The Packaging Industry Report for 2024 explores a sector responding to global trends in innovation, sustainability, and customization. As environmental awareness grows worldwide, companies are shifting to more sustainable materials, with compostable packaging being a notable example. At the same time, the market desire for personalization drives demand for custom packaging solutions. This report examines the emerging trends, firmographic data, and key data that shape the industry. With the entry of new companies, the report provides insights into how the packaging sector adjusts to the changing needs of businesses and consumers.

This report was last updated in July 2024.

This Packaging Industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Packaging Industry Report 2024

- Executive Summary

- Introduction to the Packaging Industry Report 2024

- What data is used in this Packaging Industry Report?

- Snapshot of the Global Packaging Industry

- Funding Landscape in the Packaging Industry

- Who is Investing in the Packaging Industry?

- Emerging Trends in the Packaging Industry

- 5 Packaging Startups impacting the Industry

Executive Summary: Packaging Industry Outlook Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 4000+ packaging startups developing innovative solutions to present five examples from emerging packaging industry trends.

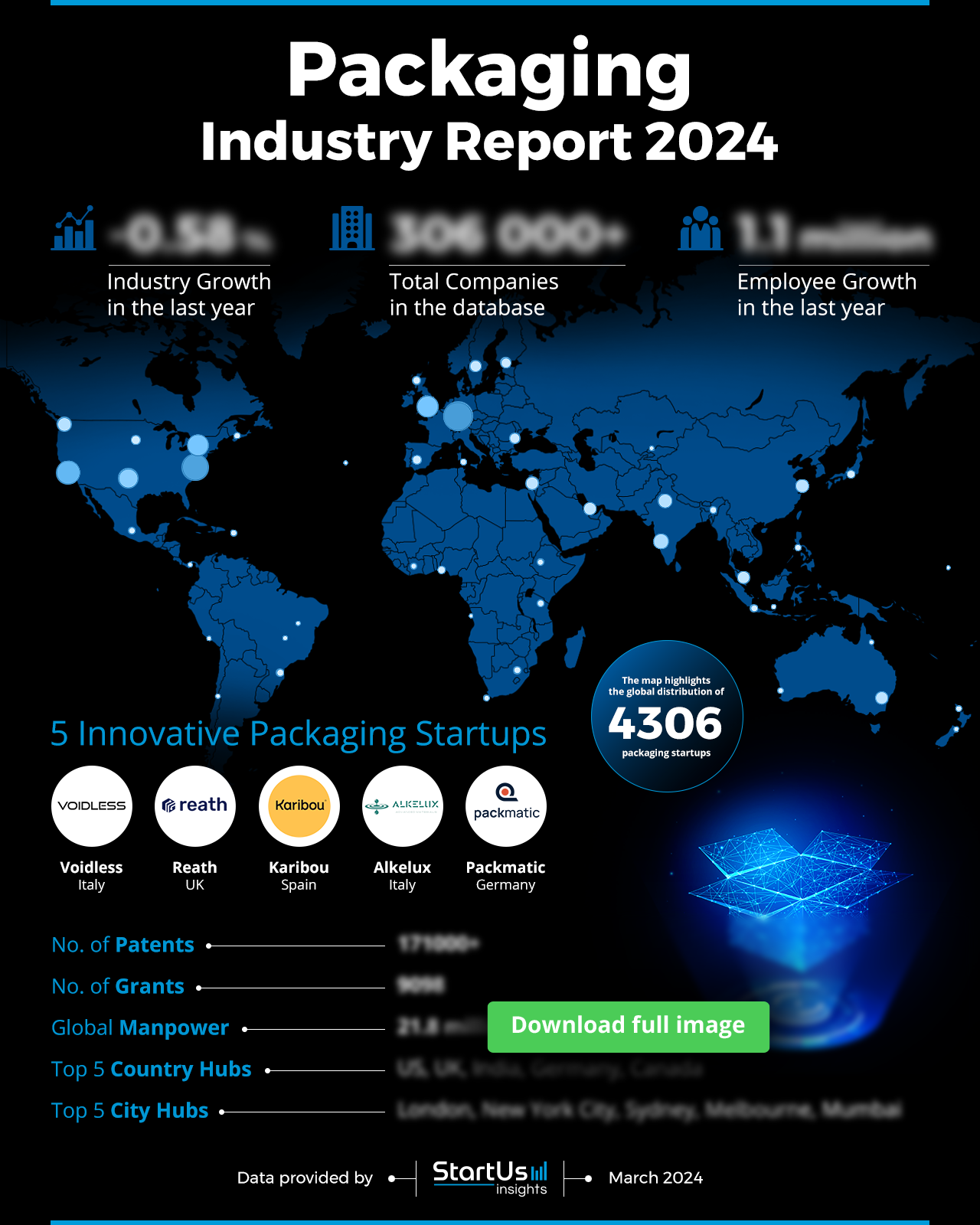

- Industry Growth Overview: The packaging market report shows a slight contraction of 0.58% in growth last year, with over 306000 companies listed.

- Manpower & Employment Growth: The industry employs 21.8 million people worldwide, with an increase of 1.1 million new employees last year.

- Patents & Grants: The sector holds more than 171000 patents, supported by 9000+ grants, indicating a focus on innovation.

- Global Footprint: It has a significant presence in the US, UK, India, Germany, and Canada, with major city hubs in London, New York City, Sydney, Melbourne, and Mumbai.

- Investment Landscape: The average investment value is USD 36 million, with 36000+ funding rounds and 13000+ investors.

- Top Investors: Leading investors have collectively invested over USD 8 billion, with notable contributors being SoftBank Vision, International Finance Corporation, and Tiger Global.

- Startup Ecosystem: It features five startups—Voidless (on-demand packaging), Reath (reusable packaging software), Karibou (plant-based packaging), Alkelux (water-soluble active packaging), Packmatic (packaging sourcing platform).

- Recommendations for Stakeholders: Consider investing in sustainable and custom packaging solutions to meet consumer trends and environmental objectives. Emerging automation and robotic solutions also present new opportunities to improve efficiencies. The highly diversified and global proliferation of packaging companies also offers new business opportunities in new markets.

Explore the Data-driven Packaging Industry Report for 2024

This packaging report uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The industry saw a minor decline of 0.58% in growth last year. Our database shows a broad network of over 306000 companies. This suggests a mature market with potential for both innovation and competition. It employs 21.8 million people worldwide, and added 1.1 million new employees last year, indicating strong job creation and increased industry activity.

What data is used to create this packaging industry report?

Based on the data provided by our Discovery Platform, we observe that the packaging industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The packaging industry has a significant presence with over 185000 publications in the past year.

- Funding Rounds: The sector shows strong financial engagement with more than 36000 funding rounds recorded in our database.

- Manpower: It employs over 21 million workers and has expanded its workforce by over 1 million new employees in the last year.

- Patents: The industry holds more than 171000 patents, indicating a strong focus on innovation and intellectual property.

- Grants: The sector’s research and development efforts have been acknowledged with 9098 grants awarded.

A Snapshot of the Global Packaging Industry

The packaging industry has a workforce of 21.8 million employees, underscoring its significant role in global employment. Over the past year alone, the industry has added over 1.1 million new employees, demonstrating its steady growth and the rising demand for packaging solutions. Moreover, the industry’s broad scope is evident in 306K companies that operate within it, contributing to innovation, sustainability, and supply chain efficiency.

Explore the Funding Landscape of the Packaging Industry

An average investment value is USD 36 million in the packaging industry, showing a steady flow of capital. Over 13000 investors have participated, directing funds into diverse ventures and technologies. This activity is reflected in the closure of more than 36000 funding rounds, showing investor’s dedication to its growth. Moreover, 16000 companies have received investment, showcasing the wide range of innovation and numerous growth opportunities within the industry.

Who is Investing in the Packaging Industry?

The top investors in the packaging industry have collectively invested more than USD 8 billion. Here are the contributions of these leading investors:

- SoftBank Vision Fund has invested USD 1.3 billion across 11 companies, showing its focus on innovative packaging solutions.

- International Finance Corporation has invested USD 1.2 billion in 19 companies, supporting sustainability and development.

- Tiger Global Management has invested USD 1 billion in 20 companies, reflecting its belief in the future of packaging.

- Insight Partners has contributed USD 818.5 million to 17 companies, targeting firms with the potential for rapid growth and technological innovation.

- Sequoia Capital has invested USD 802.7 million in 32 companies, supporting disruptive startups.

- Qatar Investment Authority has invested USD 800 million in 6 companies, showing its strategic interest in the sector.

- General Atlantic has allocated USD 607.1 million to 15 companies, supporting scalable models in the packaging ecosystem.

- Alibaba Group has invested USD 572.6 million in 4 companies, integrating packaging solutions within its e-commerce operations.

- HSBC has spread its investments of USD 562.8 million across 27 companies, showing a broad interest in the industry.

- T. Rowe Price has invested USD 480.5 million in 4 companies, indicating confidence in the sector’s long-term prospects.

These investments contribute to innovation in the packaging industry and highlight the strategic importance of packaging in the global market.

Explore Firmographic Data for All Packaging Trends

- Compostable packaging is a growing trend in the sustainability-driven market, with 700+ companies adopting this eco-friendly approach. It employs 43K+ individuals and has added 2K+ new employees over the last year. Its annual trend growth rate of 5.24% signifies an increasing demand for packaging solutions that have minimal environmental impact.

- Custom packaging is represented by 8K+ companies, marking its vast presence in the industry. It employs 500K+ employees and added 28K+ new employees last year, reflecting the consumer preference for a personalized touch. Despite an annual trend growth rate of -1.39%, businesses continue to seek unique packaging to differentiate their products

- Active packaging is a specialized trend with 157 companies at its forefront, employing 40K individuals. The addition of 800+ new employees last year shows a consistent interest in developing packaging that extends product shelf life and enhances quality. However, its annual trend growth rate of -9.19% suggests it faces challenges, possibly due to high costs or regulatory hurdles.

5 Top Examples from 4000+ Innovative Packaging Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Voidless offers On-demand Packaging

Italian startup Voidless develops a system for on-demand packaging. This system emphasizes modularity and integrability. It uses cardboard, available in fanfold, roll, or sheet form, as the input. Further, its proprietary optimization algorithms determine the best box template. These templates then become ready-to-use boxes. The system reduces costs and streamlines logistics. Voidless offers packaging solutions with a focus on reducing waste and solving the e-commerce industry’s overpackaging problem.

Reath develops Reusable Packaging Software

UK startup Reath provides a software platform for businesses to transition to safe, data-driven reusable packaging. This platform focuses on gathering data about reusable packaging, which is essential for maintaining compliance. The startup’s technology integrates machine-readable trackers like QR codes with the reuse.id® Data Standard. This integration results in reusable packaging systems that are secure, compliant, and driven by data.

Karibou creates Plant-based Packaging

Spanish startup Karibou produces packaging products that are plant-based and free from plastic. It employs a circular production model for environmentally friendly manufacturing. The entire manufacturing process uses energy derived from renewable sources. The startup’s product line comprises hypercell fiber cutlery, plates, square and rectangular trays, along with paper cups and lids. These products serve a variety of sectors such as vending, food service, retail, agriculture, cash and carry, and beverages.

Alkelux offers Water-soluble Active Packaging

Italian startup Alkelux develops Alkelux VT-1, a water-soluble additive derived from licorice waste. The development process includes the creation of carbon nanoparticles. These nanoparticles exhibit antiviral, antibacterial, and antifungal activity. The startup follows a “blue thinking” approach, highlighting its commitment to sustainability and environmental responsibility. This enables it to adjust to changes in climate and economy. Further, Alkelux operates within the food industry, with a particular focus on food packaging.

Packmatic simplifies Packaging Sourcing

German startup Packmatic provides a digital platform for product packaging. Its smart matching engine pairs large FMCG brands, industrial companies, and medium-sized product companies individually. This pairing process brings cost savings and efficiencies for customers. The startup’s sourcing platform also aligns with broader environmental goals by facilitating access to sustainable alternatives. Packmatic connects businesses with a network of packaging suppliers throughout Europe, aiding businesses locate suitable and specialized packaging suppliers.

Gain Comprehensive Insights into Packaging Trends, Startups, or Technologies

The packaging industry report highlights a phase of significant change, influenced by sustainability and the integration of technology. Compostable and custom packaging have come to the fore, indicating an industry moving towards environmentally friendly practices and innovation focused on the consumer. Trends like smart packaging and heavy-duty automation suggest a future that combines human expertise with robotic/automated labor tools and equipment. Get in touch to explore all 4000+ startups and scaleups, as well as all industry trends impacting packaging companies.