The 2025 Remanufacturing Market Report analyzes the growing adoption of remanufacturing across industries like automotive, aerospace, electronics, and industrial machinery. The emerging trends include AI-driven inspections, additive manufacturing for parts restoration, and digital twins for process optimization.

Increasing consumer awareness, strict environmental regulations and the need to lower carbon footprints drive demand. The report highlights leading players, startups, and collaborations, exploring investment patterns and emerging opportunities.

Executive Summary: Remanufacturing Market Report 2025

- Industry Growth Overview: The remanufacturing market grew by 4.96% annually, supported by a database of over 3200 companies, including 350+ startups driving innovation and expansion.

- Manpower & Employment Growth: The sector employs more than 250 000 workers globally, with 8000 new employees added last year. This is a reflection of a steady workforce growth.

- Patents & Grants: Over 2900 patents and 320 grants highlight strong research and development activity.

- Global Footprint: Top country hubs driving remanufacturing activities include the United States, United Kingdom, Canada, Australia, and Germany. City hubs such as Houston, Melbourne, and Miami lead regional growth.

- Investment Landscape: The remanufacturing market secured over 500 funding rounds, with an average investment value of USD 94.7 million per round. More than 400 investors supported over 320 companies.

- Top Investors: The key investors — Dayton Parts, Alliance Resource Partners, Aggreko, and more — contributed over USD 1 billion, showing confidence in the market.

- Startup Ecosystem: Five innovative startups include Revive Battery (lead battery regeneration), Ecopath (sustainable ink), Reposit (reusable packaging), ReMatter (scrapyard software), and Open Funk (circular kitchen blenders).

What Data is Used to Create This Remanufacturing Market Report?

Based on the data provided by our Discovery Platform, we observe that the remanufacturing ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The remanufacturing market gained visibility, with over 950 publications highlighting developments last year.

- Funding Rounds: The funding activities are steady, with over 500 funding rounds recorded.

- Manpower: The workforce is strong, with over 250 000 workers employed and more than 8000 new employees added last year.

- Patents: Innovation is evident, with over 2900 patents filed, which indicates strong research and development efforts.

- Grants: The sector secured more than 320 grants, further supporting growth and innovation.

- Yearly Global Search Growth: The interest in remanufacturing is reflected in a 0.2% yearly growth in global search volume.

Methodology: How We Created This Remanufacturing Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of compliance management over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within remanufacturing

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the remanufacturing market.

Explore the Data-driven Remanufacturing Market Outlook for 2025

The remanufacturing market outlook for 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. This report provides insights into the remanufacturing market, highlighting company distribution and workforce dynamics.

Over 350 startups and 3200 companies populate the industry database, reflecting steady participation. The sector grew by 4.96% last year, supported by innovations.

The market is growing across various segments. For instance, the global automotive parts remanufacturing market is projected to grow at a CAGR of 9.3% from 2024 to 2034, with another source estimating a 9.9% CAGR from 2023 to 2030.

The industrial machinery remanufacturing market is anticipated to grow at a CAGR of 18.54% between 2023 and 2028. The engine remanufacturing segment is expected to grow at a CAGR of 5.5% from 2024 to 2031.

These estimates indicate a significant expansion of the remanufacturing market, driven by rising demand for sustainable and cost-efficient solutions across industries.

Further, patent filings exceeded 2900, with 320 grant approvals, indicating active research and development. The sector employs over 250 000 people globally, with 8000 new employees added last year.

Top country hubs include the United States, the United Kingdom, Canada, Australia, and Germany. North America leads the global market, holding over 40% of the share. Projected revenue for 2024 is USD 26.46 billion, with a CAGR of 8.7% through 2031.

Prominent city hubs driving remanufacturing activities are Houston, Melbourne, Sydney, Edmonton, and Miami. The data illustrates both regional leadership and global participation in remanufacturing.

A Snapshot of the Global Remanufacturing Market

The remanufacturing market shows steady growth at an annual rate of 4.96%. Over 350 startups are shaping the industry, focusing on innovation and expansion.

The various company stages reflect diverse activities, with over 45 early-stage startups driving innovation. Mergers and acquisitions are strong, with more than 240 transactions highlighting consolidation and partnerships.

Patent activity highlights the sector’s focus on research and development, with over 2900 patents filed by more than 300 applicants globally. The yearly patent growth rate of 0.71% shows consistent innovation.

China leads in patent filings with over 1300, followed by the United States with 750, which reflects key geographic hubs driving technological advancements.

Explore the Funding Landscape of the Remanufacturing Market

The remanufacturing market shows active investment, with an average investment value of USD 94.7 million per funding round. This appeals to financial stakeholders.

The domain has attracted more than 400 investors, which reflects a diverse pool supporting growth and innovation. Over 500 funding rounds have been successfully closed, showing steady financial activity.

More than 320 companies have secured investments. It indicates broad support across different players in the market. This level of funding activity highlights investor confidence in the market’s long-term potential.

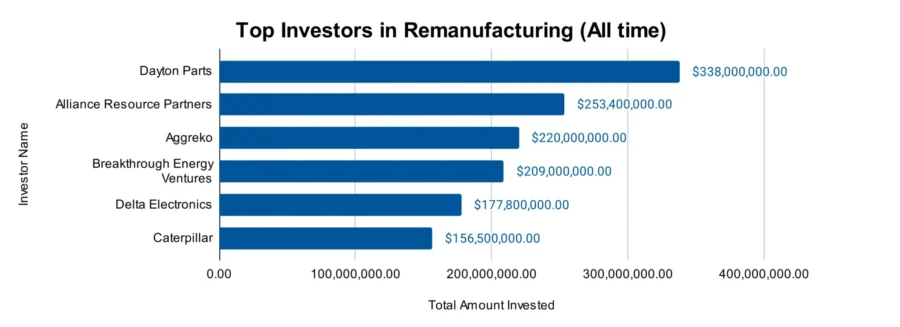

Who is Investing in the Compliance Management Market?

Top investors in the remanufacturing market have collectively invested over USD 1 billion, showing strong interest in the sector’s growth.

- Dayton Parts invested USD 338 million in at least one company.

- Alliance Resource Partners invested USD 253.4 million in at least one company.

- Aggreko invested USD 220 million in at least one company.

- Breakthrough Energy Ventures invested USD 209 million in at least one company.

- Delta Electronics invested USD 177.8 million in at least one company.

- Caterpillar invested USD 156.5 million across two companies. It has allocated USD 90 million in its Texas facilities to produce the C13D industrial engine and an additional USD 66.5 million in other remanufacturing-related projects.

Top Remanufacturing Innovations & Trends with the Discovery Platform

Discover the emerging trends in the remanufacturing market along with their firmographic details:

- Digital Modeling: Over 1000 companies employ 34 000 workers, adding 3000 new employees last year. Its annual growth rate of 9.86% shows increased adoption of digital tools for precision and efficiency.

- Closed Loop Recycling: More than 300 companies with 56 000 employees added 2000 new hires last year. With a 28.94% annual growth rate, this trend highlights a commitment to sustainability and resource optimization.

- Remanufactured Toner Cartridges: Over 180 companies employ 6000 workers, adding 200 new employees last year. Despite a -2.01% growth rate, it remains relevant for addressing niche demands in sustainable printing solutions.

5 Top Examples from 350+ Innovative Remanufacturing Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Revive Battery produces Regenerated Lead Batteries

Dutch startup Revive Battery regenerates lead-acid batteries to restore up to 95% of their original capacity. It uses algorithmically controlled electrical impulses to break down sulfur crystals and rejuvenate the battery without causing structural damage. This process reduces greenhouse gas emissions compared to traditional recycling.

The startup decreases the need for new batteries by extending battery life up to three times. It reduces lead waste and supports environmental sustainability. Revive Battery’s approach offers a cost-effective and eco-friendly solution for maintaining optimal battery performance across various industries.

Ecopath develops Eco-friendly Digital Duplicator Ink

Nigerian startup Ecopath produces Janibis Eco-friendly Digital Duplicator Ink to support a circular economy for photocopiers, printers, and duplicator consumables. It retrieves used cartridges through buy-back programs and remanufactures them using advanced machinery and non-toxic ink formulations.

The startup’s ink delivers high-quality printing performance while reducing plastic waste and minimizing the environmental hazards of traditional cartridge disposal. Ecopath serves industries with high print demands, such as education and healthcare to promote environmental responsibility and sustainability.

Reposit operates a Returnable Packaging Platform

UK startup Reposit offers a returnable packaging platform that enables brands and retailers to transition from single-use to reusable packaging. It provides standardized, smart packaging that is asset-tracked throughout its lifecycle. The system collects and professionally washes returned packaging, which is then refilled and redistributed.

Reposit also offers a web app that rewards customers for returning empty packaging to encourage sustainable behavior. By coordinating stakeholders and offering packaging-as-a-service, the startup provides a scalable, commercially viable alternative to single-use packaging to promote environmental sustainability and reduce waste.

ReMatter offers Scrapyard Software

US startup ReMatter creates software solutions for the scrap metal recycling industry. Its platform integrates scale ticketing, inventory management, dispatch scheduling, and financial reporting into a unified system accessible from any device. This design enables real-time tracking of materials, efficient scheduling of pickups and deliveries, and management of financial transactions.

Its features include automated bin tracking, customizable reports, and integration with accounting systems like QuickBooks and Sage to enhance operational efficiency and provide recyclers with actionable insights.

The startup’s SOC-2 certification ensures data security, protecting sensitive business information. ReMatter allows scrap metal recyclers to streamline operations, improve customer service, and make informed decisions that drive profitability.

Open Funk creates a Circular Kitchen Blender

German startup Open Funk develops re:Mix, a kitchen blender that works with standard glass jars to promote sustainability and convenience. The modular design features a casing made from recycled plastic, allowing users to blend directly in reusable jars, reducing waste and simplifying food preparation.

Its high-performance 1000W motor processes a variety of ingredients, from frozen fruits to nuts, and the compact size fits comfortably in small kitchens. re:Mix emphasizes durability and repairability to support circular economy principles.

Open Funk integrates open-source designs and local manufacturing to offer an eco-friendly blending solution that minimizes environmental impact and enhances functionality.

Gain Comprehensive Insights into Remanufacturing Trends, Startups, or Technologies

The 2025 remanufacturing market shows steady growth, driven by sustainability efforts, digital modeling, and closed-loop recycling. Advanced recycling technologies and AI-driven efficiency tools will shape the industry’s future. As investments and innovation increase, remanufacturing will play a crucial role in advancing circular economy practices worldwide.

Get in touch to explore all 350+ startups and scaleups, as well as all market trends impacting remanufacturing companies.