The 2024 Pharmacology Report presents an analysis of the current landscape, highlighting key trends, and innovations. It emphasizes the challenges the sector faces such as lengthy drug development timelines and high costs, which are being addressed through AI-driven drug discovery and advanced clinical trial methodologies. This report also explores the emerging therapeutic areas and the impact of the latest technologies on the industry. It examines key players, investment patterns, and workforce dynamics that are driving the pharmacology sector forward.

This pharmacology report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Pharmacology Report 2024

- Executive Summary

- Introduction to the Pharmacology Report 2024

- What data is used in this Pharmacology Report?

- Snapshot of the Global Pharmacology Industry

- Funding Landscape in the Pharmacology Industry

- Who is Investing in Pharmacology Solutions?

- Emerging Trends in the Pharmacology Industry

- 5 Innovative Pharmacology Startups

Executive Summary: Pharmacology Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 600+ pharmacology startups developing innovative solutions to present five examples from emerging pharmacology industry trends.

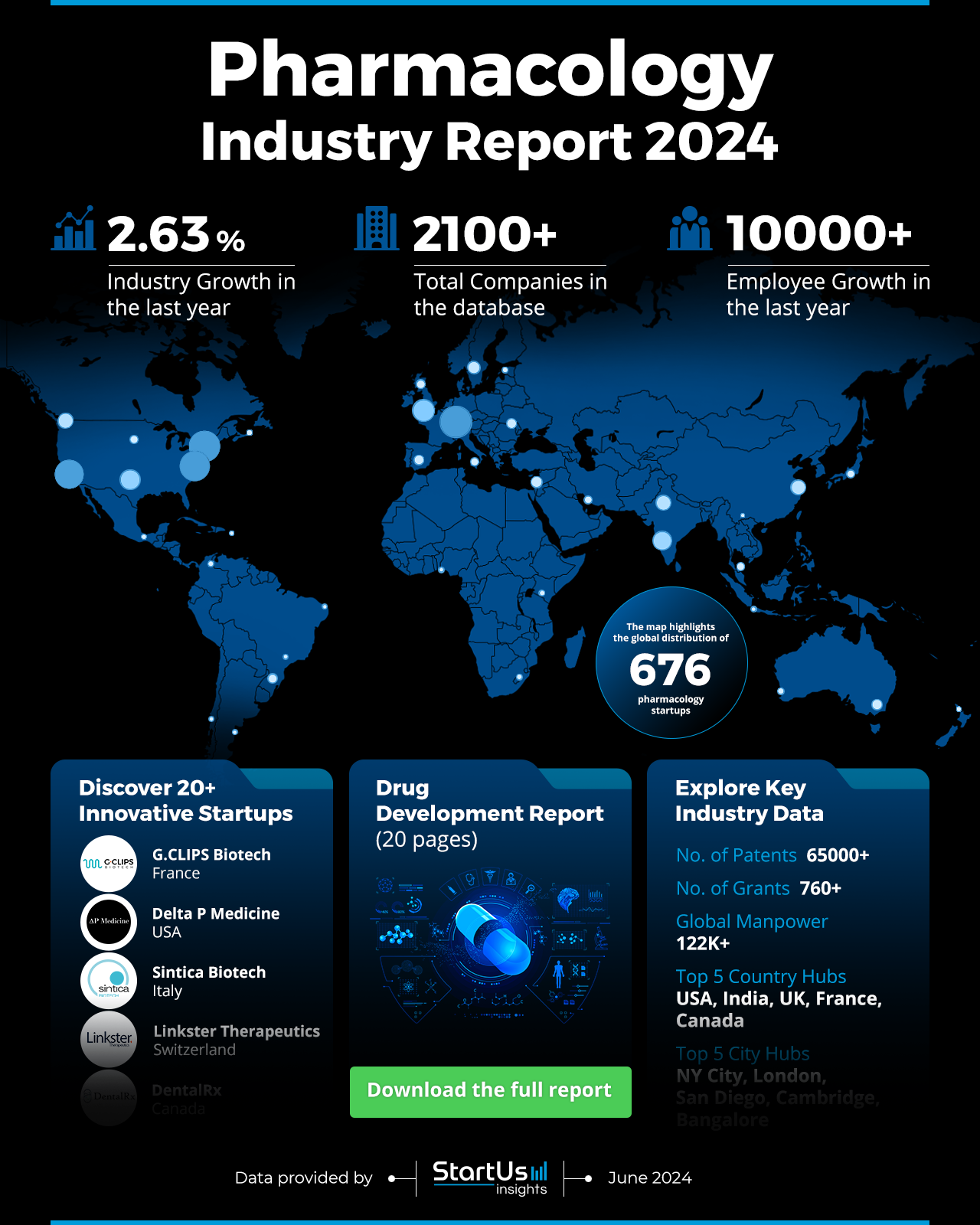

- Industry Growth Overview: The pharmacology industry saw steady annual growth of 2.63%, with contributions from over 2100 companies.

- Manpower & Employment Growth: Globally, the industry employs more than 122000 people, adding over 10000 new employees last year.

- Patents & Grants: The sector has over 65000 patents, emphasizing its focus on innovation. It also secured more than 760 grants for research and development.

- Global Footprint: Key country hubs driving industry growth include the USA, India, the UK, France, and Canada. Major city hubs include New York City, London, San Diego, Cambridge, and Bangalore.

- Investment Landscape: Investor confidence remains strong, with an average investment value of USD 23 million per funding round. Over 330 investors participated in 1200 funding rounds, supporting 370 companies.

- Top Investors: Nextech Invest, Blackstone, ARCH Venture Partners, and more, made investments with a combined value exceeding USD 850 million.

- Startup Ecosystem: Five innovative startup features include G.CLIPS Biotech (drug and antibody discovery), Delta P Medicine (mechanopharmacological tools), Sintica Biotech (skin cancer treatment), Linkster Therapeutics (targeted therapeutics), and DentalRx (dental pharmacology).

- Recommendations for Stakeholders: Investors should continue supporting startups in developing personalized medications. Policymakers and government agencies should streamline regulatory processes for drug approvals while ensuring drug safety. Moreover, healthcare providers must become more aware of the latest tech advancements and integrate new therapies effectively.

Explore the Data-driven Pharmacology Report for 2024

The Pharmacology Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap visually represents industry data and trends, including over 2100 companies, with 600+ startups, indicating a strong entrepreneurial presence. The industry experienced a 2.63% growth in the past year and has demonstrated steady progress. Further, there are over 65000 patents and 760 grants, which highlight significant innovation and research activity.

Globally, the sector employs more than 122K people, with a growth of over 10K employees in the last year. The top five country hubs driving this expansion are the US, India, UK, France, and Canada. Key city hubs, including New York City, London, San Diego, Cambridge, and Bangalore, contribute to the industry’s advancements.

What data is used to create this pharmacology report?

Based on the data provided by our Discovery Platform, we observe that the pharmacology industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry produced more than 3900 publications in the last year. This is a reflection of high research and development activity.

- Funding Rounds: Our database contains data on over 1200 funding rounds, indicating robust financial support and investment in the industry.

- Manpower: The industry employs more than 122000 workers, with over 10000 new employees added in the last year

- Patents: There are 65000+ patents, highlighting the industry’s strong focus on innovation and intellectual property.

- Grants: The industry secured over 760 grants, emphasizing external funding for research and development.

- Yearly Global Search Growth: The industry also experienced a yearly global search growth of 5.11%, indicating increasing interest and awareness.

- and more. Connect with us to explore all data points used in this pharmacology report.

A Snapshot of the Global Pharmacology Industry

The pharmacology industry demonstrates vitality and growth, supported by growing manpower and strong financial backing. It employs over 122000 workers, with an increase of more than 10,000 employees in the last year. The sector comprises over 2100 companies, reflecting a diverse and extensive market presence.

Explore the Funding Landscape of the Pharmacology Industry

Financially, investor confidence in the industry remains strong. The average investment value per funding round is USD 23.1 million. With over 330 active investors participating, more than 1200 funding rounds have been closed. This financial activity supports over 370 companies, underscoring widespread investment and belief in the sector’s potential. Overall, the pharmacology industry shows continued innovation and development.

Who is Investing in Pharmacology Solutions?

The pharmacology industry receives financial support, with top investors contributing a combined investment value of over USD 850 million. Key investors and their contributions are as follows:

- Nextech Invest allocated USD 201 million to 2 companies.

- Blackstone Stone invested USD 133.5 million in 2 companies.

- ARCH Venture Partners contributed USD 125 million to 2 companies.

- New Enterprise Associates invested USD 116.6 million in 4 companies.

- Flagship Pioneering invested USD 100 million in 2 companies.

- Versant Ventures allocated USD 95.6 million to 2 companies.

- New Leaf Venture Partners invested USD 70.3 million in 2 companies.

- Polaris Partners invested USD 52.7 million in 2 companies.

- and more. Get in touch with us to explore all investment data in the pharmacology industry

Access Top Pharmacology Innovations & Trends with the Discovery Platform

The top trends advancing the pharmacology industry are mentioned below along with their firmographic data:

- Neuropharmacology is experiencing growth, with over 20 companies identified in this specialized field. The sector employs more than 1K individuals, adding 170 new employees in the last year. This reflects an expanding workforce. The annual trend growth rate for neuropharmacology stands at 19.34%, indicating strong interest and investment in this area.

- Pharmacometrics shows steady expansion with more than 60 companies operating in the field. The sector employs over 1K individuals, with an increase of 220 new employees in the past year. The annual trend growth rate for pharmacometrics is 8.94%.

- Systems Pharmacology is advancing, with 42 companies identified in this field. The sector employs over 760 individuals, adding 110 new employees last year. The annual trend growth rate for systems pharmacology is 29.96%.

5 Top Examples from 600+ Innovative Pharmacology Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a platform demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

G.CLIPS Biotech accelerates Drug & Antibody Discovery

French startup G.CLIPS Biotech offers a G.Screen platform that integrates the expression, purification, stabilization, and functional characterization of membrane proteins in pathology-like environments. Its G.Mixes are tailor-made for structural and conformational stabilization of membrane proteins that aid in drug, antibody, and vaccine discovery. The G.Select assay combines G.Mixes with activation assays to explore the conformational complexity of membrane proteins. Further, G.Lipidomics offers a proprietary database of lipid compositions from many tissues and cell types and allows the reconstitution of membrane proteins. Also, the G.Validation assay provides insights for selecting and validating the best candidates from initial hits to clinical candidates. G.CLIPS Biotech’s approach supports the generation of lead-like candidates and target validation.

Delta P Medicine builds Mechanopharmacological Tools

US startup Delta P Medicine develops drug testing systems that provide physical and chemical readouts for evaluating drug candidates. Its Cyst Growth Platform utilizes 3D human and mouse cysts for high-throughput screening in physiologically relevant conditions. Its other product, Organ-Chip Platform offers human-relevant physical readouts, including barrier function, toxicity, and pharmacokinetics. These platforms closely mimic human physiology and are compatible with standard microscopes. Delta P Medicine’s products also have contributed to discoveries in polycystic kidney disease research.

Sintica Biotech develops a Skin Cancer Treatment

Italian startup Sintica Biotech develops treatments for melanoma by targeting the CD271 receptor, also known as p75NTR. Its approach involves inducing apoptosis through CD271 activation to address primary and acquired resistance against current therapies. The startup has developed a proprietary new chemical entity, SNT001, which shows results in neutralizing metastasis and demonstrates efficacy both in vitro and in vivo.

Linkster Therapeutics advances Targeted Therapeutics

Swiss startup Linkster Therapeutics develops Flycode, a platform that profiles large pools of peptide-barcoded antibodies in vitro, in vivo, and in silico. This technology measures antibody effects in living organisms, tissue micro-environments, proteins, and cells. Flycode identifies candidates with optimal pharmacology, pharmacokinetics, and targeting properties using high-throughput engineering and advanced bioinformatics. Further, Flycode peptide barcodes track antibodies through all experimental stages improve decision-making and reduce failure risks. Therapeutics’ approach advances pharmacology profiling and drug development.

DentalRx streamlines Dental Pharmacology

Canadian startup DentalRx offers a dental pharmacology platform for web and mobile to aid dentists in providing safe and effective patient care. The platform includes features like patient medical history, which also checks drug indications, dental interactions, and clinical pearls. The prescribing monographs provide detailed information on commonly prescribed dental medications. Further, it offers clinical calculators that assist with local anesthetic, renal, and pediatric dose adjustments. The practice guidelines feature offers current guidelines for dental pharmacology, while prescription templates allow customization of prescriptions for various oral health conditions.

Gain Comprehensive Insights into Pharmacology Trends, Startups, or Technologies

The 2024 pharmacology report highlights the sector’s progress and resilience. The regulatory adaptations and technological integration continue to shape strategic directions and enhance therapeutic outcomes. Reach out to us to explore all 600+ startups and scaleups, as well as all industry trends impacting pharmacology companies.