The 2025 Petrochemical Industry Outlook examines the evolving dynamics of the global sector that supports industries like plastics, automotive, construction, and packaging. In response to sustainability demands and changing regulations, the industry is transforming through innovation and strategic adaptation. The key trends include the adoption of green feedstocks, chemical recycling, and advanced manufacturing technologies that promote cleaner and more efficient operations.

Also, the demand for lightweight, high-performance materials is increasing, driven by the need for sustainable solutions in automotive and packaging sectors. At the same time, digital technologies, including AI and predictive analytics, are being used to streamline operations and improve productivity. The report highlights the major players, innovative startups, and investment patterns shaping the future of the sector.

This petrochemical industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Petrochemical Industry Outlook 2025

- Executive Summary

- Introduction to the Petrochemical Report 2025

- What data is used in this Petrochemical Report?

- Snapshot of the Global Petrochemical Industry

- Funding Landscape in the Petrochemical Industry

- Who is Investing in the Petrochemical Industry?

- Emerging Trends in the Petrochemical Industry

- 5 Innovative Petrochemical Startups

Executive Summary: Petrochemical Market Outlook 2025

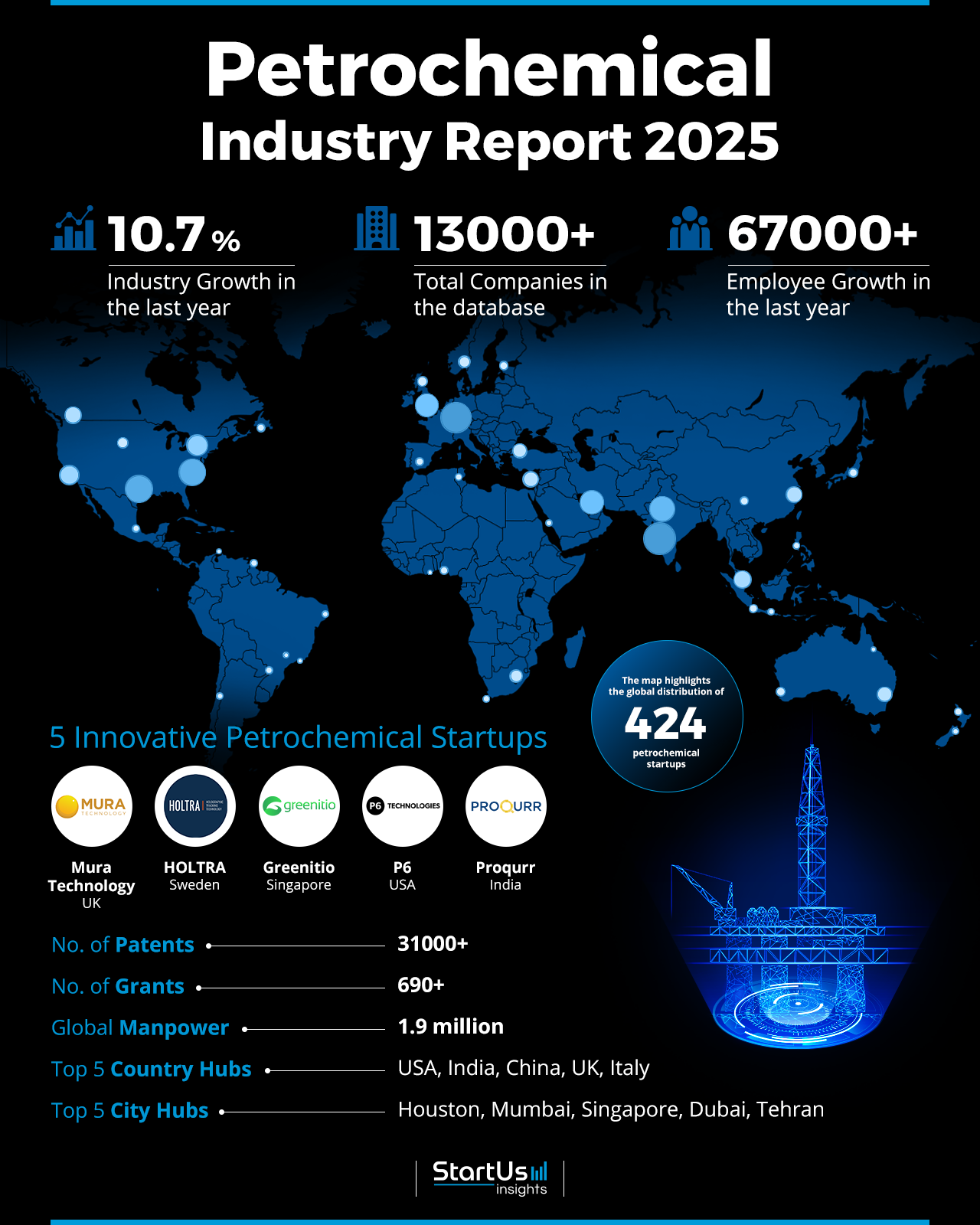

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 420+ petrochemical startups developing innovative solutions to present five examples from emerging petrochemical industry trends.

- Industry Growth Overview: The petrochemical industry grows at an annual rate of 10.70%, supported by over 13000 companies, including 420+ startups.

- Manpower & Employment Growth: The sector employs about 1.9 million individuals globally, with over 67000 new roles added last year. This shows its contribution to global employment growth.

- Patents & Grants: Innovation is central, with over 31000 patents and 690 grants recorded. The yearly patent growth rate of 2.03% highlights continuous advancements.

- Global Footprint: The industry’s top country hubs include the United States, India, China, the United Kingdom, and Italy. Key city hubs are Houston, Mumbai, Singapore, Dubai, and Tehran.

- Investment Landscape: The average investment per funding round is USD 114.8 million. More than 1400 investors have supported 1700+ funding rounds, impacting over 570 companies.

- Top Investors: Key investors have collectively invested over USD 3 billion in the sector. Leading names include the Agricultural Bank of China, the European Investment Bank, Warburg Pincus, and more.

- Startup Ecosystem: Innovative startups include Mura Technology (Hydrothermal Plastic Recycling), HOLTRA (Particle Tracking & Holographic Microscopy), Greenitio (Biogenic Manufacturing Process), P6 (Life Cycle Assessments for Petrochemicals), and Proqurr (Polymer Distribution Supply Chain).

- Recommendations for Stakeholders: Investors should fund sustainable technologies and advanced material innovations to align with environmental regulations and market demand for green products. Governments must support policies promoting renewable feedstocks, circular economy practices, and R&D incentives for low-emission processes. Companies should invest in digitalization, carbon capture solutions, and partnerships to enhance operational efficiency, reduce emissions, and maintain global competitiveness.

Explore the Data-driven Petrochemical Outlook for 2025

The Petrochemical Outlook 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database includes 424 petrochemical startups and over 13000 total companies. It is expanding at an annual growth rate of 10.70%, driven by innovation and global demand. Intellectual property remains a focus, with over 31000 patents and 690 grants recorded.

The global workforce in the sector comprises approximately 1.9 million individuals, with employee growth last year exceeding 67000 new roles. The industry is geographically diverse, with the United States, India, China, the United Kingdom, and Italy leading as top country hubs. Major city hubs include Houston, Mumbai, Singapore, Dubai, and Tehran, which reflects strategic global positioning.

What data is used to create this petrochemical market report?

Based on the data provided by our Discovery Platform, we observe that the petrochemical industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The petrochemical industry appeared in over 4200 news publications last year.

- Funding Rounds: Data on 1700 funding rounds shows strong financial activity.

- Manpower: Employing 1.9 million workers globally, the industry added over 67000 new employees last year.

- Patents: The sector has over 31000 patents, reflecting its innovation capabilities.

- Grants: The petrochemical industry secured over 690.

- Yearly Global Search Growth: With a yearly global search growth of 4.67%, the industry maintains significant interest and visibility.

A Snapshot of the Global Petrochemical Industry

The petrochemical industry is growing at an annual rate of 10.70%, supported by 420+ startups and significant activity across company stages. Among these startups, over 160 are at the early stage, while mergers and acquisitions exceed 740. This is an indication of dynamic restructuring and investment patterns. Innovation remains central to the sector, with over 31000 patents filed by more than 2800 applicants. Patent filings grow at a steady annual rate of 2.03%, with China (8900+) and the United States (6700+) as top issuers.

Explore the Funding Landscape of the Petrochemical Industry

The petrochemical industry attracts significant financial interest, with an average investment of USD 114.8 million per funding round. The sector has engaged over 1400 investors, which shows widespread confidence in its potential. More than 1700 funding rounds have been successfully closed, highlighting the industry’s ability to secure capital. Investments have supported over 570 companies. It reflects diverse initiatives and opportunities within the sector. This financial activity underscores the industry’s strategic importance and appeal to stakeholders.

Who is Investing in Petrochemical Industry?

The top investors in the petrochemical industry have invested more than USD 3 billion, showing strong financial backing and confidence in the sector.

- The Agricultural Bank of China invested USD 730.4 million across 2 companies.

- The European Investment Bank allocated USD 725.3 million to 2 companies.

- Warburg Pincus invested USD 655.8 million across 4 companies.

- Quanta Services directed USD 450 million into 2 companies.

- IDEX supported 4 companies with an investment of USD 430.2 million.

- Flowserve invested USD 281.5 million in 2 companies.

- Hillhouse Capital committed USD 255.3 million to 2 companies.

Access Top Petrochemical Innovations & Trends with the Discovery Platform

Explore the emerging trends within the petrochemical landscape along with the firmographic data:

- Biofuel Technology is growing within the petrochemical industry, with over 3100 companies participating. This trend employs 299K workers globally and added more than 14K new employees last year. The sector is expanding at an annual growth rate of 9.29%. This reflects the demand for renewable energy solutions and biofuel innovation.

- Nickel & Nickel Alloys are a growing trend in the petrochemical sector, with more than 7400 companies engaged. Employing over 453K workers, the sector saw 18K new employees join last year. Growing at an annual rate of 3.98%, this trend supports industries requiring high-performance materials for applications like corrosion resistance and thermal stability.

- Dehydrogenation is an emerging trend with 45 active companies and a workforce of over 3K employees. The sector added 170 new roles last year and grows at an annual rate of 3.22%. This process is critical for producing high-value petrochemical intermediates and aligns with the industry’s focus on efficiency and innovation.

5 Top Examples from 420+ Innovative Petrochemical Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Mura Technology advances Hydrothermal Plastic Recycling

UK startup Mura Technology develops Hydro-PRT, an advanced recycling process that uses supercritical water to convert mixed plastic waste into hydrocarbons. The process involves shredding and removing contaminants from the plastic feedstock, melting and pressurizing it via an extruder, and mixing it with supercritical water under high pressure and temperature. This mixture is then heated in a reactor to break down the plastics into liquid hydrocarbons and gas within minutes.

Subsequent depressurization allows for energy recovery, followed by product separation into individual fractions for storage and sale. Hydro-PRT processes a wide range of post-use, flexible, and rigid mixed plastics, including those considered unrecyclable through traditional methods. Mura technology offers a scalable solution that reduces CO₂ emissions and supports a circular economy by producing chemicals and oils for new plastics manufacturing.

HOLTRA develops Particle Tracking & Holographic Microscopy

Swedish startup HOLTRA builds analytical instruments using a combination of particle tracking and off-axis holographic microscopy to characterize suspended particles in liquids. This technology captures detailed holographic images of particles, which are then analyzed using algorithms and machine learning to determine properties such as size, shape, refractive index, and movement.

It differentiates between various particle types — including mineral particles, oil droplets, viruses, bacteria, and gas bubbles — by assessing their refractive indices and morphologies. Further, the system distinguishes between solid particles and agglomerates to provide insights into particle behavior. HOLTRA’s technology benefits the petrochemicals industry by providing precise particle characterization to aid in quality control, process optimization, and contamination analysis for improved operational efficiency.

Greenitio implements Biogenic Manufacturing Process

Singaporean startup Greenitio manufactures bio-based alternatives to synthetic polymers using proprietary computational modeling and green chemistry principles. It’s technology designs biopolymers that replicate the properties and functions of traditional synthetic polymers to address environmental concerns. The startup’s method utilizes an aqueous medium and a one-pot synthesis process and operates at ambient temperatures without toxic chemicals or organic solvents.

This approach offers a cost-effective and scalable solution for producing sustainable materials from plant-derived sources or food production waste. Greenitio offers sustainable bio-based polymer alternatives to reduce reliance on petroleum-derived materials, and address environmental and regulatory challenges.

P6 enables Life Cycle Assessments for Petrochemicals

US startup P6 offers a SaaS-based Life Cycle Assessment (LCA) platform for environmental impact evaluations in transportation fuels, biogas, and petrochemicals industries. The platform guides businesses through data collection and analysis to enable LCAs that comply with standards like ISO 14040/44/67 and California’s Low Carbon Fuel Standard (LCFS).

Its key features include pre-built templates for renewable diesel, biodiesel, ethanol, and renewable natural gas (RNG), as well as tools for process modeling, results analysis, and supply chain collaboration. P6 streamlines the LCA process and aids petrochemical companies measure and improves the carbon intensity of their products to support informed decision-making and sustainability goals.

Proqurr supports Polymer Distribution Supply Chain

Indian startup Proqurr develops a B2B platform that streamlines polymer distribution. It directly connects suppliers and MSMEs through an intuitive digital interface, including WhatsApp. The platform integrates procurement, delivery, and payment workflows to enable businesses to source branded polymers from verified distributors.

The startup leverages automation and data-driven insights and eliminates manual inefficiencies to ensure transactions from order placement to fulfillment. Proqurr advances the polymer procurement process and offers features such as transparent pricing, real-time order tracking, and a supply chain network tailored to MSMEs’ diverse needs.

Gain Comprehensive Insights into Petrochemical Trends, Startups, or Technologies

The 2025 Petrochemical Industry Outlook shows a future shaped by sustainability, innovation, and global demand. Trends like biofuel technology, advanced materials, and dehydrogenation will drive efficiency and reduce environmental impact. Get in touch to explore all 420+ startups and scaleups, as well as all industry trends impacting petrochemical companies.