The retail industry is undergoing rapid digital change, accelerated by the pandemic’s disruption of global supply chains. In 2025, key retail industry trends include the adoption of artificial intelligence (AI), omnichannel distribution, and store automation. Additionally, immersive technologies and the metaverse are improving customer experiences, while sustainability efforts are leading retailers to offer eco-friendly products and reduce their carbon footprints.

What are the Top 8 Retail Industry Trends in 2025

- Retail Fulfillment

- Omnichannel Commerce

- In-Store Automation

- Smart Checkout

- Immersive Customer Experience

- Sustainability

- Artificial Intelligence

- Big Data & Analytics

Methodology: How We Created the Retail Industry Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, which covers and tracks nearly 5 million startups and technology companies worldwide, spanning all industries as well as 20 000 technologies and trends.

Creating a report involves approximately 40 hours of analysis. We evaluate our startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the retail industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2024.

- Company Size: A maximum of 100 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the retail innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 8 Retail Industry Trends & 16 Promising Startups

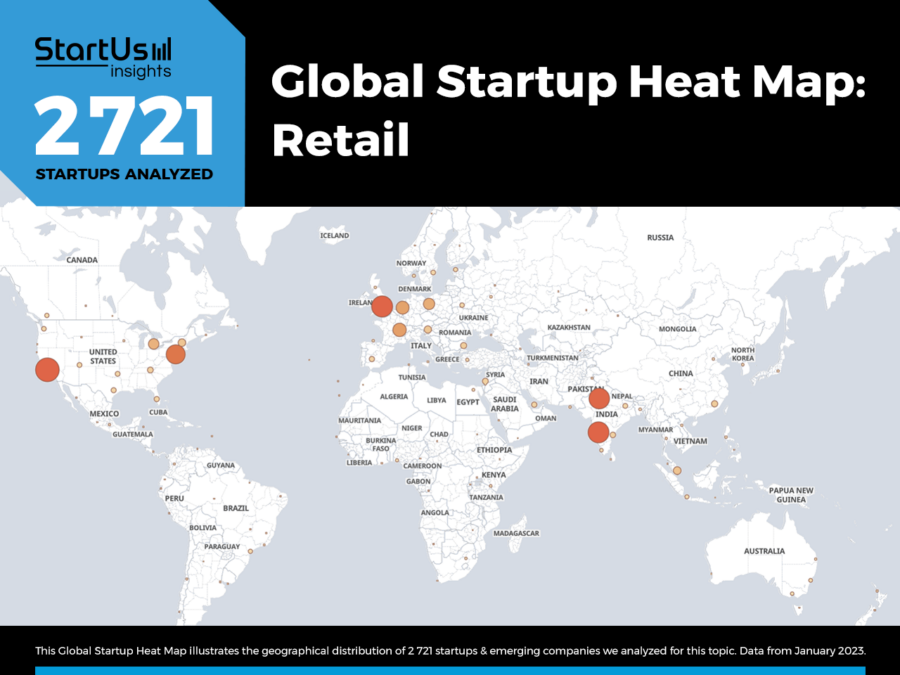

For this in-depth research on the top trends in retail and innovative startups, we analyzed a sample of 2721 global startups and scaleups. This data-driven research provides innovation intelligence that helps you improve strategic decision-making by giving you an overview of emerging technologies across numerous industries.

In the Retail Industry Innovation Map below, you get a comprehensive overview of the innovation trends & startups that impact your company.

Based on the Top 8 Retail Industry Trends & the Innovation map above, the TreeMap below illustrates the impact of the Top 8 Retail Industry Trends in 2025 and beyond.

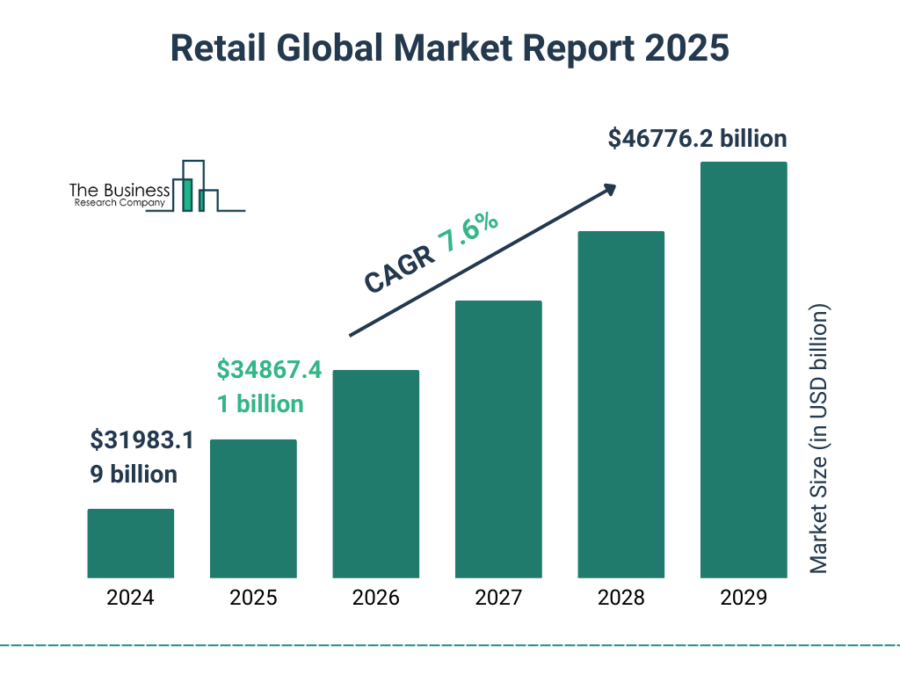

The retail market size will grow from USD 34867.41 billion in 2025 to USD 46776.2 billion in 2029 at a compound annual growth rate of 7.6%.

Credit: The Business Research Company

Retailers increasingly adopt AI tools, with 70% of executives expecting to implement AI capabilities in 2025 to improve personalization and operational efficiency.

The pandemic exposed supply chain vulnerabilities, making fulfillment-improving retail technologies and a multi-channel presence essential for competitiveness.

In-store automation addresses labor shortages and improves productivity, while web3, the metaverse, and extended reality enable personalized customer experiences and operational efficiency.

Moreover, there is a growing emphasis on supply chain transparency and sustainable practices.

Global Startup Heat Map covers 2721 Retail Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 2721 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals high startup activity in the US and Western Europe, followed by India.

Below, you get to meet 16 out of these 2721 promising startups & scaleups as well as the solutions they develop.

These retail startups are hand-picked based on criteria such as founding year, location, funding raised, & more. Depending on your specific needs, your top picks might look entirely different.

Further, global retail sales: are expected to reach USD 31.1 trillion in 2024, with a projected growth rate of 4.9%. By 2025, sales are anticipated to rise to USD 31.3 trillion.

Want to Explore Retail Industry Innovations & Trends?

Top 8 Innovations & Trends in Retail Industry [2025 and Beyond]

1. Retail Fulfillment

Retailers are shaping their business strategies around retail fulfillment to achieve better market penetration. The proliferation of last-mile delivery services and micro-fulfillment centers meets customer expectations for same-day or faster deliveries.

Both physical and online retailers offer local and hyper-local delivery services, either by repurposing stores as distribution centers or collaborating with logistics partners.

Buy-online-and-pick-up-in-store (BOPIS) and curbside pickup strategies drive store-based fulfillment.

Automation of fulfillment services tackles worker shortages, enables instant fulfillment, and improves order tracking. Startups employ automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and drones for efficient last-mile delivery.

Moreover, the integration of cloud computing facilitates real-time data analysis.

This technology provides valuable insights for improving inventory turnover and reducing overhead costs, thereby enhancing overall efficiency.

By early 2025, Amazon’s 750K+ robots in fulfillment are set to save up to USD 10 billion annually by 2030.

As per The Business Research Company report, the micro fulfillment market size will grow from USD 9.39 billion in 2025 to USD 43.66 billion in 2029 at a compound annual growth rate of 46.8%.

Credit: The Business Research Company

Further, micro-fulfillment adoption is set to rise, with 64% of retail executives expecting more automated centers in five years to improve delivery.

Urbx Logistics provides Automated Micro Fulfillment

US-based startup Urbx Logistics develops automated storage and retrieval systems (ASRS) for grocery and eCommerce fulfillment.

The startup’s system, Curbside, enables micro-fulfillment in existing stores by automating picking and packing with its AMRs, Grid, and TowerBots.

The system is customizable to store requirements and includes racking systems, totes, pick stations, and software to manage and control the micro warehouse.

Urbx Logistics thus cuts down order fulfillment and processing time, increasing the delivery efficiency of local and multi-store retail chains.

Delivers.ai offers Autonomous Last-Mile Delivery Vehicles

Turkish startup Delivers.ai facilitates contactless and zero-emissions grocery and package delivery through its proprietary navigation technology and AGVs.

The startup leverages camera-based sensor fusion and AI to navigate its autonomous robotic delivery vehicles through traffic signals, and pedestrian, and cycling lanes.

This mitigates food tampering as well as ensures timely and contactless delivery.

Cloud kitchens, virtual restaurants, and online order platforms use Delivers.ai’s solution to optimize last-mile deliveries.

Delivers.AI also secured funding from investors including Japan Post Capital, Turkey Development Fund, Impetus Capital, and Istanbul Technical University, resulting in a valuation of USD 36 million.

2. Omnichannel Commerce

Retailers, both digital-native and brick-and-mortar, adopt a unified approach to captivate consumers. Integration of eCommerce and mobile commerce is a strategy employed by big box and small store retailers.

Online-only retailers, on the other hand, devise innovative methods to offer customers physical experiences. Phygital retail facilitates a smooth transition to a direct-to-consumer (D2C) strategy.

It also enables retailers to adapt to small store formats with minimum inventory. Brands invest more in targeted digital advertisements for customer retention, demand shaping, and loyalty-building.

Social media platforms serve as new storefronts, enabling micro sales without redirecting customers to the store website. Advancements in social commerce include live streaming, post sharing, podcasting, and influencer networks on social media.

Additionally, retail technologies like voice and visual commerce create opportunities for interactive upselling, cross-selling, and remarketing.

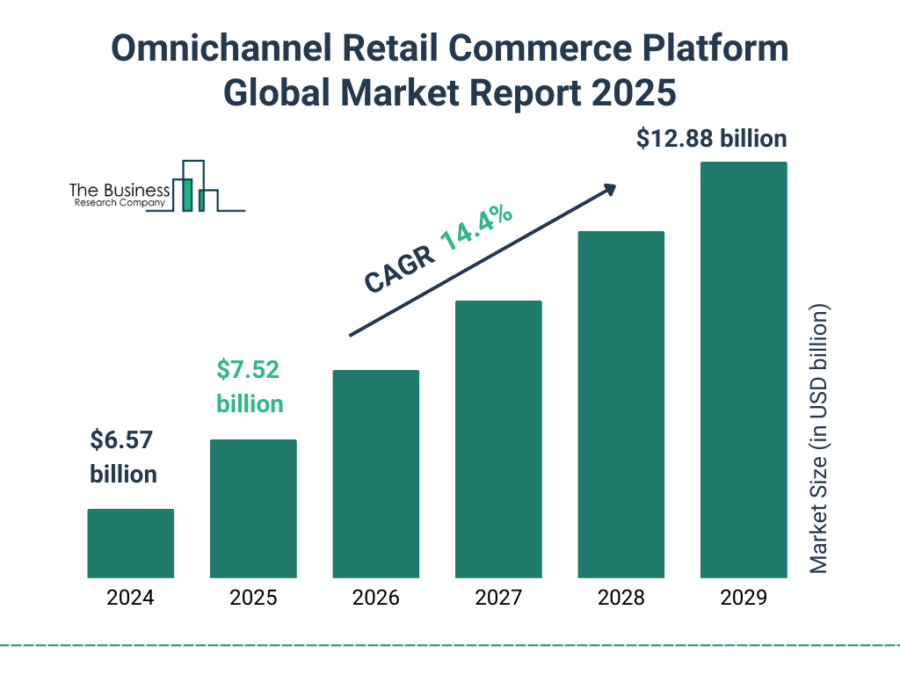

Credit: The Business Research Company

Further, the omnichannel retail commerce platform market is projected to grow from USD 6.57 billion in 2024 to USD 7.52 billion in 2025, reflecting a compound annual growth rate of 14.4%.

Confer With enables Social Commerce

Confer With is a UK-based startup that provides a social commerce platform to create a store-like shopping environment for customers.

The platform equips in-store staff to directly share product images as well as provide demos and shopping recommendations while engaging customers with video.

The live video shopping approach enables retailers to provide a personalized experience and boost customer loyalty.

Pairzon simplifies Omnichannel Marketing Automation

Israeli startup Pairzon combines customer data from online and offline touchpoints to automate omnichannel marketing.

The startup’s eponymous platform utilizes AI to enrich first-party business data from unknown in-store shoppers and assigns it an online identity.

This data is used to form audience segments and automatically deliver personalized promotions to previously unreachable shoppers online. This optimizes digital marketing efforts and drives revenue for physical retailers and brands.

3. In-Store Automation

To provide a better, hygienic, and safer in-store experience, retailers are using cleaning robots and chatbots that offer optimum times to visit stores.

Workforce upgrades in startups are underway to align with automated stores, boosting productivity. These improvements allow for home-based order management and the operation of virtual shopping assistants.

Conversational chatbots are deployed to address customer inquiries.

Technologies such as IoT, 5G, AI, edge computing, AR, and VR are revolutionizing store operations. These advancements facilitate efficient management of shelf space, inventory levels, and product labels.

They also guide customers in large stores through store navigation and positioning. In-store automation provides retailers with valuable data points to discover revenue opportunities, engage customers, and optimize store operations.

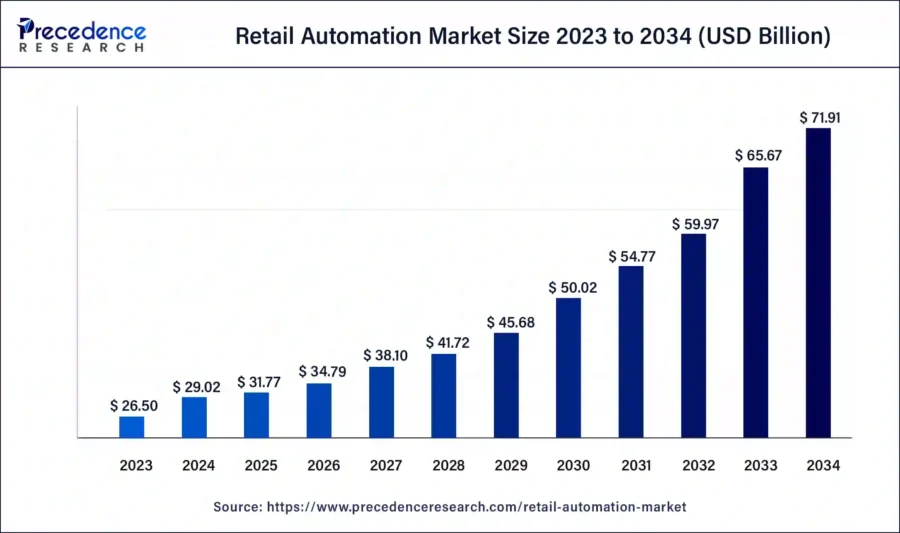

Credit: Precedence Research

Moreover, the global retail automation market size is expected to reach USD 31.77 billion in 2025 and around USD 71.91 billion by 2034.

Milky Way AI enables Remote Shelf Management

Singaporean startup Milky Way AI builds InstaShelf, a proprietary merchandising platform for remote shelf management. It combines computer vision and AI algorithms to analyze shelf photographs in real time.

The platform then provides insights into product performance and suggests corrective actions such as shelf replenishment.

It also generates alerts if products are out-of-stock, placed out of specification, or priced incorrectly. This reduces the time and cost of manual shelf audits and allows retailers to remotely manage store operations.

Naviteel develops Indoor Positioning Systems

Naviteel, an Estonian startup, offers an all-inclusive indoor navigation system for retail spaces. Its interactive maps facilitate efficient shopping list organization and swift item location.

The system provides real-time updates on product locations, stock levels, and discounts, thereby enriching the consumer experience.

Naviteel’s solution streamlines shopping, making it more personalized and convenient.

4. Smart Checkout

Contactless payments and cashier-less checkouts, powered by advanced technologies, are enhancing convenience and minimizing customer wait time.

Startups employ sensors, blockchain, NFC, and biometrics to automate and authenticate retail payments.

Given that smartphones often serve as the initial digital touchpoint for most customers, mobile checkout has become a necessity.

Contactless point-of-sale (POS) solutions like scan-and-go use the customer’s smartphone for payment authentication, while facial ID checkouts and wearables rely on biometrics.

The implementation of self-service kiosks, automated checkouts, and Buy Now Pay Later (BNPL) strategies curtails queue and waiting times in stores. These technologies extend customer conversion beyond the store’s physical boundaries.

Retailers benefit from reduced labor costs and increased customer throughput, which is important during peak shopping hours.

Zeroqs builds a Smart Shopping Cart

Polish startup Zeroqs manufactures a patented smart shopping cart that functions as a self-service kiosk for faster checkout.

The startup’s shopping trolley, SmartCart, combines a barcode scanner, touchscreen monitor, as well as weight and vision sensors to scan products added to the cart.

Further, shoppers use the monitor to navigate through the store, make shopping lists, and automate payment using their preferred method.

This allows physical store owners to eliminate shopping queues and inventory shrinkage as well as push personalized offers to shoppers.

Leav offers Contactless Mobile Checkouts

Canadian startup Leav develops a smartphone-based contactless self-checkout platform.

It is integrated into new or existing stores with minimum infrastructural changes. Shoppers scan product QR codes using smartphones which redirects them to the retail store portal on Leav’s platform.

Moreover, the platform functions as a digital shopping cart and allows shoppers to pay for each item after scanning the product. This prevents theft, tracks inventory cycles, and provides real-time insights into store operations.

5. Immersive Customer Experience

Engaging experiences in shopping translate into loyalty from customers, ensuring repeated sales and minimizing product returns.

Immersive technologies like AR and VR offer shoppers a new dimension of interaction, including virtual try-on, 3D product visualization, and personalized recommendations.

These technologies also provide retailers with the ability to test products before launch, train employees effectively, and promote a no-inventory store format.

The metaverse, non-fungible tokens (NFTs), and gamified brand experiences are emerging trends in the retail industry, particularly in retail marketing as entertainment or retailtainment.

These innovations have demonstrated their effectiveness in enhancing brand engagement and loyalty, particularly among Gen Z shoppers.

Credit: Globe News Wire

Further, the global market for VR in retail was valued at approximately USD 5.7 billion in 2024 and is projected to reach USD 24.1 billion by 2030, growing at a compound annual growth rate of 27.0%.

Mazing develops Web-based AR Software for Virtual Try-on

Mazing is an Austrian startup that provides web-based AR software for retail brands. It allows businesses to create AR-ready models from photos, CAD models, dimensional sketches, and 3D scans.

Customers use a web platform to access the product models and try on them virtually.

The software eliminates in-house software development and, in turn, accelerates time-to-market for retail companies with online channels.

At the same time, customers benefit from enhanced buying experiences and the AR virtual try-ons improve buying decisions.

So Real develops Immersive 3D Catalogs

Swiss startup So Real offers 3D product catalogs for eCommerce brands.

The startup uses its patented scanning and conversion technology to develop digital twins of products. These plug-and-play models are ready to use with XR and other immersive technologies.

So Real’s virtual asset viewer allows retailers to leverage these digital twins and virtually showcase their products in simulated physical environments.

This further allows online retailers to promote their products and make engaging marketing materials.

6. Sustainability

As climate change impacts become more evident, customer consciousness about their shopping habits and lifestyles is increasing.

This shift is leading startups and established retailers to incorporate sustainability into their product assortments and operations.

Trends such as organically grown food, locally sourced products, digital receipts, and emission-free shipping are advancing retail sustainability.

Did you know that approximately 73% of Gen Z consumers are prepared to spend more on green products, reflecting a significant generational shift toward sustainability?

Credit: Diversitech Global

In addition, retailers are adopting biodegradable packaging and renewable energy sources, which not only reduce environmental impact but also appeal to eco-conscious consumers.

Retailers are also striving to achieve net-zero goals by measuring the carbon footprint and energy efficiency of their operations.

On-demand manufacturing is being used to tackle overproduction, while rental or subscription business models are reducing wastage. The promotion of reverse commerce or reCommerce is encouraging a circular economy.

Retail startups are leveraging technologies like blockchain, NFTs, IoT, and 5G to enhance supply chain transparency, verify product authenticity, and facilitate distributed order management.

Further, a Nielsen survey found that 73% of global consumers are willing to change their consumption habits to reduce environmental impact.

Textile Genesis aids Supply Chain Traceability

Hong Kong-based startup Textile Genesis provides TextileGenesis, a fiber-to-retail supply chain traceability platform for the textile and fashion industry.

It uses blockchain, AI, and digital twins to trace and authenticate textiles to their source of origin across supply tiers.

The platform digitizes any textile assets such as fiber, yarns, or garments into its blockchain tokens, Fibercoins, that trace the flow of goods in real-time.

Sustainable textile and apparel manufacturers use this platform to certify the provenance information of their products and ensure ESG compliance.

TextileGenesis and EON have partnered to create digital product passports, enabling brands to connect the entire product lifecycle for improved supply chain optimization, customer transparency, and regulatory compliance.

reverse. supply enables ReCommerce

German startup reverse.supply develops a circular retail platform to advance retail reCommerce.

The startup’s reCommerce-as-a-service platform sources information on the second-hand market of a brand’s products. It then optimizes the second sale operations using an AI-driven grading system.

This enables brands to resell products through their own channels, extending product lifecycles. The platform also enables brands and retailers to increase brand value and sustainability efforts while improving customer loyalty.

7. Artificial Intelligence

In retail, technologies such as AI, natural language processing (NLP), machine learning (ML), and deep learning (DL) are enhancing in-store operations and customer experiences.

Algorithmic merchandising optimized by AI enables predictive inventory planning and efficient stock allocation.

This technology also increases supply chain efficiency and allows for cost and pricing optimization in storefronts and when sourcing goods from suppliers.

These applications of AI help retailers improve margins and devise optimal marketing strategies.

AI-powered consumer behavior and sentiment analysis contribute to the hyper-personalization of product offerings and promotions.

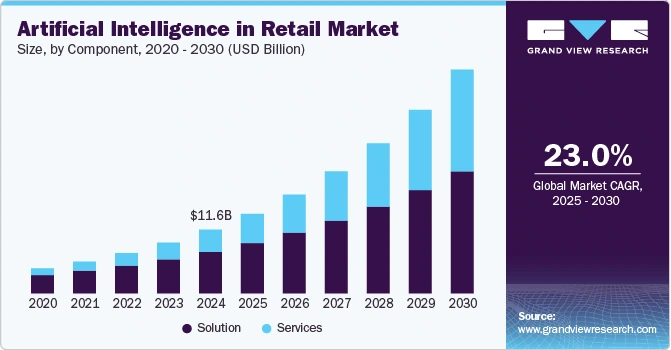

The global AI in retail market was valued at approximately USD 11.61 billion in 2024 and is projected to grow at a CAGR of 23.0% from 2025 to 2030.

Credit: Grand View Research

Additionally, AI is leveraged for product design customization and personalized recommendations, facilitating seamless customer journeys.

Puzl facilitates Advertisement Cost Optimization

US-based startup Puzl is an AI-based advertisement planning platform for supermarkets. It is a cloud-based platform that combines data from POS and enterprise retail planning (ERP) systems.

The platform then automates weekly ad planning and gross margin management.

This allows supermarket brands and grocery stores to drive more traffic into the stores and, in turn, improve profitability.

DTEK automates Self-Checkout

DTEK, a UAE-based startup offers AI-powered self-checkout solutions. It offers SWIFT, a platform that integrates AI, computer vision, and data analytics to transform the checkout process.

By tackling common retail pain points such as long queues and inventory management challenges—SWIFT enhances in-store efficiency.

Its high-speed transaction capabilities accommodate multiple items simultaneously, ensuring throughput and increased customer satisfaction.

Moreover, retailers integrate SWIFT with existing POS systems, offering diverse payment options for the shopping experience.

DTEK also entered the Polish renewables market by acquiring rights to build a 133 MW battery storage facility in southern Poland.

8. Big Data & Analytics

Insights into previously unmeasured retail metrics are now accessible through big data and analytics, revealing unexpected opportunities for process improvements.

Startups also utilize collaborative analytics to personalize the customer experience across various channels. Clustering data from first and third-party business sources into targeted segments yields valuable insights across key performance indicators.

Retail analytics enhance understanding of store and workforce performance, as well as customer traffic data. Demand forecasting and inventory management are now empowered by big data, leading to more effective retail planning.

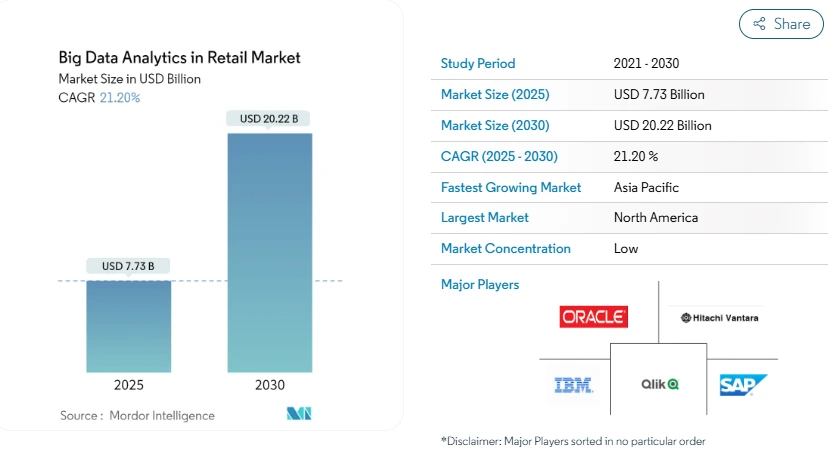

Credit: Mordor Intelligence

Big data analytics in the retail market is expected to reach USD 7.73 billion in 2025 and grow at a CAGR of 21.20% to reach USD 20.22 billion by 2030.

In addition, the optimization of product placement and pricing strategies through such analytics enhances sales and profitability. These numerous opportunities for innovation and streamlining make big data one of the top retail industry trends.

Belle AI advances Retail Demand Forecasting

Belle AI is an Israeli startup that makes a solution for demand forecasting in retail businesses. It features automated planning in real-time and data mining. For this, the solution leverages behavior analysis.

Consequently, Belle AI enables retailers to improve inventory planning and avoid overstock or understock.

Palexy provides Retail Store Analytics

Singaporean startup Palexy builds Store Optimizer, a business intelligence platform for store health analytics. It combines big data and AI to collect data from POS systems, surveillance camera feeds, weather information, and promotion calendars.

Based on this data, the platform generates tailored reports on store performance and customer traffic.

This offers insights into store layout, product assortment, and workforce performance, enabling small stores and retail chains to improve promotion planning, staff allocation, and customer experience.

Discover all Retail Industry Trends, Technologies & Startups

The pandemic has accelerated the retail industry’s digital transformation, leading to the adoption of distributed order management and multi-hyphenate business models.

While edge computing offers solutions for data processing in a cookieless environment, digitization introduces risks that startups are addressing through cybersecurity and data protection measures.

Sustainability remains central, with technologies like AI, blockchain, IoT, and data analytics driving efforts toward net-zero retail.

The Retail Industry Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.

WATCH THE VIDEO VERSION

WATCH THE VIDEO VERSION