The Sensor Report 2025 shows a market driven by demand for automotive, consumer electronics, healthcare, and industrial applications. With increasing reliance on the Internet of Things (IoT) and Industry 4.0 technologies, sensors are integrated into various devices for real-time monitoring, predictive maintenance, and operational efficiency. Sensor manufacturers focus on improving precision, miniaturization, and cost-efficiency, for example, to meet the needs of applications in robotics, medical devices, and environmental monitoring. This report explores the current state of the sensor market, key trends, and future growth opportunities.

This sensor industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Sensor Technology Report 2025

- Executive Summary

- Introduction to the Sensor Report 2025

- What data is used in this Sensor Report?

- Snapshot of the Global Sensor Industry

- Funding Landscape in the Sensor Industry

- Who is Investing in Sensor Technology?

- Emerging Trends in the Sensor Industry

- 5 Innovative Sensor Tech Startups

Executive Summary: Sensor Technology Report 2025

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 900+ sensor startups developing innovative solutions to present five examples from emerging sensor industry trends.

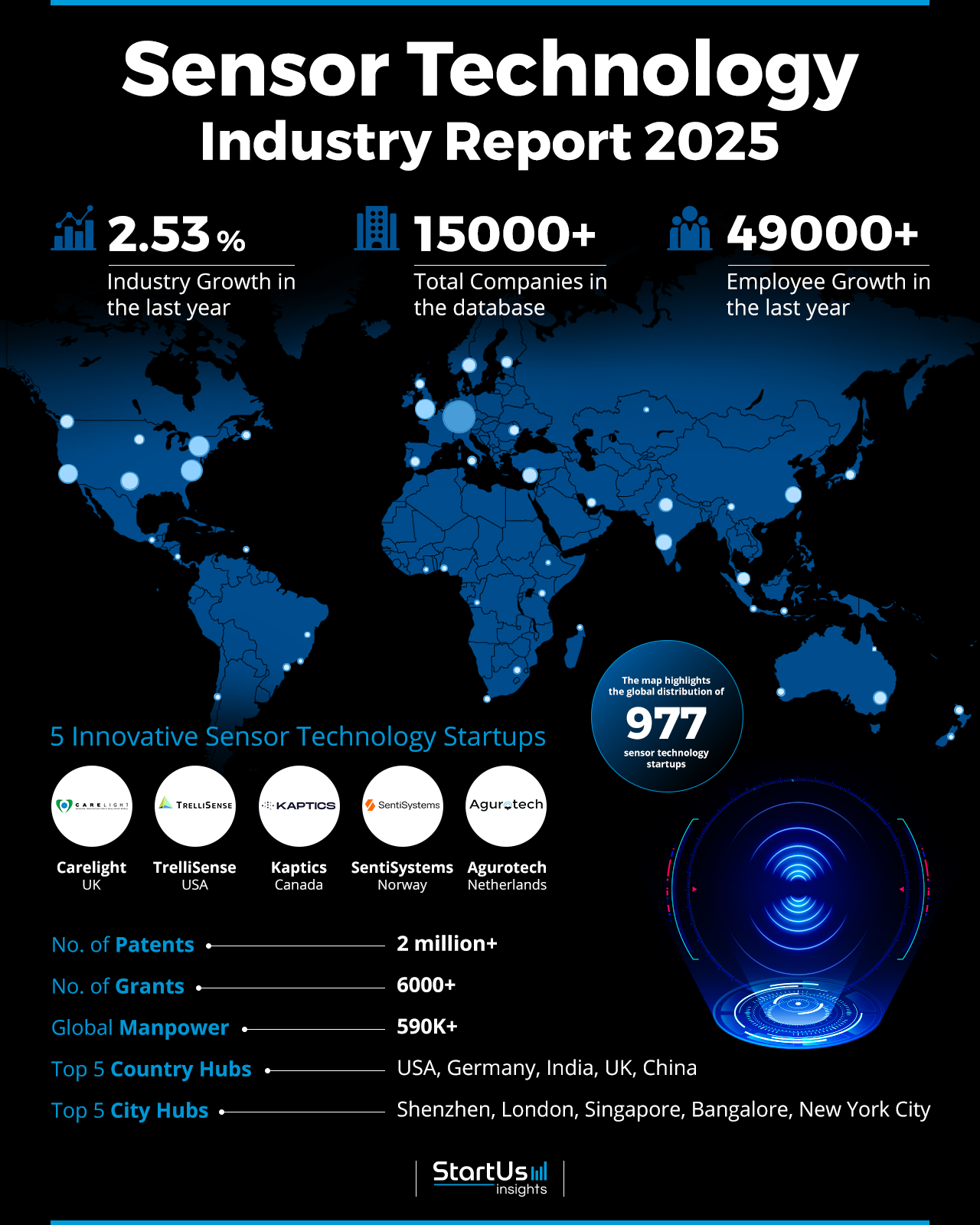

- Industry Growth Overview: The sensor industry grows at an annual rate of 2.53%, with over 15000 companies in the market, including more than 900 startups.

- Manpower & Employment Growth: The industry employs over 590,000 people globally, adding 49000+ new employees in the past year.

- Patents & Grants: The sensor sector holds over 2 million patents and over 6000 grants have been awarded.

- Global Footprint: Key hubs include the USA, Germany, India, the UK, and China, with major cities like Shenzhen, London, Singapore, Bangalore, and New York City.

- Investment Landscape: The sensor industry attracts investment, with an average investment value of USD 12.2 million per round and over 7,900 funding rounds closed across 2,400 companies.

- Top Investors: TransDigm, Perceptive Advisors, General Catalyst, and more have contributed more than USD 600 million.

- Startup Ecosystem: Five startups include Carelight (Opto-Physiological Monitoring), TrelliSense (Methane Emissions Detection), Kaptics (Biosensors for Immersive Applications), SentiSystems (Sensor Fusion Technology), and Agurotech (Irrigation Management).

- Recommendations for Stakeholders: Entrepreneurs should focus on developing multi-functional, energy-efficient sensors with precision to meet the growing demand across sectors like healthcare, automotive, energy, manufacturing, and more. Companies should also invest in advanced manufacturing techniques, such as miniaturization and sensor fusion, to improve product performance and integration capabilities. Governments should find ways to incentivize technologies that reduce waste and improve productivity.

Explore the Data-driven Sensor Market Report (2025)

The Sensor Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database includes over 15000 companies, with 900+ startups driving innovation in the sensor technology market. The sector grows at an annual rate of 2.53%, supported by over 2 million patents and 6000 grants.

The industry employs over 590000 people globally, with an employee growth of 49000 last year. The top five country hubs are the USA, Germany, India, the UK, and China, while city hubs are in Shenzhen, London, Singapore, Bangalore, and New York City. This shows the industry’s sustained growth and strategic concentration across key global hubs.

What data is used to create this sensor market report?

Based on the data provided by our Discovery Platform, we observe that the sensor industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the industry’s short-term future direction.

- News Coverage & Publications: The sensor industry generated over 10000 publications in the past year.

- Funding Rounds: Over 7900 funding rounds are recorded in our database.

- Manpower: The market employs over 590000 workers and added more than 49000 new employees in the past year.

- Patents: The industry holds over 2 million patents, making it one of the top patent-heavy industries across all sectors analyzed.

- Grants: More than 6000 grants have been awarded in the industry.

- Yearly Global Search Growth: The sensor industry achieved a 4.97% yearly global search growth.

A Snapshot of the Global Sensor Market

The sensor industry grows at an annual rate of 2.53%, with a startup ecosystem of 900+ companies. It emphasizes early innovation, with over 900 early-stage startups and more than 600 companies involved in mergers and acquisitions (M&A).

The sector holds 2 million+ patents, with over 506000 applicants contributing to a yearly patent growth rate of 3.59%. The United States leads with over 639000 patents, followed by China with over 355000 patents.

Explore the Funding Landscape of the Sensor Market

Investment activity in the sensor market remains strong, with an average investment value of USD 12.2 million per round. The industry has attracted over 1900 investors, resulting in more than 7900 funding rounds. This activity has led to investments in 2400+ companies, driving innovation and growth within the sector.

Who is Investing in Sensor Technology?

Top investors in the sensor industry have collectively invested over USD 600 million and contributed to the sector’s development and innovation.

- TransDigm has invested USD 123 million across 2 companies.

- Perceptive Advisors has allocated USD 86.5 million to 3 companies.

- General Catalyst has invested USD 81.1 million into 3 companies.

- Intel Capital has committed USD 79.7 million across 4 companies.

- EDBI has contributed USD 72.4 million to 2 companies.

- Green Pine Capital Partners has invested USD 62.2 million into 2 companies.

- IDG Capital has injected USD 56 million across 4 companies.

Access Top Sensor Innovations & Trends with the Discovery Platform

The sensor industry is evolving, with key trends shaping its future. Here are a few of them along with firmographic insights:

- Sensor Data Analytics includes more than 1100 companies and employs over 31K people, with 4K new employees added in the past year. This trend shows a 4.53% annual growth rate, indicating the increasing demand for advanced data analytics solutions in sensor technology.

- Wearable Sensors are represented by more than 450 companies with 14K employees, of which K joined in the last year. This trend has a 17.98% annual growth rate, transforming industries such as healthcare and fitness by integrating sensor capabilities into everyday devices.

- Quantum Sensors involves over 90 companies and 5K employees, including 600 new hires in the past year. This trend has a 35.44% annual growth rate, driven by breakthroughs in precision sensing applications across industries like defense, telecommunications, and healthcare.

5 Top Examples from 900+ Innovative Sensor Tech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Carelight offers Opto-Physiological Monitoring

UK-based startup Carelight develops Opto-Physiological Monitoring (OPM) technology, a smart sensor system for precise physiological monitoring. The startup’s patented OPM sensors use multi-wavelength illumination and 3D modeling to capture data on light interactions with biological tissue to provide readings without motion interference. This non-invasive technology adapts to individual users, optimizing performance for differences in skin tone, body composition, and activity levels. It allows real-time monitoring of vital signs like heart rate, respiration, and oxygen saturation. Carelight’s technology improves wearable medical devices and expands their use in healthcare and fitness.

TrelliSense enables Methane Emissions Detection

US-based startup TrelliSense provides methane emissions detection through its sensor platform for continuous monitoring across various industries and complying with regulations. The startup’s sensors use optical, ground-based systems that act like methane radars and detect, localize, and quantify methane leaks in real-time. These sensors employ path-integrated measurement to ensure sensitivity and monitor large areas, such as landfills, oil and gas facilities, and agricultural operations.

Kaptics develops Biosensors for Immersive Applications

Canadian startup Kaptics develops biosensors to enable real-time analysis of emotional responses and user engagement in virtual reality (VR) environments. The startup’s solution includes dry and flexible biosensors that monitor physiological signals like PPG, EEG, EMG, and EOG. These sensors integrate into head-mounted displays and stream signals wirelessly for hours. Kaptics’ platform allows live streaming of biosignals and creates objective outcome measures for entertainment, healthcare, and defense applications.

SentiSystems builds Sensor Fusion Technology

Norwegian startup SentiSystems creates sensor fusion technology for real-time data processing in autonomous operations. Its SentiBoard, a circuit board, synchronizes and timestamps data from multiple sensors to ensure accurate decision-making. The platform works with various sensor types, including GNSS receivers and inertial measurement units. The startup’s SentiUtils software framework supports data interpretation and processing, while SentiConnect interface cards offer integration for different sensor setups. SentiSystems’ technology provides navigation and situational awareness, even without GPS access, and benefits sectors like defense, logistics, and maritime operations.

Agurotech advances Irrigation Management

Dutch startup Agurotech provides a data-driven irrigation management solution to optimize water usage for farmers. It combines sensors, satellite imagery, and crop and soil models to recommend where, when, and how much to irrigate. Its Saturnia sensor, measures soil moisture, air humidity and pressure, air and soil temperature, solar radiation, and soil electrical conductivity and texture. Further, Agurotech’s platform integrates this data with weather stations and public databases to enable farmers to increase productivity, save water, and reduce the use of fertilizers and pesticides.

Gain Comprehensive Insights into Sensor Trends, Startups, or Technologies

The sensor industry will grow in 2025, driven by advancements in data analytics, wearables, and quantum sensors. Trends like AI integration, edge computing, and precision sensing will transform industries from healthcare to telecommunications. Get in touch to explore all 900+ startups and scaleups, as well as all industry trends impacting sensor companies.