The RegTech Industry Report 2025 explores the dynamics of organizations facing increasing regulatory challenges in data privacy, anti-money laundering, and digital identity verification, among others. Technologies like AI, machine learning, and cloud computing automate regulatory reporting, fraud detection, and risk management tasks. This report also presents investment patterns, market growth, and innovative startups that form the industry.

The report was last updated in January 2025.

This RegTech report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: RegTech Industry Report 2025

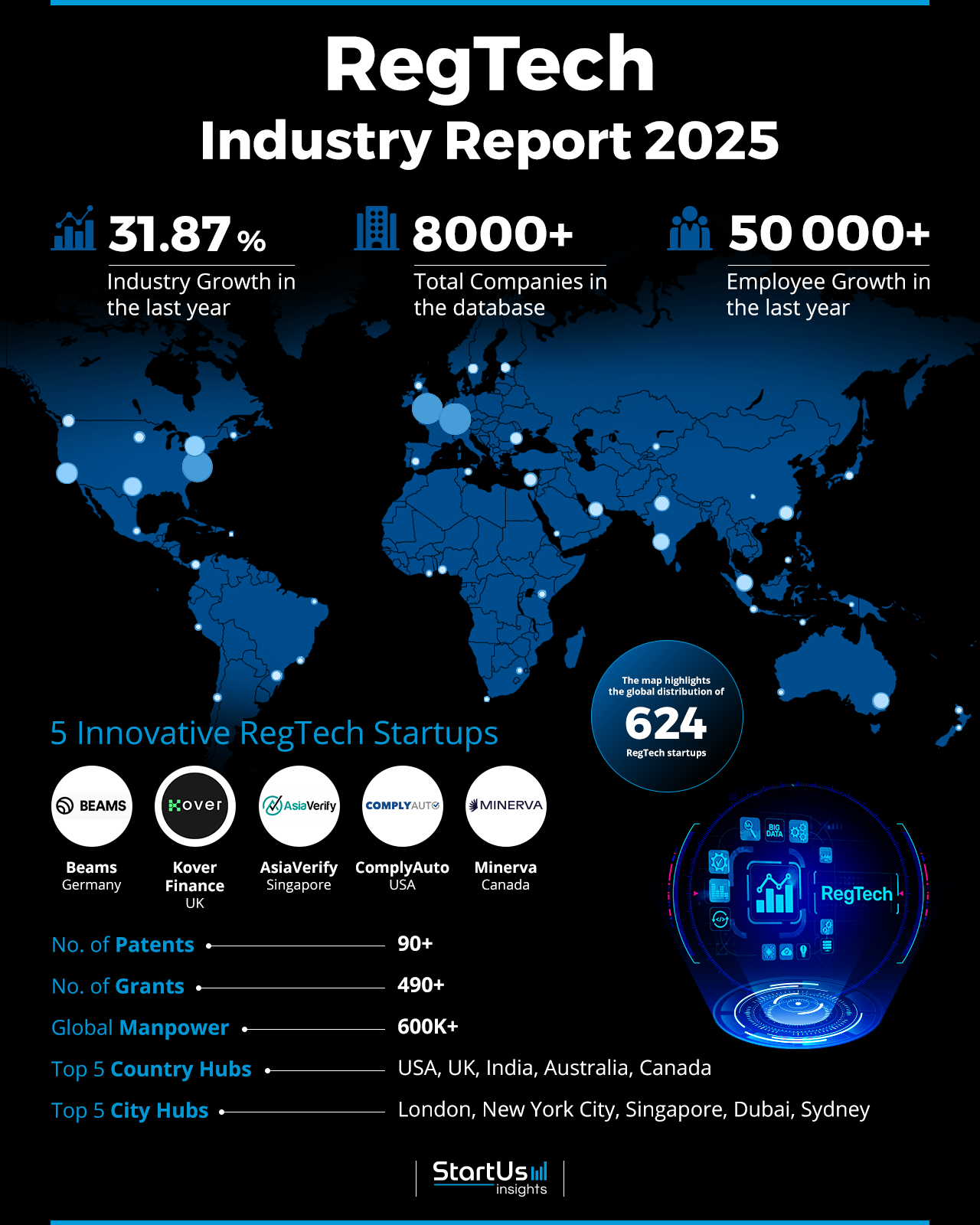

- Industry Growth Overview: The RegTech industry has an annual growth rate of 31.87%, and includes over 600 startups and a total of more than 8000 companies. Spending on regulatory technologies is expected to exceed USD 130 billion in 2025.

- Manpower & Employment Growth: The global workforce exceeds 600K employees, with over 50000 new jobs added in the last year.

- Patents & Grants: The sector secured over 95 patents and received 490+ grants supporting R&D.

- Global Footprint: The top five country hubs are the US, UK, India, Australia, and Canada, while major city hubs include London, New York City, Singapore, Dubai, and Sydney. The Asia Pacific regulatory technology businesses are set to grow by 29% to reach USD 3.21 billion in 2025.

- Investment Landscape: The average funding round value is USD 35.5 million, with more than 1400 investors supporting over 4000 funding rounds and 1200+ companies.

- Top Investors: The major investors including Wendel, Thoma Bravo, Spectrum Equity, and more have made a combined investment of over USD 2 billion.

- Startup Ecosystem: Highlights include innovative startups such as Beams (risk safety intelligence), Kover Finance (decentralized insurance), AsiaVerify (compliance verification), ComplyAuto (compliance automation), and Minerva (AML investigations).

Methodology: How We Created This RegTech Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of regtech over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the regtech 4.0 industry

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the regtech market.

What data is used to create this regtech report?

Based on the data provided by our Discovery Platform, we observe that the regulatory technology market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The RegTech industry saw over 1100 publications in the past year.

- Funding Rounds: More than 4000 funding rounds recorded in the database reflect strong investor interest.

- Manpower: The industry has over 600K workers globally and added over 50000 new employees in the last year.

- Patents: The sector also secured more than 90 patents.

- Grants: Further, about 490 awarded grants support further research and development in regulatory technology.

Explore the Data-driven RegTech Report for 2025

The industry includes 600+ startups and over 8000 companies, recorded within our database. The sector experienced a growth rate of 31.87% in the last year, which is driven by ongoing innovation. It has produced over 90 patents and secured more than 490 grants and supports technological advancements and regulatory solutions.

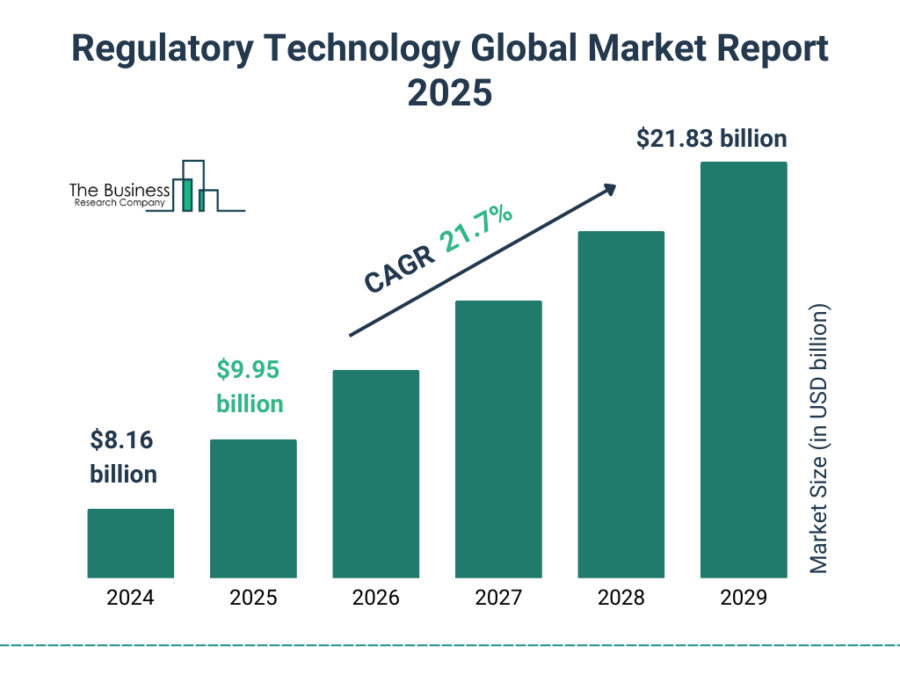

The regulatory technology market is set to grow at a CAGR of 21.7% from 2025 to 2034.

Credit: The Business Research Company

With a global workforce exceeding 600000, the industry saw an employee growth of over 50000 last year. The top five country hubs are the US, UK, India, Australia, and Canada, while key city hubs include London, New York City, Singapore, Dubai, and Sydney. The Indian regulatory technology market is set to grow by 37.8% to reach USD 354.72 million in 2025.

A Snapshot of the Global RegTech Industry

The banking segment dominated the global regtech market in 2025, holding a 22% market share.

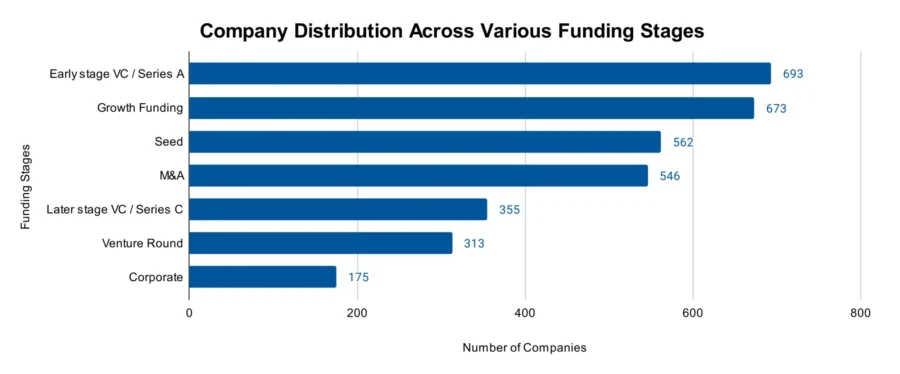

The RegTech industry has grown by 31.87% in the last year. More than 550 early-stage startups and 500 companies involved in mergers and acquisitions illustrate the sector’s maturity and expansion. Coming to patent activity, it has over 95 patents filed by 90+ applicants.

Also, the annual patent growth rate stands at 7.08%. The US and China lead in patent issuance, with over 40 and 30 patents, respectively.

Explore the Funding Landscape of the RegTech Industry

Investment trends show an average funding round value of USD 35.5 million, with more than 1400 investors contributing to over 4000 funding rounds, and supporting over 1200 companies across the industry.

Who is Investing in RegTech Solutions?

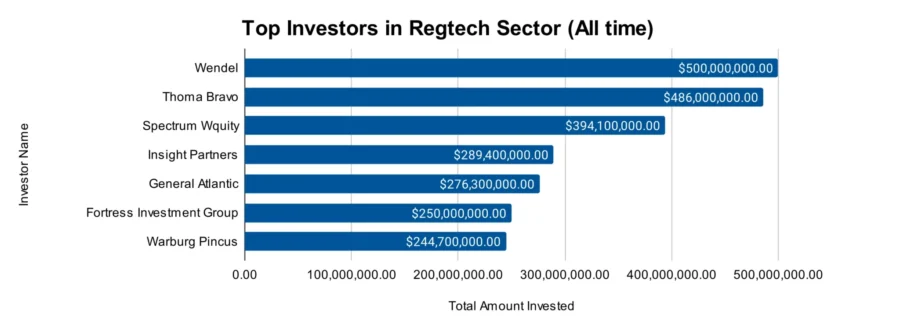

Top investors in the RegTech industry have invested over USD 2 billion to support the sector’s growth.

- Wendel has invested USD 500 million across 2 companies. It acquired 98% of the Association of Certified Anti-Money Laundering Specialists (ACAMS) worth USD 338 million.

- Thoma Bravo has allocated USD 486 million to 5 companies. It invested in companies like Adenza, Bottomline Technologies, and ForgeRock.

- Spectrum Equity has contributed USD 394.1 million to 4 companies. Zenwork, a provider of digital tax compliance and regulatory reporting software, raised USD 163 million from Spectrum Equity.

- Insight Partners has invested USD 289.4 million across 6 companies. Transmit Security: raised a USD 543 million series A funding co-led by Insight Partners.

- General Atlantic has committed USD 276.3 million to 4 companies.

- Fortress Investment Group has allocated USD 250 million across 2 companies.

- Warburg Pincus has contributed USD 244.7 million to 2 companies.

Access Top RegTech Innovations & Trends with the Discovery Platform

Explore the key trends rapidly advancing the regtech industry, with firmographic data:

- AI Prediction trend includes over 276 companies and more than 13 500 employees, with 1500 new employees added in the past year. The annual trend growth rate of 30.68% reflects the increasing demand for AI-driven regulatory solutions.

- Smart Contract Audit has over 600 companies and 13 700 employees, including 2800 new hires last year. The annual trend growth rate of 44.82% shows its increasing role in enhancing transparency, automating compliance processes, and reducing human error in regulatory adherence.

- AML Transaction Monitoring trend involves over 90 companies with 11 700 employees, and 960 new employees added last year. It has an annual trend growth rate of 21.65%, highlighting efforts to improve anti-money laundering compliance through monitoring technologies.

5 Top Examples from 600+ Innovative RegTech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Beams provides Risk Safety Intelligence

German startup Beams offers an AI-powered risk safety intelligence platform that assists regulated industries in safety reporting and improving decision-making. Its CoAnalyst solution automates report processing, hazard detection, and risk management.

The startup uses machine learning models to prioritize high-risk reports, save time, and reduce errors while providing actionable safety insights. The platform also scans historical data for hazard identification and trending to encourage proactive safety measures.

Kover Finance builds a Decentralized Insurance Marketplace

UK-based startup Kover Finance provides a decentralized insurance marketplace for insurance processes. It uses blockchain to offer real-time access to insurance data, including claims and solvency details to ensure security and compliance with global regulatory standards.

The startup’s platform facilitates collaboration between policyholders, insurance providers, and investors to create cost-effective risk pools and promote transparency. Kover Finance introduces new capital sources and pricing models that improve insurance coverage and investment opportunities.

AsiaVerify facilitates UBO, KYB, KYC Verification

Singaporean startup AsiaVerify provides a platform to streamline compliance processes for businesses in the Asia-Pacific region. It offers real-time know-your-business (KYB), know-your-customer (KYC), and ultimate beneficial owner (UBO) verification with access to government databases.

The platform uses optical character recognition and automated translation for verification across multiple languages. AsiaVerify’s API integration enhances onboarding processes, mitigates fraud risks, and reduces blind spots in anti-money laundering (AML) checks.

ComplyAuto offers SaaS RegTech

US-based startup ComplyAuto offers a compliance automation platform for various industries including automotive and legal. Its product ComplyAuto Guardian uses AI to automate consumer privacy, cybersecurity compliance, and advertising oversight by scanning dealership ads, auditing deal jackets, and creating compliant policies.

It also features a dashboard for issue review, vendor management, record retention, and staff training. Further, the startup offers ComplyAuto Safety, a cloud-based solution to reduce workplace risk and streamline safety compliance. ComplyAuto Workforce is a human resources tool for managing policies and training according to legal requirements, and ComplyCrypt, ensures end-to-end encryption for secure messaging.

Minerva advances AML Screening & Investigations

Canadian startup Minerva provides an AI-powered platform for anti-money laundering (AML) screening and investigations. The platform uses deep learning models to analyze data from various sources, including structured, unstructured, and open-source data. It creates context-rich customer profiles and offers real-time, actionable insights.

The startup’s platform resolves identities across multiple data sets, reduces false positives, and lowers compliance costs. Minerva assesses risk, meets regulatory requirements, and accelerates the investigation process.

Gain Comprehensive Insights into RegTech Trends, Startups, or Technologies

The RegTech industry will expand in 2025, driven by advancements in AI, smart contract auditing, and AML transaction monitoring. Emerging trends like AI-driven predictive analytics and blockchain-based solutions will enhance regulatory compliance. Get in touch to explore all 600+ startups and scaleups, as well as all industry trends impacting regtech companies.