Finding the right startups to invest in can be as challenging as it is rewarding. This article explores 10 diverse strategies on how to do it, from leveraging technology and expanding your network to personal discovery methods. We’ll make sure you have the right tools to uncover promising startups aligning with your investment goals.

10 Proven Strategies to Discover Promising Startups for Investment

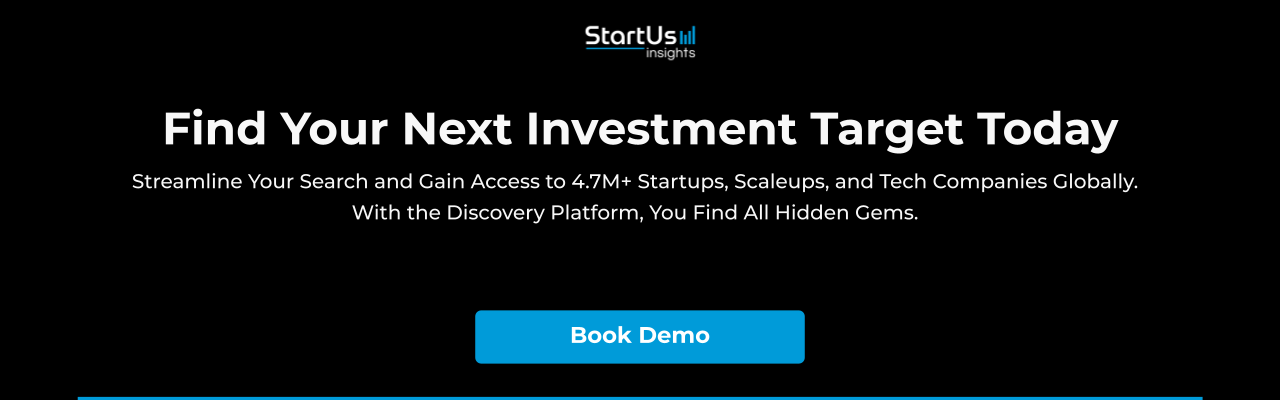

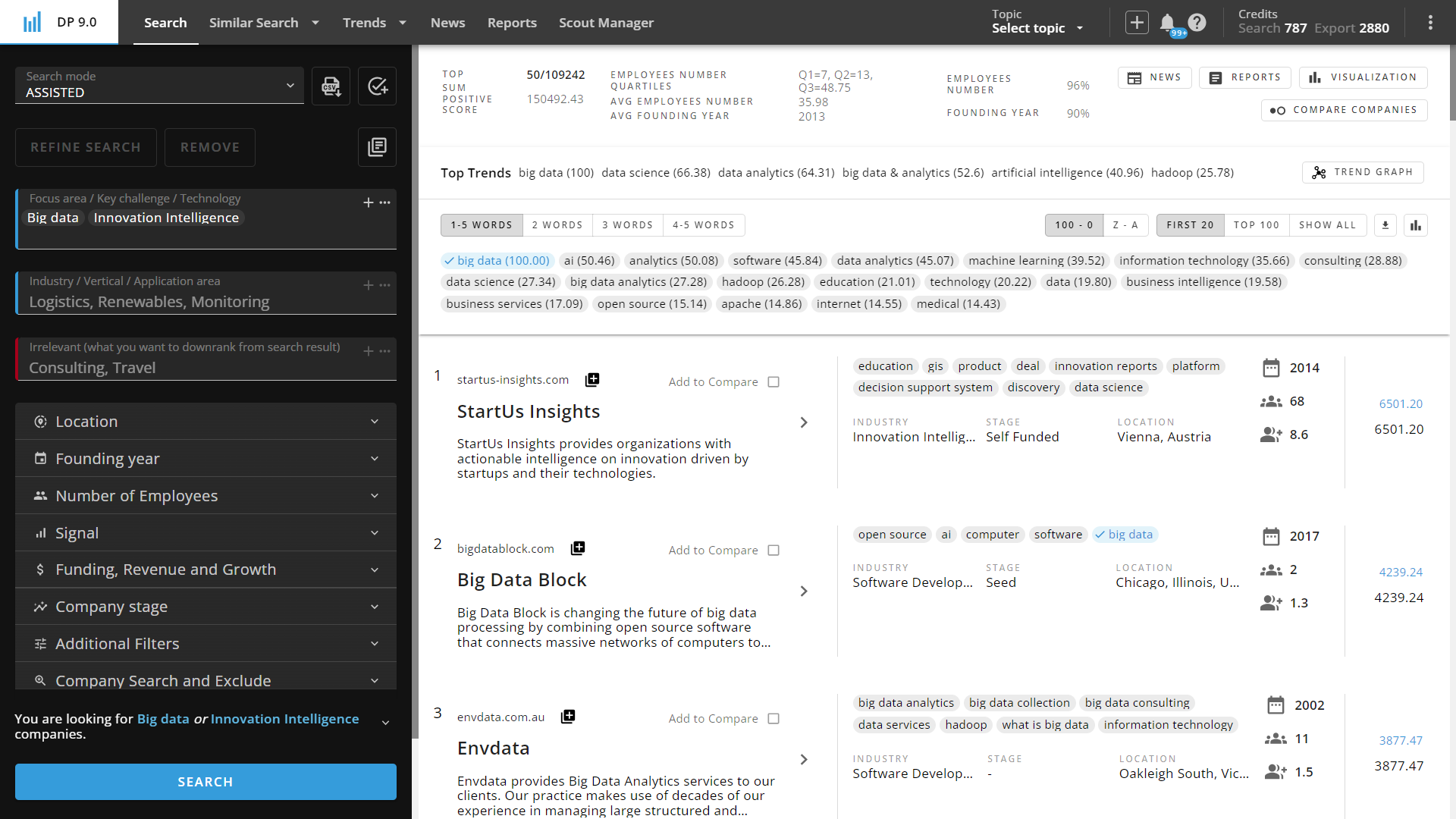

1. SaaS Platforms: The Digital Investor’s Toolbox

SaaS platforms gather and analyze startup data, offering insights into growth, industry trends, and potential, making them invaluable for investors who prioritize data-driven decision-making. These platforms deliver high-quality insights and allow you to discover startups globally, filter them based on your criteria, and consolidate all crucial information in one place – it is convenient, fast, and reliable.

Why is it useful? These platforms aggregate vast amounts of data on startups, providing analytics, firmographics, growth metrics, and industry insights that allow you to identify promising investment opportunities.

Keep in mind: Access to the most valuable data often requires a subscription.

How to do it: Subscribe to popular SaaS platforms like StartUs Insights that focus on the global startup ecosystems, and use their tools to filter and identify startups that precisely meet your investment criteria.

Credit: StartUs Insights

2. Google Search: The Free Resource You’re Overlooking

Just about everyone knows how to use Google, but few master the art of striking startup gold with the right search techniques. It’s a vast sea of information where valuable finds require patience and skill to unearth.

Why is it useful? It’s a free, accessible way to find news articles, press releases, and direct websites of startups across the globe.

Keep in mind: Information can be overwhelming and unstructured, requiring significant time to sift through and verify.

How to do it: Use targeted search queries including industry keywords, investment rounds, and specific terms like “emerging startups in [industry/region].”

Credit: Google

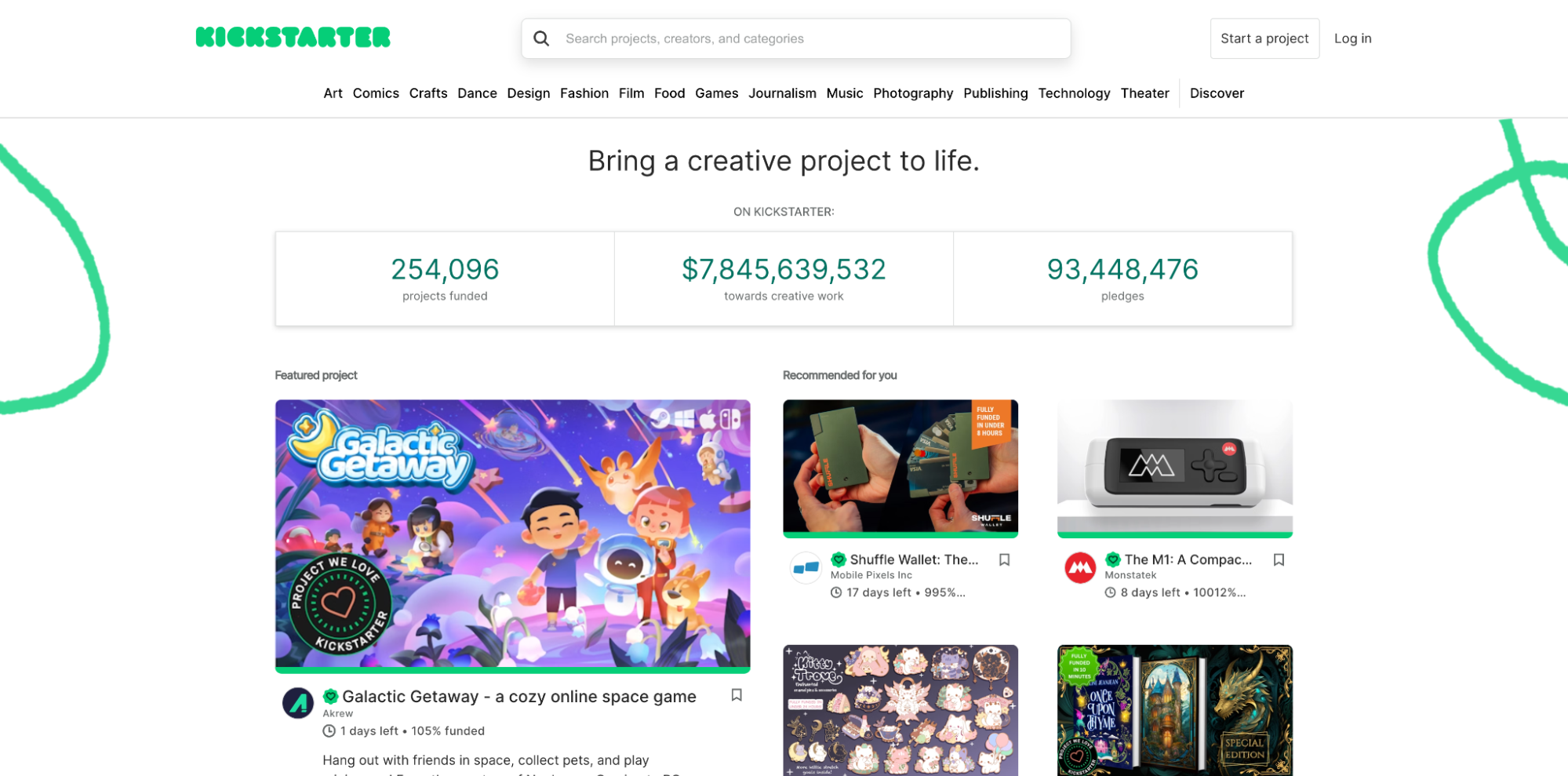

3. Crowdfunding Platforms: Public Sentiment as Your Guide

Crowdfunding platforms showcase startups that have captured the public’s imagination and received initial financial backing. They offer a peek into market acceptance, though not every crowd favorite turns into a long-term success.

Why is it useful? They provide early insight into startups that have managed to generate public interest and secure initial funding, indicating their growth potential.

Keep in mind: Not all startups looking for crowdfunding will succeed in the long term, and the platforms’ focus might not align with your investment strategy.

How to do it: Regularly browse crowdfunding platforms like Kickstarter or Indiegogo for startups with high backing and engagement, and research their market potential further.

Credit: Kickstarter

4. Networking: Your Connection to the Startup World

Building a solid network within the startup ecosystem can unlock doors to potential investment opportunities that you wouldn’t find elsewhere. It’s about who you know, as much as what you know.

Why is it useful? Personal connections provide insider information and direct introductions to startup founders, offering you a competitive edge.

Keep in mind: Building a valuable network takes a lot of time and effort, and not all connections will lead to fruitful opportunities.

How to do it: Attend industry meetups, join relevant online forums, and actively participate in the startup ecosystem to build and maintain your network.

5. Accelerators/Incubators: The Early Bird’s View

These programs are a hotbed for innovation, providing support and resources to startups in their initial stages. They’re a direct line to fresh talent and ideas, though they lean towards the riskier, early-stage ventures.

Why is it useful? These programs typically support startups in their early stages, and being associated with them provide access to a curated pool of innovating companies.

Keep in mind: The focus is often on very early-stage startups, which may carry a higher risk for investors.

How to do it: Follow and engage with well-known accelerators like Station F or YC, attend their demo days, and establish connections with both the programs and their startups.

Credits: Station F

6. VCs: Jumping the Train of Industry Insiders

Venture capitalists are in the business of spotting winners early. Keeping an eye on their movements can lead you to promising startups, albeit the competition for these investments is fierce.

Why is it useful? Venture capitalists have extensive networks and a keen eye for successful startups, making them a valuable source of potential leads.

Keep in mind: VCs may be reluctant to share their best finds with potential competitors in investment.

How to do it: Network with VCs like Sequoia, attend industry events where they speak, and follow their public recommendations and investments as leads for your own research.

Credit: Sequoia

7. Attending Events: Where Ideas and Investors Mingle

From MWC to local meetups, events offer a platform for startups to shine and investors to discover. The right event can be a goldmine of opportunities if you’re willing to dig.

Why is it useful? Events offer opportunities to meet startup founders face-to-face and get a firsthand look at their products and pitches.

Keep in mind: Attending events can be time-consuming and costly, with no guarantee of finding a viable investment.

How to do it: Plan your event calendar, focusing on those with startup pitches, networking opportunities, and industry relevance to your investment focus.

8. Social Media: Talk of the Town

Social media platforms are not just for cat videos; they’re a real-time source of startup buzz, founder insights, and community sentiment. It’s a dynamic way to track emerging trends, though it requires sifting through a lot of noise.

Why is it useful? It is a dynamic way to follow startups, see real-time updates, and gauge public interest and sentiment towards them.

Keep in mind: Social media can contain a lot of noise and unverified information, requiring discernment to identify real business opportunities.

How to do it: Follow hashtags, join groups, and engage with communities relevant to your investment areas on platforms like LinkedIn, X, and specialized forums.

9. Looking at Products You Use: Personal Experience as Your Guide

Sometimes, the best investment opportunities come from your own experiences with innovative products or services. It’s a personal touch to investing, though your individual taste may not always align with the broader market.

Why is it useful? Investing in startups behind products you personally believe in can offer unique insights into their market fit, user experience, and potential for growth. It’s a firsthand understanding that external data might not fully capture.

Keep in mind: Your personal preferences might not align with broader market trends or needs, potentially skewing your investment focus towards niche or less profitable areas. Additionally, there’s a risk of confirmation bias, where you might overlook flaws or overestimate the potential of a product because you like it.

How to do it: Keep track of the products or services that genuinely excite you or solve a problem in a way that you find innovative. Research the companies behind these products, their market position, growth trajectory, and funding history to evaluate their potential as an investment.

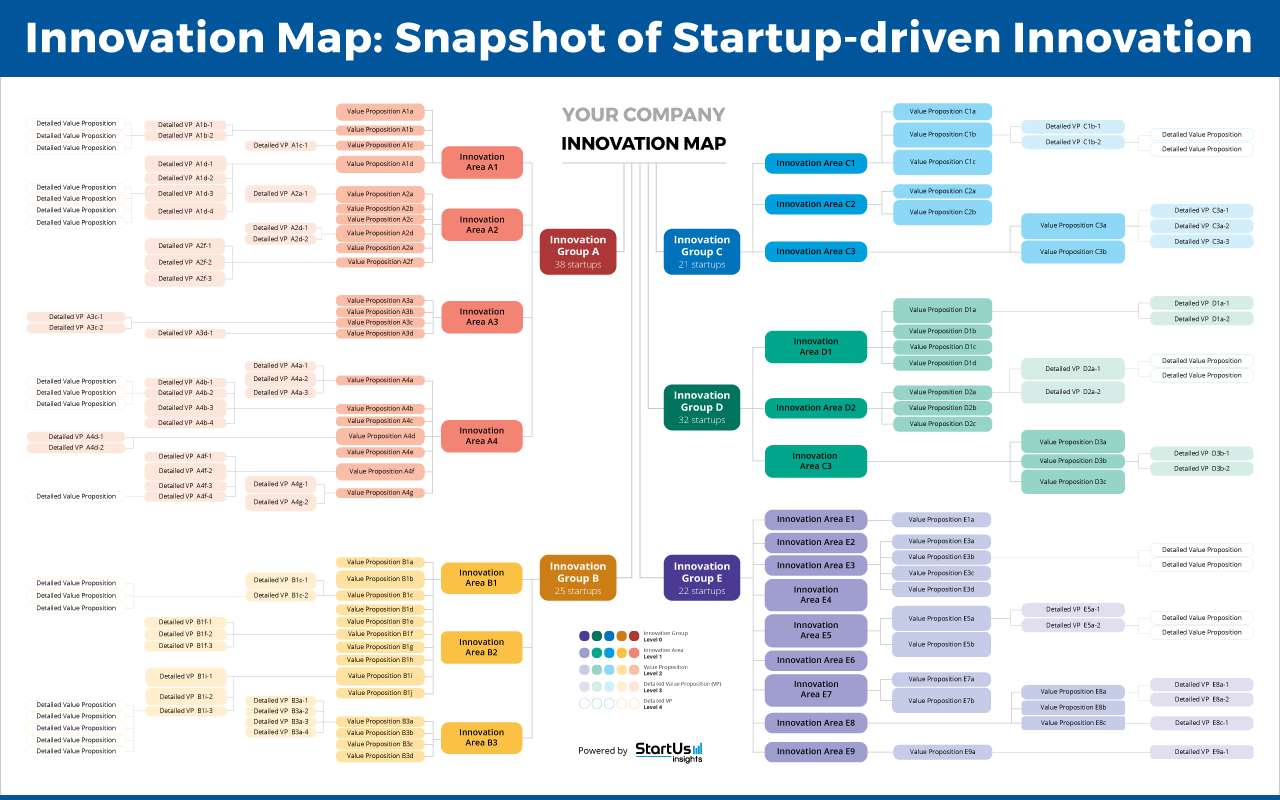

10. Startup Scouting: The Proactive Approach to Investment

Actively seeking out startups that match your investment targets allows for a tailored approach to finding potential winners. It’s about knowing what you want and going after it, a strategy that demands clarity on your investment goals.

Why is it useful? It allows investors to take a more proactive role in their investment choices, focusing on areas with the most personal or professional interest. This method can uncover startups that might not yet be on the radar of larger investors or platforms, providing early access to potentially lucrative opportunities.

Keep in mind: Startup scouting requires a deep understanding of the sectors or technologies you’re interested in to effectively identify promising startups.

How to do it: Leverage full-service providers like StartUs Insights to quickly explore startups across various sectors and technologies that precisely match your investment criteria. Engage with the ecosystem through their curated data, saving time and resources in your scouting efforts. Their platform ensures you’re well-equipped for initial contact, evaluation, and due diligence, streamlining your investment process and enhancing the effectiveness of your startup scouting strategy.

The Innovation Map is an example of a Data-Driven Startup Scouting Deliverable. It gives you an overview of innovation areas and applications, accessible at one glance.

Find Your Next Investment Target Today

As you venture for your next startup investments, remember that the journey is as critical as the destination. To truly streamline your search and gain access to an expansive database covering 4.7 million startups, scaleups, and tech companies globally, book a demo with our Discovery Platform. This step could be the game-changer in your investment strategy, providing you with unparalleled insights and opportunities. Don’t miss out on uncovering the hidden gems.