhere to industry standards.

The startup’s predictive analytics tool enhances overall site safety and operating effectiveness by assisting operators in anticipating any leaks. The platform is scalable, meets long-term sustainability objectives, and interacts with current infrastructure.

In 2024, atmio secured around USD 5.28 million in seed funding to advance its methane emission detection and reporting platform.

Beyond Scroll offers Low-pressure Scroll Compressors

Swiss startup Beyond Scroll provides economical and energy-efficient solutions for gas compression requirements. It designs and manufactures low-pressure scroll compressors for the oil and gas sector. These compressors are ideal for delicate operating settings. It is because they use a special scroll mechanism to compress gases with little noise, vibration, or energy usage.

This small and lightweight design lowers operating expenses while making installation and maintenance easier. Beyond Scroll’s technology ensures high durability and dependability, meeting the rigorous demands of industrial applications.

The compressors are well-suited for processes like distribution, refining, and process optimization that require low-pressure gas management.

Pivoten creates an Oil & Gas Accounting Software

US-based startup Pivoten offers oil and gas accounting software. It aids industry operators in making better decisions and streamlining financial management. The platform combines tasks like budgeting, revenue tracking, and compliance reporting into a user-friendly solution.

Pivoten enables businesses to optimize financial processes by automating time-consuming tasks and lowering errors in human data entry. It allows businesses to make well-informed decisions and allocate resources more efficiently by offering detailed insights into financial performance.

Additionally, the platform facilitates uninterrupted team cooperation to ensure transparency and efficient operations. The startup’s compliance tools lower risks and increase reporting accuracy by assisting businesses in adhering to industry-specific requirements.

In 2024, Pivoten acquired P&C Business Solutions and SherWare Inc., enhancing its service offerings and expanding its client base.

Gain Comprehensive Insights into Oil and Gas Trends, Startups, and Technologies

The 2025 Oil & Gas industry report highlights a sector navigating significant transformation amidst global challenges. The industry’s resiliency is shown by innovation, sustainability initiatives, and staff expansion. Strong financial support, smart acquisitions, and technological investments in analytics and emissions control indicate innovations in energy demands.

Get in touch to explore 2700+ startups and scaleups, along with all market trends impacting oil and gas companies.