The digital age has forced banks and financial institutions to rethink how to engage with their customers in order to provide them with the solutions they need. At the same time, a large number of the global population still lack access or information to operate bank accounts. Changing consumer behavior, with younger people owning much less collateral or security and the demand for instant money transfers, encourages FinTech startups to develop novel solutions that incorporate blockchain, artificial intelligence (AI), and big data to include more people in the formal banking sector. This research provides you with the top 5 global hubs for fintech startups.

Top 5 Global FinTech Startup Hubs

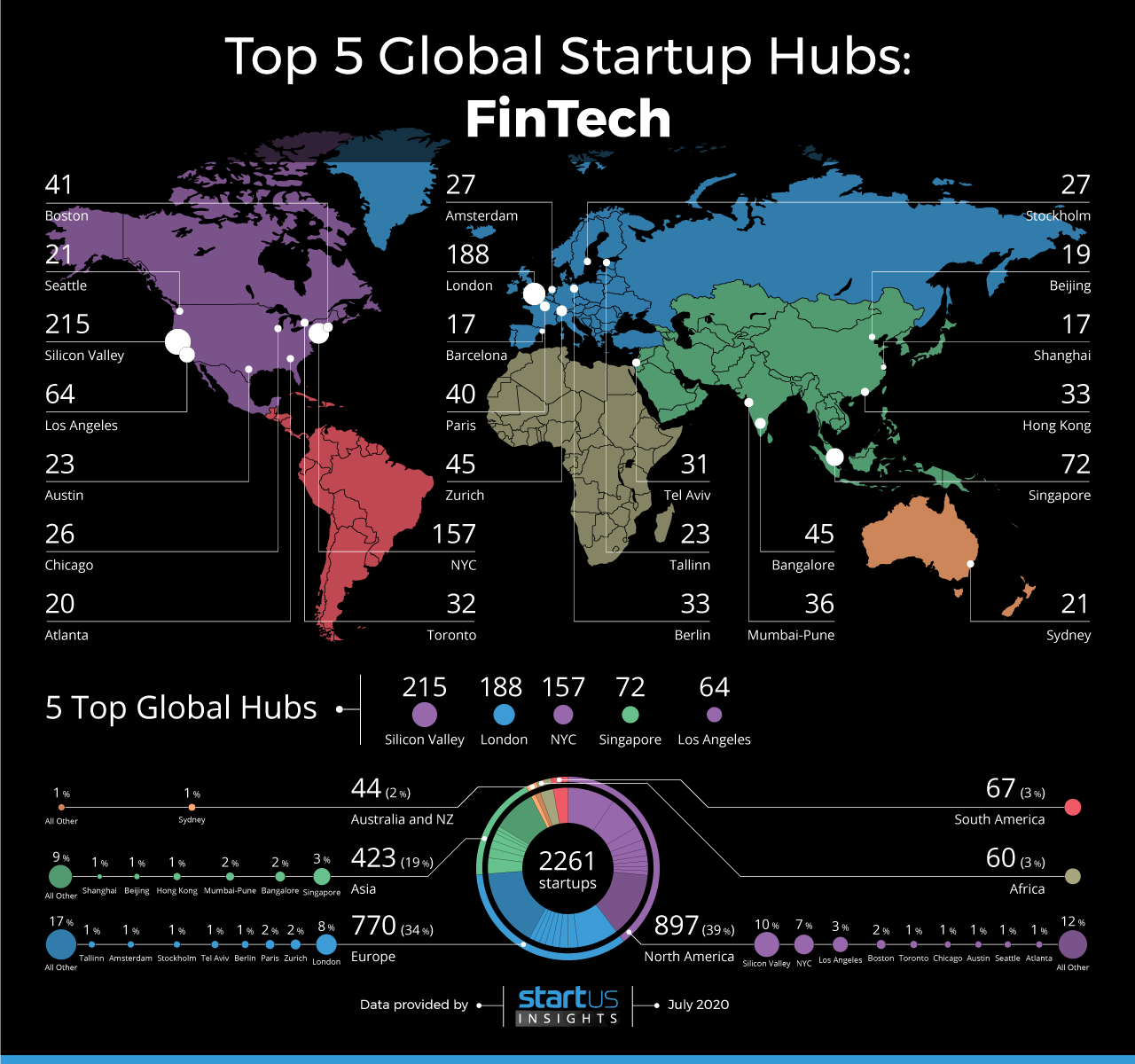

Using our StartUs Insights Discovery Platform, we analyzed the geographic distribution of global activity in the financial services sector. We identified 61 regional hubs* that observe high activity in developing technology-driven solutions across the industry such as digital banking, advanced analytics, blockchain technology, biometrics, and RegTech, to name a few.

Within the hubs, we analyzed a sample of 2.261 startups* employing technology-driven solutions to innovate in the industry. Silicon Valley, London, New York City, Singapore, and Los Angeles are home to 696 startups and scaleups and account for 31% of global FinTech activity. Let us have a look at some of the innovative solutions from these 5 top hubs.

Based on a sample of 2.261 startups & scaleups, we observe that North America and Europe account for three-fourths of the global FinTech startup activity. These regions are on top thanks to big financial centers in the US, UK, Germany, and Switzerland. Emerging Asian FinTech hubs in Singapore, Mumbai, and Hong Kong are home to 20% of emerging FinTech companies. Africa, South America, and Australia & New Zealand also beginning to see an increasing number of FinTech startups & scaleups according to our data.

1. Silicon Valley: 215 Startups

The San Francisco Bay Area is home to a vast technology talent pool and has high rates of technology adoption. This encourages startups from various industries, including banking and financial services, to develop novel solutions in the region. From digital and mobile banking to improving customer profiling and credit scoring, FinTech startups in Silicon Valley are working on diverse application areas.

San Francisco-based startup Rehive provides an end-to-end white-label wallet solution for any business. The startup’s transaction ledger and user management system allows companies to develop custom FinTech applications. The wallets are suitable for implementing loyalty and reward points, blockchain wallets, and prepaid wallets, among others. The startup offers web and mobile variants of its wallet technology along with a dashboard for transaction management.

2. London: 188 Startups

Despite uncertainties regarding Brexit, the UK remains a crucial financial player globally. London, in particular, offers startups and emerging companies access to investment opportunities and boasts a diverse talent pool. Technology such as AI and Blockchain support companies to build sophisticated products that impact the banking, finance, and insurance sectors. Moreover, easy payment options remove income or location constraints that currently affect traditional banking to help farmers, retailers, and manufacturers, among others, to run their businesses.

London-based startup TrueLayer develops open banking application programming interfaces (APIs) to help customers securely access data and initiate payments in real-time. This solution is payment services directive 2 (PSD2)-compliant and allows companies to focus on accelerating their businesses rather than building financial platforms from scratch. The startup’s Data API enables financial institutions to securely access their customers’ data to gather valuable insights by storing information tokens instead of customer credentials. Further, TrueLayer encrypts at rest and does not save the encryption keys either, in turn, significantly reducing the chances of data breaches.

3. New York City: 157 Startups

Considered by many as the world’s financial capital, New York is also associated with the availability of skilled talent and high startup incubator activity. Besides, growth in public adoption of financial technology also encourages emerging startups to develop novel solutions. At the same time, concerns around data privacy and security, along with financial fraud and non-compliance, force FinTechs to build technology-driven solutions to solve these issues.

Solidus Labs is a New York City-based startup offering a machine learning (ML) powered surveillance, monitoring, and compliance solution tailored for digital & crypto assets. The startup works with financial regulators as well as banking institutions to develop cloud-based transaction monitoring systems to enhance risk detection. This solution considerably impacts compliance professionals by enabling them to identify, analyze, backtest, collaborate, and report all types of patterns and anomalies.

4. Singapore: 72 Startups

Singapore is one of Asia’s largest financial centers, providing global trade services. This FinTech hub includes all major financial sectors, such as banking, payments, and capital markets. From RegTech, AI, and distributed ledger technology (DLT) to cloud computing, APIs, and cybersecurity, Singapore is home to a diverse range of financial technology startups. According to the government, 2020 has seen a 20% rise in investments over last year.

Singapore-based startup PortfolioQuest creates gamified simulation training platforms for banking professionals. The startup aims to equip the existing finance talent to upskill and be ready to use FinTech in their everyday work. The startup utilizes AI and ML algorithms to train bankers in a virtual reality (VR) environment. PortfoiloQuest’s products are suitable for underwriting, collections, credit life cycle management, and tackling anti-money laundering (AML) practices.

5. Los Angeles: 64 Startups

Over the past few years, Los Angeles has seen significant growth in local startup activity. With a large and diverse population, this FinTech hub offers startups with increasingly better incentives in terms of costs in comparison to both Silicon Valley and New York City. Moreover, Los Angeles enables widespread innovation due to the involvement and collaboration with non-finance talent to improve services across industries.

Maya Labs is working to bring affordable financial products and services for unbanked and underbanked communities. The startup’s Smart ATM is a self-service payment platform that connects cash-based communities to the digital economy. Similar to a smartphone, Smart ATM runs multiple applications that include checking cashing, money transfers, bill payments, mobile reloads, and offer APIs for businesses to add their apps. Further, the cloud-based Smart ATM provides real-time transaction data and enables remote control of the hardware.

What’s Next?

The widespread penetration of smartphones globally provides numerous opportunities for financial technology startups. Big banks look to implement cloud-based services and utilize regulatory technology to improve their compliance. Secure and transparent platforms, easy access to low-amount loans, and innovative solutions to enable financial inclusion drives digital and mobile banking adoption as well as FinTech innovation.

*We define a hub as the regional geographic center of activity for this topic. It covers the center point with a radius of 100km. For this report, we define startups as those founded after 2015.