The 2025 Payment Processing Market Report highlights the sector’s role in global economic growth through digital transactions and innovation. Trends like embedded payments, contactless solutions, and fraud protection signal the market’s adaptability and resilience. With rising investments and a dynamic startup ecosystem, the report explores key forces, challenges, and opportunities shaping the market. It offers stakeholders, investors, and policymakers insights into the market’s health and future trajectory.

Executive Summary: Payment Processing Market Report 2025

- Industry Growth Overview: The payment processing market has more than 6000+ companies and 1360+ startups. It is expected to grow to USD 227.19 billion in 2028 at a compound annual growth rate (CAGR) of 16.9%. On a granular level, the payment processing market is experiencing steady growth, with an annual expansion rate of 4.72%, according to the latest data from our platform.

- Manpower & Employment Growth: The sector has over 393000 employees worldwide; in the past year, it has added 37000+ employees. This demonstrates its ability to create a sizable number of job opportunities.

- Patents & Grants: With more than 310 applications filing 6290+ patents and more than 250 grants provided, the sector demonstrates strong innovation and substantial support for R&D projects.

- Global Footprint: Key geographic hubs include the United States, United Kingdom, Germany, Canada, and India. Prominent city hubs driving the sector are London, New York City, Toronto, San Francisco, and Los Angeles.

- Investment Landscape: With an average investment value of USD 49.5 million per round across more than 4700 funding rounds, the sector is growing at a steady pace.

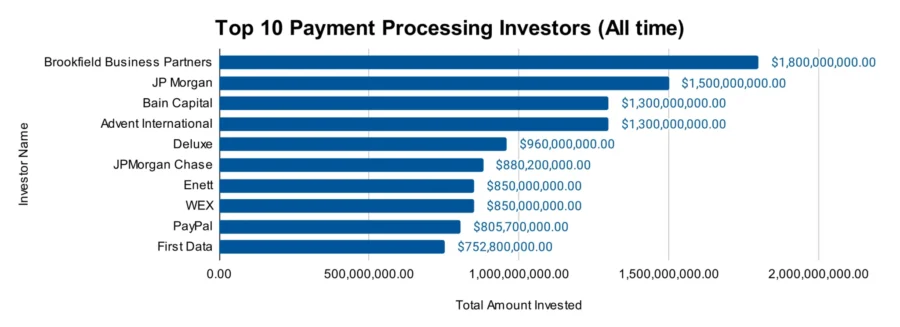

- Top Investors: Major investors such as Brookfield Business Partners, JP Morgan, Bain Capital, Advent International, and more have collectively invested around USD 11 billion in the sector.

- Startup Ecosystem: Five innovative startups, Billment (invoice management software), CLOWD9 (decentralized issuer processing platform), Swahilies (digital payment acceptance), Simfuni (insurance premium payment management software), and PayRent Software (SaaS payment system solutions), showcase the sector’s global reach and entrepreneurial spirit.

What data is used to create this payment processing market report?

Based on the data provided by our Discovery Platform, we observe that the payment processing market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The payment processing domain attracted a lot of interest, with more than 15300 publications covering its developments in the last year.

- Funding Rounds: Our database has information on more than 4700 investment rounds, indicating that the sector is attracting a lot of investors.

- Manpower: With more than 393000 employees, the sector has seen significant expansion in manpower, with over 37000 new hires in the last 12 months alone.

- Patents: The sector’s portfolio of more than 6290 patents demonstrates its commitment to innovation.

- Grants: The sector has also received more than 250 grants which shows its popularity with institutions and funding agencies.

- Yearly Global Search Growth: With an annual search growth rate of 15.37%, interest in the sector is expanding quickly on a global scale.

Methodology: How We Created This Extended Reality Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of payment processing over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the payment processing

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the payment processing market.

Explore the Data-driven Payment Processing Market Report for 2025

According to the Business Research Company report, the payment processing market is projected to grow by USD 227.19 billion in 2028 at a compound annual growth rate (CAGR) of 16.9%, attributed to e-commerce expansion, credit cards, and more.

The payment processing solutions market report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. This heatmap offers a summary of the payment processing sector based on a strong database of more than 6100 companies, including more than 1360 startups.

The Precedence Research report highlights that the global payment processing market is expected to grow from USD 144.12 billion in 2024 to surpass around USD 914.91 billion by 2034, representing a CAGR of 20.30% between 2024 and 2034. On a granular level, the market grew by a rate of 4.72% last year as per our platform’s latest data.

Additionally, with 393 000+ employees worldwide, this ecosystem is supported by a sizable workforce that has grown by 37 000+ over the last 12 months.

Credit: The Business Research Company

According to the GlobeNewswire report, the Asia-Pacific region is projected to experience the highest compound annual growth rate from 2024 to 2032, driven by a surge in digital transactions, expanding user bases of platforms like Alipay and WeChat Pay, and advancements in mobile technologies.

The United States, United Kingdom, Germany, Canada, and India are important geographic hubs, and major cities like London, New York City, Toronto, San Francisco, and Los Angeles are at the forefront of innovation and development. This data highlights the payment processing market’s dynamic development and worldwide influence.

A Snapshot of the Global Payment Processing Market

With an annual growth rate of 4.72%, the payment processing sector is growing steadily, underscoring its growing market relevance and influence. More than 1360 startups make up the ecosystem, with more than 510 of them being early-stage startups.

Additionally, the domain’s continuous consolidation and strategic partnerships are shown in the more than 380 mergers and acquisitions (M&A). The sector has achieved an exceptional yearly patent growth rate of 7.93%, with over 310 applicants filing 6290+ applications.

With more than 2200 patents, the United States is the largest issuer, followed by South Korea with more than 1790 patents issued.

Explore the Funding Landscape of the Payment Processing Market

With an average investment value of USD 49.5 million per funding round, the payment processing sector shows solid financial support and investor trust. The domain has drawn more than 3900 investors which highlights its appeal to a wide spectrum of financial players.

Over 4700 funding rounds have been closed successfully which shows the ecosystem’s thriving investment activity. Further, more than 1100 companies have received investments in these funding initiatives.

Who is Investing in the Payment Processing Market?

The leading investors in the payment processing sector have made over USD 11 billion in investments.

- Brookfield Business Partners invested USD 1.8 billion in at least 1 company. In 2024, it completed the acquisition of Network International, a leading digital payment processor in the Middle East and Africa.

- JP Morgan invested USD 1.5 billion across 8 companies.

- Bain Capital allocated USD 1.3 billion to 4 companies. They invested in the Openwork Partnership which is one of the UK’s largest financial advice networks.

- Advent International invested USD 1.3 billion in 5 companies. It is also investing USD 228.61 million in Svatantra Microfin, co-led with Multiples Private Equity.

- Deluxe supported 2 companies with a total investment of USD 960 million. It announced a partnership with Fintech Ventures, committing USD 25 million to support emerging fintech startups.

- JPMorgan Chase invested USD 880.2 million across 4 companies.

- Enett invested USD 850 million in at least 1 company.

- PayPal invested USD 805.7 million in 4 companies. It led a USD 15 million series A funding round for Ume, a startup focused on improving digital payment solutions.

- First Data supported 3 companies with a total investment of USD 752.8 million.

Top Payment Processing Innovations & Trends

Following are the emerging trends in the payment processing market along with their firmographic details:

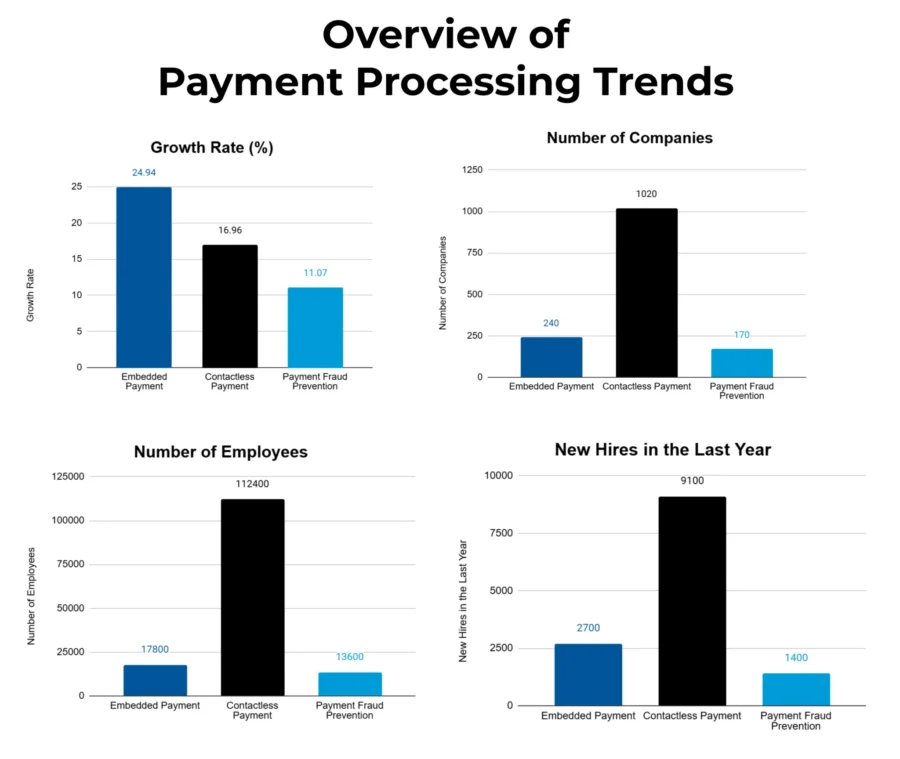

- Embedded Payment is one of the fastest-growing trends, with an annual growth rate of 24.94%. The segment encompasses 240+ companies employing over 17800 employees, with 2700+ new employees added in the past year alone. This trend highlights the domain’s focus on continuously integrating payment capabilities into broader applications and services, streamlining user experiences, and enhancing operational efficiency.

- Contactless Payment continues to dominate the payment processing landscape, driven by widespread adoption and technological innovation. This segment includes 1020+ companies with a combined workforce exceeding 112400 employees, supported by 9100+ new employees in the last year. An annual growth rate of 16.96% underscores the strong demand for secure, convenient, and touch-free payment solutions across global markets.

- Payment Fraud Prevention is the rising need for security with an annual growth rate of 11.07%. The segment comprises 170+ companies employing over 13600 employees, with 1400+ new employees added in the last year. This trend also highlights the sector’s commitment to developing advanced technologies to mitigate fraud and build consumer trust in digital payment systems.

5 Top Examples from 1360+ Innovative Payment Processing Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Billment provides Advanced Invoice Management Software

US-based startup Billment provides organizations with invoice management software that streamlines billing and payment procedures. Its system connects with various bookkeeping platforms which allows customers to send, automate, and modify invoices while handling payments using various methods.

It enables cost savings and operational efficiency through features like next-day funding, recurring invoicing, batch payments, and payment reminders. It reduces the processing charges for eChecks and card payments which offer users financial advantages.

Moreover, Billment puts dependability and security first with a regulatory-compliant infrastructure, secure payment gateways, and all-time support.

CLOWD9 provides Decentralized Issuer Processing Platform

UK-based startup CLOWD9 creates a decentralized issuer processing platform to provide dependable and expandable payment solutions. It routes payment transactions through the closest cloud instance with its elastic, horizontally scaled architecture. This enables low latency and better dependability.

It is developed in the cloud utilizing native microservices technologies. Its modular design supports rapid geographic development which provides multilingual, configurable card and payment products that fulfill compliance requirements.

The platform ensures zero downtime during upgrades and shorter deployment cycles utilizing multiple microservices, automatic infrastructure provisioning, and dynamic routing. Additionally, CLOWD9 offers real-time carbon emission data for each transaction by sustainability objectives.

Swahilies simplifies Digital Payment Acceptance

Tanzania-based startup Swahilies’ digital payment acceptance platform enables businesses to handle domestic and foreign transactions. Its system incorporates layaway payment options, payment links, and application programming interfaces (APIs) to ease companies’ payment acceptance from clients.

The platform enables merchants to share payment links across several media to offer customers freedom and convenience of payment. It streamlines transaction processes by supporting card payments and mobile money services through an API.

Additionally, its features, including foreign currency bank accounts, virtual and physical card issuing, and layaway payment management, enable companies to grow internationally and improve customer satisfaction. Swahilies also ensures that companies focus on expansion, sell with ease, and get money promptly.

Simfuni manages Insurance Premium Payment

Australian startup Simfuni provides insurance premium payment management software to improve client self-service and expedite insurers’ back-office operations. Its platform integrates technologies for automated billing, unified payment processing, and arrears management. It enables insurers to compute installments, send digital bills with integrated payment alternatives, and send automated reminders.

The startup’s system also offers a dashboard for real-time payment reconciliation, actionable insights, and compliance workflows to ensure accurate reporting and regulatory compliance. It offers clients round-the-clock access to a self-service platform for digital policy renewal, payment management, and question resolution.

Further, Simfuni enables insurers to increase operational effectiveness, improve customer satisfaction, and promote policy retention by streamlining insurance billing and payment procedures.

PayRent Software provides SaaS Payment System Solutions

Serbian startup PayRent Software offers SaaS payment system solutions for companies to handle payments effectively and safely. This allows businesses to collect payments and handle transactions with ease. Its platform’s interaction with APIs and content management systems (CMS) offers a variety of integration options.

It offers various features like access to various payment options, an anti-fraud monitoring system, certified security, and all-time assistance for continuous service. It also offers customers control over financial operations with a personal, protected account that allows them to track payments, create reports, and set up procedures.

Additionally, PayRent Software enables companies to maximize payment infrastructure, improve operational effectiveness, and support sustainable growth.

Gain Comprehensive Insights into Payment Processing Trends, Startups, or Technologies

In 2025, the payment processing sector will showcase innovation, adaptability, and global teamwork. The sector is redefining how transactions are carried out globally, driven by technological developments, rising customer expectations, and increased investor activity.

The sector’s dedication to security, effectiveness, and consumer comfort is demonstrated by emerging trends like contactless solutions, embedded payments, and strong fraud prevention frameworks.

Get in touch to explore all 1360+ startups and scaleups, as well as all market trends impacting 6100+ companies.