In times of energy uncertainty, it becomes more important to understand the risks involved in being part of the energy industry. In this report, you get to discover five technology-driven risk management solutions developed by startups for energy companies.

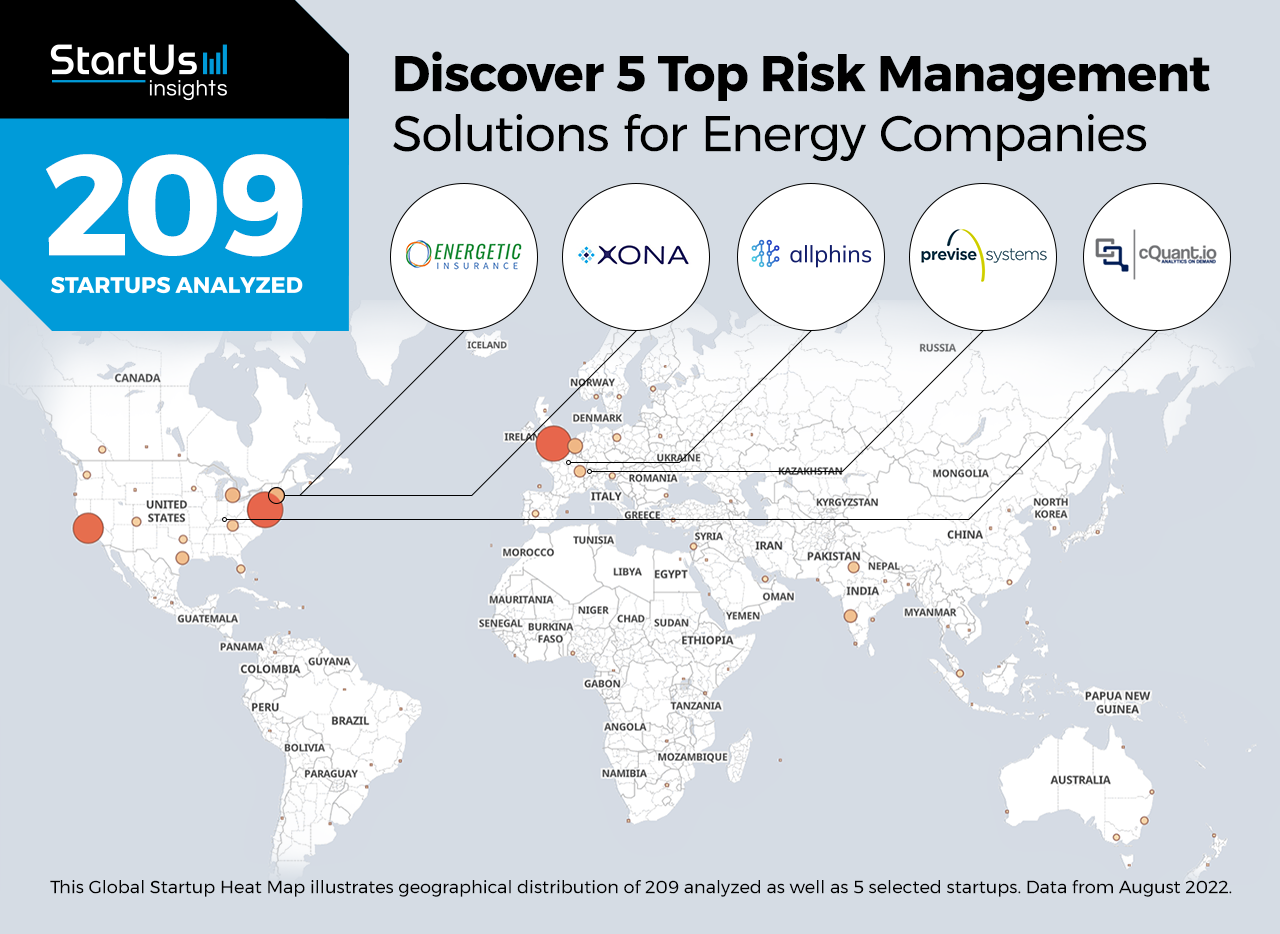

Out of 209, the Global Startup Heat Map highlights 5 Top Risk Management Solutions for Energy Companies

Startups such as the examples highlighted in this report focus on safe energy trading, energy portfolio management, remote energy asset maintenance, and solar project financing. While all of these technologies significantly advance the energy sector, they only represent the tip of the iceberg. This time, you get to discover five hand-picked risk management solutions for energy companies.

The Global Startup Heat Map below reveals the geographical distribution of 209 exemplary startups & scaleups we analyzed for this research. Further, it highlights five energy startups that we hand-picked based on scouting criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 204 risk management solutions for energy companies, get in touch with us.

Previse System offers Safe Energy Trading

Founding Year: 2019

Location: Zug, Switzerland

Innovate for Advanced Energy Trading & Risk Management (ETRM)

Previse system is a Swiss startup that develops software for electricity and natural gas trading. Its ETRM solution, Previse Coral, is a subscription-based software-as-a-service (SaaS), developed using .Net Core and Azure functions. It comes with built-in automated testing, eliminating the need for any future software upgrades. Previse System, thus, provides a safe risk management platform that also stores each trade, making them accessible to all the parties involved.

Allphins enables Rapid Underwriting Decisions

Founding Year: 2018

Location: Paris, France

Reach out for Energy Risk Analysis

Allphins is a French startup that builds a data analytics platform for insurers and reinsurers in the energy industry. The platform combines large datasets and the Allphins’ machine learning engine automatically recognizes risks and supplements them with Allphins or third-party data. It allows insurers to make better and data-driven underwriting decisions. This way, the startup offers clarity on risks in offshore and renewable energy companies with complex and overlapping insurance coverages.

cQuant advances Energy Portfolio Management

Founding Year: 2016

Location: Louisville, USA

Use for Energy Demand Forecasting

cQuant is a US-based startup that builds software to analyze and manage risks in energy portfolios. The startup’s cloud-based analytics tool allows energy retailers to optimize their portfolios and increase net profits. cQuant’s platform simplifies the designing of rate structures, forecasting retail demand across regions, and reducing the net-position-at-risk (NPaR).

Xona Systems simplifies Remote Energy Asset Maintenance

Founding Year: 2017

Location: Annapolis, USA

Funding: USD 9,2 M

Partner for Critical Infrastructure Security

Xona Systems is a US-based startup that offers critical infrastructure security solutions for the energy industry. Its user access platform, Critical System Gateway (CSG), leverages zero-trust architecture and multi-factor authentication to ensure the safety of remote connections. The startup also offers a Remote Operations Access Manager (ROAM) to configure its CSGs. This way, Xona Systems allows energy companies to perform maintenance tasks remotely while mitigating cyber risks with strong encryption. This also increases visibility across remote sites.

Energetic Insurance streamlines Solar Project Financing

Founding Year: 2016

Location: Boston, USA

Funding: USD 11,4 M

Collaborate for Energy Credit Risk Mitigation

Energetic Insurance is a US-based startup that acts as a managing general underwriter (MGU) with a data-driven approach to develop new risk management products and unlock growth in renewables. For solar industry participants who want to engage in more projects and deploy more capital, Energetic offers its product, EneRate Credit Cover. Using this, the startup enables solar project financing for the unrated and below-investment-grade counterparties by covering payment default risk.

Where is this Data from & how to Discover More Energy Startups?

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the energy industry. The insights of this data-driven analysis are derived from our Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & lets you scout relevant startups within a specific field in just a few clicks. To explore energy technologies in more detail, let us look into your areas of interest. For a more general overview, download our free Energy Innovation Report to save your time and improve strategic decision-making.

![Dive into the Top 10 Energy Industry Trends and Innovations [2025]](https://www.startus-insights.com/wp-content/uploads/2025/03/Energy-Trend-SharedImg-StartUs-Insights-noresize-420x236.webp)