The 2024 Spectroscopy Market Report highlights emerging trends, investment patterns, and technological advancements that are shaping the sector. Despite a slight decline in growth, the industry showcases investments and workforce expansion. Key areas such as Raman, nuclear magnetic resonance (NMR), and infrared spectroscopy emerge as R&D focal points. This report offers an analysis of the current state of the industry and the innovations driving it forward.

This spectroscopy report serves as a reference for key stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Spectroscopy Market Report 2024

- Executive Summary

- Introduction to the Spectroscopy Report 2024

- What data is used in this Spectroscopy Report?

- Snapshot of the Global Spectroscopy Industry

- Funding Landscape in the Spectroscopy Industry

- Who is Investing in Spectroscopy Solutions?

- Emerging Trends in the Spectroscopy Industry

- 5 Innovative Spectroscopy Startups

Executive Summary: Spectroscopy Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 300+ spectroscopy startups developing innovative solutions to present five examples from emerging spectroscopy industry trends.

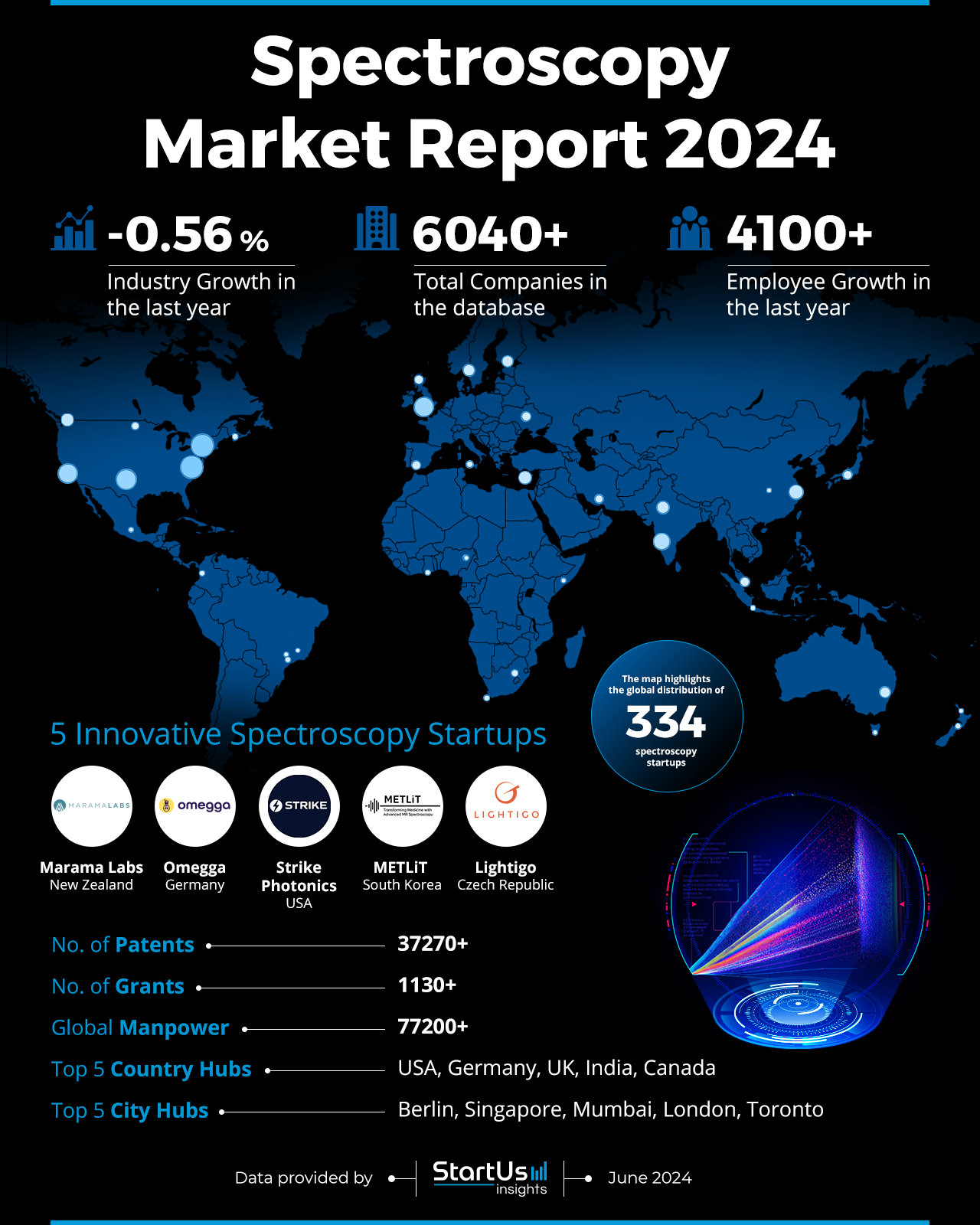

- Industry Growth Overview: The spectroscopy industry encompasses over 6040 companies and experienced a slight decline in growth, with an annual rate of -0.56%.

- Manpower & Employment Growth: The global workforce in the spectroscopy industry consists of over 77K professionals, with 4100+ employees added in the past year.

- Patents & Grants: The industry demonstrated innovation with over 37270 patents filed and more than 1130 grants awarded.

- Global Footprint: The top country hubs driving the industry forward are the USA, Germany, the UK, India, and Canada, while the top city hubs include Berlin, Singapore, Mumbai, London, and Toronto.

- Investment Landscape: The average investment value per funding round in the spectroscopy industry is USD 2.3 billion, with over 170 investors closing over 830 funding rounds with investments in 250+ companies.

- Top Investors: The top investors in the spectroscopy industry include EIF, Fundingbox Deep Tech, and SHS Capital. The combined value from top investors is about USD 11 million.

- Startup Ecosystem: Five innovative startup features include Marama Labs (UV-vis spectroscopy), Omegga (in-ovo chicken embryos sexing), Strike Photonics (photonic chip), METLiT (MRS AI solution), and Lightigo (laser-induced breakdown spectroscopy).

- Recommendations for Stakeholders: Investors should provide financial backing to Raman, NMR, and infrared spectroscopy. Driving growth through grants and favorable policies will allow companies to benefit from workforce development and innovation by collaborating with academic institutions.

Explore the Data-driven Spectroscopy Market Outlook 2024

The Spectroscopy Report 2024 uses data from the Discovery Platform and covers the key metrics that show the sector’s growth. The spectroscopy industry, despite facing a slight decline of 0.56% in growth last year, remains a growing field with a decent presence worldwide. Our comprehensive database includes over 6040 companies, among which 334 are innovative startups that drive new advancement in the sector. The industry also showed innovation with over 37270 patents filed and more than 1130 grants awarded.

In terms of manpower, the global workforce in the spectroscopy industry reached over 77K professionals, with an employee growth of 4100+ in the past year. The top five country hubs leading the industry are the USA, Germany, the UK, India, and Canada, while the top five city hubs include Berlin, Singapore, Mumbai, London, and Toronto. These hubs explore research, development, and commercialization in the field of spectroscopy.

What data is used to create this spectroscopy report?

Based on the data provided by our Discovery Platform, we observe that the spectroscopy industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: Over 4990 news articles were published on the spectroscopy industry in the last year.

- Funding Rounds: The sector experienced significant investment activity, with data on over 830 funding rounds available in our database.

- Manpower: The industry shows a substantial workforce and employs over 77K workers globally. It added 4100+ new employees in the last year alone.

- Patents: More than 37270 patents were filed in the spectroscopy industry.

- Grants: The sector also secured over 1130 grants and supported ongoing research and development.

- Yearly Global Search Growth: The spectroscopy industry experienced a yearly global search growth of 3.93% reflecting increasing interest and engagement worldwide.

- and more. Contact us to explore all data points used to create this spectroscopy report.

A Snapshot of the Global Spectroscopy Industry

The total manpower within the industry stands at over 77K professionals and showcases the dedicated workforce. In the past year alone, the industry saw an employee growth of over 4100 to indicate expansion and increased employment opportunities. The industry comprises more than 6040 companies and reflects a diverse landscape of organizations contributing to its development and innovation.

Explore the Funding Landscape of the Spectroscopy Industry

The average investment value per funding round is USD 2.3 billion. The industry attracted more than 170 investors and closed over 830 funding rounds. This resulted in investments in over 250 companies and highlighted the industry’s potential to investors for continued growth and innovation.

Who is Investing in Spectroscopy?

The spectroscopy industry attracted investments from top investors, contributing a combined value of more than USD 11 million. The breakdown of these investments is as follows:

- EIF invested in 3 companies with a total investment value of USD 54K.

- Fundingbox Deep Tech funded 2 companies with a total investment value of USD 500K.

- SHS Capital contributed a total investment value of USD 6 million to 2 companies.

- Sartorius allocated at least 1 company with a total investment value of USD 4 million.

- The Iowa Economic Development Authority financed at least 1 company with a total investment value of USD 100K.

- and more. Reach out to us to explore all investment data in the spectroscopy industry.

Access Top Spectroscopy Innovations & Trends with the Discovery Platform

Quantum Dot technology includes 290+ companies. These companies employ 14400 professionals, including 1400 new employees added last year. Despite this, the trend’s annual growth rate declined by 1.71%.

Near-Infrared Spectroscopy (NIRS) experiences growth with an annual growth rate of 10.41%. The sector comprises 150+ companies. The trend employs 6300+ professionals, with 510+ new employees added last year.

Optoelectronics encompasses 2400+ companies. This sector employs over 344K professionals, with 17300 new employees added in the past year. However, the annual trend growth rate saw a decline of 5.33%, suggesting market saturation and new obstacles.

5 Top Examples from 300+ Innovative Spectroscopy Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Get in touch to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Marama Labs offers UV-Vis Spectroscopy

New Zealand-based startup Marama Labs provides quantification of therapeutic content in nanoparticle formulations. Its CloudSpec device uses scatter-corrected absorption (SCA) technology to measure ribonucleic acid (RNA) in lipid nanoparticles without fluorescence interference. This technology eliminates light scattering issues and ensures absorption spectra for analysis. CloudSpec employs dual-pathway integrating-sphere technology to allow simultaneous measurement of regular UV-Vis and scattering spectra. Applications include spectroscopy of therapeutic particles, bacterial growth monitoring, and nanoparticle formulation characterization.

Omegga provides In Ovo Chicken Embryos Sexing

German startup Omegga develops a non-invasive, AI-powered spectroscopy solution for early in-ovo sex detection of chicken embryos. Its technology integrates with existing incubation infrastructure. It uses light to scan eggs every five hours from day three to day six. The AI, using optical and machine learning, then detects the sex of the chick by the seventh day of incubation based on time-based indicators. This offers a cost-effective method for egg-laying farms to adopt sustainable practices.

Strike Photonics develops Photonic Chips

US-based startup Strike Photonics develops photonic chips for applications in viral testing, electronic warfare, telecommunications, and biomedical testing and monitoring. The startup’s proprietary technology integrates Raman spectroscopy with semiconductor manufacturing for biotechnology solutions. The initial production phase provides pathogen detection, screening, and monitoring. Applications include COVID and multi-pathogen detection, drug screening, toxicology, blood screening, and respiratory diagnostics. Also, it supports blood chemistry, antibody therapeutics, and remote patient monitoring.

METLiT provides an AI-powered MRS Solution

South Korean startup METLiT builds an AI-powered solution for advancing magnetic resonance spectroscopy (MRS) in clinical settings. It integrates conventional MRS methods with deep learning-based quantification to analyze metabolites. Moreover, it automates the analysis of metabolite information to enhance the diagnostic and treatment processes. The solution also reduces MRS scan and analytic time while improving workflow efficiency. It assists with early diagnosis, drug development, therapeutic efficacy evaluation, and new disease mechanisms.

Lightigo uses Laser-induced Breakdown Spectroscopy

Czech Republic-based startup Lightigo uses laser-induced breakdown spectroscopy (LIBS) for multi-elemental analysis and chemical imaging. The technology utilizes laser ablation to create microplasma and enable both quantitative and qualitative analysis of chemical elements. The startup’s FireFly system offers fast elemental imaging with a motorized 3-axis stage and microscopy sample view unit. SyncRay, a 5-channel digital delay generator, ensures precise synchronization of analytical components. Lightigo’s 3-axes motorized stage provides micrometer precision and automated sample manipulation for chemical mapping.

Gain Comprehensive Insights into Spectroscopy Trends, Startups, or Technologies

The 2024 Spectroscopy Industry Report underscores the innovation within the sector. Despite facing a slight decline in growth, the industry demonstrated strength through investments and workforce expansion. Key areas like molecular spectroscopy, atomic spectroscopy, and mass spectrometry highlight the potential for future R&D advancements. Contact us to explore all 300+ startups and scaleups, as well as all industry trends impacting spectroscopy companies.