Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

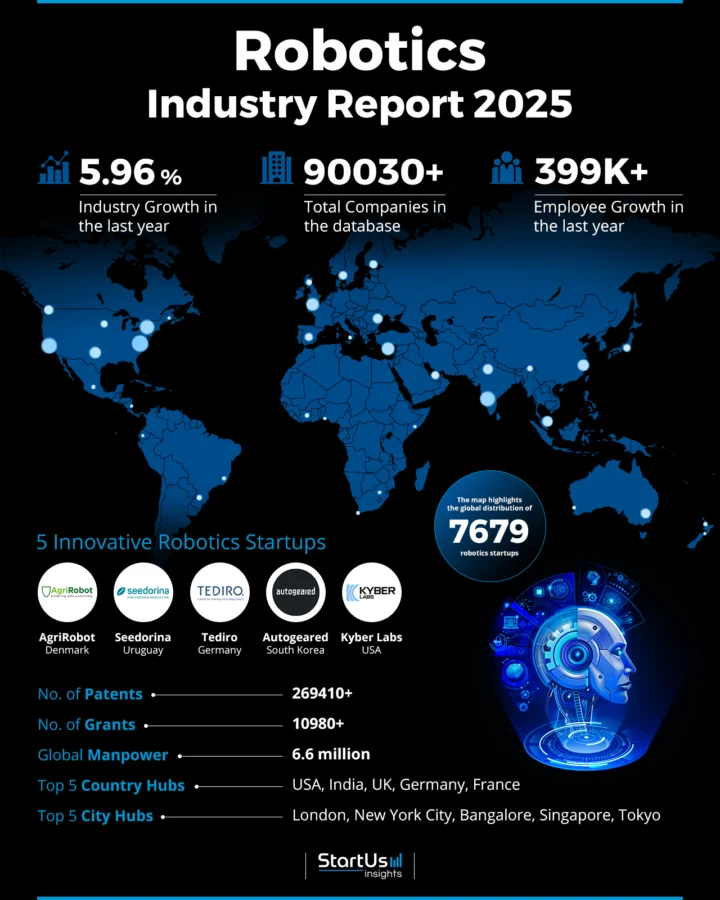

This robotics industry report explores an industry driven by investments and innovation, as well as advancements in AI, machine learning, and automation technologies. Emerging trends in autonomous mobile robots, collaborative robotics, and reinforcement learning assist sectors from manufacturing to healthcare. You will explore how companies integrate robotics into their operations to improve efficiency, precision, and productivity. This report explores the key developments, major players, and prospects for the industry.

Also, this robotics report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

The report was last updated in January, 2025.

Executive Summary: Robotics Industry Outlook 2025

- Industry Growth Overview: The robotics industry experiences growth with over 90 030 companies. The annual industry growth rate stands at 5.96%. The global robotics market is projected to reach USD 100.59 billion in 2025, growing at a compound annual growth rate (CAGR) of 12.17% to reach USD 178.63 billion by 2030.

- Manpower & Employment Growth: The global workforce in the robotics industry lies at 6 million individuals. The industry added more than 399 000 new jobs in the past year.

- Patents & Grants: The industry showcases over 269 000 patents and more than 11K grants to reflect continuous technological advancement.

- Global Footprint: Major hubs for the robotics industry include the USA, India, the UK, Germany, and France. Leading city hubs with high startup activity include London, New York City, Bangalore, Singapore, and Tokyo. The Asia Pacific region dominated the robotics market in 2024 with 35.4% share.

- Investment Landscape: The average investment value is USD 25 million per funding round. The sector attracted over 4500 investors and closed 20 000+ funding rounds.

- Top Investors: Top investors in this sector include Tiger Global, Insight Partners, and BPI France. The combined investment of the top investors amounts to USD 2 billion.

- Startup Ecosystem: Five startup features include AgriRobot (autonomous agricultural robots), Seedorina (robotic sowing), Tediro (robots for therapy and diagnostics), Autogeared (robot joint technology), and Kyber Labs (artificial muscle fiber actuator technology).

Methodology: How we created this Robotics Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies and market trends.

For this report, we focused on the evolution of robotics over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within robotics sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the robotics market.

What data is used to create this robotics market report?

Based on the data provided by our Discovery Platform, we observe that the robotics market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: About 78 430 news articles were published about the robotics industry in the last year alone.

- Funding Rounds: The robotics sector closed 20 000+ funding rounds to demonstrate financial backing and investor interest.

- Manpower: It employs more than 6 million workers worldwide. Last year, the industry added more than 399 000 new employees.

- Patents: The database covers data on over 269 000 patents.

- Grants: The industry has been awarded more than 11 000 grants to advance R&D.

- Yearly Global Search Growth: Yearly global search growth for the robotics industry increased by 1.95%.

Explore the Data-driven Robotics Industry Report for 2025

The robotics industry experiences growth with about 90 030 companies and 7679 startups operating within it. The past year saw an industry growth rate of 5.96%, underpinned by innovation and development. More than 269 000technologies filed for patents. Additionally, the industry received 11 000+ grants, further supporting research and development activities.

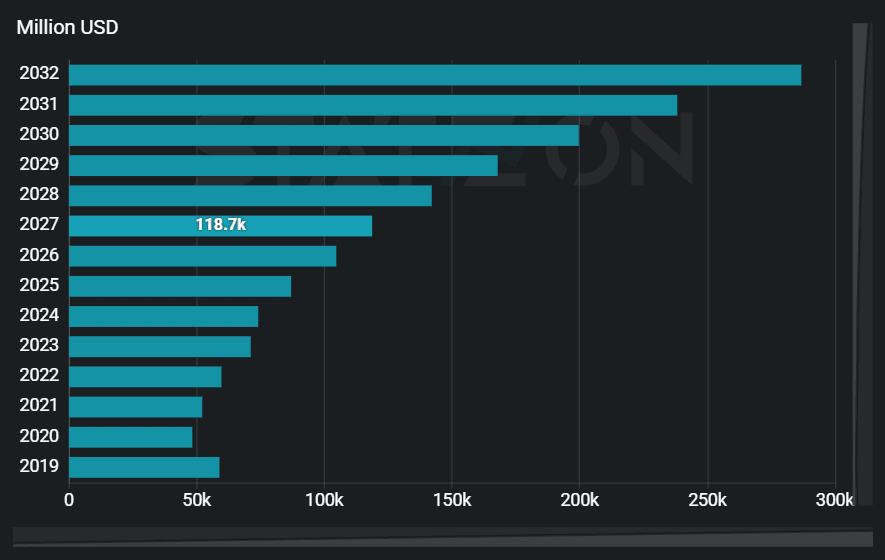

The global robot market is set to grow at a CAGR of 18.4% from 2024 to 2032.

Credit: Statzon

The global manpower within this industry stands at 6 million individuals, with employee growth reaching over 399 000 in the last year alone.

This growth is distributed across major hubs worldwide, with the top five country hubs being the USA, India, the UK, Germany, and France. On a city level, the leading hubs include London, New York City, Bangalore, Singapore, and Tokyo. The India industrial robots market is expected to grow from USD 522.12 million in 2025 to USD 733.91 million by 2033, at a CAGR of 9.6%.

A Snapshot of the Global Robotics Industry

The industry employs a global workforce of 6 million individuals. Last year, the sector saw employee growth and added approximately 399 000 new jobs. This expansion highlights the increasing demand for skilled professionals in robotics.

Moreover, the industry includes over 90 030 companies that contribute to its development. Additionally, The robotics technology market size is estimated to grow from USD 108.43 billion in 2025 to USD 372.59 billion by 2034, at a CAGR of 14.70%.

Explore the Funding Landscape of the Robotics Industry

Investment in the robotics industry remains strong, with an average investment value of USD 25 million per round. The sector attracted over 4500 investors and indicated interest in the potential of robotics. The industry closed more than 20 000 funding rounds, demonstrating its appeal to investors and capacity for growth and innovation.

In 2024, robotics startups secured USD 748.9 million in funding in just 12 weeks, with March alone seeing USD 642 million invested across 37 firms.

More than 6300 companies received investments to showcase the distribution of financial support across the industry. This widespread investment underscores the industry’s diversity and the opportunities for growth and development within the sector.

Who is Investing in Robotics Solutions?

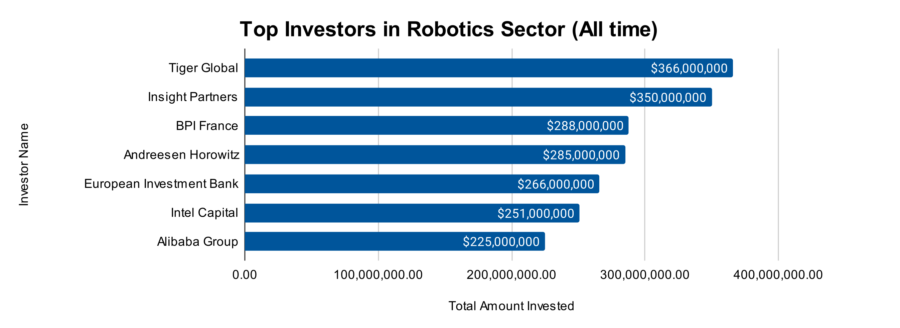

The robotics industry attracted investment from leading venture capitalists and financial institutions, with a combined value of more than USD 2 billion invested by the top investors. This financial backing underscores the industry’s potential and the confidence that investors have in its growth and innovation capabilities.

- Tiger Global poured USD 366 million into 9 companies. Its portfolio includes companies like Ambi Robots, Locus Robotics, Rapid Robotics, Path Robotics, and more.

- Insight Partners invested USD 350 million across 4 companies. It led a USD 37 million series B funding round for Blue White Robotics, a platform that provides robots-as-a-service for autonomous farming.

- BPI France allocated USD 288 million to 17 companies. It provided a USD 1.09 million loan to Ganymed Robotics.

- Andreessen Horowitz backed 9 robotic companies with USD 285 million.

- The European Investment Bank supported 6 companies with USD 266 million.

- Intel Capital contributed USD 251 million to 9 companies. It made a USD 9 million equity investment in Figure, an AI Robotics company building general-purpose humanoid robots.

- Alibaba Group financed 4 companies with USD 225 million. It participated in a pre-A financing round of nearly USD 41.37 million for Xingdong Jiyuan, a startup focusing on embodied intelligence and general humanoid robot technology.

Access Top Robotics Innovations & Trends with the Discovery Platform

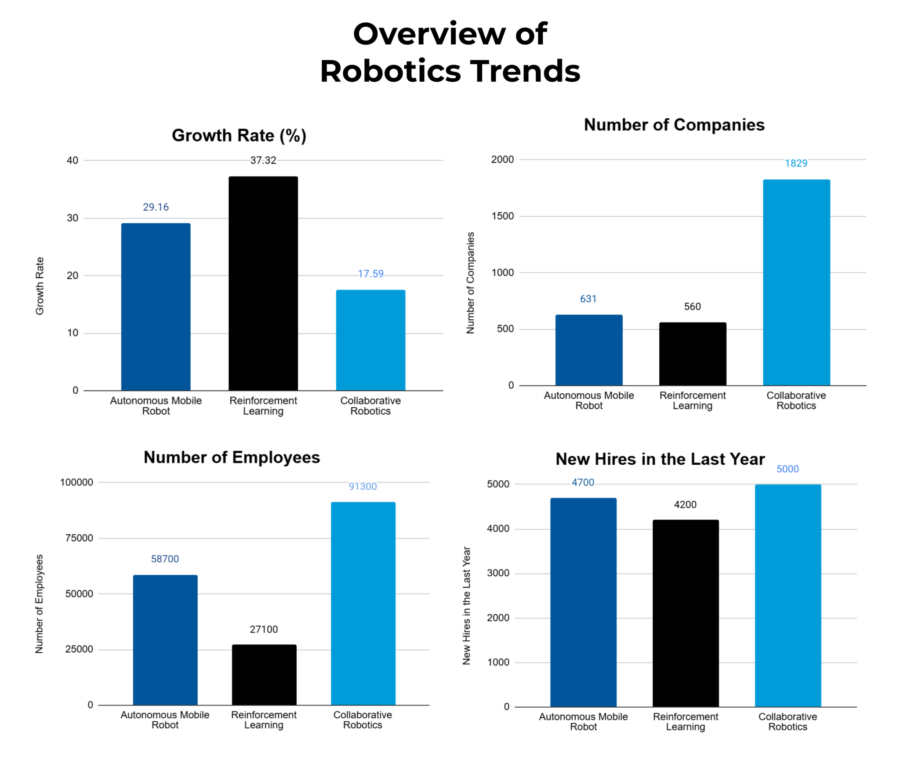

- The Autonomous Mobile Robot (AMR) trend is experiencing growth with 631 companies currently identified. These companies collectively employ 58 700 individuals, with 4700 new employees added in the last year. This area’s annual trend growth rate stands at 29.16%.

- Reinforcement Learning (RL) encompasses about 560 companies, specializing in this advanced area of machine learning. These companies employ a total of 27 100 individuals and added 4200 new employees in the past year. The trend’s annual trend growth rate stands at 37.32% and reflects its expansion and the increasing interest in leveraging RL for robotics applications.

- Collaborative Robotics or Cobots trend is used by 1829 companies in our database. These companies employ over 91 300 individuals and saw an addition of 5000 new employees last year. The annual trend growth rate for this segment is 17.59%.

5 Top Examples from 7670+ Innovative Robotics Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Get in touch to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Tediro builds Robots for Diagnostics and Therapies

German startup Tediro develops a mobile robot THERY suitable for various physiotherapy applications in the healthcare sector. The robot initially assisted patients in gait training by accompanying them and providing audio-visual correction recommendations. The app THERY UAG features a cloud-based therapy management system (TMS).

The patients log into the robot using a personal RFID chip before starting the training session. Then, they follow the robot for gait training, which slowly adapts to the speed of the patients. It also provides a summary of the training results.

THERY is suitable for therapists and patients to improve patient mobility regardless of staff presence. It is used for total hip arthroplasty (THA), total knee arthroplasty (TKA), femur fractures, musculoskeletal injuries, cartilage lesions, corrective osteotomy, and more.

Seedorina offers a Robotic Sowing Solution

Uruguay-based startup Seedorina offers robotic sowing technology for the agriculture sector. The startup’s programmable Seedorina system configures specific sowing parameters. It utilizes IoT and robotics to provide real-time productivity reports, and alerts, controlling production statistics for enhancing operational efficiency.

Moreover, the system’s versatility accommodates any seed type, integrates with existing production systems, and operates remotely via an app. This solution saves seeds, fertilizer, and water while improving germination rates and plant health.

AgriRobot builds Autonomous Farming Robots

Danish startup AgriRobot manufactures agricultural field robots that are autonomous, safer, and reduces the requirement of farmers to monitor robots in the field. The robots are equipped with technologies from self-driving cars and last-mile delivery robots. These technologies enable the robot to perform in agricultural environments with plants, weeds, and obstacles like livestock and machine operators.

The software in the robot has a core 2D and 3D algorithm developed according to safety standards. Further, the robots come with lidar, camera, and radar for high performance 3D perception and 360 degree field view. It is capable of obstacle detection and geofencing due to its added sensor. The robots are suitable for farmers looking for safe and autonomous agricultural robots.

Autogeared makes Robot Joint Technology

South Korean startup Autogeared creates robot joint technology while integrating motors, sensors, brakes, and reducers into one compact unit. The startup’s Pancake Actuator features a center rotation mechanism and provides large torque in limited spaces to make robots slimmer.

Additionally, its traction drive technology replaces gear-type reducers and delivers speed and accuracy. This solution finds applications in constant-speed, low-vibration, and high-precision systems.

Kyber Labs provides Artificial Muscle Fiber Actuator Technology

US-based startup Kyber Labs develops a robotic manipulation platform for AI-based controls. The startup’s artificial muscle fiber actuators mimic human muscles and enable fluid and dexterous movements. These fibers paired with neural network-based controls allow for natural interactions with the environment.

The platform, built for machine learning controls, performs complex tasks in unstructured environments with minimal setup and learns by demonstration.

Gain Comprehensive Insights into Robotics Trends, Startups, or Technologies

The robotics industry is expanding with new technologies that achieve productive automation and intelligent systems. The potential for robotics to impact numerous sectors remains immense. This report underscores the importance of continued investment and R&D to maintain the industry’s current momentum. Reach out to us to explore all 7670+ startups and scaleups, as well as all industry trends impacting robotics companies.