The 2024 polyester industry outlook analyzes a market that continues to dominate various sectors including textiles, packaging, and industrial applications. This report explores key trends such as advancements in recycling technologies and the increasing demand for sustainable and eco-friendly materials. It examines firmographic data, investment trends, and innovative startups driving the industry forward.

This polyester report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Polyester Industry Outlook 2024

- Executive Summary

- Introduction to the Polyester Report 2024

- What data is used in this Polyester Report?

- Snapshot of the Global Polyester Industry

- Funding Landscape in the Polyester Industry

- Who is Investing in Polyester Solutions?

- Emerging Trends in the Polyester Industry

- 5 Innovative Polyester Startups

Executive Summary: Polyester Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 600+ polyester startups developing innovative solutions to present five examples from emerging polyester industry trends.

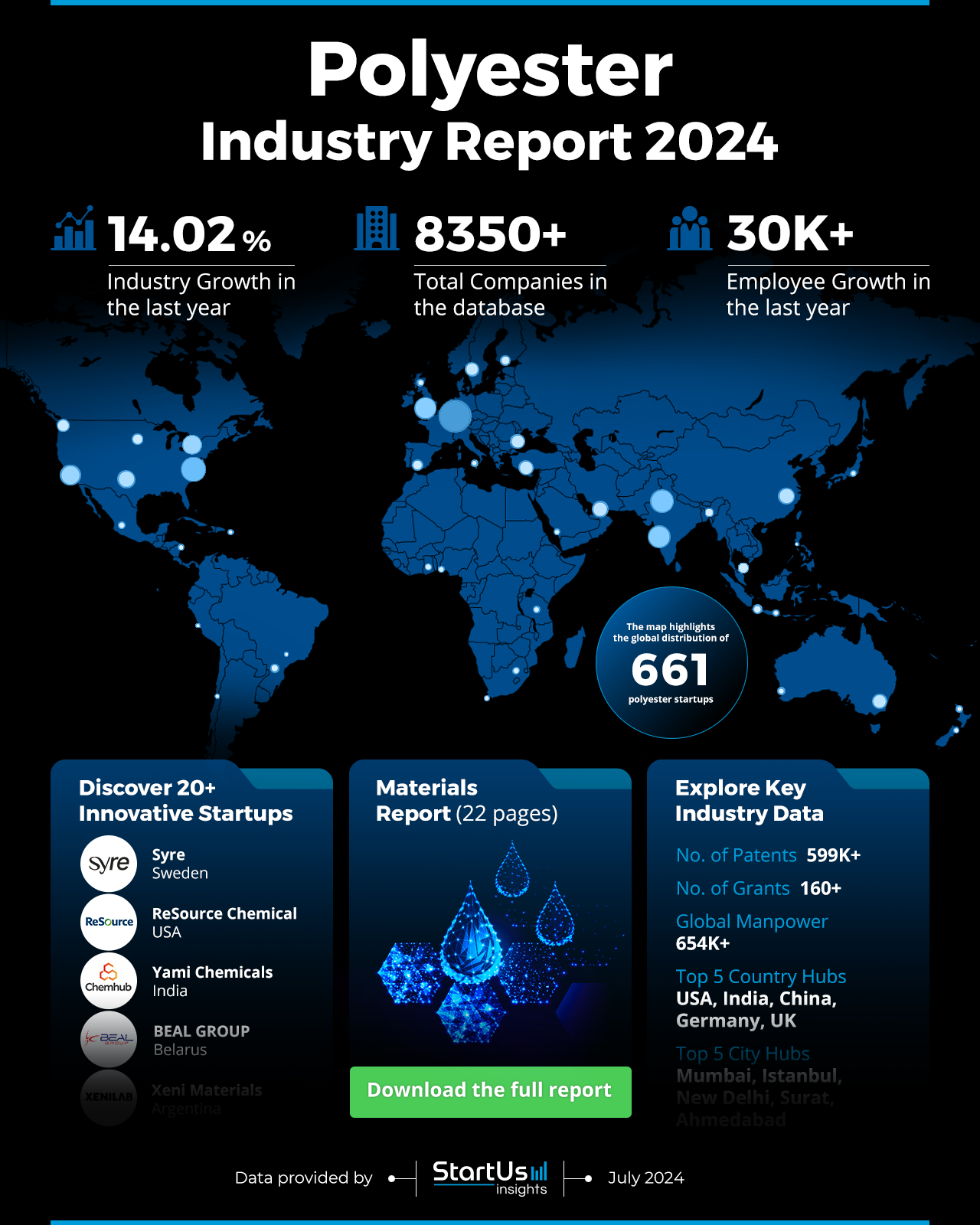

- Industry Growth Overview: The polyester market report shows the industry experiencing steady expansion, with an annual growth rate of approximately 14.02%. It encompasses a network of over 8000 companies.

- Manpower & Employment Growth: The industry employs over 654000 individuals globally. There has been an increase of more than 30000 new employees in the last year.

- Patents & Grants: The industry holds over 599000 patents, highlighting a high level of innovation. In addition, it has received more than 160 grants, which support research and development efforts.

- Global Footprint: Key country hubs for the polyester industry include the USA, India, China, Germany, and UK. Major city hubs driving industry progress include Mumbai, Istanbul, New Delhi, Surat, and Ahmedabad.

- Investment Landscape: The average investment value per funding round stands at approximately USD 23.4 million. In total, over 540 funding rounds have been successfully closed, supporting more than 220 companies. The industry has attracted the interest of more than 300 investors, indicating strong financial backing.

- Top Investors: Noteworthy investors, including Bank Woori Saudara, Keb Hana Bank, Hyosung Chemical, and more have collectively contributed an investment value of USD 400 million.

- Startup Ecosystem: Innovative startups include Syre (circular polyester), ReSource Chemical (inedible biomass packaging), Yami Chemicals (epoxy and polyester resins), BEAL GROUP (polyester polyols), and Xeni Materials (Biopolyester resins)

- Recommendations for Stakeholders: Entrepreneurs should focus on integrating advanced recycling technologies and circular economy principles to reduce environmental impact. Companies should adopt cleaner production methods, enhance transparency in their supply chains, and collaborate with academia and research institutions to drive technological advancements.

Explore the Data-driven Polyester Report for 2024

The Polyester Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database includes 650+ startups and 8000+ companies working within the polyester industry. The sector maintains an annual growth rate of 14.02%. This is an indication of substantial expansion. More than 599K patents highlight the sector’s innovative capacity, while over 160 grants emphasize research and development efforts.

Global manpower exceeds 654K, a reflection of the industry’s extensive workforce. The employee growth reached over 30K in the last year. The top country hubs comprise the US, India, China, Germany, and the UK, showcasing geographical diversity. Major city hubs such as Mumbai, Istanbul, New Delhi, Surat, and Ahmedabad play a key role in driving industry progress.

What data is used to create this polyester report?

Based on the data provided by our Discovery Platform, we observe that the polyester industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage and Publications: Over 4300 publications in the last year highlight industry activity and interest.

- Funding Rounds: Our database lists more than 540 funding rounds, indicating financial investment and growth.

- Manpower: The industry employs over 654000 workers, with 30000 new employees added last year. This showcases substantial workforce expansion.

- Patents: The industry has over 599K patents, reflecting high levels of innovation and intellectual property activity.

- Grants: More than 160 grants underscore significant research and development support.

- Global Search Growth: The yearly global search growth stands at 13.3%, demonstrating increasing interest and relevance in the polyester industry.

A Snapshot of the Global Polyester Industry

The polyester industry report provides an overview of key metrics and data points indicating growth and industry activity. The annual growth rate stands at 14.02%, reflecting market expansion. The ecosystem includes over 650 startups, including 70 early-stage ones, and over 300 companies involved in mergers and acquisitions.

Patent data reveals an innovation landscape with over 599000 patents and more than 130000 applicants, demonstrating substantial intellectual property activity. The USA leads with over 135000 patents, followed by China with more than 86000 patents. Despite the high number of patents, the yearly growth rate remains modest at 0.33%, suggesting a long-term focus on innovation in the industry.

Explore the Funding Landscape of the Polyester Industry

Investment data underscores significant financial support for the industry, with an average investment value of USD 23.4 million per round. The total number of investors exceeds 300, contributing to more than 540 funding rounds closed. These investments have supported over 220 companies, indicating confidence in the industry’s potential. This data underscores the polyester industry’s dynamic growth, innovation, and investment support.

Who is Investing in Polyester Solutions?

The polyester industry has received substantial investments from prominent investors, totaling over USD 400 million.

- Bank Woori Saudara has invested USD 150 million in at least 1 company.

- Keb Hana Bank has allocated USD 150 million to at least 1 company.

- Hyosung Chemical has contributed USD 120 million to at least 1 company.

- Think Investments has added USD 33 million across 2 companies.

- Closed Loop Partners has invested USD 3.7 million in 2 companies.

Access Top Polyester Innovations & Trends with the Discovery Platform

Explore the trends in the polyester industry including the firmographic data:

- Sustainable Packaging involves developing packaging materials made from recycled polyester, designing packaging for recyclability, and reducing the use of plastic in packaging. This trend is growing steadily, with over 3K companies in this sector. These companies employ more than 350K individuals, including an addition of over 18K new employees in the past year. The annual growth rate for this trend is 29.95%.

- Sustainable Manufacturing includes using recycled polyester (rPET) from post-consumer plastic waste, reducing water and energy consumption during production. This trend encompasses over 2K companies dedicated to eco-friendly production practices and employs more than 304K workers. Over 18K new employees were added in the last year. Further, the annual trend growth rate stands at 3.47%.

- Polyester Powder Coating, an emerging trend with over 160 companies in this niche market, employs more than 16K individuals. There was an addition of over 700 new employees in the past year, reflecting a steady rise in adoption. This trend has an annual growth rate of 6.24%.

5 Top Examples from 600+ Innovative Polyester Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Syre offers Circular Polyester

Swedish startup Syre develops a textile-to-textile recycling solution that provides circular polyester, equivalent in quality to virgin polyester but with sustainable performance. The process begins with collecting post-consumer, production, and industrial textile waste. This is followed by sorting based on material type and quality. The sorted textile undergoes depolymerization that breaks down polymers into monomers, which are then polymerized to form new fibers. These fibers are woven or knitted into fabrics, manufactured into final products, and eventually recycled, maintaining a continuous value.

ReSource Chemical provides Inedible Biomass Packaging

ReSource Chemical, a US-based startup, creates a technology to produce high-volume plastics from sustainable feedstocks—CO2 and inedible biomass. Its process produces bio-based FDCA, used for plastics like PEF. These materials surpass fossil fuel-based plastics in physical properties and performance. The startup’s PEF has applications in packaging, including cartons, bottles, films, trays, and pouches.

Yami Chemicals makes Epoxy & Polyester Resins

Indian startup Yami Chemicals manufactures epoxy and polyester resins. Its unsaturated polyester resins, derived from styrene, combine with glass fiber to create fiber-reinforced plastic (FRP). These FRP products exhibit lightweight properties, high strength, chemical resistance, and electrical insulation. The startup’s product includes General Purpose Resin, Isophthalic Polyester Resin, and Rooflite Resin. The applications span various industries, including automobiles, electrical equipment encapsulation, protective coatings, piping, roof sheeting, bathtubs, boat hulls, and chemical and electrical sectors

BEAL GROUP specializes in Polyester Polyols

Belarus-based startup BEAL GROUP develops Polyol Polyester 240B, a liquid flame retardant polyester polyol containing bromine and chlorine. This product offers highly effective flame suppression across various applications. For one-component PUR foams, combining Polyester 240B with polyester polyols results in foam with a B2 classification, demonstrating fire resistance. In polyisocyanurate PIR foams, it positively impact foam friability. In addition, PUR spraying systems achieve high fire resistance while maintaining low thermal conductivity. BEAL GROUP’s product also enhances the fire performance of PU-based adhesives.

Xeni Materials develops Biopolyester

Argentina-based startup Xeni Materials makes polyhydroxyalkanoate bio-polyester resin. This product is synthesized through chemical recycling and chemical-enzymatic upcycling technologies. By optimizing BHET chemically and using microorganisms, the startup biodegrades PET depolymerization by-products into monomers. Then these are biosynthesized into PHA resin. The biopolyester serves as a biotechnological, biodegradable, and biocompatible platform and enables the production of various derived products. This includes biodegradable coatings, paints, adhesives, packaging, disposable items, and 3D printer filaments. Also, Xeni Materials’ Neptuno product line features decorative paints for interiors, exteriors, and artistic use.

Gain Comprehensive Insights into Polyester Trends, Startups, or Technologies

The 2024 polyester industry outlook emphasizes a future shaped by growth, innovation, and sustainability efforts. Trends like sustainable packaging, eco-friendly manufacturing, and advanced coating technologies continue to change the industry. Get in touch to explore all 600+ startups and scaleups, as well as all industry trends impacting polyester companies.