Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the FinTech industry. This time, you get to discover five hand-picked point of sale (POS) startups.

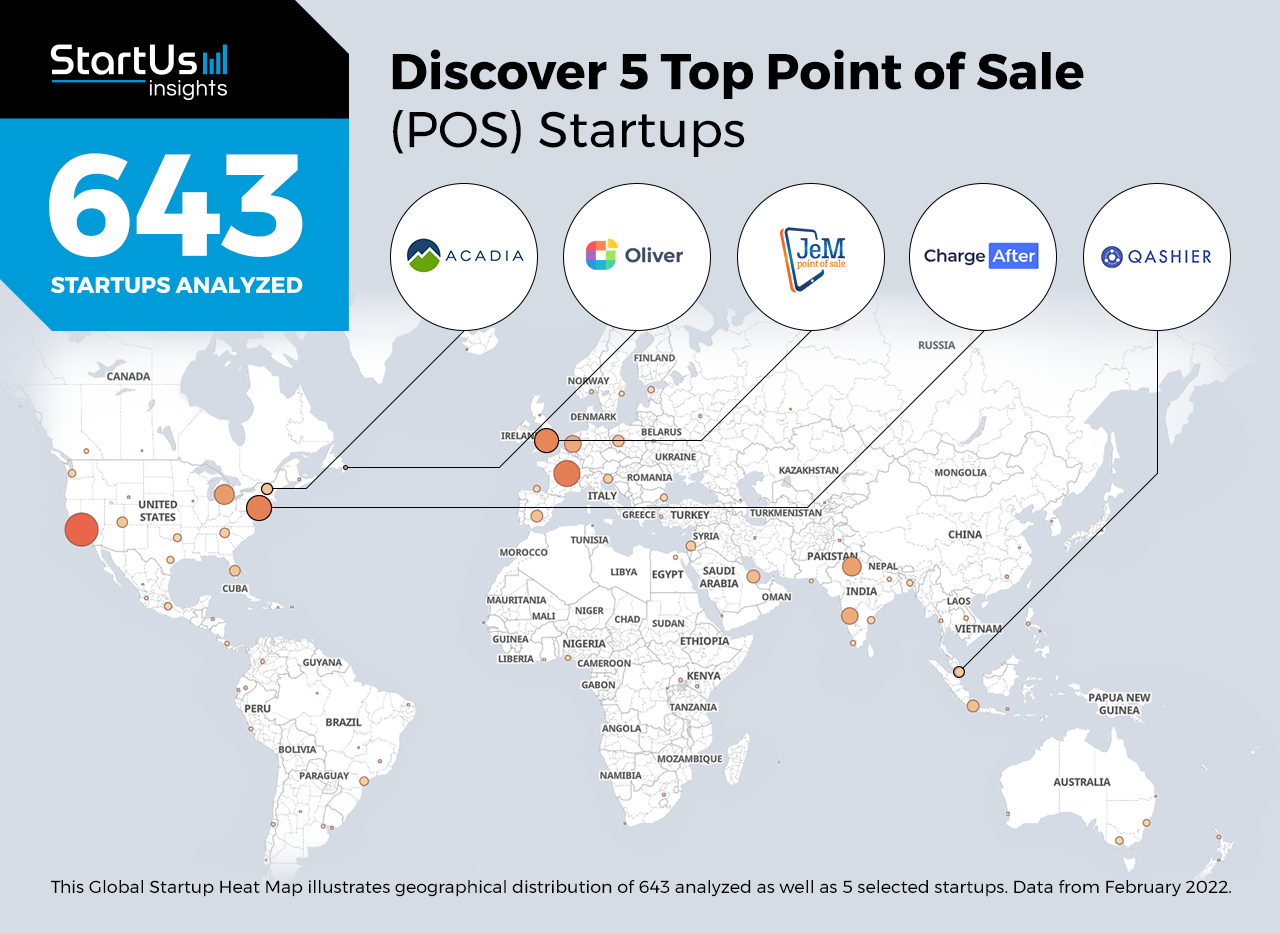

Out of 643, the Global Startup Heat Map highlights 5 Top Point of Sale Startups

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 643 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 638 point of sale startups, get in touch with us.

Qashier provides a Multipurpose POS Device

Founding Year: 2019

Location: Singapore

Funding: USD 900 000

Reach out for Business Digitization

Singaporean startup Qashier provides point-of-sale (POS) solutions to enable merchants to digitize their businesses. Its connected device, Qashier Smart Terminal, merges cloud-based POS software, integrated payment processing, and a customized app store. This allows businesses to manage their entire stores with just one terminal on the counter.

Oliver POS facilitates Omnichannel Retail

Founding Year: 2018

Location: St. John’s, Canada

Use this solution for Integrated POS

Canadian startup Oliver POS offers an all-in-one integrated point of sale software. It is easy to use and adaptable to practically any business volume. The Oliver POS is a cloud-based point of sale system that works on the devices that a business already owns. The software interfaces directly with the WooCommerce store. It streamlines the omnichannel retail by offering small businesses a customizable solution to enhance and sync their online and in-store sales.

Acadia enables Inventory Management

Founding Year: 2017

Location: Winthrop, US

Partner for Employee & Warehouse Management

US-based startup Acadia builds point of sale and eCommerce solutions for businesses. Acadia POS is a platform solution that allows business owners to reduce the cost and timelines it takes to manage a large array of assets with convenient inventory and warehouse solutions. Other features of the platform include data collection from multiple locations, reporting & accounting, and employee management.

JeM POS offers an AI-Powered POS System

Founding Year: 2016

Location: Berkshire, UK

Funding: USD 100 000

Work with JeM POS for Customer Engagement

British startup JeM POS develops an iPad-based, AI-powered POS for hospitality businesses. The POS system utilizes artificial intelligence and machine learning algorithms to help businesses increase their revenues and amplify customer engagement. The system learns from existing sales data and trends to produce sales forecasts. Further, it comes with stock management and integrated payment gateway features.

ChargeAfter builds a Buy-Now-Pay-Later Platform

Founding Year: 2017

Location: New York, US

Funding: USD 8 M

Use this solution for Personalized Consumer Financing

US-based startup ChargeAfter offers instant and personalized consumer financing platforms. Its buy-now-pay-later platform enables personalized consumer financing. It connects retailers and lenders to offer customers personalized financing options. ChargeAfter delivers suitable financing options to clients from numerous lenders using its data-driven decision engine and global lender network. This results in credit approvals for up to 85% of customer applications.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on personal finance, digital wallets, and neobanking. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.