The oil and gas sector is undergoing a digital and sustainable transformation, with advanced technologies and efficiency-focused solutions driving this change. The oil and gas industry trends like artificial intelligence (AI) and machine learning (ML) are optimizing operations, predictive maintenance, and exploration processes. Besides, the industrial internet of things (IIoT), along with cloud and edge computing, is enhancing real-time data analytics and remote monitoring.

Further, carbon capture and storage (CCS) technologies reduce emissions, and renewable energy integration reshapes the sector’s energy mix. Meanwhile, advanced drilling and imaging technologies improve extraction efficiency, with cybersecurity safeguarding digital infrastructure from evolving threats.

What are the Top 10 Oil & Gas Industry Trends in 2025?

- Artificial Intelligence and Machine Learning

- Renewable Energy Integration

- Cloud and Edge Computing

- Blockchain

- Advanced Robotics

- Imaging Technologies

- Industrial Internet of Things

- Carbon Capture and Storage Technologies

- Cybersecurity

- Advanced Drilling Technologies

Methodology: How We Created the Oil & Gas Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 5M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the oil and gas industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the oil and gas innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Oil & Gas Industry Trends & 20 Promising Startups

For this in-depth research on the Top Oil and Gas Trends & Startups, we analyzed a sample of 8300+ global startups & scaleups. The Oil & Gas Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the latest trends in the oil and gas industry & startups that impact your company.

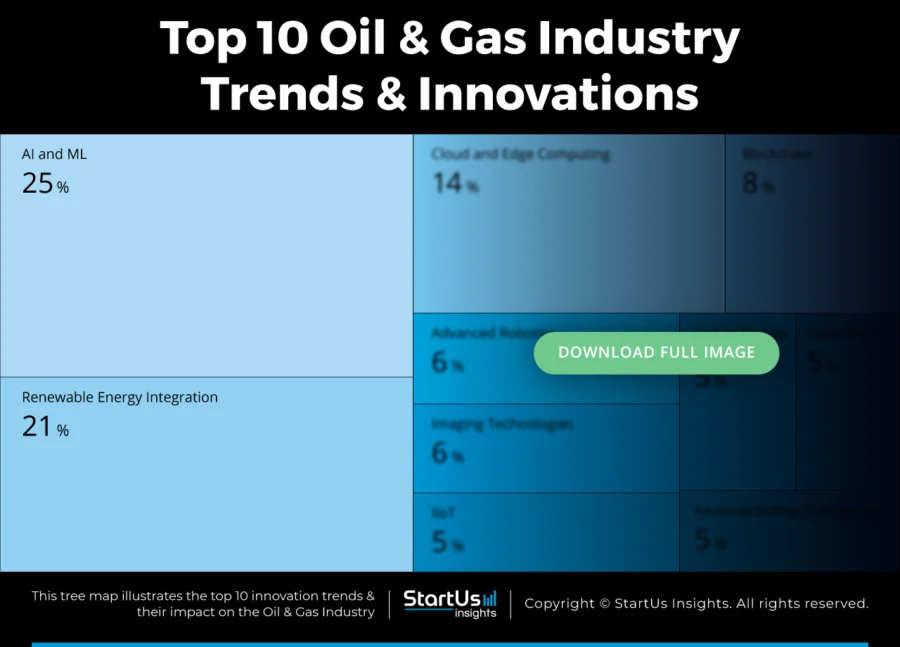

Tree Map reveals the Impact of the Top 10 Oil & Gas Trends

The Tree Map below highlights the key trends in the oil and gas industry in 2025. AI and machine learning transform predictive analytics and optimize exploration and refining processes. The industrial internet of things (IIoT), cloud, and edge computing enable real-time monitoring and operational automation.

Moreover, advanced robotics and imaging technologies improve precision and safety in exploration and drilling. Sustainability-driven innovations, like CCS technologies and renewable energy integration, are reducing environmental impact. Lastly, blockchain enhances transparency in supply chains.

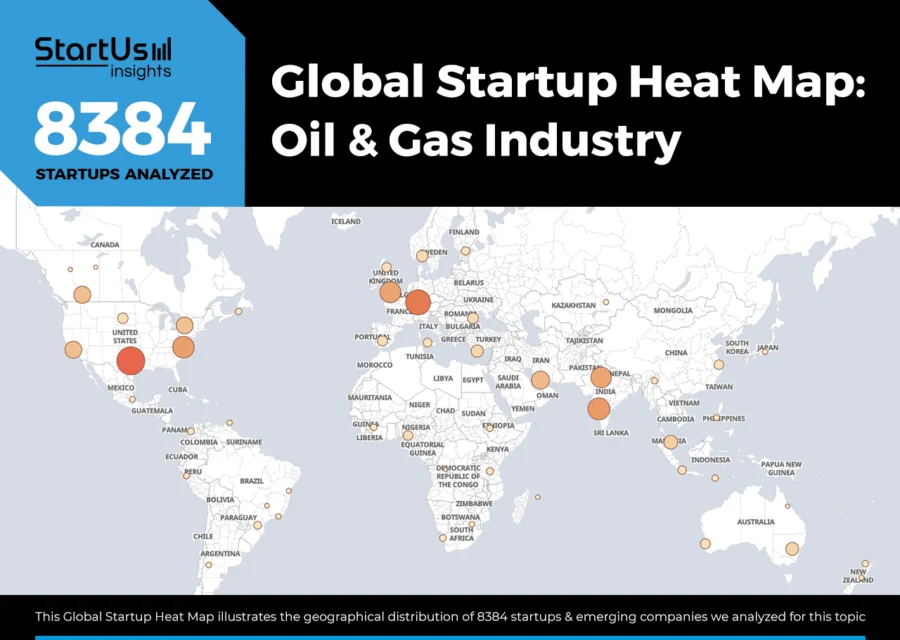

Global Startup Heat Map covers 8300+ Oil and Gas Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 8300+ exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the United States and Western Europe, followed by India. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Oil & Gas Innovations & Trends?

Top 10 Emerging Oil & Gas Technology Trends [2025 and Beyond]

1. Artificial Intelligence and Machine Learning

The global AI in oil and gas market will reach USD 25.24 billion by 2034, growing at a CAGR of 14.2% from 2024 to 2034. The industry is undergoing a digital transformation as AI and ML optimize exploration, production, and operational efficiency.

Credit: Precedence Research

AI integrates into various segments of the oil and gas sector. In exploration and production (E&P), AI-powered tools improve seismic interpretation, well planning, and production efficiency. Predictive maintenance solutions powered by AI reduce equipment downtime, which leads to cost savings.

Companies use AI to simulate reservoir behavior to enhance extraction efficiency and improve resource management. In pipeline operations, AI enables real-time monitoring to prevent leaks and optimize transportation networks.

Moreover, North America led the AI in the oil and gas market in 2024, accounting for 30% of total revenue. This was supported by major investments in predictive maintenance, drilling optimization, and reservoir management.

Emerging economies in Asia-Pacific, particularly China and India, are rapidly deploying AI-driven solutions to enhance drilling efficiency, reservoir management, and production monitoring.

In the Middle East, AI’s economic impact will reach USD 320 billion by 2030, with annual growth rates between 20% and 34%.

The Insight enables AI-driven Industrial Optimization

Brazilian startup The Insight develops digital transformation solutions for the oil, gas, and energy sectors by integrating AI, RPA, 5G connectivity, and digital twins. Its Prediction-e platform uses big data and AI to forecast short-term (up to 45 days) and medium-to-long-term (6 to 12 months) price trends. This reduces simulation time and enables faster, data-driven decision-making.

The startup’s Lubrai system analyzes lubricant oil conditions, detects contaminants, and monitors machine wear to extend equipment lifespan and lower maintenance costs. Further, the Smarttwins digital twin for FPSOs predicts structural failures and optimizes preventive maintenance, which improves operational reliability and reduces unplanned downtime.

Moreover, the TIM service employs IoT sensors and AI to track asset conditions in real-time for identifying wear and potential failures and facilitating proactive interventions. Lastly, the startup provides a custom generative AI model Insighter Pro trained on client-specific operational data and integrated with ERP systems to automate workflows and adapt to unique business needs.

Datall advances Rotating Equipment Predictive Maintenance

Iranian startup Datall builds Gubras, a solution that uses AI for predictive maintenance and condition monitoring of rotating equipment. It operates at the manufacturing execution system (MES) level, connecting to SCADA and ERP systems through its modular design.

The startup’s Gubras Matrix collects data from up to 64 sensors, while the Gubras Kernel processes this information using AI-driven algorithms to calculate performance parameters and detect faults. The decision support module applies AI to analyze patterns and provide actionable insights, which enables real-time fault detection and predictive analytics.

In addition, the Gubras Visage interface presents these insights in a user-friendly format that allows operators to make informed decisions. Datall enhances equipment reliability, reduces unplanned downtime, and supports proactive maintenance strategies.

2. Renewable Energy Integration

The US oil and gas electrification market was valued at USD 106 million in 2024. It is projected to grow at a CAGR of 6% from 2025 to 2034, driven by government policies and technological advancements that reduce emissions and increase energy efficiency.

Credit: Global Market Insights

The push for decarbonization accelerates investments in renewable energy and alternative fuels across the oil and gas sector.

Globally, oil majors such as BP and Shell invest in green hydrogen projects, using offshore wind for electrolysis to decarbonize refining and petrochemical operations.

The biofuels segment is also expanding, with over 40 biofuel projects announced by the end of 2024, targeting a combined production capacity of 260 000 barrels per day (bpd).

Further, sustainable aviation fuel (SAF) and hydrotreated vegetable oil (HVO) are expected to account for nearly 90% of biofuel output. This is a reflection of the industry’s transition toward low-carbon energy sources.

Moreover, the demand for reliable renewable energy solutions fuels the growth of the remote microgrid market, which was valued at USD 8.8 billion in 2024. It is projected to exceed USD 97.2 billion by 2037, growing at a CAGR of 20.2% from 2025 to 2037.

In 2025, the industry is expected to reach USD 10.6 billion, with strong adoption in oil and gas operations, where microgrids provide stable and renewable power solutions for remote facilities.

Cowboy Clean Fuels produces Renewable Natural Gas

US-based startup Cowboy Clean Fuels develops BiCRS+RNG, a patented technology that produces carbon-negative renewable natural gas (RNG) while permanently sequestering CO₂. This method leverages existing geologic formations and native microbial ecosystems to generate sustainable energy while capturing and storing CO₂.

The process begins with the injection of organic biomass into coalbed methane (CBM) wells in Wyoming’s Powder River Basin. Native methanogenic microorganisms convert the biomass into RNG and CO₂. The RNG is extracted through existing CBM wells and transported via existing pipeline infrastructure, while the CO₂ is adsorbed onto the coal seam to ensure permanent underground storage.

Cowboy Clean Fuels’ solution reduces carbon footprints, expands the RNG market, and supports net-zero carbon emission goals by integrating carbon removal credits into energy production.

Moreover, Cowboy Clean Fuels announces the final close of a USD 13 million Series B round. The funds will commercialize technology for scalable, simultaneous production of renewable natural gas and sequestration of carbon dioxide.

Capstone Power Solutions builds Low-emission Microturbine Systems

UK-based startup Capstone Power Solutions offers green energy microturbine systems for the oil and gas industry. These systems apply across upstream, midstream, and downstream operations, both onshore and offshore. The microturbines use patented air-bearing technology to eliminate the need for lubricants or coolants, and feature a single moving part to minimize maintenance requirements.

The startup’s microturbines integrate with existing infrastructure to provide a compact footprint and operate in stand-alone or grid-connected modes. The product lineup includes models like C65, C200S, C600S, C800S, and C1000S, which offer scalable power solutions from 65kW to 1MW. Multiple units also connect in parallel for up to 30MW of power generation.

Further, these microturbines are compatible with various fuels, including natural gas, associated gas, biogas, LPG/propane, flare gas, and landfill gas. Its benefits include low emissions through advanced combustion controls without exhaust after treatment, remote monitoring for continuous performance oversight, and the production of clean waste heat for combined heat and power (CHP) applications.

3. Cloud and Edge Computing

The global cloud computing in the oil and gas market will grow from USD 12.5 billion in 2024 to USD 32.7 billion by 2034, at a CAGR of 10.10% from 2025 to 2034.

Credit: market.us

Cloud-based IoT platforms analyze equipment data to predict failures to reduce downtime and maintenance costs. Integrated geological data on cloud platforms enhance drilling strategy optimization through accurate simulations.

Cloud computing also streamlines procurement and inventory management to cut down operational expenses while enabling real-time emissions tracking and regulatory compliance.

Besides, edge computing plays a critical role in remote operations to ensure low-latency data processing at offshore rigs and other isolated sites. By keeping critical data within local networks, edge computing minimizes exposure to cyber threats and enables continuous monitoring of equipment and pipelines, even in challenging environments.

Moreover, PakEnergy LLC acquired Plow Technologies in August 2024 to enhance its cloud and SCADA offerings for automation and data management in oilfields.

AlphaCons provides Cloud & In-memory Computing

Greek startup AlphaCons offers SAP – cloud & in-memory computing solutions to enhance business performance and operational efficiency. It offers the SAP HANA Business Technology Platform (BTP), which integrates data and business processes to support AI, big data, IoT, and ML technologies.

The startup also delivers SAP Analytics Cloud (SAC), a data visualization tool that combines business intelligence, predictive analysis, and budget planning for real-time decision-making. In addition, AlphaCons implements SAP S/4HANA, an in-memory ERP system that streamlines business operations and automates routine activities. It allows companies in the oil and gas sector to automate daily business processes to improve interactions with customers, suppliers, and employees.

dispoGas offers Natural Gas Nominations SaaS

Swiss startup dispoGas builds a cloud-native SaaS platform for natural gas nomination handling. The platform simplifies message exchanges between customers, transmission system operators (TSOs), and market area coordinators. It manages gas nominations and matchings at major European trading hubs, physical interconnection points, and storage facilities.

The startup’s platform allows users to input nomination quantities and automatically transmits the information to market partners over encrypted AS2/AS4 channels. It offers features such as a user-friendly interface with clear overviews of nomination statuses, automation for scheduling processes or API-triggered operations, and customizable notifications through email, SMS, or other preferred channels.

dispoGas is hosted on the Microsoft Azure cloud and ensures secure, reliable access without the need for on-premises infrastructure. It integrates with existing systems via a documented REST API and supports connections to corporate user directories for streamlined user management.

4. Blockchain

The global blockchain in the oil & gas market was valued at USD 984.4 million in 2024. It is projected to grow at a CAGR of 41.9% from 2025 to 2034, driven by the adoption of blockchain-based automation, cost-reduction strategies, and regulatory compliance solutions.

Credit: Global Market Insights

North America dominated the market in 2024, accounting for 37.4% of the global share and generating USD 0.4 billion in revenue. Moreover, the US contributed USD 0.3 billion.

Industry players are actively investing in blockchain applications. Seven oil companies, including ExxonMobil and Chevron, formed the OOC Oil & Gas Blockchain Consortium. They aim to leverage blockchain for cost reduction, faster transactions, and improved safety.

Blockchain-enabled smart contracts automate procurement, payments, and compliance processes, which reduces errors and operational costs.

Further, blockchain is growing in carbon credit tracking and trading for providing transparent emissions data management to enable companies to comply with environmental regulations.

Peer-to-peer energy trading powered by blockchain reduces costs and enables greater renewable energy integration. Besides, decentralized platforms enhance supply chain efficiency by enabling direct, secure transactions between stakeholders.

SmartChain advances Oil & Gas Contract Management

US-based startup SmartChain makes a digital contract automation platform leveraging blockchain for the upstream oil and gas industry. This platform digitizes contract terms and integrates with multiple data sources to create a digital twin of paper contracts. It automates processes from procurement to payment.

The platform enables real-time financial visibility by overlaying financial and operational data, which allows for immediate issue identification and operational adjustments. Its features include automated invoice processing to minimize administrative tasks and reduce fraud, as well as advanced performance contracts that align vendor objectives with operational goals.

Neoflow builds Energy Traceability Platform

Canadian startup Neoflow develops an energy traceability platform that provides a digital passport for commodities like crude oil, natural gas, and renewables to track their lifecycle through the value chain. The platform uses decentralized identifiers (DID) and verifiable credentials (VC) to securely record and share data among stakeholders, including producers, transporters, refineries, regulators, and service providers.

The startup’s system captures product lifecycle events to offer proof of origin, composition, and environmental impact while digitizing relevant value chain data. It offers features such as automated border clearance, which streamlines cross-border movements and reduces tariffs.

Further, the pipeline optimization tools enhance decision-making and operational efficiency through algorithmic calculations. An environmental passport module provides a comprehensive view of the environmental impact associated with the lifecycle of energy commodities to facilitate compliance and sustainable practices.

Moreover, the US Department of Homeland Security awarded a Phase 4 contract to Neoflow in March 2024 for blockchain-based tracking of energy products between Canada and the US.

5. Advanced Robotics

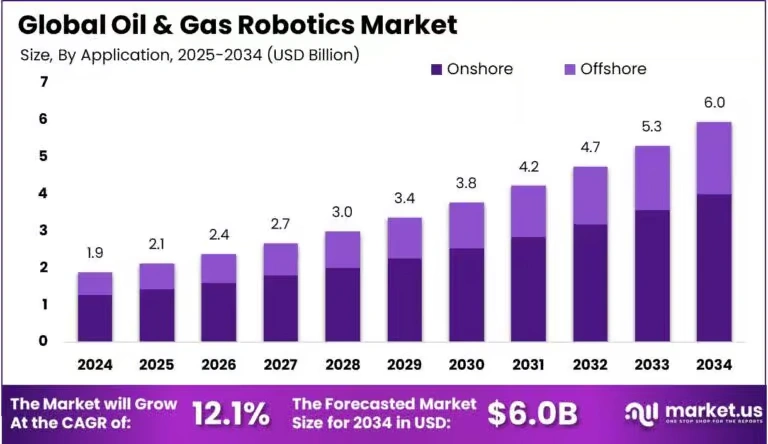

The global oil & gas robotics market will grow from USD 1.9 billion in 2024 to USD 6.0 billion by 2034, at a CAGR of 12.10% during the forecast period.

Credit: market.us

The adoption of robotics in inspection, maintenance, and drilling is driving market expansion. Companies seek to enhance operational efficiency, reduce downtime, and improve safety in hazardous environments.

The inspection robots segment, valued at USD 400 million in 2024, grows due to its role in pipeline monitoring, equipment inspections, and facility assessments. On the other hand, maintenance robots, valued at USD 1.8 billion in 2024, address industry needs by enabling predictive maintenance solutions that minimize unplanned downtime.

In addition, drilling robots will double in market size, growing from USD 1.2 billion in 2024 to USD 2.4 billion by 2032, enhancing precision and reducing the environmental impact of drilling operations.

Major energy companies such as Petrobras, Shell, and TotalEnergies deploy robotic solutions for offshore inspections, AI-driven drilling optimization, and subsea pipeline maintenance.

Robotics technologies increasingly integrate with AI, IoT, machine learning, and computer vision to enable real-time monitoring, predictive maintenance, and autonomous decision-making for complex oil and gas operations.

Advancements in autonomous underwater vehicles (AUVs) further transform offshore operations. Innovations such as SPICE by Kawasaki Heavy Industries address deep-sea pipeline inspection challenges to improve efficiency in hard-to-reach environments.

Pike Robotics manufactures Wall Climbing Robot

US-based startup Pike Robotics builds the Wall-Eye, a wall-climbing robot for explosive atmospheres. It enhances safety and efficiency in inspecting above-ground storage tanks. The Wall-Eye magnetically adheres to tank walls, navigates confined spaces with a forward-leading manipulator, and uses sensors like depth cameras, LIDAR, contact sensors, and hydrocarbon gas detectors. These sensors detect critical defects such as gaps, tears, and harmful vapors.

The startup’s software enables autonomous navigation, real-time reporting, and repair recommendations. It also collects extensive data for AI and machine learning applications. By eliminating the need for human entry into hazardous environments, the Wall-Eye reduces operational risks and lowers inspection costs.

AIS Field builds Robotic Inspection Systems

Turkish startup AIS Field develops robotic inspection and maintenance solutions for the oil, gas, energy, and power generation industries. It offers the RUVI OilDiver, an ATEX-certified robot that inspects storage tank floors in explosive environments. The robot uses ultrasonic modules for precise thickness measurements and corrosion mapping.

The startup’s I-Cleaner robot cleans and inspects fire water tanks without draining to maintain continuous operation and reduce risks. Further, the RUVI Diver is an underwater drone with ultrasonic units for visual inspections and thickness measurements in marine environments and water tanks. It eliminates the need for human divers and enhances safety standards.

6. Imaging Technologies

The global optical gas imaging (OGI) camera market is projected to reach USD 0.75 billion by 2032, growing at a CAGR of 7.5% from 2024 to 2032. The increased focus on environmental compliance, safety, and operational efficiency drives the adoption of advanced imaging technologies in this sector.

Credit: Business Research Insights

AI-driven seismic imaging improves hydrocarbon exploration by enhancing resolution, removing noise, and detecting subtle geological features. This technology enables more precise reservoir mapping and reduces environmental risks.

In addition, integrating IoT sensors with imaging systems allows real-time pipeline monitoring. This improvement enhances leak detection, emissions tracking, and overall safety while minimizing downtime and financial losses.

Further, emerging technologies such as augmented reality (AR) are used for remote inspections and training in hazardous environments to improve worker safety and operational efficiency.

Moreover, OGI cameras are essential for methane leak detection. They enable companies to comply with strict environmental regulations while actively reducing greenhouse gas emissions.

Lastly, AI-powered imaging platforms prevent major pipeline leaks through real-time analysis to save millions in damages and environmental cleanup costs.

GeoKinesia provides InSAR Imagery

Spanish startup GeoKinesia offers InSAR monitoring to detect and analyze ground displacements over large areas, including oil wells, gas reservoirs, and pipeline infrastructures. It uses satellite-based radar imagery to measure surface movements with millimeter precision to identify subsidence or uplift that may compromise structural integrity.

The startup monitors large, remote, or urban areas without the need for on-site sensors, and also provides historical data analysis to assess long-term ground stability trends. GeoKinesia delivers accurate and timely deformation insights to enhance operational safety and support environmental compliance. This prevents incidents such as oil spills and gas leaks in the oil and gas sector.

NextAV enables Methane & Oil Leak Detection

Tunisian startup NextAV offers AI-enhanced satellite monitoring solutions for the oil and gas industry. Its super-resolution AI technology processes low-resolution multispectral satellite images into detailed, high-resolution data, which allows operators to detect methane leaks in remote or inaccessible locations. This reduces greenhouse gas emissions through early identification and prompt mitigation.

The platform enhances oil spill detection by identifying leaks up to three meters underground in pipelines, offshore rigs, and storage facilities to enable faster containment and damage prevention. Its infrastructure monitoring system automatically tracks changes in pipelines, rigs, and geohazards such as erosion or vegetation encroachment to ensure asset integrity. Further, its AI-driven change detection identifies unauthorized third-party activities near critical infrastructure to provide near real-time alerts for proactive security measures.

7. Industrial Internet of Things

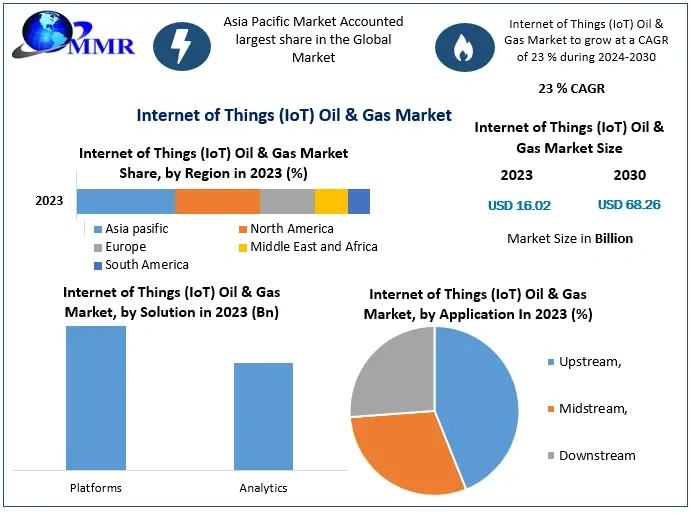

The IIoT in the oil and gas market is expected to reach USD 68.26 billion by 2030, growing at a CAGR of 23% from 2024 to 2030. The increasing adoption of IIoT solutions drives improvements in predictive maintenance, pipeline monitoring, asset management, safety, and environmental compliance.

Credit: Maximize Market Research

Predictive maintenance, powered by IIoT-enabled sensors, transforms equipment monitoring by detecting early signs of failure to reduce downtime and maintenance costs.

Moreover, the market trends in the oil and gas industry for IIoT sensors, valued at USD 1.1 billion in 2023, are projected to reach USD 2.4 billion by 2030, growing at a CAGR of 11.3%.

Pipeline monitoring solutions also enhance operational integrity by detecting leaks or corrosion early to improve safety and minimize environmental risks and financial losses.

Asset management, a major application of IoT in oil and gas, accounts for over 36.9% of the market share in 2024. Real-time tracking and optimization of assets improve operational efficiency and cost control, driving IoT adoption in the sector.

IoT also enhances worker safety through real-time monitoring of hazardous conditions such as gas leaks and emissions beyond regulatory limits to ensure compliance and reduce workplace risks.

Besides, environmental monitoring solutions track emissions, optimize energy consumption, and ensure adherence to sustainability goals.

Bharat Flow Analytics supports Pipeline Monitoring & Inspection

Indian startup Bharat Flow Analytics makes pipeline monitoring solutions to enhance oil and gas transportation safety and efficiency. Its iPTran uses non-intrusive technology to estimate wax and debris accumulation.

This enables data-driven pigging operations that allow operators to calibrate pigging frequency, refine schedules, and manage blockages by identifying their location and severity. Further, it aids informed pig selection and enhances chemical treatments to mitigate corrosion and maintain system integrity.

The startup’s iLDS integrates AI and IoT technologies to detect leaks with a sensitivity of less than 0.5% flow rate. It pinpoints leak locations within 10 meters in under a minute to minimize false positives, reduce operational downtime, and lower maintenance costs.

TrackAlytix facilitates Wireless Tank Level Monitoring

US-based startup TrackAlytix offers telemetry and wireless monitoring solutions to enhance efficiency in the oil, gas, and industrial sectors. The TrackGas V5 sensor monitors fluid levels in oil tanks by transmitting real-time data to a cloud-based platform for precise tracking and management. It features quick installation, a battery life of up to five years, and compatibility with various communication networks to ensure reliable performance even in remote areas.

The startup’s TrackGas G5 is a smart meter for liquid propane tanks. It uses a magnetic hall effect sensor to measure levels via the remote-ready Rochester gauge. It offers customizable data transmission frequencies and integrates with the TrackGas portal for real-time monitoring and historical data analysis.

Further, the SiloTrack monitor measures load levels in silos by detecting leg deformation, and transmits data through networks like Nb-IoT and CATM-1. Its patented dual strain gauge technology compensates for environmental factors to ensure accurate readings.

8. Carbon Capture and Storage Technologies

The global CCS market, valued at USD 3.9 billion in 2024, is projected to grow at a CAGR of 14.5% from 2025 to 2034. This growth is driven by increasing environmental regulations and the push for carbon neutrality.

Credit: Global Market Insights

Governments and energy companies are investing in CCS infrastructure to reduce greenhouse gas emissions and enhance energy sustainability.

The United States leads CCS investments, with the Department of Energy (DOE) allocating over USD 3.5 billion in 2025 for carbon management projects. This includes USD 1.3 billion for point-source CCS and USD 1.8 billion for direct air capture hubs.

In Europe, the Netherlands has committed USD 7.3 billion to CCS projects through its SDE++ scheme. Denmark has also allocated USD 1.2 billion for retrofitting power stations with CCS technologies.

CCS is crucial for decarbonizing industrial sectors and supporting enhanced oil recovery (EOR). CO₂ injection in EOR increases oil recovery by up to 20% while reducing greenhouse gas emissions by up to 90%, which makes it a viable strategy for both economic and environmental benefits.

Moreover, oxyfuel combustion technology is the fastest-growing CCS segment, projected to grow at a CAGR of 26.1% from 2024 to 2030. This technology produces concentrated CO₂ streams for efficient capture.

Energy companies are repurposing depleted reservoirs for CO₂ storage, leveraging geological expertise from oil exploration to create new revenue streams while meeting environmental goals.

CarbonOrO captures Carbon from Fuel Gases

Dutch startup CarbonOrO builds carbon capture solutions using a proprietary bi-phasic amine solvent to reduce CO₂ emissions from industrial sources. This technology absorbs CO₂ from flue gases and releases it at a pressure of 4-6 bar when heated to 105-120°C.

The solvent offers 40% energy savings compared to standard monoethanolamine (MEA) processes and shows lower oxidative and thermal degradation, which enhances operational stability. Moreover, its high CO₂ loading capacity allows for compact installations to minimize the system’s physical footprint.

DecarbonICE makes CO2 Transport Technology

Danish startup DecarbonICE develops carbon capture and transportation solutions using a proprietary method that converts CO₂ emissions into dry ice. The technology captures CO₂ at emission sources and solidifies it into dry ice. The dry ice is loaded into insulated standard 20-foot containers and transported using existing logistics networks like trucks, trains, ships, or barges to storage sites.

There, the dry ice is re-liquefied and stored permanently. This approach eliminates the need for specialized infrastructure, reduces transportation costs, and leverages the global availability of over 43 million shipping containers.

9. Cybersecurity

The global oil and gas cybersecurity market is projected to grow at a CAGR of 5.8% from 2023 to 2030, reaching USD 44.2 billion by 2030.

Credit: Fairfield Market Research

Increasing cyberattacks on critical energy infrastructure drive demand for advanced security solutions to safeguard operational technology (OT) and IT networks.

High-profile incidents, like the Colonial Pipeline ransomware attack, have revealed vulnerabilities in oil and gas infrastructure.

In 2024, 67% of energy-related organizations experienced ransomware attacks, with average recovery costs per incident reaching USD 3.12 million. The rising cyber threat landscape has accelerated the adoption of AI-powered threat detection, blockchain-based secure transactions, and machine learning for predictive maintenance.

Further, software-based security solutions accounted for 51.2% of the market share in 2024. There is a demand for firewalls, intrusion detection systems, and encryption tools to protect critical oil and gas infrastructure.

Leading industry players are introducing tailored cybersecurity solutions to address specific sector needs. For instance, Siemens launched an AI-powered physical security platform to enhance perimeter security at oil facilities. IBM Security also introduced a Managed Security Service for real-time monitoring of oil and gas operations.

Novaigu advances Industrial Cybersecurity

US-based startup Novaigu provides industrial cybersecurity solutions through its proactive defense platform, Mission Guard. This platform protects critical missions in ICS/OT environments by offering comprehensive asset visibility, attack surface analysis, and real-time threat detection. It enables organizations to identify vulnerabilities and mitigate risks effectively.

Mission Guard features agentless, lightweight, and non-intrusive deployments, along with customizable configurations tailored to unique operational requirements. It also includes predictive analytics for proactive threat response. Novaigu allows industries such as oil and gas, energy, and manufacturing to safeguard their critical infrastructure against evolving cyber threats.

DeepInspect makes Oil & Gas Probe

Italian startup DeepInspect offers an integrated OT cybersecurity platform that combines methodology, hardware, and software to secure critical infrastructures in industrial environments.

The platform automates asset discovery, improves network visibility, and operates effectively in air-gapped environments through embedded data processing capabilities. It also securely collects and stores data on DeepInspect devices, which allows for controlled forwarding to third parties.

For oil and gas applications, the DeepInspect Oil&Gas Probe ensures resilience in hazardous environments by withstanding electromagnetic interference, temperature fluctuations, and physical strain. It uses specialized antennas for enhanced monitoring in remote locations.

10. Advanced Drilling Technologies

The global horizontal directional drilling (HDD) market was valued at USD 9.90 billion in 2024 and is projected to grow at a CAGR of 4.48%, reaching USD 14.98 billion by 2033.

Credit: IMARC Group

The advancements in drill data management, automation, and AI-powered predictive maintenance drive this market expansion by improving efficiency and reducing environmental impact.

Besides, the advanced drill data management solutions market, valued at USD 2.36 billion in 2024, is expected to grow to USD 2.56 billion in 2025, with a CAGR of 10.8% from 2025 to 2037.

Cloud-based drill data management solutions are gaining adoption due to their scalability and real-time analytics capabilities to enable better decision-making in complex drilling operations.

Horizontal drilling remains transformative, enhancing production rates while minimizing environmental impact, particularly in unconventional reservoirs such as shale formations.

Further, advanced automated drilling rigs equipped with robotics and AI-powered systems reduce human error, improve safety, and enhance operational efficiency. Predictive maintenance, powered by AI, also plays a crucial role in extending equipment lifespans and reducing unplanned downtime.

Chevron’s successful high-pressure drilling at 20 000 psi unlocked up to 5 billion barrels of previously inaccessible oil. This sets a new precedent for exploration in challenging regions such as offshore Brazil and Angola.

Moreover, environmental concerns are shaping the evolution of HDD and advanced drilling technologies. Non-invasive drilling methods are being developed to minimize surface disruption, while advanced well placement optimization is reducing ecological footprints and maximizing recovery rates.

Ryptx provides Downhole Drilling and Optimization Tools

UK-based startup Ryptx makes downhole drilling and optimization tools for the oil, gas, and geothermal industries. Its products, including the RYPSUB-XB circulation sub and the RYPGEN downhole generator, enhance drilling efficiency and reduce non-productive time.

The startup’s RYPSUB-XB features a single-collar design without mid-body connections, variable cycle capability, and rugged ball-drop activation. This facilitates reliable multi-cycle operations across various downhole applications.

Further, the RYPGEN generates up to 1.75 kW of power, operates at pressures up to 20,000 psi, and temperatures up to 175°C. It offers customizable voltage outputs and flow rate ranges to ensure compatibility with diverse downhole conditions.

ComputerWell offers Computational Surveillance

Norwegian startup ComputerWell builds the DrillComputer, a software to enhance decision support in drilling operations. DrillComputer combines an ultrafast drillstring simulator with tested pattern recognition methods to predict critical parameters in real time. It computes axial and torsional motions and stresses faster than real-time for any drillstring configuration, fluid, or wellbore geometry.

The high-resolution graphical user interface handles vast amounts of data efficiently to provide smooth zooming even at 1000 Hz data rates. The startup’s software enables connectivity to offset data, facilitating comparative analysis across multiple wells.

Discover all Oil & Gas Trends, Technologies & Startups

The oil and gas industry is evolving with a focus on digitalization, efficiency, and sustainability. AI and machine learning optimize exploration and refining, while CCS technologies mitigate environmental impact. In addition, advanced drilling technologies are improving resource extraction and operational safety.

The Oil & Gas Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.