The 2025 Telecommunications Market Report highlights the sector’s evolution, driven by 5G expansion, early 6G development, and rising demand for IoT, edge computing, and cloud-based services. It examines key trends, investment flows, major players, and partnerships shaping the industry’s growth. The report serves as a reference for stakeholders as it offers insights into the telecom market’s trajectory for innovation and expansion.

This report was last updated in January 2025.

Executive Summary: Telecommunications Industry Report 2025

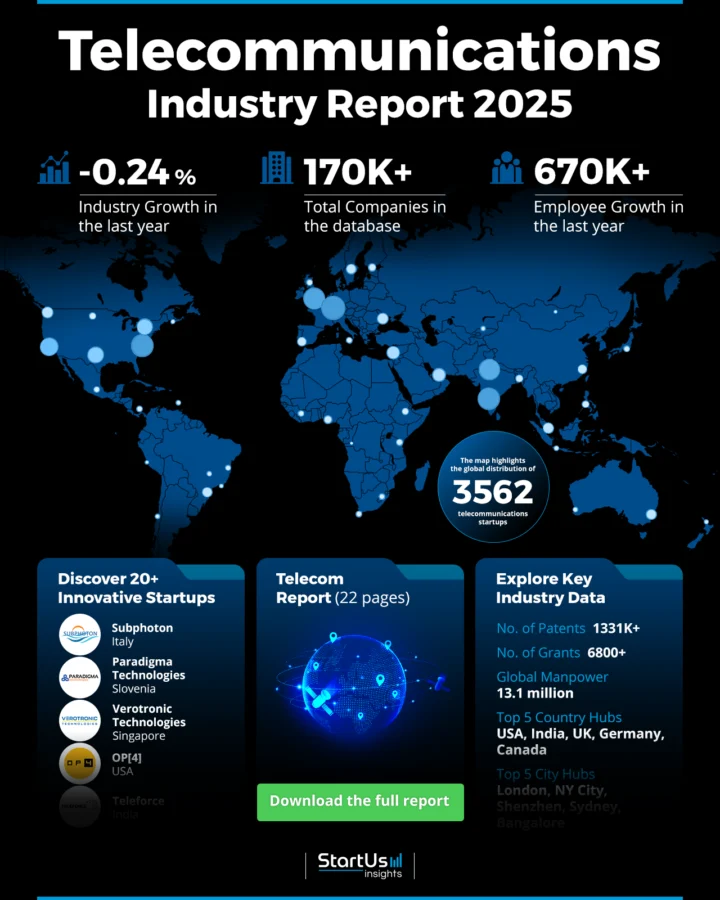

- Industry Growth Overview: The telecom industry features over 170K active companies and about 3500 startups. The global telecommunications market is projected to reach USD 3164.35 billion in 2025, reflecting a compound annual growth rate of 6.0%. On a granular level, the telecom industry recorded a decline of 0.24% last year as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The industry employs over 13 million people globally, adding 670K workers last year.

- Patents & Grants: Telecom companies hold more than 1.33 million patents and have secured over 6800 grants worldwide.

- Global Footprint: Key country hubs include the USA, India, the UK, Germany, and Canada. City hubs such as London, New York City, Shenzhen, Sydney, and Bangalore highlight telecom’s international distribution.

- Investment Landscape: The average investment round in telecom is valued at USD 55.6 million, with over 41K rounds completed and more than 11K companies receiving investment.

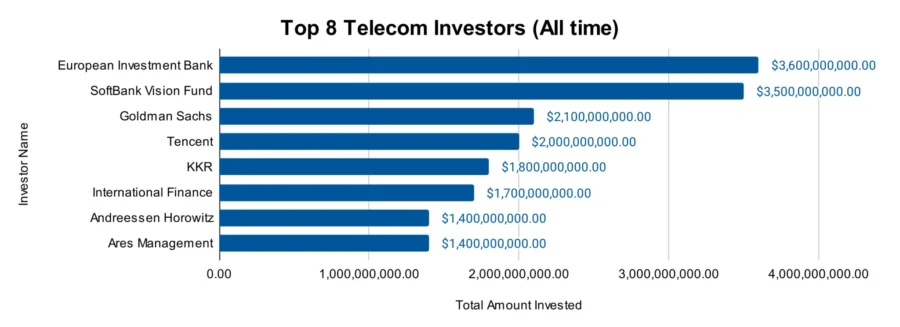

- Top Investors: The European Investment Bank, SoftBank, Goldman Sachs, and more investors contribute to a combined investment value exceeding USD 17 billion.

- Startup Ecosystem: Innovative startups include Subphoton (submarine optical amplifiers), Paradigma Technologies (mmWave for satellites), Verotronic Technologies (RF cables and connectors), OP[4] (automated cybersecurity), and Teleforce (CPaaS), each contributing unique solutions to industry growth.

Methodology: How we created this Telecommunication Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of telecommunication over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within telecommunication

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the telecommunication industry.

What Data is Used to Create This Telecom Market Report?

Based on the data provided by our Discovery Platform, we observe that the telecom industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The telecom industry received coverage in over 24K articles last year.

- Funding Rounds: More than 41K funding rounds are recorded in our database.

- Manpower: With a workforce exceeding 13 million, the industry added over 670K employees last year.

- Patents: The market has more than 1.33 million patents.

- Grants: Telecom companies have secured over 6800 grants. This emphasizes access to public and private funding support.

- Yearly Global Search Growth: Despite other growth indicators, global search interest for telecom declined by 2.56% last year.

Explore the Data-Driven Telecommunications Industry Outlook for 2025

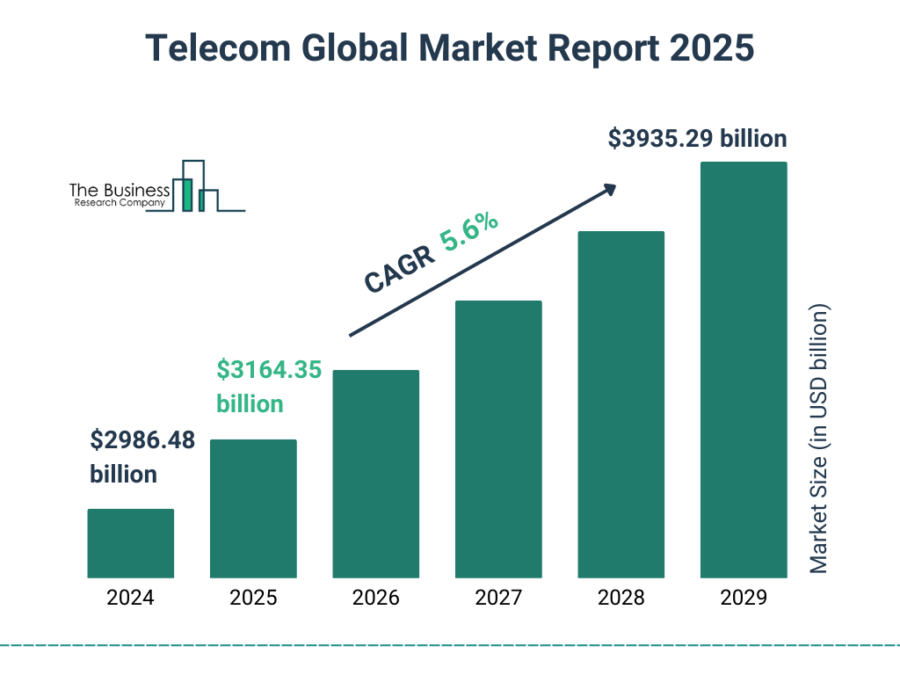

According to Business Research Company, the global market telecommunication market is projected to reach from USD 3164.35 billion in 2025 to USD 3935.29 billion in 2029 at a compound annual growth rate of 5.6%.

The Telecom Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

Our database features 3500+ startups within a pool of over 170K companies. The telecom industry slightly declined with a 0.24% annual growth rate.

Credit: Business Research Company

Mordor Intelligence predicts that India’s telecom market size is estimated at USD 53.18 billion in 2025, and is expected to reach USD 83.34 billion by 2030, at a CAGR of 9.4% during the forecast period 2025-2030.

In 2024, worldwide spending in the telecom industry reached nearly USD 1.6 trillion, marking a 4.3% increase.

Another analysis by Grand View Research estimates the telecom services market to grow from USD 1983.08 billion in 2024 to USD 2095.72 billion in 2025, with a CAGR of 6.5% from 2025 to 2030.

Additionally, the workforce comprises 13.1 million professionals, with an addition of 670K employees last year.

The top country hubs include the USA, India, the UK, Germany, and Canada. Also, the key city hubs are London, New York City, Shenzhen, Sydney, and Bangalore, showcasing the industry’s global distribution.

Moreover, India’s telecom sector has over 1.19 billion subscribers and 949.21 million broadband users, reflecting rapid digital adoption.

A Snapshot of the Global Telecom Industry

The annual growth rate shows a slight decline at 0.24%. The ecosystem includes 3500+ startups, with over 5100 in the early stages and 7700 companies involved in mergers and acquisitions.

Additionally, innovation remains strong, with over 1.33 million patents and 266K applicants globally.

The patents grew at 4.27% annually, with the USA issuing more than 454K patents and China contributing over 219K.

Further, the UK’s Competition and Markets Authority approved the USD 20.2 billion merger between Vodafone’s UK business and CK Hutchison’s Three UK, creating the largest mobile operator in Britain, with a commitment to invest USD 13.5 billion in 5G infrastructure over eight years.

Explore the Funding Landscape of the Telecom Industry

Investment remains active, with an average of USD 55.6 million per funding round. The industry has seen over 22K investors, supporting more than 11K companies through 41K completed funding rounds.

Moreover, Verizon Communications announced a USD 20 billion acquisition of Frontier Communications to expand its fiber footprint and improve convergence strategies by integrating wireless and wired networks.

The Australian government also unveiled a USD 3.8 billion investment to upgrade the national broadband network (NBN) from copper to fiber to reduce reliance on services like Elon Musk’s Starlink and improve network reliability.

Who is Investing in the Telecom Industry?

The top investors in the telecom industry have invested over USD 17 billion, reflecting significant financial backing.

- European Investment Bank leads with USD 3.6 billion invested across 27 companies. The EIB plans to invest over 50% of annual lending in climate action by 2025, supporting USD 1.03 trillion in projects through 2030.

- SoftBank Vision Fund has allocated USD 3.5 billion to 15 companies. SoftBank’s Vision Fund announced a USD 500 million investment in OpenAI, reflecting its strategic focus on AI and related technologies.

- Goldman Sachs invested USD 2.1 billion across 31 companies. Goldman Sachs reported 2024 net revenues of USD 53.51 billion, net earnings of USD 14.28 billion, a diluted EPS of USD 40.54, and an ROE of 12.7%.

- Tencent invested USD 2 billion in 25 companies. Tencent expanded in gaming by raising its stake in Remedy Entertainment to 14% and providing a USD 18.3 million loan to the company.

- KKR invested USD 1.8 billion across 22 companies.

- International Finance Corporation provided USD 1.7 billion to 23 companies. The IFC announced a USD 534 million green and sustainability-linked loan to ENGIE S.A.

- Andreessen Horowitz committed USD 1.4 billion to 22 companies. It participated in a USD 105 million funding round for Anysphere, an AI startup. Moreover, Andreessen Horowitz and Eli Lilly launched a USD 500 million biotech venture fund for health technologies and innovation.

- Ares Management invested USD 1.4 billion in 10 companies. Also, Ares Management announced the acquisition of GLP Capital Partners’ international business (excluding China) for USD 3.7 billion.

Moreover, telecom operators are projected to invest over USD 1 trillion in network infrastructure globally by 2025. This investment is primarily focused on improving capabilities for emerging technologies like 5G and IoT.

Further, The US telecom market is expected to reach USD 459.38 billion in 2025, growing from an estimated USD 442.52 billion in 2024.

Top Telecom Innovations & Trends

Explore the emerging trends in the telecom industry including the firmographic insights:

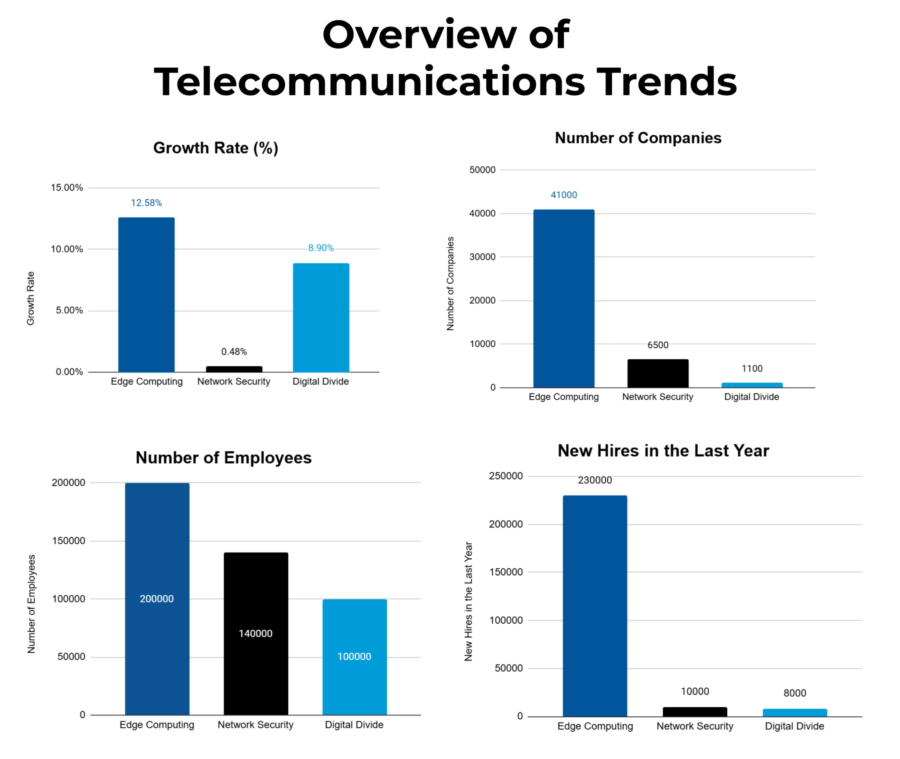

- Edge Computing is emerging as companies seek faster processing and reduced latency for real-time applications. This trend includes over 41K companies and employs more than 2 million people. The workforce grew by 230K employees last year, which reflects the rising demand for localized data processing. The annual trend growth rate is 12.58%, showing rapid industry adoption and investment.

- Network Security is a critical priority, driven by evolving cyber threats and increasing digital connectivity. With 6500 companies engaged, the sector employs over 140K professionals. Last year, 10K new employees joined the workforce, emphasizing the growing need for security solutions. The annual trend growth rate is 0.48%, which indicates a steady focus on cybersecurity across industries.

- The Digital Divide is a focal area for industry leaders to bridge connectivity gaps in underserved regions. This trend involves 1100 companies and employs more than 100K people, with 8K new employees added last year. The annual trend growth rate is 8.90%, which demonstrates increasing efforts to address accessibility and connectivity issues worldwide.

5 Top Examples from 3500+ Innovative Telecom Startups

The five innovative startups showcased below are hand-picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Subphoton develops Submarine Optical Amplifier

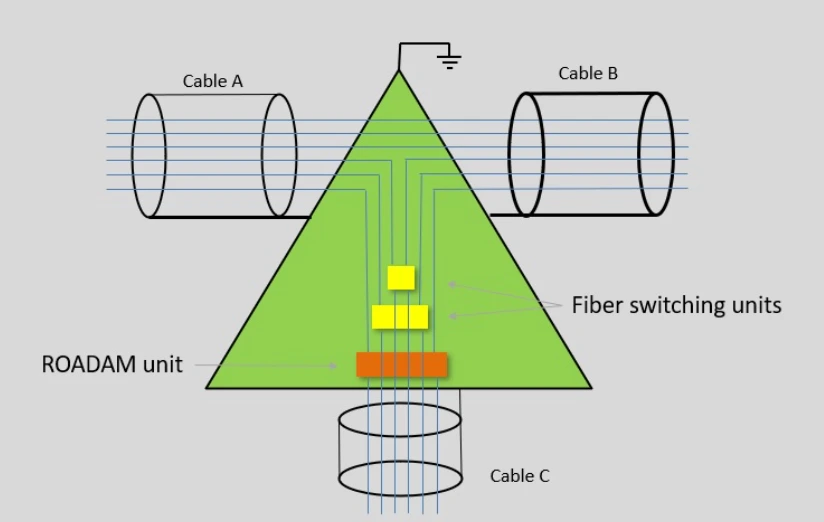

Italian startup Subphoton makes submarine telecommunication technology, specializing in optical amplifiers and reconfigurable branching units for underwater cable systems.

Its technology improves signal transmission across ocean depths to ensure bandwidth and data capacity with minimal signal loss.

The startup’s optical amplifiers increase efficiency and reliability to support global internet infrastructure by meeting the rising demand for high-speed data transmission.

Further, Subphoton’s products integrate with existing networks to offer telecom operators enhanced performance and lower operating costs.

Paradigma Technologies delivers mmWave Radio for Satellites

Slovenian startup Paradigma Technologies develops telecommunication solutions for small satellites, CubeSats, and satellite-on-the-move (SOTM) applications.

Its products include K-band and Ka-band transmitters and receivers to enhance satellite communication with high data rates and low power consumption.

In addition, the startup’s systems integrate compact, lightweight designs for space missions and offer features like multi-standard modulation, EMI shielding, and communication protocols for compatibility with diverse satellite platforms.

With integrated modems and support for low and high data-rate transmissions, the solutions cater to next-generation satellite networks and facilitate high-throughput communication for low Earth orbit (LEO) and geostationary satellites.

Moreover, Paradigma Technologies advances satellite communication infrastructure by delivering scalable and energy-efficient systems to meet the demands of the space and telecommunications industries.

Verotronic Technologies manufactures RF Cables and Connectors

Singaporean startup Verotronic Technologies provides RF cables, connectors, and precision adapters for industries like aerospace, telecommunications, quantum computing, and healthcare.

The startup offers specialized cable series, including VERO PHASE for high-frequency testing, VERO FLEX for flexible testing environments, and VERO TEST for low-loss laboratory setups.

Further, these solutions ensure minimal insertion loss, high phase stability, and precise signal transmission to meet the needs of demanding applications like satellite systems and 5G networks.

OP[4] offers AI-powered Automated Remediation

US startup OP[4] develops an automated cybersecurity platform to detect, prioritize, and remediate vulnerabilities in IoT devices and embedded systems.

The platform leverages technology developed through DARPA to simulate devices, analyze risk at the binary code level, and differentiate between active and inactive vulnerabilities.

This system enables continuous monitoring and real-time remediation of N-day and zero-day vulnerabilities, which enables organizations to address critical risks efficiently.

Its key features include AI-powered vulnerability mitigation, integration with supply chain risk management, and support for OEMs and integrators in industries like aerospace, telecommunications, and medical devices.

Additionally, OP[4] automates complex security tasks and enables organizations to build safer products, reduce time to market, and protect critical infrastructure from cyberattacks.

Teleforce provides a Communication Platform as a Service (CPaaS)

Indian startup Teleforce offers a Communications Platform as a Service (CPaaS) to enhance business communication with AI-powered tools and multi-channel support.

The platform uses large language models (LLMs) to create dynamic chatbots, automate routine inquiries, and manage organizational knowledge bases efficiently. These features allow businesses to streamline customer interactions across voice, email, SMS, and chat channels and offer consistent, context-aware responses.

Moreover, the startup’s platform supports scaling operations as businesses grow to ensure the management of increasing query volumes without compromising performance.

It also improves sales and marketing functions by automating lead management and delivering personalized email campaigns driven by predictive analytics.

Gain Comprehensive Insights into Telecom Trends, Startups, or Technologies

The telecom industry in 2025 is set for steady growth, driven by advancements in edge computing, network security, and efforts to bridge the digital divide. Innovation and investment will shape the future, with companies focusing on localized processing, enhanced cybersecurity, and expanding global connectivity.

Get in touch to explore all 3500+ startups and scaleups and all industry trends impacting telecom companies.