The 2025 Plastic Industry Report analyzes the global plastic market, showing how innovation and sustainability are reshaping production and consumption patterns. Industries and governments collaborate to address environmental concerns related to plastic use which makes sustainable plastic solutions essential in packaging, manufacturing, and waste management. The report explores key trends, including the rise of bioplastics, developments in chemical recycling to reduce plastic waste, and the adoption of plastic to energy trends. This report also examines emerging startups and provides insights into the evolving market landscape which illustrates how sustainable practices will influence the future of the plastic industry.

This plastic industry outlook serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Plastic Industry Report 2025

- Executive Summary

- Introduction to the Plastic Industry Report 2025

- What data is used in this Plastics Industry Report?

- Snapshot of the Global Plastic Industry

- Funding Landscape in the Plastic Industry

- Who is Investing in the Plastic Industry?

- Emerging Trends in the Plastic Industry

- 5 Innovative Plastic Industry Startups

Executive Summary: Plastic Industry Report 2025

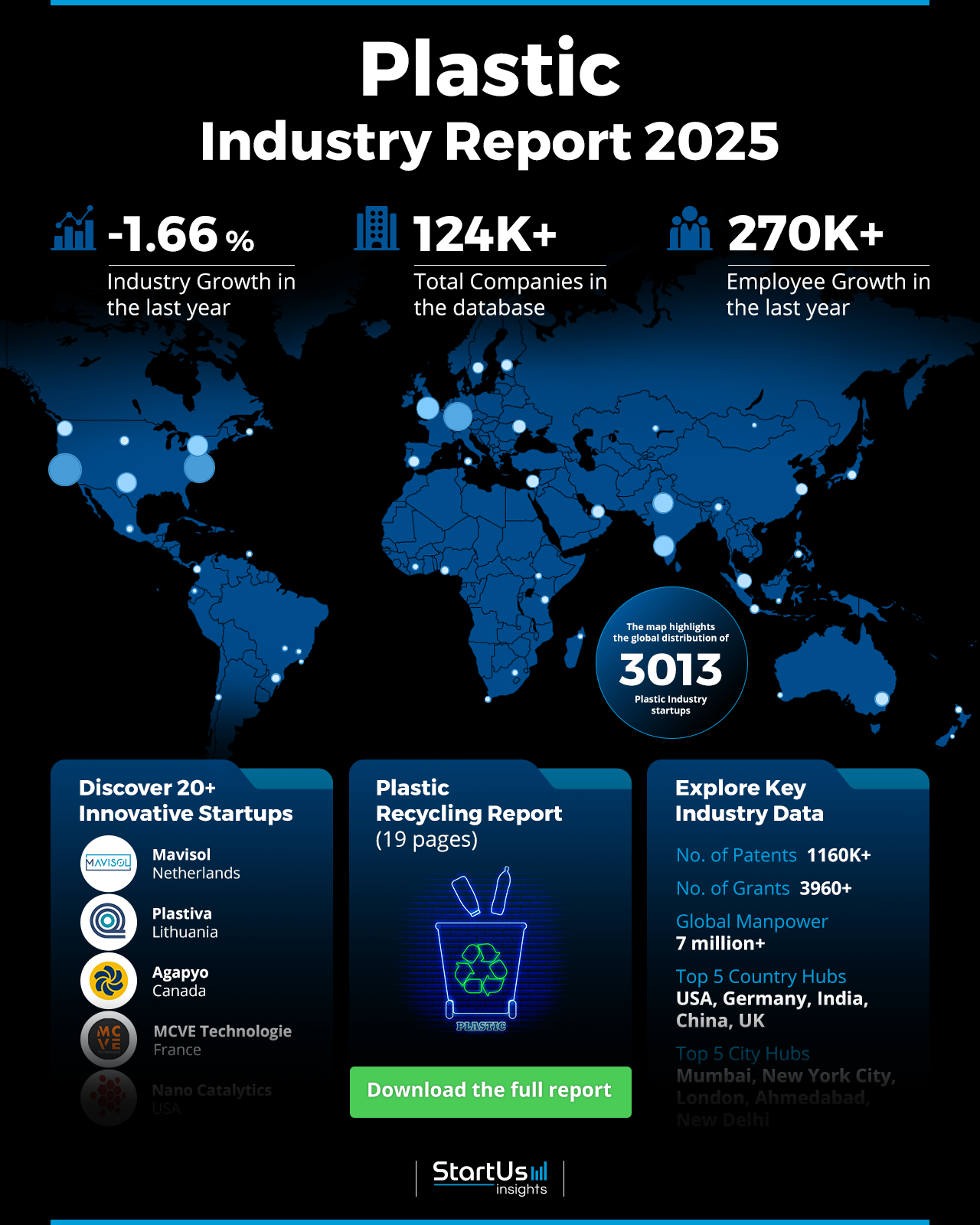

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. Plus, we also analyzed a sample of 3010+ plastic industry startups developing innovative solutions to present five examples from emerging plastic industry trends.

- Industry Growth Overview: The plastic industry faced a slight decline in annual growth, with a rate of -1.66%. More than 3000 startups are actively contributing to this landscape.

- Manpower & Employment Growth: The industry employs over USD 7+ million workers, with an addition of 270K+ new jobs in the last year.

- Patents & Grants: Companies in the plastic sector filed over 1 million patents and received approximately 3960+ grants, with the U.S. and China leading in patent issuance.

- Global Footprint: Key country hubs include the USA, Germany, India, China, and the UK, while major city hubs are Mumbai, New York City, London, Ahmedabad, and New Delhi.

- Investment Landscape: The average investment value per funding round is USD 24+ million, with over 16800 funding rounds closed across more than 4960 companies.

- Top Investors: Notable investors such as MassChallenge, Crowdcube, Techstars, Y Combinator, SFC Capital, Circulate Capital, and more have collectively invested over USD 132.9 million.

- Startup Ecosystem: Five innovative startups, Mavisol (AI for plastic converters), Plastiva (recycling plastic waste), Agapyo (plant-based thermoplastic), MCVE Technologie (metallization of plastics), and Nano Catalytics (on-demand polymerization) showcase the sector’s global reach and entrepreneurial spirit.

- Recommendations for Stakeholders: Governments should implement policies and incentives to reduce plastic waste and encourage recycling to promote eco-friendly practices within the plastics industry. Support for research and development in alternative materials and plastic waste management is essential. Public-private partnerships should also drive innovation and resource-sharing for more sustainable practices. Further, entrepreneurs should invest in sustainable plastic alternatives and recyclable product designs to reduce environmental impact.

Explore the Data-driven Plastic Industry Outlook for 2025

The Plastic Industry Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database includes 3013 startups which contributes to a larger pool of over 124K companies involved in the plastics industry. Despite the major number of entities, the industry experienced a slight decline in growth over the past year, registering a decrease of 1.66%.

The innovation landscape within the industry offers over 1 million patents filed and over 3960+ grants awarded. The global manpower dedicated to the plastic industry stands at approximately 7 million, with an employee growth of 270K+ in the last year. Geographically, the analysis highlights the top five country hubs as the US, Germany, India, China, and the UK. In terms of city hubs, Mumbai, New York City, London, Ahmedabad, and New Delhi emerge as key centers for activity.

What data is used to create this plastic industry report?

Based on the data provided by our Discovery Platform, we observe that the plastic industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The plastics industry had over 1120 publications last year.

- Funding Rounds: With over 16800 funding rounds globally, the industry showcases major financial activity.

- Manpower: Employing more than USD 7 million workers, it added over 270K new employees in the past year.

- Patents: The sector has over 1 million patents filed.

- Grants: The plastic sector has secured approximately 3960 grants.

- Yearly Global Search Growth: The annual growth in worldwide searches reached 37.85% which reflects increased public interest and engagement.

A Snapshot of the Global Plastic Industry

The annual growth rate has declined by 1.66% which indicates challenges in market expansion. The database features 3013 startups, with over 1620+ classified as early-stage ventures. Further, more than 5K companies have undergone mergers and acquisitions.

Intellectual property drives innovation, with over 1 million patents registered by more than 170K applicants. However, the yearly patent growth has slightly decreased by 0.49%. The United States and China emerge as the top patent issuers, with over 240K and 200K+ patents, respectively.

Explore the Funding Landscape of the Plastic Industry

The average investment value per funding round is USD 24 million. The plastic industry has attracted over 9K+ investors. These investors contribute to a total of more than 16800 funding rounds. Further, the funding efforts have reached over 4960 companies which showcases a wide distribution of capital across the industry.

Who is Investing in the Plastic Industry?

The combined investment value from the top investors in the plastic industry exceeds USD 132.9 million.

- MassChallenge invested USD 1.9 million across 42 companies.

- Crowdcube committed USD 34.4 million to 32 companies.

- Techstars invested USD 11.9 million in 31 companies.

- Y Combinator allocated USD 9.2 million to 22 companies.

- SFC Capital supported 14 companies with an investment of USD 13 million.

- Circulate Capital invested USD 52.4 million in 13 companies.

- Enterprise Ireland provided USD 10.1 million to 11 companies.

Access Top Plastic Innovations & Trends with the Discovery Platform

The firmographic data reveals three major trends influencing the plastics industry.

- The bioplastics trend is developing the plastic industry with sustainable alternatives. The trend comprises over 1070 companies with 50K+ employees and added 2K+ new jobs in the past year, driven by an annual growth rate of 11.89%.

- The plastic-to-energy trend is converting waste plastic into valuable energy while offering sustainability and reducing environmental impact. The trend includes 350+ companies employing over 27K workers, with 1K+ new employees added in the last year which further reflects a steady 9.63% annual growth rate.

- The chemical recycling trend offers transformative waste management solutions by converting plastic waste into reusable raw materials, reducing landfill waste, and lowering the demand for plastics. This trend includes around 300+ companies that employ approximately 30K individuals, with over 1K+ new employees added in the past year, and also has an annual growth rate of 60.34%.

5 Top Examples from 3010+ Innovative Plastic Industry Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Mavisol supports AI for Plastic Converters

Dutch startup Mavisol delivers a machine vision and AI system for plastic converters to encourage sustainability and efficient material reuse. Its system enables the integration of rPET into packaging production by identifying contaminants such as black specks, bubbles, dye particles, and other defects in preforms. Mavisol’s quality control system is installed on molding machines to offer continuous monitoring and logging of defects. It is then uploaded to a secure cloud for real-time data access. The system’s benefits include defect detection accuracy, operational efficiency through data-driven insights, and support for circular economy practices through broader use of rPET. Additionally, Mavisol provides a SaaS model with remote monitoring, diagnostic support, and regular software updates to align production processes and maintain the highest quality standards.

Plastiva specializes in Recycling Plastic Waste

Lithuanian startup Plastiva specializes in recycling plastic waste to produce recycled plastic granules, including HDPE, LDPE, and PP granules. It processes plastic waste through sorting, crushing, washing, and melting to create granules that meet the quality requirements for various manufacturing applications. The startup’s recycled granules provide a cost-effective and eco-friendly alternative to virgin plastics which support sustainability efforts across industries. Further, these granules are used to manufacture packaging materials, automotive parts, construction materials, and consumer goods.

Agapyo creates Plant-based Thermoplastic

Agapyo, a Canadian startup, develops a biodegradable, plant-based thermoplastic called Jam. It is a sustainable alternative to petroleum-based ABS plastic. Using a patented process, the startup converts plant biomass into this eco-friendly material, which is processed using existing molding equipment. Jam maintains the required properties for consumer product manufacturing while reducing environmental impact. With its cradle-to-cradle design, Jam also begins and ends its life cycle in nature to tackle plastic pollution by minimizing waste and promoting sustainability in the industry.

MCVE Technologie delivers the Metallization of Plastics & Composites

MCVE Technologie is a French startup specializing in metallization solutions for plastics and composites. It develops a patented product, EOPROM paste which is a copper-based paste to increase adhesion on various thermoplastic and thermoset substrates. The paste enables metallization without special surface preparation and offers selective deposition of metals like copper, nickel, tin, silver, and gold. This supports the development of smart composites, flexible antennas, and electronic circuits. Additionally, MCVE Technologie’s EOPROMFLEX process uses roll-to-roll and sheet-to-sheet methods for high-volume industrial manufacturing, with adjustable conductivity to suit different applications. This technology benefits industries that require efficient, scalable solutions for producing materials.

Nano Catalytics provides On-Demand Polymerization

US based startup Nano Catalytics develops an on-demand polymerization technology that uses nano and microparticles to activate radio frequency. These particles release catalysts when heated and trigger polymerization at targeted points within a material, rather than uniformly heating the entire part. This process allows for UV-like curing through opaque objects and improves production speed and precision. The nano and microparticles offer benefits, such as up to 10x faster production times, a 75% reduction in footprint, and lower energy costs due to the absence of input heat. Additionally, the polymerization process supports heat-sensitive materials for broader design possibilities and reduces manufacturing complexities by eliminating solvents, mixing, and high-energy inputs. Moreover, the startup’s polymerization process delivers a cost-effective, energy-efficient solution for industries such as coatings, plastics, 3D printing, fibers, textiles, composites, and injection molding.

Gain Comprehensive Insights into Plastic Industry Trends, Startups, or Technologies

The plastic industry is poised for transformation in 2025, driven by sustainability initiatives and innovative solutions. Bioplastics, chemical recycling, and plastic-to-energy trends are set to redefine production processes and consumption patterns. As companies invest in eco-friendly technologies and adapt to regulatory changes, the plastic industry will address environmental challenges effectively. Get in touch to explore all 3010+ startups and scaleups, as well as all industry trends impacting plastic companies.