Growing concerns around energy sourcing and demand for secondary raw materials are forcing recyclers to increase recycling efficiency. We give you a comprehensive view of global recycling technology trends so that you can follow the latest developments in the industry. For example, you will discover how chemical and advanced mechanical recycling technologies attract investments to increase the value of waste and wastewater streams. At the same time, recycling facilities are integrating artificial intelligence (AI) and the Internet of Things (IoT) to improve operational efficiency. Read more to explore the top trends impacting the recycling sector.

Top 8 Recycling Technology Trends in 2025

- Internet of Waste

- Chemical Recycling

- Recycling Robots

- Waste Valorization

- Artificial Intelligence

- Green Waste Management

- Material Life Cycle Extension

- Big Data & Analytics

Methodology: How We Created the Recycling Industry Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 5M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the recycling industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the recycling industry innovation ecosystem while highlighting startups driving technological advancements in the industry.

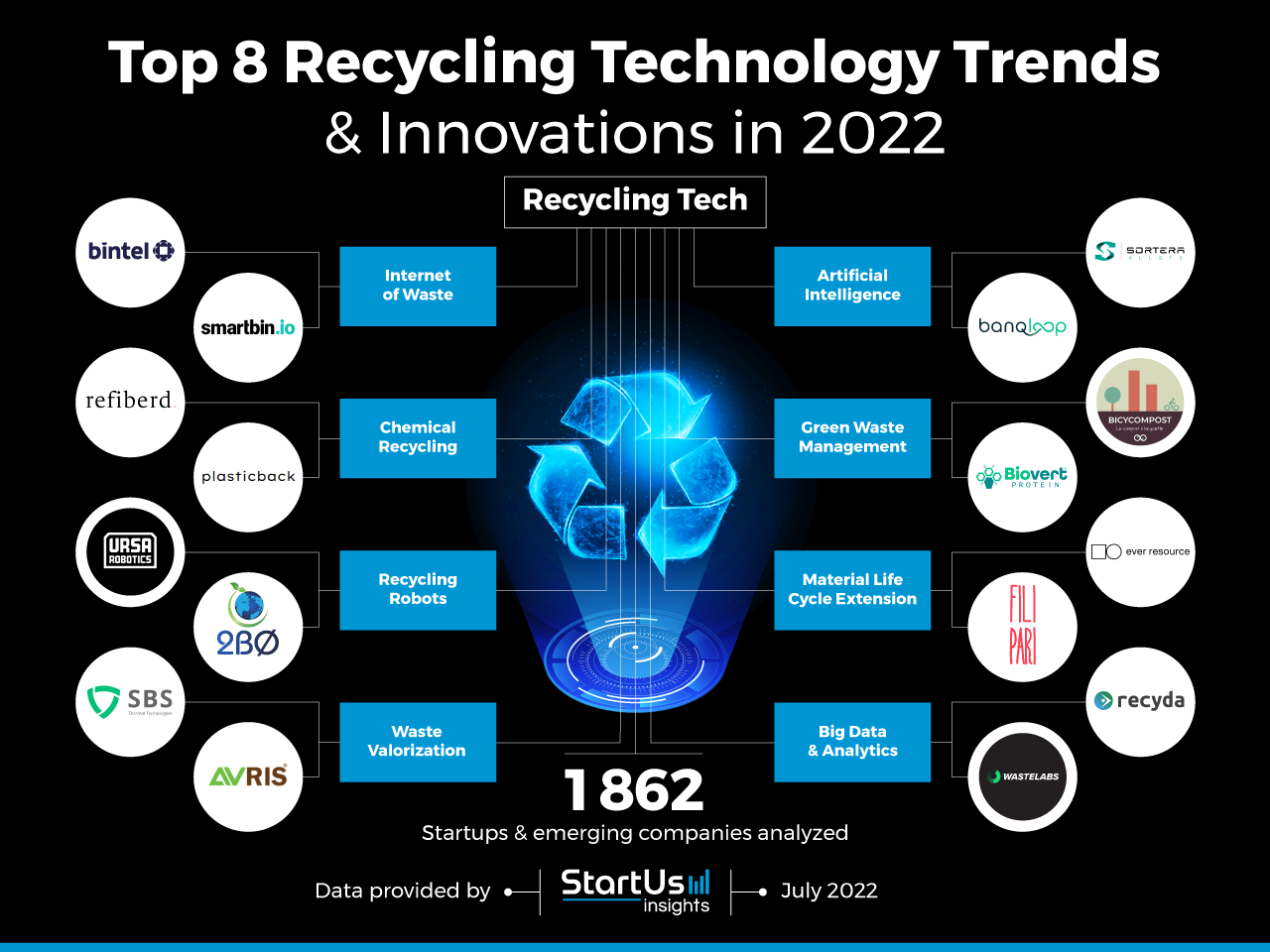

Innovation Map outlines the Top 8 Recycling Technology Trends & 16 Promising Startups

For this in-depth research on the Top Recycling tech Trends & Startups, we analyzed a sample of 1800+ global startups & scaleups. The Recycling Tech Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the recycling technology industry trends & startups that impact your company.

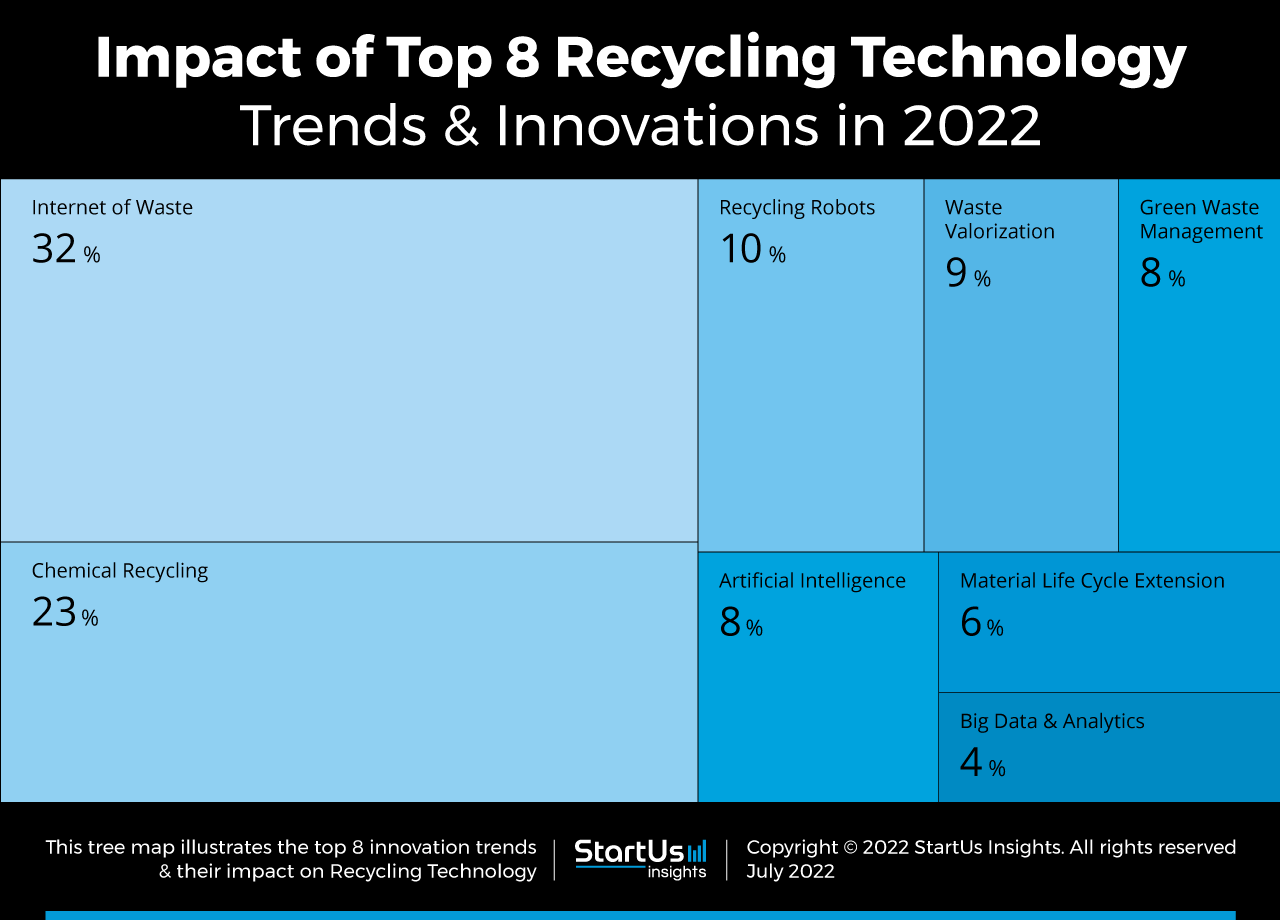

Tree Map reveals the Impact of the Top 8 Recycling Technology Trends

IoT increases visibility into recycling workflows and improves quality control of waste streams. This is crucial to improve the performance of the recycling sector, making IoT the top recycling trend. Chemical recycling and recycling robots are the other major trends after IoT and they improve recycling efficiency.

The recycling industry further innovates in waste valorization, green waste management, and material life cycle extension. This generates value for recyclers and diverts a significant amount of solid and organic waste away from landfills and incinerators.

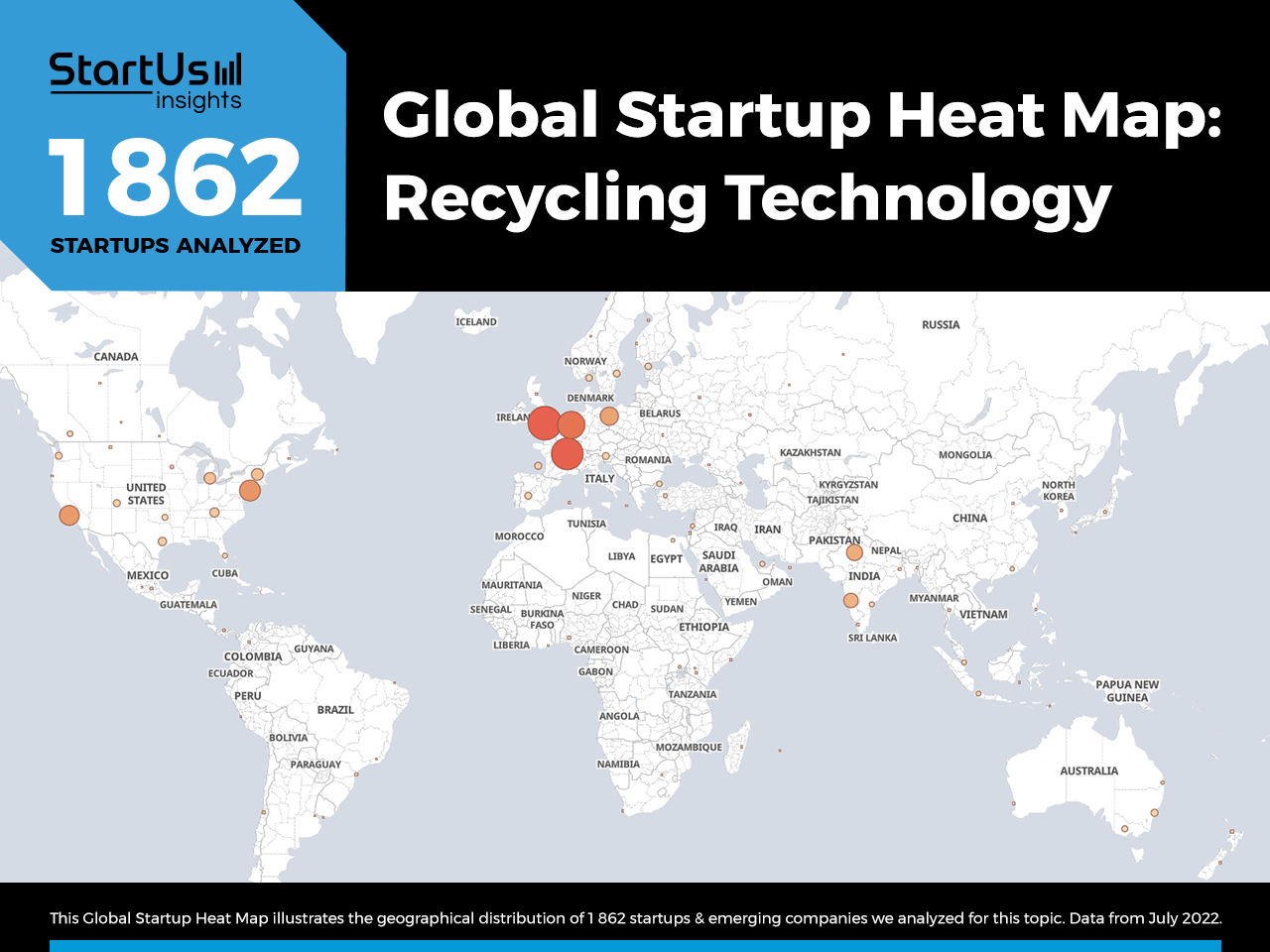

Global Startup Heat Map covers 1862 Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 1800+ exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the Western Europe and India. From these, 16 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Recycling Industry Innovations & Trends?

Top 8 Recycling Technology Trends for 2025

1. Internet of Waste

IoT-enabled waste management and recycling significantly reduce the inefficiencies in waste logistics. From fill-level sensors to smart bins and material quality assessing sensors, the recycling industry is leveraging the internet of waste to streamline operations. For example, monitoring fill levels in garbage containers allows collection facilities to ensure timely pickup.

This enables recyclers to move from periodical workflows to waste generation-based task schedules. Additionally, integrating IoT into recycling processes generates digital points. Startups combine this data and advanced analytics to further optimize waste collection and operational efficiency.

The global smart waste management market size reached USD 2733.1 million in 2024. Over the projection period of 2025 to 2035, the global smart waste management sales are predicted to rise swiftly at 16% compound annual growth rate (CAGR) and climb to a market size of USD 13 986 million by end of 2035.

Bintel offers Waste Fill Level Sensors

Bintel is a Swedish startup that develops fill-level sensors for trash bins, containers, and recycling stations. The startup’s sensors utilize low-power wide area networking (LoRaWAN) or narrowband IoT (NB-IoT) based on range requirements.

These sensors allow waste collectors and recyclers to increase visibility into container status without incurring massive capital expenses. Moreover, the sensors enable recyclers to optimize emptying frequency and waste logistics.

Smartbin.io makes Smart Bins

Smartbin.io is a US-based startup that creates smart bins for commercial spaces. The startup’s bin combines various sensors to track fill levels and notifies collectors when the bins are almost full. Smartbin.io also offers insights into the types of waste generated.

This allows businesses, retail outlets, and other commercial spaces to better manage waste and recycling indoors.

2. Chemical Recycling

Sustainable development goals (SDG) and customer preferences are driving the demand for secondary raw materials. That is why the industry is adopting chemical waste recycling methods. Chemical recycling plants leverage pyrolysis, gasification, and solvolysis, among other techniques, to recover materials without degrading their quality.

Unlike conventional methods, chemical recycling results in intermediates and petrochemical alternatives suitable for high-value applications. As a result, chemical recycling-based secondary materials replace virgin raw materials from the manufacturing supply chain and reduce carbon emissions. This, in turn, expands the market for secondary raw materials.

The global recycling market size is estimated to grow at a CAGR of around 9.8% during 2024-30. Additionally, by 2034, pyrolysis and depolymerization plants are expected to process over 17 million tonnes of plastic waste annually.

Credit: MarkNtel Advisors

Refiberd advances Textile Chemical Recycling

US-based startup Refiberd specializes in the chemical recycling of post-consumer textile waste. The startup combines AI, robotics, and its proprietary green chemical recycling technology to convert used and discarded textiles into new, reusable threads.

Refiberd offers recycled polyester and cellulose thread kits. This approach diverts significant amounts of waste from landfills and reduces the need for virgin materials in textile manufacturing.

Plastic Back specializes in Plastic Chemical Oxidation

Plastic Back is an Israeli startup that leverages chemical oxidation for plastic recycling. The startup’s proprietary process breaks down plastic polymers into oils, waxes, and other chemicals. Additionally, Plastic Back develops conversion units based on its process with a small footprint, enabling decentralized plastic recycling. This allows waste generators and recyclers to treat waste on-site as well as process mixed and contaminated plastic wastes.

3. Recycling Robots

While chemical recycling solutions offer better conversion efficiency, mechanical recycling is the most profitable means to recover materials. However, waste contamination and lack of workforce affect mechanical recycling operations. To tackle this, startups develop recycling robots to automate and augment sorting lines with AI-powered classification and sorting systems.

Additionally, such robots increase the picking speed, minimize errors, and improve picking efficiency. As a result, materials recovery facilities (MRFs) reduce their operational expenses, optimize waste stream quality control, and increase visibility into waste flows.

Global recycling robots market size is set to grow from USD 202.54 million in 2024 to USD 673.21 million by 2032, growing at a CAGR of 16.2% during the forecast period (2025-2032). One of the major manufacturers of recycling robots, AMP Robotics raised USD 91 million to speed the deployment of recycling systems.

2B0 enables Robotic Waste Sorting & Processing

2B0 is a US-based startup that develops waste sorting and processing robots. The startup’s patented recycling unit combines IoT, robotics, and AI to identify co-mingled waste materials and assess their recycling potential. It then grinds the waste to create high-value materials. This allows offices and retail stores to recycle waste on the premises and reduce waste management costs, in turn, lowering their carbon footprint.

Ursa Robotics offers Autonomous Waste Collection Vehicles

UK-based startup Ursa Robotics makes autonomous waste collection vehicles.

The startup replaces communal bins and garbage trucks with its automated containers. Once a container gets filled, another automated container replaces it. This allows recycling facilities to automate, scale, and optimize waste logistics.

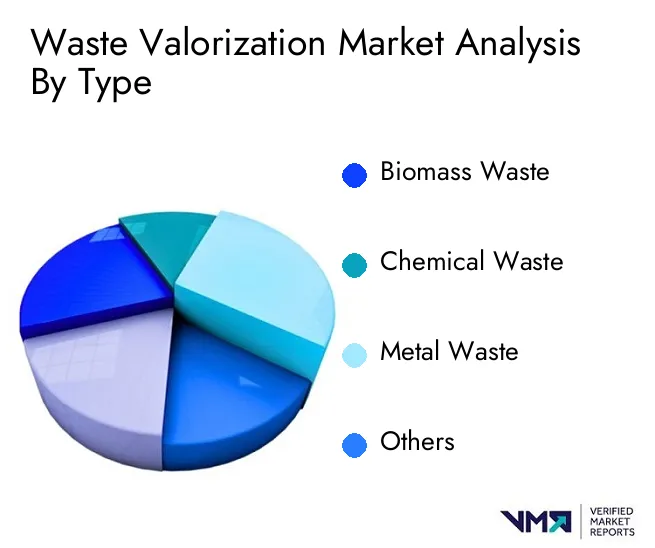

4. Waste Valorization

Waste recovery companies leverage biological and chemical means to upcycle their waste streams. Unlike conventional recycling, waste valorization solutions recover materials without quality loss or repurpose waste into new products. This generates more value than the original raw materials or products.

Startups are developing novel recycling technologies to convert solid and organic waste into energy and other chemicals. For example, some startups offer anaerobic digesters that use bacteria to treat organic waste and generate biogas. Such solutions allow recycling facilities to divert waste from landfills and create more revenue.

Moreover, the growing demand for clean energy is generating high interest in waste-to-energy (WTE) solutions. For instance, plastic-to-fuel conversion technologies address plastic waste and augment the energy supply.

Waste valorization market size is projected to reach USD 35.75 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030.

Credit: Verified Market Reports

Spouted Bed Solutions (SBS) Thermal Technologies provides Waste Heat Valorization Solutions

SBS Thermal Technologies is a Spanish startup that develops a patented waste heat valorization technique. The startup uses high-efficiency contact (HECO) technology to achieve optimized conditions for mass and energy transfer for increased waste conversion efficiency.

Its process supports various wastes and materials such as organic waste, industrial sludge and minerals, and forestry products. Therefore, recycling facilities use this technology to enhance chemical recycling efficiency and recover clean energy, biofuels, and raw materials faster.

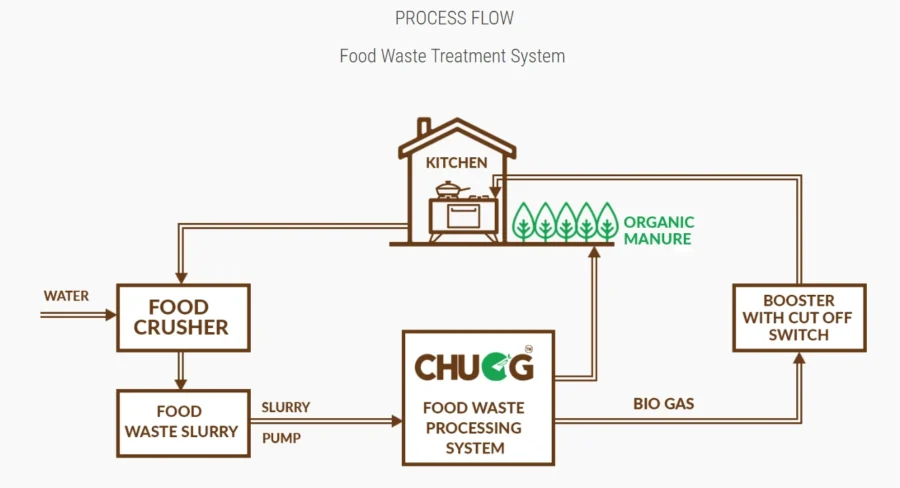

Avris Environment Technologies develops a Food Waste Treatment System

Avris Environment Technologies is an Indian startup that offers Chugg, a food waste treatment system. It leverages anaerobic digestion to convert food waste into biogas. Chugg features a modular design and requires minimal intervention for operations. This allows restaurants and hotels to deploy biogas plants on site and reduce dependence on liquified petroleum gas (LPG), reducing energy costs.

5. Artificial Intelligence

AI allows plastic recycling facilities to automate material analysis, sorting, and picking tasks. It also improves worker safety by reducing human exposure to hazardous waste streams. To integrate AI into workflows, startups utilize machine learning and computer vision, among others to capture unique characteristics in mixed waste streams and improve quality control.

The technology also allows recyclers to optimize waste collection routes and pickup schedules in waste logistics. This, in turn, enables them to improve recycling performance and recover more value from waste.

It is projected that the AI in the waste market is set to reach USD 18.2 billion by 2033.

Sortera Alloys provides an Automated Metal Sorting System

Sortera Alloys is a US-based startup that offers an automated metal sorting system for scrap metal recycling and reuse industries. The sorting system combines AI, data analytics, and sensors to classify and sort waste streams. It also upgrades feedstock streams and removes unwanted contaminants.

The startup’s high-throughput sorter enables recyclers to increase material recovery efficiency, create low-cost, high-quality metal alloys, and enable local supply chains.

BANQloop offers Smart Waste Management

BANQloop is a US-based startup that develops an eponymous smart waste management platform. The startup deploys its smart trash units, banQx1, or its heavy-duty variant, banQx1.HD, at waste generation sites. They use AI-driven robotics to sort waste at the source. The startup’s mobile smart trash unit, banQx1.HDm, also provides household waste pick-up services.

BANQloop’s intelligence platform, loopiQ, then provides material analysis data, pick-up notifications, and green scores. Government institutions and businesses leverage these solutions to increase recycling rates and optimize waste logistics.

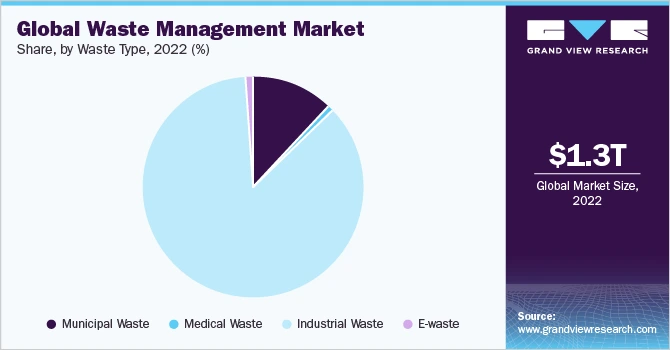

6. Green Waste Management

Food waste contributes to about 8% of anthropogenic greenhouse gas (GHG) emissions. Diverting it away from landfills enables recyclers to reduce emissions while also recovering high-value materials. Therefore, green waste management startups develop solutions to upcycle organic waste into stabilized organic compounds, carbon dioxide, and methane.

This includes compost facilities that convert green waste into biofuel or fertilizers. Besides, the growing market penetration of biopolymers enables a newer market for materials sourced from biomass waste.

The global waste management market size was valued at USD 1293.70 billion in 2022 and is expected to grow at a CAGR of 5.4% from 2023 to 2030.

Credit: Grand View Research

BicyCompost offers Bio-Waste Valorization

BicyCompost is a French startup that provides bio-waste valorization. The startup collects organic waste using electric bikes and naturally composts it.

BicyCompost then distributes the compost, free of charge, to its partner farmers, promoting local agriculture. This allows food businesses to ensure sustainable management of the waste they generate.

Wastelink upcycles Food Waste

Wastelink, an Indian startup, transforms food waste sourced from manufacturers and retailers into valuable animal feed. It acquires surplus and rejected food items from various stages such as harvest, sales returns, pre-production, and baking. The startup’s food waste management platform provides end-to-end tracking of the waste processing journey. Through its upcycling solution, Wastelink also contributes to reducing the carbon footprint of manufacturers and retailers.

7. Material Life Cycle Extension

Recycling technologies play a significant role in extending material life cycles. Closed-loop recycling and chemical recycling techniques have a great impact on material life cycle extension. However, a few challenges in achieving infinite recyclability include the quality of waste and recycling methods involved. For example, recycling metals and glass without degrading their quality is relatively easier compared to recycling plastics.

To overcome these challenges, startups develop advanced recycling solutions based on depolymerization, chemical treatment, and tech-driven mechanical recycling, among others. They enable recycling facilities to produce high-quality secondary materials and extend the lifetime of materials infinitely, reducing dependence on virgin raw materials.

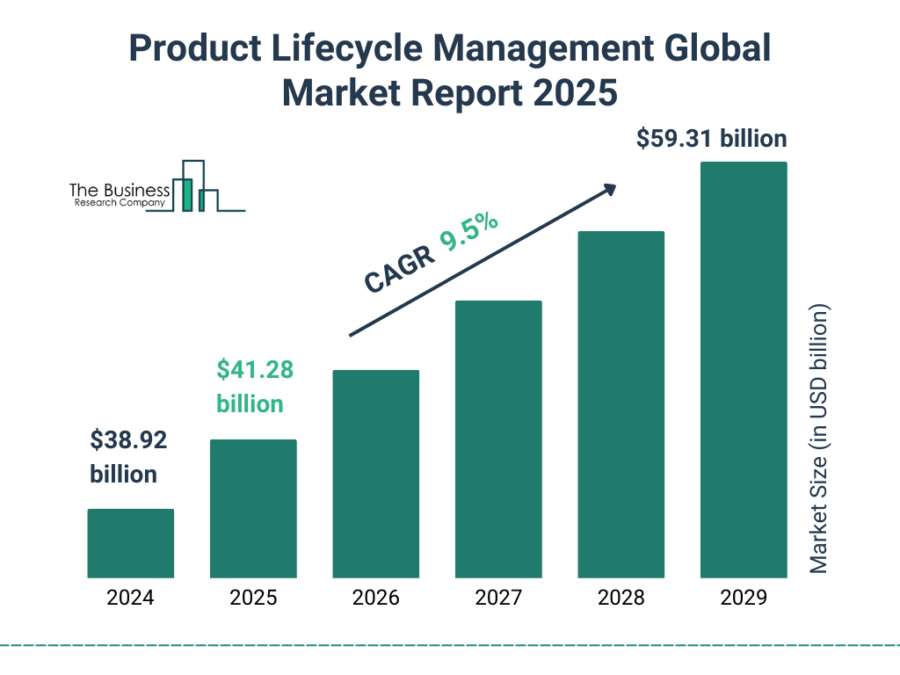

The product lifecycle management market size is expected to grow to USD 59.31 billion in 2029 growing at a CAGR of 9.5%.

Credit: The Business Research Company

Ever Resource facilitates Lead-Acid Battery (LAB) Recycling

UK-based startup Ever Resource advances LAB recycling. The startup’s hydrometallurgical process, REGENERATE, leverages mechanical separation, mixing, filtration, crystallization, and calcination. It generates high-quality lead oxide that replaces virgin lead oxide required to create LABs. The startup’s process, thus, ensures a continuous material flow between LAB manufacturers and recyclers, eliminating the use of virgin lead in batteries.

Fili Pari offers Marble-based Clothes

Fili Pari is a Spanish startup that makes marble-based clothes. The startup combines its patented marble-based material, natural materials, and recycled fabric from textile deadstock to create its products. Fili Pari repurposes marble otherwise sent to landfills into coats, raincoats, and other accessories. Additionally, it leverages process optimization and compostable packaging to enhance product sustainability.

8. Big Data & Analytics

The recycling industry utilizes data points generated by the connected waste management ecosystem through big data and advanced analytics. They allow recyclers to identify process inefficiencies and facilitate flow management. Further, big data and analytics enable advanced data processing techniques such as machine learning and deep learning for process automation.

Workflow digitization powered by analytics also drives transparency in operations and decision-making. For instance, some startups develop solutions that predict waste generation trends and identify communities or businesses that produce more waste, enabling targeted services.

GEPP provides a Waste Management Information Platform

GEPP, a Thai startup, develops a cloud-based digital waste management information platform. This platform analyzes waste data from companies to monitor material recycling practices. It calculates greenhouse gas emissions, facilitating a data-driven approach to waste reduction.

The startup also provides training on proper disposal methods for internal waste and waste generated during organizational events. GEPP ensures effective waste management and encourages recycling, diverting waste away from landfills.

Recyda facilitates Packaging Recyclability Assessment

Recyda is a German startup that aids packaging recyclability assessment. The startup’s software allows users to manually enter or import package-sourcing data. It then analyzes this data to identify missing attributes and packaging non-compliance risks.

This allows packaging manufacturers to ensure recyclability at sales and developmental stages. Besides, the increased visibility into package life cycles increases recycling efficiency at waste management facilities.

Discover all Recycling Technology Trends, Technologies & Startups

Advanced recycling technologies have the potential to significantly reduce the global demand for virgin raw materials – from plastics to energy. Recent developments include ultra-fast pyrolysis and on-site recycling systems, as well as using bacteria to tackle plastic waste. Additionally, startups are making recycling technologies affordable and scalable to address the already unsustainable waste management problem.

The Recycling Technology Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation and startup scouting process. Among others, molecular recycling, biological depolymerization, and advanced data analytics will transform the sector and shape the future of recycling technology.

Identifying new opportunities and emerging technologies to implement into your business goes a long way in gaining a competitive advantage. Get in touch to easily and exhaustively scout startups, technologies & trends that matter to you!